Beruflich Dokumente

Kultur Dokumente

In Re Petition For Assistance V BIR Digest

Hochgeladen von

Liana AcubaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

In Re Petition For Assistance V BIR Digest

Hochgeladen von

Liana AcubaCopyright:

Verfügbare Formate

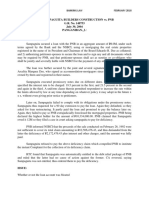

IN RE: PETITION FOR ASSISTANCE IN THE LIQUIDATION IN THE RURAL BANK OF BOKOD (BENGUET), PDIC VS.

BUREAU OF INTERNAL REVENUE GR NO. 158261 DECEMBER 18, 2006

FACTS: A special examination of Rural Bank of Bokod (Benguet), Inc. (RBBI) was conducted by the Supervision and Examination Sector (SES) Department III of what is now the Bangko Sentral ng Pilipinas (BSP), wherein various loan irregularities were uncovered.-SES Department III required the RBBI management to infuse fresh capital into the bank, within 30 days from date of the advice, and to correct all the exceptions noted. However, up to the termination of the subsequent general examination conducted by the SES Department III, no concrete action was taken by the RBBI management.In view of the irregularities noted and the insolvent condition of RBBI, the members of the RBBI Board of Directors were called for a conference at the BSP. Only one RBBI Director, a certain Mr. Wakit, attended the conference, and the examination findings and related recommendations were discussed with him. In a letter, receipt of which was acknowledged by Mr. Wakit, the SES Department III warned the RBBI Board of Directors that, unless substantial remedial measures are taken to rehabilitate the bank, it will recommend that the bank be placed under receivership. In a subsequent letter, a copy of which was sent to every member of the RBBI Board of Directors via registered mail, the SES Department III reiterated its warning that it would recommend the closure of the bank, unless the needed fresh capital was immediately infused. Despite these notices, the SES Department III received no word from RBBI or from any of its Directors. In a meeting, the Monetary Board of the BSP decided to take the following; forbid the bank to do business in the Philippines and place its assets and affairs under receivership in accordance with Section 29 of R.A. No. 265, as amended; designate the Special Assistant to the Governor and Head, SES Department III, as Receiver of the bank; refer the cases of irregularities/frauds to the Office of Special Investigation for further investigation and possible filing of appropriate charges against the following present/former officers and employees of the bank. A memorandum and report, were submitted by the Director of the SES Department III concluding that the RBBI remained in insolvent financial condition and it can no longer safely resume business with the depositors, creditors and the general public. Monetary Board, after determining and confirming the said memorandum and report, ordered the liquidation of the bank and designated the Director of the SES Department III as liquidator. The designated BSP liquidator of RBBI caused the filing with the RTC of a Petition for Assistance in the Liquidation of RBBI. Subsequently, the Monetary Board transferred to herein Philippine Deposit Insurance Corporation (PDIC) the receivership/liquidation of RBBI.-PDIC then filed, a Motion for Approval of Project of Distribution of the assets of RBBI, in accordance with Section31, in relation to Section 30, of Republic Act No. 7653, otherwise known as the New Central Bank Act. During the hearing, Bureau of Internal Revenue (BIR), through Atty. Justo Reginaldo, manifested that PDIC should secure a tax clearance certificate from the appropriate BIR Regional Office, pursuant to Section 52(C) of Republic Act No. 8424,or the Tax Code of 1997, before it could proceed with the dissolution of RBBI. On even date, the RTC issued order directing PDIC to comply with Section 52(C) of the Tax Code of 1997 within 30days from receipt of a copy of the said order. Pending compliance therewith, the RTC held in abeyance the Motion for Approval of Project of Distribution. In order therefore that all taxes due the government should be paid, petitioner should secure a tax clearance from the Bureau of Internal Revenue. Hence, PDIC filed the present Petition for Review on Certiorari, under Rule 45 of the revised Rules of Court, raising pure questions of law. PDIC argues that the closure of banks under Section 30 of the New Central Bank Act is summary in nature and procurement of tax clearance as required under Section 52(C) of the Tax Code of 1997 is not a condition precedent thereto; that under Section 30, in relation to Section 31, of the New Central Bank Act, asset distribution of a closed bank requires only the approval of the liquidation court; and that the BIR is not without recourse since, subject to the applicable provisions of the Tax Code of 1997, it may therefore assess the closed RBBI for tax liabilities, if any. ISSUE: -Whether or not RBBI, as represented by its liquidator, PDIC, still needs to secure a tax clearance from the BIR before the RTC could approve the Project of Distribution of the assets of RBBI. -Whether or not the government can claim preference of credit

HELD: Section 30 of the New Central Bank Act lays down the proceedings for receivership and liquidation of a bank. The said provision is silent as regards the securing of a tax clearance from the BIR. The omission, nonetheless, cannot compel this Court to apply by analogy the tax clearance requirement of the SEC, as stated in Section 52(C) of the Tax Code of 1997 and BIR-SEC Regulations No. 1, since, again, the dissolution of a corporation by the SEC is a totally different proceeding from the receivership and liquidation of a bank by the BSP. This Court cannot simply replace any reference by Section 52(C) of the Tax Code of 1997 and the provisions of the BIR -SEC Regulations No.1 to the SEC with the BSP. To do so would be to read into the law and the regulations something that is simply not there, and would be tantamount to judicial legislation.-It should be noted that there are substantial differences in the procedure for involuntary dissolution and liquidation of a corporation under the Corporation Code, and that of a banking corporation under the New Central Bank Act, so that the requirements in one cannot simply be imposed in the other. The Government, in this case, cannot generally claim preference of credit, and receive payment ahead of the other creditors of RBBI. Duties, taxes, and fees due the Government enjoy priority only when they are with reference to a specific movable property, under Article 2241(1) of the Civil Code, or immovable property, under Article 2242(1) of the same Code. However, with reference to the other real and personal property of the debtor, sometimes referred to as free property, the taxes and assessments due the National Government, other than those in Articles 2241(1) and 2242(1) of the Civil Code, will come only in ninth place in the order of preference. Thus, the recourse of the BIR, after assessing the final return and examining all other pertinent documents of RBBI, and making a determination of the latters outstanding tax liabilities, is to present its claim, on behalf of the National Government, before the RTC during the liquidation proceedings. The BIR is expected to prove and substantiate its claim, in the same manner as the other creditors. It is only after the RTC allows the claim of the BIR, together with the claims of the other creditors, can a Project for Distribution of the assets of RBBI be finalized and approved. PDIC, then, as liquidator, may proceed with the disposition of the assets of RBBI and pay the latters financial obligations, including its outstanding tax liabilities. And, finally, only after such payment, can the BIR issue a certificate of tax clearance in the name of RBBI.

Das könnte Ihnen auch gefallen

- Rural Bank of San Miguel vs. MB DigestDokument1 SeiteRural Bank of San Miguel vs. MB DigestMae NavarraNoch keine Bewertungen

- In Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRDokument3 SeitenIn Re Petition For Assistance in The Liquidation of The Rural Bank of Bokod (Benguet), Inc., PDIC vs. BIRnia coline mendozaNoch keine Bewertungen

- Domingo Manalo v. Court of AppealsDokument1 SeiteDomingo Manalo v. Court of AppealsCheChe100% (1)

- 9) Ana Maria A. Koruga vs. Teodoro O. Arcenas, JR., Et. Al - Teodoro O. Arcenas Et. Al. vs. Hon. Sixto Marella (2009)Dokument2 Seiten9) Ana Maria A. Koruga vs. Teodoro O. Arcenas, JR., Et. Al - Teodoro O. Arcenas Et. Al. vs. Hon. Sixto Marella (2009)AlexandraSoledadNoch keine Bewertungen

- Far East Bank Vs Pacilan JRDokument2 SeitenFar East Bank Vs Pacilan JRJeraldine Tatiana PiñarNoch keine Bewertungen

- 127 Republic V Eugenio, Jr.Dokument5 Seiten127 Republic V Eugenio, Jr.adeeNoch keine Bewertungen

- 20 - General Bank and Trust Company VDokument2 Seiten20 - General Bank and Trust Company VMokeeCodillaNoch keine Bewertungen

- Robles v. YapcincoDokument2 SeitenRobles v. YapcincoRem SerranoNoch keine Bewertungen

- BSP and Chuchi Fonacier vs. Hon. Nina G. ValenzuelaDokument2 SeitenBSP and Chuchi Fonacier vs. Hon. Nina G. ValenzuelaKelsey Olivar MendozaNoch keine Bewertungen

- Colinares Vs CADokument2 SeitenColinares Vs CARyD100% (1)

- Abacus Real Estate Development Center, Inc. v. Manila Banking CorporationDokument1 SeiteAbacus Real Estate Development Center, Inc. v. Manila Banking CorporationCheCheNoch keine Bewertungen

- Dizon V CTA DigestDokument2 SeitenDizon V CTA DigestNicholas FoxNoch keine Bewertungen

- Go vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Dokument5 SeitenGo vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Carlos JamesNoch keine Bewertungen

- First Planters Pawnshop Inc V CIRDokument1 SeiteFirst Planters Pawnshop Inc V CIRcrisNoch keine Bewertungen

- Land Bank v. Monet's Export and ManufacturingDokument3 SeitenLand Bank v. Monet's Export and ManufacturingAndre Philippe RamosNoch keine Bewertungen

- CIR Vs First Express Pawnshop Company IncDokument1 SeiteCIR Vs First Express Pawnshop Company IncJennilyn TugelidaNoch keine Bewertungen

- 27 Ricardo B. Bangayan vs. Rizal Commercial Banking CorporationDokument2 Seiten27 Ricardo B. Bangayan vs. Rizal Commercial Banking CorporationArthur Archie TiuNoch keine Bewertungen

- Bacolod Vs CBDokument2 SeitenBacolod Vs CBAnonymous apYVFHnCYNoch keine Bewertungen

- Pbcom vs. CirDokument2 SeitenPbcom vs. CirCaroline A. LegaspinoNoch keine Bewertungen

- Central Bank vs. CADokument2 SeitenCentral Bank vs. CAxx_stripped52Noch keine Bewertungen

- II. Ownership - Sps Chingkoe Vs Sps ChingkoeDokument2 SeitenII. Ownership - Sps Chingkoe Vs Sps ChingkoeSyElfredGNoch keine Bewertungen

- CIR v. MINDANO II (G.R. No. 191498. January 15, 2014.)Dokument2 SeitenCIR v. MINDANO II (G.R. No. 191498. January 15, 2014.)Emmanuel YrreverreNoch keine Bewertungen

- BSP Vs ValenzuelaDokument1 SeiteBSP Vs ValenzuelachaNoch keine Bewertungen

- Gabionza v. CADokument3 SeitenGabionza v. CAIan Joshua RomasantaNoch keine Bewertungen

- CIR Vs Seagate, GR 153866Dokument3 SeitenCIR Vs Seagate, GR 153866Mar Develos100% (1)

- 46-Quezon City Vs BayantelDokument3 Seiten46-Quezon City Vs BayantelIshNoch keine Bewertungen

- CIR vs. Gonzales 177279Dokument1 SeiteCIR vs. Gonzales 177279magen100% (1)

- Fidelity Case DigestDokument2 SeitenFidelity Case DigestCandypopNoch keine Bewertungen

- Tax DigestsDokument206 SeitenTax DigestsPio Guieb AguilarNoch keine Bewertungen

- American Home vs. FF Cruz (Digest)Dokument2 SeitenAmerican Home vs. FF Cruz (Digest)Clarissa dela CruzNoch keine Bewertungen

- Leticia Miranda v. PDIC, BSP and Prime Savings BankDokument1 SeiteLeticia Miranda v. PDIC, BSP and Prime Savings BankCheCheNoch keine Bewertungen

- Union Bank Vs Edmund SantibanezDokument3 SeitenUnion Bank Vs Edmund SantibanezReycy Ruth TrivinoNoch keine Bewertungen

- China Banking Corporation vs. CADokument1 SeiteChina Banking Corporation vs. CAArmstrong BosantogNoch keine Bewertungen

- Cabasal v. BPI Family Savings Bank Case DigestDokument4 SeitenCabasal v. BPI Family Savings Bank Case DigestSamantha MagpaleNoch keine Bewertungen

- CIR V BurmeisterDokument3 SeitenCIR V BurmeisterGenevieve Kristine Manalac100% (1)

- New Sampaguita Builders Construction vs. PNB G.R. No. 148753 July 30, 2004 Panganiban, J.: FactsDokument2 SeitenNew Sampaguita Builders Construction vs. PNB G.R. No. 148753 July 30, 2004 Panganiban, J.: FactsAdi LimNoch keine Bewertungen

- Ungab vs. Cusi (Taxation Law)Dokument2 SeitenUngab vs. Cusi (Taxation Law)JD BallosNoch keine Bewertungen

- MANALO Vs CADokument2 SeitenMANALO Vs CARmLyn MclnaoNoch keine Bewertungen

- Cesar v. Areza and Lolita B. Areza Vs - Express Savings Bank, Inc. and Michael PotencianoDokument4 SeitenCesar v. Areza and Lolita B. Areza Vs - Express Savings Bank, Inc. and Michael PotencianoSam SaripNoch keine Bewertungen

- Allied Banking Corporation v. Spouses Macam (Fausto)Dokument3 SeitenAllied Banking Corporation v. Spouses Macam (Fausto)Bluei FaustoNoch keine Bewertungen

- RACCA and LERIOUDokument4 SeitenRACCA and LERIOUKaye Rabadon100% (1)

- 1 - My DigestDokument3 Seiten1 - My DigestPrudencio Ruiz AgacitaNoch keine Bewertungen

- Ejercito V SandiganbayanDokument6 SeitenEjercito V SandiganbayanErikha AranetaNoch keine Bewertungen

- RBSM vs. MB Case DigestDokument2 SeitenRBSM vs. MB Case DigestCaitlin KintanarNoch keine Bewertungen

- PNB Vs FF CruzDokument4 SeitenPNB Vs FF CruzSu Kings AbetoNoch keine Bewertungen

- Mindanao II Geothermal vs. CIRDokument2 SeitenMindanao II Geothermal vs. CIRMia100% (1)

- Sevilla Vs CADokument1 SeiteSevilla Vs CACarlo TalatalaNoch keine Bewertungen

- RCBC vs. Court of Appeals, Goyu & SonsDokument2 SeitenRCBC vs. Court of Appeals, Goyu & SonsVian O.Noch keine Bewertungen

- Tax Digest Case 9Dokument1 SeiteTax Digest Case 9Boogie San Juan100% (1)

- Central Bank v. CA, G.R. No. 76118Dokument2 SeitenCentral Bank v. CA, G.R. No. 76118xxxaaxxx100% (1)

- First National Bank of Portland v. NobleDokument2 SeitenFirst National Bank of Portland v. NoblePat NaffyNoch keine Bewertungen

- BSP Vs ValenzuelaDokument3 SeitenBSP Vs ValenzuelaCaroline A. LegaspinoNoch keine Bewertungen

- Aguenza V Metropolitan BankDokument3 SeitenAguenza V Metropolitan BankBill MarNoch keine Bewertungen

- Ilusorio v. CaDokument2 SeitenIlusorio v. Camichelle m. templadoNoch keine Bewertungen

- Hao v. Galang, G.R. No. 247472, October 6, 2021Dokument1 SeiteHao v. Galang, G.R. No. 247472, October 6, 2021Ian Butaslac100% (1)

- CREDIT - PHIL DEPOSIT - Vs BIRDokument3 SeitenCREDIT - PHIL DEPOSIT - Vs BIRmichelle zatarainNoch keine Bewertungen

- Case Digest - PDIC Vs BIRDokument2 SeitenCase Digest - PDIC Vs BIRAnonymous NP2h8DAHQNoch keine Bewertungen

- Philippine Deposit Insurance Corporation vs. BirDokument2 SeitenPhilippine Deposit Insurance Corporation vs. BirBrian Jonathan ParaanNoch keine Bewertungen

- PDIC v. BIRDokument2 SeitenPDIC v. BIRJhon Edgar Ipan100% (1)

- PDIC Vs BIR DigestDokument3 SeitenPDIC Vs BIR DigestRONPENoch keine Bewertungen

- Hur Tin Yang vs. People (Full)Dokument5 SeitenHur Tin Yang vs. People (Full)Liana AcubaNoch keine Bewertungen

- Court Record and General Duties of Clerks and StenographersDokument6 SeitenCourt Record and General Duties of Clerks and StenographersLiana AcubaNoch keine Bewertungen

- Resolution: 2004 Rules On Notarial PracticeDokument17 SeitenResolution: 2004 Rules On Notarial PracticeLiana AcubaNoch keine Bewertungen

- Salient Features of The Revised Guidelines For Continuous Trial of Criminal CasesDokument6 SeitenSalient Features of The Revised Guidelines For Continuous Trial of Criminal CasesLiana AcubaNoch keine Bewertungen

- Cases 1 (Fulltxt)Dokument46 SeitenCases 1 (Fulltxt)Liana AcubaNoch keine Bewertungen

- A.M. 15-06-10-SC Continuous Trial GuidelinesDokument18 SeitenA.M. 15-06-10-SC Continuous Trial GuidelinesArisa AdachiNoch keine Bewertungen

- Umali V CaDokument5 SeitenUmali V CaLiana AcubaNoch keine Bewertungen

- Hur Tin Yang vs. People (Full)Dokument5 SeitenHur Tin Yang vs. People (Full)Liana AcubaNoch keine Bewertungen

- Hur Tin Yang Vs People (Digest)Dokument4 SeitenHur Tin Yang Vs People (Digest)Liana Acuba100% (2)

- Pil Full TextDokument57 SeitenPil Full TextKris BorlonganNoch keine Bewertungen

- Digest PilDokument17 SeitenDigest PilLiana AcubaNoch keine Bewertungen

- Filipinas V Christern Case DigestDokument2 SeitenFilipinas V Christern Case DigestLiana AcubaNoch keine Bewertungen

- Hur Tin Yang Vs People (Digest)Dokument4 SeitenHur Tin Yang Vs People (Digest)Liana Acuba100% (2)

- People V Tundag DigestDokument2 SeitenPeople V Tundag DigestLiana AcubaNoch keine Bewertungen

- Dela Pena Vs HidalgoDokument1 SeiteDela Pena Vs HidalgoLiana AcubaNoch keine Bewertungen

- Diaz V SofDokument5 SeitenDiaz V SofLiana AcubaNoch keine Bewertungen

- No Amendment by Substitution Shall Be Entertained Unless The Text Thereof Is Submitted in WritingDokument10 SeitenNo Amendment by Substitution Shall Be Entertained Unless The Text Thereof Is Submitted in WritingLiana AcubaNoch keine Bewertungen

- Santos vs. BuencosejoDokument1 SeiteSantos vs. BuencosejoLiana AcubaNoch keine Bewertungen

- Severino v. SeverinoDokument1 SeiteSeverino v. SeverinoLiana AcubaNoch keine Bewertungen

- Sevilla vs. CADokument2 SeitenSevilla vs. CALiana AcubaNoch keine Bewertungen

- Conde vs. CADokument1 SeiteConde vs. CALiana AcubaNoch keine Bewertungen

- Calibo vs. CADokument1 SeiteCalibo vs. CALiana AcubaNoch keine Bewertungen

- Great Pacific Life vs. CA Case DigestDokument3 SeitenGreat Pacific Life vs. CA Case DigestLiana Acuba100% (1)

- Victorias Milling CoDokument1 SeiteVictorias Milling CoLiana AcubaNoch keine Bewertungen

- Quiroga vs. ParsonsDokument1 SeiteQuiroga vs. ParsonsLiana AcubaNoch keine Bewertungen

- Paray V Rodriguez DigestDokument3 SeitenParay V Rodriguez DigestLiana AcubaNoch keine Bewertungen

- The Insular Life v. Ebrado DigestDokument2 SeitenThe Insular Life v. Ebrado DigestLiana AcubaNoch keine Bewertungen

- Limpin V Sarmiento DigestDokument3 SeitenLimpin V Sarmiento DigestLiana AcubaNoch keine Bewertungen

- Alcantara V Alinea DigestDokument2 SeitenAlcantara V Alinea DigestLiana Acuba100% (1)

- Pledge 33, 34Dokument5 SeitenPledge 33, 34Liana AcubaNoch keine Bewertungen

- 58Dokument2 Seiten58VEDIA GENONNoch keine Bewertungen

- العقد الموثقDokument3 Seitenالعقد الموثقZodiacNoch keine Bewertungen

- ILEC Practice TestDokument23 SeitenILEC Practice TesttejedaooNoch keine Bewertungen

- Anti Corruption Laws in Asia PacificDokument100 SeitenAnti Corruption Laws in Asia PacificSutikno Lukito NitidisastroNoch keine Bewertungen

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudence Contact UsDokument28 SeitenPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudence Contact UsWedmark Dannwil WagaNoch keine Bewertungen

- Civ-Rev-Case Digest - by LuigiDokument9 SeitenCiv-Rev-Case Digest - by LuigiLuigi JaroNoch keine Bewertungen

- Extingushment of Obligation ReviewerDokument18 SeitenExtingushment of Obligation ReviewerLabele MikkaNoch keine Bewertungen

- Ace Foods, Inc., Petitioner, vs. Micro Pacific Technologies Co., LTD., RespondentDokument13 SeitenAce Foods, Inc., Petitioner, vs. Micro Pacific Technologies Co., LTD., RespondentRenzo JamerNoch keine Bewertungen

- Case DigestDokument17 SeitenCase DigestKeith RosalesNoch keine Bewertungen

- United States Court of Appeals, Eleventh CircuitDokument12 SeitenUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNoch keine Bewertungen

- Personal JurisdictionDokument3 SeitenPersonal JurisdictionGene'sNoch keine Bewertungen

- Contract Law Written AssignmentDokument18 SeitenContract Law Written AssignmentEunice Lee Sin YeeNoch keine Bewertungen

- Full Download Health Safety and Nutrition For The Young Child 9th Edition Marotz Test BankDokument26 SeitenFull Download Health Safety and Nutrition For The Young Child 9th Edition Marotz Test Bankretainalgrainascjy100% (37)

- Title 12 Civil StatusDokument4 SeitenTitle 12 Civil StatusAlfred AmindalanNoch keine Bewertungen

- Basan Vs Coca-Cola BottlersDokument2 SeitenBasan Vs Coca-Cola Bottlerslovekimsohyun89Noch keine Bewertungen

- Insurance Class NotesDokument26 SeitenInsurance Class NotessaNoch keine Bewertungen

- AZNAR BROTHERS REALTY COMPANY Vs AYINGDokument3 SeitenAZNAR BROTHERS REALTY COMPANY Vs AYINGfermo ii ramosNoch keine Bewertungen

- Are You Aware of Your Mortgage Reinstatement Letter?Dokument2 SeitenAre You Aware of Your Mortgage Reinstatement Letter?PersonalStatementWriNoch keine Bewertungen

- Vasavi Urban RERADokument2 SeitenVasavi Urban RERAPradeep KNoch keine Bewertungen

- Exclusive License TemplateDokument17 SeitenExclusive License TemplateMacris MallariNoch keine Bewertungen

- Bpi VS Sarabia Manor Hotel CorpDokument3 SeitenBpi VS Sarabia Manor Hotel CorpAlexis PiocosNoch keine Bewertungen

- AIF Regulations 290124Dokument81 SeitenAIF Regulations 290124Saurav BhowmikNoch keine Bewertungen

- Tuatis v. Escol DigestDokument2 SeitenTuatis v. Escol DigestErla ElauriaNoch keine Bewertungen

- MPMRA10486008Dokument2 SeitenMPMRA10486008kushalrathod565Noch keine Bewertungen

- Agency Trust and PartnershipDokument38 SeitenAgency Trust and PartnershipCarlo John C. RuelanNoch keine Bewertungen

- ObliconDokument22 SeitenObliconCristopher Dave CabañasNoch keine Bewertungen

- 367308171-Uy-v-Capulong With Synospis and DoctrineDokument2 Seiten367308171-Uy-v-Capulong With Synospis and DoctrineJESSIE JAMES YAPAONoch keine Bewertungen

- G.R. No. L-11658Dokument3 SeitenG.R. No. L-11658Desai SarvidaNoch keine Bewertungen

- Pastor D. Ago vs. Court of Appeals CASE DIGEST 2Dokument2 SeitenPastor D. Ago vs. Court of Appeals CASE DIGEST 2Marion Lawrence Lara100% (3)

- Sample Co Hosting ContractDokument7 SeitenSample Co Hosting ContractArte CasaNoch keine Bewertungen

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyVon EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyBewertung: 5 von 5 Sternen5/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationVon EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (89)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementVon EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementBewertung: 4.5 von 5 Sternen4.5/5 (20)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Von EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Bewertung: 3.5 von 5 Sternen3.5/5 (9)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseVon EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNoch keine Bewertungen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- The Best Team Wins: The New Science of High PerformanceVon EverandThe Best Team Wins: The New Science of High PerformanceBewertung: 4.5 von 5 Sternen4.5/5 (31)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)

- Contract Law in America: A Social and Economic Case StudyVon EverandContract Law in America: A Social and Economic Case StudyNoch keine Bewertungen

- Sacred Success: A Course in Financial MiraclesVon EverandSacred Success: A Course in Financial MiraclesBewertung: 5 von 5 Sternen5/5 (15)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeVon EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeBewertung: 5 von 5 Sternen5/5 (4)

- Public Finance: Legal Aspects: Collective monographVon EverandPublic Finance: Legal Aspects: Collective monographNoch keine Bewertungen

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouVon EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouBewertung: 5 von 5 Sternen5/5 (5)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningVon EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningBewertung: 4.5 von 5 Sternen4.5/5 (8)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsVon EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsBewertung: 4 von 5 Sternen4/5 (4)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASVon EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASBewertung: 3 von 5 Sternen3/5 (5)