Beruflich Dokumente

Kultur Dokumente

Case Solar 2012

Hochgeladen von

Gergő KissCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case Solar 2012

Hochgeladen von

Gergő KissCopyright:

Verfügbare Formate

From www.solar.

eu If relevant: Analysis should be for Group not for Parent Company

Document1

02-04-2013

Extract from Solar Annual Report 2012, source: www.solar.eu If you have problems in reading the details below, you may look at pages 13 ff. And be prepared to calculate the New business opportunity on page 12.

Document1

02-04-2013

Document1

02-04-2013

Document1

02-04-2013

Document1

02-04-2013

Document1

02-04-2013

If relevant, analysis should be for Group not for Parent company.

Document1

02-04-2013

If relevant, analysis should be for Group not for Parent company.

Document1

02-04-2013

If relevant, analysis should be for Group not for Parent company.

Document1

02-04-2013

Document1

02-04-2013

10

Document1

02-04-2013

11

New business opportunity. Solar has the opportunity to have a new product in the portfolio. After investigating this product, analyzing the market and calculating internal costs, following information is presented to the management. Estimated quantity/price relation for the following 5 years: Year 2014 2015 Quantity sold 25.000 55.000 Price dkk. 40 40

2016 115.000 35

2017 115.000 35

2018 65.000 30

The product is supplied by a manufacturer in China. The price for 2014 and 2015 can be agreed now, however based on previous experience Solar is expecting higher prices in the following years as follows. In addition Solar has to modify and test the product in order to make it compatible with existing Solar product lines. The import price and the costs to modify and test are estimated per piece : Year 2014 2015 2016 2017 2018 Net import price in Denmark dkk. 7 7 10 11 13 Modify and test costs in dkk. 5 7 7 7 12 Solar is expecting considerable costs in order to have this new product introduced in Denmark: Year 2014 2015 2016 2017 2018 Sales promotion dkk. 150.000 150.000 125.000 100.000 40.000 Education and support programme for customers 70.000 70.000 70.000 50.000 50.000 Solar has to make some expensive changes in the site in Vejen to be able to handle this product. The price of a new building is estimated to dkk 2.200.000. The equipment for modification and test of the product is estimated to dkk 1.200.000. Setup of the equipment is estimated to dkk 150.000, education of Solar workers is estimated to dkk. 150.000. At the end of the planning period of 5 years the building and equipment may have a net value dkk. 600.000. Please make calculations to decide whether this project is profitable at a calculation rate of 12 %. Calculate the Net Present Value and the Internal Rate of Return. Determine the Pay-Back period for the project. Sensitivity analyses: Will the project be profitable, if the net value of the building and equipment is dkk. 0 at the end of the 5 years, assuming prices and costs at the original level. Calculate minimum scrap value. Calculate Max initial investment. Calculate Max rate of return. Will the project be profitable, if the price is dkk 35 all 5 years ? Same quantities as initial expectations. Calculate minimum profitable price, assuming the same price all 5 years.

Document1

02-04-2013

12

Text-extract of Solar Annual Report, 2012.

FINANCIAL HIGHLIGHTS

Consolidated ( million) 2012 2011 1,532.4 51.2 39.1 26.7 26.7 19.6 12.2 723.5 282.2 120.3 48.5 2010 1,401.5 60.6 49.0 41.6 41.6 35.4 24.6 684.1 284.9 98.5 46.6 2009 1,431.4 48.0 36.2 29.4 22.4 17.4 10.1 620.5 257.3 102.8 118.2 2008 1,500.3 74.2 65.0 58.3 58.3 45.4 31.0 604.1 203.6 229.0 44.3 Revenue 1,700.9 Earnings before interest, tax, depreciation and amortisation (EBITDA) 49.5 Earnings before interest, tax and amortisation (EBITA) 38.0 Operating profit or loss before special items 28.9 Earnings before interest and tax (EBIT) 28.9 Earnings before tax (EBT) 23.2 Net profit for the year 15.7 Balance sheet total 767.4 Equity 294.8 Interest-bearing liabilities, net 74.9 Cash flow from operating activities 61.4 Financial ratios (% unless otherwise stated) Organic growth 0.1 EBITDA margin 2.9 EBITA margin 2.2 Effective tax rate 32.4 Net working capital (year-end NWC)/revenue (LMT) 12.6 Gearing (net interest-bearing liabilities/EBITDA), no. of times 1.5 Return on equity (ROE) excl. amortisation 8.6 Return on invested capital (ROIC) excl. amortisation 7.4 Equity ratio 38.4 Share ratios Earnings per share in per share outstanding (EPS) Earnings per share excl. amortisation in per share outstanding (EPS) Dividend in per share Dividend in % of net profit for the year (payout ratio) Dividend in DKK per share Employees Average number of employees (FTE)

3.6 3.3 2.6 37.8 15.8 2.3 8.7 6.9 39.0

(4.8) 4.3 3.5 30.5 15.9 1.6 11.8 8.8 41.6

(12.1) 3.4 2.5 42.0 15.0 2.1 7.3 6.5 41.5

5.0 4.9 4.3 31.7 18.7 3.1 17.5 10.3 33.7

2.00 3.16 0.89 44.8 6.65

1.55 3.13 0.70 45.0 5.20

3.13 4.08 1.34 42.9 10.00

1.48 2.48 0.57 44.4 4.25

4.55 5.53 2.01 43.6 15.00

3,596

3,200

2,955

3,175

3,010

Outline

2012 was characterised by slowdown in all markets where Solar operates, and trends were particularly disappointing in late Q4. The groups revenue and earnings in 2012 fell short of our previously announced expectations. Net working capital was reduced to 215.4m, equalling 12.6% of revenue against 15.8% in 2011. This positive development in net working capital contributed to a rise in cash flow from operating activities at 61.4m, up from 48.5m in 2011. The group will maintain our target for financial gearing of 1.5 to 2.5 times EBITDA. Solar does not expect to make any major acquisitions in 2013. In this light, the Supervisory Board will assess the option to pay out extraordinary dividends in the autumn of 2013. Therefore, at the upcoming annual general meeting, the Supervisory Board will propose that it be granted the authority to pay out extraordinary dividends of up to DKK 15.00 per share for the period until the next annual general meeting.

Document1

02-04-2013

13

SUMMARY FOR THE SOLAR GROUP 2008-2012

Income statement ( million) 2012 Revenue 1,700.9 Earnings before interest, tax, depreciation and amortisation (EBITDA) 49.5 Earnings before interest, tax and amortisation (EBITA) 38.0 Operating profit or loss before special items 28.9 Earnings before interest and tax (EBIT) 28.9 Financials, net (5.7) Earnings before tax (EBT) 23.2 Net profit for the year 15.7 Balance sheet ( million) Non-current assets Current assets Balance sheet total Equity Non-current liabilities Current liabilities Interest-bearing liabilities, net Invested capital Net working capital, year-end Net working capital, average 2011 1,532.4 51.2 39.1 26.7 26.7 (7.1) 19.6 12.2 2010 1,401.5 60.6 49.0 41.6 41.6 (6.2) 35.4 24.6 2009 1,431.4 48.0 36.2 29.4 22.4 (5.0) 17.4 10.1 2008 1,500.3 74.2 65.0 58.3 58.3 (12.9) 45.4 31.0

255.8 511.6 767.4 294.8 144.1 328.5 74.9 395.4 215.4 228.7

260.4 463.1 723.5 282.2 153.9 287.4 120.3 433.8 242.2 233.9

245.0 439.1 684.1 284.9 163.0 236.2 98.5 415.1 223.1 216.5

230.5 390.0 620.5 257.3 163.7 199.5 102.8 388.4 214.9 235.6

221.0 383.1 604.1 203.6 167.5 233.0 229.0 457.8 280.8 265.3

Cash flow ( million) Cash flow from operating activities 61.4 Cash flow from investing activities (9.4) Cash flow from financing activities (14.3) Net investments in intangible assets (2.3) Net investments in property, plant and equipment (7.1) Acquisition and disposal of subsidiaries and activities, net 0.0 Financial rations (% unless otherwise stated) Revenue growth 11.0 Organic growth 0.1 EBITDA margin 2.9 EBITA margin 2.2 EBIT margin 1.7 Effective tax rate 32.4 Net working capital (year-end NWC)/revenue (LTM) 12.6 Net working capital (average NWC)/revenue (LTM) 14.0 Gearing (interest-bearing liabilities, net/EBITDA) no. of times 1.5 Return on equity (ROE) 5.4 Return on equity (ROE) excl. amortisation 8.6 Return on invested capital (ROIC) 4.9 Return on invested capital (ROIC) excl. amortisation 7.4 Adjusted market capitalisation/earnings before interest, tax and amortisation (EV/EBITA) 8.9 Equity ratio 38.4

48.5 (68.8) (23.1) (4.2) (2.3) (62.0)

46.6 (32.1) (13.8) (15.7) (6.4) (10.3)

118.2 (20.4) 23.0 (12.4) (7.8) 0.0

44.3 (74.7) 11.8 (4.7) (11.2) (58.6)

9.3 3.6 3.3 2.6 1.7 37.8 15.8 15.3 2.3 4.3 8.7 3.8 6.9 9.0 39.0

(2.1) (4.8) 4.3 3.5 3.0 30.5 15.9 15.4 1.6 9.1 11.8 7.0 8.8 11.1 41.6

(4.6) (12.1) 3.4 2.5 1.6 42.0 15.0 16.5 2.1 4.4 7.3 4.4 6.5 11.5 41.5

9.7 5.0 4.9 4.3 3.9 31.7 18.7 17.7 3.1 14.4 17.5 8.7 10.3 6.2 33.7

Document1

02-04-2013

14

SUMMARY FOR THE SOLAR GROUP 2008-2012 continued

Share ratios (% unless otherwise stated) 2012 Earnings per share in per share outstanding (EPS) 2.00 Earnings per share excl. amortisation in per share outstanding (EPS) 3.16 Intrinsic value in per share outstanding 37.5 Cash flow from operations per share outstanding 7.81 Share price in 34.4 Share price/intrinsic value 0.92 Dividend in per share 0.89 Dividend in % of net profit for the year (payout ratio) 44.8 Price earnings (P/E) 17.2 Share price in DKK 257 Dividend in DKK per share 6.65 Employees Average number of employees (FTE) Definitions Organic growth 2011 1.55 3.13 35.9 6.17 30.2 0.84 0.70 45.0 19.4 224 5.20 2010 3.13 4.08 36.3 5.93 56.6 1.56 1.34 42.9 18.1 422 10.00 2009 1.48 2.48 32.8 15.05 46.0 1.40 0.57 44.4 31.1 343 4.25 2008 4.55 5.53 30.3 6.60 25.6 0.85 2.01 43.6 5.6 191 15.00

3,596

3,200

2,955

3,175

3,010

Revenue growth adjusted for enterprises acquired and sold off and any exchange rate changes. No adjustments have been made for number of working days. Inventories and trade receivables less trade payables. Interest-bearing liabilities, net, relative to EBITDA. EBITDA have not been adjusted for enterprises and activities acquired. Return on invested capital calculated on the basis of operating profit or loss before special items less calculated tax.

Net working capital Gearing

ROIC

Financial ratios are calculated in accordance with the Danish Society of Financial Analysts' Recommendations & Financial Rat ios 2010.

Document1

02-04-2013

15

If relevant, analysis should be for Group not for Parent Company.

INCOME STATEMENT

Note 3 million 2012 Group 2011 Parent company 2012 2011

4 5 6

7 7

8 9 10 11 12 12

Revenue Cost of sales Gross profit Other operating income External operating costs Staff costs Loss on trade receivables Earnings before interest, tax, depreciation and amortisation (EBITDA) Depreciation on property, plant and equipment Earnings before interest, tax and amortisation (EBITA) Amortisation of intangible assets Earnings before interest and tax (EBIT) Dividends from subsidiaries Financial income Financial costs Earnings before tax (EBT) Income tax Net profit for the period

1,700.9 (1,337.9) 363.0 (80.1) (227.5) (5.9) 49.5 (11.5) 38.0 (9.1) 28.9 5.3 (11.0) 23.2 (7.5) 15.7 2.00 2.00

1,532.4 (1,206.4) 326.0 (70.9) (199.4) (4.5) 51.2 (12.1) 39.1 (12.4) 26.7 4.9 (12.0) 19.6 (7.4) 12.2 1.55 1.55

411.5 (299.6) 111.9 4.7 (11.5) (63.1) (1.7) 40.3 (3.7) 36.6 (4.8) 31.8 8.3 3.6 (26.9) 16.8 (8.1) 8.7

371.4 (270.6) 100.8 4.5 (11.1) (59.3) (2.5) 32.4 (3.5) 28.9 (4.4) 24.5 4.3 5.3 (19.5) 14.6 (6.4) 8.2

Earnings per share in per share outstanding (EPS) Diluted earnings per share in per share outstanding (EPS-D)

STATEMENT OF COMPREHENSIVE INCOME

Net profit for the period Other income and costs recognised: Foreign currency translation adjustment at the beginning of the year Foreign currency translation adjustment of foreign subsidiaries Value adjustment of hedging instruments before tax Tax on value adjustments of hedging instruments Other income and costs recognised after tax Total comprehensive income for the year 15.7 12.2 8.7 8.2

(1.0) 5.5 (2.8) 0.7 2.4 18.1

0.7 (0.7) (5.9) 1.5 (4.4) 7.8

(1.1) (3.0) 0.8 (3.3) 5.4

0.9 (4.3) 1.1 (2.3) 5.9

Document1

02-04-2013

16

If relevant, analysis should be for Group not for Parent Company.

BALANCE sheet

Note million 31.12 2012 Group 31.12 2011 31.12 2012 Parent company 31.12 2011

Assets: 13 Intangible assets 14 Property, plant and equipment 15 Investments Non-current assets 16 Inventories 17 Trade receivables Receivables from subsidiaries Income tax receivable Other receivables 18 Prepayments Cash at bank and in hand Assets held for sale Current assets Total assets

80.7 168.1 7.0 255.8 198.4 242.1 5.3 3.4 4.2 56.6 1.6 511.6 767.4

86.4 170.0 4.0 260.4 178.2 243.3 6.2 3.7 3.9 25.6 2.2 463.1 723.5

29.4 40.1 228.6 298.1 36.9 54.5 91.6 3.3 1.5 0.8 23.7 0.0 212.3 510.4

31.9 41.3 252.5 325.7 33.6 54.3 67.4 0.0 1.7 1.2 4.7 0.0 162.9 488.6

19

20 22 23 24 20

25 26 24

Equity and liabilities: Share capital Reserves Retained earnings Proposed dividend for the year Equity Interest-bearing liabilities Provision for pension obligations Provision for deferred tax Other provisions Non-current liabilities Interest-bearing liabilities Trade payables Amounts owed to subsidiaries Income tax payable Other payables Prepayments Other provisions Current liabilities Liabilities Total equity and liabilities

106.2 (8.1) 189.7 7.0 294.8 111.4 4.2 24.7 3.8 144.1 20.1 225.1 3.2 75.2 1.0 3.9 328.5 472.6 767.4

106.5 (11.5) 181.7 5.5 282.2 118.6 3.9 26.4 5.0 153.9 27.3 179.4 7.0 71.5 0.7 1.5 287.4 441.3 723.5

106.2 (9.8) 218.2 7.0 321.6 45.9 0.3 11.5 0.0 57.7 12.5 68.5 13.0 0.7 35.4 0.0 1.0 131.1 188.8 510.4

106.5 (7.6) 217.3 5.5 321.7 50.0 0.3 11.7 0.0 62.0 14.7 46.2 11.1 2.7 30.2 0.0 0.0 104.9 166.9 488.6

Document1

02-04-2013

17

If relevant, analysis should be for Group not for Parent Company.

Cash flow statement

Note million 2012 Group 2011 2012 Parent company 2011

8, 9 8, 9

13 27 28 27

Net profit for the period Depreciation and amortisation Change in provisions and other adjustments Financials, net Income tax Financials, net, paid Income tax paid Cash flow before change in working capital Change in inventories Change in receivables Change in interest-bearing liabilities Cash flow from operations Purchase of intangible assets Purchase of property, plant and equipment Purchase of investments Acquisition of subsidiaries and activities Divestment of property, plant and equipment Cash flow from investing activities Repayments of long-term, interest-bearing debt Raising of non-current interest-bearing liabilities Loans to subsidiaries Dividends distributed Cash flow from financing activities Total cash flow Cash as at 1 January Assumed on acquisition of subsidiaries Foreign currency translation adjustments Cash as at 31 December Cash as at 31 December Cash at bank and in hand Current interest-bearing liabilities Cash as at 31 December

15.7 20.6 (0.1) 5.7 7.5 (6.0) (14.9) 28.5 (17.1) 7.3 42.7 61.4 (2.3) (8.4) 0.0 0.0 1.3 (9.4) (8.9) 0.1 (5.5) (14.3) 37.7 (1.7) 0.0 0.5 36.5

12.2 24.5 (2.0) 7.1 7.4 (6.6) (5.2) 37.4 (1.2) 1.3 11.0 48.5 (4.2) (5.7) (0.3) (62.0) 3.4 (68.8) (12.6) 0.0 (10.5) (23.1) (43.4) 32.0 9.5 0.2 (1.7)

8.7 8.5 (0.9) 23.3 8.1 (0.6) (12.7) 34.4 (3.3) (4.9) 20.0 46.2 (2.3) (3.3) 0.0 0.0 0.7 (4.9) (4.2) 0.1 (10.5) (5.5) (20.1) 21.2 (10.0) 0.0 0.0 11.2

8.2 7.9 (0.1) 14.2 6.4 (0.2) (0.4) 36.0 (0.6) 0.8 14.1 50.3 (3.7) (3.9) (23.5) (18.5) 2.5 (47.1) (5.9) 0.0 (13.6) (10.5) (30.0) (26.8) 16.8 0.0 0.0 (10.0)

56.6 (20.1) 36.5

25.6 (27.3) (1.7)

23.7 (12.5) 11.2

4.7 (14.7) (10.0)

Document1

02-04-2013

18

Statement of changes in equity

Group Reserves for foreign currency translation adjustment

million

Share capital

Reserves for hedging transactions

Retained earnings

Proposed dividend

Total

2012: Equity as at 1 January 106.5 Foreign currency translation adjustment at the beginning of the year (0.3) Foreign currency translation adjustment of foreign subsidiaries Value adjustment of hedging instruments before tax Tax on value adjustments Net income recognised directly in equity (0.3) Net profit for the period Comprehensive income (0.3) Distribution of dividends Other movements 0.0 Equity as at 31 December 106.2

(11.7)

0.2

181.7 (0.7)

5.5

282.2 (1.0) 5.5 (2.8) 0.7 2.4 15.7 18.1 (5.5) (5.5) 294.8

5.5 (2.8) 0.7 (2.1) (2.1) 0.0 (13.8)

5.5 5.5 0.0 5.7

(0.7) 8.7 8.0 0.0 189.7

0.0 7.0 7.0 (5.5) (5.5) 7.0

2011: Equity as at 1 January 106.3 Foreign currency translation adjustment at the beginning of the year 0.2 Foreign currency translation adjustment of foreign subsidiaries Value adjustment of hedging instruments before tax Tax on value adjustments Net income recognised directly in equity 0.2 Net profit for the period Comprehensive income 0.2 Distribution of dividends Other movements 0.0 Equity as at 31 December 106.5

(7.3)

0.9

174.5 0.5

10.5

284.9 0.7 (0.7) (5.9) 1.5 (4.4) 12.2 7.8 (10.5) (10.5) 282.2

(0.7) (5.9) 1.5 (4.4) (4.4) 0.0 (11.7)

(0.7) (0.7) 0.0 0.2

0.5 6.7 7.2 0.0 181.7

0.0 5.5 5.5 (10.5) (10.5) 5.5

Document1

02-04-2013

19

Statement of changes in equity continued

Parent company Reserves for foreign currency translation adjustment Share capital Reserves for hedging transactions Retained earnings Proposed dividend

million

Total

2012: Equity as at 1 January 106.5 Foreign currency translation adjustment at the beginning of the year (0.3) Value adjustment of hedging instruments before tax Tax on value adjustments Net income recognised directly in equity (0.3) Net profit for the period Comprehensive income (0.3) Distribution of dividends Other movements 0.0 Equity as at 31 December 106.2

(7.5)

(0.1)

217.3 (0.8)

5.5

321.7 (1.1) (3.0) 0.8 (3.3) 8.7 5.4 (5.5) (5.5) 321.6

(3.0) 0.8 (2.2) (2.2) 0.0 (9.7)

0.0 0.0 0.0 (0.1)

(0.8) 1.7 0.9 0.0 218.2

0.0 7.0 7.0 (5.5) (5.5) 7.0

2011: Equity as at 1 January 106.3 Foreign currency translation adjustment at the beginning of the year 0.2 Value adjustment of hedging instruments before tax Tax on value adjustments Net income recognised directly in equity 0.2 Net profit for the period Comprehensive income 0.2 Distribution of dividends Other movements 0.0 Equity as at 31 December 106.5

(4.3)

(0.1)

213.9 0.7

10.5

326.3 0.9 (4.3) 1.1 (2.3) 8.2 5.9 (10.5) (10.5) 321.7

(4.3) 1.1 (3.2) (3.2) 0.0 (7.5)

0.0 0.0 0.0 (0.1)

0.7 2.7 3.4 0.0 217.3

0.0 5.5 5.5 (10.5) (10.5) 5.5

Document1

02-04-2013

20

Das könnte Ihnen auch gefallen

- Trine UpdatesDokument3 SeitenTrine UpdatesGergő KissNoch keine Bewertungen

- Gergo - Kiss FirstsemesterlogisticsexamDokument6 SeitenGergo - Kiss FirstsemesterlogisticsexamGergő KissNoch keine Bewertungen

- Case 8 Manny Flavours Cookie Company: Read The Following Case, Consider Relevant Issues Involved in The CaseDokument1 SeiteCase 8 Manny Flavours Cookie Company: Read The Following Case, Consider Relevant Issues Involved in The CaseGergő KissNoch keine Bewertungen

- Balance Sheet Key Figures and Asset/Liability BreakdownDokument1 SeiteBalance Sheet Key Figures and Asset/Liability BreakdownGergő KissNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Accenture Study Guide Certified AdministratorDokument7 SeitenAccenture Study Guide Certified AdministratorViv ekNoch keine Bewertungen

- Shooting StarDokument2 SeitenShooting Starlaba primeNoch keine Bewertungen

- I HG F Autumn 2018 ApplicationformDokument8 SeitenI HG F Autumn 2018 ApplicationformSnzy DelNoch keine Bewertungen

- Case InstructionsDokument4 SeitenCase InstructionsHw SolutionNoch keine Bewertungen

- Chap 009Dokument21 SeitenChap 009Kedia Rama50% (2)

- Institute of Rural Management AnandDokument6 SeitenInstitute of Rural Management AnandAmit Kr GodaraNoch keine Bewertungen

- DevelopmentThatPays Scrumban CheatSheet 3 - 0Dokument1 SeiteDevelopmentThatPays Scrumban CheatSheet 3 - 0Hamed KamelNoch keine Bewertungen

- STAFF INSTRUCTIONSDokument56 SeitenSTAFF INSTRUCTIONSBatjargal EnkhbatNoch keine Bewertungen

- Square Inc - 2016 Annual Report (Form 10-K)Dokument172 SeitenSquare Inc - 2016 Annual Report (Form 10-K)trung ducNoch keine Bewertungen

- Freddie Mac internal controlsDokument2 SeitenFreddie Mac internal controlsElla Marie LopezNoch keine Bewertungen

- Develop Business in Rural Areas With The Help of Digital PlatformsDokument30 SeitenDevelop Business in Rural Areas With The Help of Digital PlatformsMd Tasnim FerdousNoch keine Bewertungen

- Handbook of Value Added Tax by Farid Mohammad NasirDokument15 SeitenHandbook of Value Added Tax by Farid Mohammad NasirSamia SultanaNoch keine Bewertungen

- Fashion Fund SACDokument22 SeitenFashion Fund SACKartik RamNoch keine Bewertungen

- How Thought Leadership Drives Demand Generation: 2019 Edelman-Linkedin B2B Thought Leadership Impact StudyDokument27 SeitenHow Thought Leadership Drives Demand Generation: 2019 Edelman-Linkedin B2B Thought Leadership Impact StudyDiego TellezNoch keine Bewertungen

- BP Steve FlynnDokument11 SeitenBP Steve Flynngeorgel.ghitaNoch keine Bewertungen

- Practices by KFCDokument17 SeitenPractices by KFCfariaNoch keine Bewertungen

- Brand Book AmChamDokument16 SeitenBrand Book AmChamDraganescu OanaNoch keine Bewertungen

- Economic ServicesDokument34 SeitenEconomic ServicesTUMAUINI TOURISMNoch keine Bewertungen

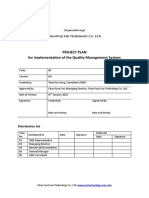

- 01 - Project - Plan - EN For CPS Co - LTDDokument8 Seiten01 - Project - Plan - EN For CPS Co - LTDThant AungNoch keine Bewertungen

- Import Direct From ChinaDokument29 SeitenImport Direct From Chinagrncher100% (2)

- HIPPADokument5 SeitenHIPPAAsmita Wankhede MeshramNoch keine Bewertungen

- A Rib A Supplier EnablementDokument2 SeitenA Rib A Supplier Enablementeternal_rhymes6972Noch keine Bewertungen

- Strategic Analysis of United Bank Limited. MS WordDokument39 SeitenStrategic Analysis of United Bank Limited. MS Wordshahid_pak1_26114364100% (2)

- Go-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaDokument58 SeitenGo-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaFounderinstituteNoch keine Bewertungen

- Problem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at ADokument2 SeitenProblem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at AMa Teresa B. CerezoNoch keine Bewertungen

- (N-Ab) (1-A) : To Tariffs)Dokument16 Seiten(N-Ab) (1-A) : To Tariffs)Amelia JNoch keine Bewertungen

- CMA TOPIC4 Differential Analysis (Chapter 14) PDFDokument3 SeitenCMA TOPIC4 Differential Analysis (Chapter 14) PDF靳雪娇Noch keine Bewertungen

- Sustainable Supply Chain Evolution and FutureDokument42 SeitenSustainable Supply Chain Evolution and Futureatiqa tanveerNoch keine Bewertungen

- MB4 - Compliance Requirements 010615Dokument12 SeitenMB4 - Compliance Requirements 010615ninja980117Noch keine Bewertungen

- Organisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaDokument62 SeitenOrganisation Study - Project Report For Mba Iii Semester - MG University - Kottayam - KeralaSasikumar R Nair79% (19)