Beruflich Dokumente

Kultur Dokumente

Thesun 2009-03-26 Page15 Japanese Exports Suffer Record Plunge

Hochgeladen von

Impulsive collectorOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Thesun 2009-03-26 Page15 Japanese Exports Suffer Record Plunge

Hochgeladen von

Impulsive collectorCopyright:

Verfügbare Formate

theSun | THURSDAY MARCH 26 2009 15

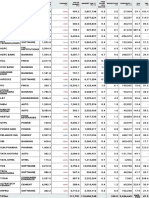

business KLCI

STI

878.81

1,691.68

0.89

14.66

Nikkei

TSEC

8,479.99

5,346.38

8.31

104.20

Hang Seng 13,622.11 288.23 KOSPI 1,229.02 7.32

SCI 2,291.56 46.87 S&P/ASX200 3,609.30 29.30

market summary

Japanese exports

MARCH 25, 2009

INDICES CHANGE

FBMEMAS 5,723.25 -4.28

COMPOSITE 878.81 +0.89

INDUSTRIAL 2,125.62 +18.91

CONSUMER PROD 284.72 +1.30

suffer record plunge

INDUSTRIAL PROD 66.08 +0.08

CONSTRUCTION 167.85 +1.74

TRADING SERVICES 116.88 +0.13

FINANCE 6,540.63 +1.55

PROPERTIES 508.78 -0.85

PLANTATIONS 4,563.39 -27.00

MINING 231.01 UNCH

FBMSHA 6,073.33 -17.83

TOKYO: Japan announced yester- passing January’s slump of 45.7%, the FBM2BRD 3,887.00 -13.49

day a record fall in exports, keeping finance ministry reported. TECHNOLOGY 11.24 -0.20

its economy on course for the worst Shipments to the US and Europe

TURNOVER VALUE

recession since World War II as the more than halved while demand

global downturn pummels demand from the once-booming Chinese 362.995mil RM671,501mil

for cars and hi-tech goods. economy dropped almost 40%. Japanese

Exports roughly halved in Japan’s trade surplus plunged

February compared with a year 91.2% in February from a year earlier

exports are Prices end mixed

earlier, making it likely the world’s to ¥82.35 billion (RM3.11 billion), al- unlikely to SHARE prices on Bursa Malaysia

second-largest economy will log an- though that was better than a record recover ended mixed yesterday, with the key

other sharp contraction in the current deficit logged in January, the govern- (soon), and index in positive territory supported

quarter. ment said. it is difficult by last-minute buying on selected

Japan’s heavy dependence on The Japanese economy logged its blue-chips, dealers said. The KLCI

foreign markets means its economy worst performance in almost 35 years to foresee added 0.89 point to 878.81.

has been one of the worst affected by in the last quarter of 2008, contracting a rapid Dealers said the market started the

the global economic downturn, and at an annualised pace of 12.1%. recovery day on negative territory as investors

analysts see little prospect of a quick The economy is likely to shrink at unless trimmed their positions following the

turnaround. a slightly faster pace in the current the global overnight fall on Wall Street.

“Japanese exports are unlikely quarter and it will remain weak for A dealer said, however, the senti-

to recover (soon), and it is difficult some time to come, said Hiroshi financial ment was positive due to ongoing

to foresee a rapid recovery unless Shiraishi, an economist at BNP Pari- crisis Umno general assembly which he

the global financial crisis eases,” bas. eases.” hoped some positive news would

said Commerzbank analyst Ryohei “The rate of contraction should – Ryohei emerge to boost the market.

Muramatsu. ease fairly sharply from the second Muramatsu “Profit-taking was seen on planta-

He warned Japan’s economy looks quarter onwards” but the economy Commerzbank tion and banking-related stocks in the

unlikely to improve until demand will remain weak for some time to analyst morning. However, last-minute buying

from the US and China picks up. come, he said. had pushed the KLCI to close the day

“As the US is expected to be the The economy is also bracing in positive territory,” a dealer said.

first one out of the crisis, other econo- for another bout of deflation. The Among the active stocks, TM In-

mies will recover six months later, government may report on Friday ternational fell 32 sen to RM2.29 after

including Japan,” Muramatsu said. the first year-on-year decline in core it announced the price of the rights

Japanese exports plunged 49.4% consumer prices since September issue. – Bernama

last month from a year earlier, sur- 2007, analysts said. – AFP

IMF reforms lending, creates new credit line

WASHINGTON: The International October, that attracted no takers can stock markets, but did not stop and risks are rising in emerging and

Monetary Fund on Tuesday over- because countries said funding most currencies in the region from developing countries as demand

hauled the way it lends to member was too small and repayment weakening. slumps and credit dries up.

countries in the face of a worsening schedules too rigid. Goldman Sachs’ senior emerg- Under the changes, the IMF Millions of Thais prepare for

global economic crisis and created “These reforms represent a sig- ing markets economist, Alberto said, once the emerging econo- stimulus handouts

a new line of credit for well-run nificant change in the way the Fund Ramos, said in a research note on mies have qualified for the credit BANGKOK: Thailand’s government prepared yesterday to

emerging-market economies. can help its member countries, Tuesday that the new flexible credit line, there would be “no hard cap” give 2,000-baht (RM220) handouts to millions of people

Senior IMF officials said the which is especially needed at this line was a “major improvement” on the amount a country could as part of a stimulus programme aimed at fighting the

move represented a turning point time of global crisis,” IMF managing over the more limited short-term borrow, and repayments would be effects of the global slowdown.

in the way the Fund supports director Dominique Strauss-Kahn liquidity facility. in three to five years. Social security offices were opening at 8am (same

countries and will make it easier said in a statement. Ramos said that in Latin IMF first deputy managing time in Malaysia) across the country today to hand out

for emerging market economies to “More flexibility in our lending America, countries such as Brazil, director John Lipsky told Reuters the so-called “gift cheques”, while shops and businesses

seek help from the IMF to weather along with streamlined conditional- Chile, Colombia, Mexico and Peru Financial Television many countries, have launched promotions to entice consumers.

the global downturn. ity will help us respond effectively would probably qualify for the even those with good track records, Around 7.5 million people have registered for the

The new flexible credit line to the various needs of members. IMF credit line, while others like were having a hard time accessing handouts. Only people with a monthly salary of 15,000

will give countries that meet a set This, in turn, will help them to Argentina, Ecuador and Venezuela financing, and the new credit line baht (RM1,650) or less and who are registered for social

of conditions access to a pool of weather the crisis and return to would not. would ensure they are not forced security support are eligible.

money they can either tap imme- sustainable growth,” he added. The changes in IMF lending into a serious downturn. “The cheque will help people’s purchasing power,”

diately or keep as a guarantee in News of new IMF lending come as the global institution He said changes in lending Prime Minister Abhisit Vejjajiva told reporters. “This is the

case global conditions worsen. instruments to help emerging projects the world economy will instruments for low-income coun- hardest period of time, I hope it will help the economy.”

It replaces a short-term liquid- economies helped buoy improved contract this year for the first time tries will be dealt with separately The handouts are part of a US$3.35 billion (RM12.4 billion)

ity facility, approved by the IMF in investor sentiment in Latin Ameri- since World War Two, by 0.5 to 1%, “in coming months.” – Reuters stimulus package announced by Abhisit in January. – AFP

Das könnte Ihnen auch gefallen

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsDokument1 SeiteThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorNoch keine Bewertungen

- Thesun 2008-12-18 Page20 Msias rm2Dokument1 SeiteThesun 2008-12-18 Page20 Msias rm2Impulsive collectorNoch keine Bewertungen

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDokument1 SeiteTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDokument1 SeiteTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Dokument1 SeiteTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNoch keine Bewertungen

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDokument1 SeiteThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNoch keine Bewertungen

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyDokument1 SeiteTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensDokument1 SeiteTheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDokument1 SeiteTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNoch keine Bewertungen

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDokument1 SeiteThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDokument1 SeiteTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDokument1 SeiteTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNoch keine Bewertungen

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDokument1 SeiteTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDokument1 SeiteTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNoch keine Bewertungen

- Thesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesDokument1 SeiteThesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDokument1 SeiteThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDokument1 SeiteThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNoch keine Bewertungen

- The Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryDokument1 SeiteThe Sun 2008-10-24 Page28 Govt To Review Policy On Iron and Steel IndustryImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefDokument1 SeiteTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDokument1 SeiteTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bDokument1 SeiteTheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bImpulsive collectorNoch keine Bewertungen

- Thesun 2009-07-07 Page13 Great Eastern Targets 25pct Growth in Premiums This YearDokument1 SeiteThesun 2009-07-07 Page13 Great Eastern Targets 25pct Growth in Premiums This YearImpulsive collectorNoch keine Bewertungen

- TheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyDokument1 SeiteTheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinDokument1 SeiteThesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinImpulsive collector100% (2)

- TheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangDokument1 SeiteTheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDokument1 SeiteThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNoch keine Bewertungen

- The Sun 2008-10-30 Page22Dokument1 SeiteThe Sun 2008-10-30 Page22Impulsive collectorNoch keine Bewertungen

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Dokument1 SeiteTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDokument1 SeiteThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNoch keine Bewertungen

- Thesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsDokument1 SeiteThesun 2009-10-30 Page19 Maxis To Attract Institutional InvestorsImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDokument1 SeiteThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessDokument1 SeiteThesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessImpulsive collectorNoch keine Bewertungen

- Thesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingDokument1 SeiteThesun 2009-07-08 Page15 World Bank Rolls Out Rm32bil in FinancingImpulsive collectorNoch keine Bewertungen

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDokument1 SeiteThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyDokument1 SeiteThesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownDokument1 SeiteTheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpDokument1 SeiteTheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpImpulsive collectorNoch keine Bewertungen

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDokument1 SeiteThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNoch keine Bewertungen

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDokument1 SeiteThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierDokument1 SeiteThesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierImpulsive collectorNoch keine Bewertungen

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDokument1 SeiteTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNoch keine Bewertungen

- SensexDokument1 SeiteSensexJatin JainNoch keine Bewertungen

- TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisDokument1 SeiteTheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisImpulsive collectorNoch keine Bewertungen

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDokument1 SeiteTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyDokument1 SeiteThesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyImpulsive collectorNoch keine Bewertungen

- August 2009 Chicago Airport StatisticsDokument1 SeiteAugust 2009 Chicago Airport StatisticsGavin CunninghamNoch keine Bewertungen

- Thesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpDokument1 SeiteThesun 2009-09-02 Page12 Regional Surveys Show Us Economy Picking UpImpulsive collectorNoch keine Bewertungen

- Thesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeDokument1 SeiteThesun 2009-08-06 Page13 Lloyds Posts Huge Loss As Bad Debts SurgeImpulsive collector100% (2)

- Thesun 2009-08-25 Page17 Market SummaryDokument1 SeiteThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-03 Page13 Property Mart Likely To Be BearishDokument1 SeiteThesun 2009-03-03 Page13 Property Mart Likely To Be BearishImpulsive collectorNoch keine Bewertungen

- Poly 2180 PDFDokument2 SeitenPoly 2180 PDFArpad BartiNoch keine Bewertungen

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDokument1 SeiteThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-12 Page30 TNB Seeks Govt Help To Raise Financing For Bakun ProjectDokument1 SeiteTheSun 2008-12-12 Page30 TNB Seeks Govt Help To Raise Financing For Bakun ProjectImpulsive collectorNoch keine Bewertungen

- Thesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaDokument1 SeiteThesun 2009-08-20 Page17 Australia Inks Massive Engery Deal With ChinaImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaDokument1 SeiteThesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaImpulsive collectorNoch keine Bewertungen

- DAILY - May 4-5, 2011Dokument1 SeiteDAILY - May 4-5, 2011JC CalaycayNoch keine Bewertungen

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDokument1 SeiteThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNoch keine Bewertungen

- Daily Report Production - 20230726 - S-2Dokument3 SeitenDaily Report Production - 20230726 - S-2Zulkifli HaidarNoch keine Bewertungen

- Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBDokument1 SeiteThesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBImpulsive collectorNoch keine Bewertungen

- Islamic Financial Services Act 2013Dokument177 SeitenIslamic Financial Services Act 2013Impulsive collectorNoch keine Bewertungen

- Futuretrends in Leadership DevelopmentDokument36 SeitenFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Coaching in OrganisationsDokument18 SeitenCoaching in OrganisationsImpulsive collectorNoch keine Bewertungen

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDokument15 SeitenHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNoch keine Bewertungen

- Hay Group Guide Chart - Profile Method of Job EvaluationDokument27 SeitenHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Developing An Enterprise Leadership MindsetDokument36 SeitenDeveloping An Enterprise Leadership MindsetImpulsive collectorNoch keine Bewertungen

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDokument4 SeitenHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Managing Conflict at Work - A Guide For Line ManagersDokument22 SeitenManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNoch keine Bewertungen

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDokument117 SeitenCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Megatrends Report 2015Dokument56 SeitenMegatrends Report 2015Cleverson TabajaraNoch keine Bewertungen

- Compensation Fundamentals - Towers WatsonDokument31 SeitenCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Strategy+Business - Winter 2014Dokument108 SeitenStrategy+Business - Winter 2014GustavoLopezGNoch keine Bewertungen

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDokument1 SeiteTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNoch keine Bewertungen

- Deloitte Analytics Analytics Advantage Report 061913Dokument21 SeitenDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNoch keine Bewertungen

- 2015 Summer Strategy+business PDFDokument104 Seiten2015 Summer Strategy+business PDFImpulsive collectorNoch keine Bewertungen

- Strategy+Business Magazine 2016 AutumnDokument132 SeitenStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- 2016 Summer Strategy+business PDFDokument116 Seiten2016 Summer Strategy+business PDFImpulsive collectorNoch keine Bewertungen

- Talent Analytics and Big DataDokument28 SeitenTalent Analytics and Big DataImpulsive collectorNoch keine Bewertungen

- Global Talent 2021Dokument21 SeitenGlobal Talent 2021rsrobinsuarezNoch keine Bewertungen

- KL City Plan 2020Dokument10 SeitenKL City Plan 2020Impulsive collector0% (2)

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDokument1 SeiteTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNoch keine Bewertungen

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDokument1 SeiteTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNoch keine Bewertungen

- FIN211 Financial Management Lecture Notes Text Reference: Chapter 1 Topic: Role of Financial ManagementDokument8 SeitenFIN211 Financial Management Lecture Notes Text Reference: Chapter 1 Topic: Role of Financial ManagementAnonymous y3E7iaNoch keine Bewertungen

- Executive Programme In: Business ManagementDokument4 SeitenExecutive Programme In: Business ManagementKARTHIK145Noch keine Bewertungen

- Mumbai Mint 07-07-2023Dokument18 SeitenMumbai Mint 07-07-2023satishdokeNoch keine Bewertungen

- Reves v. Ernst & Young, 494 U.S. 56 (1990)Dokument21 SeitenReves v. Ernst & Young, 494 U.S. 56 (1990)Scribd Government DocsNoch keine Bewertungen

- MCQs On 301 SM PDFDokument3 SeitenMCQs On 301 SM PDFNeelNoch keine Bewertungen

- Kritika AbstractDokument3 SeitenKritika AbstractKritika SinghNoch keine Bewertungen

- Vietnam Tax Legal HandbookDokument52 SeitenVietnam Tax Legal HandbookaNoch keine Bewertungen

- Access To Finance For Women Entrepreneurs in South Africa (November 2006)Dokument98 SeitenAccess To Finance For Women Entrepreneurs in South Africa (November 2006)IFC SustainabilityNoch keine Bewertungen

- Xlpe Recycling Project 2021-22Dokument5 SeitenXlpe Recycling Project 2021-22NORTECH TRINITYNoch keine Bewertungen

- F6zwe 2015 Dec ADokument8 SeitenF6zwe 2015 Dec APhebieon MukwenhaNoch keine Bewertungen

- Quality Management and Practises in Automobile SectorDokument57 SeitenQuality Management and Practises in Automobile Sectorshivi73100% (16)

- Group 4 Amazon 45k01.1Dokument73 SeitenGroup 4 Amazon 45k01.1Đỗ Hiếu ThuậnNoch keine Bewertungen

- Accounting For Joint Product and by ProductsDokument23 SeitenAccounting For Joint Product and by ProductsQwerty UiopNoch keine Bewertungen

- Far301 Quiz - Chapter 6Dokument2 SeitenFar301 Quiz - Chapter 6Nicole TeruelNoch keine Bewertungen

- Equity Research AssignmentDokument3 SeitenEquity Research Assignment201812099 imtnagNoch keine Bewertungen

- E1.developments in The Indian Money MarketDokument16 SeitenE1.developments in The Indian Money Marketrjkrn230% (1)

- Monthly Construction Status Report TemplateDokument22 SeitenMonthly Construction Status Report TemplatePopescu Mircea IulianNoch keine Bewertungen

- Procurement Manual of WapdaDokument170 SeitenProcurement Manual of WapdaWaqar Ali Rana69% (13)

- Chapter 14Dokument5 SeitenChapter 14RahimahBawaiNoch keine Bewertungen

- 9 Books of AccountsDokument19 Seiten9 Books of Accountsapi-267023512100% (2)

- Distribution Channel of United BiscuitsDokument5 SeitenDistribution Channel of United BiscuitsPawan SharmaNoch keine Bewertungen

- Consultancy Paper FinalDokument20 SeitenConsultancy Paper FinalRosemarie McGuireNoch keine Bewertungen

- Equinox Is A Boutique Investment Bank and ConsultingDokument1 SeiteEquinox Is A Boutique Investment Bank and ConsultingRoderick SumalloNoch keine Bewertungen

- India's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsDokument439 SeitenIndia's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsАнастасия ТукноваNoch keine Bewertungen

- 2015aptransco Ms 9Dokument14 Seiten2015aptransco Ms 9vijaybunny141Noch keine Bewertungen

- Costing TheoryDokument26 SeitenCosting TheoryShweta MadhuNoch keine Bewertungen

- Non Current Assets 2019ADokument4 SeitenNon Current Assets 2019AKezy Mae GabatNoch keine Bewertungen

- Report On "E-Banking and Customer Satisfaction-: A Comprehensive Study On Sonali Bank Limited."Dokument37 SeitenReport On "E-Banking and Customer Satisfaction-: A Comprehensive Study On Sonali Bank Limited."ঘুম বাবুNoch keine Bewertungen

- Bs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)Dokument9 SeitenBs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)JANISCHAJEAN RECTONoch keine Bewertungen

- Bay' Al-TawarruqDokument12 SeitenBay' Al-TawarruqMahyuddin Khalid67% (3)