Beruflich Dokumente

Kultur Dokumente

Financial Analysis - Total SA Explores For, Produces, Refines, Transports, and Markets Oil and Natural Gas

Hochgeladen von

Q.M.S Advisors LLCOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Analysis - Total SA Explores For, Produces, Refines, Transports, and Markets Oil and Natural Gas

Hochgeladen von

Q.M.S Advisors LLCCopyright:

Verfügbare Formate

24.04.

2013

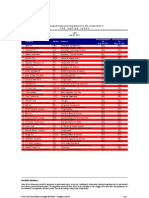

Company Analysis - Overview

Ticker:

Total SA

FP FP

Currency:

Sector: Energy

Industry: Oil, Gas & Consumable Fuels

Year:

Telephone

33-1-47-44-45-46

Revenue (M)

Website

www.total.com

No of Employees

Address

2 place Jean Miller La Defense 6 Paris La Defense Cedex, 92400 France

Share Price Performance in EUR

Price

37.49

1M Return

52 Week High

40.21

6M Return

52 Week Low

31.46

52 Wk Return

52 Wk Beta

0.90

YTD Return

Credit Ratings

Bloomberg

S&P

Moody's

Fitch

IG2

AAAa1

AA

Date

Date

Date

Total SA explores for, produces, refines, transports, and markets oil and natural gas.

The Company also operates a chemical division which produces polypropylene,

polyethylene, polystyrene, rubber, paint, ink, adhesives, and resins. Total operates

gasoline filling stations in Europe, the United States, and Africa.

Benchmark:

CAC 40 INDEX (CAC)

EN Paris: FP, Currency: EUR

12.04.2011

12.04.2002

Outlook

Outlook

Outlook

182'299

97'126

-1.6%

-0.1%

10.9%

-2.4%

Business Segments in EUR

Chemicals Net

Downstream Net

Upstream Net

Corporate Net

Intercompany

12%

STABLE

NEG

STABLE

Sales (M)

87524

72445

22143

187

0%

Sales (M)

103862

45981

17921

17648

14649

-17762

8%

7%

8%

Valuation Ratios

12/09

11.9x

7.7x

5.2x

0.9x

1.9x

5.1%

12/10

8.4x

5.5x

3.7x

0.6x

1.5x

5.8%

12/11

7.2x

4.4x

3.3x

0.5x

1.3x

5.8%

12/12

8.2x

4.8x

3.3x

0.5x

1.2x

6.0%

12/13E

7.2x

3.2x

0.5x

1.1x

6.4%

12/14E

7.1x

3.1x

0.5x

1.0x

6.5%

12/15E

6.7x

2.9x

0.5x

0.9x

6.7%

12/09

Gross Margin

EBITDA Margin

19.8

Operating Margin

13.5

Profit Margin

7.5

Return on Assets

6.9

Return on Equity

16.6

Leverage and Coverage Ratios

12/09

Current Ratio

1.4

Quick Ratio

0.8

EBIT/Interest

28.5

Tot Debt/Capital

0.3

Tot Debt/Equity

0.5

Eff Tax Rate %

47.3

12/10

20.0

13.4

7.5

7.8

18.7

12/11

19.8

14.6

7.4

8.0

19.1

12/12

17.7

12.0

5.9

6.4

15.2

12/13E

18.5

13.1

6.6

10.6

15.4

12/14E

19.0

12.7

6.9

11.3

14.4

12/15E

20.6

13.0

7.4

11.9

13.8

P/E

EV/EBIT

EV/EBITDA

P/S

P/B

Div Yield

Profitability Ratios %

Geographic Segments in EUR

Rest of Europe

France

Africa

North America

Rest of the World

Unallocated- Excise taxes

48%

48%

8%

40%

21%

Chemicals Net

Downstream Net

Rest of Europe

France

Africa

North America

Upstream Net

Corporate Net

Rest of the World

Unallocated- Excise taxes

12/10

1.4

0.8

40.6

0.3

0.5

48.6

12/11

1.4

0.7

34.1

0.3

0.5

52.8

12/12

1.4

0.7

32.6

0.3

0.4

54.7

Current Capitalization in EUR

Common Shares Outstanding (M)

Market Capitalization (M)

Cash and ST Investments (M)

Total Debt (M)

Preferred Equity (M)

LT Investments in Affiliate Companies (M)

Investments (M)

Enterprise Value (M)

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

2257.5

88698.9

17031.0

33290.0

0.0

0.0

1281.0

106238.9

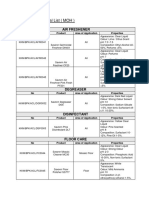

Company Analysis - Analysts Ratings

Total SA

Buy and Sell Recommendations vs Price and Target Price

50

100%

14%

11%

14%

9%

9%

9%

9%

80%

32%

37%

34%

38%

41%

39%

41%

9%

12%

11%

11%

11%

32%

26%

26%

22%

22%

45

40

35

30

60%

Price

Brokers' Target Price

60

50

40

30

25

20

40%

62%

59%

15

Date

Buy

Hold

Sell

Date

29-Mar-13

28-Feb-13

31-Jan-13

31-Dec-12

30-Nov-12

31-Oct-12

28-Sep-12

31-Aug-12

31-Jul-12

29-Jun-12

31-May-12

30-Apr-12

67%

67%

63%

62%

59%

50%

52%

50%

53%

51%

51%

54%

22%

22%

26%

26%

32%

41%

39%

41%

38%

34%

37%

32%

11%

11%

11%

12%

9%

9%

9%

9%

9%

14%

11%

14%

24-Apr-13

23-Apr-13

22-Apr-13

19-Apr-13

18-Apr-13

17-Apr-13

16-Apr-13

15-Apr-13

12-Apr-13

11-Apr-13

10-Apr-13

9-Apr-13

8-Apr-13

5-Apr-13

4-Apr-13

3-Apr-13

2-Apr-13

1-Apr-13

29-Mar-13

28-Mar-13

27-Mar-13

26-Mar-13

25-Mar-13

22-Mar-13

21-Mar-13

20-Mar-13

19-Mar-13

18-Mar-13

15-Mar-13

14-Mar-13

Price Target Price

37.49

36.95

35.79

35.54

35.28

35.25

36.19

36.55

37.19

37.51

37.46

37.11

36.75

36.75

37.32

37.51

38.20

37.36

37.36

37.36

37.44

37.70

37.80

38.10

38.25

38.73

38.40

38.73

38.58

38.97

45.36

45.36

45.40

45.40

45.40

45.40

45.40

45.25

45.33

45.69

45.65

45.62

45.65

45.65

45.65

45.78

45.78

45.78

45.78

45.78

45.78

45.78

45.78

45.74

45.74

45.74

45.69

45.69

45.69

45.69

Broker

Analyst

Societe Generale

Sanford C. Bernstein & Co

Tudor Pickering & Co

Barclays

Grupo Santander

Deutsche Bank

RBC Capital Markets

Jefferies

Nomura

AlphaValue

Exane BNP Paribas

JPMorgan

Hamburger Sparkasse

Macquarie

Simmons & Company International

Investec

Credit Suisse

Independent Research GmbH

Day by Day

Raymond James

Goldman Sachs

VTB Capital

HSBC

Canaccord Genuity Corp

Banco Sabadell

CM - CIC Securities(ESN)

S&P Capital IQ

Natixis

Ahorro Corporacion Financiera SA

EVA Dimensions

IRENE HIMONA

OSWALD CLINT

ROBERT KESSLER

LYDIA RAINFORTH

JASON KENNEY

LUCAS HERRMANN

PETER HUTTON

IAIN REID

THEEPAN JOTHILINGAM

ALEXANDRE ANDLAUER

ALEJANDRO DEMICHELIS

NITIN SHARMA

INGO SCHMIDT

JASON D GAMMEL

JEFFREY A DIETERT

STUART JOYNER

KIM FUSTIER

SVEN DIERMEIER

VALERIE GASTALDY

BERTRAND HODEE

MICHELE DELLA VIGNA

COLIN SMITH

PAUL SPEDDING

GORDON GRAY

JORGE GONZALEZ SADORNIL

JEAN-LUC ROMAIN

CHRISTINE TISCARENO

ANNE PUMIR

VIRGINIA PEREZ REPES

CRAIG STERLING

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Recommendation

buy

outperform

accumulate

underweight

buy

buy

outperform

buy

neutral

reduce

outperform

overweight

hold

neutral

overweight

hold

neutral

hold

hold

market perform

Sell/Cautious

buy

overweight

buy

buy

buy

buy

buy

buy

buy

CA Cheuvreux

Morgan Stanley

EVA

Landesbank

Natixis

Ahorro

CM - CIC

S&P Capital IQ

HSBC

Canaccord

Raymond

Banco Sabadell

Target Price

Day by Day

mars.13

Investec

fvr.13

Macquarie

janv.13

VTB Capital

Price

dc.12

Goldman Sachs

Sell

nov.12

Independent

Hold

oct.12

Credit Suisse

Buy

sept.12

Simmons &

aot.12

JPMorgan

juil.12

Hamburger

juin.12

Exane BNP

0

mai.12

Nomura

0%

0

AlphaValue

5

avr.12

10

10

Jefferies

50%

RBC Capital

52%

Grupo

50%

Deutsche Bank

53%

Barclays

51%

20

Tudor Pickering

51%

67%

Societe

54%

20%

67%

63%

Sanford C.

Broker Recommendation

Target price in EUR

Target

Date

47.00

52.00

44.00

44.00

45.30

44.00

44.00

48.00

40.00

36.40

48.00

49.00

23-Apr-13

23-Apr-13

23-Apr-13

22-Apr-13

19-Apr-13

19-Apr-13

18-Apr-13

18-Apr-13

18-Apr-13

18-Apr-13

17-Apr-13

16-Apr-13

16-Apr-13

15-Apr-13

15-Apr-13

12-Apr-13

12-Apr-13

4-Apr-13

4-Apr-13

28-Mar-13

20-Mar-13

1-Mar-13

27-Feb-13

21-Feb-13

15-Feb-13

14-Feb-13

13-Feb-13

7-Feb-13

6-Feb-13

17-Jan-13

42.00

37.00

44.00

40.00

42.00

50.00

46.00

45.00

47.10

54.00

48.00

46.50

49.00

24.04.2013

Total SA

Company Analysis - Ownership

Ownership Type

Ownership Statistics

Shares Outstanding (M)

Float

Short Interest (M)

Short Interest as % of Float

Days to Cover Shorts

Institutional Ownership

Retail Ownership

Insider Ownership

France

United States

Belgium

Norway

Qatar

Luxembourg

Britain

Others

34%

33.81%

66.18%

0.01%

Geographic Ownership

Geographic Ownership Distribution

0%

2257.5

86.0%

66%

44.08%

17.59%

11.11%

5.21%

5.20%

3.89%

2.65%

10.26%

3% 10%

4%

5%

44%

5%

11%

Institutional Ownership

Retail Ownership

Insider Ownership

Pricing data is in EUR

Top 20 Owners:

Holder Name

AMUNDI

TOTAL SA

GROUPE BRUXELLES LAM

QATAR HOLDINGS LLC

NORGES BANK

NATIONALE A PORTEFEU

BLACKROCK

VANGUARD GROUP INC

CAPITAL GROUP COMPAN

AMUNDI

FRANKLIN RESOURCES

NATIXIS ASSET MANAGE

ONTARIO TEACHERS PEN

BANK OF NEW YORK MEL

AVIVA PLC

GRANTHAM MAYO VAN OT

LBPAM

WADDELL & REED FINAN

FIRST EAGLE INVESTME

ALLIANZ ASSET MANAGE

Institutional Ownership Distribution

Investment Advisor

Corporation

Holding Company

Government

Others

18%

61.93%

11.96%

10.41%

10.38%

5.32%

France

United States

Belgium

Norway

Qatar

Luxembourg

Britain

Others

TOP 20 ALL

Position

180'919'481

108'732'635

94'636'768

47'275'059

47'038'683

33'122'869

27'201'788

23'453'323

16'544'065

15'777'952

13'366'774

11'704'762

11'200'000

10'685'170

10'451'098

8'398'572

7'845'725

7'573'598

7'054'684

6'633'821

Position Change

0

0

559'401

0

0

-2'333'425

-196'341

266'904

-3'190'535

-708'338

-298'176

-4'002'760

0

187'438

0

21'870

53'504

-6'360

0

34'495

Market Value

6'782'671'343

4'076'386'486

3'547'932'432

1'772'341'962

1'763'480'226

1'241'776'359

1'019'795'032

879'265'079

620'236'997

591'515'420

501'120'357

438'811'527

419'888'000

400'587'023

391'811'664

314'862'464

294'136'230

283'934'189

264'480'103

248'701'949

% of Ownership

7.65%

4.60%

4.00%

2.00%

1.99%

1.40%

1.15%

0.99%

0.70%

0.67%

0.56%

0.49%

0.47%

0.45%

0.44%

0.35%

0.33%

0.32%

0.30%

0.28%

Report Date

Holder Name

Position

Position Change

Market Value

% of Ownership

Report Date

DESMAREST THIERRY

MARGERIE CHRISTOPHE DE

COLLOMB BERTRAND P

LAMARCHE GERARD

PEBEREAU MICHEL

186'576

105'556

4'932

2'775

2'356

31.12.2012

31.12.2012

31.12.2012

14.03.2012

31.12.2011

31.12.2012

22.04.2013

31.03.2013

31.03.2013

31.12.2012

28.02.2013

28.03.2013

31.12.2011

23.04.2013

28.03.2013

30.11.2012

31.01.2013

31.12.2012

30.09.2012

31.03.2013

Source

13G

20F

20F

Research

Research

20F

ULT-AGG

MF-AGG

ULT-AGG

MF-AGG

ULT-AGG

MF-AGG

Research

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

ULT-AGG

Top 5 Insiders:

6'994'734

3'957'294

184'901

104'035

88'326

0.01%

0.00%

0.00%

0.00%

0.00%

Source

31.12.2012

31.12.2012

31.12.2012

31.12.2012

31.12.2012

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

20F

20F

20F

20F

20F

Country

FRANCE

FRANCE

BELGIUM

QATAR

NORWAY

FRANCE

UNITED STATES

UNITED STATES

UNITED STATES

FRANCE

UNITED STATES

FRANCE

CANADA

UNITED STATES

BRITAIN

UNITED STATES

FRANCE

UNITED STATES

UNITED STATES

GERMANY

Institutional Ownership

5%

10%

10%

63%

12%

Investment Advisor

Corporation

Government

Others

Holding Company

Company Analysis - Financials I/IV

Total SA

Financial information is in EUR (M)

Periodicity:

Fiscal Year

Equivalent Estimates

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

12/13E

12/14E

12/15E

102'540

104'652

100'481

117'057

132'689

136'824

160'331

112'153

140'476

166'550

182'299

180'404

179'899

177'014

92'626

662

92'021

667

83'795

635

92'888

510

108'559

569

111'523

594

136'644

612

97'029

650

121'591

715

142'260

776

160'437

805

9'914

597

16'686

737

75

-3'845

24'169

1'214

24'130

1'731

25'301

1'783

23'687

1'000

15'124

530

18'885

465

24'290

713

21'862

671

23'609

22'900

23'067

-1'955

-3'461

-3'592

-2'412

-1'786

-2'615

-3'077

-2'716

23'846

24'495

25'311

11'959

5.20

2.38

0.46

12'366

5.31

2.43

0.46

13'105

5.58

2.53

0.45

33'435

34'266

36'421

Income Statement

Revenue

- Cost of Goods Sold

Gross Income

- Selling, General & Admin Expenses

(Research & Dev Costs)

Operating Income

- Interest Expense

- Foreign Exchange Losses (Gains)

- Net Non-Operating Losses (Gains)

-1'671

12'631

629

59

-629

Pretax Income

- Income Tax Expense

10'988

5'034

12'572

5'353

19'719

8'570

24'910

11'806

25'860

13'720

27'110

13'575

25'099

14'146

16'380

7'751

21'035

10'228

26'654

14'073

23'907

13'066

Income Before XO Items

- Extraordinary Loss Net of Tax

- Minority Interests

5'954

0

13

7'219

0

194

11'149

0

281

13'104

461

370

12'140

5

367

13'535

0

354

10'953

0

363

8'629

0

182

10'807

0

236

12'581

0

305

10'841

0

147

Diluted EPS Before XO Items

2.23

2.77

4.48

5.40

5.09

5.80

4.71

3.78

4.71

5.44

4.72

Net Income Adjusted*

EPS Adjusted

Dividends Per Share

Payout Ratio %

5'941

2.23

1.03

47.4

7'025

2.78

1.18

43.8

9'612

3.91

1.35

31.6

12'273

4.85

1.62

31.3

12'585

5.49

1.87

38.5

12'203

5.41

2.07

37.6

13'920

6.23

2.28

51.1

7'784

3.49

2.28

63.4

10'288

4.58

2.28

50.7

11'424

5.08

2.28

43.9

12'361

5.45

2.34

51.8

Total Shares Outstanding

Diluted Shares Outstanding

2'609

2'664

2'448

2'541

2'384

2'426

2'323

2'362

2'265

2'312

2'244

2'274

2'229

2'247

2'233

2'237

2'237

2'244

2'254

2'257

2'258

2'267

15'918

17'936

22'408

29'821

29'422

30'726

29'887

22'234

28'045

32'919

32'343

EBITDA

*Net income excludes extraordinary gains and losses and one-time charges.

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Company Analysis - Financials II/IV

Periodicity:

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

Total Current Assets

+ Cash & Near Cash Items

+ Short Term Investments

+ Accounts & Notes Receivable

+ Inventories

+ Other Current Assets

31319

4'966

1'508

13'087

6'515

5'243

29513

4'836

1'404

12'357

6'137

4'779

32940

3'860

477

14'025

9'264

5'314

43753

4'318

334

19'612

12'690

6'799

42787

2'493

3'908

17'393

11'746

7'247

48238

5'988

1'264

19'129

13'851

8'006

47058

12'321

187

15'287

9'621

9'642

49757

11'662

311

15'719

13'867

8'198

58206

14'489

1'205

18'159

15'600

8'753

63663

14'025

700

20'049

18'691

10'198

67517

15'469

1'562

19'206

18'055

13'225

Total Long-Term Assets

+ Long Term Investments

Gross Fixed Assets

Accumulated Depreciation

+ Net Fixed Assets

+ Other Long Term Assets

54'010

1'221

97'592

59'000

38'592

14'197

50'450

1'162

93'819

57'533

36'286

13'002

53'827

2'714

34'906

16'207

62'391

1'516

106'034

65'466

40'568

20'307

62'436

1'250

102'211

61'635

40'576

20'610

65'303

1'291

102'845

61'378

41'467

22'545

71'252

1'165

108'822

62'680

46'142

23'945

77'996

1'162

121'422

69'832

51'590

25'244

85'512

4'590

131'920

76'956

54'964

25'958

100'386

3'674

147'144

82'687

64'457

32'255

104'312

1'190

156'686

87'354

69'332

33'790

Total Current Liabilities

+ Accounts Payable

+ Short Term Borrowings

+ Other Short Term Liabilities

25'182

10'236

5'096

9'850

23'109

10'304

3'835

8'970

26'777

11'672

3'957

11'148

33'428

16'406

3'953

13'069

33'522

15'080

5'933

12'509

35'662

18'183

4'673

12'806

34'327

14'815

7'880

11'632

34'408

15'383

7'117

11'908

40'448

18'450

9'653

12'345

46'702

22'086

9'675

14'941

49'019

21'648

11'016

16'355

Total Long Term Liabilities

+ Long Term Borrowings

+ Other Long Term Borrowings

26'800

10'157

16'643

25'388

9'783

15'605

27'572

11'289

16'283

31'233

13'793

17'440

30'553

14'174

16'379

32'179

14'876

17'303

34'033

16'191

17'842

39'806

19'437

20'369

41'999

20'783

21'216

47'958

22'557

25'401

48'617

22'274

26'343

Total Liabilities

+ Long Preferred Equity

+ Minority Interest

+ Share Capital & APIC

+ Retained Earnings & Other Equity

51'982

724

37'386

-4'763

48'497

396

664

51'742

-21'336

54'349

0

810

38'067

-6'459

64'661

0

838

43'655

-3'010

64'075

0

827

47'524

-7'203

67'841

0

842

54'786

-9'928

68'360

0

958

34'213

14'779

74'214

0

987

33'042

19'510

82'447

0

857

33'082

27'332

94'660

0

1'352

5'909

62'128

97'636

0

1'281

5'915

66'997

Total Shareholders Equity

33'347

31'466

32'418

41'483

41'148

45'700

49'950

53'539

61'271

69'389

74'193

Total Liabilities & Equity

85'329

79'963

86'767

106'144

105'223

113'541

118'310

127'753

143'718

164'049

171'829

12.51

11.45

12.42

11.60

13.26

11.93

17.49

15.61

17.81

15.73

19.99

17.92

21.98

19.59

23.53

20.17

27.00

23.02

30.18

24.68

32.30

26.60

12/13E

12/14E

12/15E

34.93

37.92

41.64

Balance Sheet

Book Value Per Share

Tangible Book Value Per Share

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Company Analysis - Financials III/IV

Periodicity:

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

12/13E

12/14E

12/15E

5'941

6'004

-875

-64

7'025

5'305

-225

382

10'868

5'722

-1'675

-253

12'273

5'652

598

-3'854

11'768

5'292

-689

-310

13'181

5'425

556

-1'476

10'590

6'200

-692

2'571

8'447

7'110

119

-3'316

10'571

9'160

-742

-496

12'276

8'629

370

-1'739

10'694

10'481

203

1'084

12'036

12'709

13'858

Cash From Operating Activities

+ Disposal of Fixed Assets

+ Capital Expenditures

+ Increase in Investments

+ Decrease in Investments

+ Other Investing Activities

11'006

290

-6'942

12'487

315

-6'708

-476

743

392

14'662

225

-7'403

-996

966

-504

14'669

274

-8'848

16'061

413

-9'910

12'360

138

-11'849

-1'340

2'943

-160

18'493

1'534

-13'812

-945

2'472

-1'206

19'536

1'439

-17'950

-1'212

6'564

-4'804

22'462

1'418

-19'905

-1'949

4'101

-737

-20'793

-20'832

699

-776

18'669

130

-11'861

-1'220

2'367

-471

-21'713

135

-1'668

17'686

569

-10'549

-1'153

982

-15

Cash From Investing Activities

+ Dividends Paid

+ Change in Short Term Borrowings

+ Increase in Long Term Borrowings

+ Decrease in Long Term Borrowings

+ Increase in Capital Stocks

+ Decrease in Capital Stocks

+ Other Financing Activities

-6'849

-2'514

746

1'642

-7'712

-4'293

-2'195

2'249

0

371

-3'554

-528

-10'107

-3'510

-951

2'878

-9'574

-3'999

-6

3'722

-10'166

-4'510

-2'654

3'220

-11'055

-4'945

1'437

3'009

-10'268

-5'086

-3'124

5'522

-11'957

-5'098

-1'548

3'789

-15'963

-5'140

-2'974

4'069

-17'072

-5'184

-2'754

5'279

461

-2'945

-155

-5'734

-2'571

-2'153

2'657

-549

69

-3'994

-342

17

-3'189

-311

511

-3'830

-3'805

89

-1'526

1'356

262

-1'189

145

63

90

481

-126

-942

-473

32

-68

-1'251

Cash From Financing Activities

-2'765

-6'883

-7'950

-5'066

-7'407

-4'025

-1'281

-2'751

-3'709

-4'037

-3'946

Net Changes in Cash

1'392

-130

-1'000

-504

-920

3'495

6'333

-659

2'827

-464

1'444

Free Cash Flow (CFO-CAPEX)

4'064

5'779

7'259

5'821

6'151

7'137

6'808

511

4'681

1'586

2'557

1'195

2'819

4'672

Free Cash Flow To Firm

Free Cash Flow To Equity

Free Cash Flow per Share

4'387

6'140

1.53

2.28

7'676

7'142

3.00

6'460

8'022

2.37

6'964

10'280

2.68

8'027

8'272

3.16

7'244

11'384

3.05

790

3'047

0.23

4'920

8'456

2.09

1'923

4'120

0.71

2'861

6'500

1.13

Cash Flows

Net Income

+ Depreciation & Amortization

+ Other Non-Cash Adjustments

+ Changes in Non-Cash Capital

1'346

-1'543

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Company Analysis - Financials IV/IV

Periodicity:

12/02

12/03

12/04

12/05

12/06

12/07

12/08

12/09

12/10

12/11

12/12

12/13E

12/14E

12/15E

Valuation Ratios

Price Earnings

EV to EBIT

EV to EBITDA

Price to Sales

Price to Book

Dividend Yield

15.2x

9.9x

6.2x

0.9x

2.7x

3.0%

13.3x

7.8x

5.5x

0.9x

3.0x

3.2%

8.9x

6.4x

4.8x

1.0x

3.0x

3.4%

10.3x

5.7x

4.6x

1.1x

3.0x

3.1%

10.6x

5.7x

4.7x

0.9x

3.1x

3.4%

9.7x

5.6x

4.6x

0.9x

2.8x

3.6%

8.2x

4.2x

3.3x

0.5x

1.8x

5.9%

11.9x

7.7x

5.2x

0.9x

1.9x

5.1%

8.4x

5.5x

3.7x

0.6x

1.5x

5.8%

7.2x

4.4x

3.3x

0.5x

1.3x

5.8%

8.2x

4.8x

3.3x

0.5x

1.2x

6.0%

7.2x

7.1x

6.7x

3.2x

0.5x

1.1x

6.4%

3.1x

0.5x

1.0x

6.5%

2.9x

0.5x

0.9x

6.7%

Profitability Ratios

Gross Margin

EBITDA Margin

Operating Margin

Profit Margin

Return on Assets

Return on Equity

15.5%

9.7%

5.8%

6.8%

17.9%

17.1%

12.1%

6.7%

8.5%

22.3%

22.3%

16.6%

10.8%

13.0%

35.1%

25.5%

20.6%

10.5%

12.7%

34.0%

22.2%

18.2%

8.9%

11.1%

29.1%

22.5%

18.5%

9.6%

12.1%

30.9%

18.6%

14.8%

6.6%

9.1%

22.6%

19.8%

13.5%

7.5%

6.9%

16.6%

20.0%

13.4%

7.5%

7.8%

18.7%

19.8%

14.6%

7.4%

8.0%

19.1%

17.7%

12.0%

5.9%

6.4%

15.2%

18.5%

13.1%

6.6%

10.6%

15.4%

19.0%

12.7%

6.9%

11.3%

14.4%

20.6%

13.0%

7.4%

11.9%

13.8%

Leverage & Coverage Ratios

Current Ratio

Quick Ratio

Interest Coverage Ratio (EBIT/I)

Tot Debt/Capital

Tot Debt/Equity

1.24

0.78

14.45

0.31

0.46

1.28

0.80

20.08

0.30

0.43

1.23

0.69

22.64

0.32

0.47

1.31

0.73

19.91

0.30

0.43

1.28

0.71

13.94

0.33

0.49

1.35

0.74

14.19

0.30

0.43

1.37

0.81

23.69

0.33

0.48

1.45

0.80

28.54

0.33

0.50

1.44

0.84

40.61

0.33

0.50

1.36

0.74

34.07

0.32

0.46

1.38

0.74

32.58

0.31

0.45

1.18

7.71

1.27

8.23

1.21

7.62

1.21

6.96

1.26

7.17

1.25

7.49

1.38

9.32

0.91

7.23

1.03

8.29

1.08

8.72

1.09

9.29

45.8%

42.6%

43.5%

47.4%

53.1%

50.1%

56.4%

47.3%

48.6%

52.8%

54.7%

Ratio Analysis

Others

Asset Turnover

Accounts Receivable Turnover

Accounts Payable Turnover

Inventory Turnover

Effective Tax Rate

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Company Analysis - Peers Comparision

TOTAL SA

Latest Fiscal Year:

52-Week High

52-Week High Date

52-Week Low

52-Week Low Date

Daily Volume

Current Price (4/dd/yy)

52-Week High % Change

52-Week Low % Change

Total Common Shares (M)

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Total Revenue

EV/Total Revenue

EBITDA

EV/EBITDA

EPS

P/E

Revenue Growth

EBITDA Growth

EBITDA Margin

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

LFY

LTM

CY+1

CY+2

1 Year

5 Year

1 Year

5 Year

LTM

CY+1

CY+2

ROYAL DUTCH SHA

BP PLC

ENI SPA

EXXON MOBIL

CORP

STATOIL ASA

CHEVRON CORP

CONOCOPHILLIPS

IMPERIAL OIL

12/2012

42.00

14.09.2012

33.42

01.06.2012

2'161'740

12/2012

2'323.50

30.01.2013

1'956.50

18.05.2012

716'202

12/2012

482.05

30.01.2013

389.50

18.05.2012

7'753'519

12/2012

19.59

18.01.2013

14.94

25.07.2012

7'350'269

12/2012

93.67

19.10.2012

77.13

05.06.2012

15'571'115

12/2012

155.00

24.09.2012

132.60

18.04.2013

1'883'582

12/2012

121.56

25.03.2013

95.73

04.06.2012

6'746'638

12/2012

62.05

30.01.2013

50.62

04.06.2012

7'527'672

12/2012

48.32

14.09.2012

38.58

23.04.2013

1'297'056

37.49

2'169.50

455.10

17.88

89.30

136.80

117.48

57.78

39.18

-10.7%

12.2%

2'257.5

-6.6%

10.9%

6'331.2

-5.6%

16.8%

19'135.8

-8.7%

19.7%

3'622.8

-4.7%

15.8%

4'502.0

-11.7%

3.2%

3'180.0

-3.4%

22.7%

1'946.7

-6.9%

14.1%

1'220.0

-18.9%

1.6%

848.0

PETROBRAS-PREF OCCIDENTAL PETE

12/2012

23.84

14.09.2012

16.40

01.03.2013

34'735'500

ZAZA ENERGY

CORP

BG GROUP PLC

12/2012

93.78

01.05.2012

72.43

16.11.2012

5'486'325

12/2012

1'468.50

02.05.2012

991.00

19.11.2012

2'408'673

19.18

81.69

-19.5%

17.0%

13'044.5

-12.9%

12.8%

805.5

MOL

PAK STATE OIL

12/2012

5.18

02.05.2012

1.13

23.04.2013

729'586

12/2012

19'345.00

05.11.2012

14'800.00

30.05.2012

17'902

06/2012

209.78

06.03.2013

161.46

22.06.2012

739'400

1'072.00

1.17

16'020.00

198.37

-27.0%

8.2%

3'614.0

-77.4%

3.5%

102.5

-17.2%

8.2%

104.5

-5.4%

22.9%

247.0

88'699

139'820

86'887

64'979

400'104

436'207

228'228

70'549

33'209

238'434

65'813

36'477

120

1'674'395

48'995

33'290.0

1'281.0

17'031.0

37'754.0

1'433.0

18'550.0

48'797.0

1'206.0

20'114.0

24'463.0

3'514.0

8'000.0

11'581.0

5'797.0

9'582.0

119'400.0

700.0

80'100.0

12'192.0

1'308.0

21'205.0

21'725.0

440.0

3'618.0

1'647.0

482.0

196'350.3

2'354.0

49'302.8

7'623.0

32.0

1'592.0

15'507.0

57.0

4'434.0

149.8

34.6

1'089'702.0

547'666.0

347'509.0

45'772.6

1'624.0

220'523

Valuation

106'239

234'135

162'561

407'900

476'207

182'299.0

182'299.0

180'404.3

179'899.4

0.6x

0.6x

0.6x

0.6x

32'343.0

31'867.0

33'435.0

34'266.3

3.3x

3.3x

3.2x

3.2x

5.10

4.73

5.20

5.31

7.9x

7.9x

7.2x

7.1x

9.5%

4.5%

(1.7%)

1.0%

17.5%

18.5%

19.0%

467'153.0

467'153.0

456'217.3

465'270.1

0.5x

0.5x

0.5x

0.5x

52'114.0

52'114.0

60'992.8

62'509.0

4.6x

4.6x

3.9x

3.8x

4.11

4.25

4.12

4.20

7.8x

8.1x

8.0x

7.9x

(0.6%)

3.4%

(6.8%)

(0.7%)

11.2%

13.4%

13.4%

375'580.0

370'866.0

343'514.9

352'925.0

0.4x

0.4x

0.5x

0.4x

20'442.0

22'056.0

38'137.7

40'863.4

7.9x

7.3x

4.1x

3.9x

0.22

0.61

0.81

0.93

11.4x

20.5x

8.5x

7.5x

0.0%

5.1%

(55.4%)

(11.4%)

5.9%

11.1%

11.6%

127'220.0

127'220.0

115'218.0

120'807.1

0.7x

0.7x

0.7x

0.7x

24'564.0

24'564.0

28'443.3

29'662.0

3.5x

3.5x

2.9x

2.7x

1.12

1.12

1.93

2.06

16.0x

16.0x

9.2x

8.7x

16.1%

5.9%

(4.5%)

(1.1%)

19.3%

24.7%

24.6%

84'956

420'714.0

426'252.0

434'881.4

442'168.4

0.9x

0.9x

1.0x

0.9x

65'769.0

67'270.0

80'446.2

82'444.2

6.0x

5.9x

5.2x

5.0x

7.56

7.89

7.96

8.16

11.3x

11.3x

11.2x

10.9x

(3.0%)

2.4%

(5.6%)

(1.2%)

15.8%

18.5%

18.6%

705'700.0

705'734.0

639'860.8

655'931.6

0.7x

0.7x

0.8x

0.8x

265'400.0

266'236.0

243'800.4

250'198.9

1.8x

1.8x

2.0x

2.0x

21.66

16.49

17.08

6.3x

8.3x

8.0x

9.3%

(2.9%)

1.3%

8.6%

37.7%

38.1%

38.1%

45.7%

31.0%

1.045x

0.510x

48.201x

20.0%

16.6%

0.724x

0.368x

22.424x

41.2%

29.0%

2.212x

1.300x

13.601x

41.3%

28.1%

0.996x

0.670x

25.065x

7.0%

6.3%

0.172x

0.030x

78.954x

37.4%

27.2%

0.448x

0.148x

88.467x

AA12.04.2011

Aa1

30.08.2005

AA

03.09.2009

Aa1

20.07.2005

A

24.09.2010

-

A

17.01.2012

A3

16.07.2012

AAA

16.12.1985

WR

16.08.1993

AA03.08.2007

Aa2

23.06.2005

222'580.0

222'580.0

238'329.9

232'880.3

0.9x

0.9x

0.9x

1.0x

48'426.0

48'426.0

56'229.2

57'497.3

4.2x

4.2x

4.0x

4.0x

12.10

12.12

12.44

12.57

9.7x

9.7x

9.4x

9.3x

(5.8%)

(0.1%)

(5.4%)

7.1%

21.8%

23.6%

24.7%

89'096

34'374

387'836

71'876

66'829

57'967.0

96'888.0

54'798.9

57'508.0

1.5x

0.9x

1.5x

1.5x

19'396.0

20'383.0

21'915.3

23'665.4

4.6x

4.4x

3.8x

3.6x

5.37

6.09

5.49

6.03

9.5x

9.5x

10.5x

9.6x

(9.7%)

(13.3%)

(10.4%)

(8.8%)

21.0%

40.0%

41.2%

29'715.0

29'715.0

31'394.5

32'737.5

1.3x

1.3x

1.2x

1.2x

5'618.0

5'618.0

5'542.4

5'980.0

6.7x

6.7x

6.8x

6.4x

4.34

4.39

4.11

4.26

8.9x

8.9x

9.5x

9.2x

1.9%

3.9%

13.9%

3.1%

18.9%

17.7%

18.3%

281'379.5

281'379.5

292'543.5

307'617.6

1.4x

1.4x

1.5x

1.5x

53'158.1

53'158.2

67'257.7

78'979.6

7.6x

7.6x

6.4x

5.9x

1.62

1.62

2.43

2.77

11.8x

11.8x

7.9x

6.9x

15.2%

10.3%

(13.7%)

0.2%

18.9%

23.0%

25.7%

24'172.0

24'172.0

26'160.1

26'509.6

2.8x

2.8x

2.7x

2.6x

13'701.0

13'701.0

15'832.3

17'037.3

4.9x

4.9x

4.5x

4.0x

7.09

7.09

7.08

7.55

11.5x

11.5x

11.5x

10.8x

1.0%

4.0%

(3.3%)

6.0%

56.7%

60.5%

64.3%

18'933.0

21'665.0

20'017.2

22'880.3

3.7x

3.3x

3.4x

3.1x

10'198.0

10'561.0

10'751.8

12'863.8

6.9x

6.7x

6.3x

5.6x

1.29

1.02

1.26

1.52

16.0x

12.2x

12.9x

10.7x

7.2%

13.9%

6.5%

6.1%

48.7%

53.7%

56.2%

205.2

1.6x

90.7

3.6x

-0.29

-0.72

1067.4%

-

235

5'527'070.0

5'527'070.0

5'346'506.4

5'411'484.9

0.6x

0.6x

0.5x

0.5x

538'891.0

538'891.0

609'268.3

658'734.4

5.8x

5.8x

4.7x

4.2x

1'431.81

1'690.35

2'017.04

2'271.77

9.5x

10.6x

7.9x

7.1x

3.4%

14.4%

(8.3%)

1.7%

9.8%

11.4%

12.2%

2'964'254

92'029

45.3%

31.0%

1.066x

0.888x

14.650x

10.1%

9.1%

0.293x

0.207x

-

57.2%

36.2%

3.694x

2.766x

3.038x

19.0%

16.0%

0.556x

0.440x

105.392x

46.9%

31.9%

1.468x

1.048x

15.198x

9091.5%

98.9%

5.939x

64.1%

32.7%

2.022x

1.377x

11.685x

91.6%

47.8%

9.355x

A

07.02.2012

A1

26.04.2012

AAA

16.10.1992

WR

15.10.2002

BBB

17.11.2011

-

A

23.06.2008

A1

19.04.2012

BB+

25.11.2008

-

1'024'423.6

1'077'980.3

1'170'622.0

1'277'200.4

26'075.6

25'714.5

24'921.5

36.67

38.05

49.67

57.56

5.2x

5.2x

4.0x

3.4x

24.8%

16.6%

3.0%

23.4%

2.2%

2.0%

Leverage/Coverage Ratios

Total Debt / Equity %

Total Debt / Capital %

Total Debt / EBITDA

Net Debt / EBITDA

EBITDA / Int. Expense

8.9%

8.1%

0.252x

-0.186x

200.107x

Credit Ratings

S&P LT Credit Rating

S&P LT Credit Rating Date

Moody's LT Credit Rating

Moody's LT Credit Rating Date

AA

01.07.1987

Aa1

27.02.2009

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

Das könnte Ihnen auch gefallen

- Financial Analysis - Vivendi, Through Its Subsidiaries, Conducts Operations Ranging From Music, Games and Television To Film and TelecommunicationsDokument8 SeitenFinancial Analysis - Vivendi, Through Its Subsidiaries, Conducts Operations Ranging From Music, Games and Television To Film and TelecommunicationsQ.M.S Advisors LLCNoch keine Bewertungen

- Financial Analysis - EDF SA (Electricite de France) Produces, Transmits, Distributes, Imports and Exports Electricity. the Company, Using Nuclear Power, Coal and Gas, Provides Electricity for French Energy ConsumersDokument8 SeitenFinancial Analysis - EDF SA (Electricite de France) Produces, Transmits, Distributes, Imports and Exports Electricity. the Company, Using Nuclear Power, Coal and Gas, Provides Electricity for French Energy ConsumersQ.M.S Advisors LLCNoch keine Bewertungen

- Company Analysis - Overview: Bouygues SADokument8 SeitenCompany Analysis - Overview: Bouygues SAQ.M.S Advisors LLCNoch keine Bewertungen

- Company Analysis - Overview: Bouygues SADokument8 SeitenCompany Analysis - Overview: Bouygues SAQ.M.S Advisors LLCNoch keine Bewertungen

- Company Analysis - Overview: Credit Suisse Group AGDokument8 SeitenCompany Analysis - Overview: Credit Suisse Group AGQ.M.S Advisors LLCNoch keine Bewertungen

- Company Analysis - Overview: ABC ArbitrageDokument8 SeitenCompany Analysis - Overview: ABC ArbitrageQ.M.S Advisors LLCNoch keine Bewertungen

- Globalratings 29nov IgmDokument6 SeitenGlobalratings 29nov IgmMichael BauermNoch keine Bewertungen

- Spin Offs SGDokument72 SeitenSpin Offs SGuser121821Noch keine Bewertungen

- Company Analysis - Electricite de France SA - FR0010242511 - EDF FP EquityDokument8 SeitenCompany Analysis - Electricite de France SA - FR0010242511 - EDF FP EquityQ.M.S Advisors LLCNoch keine Bewertungen

- Final Market: Towards A New Hierarchy of Risks ?Dokument19 SeitenFinal Market: Towards A New Hierarchy of Risks ?Morningstar FranceNoch keine Bewertungen

- AG - Members of Aero Companies at The IHK TorinoDokument2 SeitenAG - Members of Aero Companies at The IHK TorinoAdrianna LpcNoch keine Bewertungen

- Financial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfDokument8 SeitenFinancial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfQ.M.S Advisors LLCNoch keine Bewertungen

- Financial Analysis - Assured Guaranty Ltd. Provides Financial Guaranty Insurance and Reinsurance, As Well As Mortgage Guaranty Coverage.Dokument8 SeitenFinancial Analysis - Assured Guaranty Ltd. Provides Financial Guaranty Insurance and Reinsurance, As Well As Mortgage Guaranty Coverage.Q.M.S Advisors LLCNoch keine Bewertungen

- MSDokument36 SeitenMSJason WangNoch keine Bewertungen

- Top100 2004Dokument3 SeitenTop100 2004thlroNoch keine Bewertungen

- PHP 1 B IWi DDokument5 SeitenPHP 1 B IWi Dfred607Noch keine Bewertungen

- EuroHedge Summit Brochure - April 2011Dokument12 SeitenEuroHedge Summit Brochure - April 2011Absolute ReturnNoch keine Bewertungen

- EuroHedge Summit Brochure - March 2012Dokument12 SeitenEuroHedge Summit Brochure - March 2012Absolute ReturnNoch keine Bewertungen

- Company Analysis - Overview: Affine SADokument8 SeitenCompany Analysis - Overview: Affine SAQ.M.S Advisors LLCNoch keine Bewertungen

- Top Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesVon EverandTop Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesNoch keine Bewertungen

- Goldman and The OIS Gold RushDokument0 SeitenGoldman and The OIS Gold Rushalexis_miaNoch keine Bewertungen

- NRC Column Bond Market IIDokument1 SeiteNRC Column Bond Market IIJoost RamaerNoch keine Bewertungen

- FastTrack100 - 2010Dokument10 SeitenFastTrack100 - 2010Swati_CopalNoch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- SharesDokument56 SeitenSharesyannis_benNoch keine Bewertungen

- ValuEngine Weekly Newsletter July 27, 2012Dokument9 SeitenValuEngine Weekly Newsletter July 27, 2012ValuEngine.comNoch keine Bewertungen

- Credit Suisse - Oil & Gas PrimerDokument230 SeitenCredit Suisse - Oil & Gas Primerhenrywang7100% (6)

- ValuEngine Weekly Newsletter February 17, 2012Dokument10 SeitenValuEngine Weekly Newsletter February 17, 2012ValuEngine.comNoch keine Bewertungen

- Liste Boutiques IESEGDokument6 SeitenListe Boutiques IESEGMaxime DehayeNoch keine Bewertungen

- ValuEngine Weekly Newsletter June 28, 2013Dokument9 SeitenValuEngine Weekly Newsletter June 28, 2013ValuEngine.comNoch keine Bewertungen

- Adviser Rank (Market Share) Market Share (%)Dokument3 SeitenAdviser Rank (Market Share) Market Share (%)iemif2013Noch keine Bewertungen

- WWW Cboe ComDokument2 SeitenWWW Cboe ComCocoy Ryan TonogNoch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Sharia Family: The Nasdaq 100 (NDX)Dokument2 SeitenSharia Family: The Nasdaq 100 (NDX)Amir Syazwan Bin MohamadNoch keine Bewertungen

- PHP KTka 4 EDokument5 SeitenPHP KTka 4 Efred607Noch keine Bewertungen

- Barings To Miami Pension PlanDokument25 SeitenBarings To Miami Pension Planturnbj75Noch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Company Analysis - Overview: Linkedin CorpDokument8 SeitenCompany Analysis - Overview: Linkedin CorpQ.M.S Advisors LLCNoch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Business in The Community CR Index 2013 Company RankingDokument4 SeitenBusiness in The Community CR Index 2013 Company RankingBITC1Noch keine Bewertungen

- Europe 500 Largest CompaniesDokument53 SeitenEurope 500 Largest Companiestawhide_islamicNoch keine Bewertungen

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDokument1 SeiteAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139440843Noch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- AIG ChartisDokument29 SeitenAIG ChartisVariantPerceptionsNoch keine Bewertungen

- CS US Multi-Industrial Analyst Presentation - July 2014 - Part 1 End Market SlidesDokument220 SeitenCS US Multi-Industrial Analyst Presentation - July 2014 - Part 1 End Market SlidesVictor CheungNoch keine Bewertungen

- Enterprise and Venture CapitalDokument336 SeitenEnterprise and Venture CapitalvadymkochNoch keine Bewertungen

- ROGERS Annual Report 09Dokument147 SeitenROGERS Annual Report 09AjayNoch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDokument1 SeiteAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDokument1 SeiteAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139665491Noch keine Bewertungen

- Binaer ViewDokument1 SeiteBinaer ViewmailrahulrajNoch keine Bewertungen

- Astrological Trade Recommendations For The Components of The S&P100 IndexDokument2 SeitenAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDokument1 SeiteAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139665491Noch keine Bewertungen

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDokument1 SeiteAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139665491Noch keine Bewertungen

- An Option Greeks Primer: Building Intuition with Delta Hedging and Monte Carlo Simulation using ExcelVon EverandAn Option Greeks Primer: Building Intuition with Delta Hedging and Monte Carlo Simulation using ExcelNoch keine Bewertungen

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDokument103 SeitenFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Dokument227 SeitenFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Q.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFDokument227 SeitenFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFQ.M.S Advisors LLCNoch keine Bewertungen

- qCIO Global Macro Hedge Fund Strategy - November 2014Dokument31 SeitenqCIO Global Macro Hedge Fund Strategy - November 2014Q.M.S Advisors LLCNoch keine Bewertungen

- Directory - All ETC Exchange Traded Commodities - Worldwide PDFDokument40 SeitenDirectory - All ETC Exchange Traded Commodities - Worldwide PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Financial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfDokument8 SeitenFinancial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDokument103 SeitenFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Analysis & Analyst Recommendations - QMS Global Agribusiness FlexIndexDokument103 SeitenFundamental Analysis & Analyst Recommendations - QMS Global Agribusiness FlexIndexQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesDokument205 SeitenFundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesQ.M.S Advisors LLC100% (1)

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryDokument205 SeitenFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCNoch keine Bewertungen

- TPX 1000 Index - Dividends and Implied Volatility Surfaces Parameters PDFDokument8 SeitenTPX 1000 Index - Dividends and Implied Volatility Surfaces Parameters PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapDokument205 SeitenFundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapDokument205 SeitenFundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Analysis & Analyst Recommendations - EM Frontier Myanmar BasketDokument25 SeitenFundamental Analysis & Analyst Recommendations - EM Frontier Myanmar BasketQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaDokument205 SeitenFundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaQ.M.S Advisors LLCNoch keine Bewertungen

- Financial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesDokument8 SeitenFinancial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryDokument205 SeitenFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCNoch keine Bewertungen

- Company Analysis - Overview: Nuance Communications IncDokument8 SeitenCompany Analysis - Overview: Nuance Communications IncQ.M.S Advisors LLCNoch keine Bewertungen

- ''Want To Learn To Speak Latin or Greek This (2018) Summer''Dokument10 Seiten''Want To Learn To Speak Latin or Greek This (2018) Summer''ThriwNoch keine Bewertungen

- Reith 2020 Lecture 1 TranscriptDokument16 SeitenReith 2020 Lecture 1 TranscriptHuy BuiNoch keine Bewertungen

- Eternal LifeDokument9 SeitenEternal LifeEcheverry MartínNoch keine Bewertungen

- Origin of "ERP"Dokument4 SeitenOrigin of "ERP"kanika_bhardwaj_2Noch keine Bewertungen

- Introduction To Instrumented IndentationDokument7 SeitenIntroduction To Instrumented Indentationopvsj42Noch keine Bewertungen

- Exercise No.2Dokument4 SeitenExercise No.2Jeane Mae BooNoch keine Bewertungen

- RubricsDokument1 SeiteRubricsBeaMaeAntoniNoch keine Bewertungen

- CIP Program Report 1992Dokument180 SeitenCIP Program Report 1992cip-libraryNoch keine Bewertungen

- Finding Nemo 2Dokument103 SeitenFinding Nemo 2julianaNoch keine Bewertungen

- Lorraln - Corson, Solutions Manual For Electromagnetism - Principles and Applications PDFDokument93 SeitenLorraln - Corson, Solutions Manual For Electromagnetism - Principles and Applications PDFc. sorasNoch keine Bewertungen

- Fansubbers The Case of The Czech Republic and PolandDokument9 SeitenFansubbers The Case of The Czech Republic and Polandmusafir24Noch keine Bewertungen

- Practice Test 4 For Grade 12Dokument5 SeitenPractice Test 4 For Grade 12MAx IMp BayuNoch keine Bewertungen

- Java ReviewDokument68 SeitenJava ReviewMyco BelvestreNoch keine Bewertungen

- Customizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesDokument191 SeitenCustomizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesCalina Sechel100% (1)

- Long 1988Dokument4 SeitenLong 1988Ovirus OviNoch keine Bewertungen

- Chapter 4 INTRODUCTION TO PRESTRESSED CONCRETEDokument15 SeitenChapter 4 INTRODUCTION TO PRESTRESSED CONCRETEyosef gemessaNoch keine Bewertungen

- MuzicaDokument3 SeitenMuzicaGiurcanas AndreiNoch keine Bewertungen

- Finding The NTH Term of An Arithmetic SequenceDokument3 SeitenFinding The NTH Term of An Arithmetic SequenceArdy PatawaranNoch keine Bewertungen

- The 5 RS:: A New Teaching Approach To Encourage Slowmations (Student-Generated Animations) of Science ConceptsDokument7 SeitenThe 5 RS:: A New Teaching Approach To Encourage Slowmations (Student-Generated Animations) of Science Conceptsnmsharif66Noch keine Bewertungen

- Review Questions Operational Excellence? Software WorksDokument6 SeitenReview Questions Operational Excellence? Software WorksDwi RizkyNoch keine Bewertungen

- E1979017519 PDFDokument7 SeitenE1979017519 PDFAnant HatkamkarNoch keine Bewertungen

- Philosophy of Jnanadeva - As Gleaned From The Amrtanubhava (B.P. Bahirat - 296 PgsDokument296 SeitenPhilosophy of Jnanadeva - As Gleaned From The Amrtanubhava (B.P. Bahirat - 296 PgsJoão Rocha de LimaNoch keine Bewertungen

- Balezi - Annale Générale Vol 4 - 1 - 2 Fin OkDokument53 SeitenBalezi - Annale Générale Vol 4 - 1 - 2 Fin OkNcangu BenjaminNoch keine Bewertungen

- Insung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningDokument81 SeitenInsung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningJack000123Noch keine Bewertungen

- On Wallace Stevens - by Marianne Moore - The New York Review of BooksDokument2 SeitenOn Wallace Stevens - by Marianne Moore - The New York Review of BooksTuvshinzaya GantulgaNoch keine Bewertungen

- Becoming FarmersDokument13 SeitenBecoming FarmersJimena RoblesNoch keine Bewertungen

- Sukhtankar Vaishnav Corruption IPF - Full PDFDokument79 SeitenSukhtankar Vaishnav Corruption IPF - Full PDFNikita anandNoch keine Bewertungen

- Approved Chemical ListDokument2 SeitenApproved Chemical ListSyed Mansur Alyahya100% (1)

- Mathematics Paper 1 TZ2 HLDokument16 SeitenMathematics Paper 1 TZ2 HLPavlos StavropoulosNoch keine Bewertungen

- A Guide To Relativity BooksDokument17 SeitenA Guide To Relativity Bookscharles luisNoch keine Bewertungen