Beruflich Dokumente

Kultur Dokumente

BofA Payment Consent Order

Hochgeladen von

Ban KKillerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BofA Payment Consent Order

Hochgeladen von

Ban KKillerCopyright:

Verfügbare Formate

UNITED STATES OF AMERICA BEFORE THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM WASHINGTON, D C .

Docket No. 12-007-CMP-HC In the Matter of BANK OF AMERICA CORPORATION Charlotte, North Carolina Order of Assessment of a Civil M oney Penalty Issued Upon Consent Pursuant to the Federal Deposit Insurance Act, as Amended

WHEREAS, Bank of America Corporation, Charlotte, North Carolina (BAC), a registered bank holding company, owns and controls Bank of America, N.A., Charlotte, North Carolina (the Bank), a national bank; WHEREAS, BAC, through the Bank, indirectly engages in the business of servicing residential mortgage loans for the Bank, U.S. government-sponsored entities (the GSEs), and various investors; WHEREAS, with respect to the residential mortgage loans it services, the Bank initiates and handles foreclosure proceedings and loss mitigation activities involving nonperforming residential mortgage loans, including activities related to special forbearances, repayment plans, modifications, short refinances, short sales, cash-for-keys, and deeds-in-lieu of foreclosure (collectively, Loss Mitigation); WHEREAS, as part of a horizontal review of various major residential mortgage servicers conducted by the Board of Governors of the Federal Reserve System (the Board of . k r b e g a P Governors), the Federal Deposit Insurance Corporation, the Office of the Comptroller of the.

C urrency (the O C C ), and the O ffice o f T hrift Supervision, exam iners from the F ederal R eserve B an k o f R ichm ond (the R eserve B an k ) and the O C C review ed certain residential m ortgage loan servicing and foreclosure-related practices at the B ank; W H E R E A S , on A pril 13, 2011, the B an k and the O C C entered into a consent order to address areas o f alleged w eakness identified by the O C C in loan servicing, L oss M itigation, foreclosure activities, and related functions (the O C C C onsent O rder); W H E R E A S , in the O C C C onsent O rder, the O C C m ade findings, w hich the B an k neither adm itted no r denied, th at there w ere u nsafe or u n sound practices w ith respect to the m anner in w hich the B an k handled various foreclosure and related activities. W H E R E A S , the O C C s findings also raised concerns th at B A C did not adequately assess the potential risks associated w ith these activities; W H E R E A S , as evidenced by the findings in the O C C C onsent O rder, B A C allegedly failed to provide effective oversight w ith respect to the loan servicing, L oss M itigation, foreclosure activities, and related functions o f the B ank, including the B a n k s risk m anagem ent, audit, and com pliance program s, ven d o r m anagem ent, docum ent execution practices, and staffing and m anagerial resources as they pertain to those activities and related functions; W H E R E A S , on A pril 13, 2011, the B oard o f G overnors and B A C entered into a C onsent O rder to address the concerns raised by the O C C C onsent O rder and requiring B A C to take specific m easures to address th o se concerns (the B oard C onsent O rder); W H E R E A S , the conduct w hich w as the subject o f the B oard C onsent O rder allegedly constitutes u nsafe or unsound practices in conducting the affairs o f B A C w ithin the m eaning o f section 8 o f the F ederal D eposit Insurance A ct, as am ended (12 U .S.C . 1818) (the F D I A ct );

2.

W H E R E A S , the B o ard o f G overnors issues this O rder o f A ssessm ent o f a Civil M oney P enalty Issued U pon C onsent (the C onsent A ssessm ent O rder) against B A C in conjunction w ith the B oard C onsent O rder; W H E R E A S , B A C has taken steps to com ply w ith the B oard C onsent O rder and continues to take additional steps; W H E R E A S , on F ebruary 9, 2012, B A C and/or certain o f its affiliates (the B A C P arties) entered into an agreem ent w ith the U nited States, acting through the U nited States D epartm ent o f Justice, and w ith the A ttorneys G eneral o f various states to settle certain potential civil claim s against the B A C P arties fo r th eir conduct, am ong other things, in connection w ith the servicing o f m ortgage loans by the B an k (the Settlem ent A greem ent); W H E R E A S , as p art o f the S ettlem ent A greem ent, the B A C P arties agreed to provide consum er relief, w hich m ay include m ortgage principal reductions or refinancing, and other assistance to certain residential m ortgage borrow ers (the B o rro w er A ssistance). A s p art o f the S ettlem ent A greem ent, the B A C P arties also agreed th a t certain paym ents w ould be m ade to the U nited States (the H ard D o llar P aym ents). P ortions o f those paym ents m ay go directly to various agencies o f the federal governm ent (the F ederal P aym ents). The am ount o f B o rro w er A ssistance provided by the B A C P arties, to g eth er w ith the H ard D o llar P aym ents m ade pursuant to the S ettlem ent A greem ent, is expected to be equal to or greater than $10.5 billion; W H E R E A S , B A C has consented to the assessm ent o f a civil m oney penalty in the am ount o f $175,500,000 by the B oard o f G overnors (the C M P ) pursuant to section 8(b)(3) and (i)(2)(B ) o f the F D I A ct (12 U .S.C . 1818(i)(2)(B )) fo r allegedly unsafe or u n sound practices described above, w h ich penalty shall be rem itted by the B oard o f G overnors to the extent, in com pliance w ith this C onsent A ssessm ent O rder: (i) the B A C P arties provide the B orrow er.

3.

A ssistance p u rsuant to the S ettlem ent A greem ent or m ake the F ederal P aym ents p u rsuant to the S ettlem ent A greem ent; or (ii) B A C provides funding for n o n profit housing counseling organizations pursu an t to a plan acceptable to the R eserve B ank; W H E R E A S , the b oard o f directors o f B A C , at a duly constituted m eeting, adopted a resolution authorizing and directing E dw ard O K eefe to enter into this C onsent A ssessm ent O rder on b e h a lf o f B A C , and consenting to com pliance w ith each and every applicable provision o f this C onsent A ssessm ent O rder by B A C and its institution-affiliated parties, as defined in sections 3(u) and 8(b)(3) o f the F D I A ct (12 U .S.C . 1813(u) and 1818(b)(3)), and w aiving any and all rights th at B A C m ay have p u rsuant to section 8 o f the F D I A ct (12 U .S .C . 1818), including, b u t not lim ited to: (i) the issuance o f a notice o f assessm ent o f civil m oney penalty; (ii) a hearing fo r the purpose o f taking evidence on any m atters set forth in this C onsent A ssessm ent O rder; (iii) ju d icial review o f this C onsent A ssessm ent O rder; (iv) contest the issuance o f this C onsent A ssessm ent O rder by the B oard o f G overnors; and (v) challenge or contest, in any m anner, the basis, issuance, validity, term s, effectiveness or enforceability o f this C onsent A ssessm ent O rder or any provision hereof. N O W , T H E R E F O R E , b efore the filing o f any notices, or tak in g o f any testim ony or adjudication o f or finding on any issues o f fact or law herein, and w ith o u t this C onsent A ssessm ent O rder constituting an adm ission by B A C o f any allegation m ade or im plied by the B oard o f G overnors in connection w ith this m atter, and solely fo r the purpose o f settling this m atter w ith o u t a form al proceeding b ein g filed and w ith o u t the necessity for protracted or extended hearings or testim ony, it is hereby O R D E R E D by the B o ard o f G overnors, p u rsuant to sections 8(b)(3) and (i)(2)(B ) o f the F D I A ct (12 U .S.C . 1818(b)(3) and 1818(i)(2)(B )), that:

4.

1.

B A C is hereby assessed a C M P in the am ount o f $175,500,000 to be paid as

p rovided in this C onsent A ssessm ent Order. 2. P u rsu an t to section 8(i)(2)(F) o f the F D I A ct (12 U .S.C . 1818(i)(2)(F)), the

B oard o f G overnors shall rem it up to $175,500,000 o f the C M P by an am ount equivalent to the aggregate dollar value o f the B o rro w er A ssistance provided and F ederal P aym ents m ade by the B A C P arties p u rsuant to the S ettlem ent A greem ent (w ith crediting to be determ ined p u rsuant to the sam e m echanism u sed in the S ettlem ent A greem ent, provided th at no am ount shall be rem itted fo r bonuses or incentives received by or credited to the B A C P arties) u n d er the follow ing conditions: (i) T he B o rro w er A ssistance is provided for the rem edial program s specified in the S ettlem ent A greem ent in accordance w ith the term s and conditions specified in the Settlem ent A greem ent for such program s; (ii) A ny docum ents associated w ith the B o rro w er A ssistance provided and F ederal P aym ents m ade by the B A C P arties pursuant to the S ettlem ent A greem ent are m ade available to the R eserve B an k upon request; (iii) O n a quarterly basis and until the earlier o f the date on w hich the Settlem ent A g reem en ts requirem ents pertaining to the B o rro w er A ssistance and F ederal P aym ents are fully satisfied or on w hich the C M P has b een fully satisfied, B A C subm its to the R eserve B an k a detailed report and accounting on the B o rro w er A ssistance provided and F ederal P aym ents m ade p u rsuant to the S ettlem ent A greem ent and a certification by B A C th at any such B orrow er A ssistance provided and F ederal P aym ents m ade w ere provided and m ade in full com pliance w ith the term s and conditions o f the S ettlem ent A greem ent; and.

5.

(iv)

W ithin the earlier o f 30 days o f full satisfaction o f the term s and conditions o f the

S ettlem ent A g reem en ts requirem ents pertaining to B o rro w er A ssistance and F ederal Paym ents or tw o years after the date o f execution o f this C onsent A ssessm ent O rder, B A C subm its to the R eserve B an k a certification th at any B o rro w er A ssistance provided and F ederal Paym ents m ade pu rsuant to the S ettlem ent A greem ent w ere provided and m ade in full com pliance w ith the term s and conditions o f the Settlem ent A greem ent. 3. P u rsu an t to section 8(i)(2)(F) o f the F D I A ct (12 U .S.C . 1818(i)(2)(F)), the

B oard o f G overnors shall also rem it up to $175,500,000 o f the C M P, to the extent not rem itted pursuant to paragraph 2, by an am ount equivalent to the aggregate am ount o f funds expended by B A C on funding fo r nonprofit housing counseling organizations, approved by the U .S. D ep artm en t o f H ousing and U rban D evelopm ent, to provide counseling to borrow ers w ho are at risk o f or are in default or foreclosure or assistance to borrow ers in connection w ith the in d ep en d en t foreclosure review s required by the B oard C onsent O rder, u n d er the follow ing conditions: (i) W ithin 30 days p rio r to the m aking o f any expenditures p u rsuant to this paragraph 3, B A C subm its to the R eserve B an k an acceptable w ritten plan fo r m aking such expenditures, including the m anner by w hich such expenditures shall be credited to B A C ; and (ii) B A C fully com plies w ith the accepted plan. 4. N o later than tw o years after the date o f execution o f this C onsent A ssessm ent

O rder, B A C shall pay any portion o f the C M P th at has not been rem itted pursuant to paragraphs 2 or 3 o f this C onsent A ssessm ent O rder as o f such date, plus interest on such portion calculated from the date o f execution o f this C onsent A ssessm ent O rder at the rate set forth in 28 U .S.C . 1961.

6.

5.

P ay m en t o f the C M P pursu an t to paragraph 4 o f this C onsent A ssessm ent O rder

shall be m ade by a F edw ire tran sfer to the F ederal R eserve B an k o f R ichm ond, A B A N o. 05 1000033, to the order o f the B oard o f G overnors G eneral Fund, FR B G eneral L ed g er A ccount n um ber 220 400 010, w hich penalties the B o ard o f G overnors shall deposit on b e h a lf o f the B oard o f G overnors into the U nited States T reasury as required by section 8(i)(2)(J) o f the F D I A ct (12 U .S.C . 1818(i)(2)(J)). N otices. 6. A ll com m unications regarding this O rder shall be sent to: (a) M r. John A. B eebe A ssistant V ice P resident F ederal R eserve B an k o f R ichm ond P.O . B o x 27622 R ichm ond, V irginia 23261-7622 M r. E dw ard O K eefe G eneral C ounsel B an k o f A m erica C orporation 100 N . T ryon Street C harlotte, N o rth C arolina 29255

(b)

M isc e lla n e o u s. 7. T he provisions o f this C onsent A ssessm ent O rder shall be b inding on B A C and its

institution-affiliated parties in th eir capacities as such, and th eir successors and assigns. 8. E ach provision o f this C onsent A ssessm ent O rder shall rem ain effective and

enforceable until stayed, m odified, term inated, or suspended in w riting by the R eserve Bank. 9. N o tw ithstanding any provision o f this C onsent A ssessm ent O rder, the R eserve

B an k m ay, in its sole discretion, grant w ritten extensions o f tim e to B A C to com ply w ith any provision o f this C onsent A ssessm ent O rder.

7.

10.

Except as provided for in this Consent Assessment Order, the Board of Governors

hereby releases and discharges BAC and its affiliates, successors, and assigns from all potential liability that has been or might have been asserted by the Board of Governors based on the conduct that is the subject of this Consent Assessment Order, to the extent known to the Board of Governors as of the effective date of this Consent Assessment Order. The foregoing release and discharge shall not preclude or affect any right of the Board of Governors to determine and ensure compliance with the Board Consent Order or this Consent Assessment Order, or any proceedings brought by the Board of Governors to enforce the terms of the Board Consent Order or this Consent Assessment Order. By Order of the Board of Governors effective this 9th day of February, 2012.

BANK OF AMERICA CORPORATION. Electronically BOARD signed by Edward OF GOVERNORS O'Keefe. GeneralOF Counsel. THE FEDERAL RESERVE E h . f J b d g s y a i n o r t c e l SYSTEM. . d B h f o y a t r c e S

P t m u c D f o d n E . 8 e g a

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Acknowledgement of Deed-ExampleDokument2 SeitenAcknowledgement of Deed-ExampleBan KKiller100% (9)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- India Fintech Report 2021: Economic Impact of COVID-19 and Future Growth DriversDokument29 SeitenIndia Fintech Report 2021: Economic Impact of COVID-19 and Future Growth Driversdevang bohraNoch keine Bewertungen

- Chapter 1 Assignment 1Dokument9 SeitenChapter 1 Assignment 1LADY TEDD PONGOSNoch keine Bewertungen

- TitleMax E-Commerce CreditDokument30 SeitenTitleMax E-Commerce Creditklassiq100% (1)

- Metlife Bank Na Unsafe and Unsound Practices-Occ Accepts Metlife Bank's 'Stipulation and Consent'-Cease and Desist Order by ComptrollerDokument34 SeitenMetlife Bank Na Unsafe and Unsound Practices-Occ Accepts Metlife Bank's 'Stipulation and Consent'-Cease and Desist Order by Comptroller83jjmackNoch keine Bewertungen

- Wells Fargo Consent Order!Dokument33 SeitenWells Fargo Consent Order!Ban KKillerNoch keine Bewertungen

- Section BDokument56 SeitenSection BForeclosure Fraud100% (1)

- Losing The Paper - MortgageDokument37 SeitenLosing The Paper - MortgageDinSFLA100% (2)

- LPS Final Stipulated Judgment-ExecutedDokument24 SeitenLPS Final Stipulated Judgment-ExecutedBan KKillerNoch keine Bewertungen

- Section CDokument16 SeitenSection CForeclosure Fraud100% (3)

- Wells Fargo Consent Order!Dokument33 SeitenWells Fargo Consent Order!Ban KKillerNoch keine Bewertungen

- Aurora V Louis - JDGMNT - 6th OH Apls CT - 20120203Dokument8 SeitenAurora V Louis - JDGMNT - 6th OH Apls CT - 20120203Ban KKillerNoch keine Bewertungen

- Intro Certainty in Chain of Title Debt Paper (2011)Dokument8 SeitenIntro Certainty in Chain of Title Debt Paper (2011)Jillian SheridanNoch keine Bewertungen

- Racketeer Influenced and Corrupt Organizations (RICO) : A Manual For FederalDokument364 SeitenRacketeer Influenced and Corrupt Organizations (RICO) : A Manual For Federalsilverbull8Noch keine Bewertungen

- NM StatutesDokument3 SeitenNM StatutesBan KKillerNoch keine Bewertungen

- Unit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovDokument5 SeitenUnit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovMarcusNoch keine Bewertungen

- UNIT ONE Introduction To Banking Principle and PracticeDokument7 SeitenUNIT ONE Introduction To Banking Principle and PracticewubeNoch keine Bewertungen

- 5 Minutes to Crack RRB PO InterviewDokument41 Seiten5 Minutes to Crack RRB PO Interviewvishalgupta90Noch keine Bewertungen

- Giacobbe Indictment FiledDokument32 SeitenGiacobbe Indictment FiledWXXI NewsNoch keine Bewertungen

- Msi Owner Occupancy AffidavitDokument1 SeiteMsi Owner Occupancy AffidavitbatinatorNoch keine Bewertungen

- Credit Risk Management and Effectiveness of CreditDokument12 SeitenCredit Risk Management and Effectiveness of CreditEfthker Uddin RafiNoch keine Bewertungen

- Engineering EconomyDokument16 SeitenEngineering EconomyElla TorresNoch keine Bewertungen

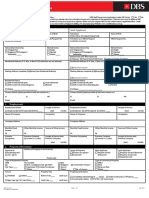

- DBS Mortgage All-In-One Application Form 2016Dokument3 SeitenDBS Mortgage All-In-One Application Form 2016Viola HippieNoch keine Bewertungen

- Project Report - IBC Final - Group CDokument50 SeitenProject Report - IBC Final - Group CKriti JaiswalNoch keine Bewertungen

- Fincfriends PVT LTD: Sub: in Principle Sanction LetterDokument2 SeitenFincfriends PVT LTD: Sub: in Principle Sanction LetterDílìp ÎñdúrkãrNoch keine Bewertungen

- Card Protection PlanDokument18 SeitenCard Protection PlanAagam JainNoch keine Bewertungen

- Credit Risk Management For EXIM Bank FinalDokument69 SeitenCredit Risk Management For EXIM Bank Finalkhansha ComputersNoch keine Bewertungen

- 108 Motion For Summary Judgment-CompleteDokument214 Seiten108 Motion For Summary Judgment-Completelarry-612445Noch keine Bewertungen

- Financial Institutions Management - Chapter 2 Solutions PDFDokument6 SeitenFinancial Institutions Management - Chapter 2 Solutions PDFJarrod RodriguesNoch keine Bewertungen

- The Production of Money - Ann Pettifor's LSE LectureDokument20 SeitenThe Production of Money - Ann Pettifor's LSE LectureemontesaNoch keine Bewertungen

- 21 Problems For CB New 1Dokument11 Seiten21 Problems For CB New 1Trần Bảo LyNoch keine Bewertungen

- Statistics CIA 3 - 2nd SemesterDokument23 SeitenStatistics CIA 3 - 2nd SemesterHigi SNoch keine Bewertungen

- Final Exam Maia Jeriashvili EconomicsDokument9 SeitenFinal Exam Maia Jeriashvili Economicsdavit kavtaradzeNoch keine Bewertungen

- BONDS PAYABLE EXAM REVIEWDokument48 SeitenBONDS PAYABLE EXAM REVIEWspur ious100% (2)

- Banking Law ProjectDokument18 SeitenBanking Law ProjectAmit GroverNoch keine Bewertungen

- RFP Mango Processing ProjectDokument92 SeitenRFP Mango Processing ProjectThemiya NimanthaNoch keine Bewertungen

- Real Estate Principles A Value Approach 5Th Edition Ling Test Bank Full Chapter PDFDokument34 SeitenReal Estate Principles A Value Approach 5Th Edition Ling Test Bank Full Chapter PDFc03a8stone100% (5)

- ST FinancingDokument30 SeitenST FinancingJeyavikinesh SelvakkuganNoch keine Bewertungen

- RBI Circular On Prudential Norms-12.11.2021Dokument6 SeitenRBI Circular On Prudential Norms-12.11.2021maneeshNoch keine Bewertungen

- Impact of Macroeconomic Factors On Money SupplyDokument30 SeitenImpact of Macroeconomic Factors On Money Supplyshrekdj88% (8)

- The Rise of Digital Banking in Southeast AsiaDokument44 SeitenThe Rise of Digital Banking in Southeast AsiaSubhro Sengupta100% (1)

- 016 - Express Investments V Bayan TelecommunicationsDokument3 Seiten016 - Express Investments V Bayan Telecommunicationsjacaringal1Noch keine Bewertungen