Beruflich Dokumente

Kultur Dokumente

IRDA Forms 08-09 PDF

Hochgeladen von

quan2332Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IRDA Forms 08-09 PDF

Hochgeladen von

quan2332Copyright:

Verfügbare Formate

IRDA Public Disclosures

Financial Year 2008-2009

Aviva Life Insurance Company India Limited

S. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44

Form No. Description EXECUTIVE SUMMARY L-1 A-RA L-2 A-PL L-3 A-BS L-4 PREMIUM SCHEDULE L-5 COMMISSION SCHEDULE L-6 OPERATING EXPENSES SCHEDULE L-7 BENEFITS PAID SCHEDULE L-8 SHARE CAPITAL SCHEDULE L-9 PATTERN OF SHAREHOLDING SCHEDULE L-10 RESERVE AND SURPLUS SCHEDULE L-11 BORROWINGS SCHEDULE L-12 INVESTMENT SHAREHOLDERS SCHEDULE L-13 INVESTMENT POLICYHOLDERS SCHEDULE L-14 ASSETS HELD TO COVER LINKED LIABILITIES SCHEDULE L-15 LOANS SCHEDULE L-16 FIXED ASSETS SCHEDULE L-17 CASH AND BANK BALANCE SCHEDULE L-18 ADVANCES AND OTHER ASSETS SCHEDULE L-19 CURRENT LIABILITIES SCHEDULE L-20 PROVISIONS SCHEDULE L-21 MISC EXPENDITURE SCHEDULE L-22 ANALYTICAL RATIOS L-23 RECEIPTS AND PAYMENTS SCHEDULE L-24 VALUATION OF NET LIABILITIES L-25 (i) GEOGRAPHICAL DISTRIBUTION CHANNEL- INDIVIDUAL L-25 (ii) GEOGRAPHICAL DISTRIBUTION CHANNEL- GROUP L-26 INVESTMENT ASSETS(LIFE INSURERS)-3A L-27 UNIT LINKED BUSINESS-3A L-28 ULIP-NAV-3A L-29 DETAIL REGARDING DEBT SECURITIES L-30 RELATED PARTY TRANSACTIONS L-31 BOARD OF DIRECTORS AND KEY PERSON L-32 SOLVENCY MARGIN - KT 3 L-33 NPAs-7A L-34 YIELD ON INVESTMENTS-1 L-35 DOWNGRADING OF INVESTMENTS - 2 L-36 PREMIUM AND NUMBER OF LIVES COVERED BY POLICY TYPE L-37 BUSINESS ACQUISITION THROUGH DFFERENT CHANNELS (GROUP) L-38 BUSINESS ACQUISITION THROUGH DFFERENT CHANNELS (INDIVIDUAL) L-39 DATA ON SETTLEMENT OF CLAIMS L-40 CLAIMS DATA FOR LIFE L-41 GREIVANCE DISPOSAL L-42 VALUATION BASIS (LIFE INSURANCE)

Page No. 1-2 3-4 5 6 7 8 9 10 11 12 13 14 15 16 17-18 19 20 21 22 23 23 24 25 26 27 28 29 30 31-33 34 35 36 37 38 39-41 42-44 45-47 48-49 50 51 52 53 54 55-56

Aviva Life Insurance Company India Limited (Registration Code: 0122) EXECUTIVE SUMMARY Aviva Life Insurance Company India Limited (the Company) was incorporated on 25 September 2000. The Company is registered as a life insurer with the Insurance Regulatory and Development Authority (IRDA) and its business comprises life insurance and pension business. The Company is a joint venture of Dabur Invest Corp. (74%) and Aviva International Holdings Limited, UK (26%). The Company benefits from the management expertise of the India's leading producer of traditional healthcare products and worlds oldest insurance Group. FINANCIAL RESULTS AND OPERATIONAL OVERVIEW The highlights of financial results of the Company for the year ended 31st March 2009 are summarised below: Rs. '000 Previous Year (31st March 2008) 388,342 94,399,094 18,981,541 (2,024,861)

Particulars Number of Policies sold Sum Assured Premium Income Profit/ (Loss) after tax

Current Year (31st March 2009) 374,188 91,116,462 19,928,667 (4,950,517)

The Company increased its Shareholders equity with a capital infusion of Rs. 4,873 million during the year. Accordingly, its share capital increased from Rs. 10,045 million to Rs.14,918 million. GROWING REACH The Company has 224 branches supporting its distribution network, widely spread across the country. The number of Financial Planning Advisers stands at 30,838. A strong foundation has been laid in Direct Sales Force and new channels of distribution like Direct Sales Team (DST) has been set-up. The Company has close to 40 bancassurance partnerships and Corporate Agents, through which, the Companys products are available in close to 3,000 towns and cities across India. RURAL AND SOCIAL SECTOR OBLIGATIONS The Company has complied with the seventh year rural and social sector obligations prescribed by IRDA and exceeded the social and rural targets for the year through a focused distribution and marketing plan and its tie-ups with Micro Financial Institutions (MFIs) and NGOs. To stimulate the rural and social sectors business, the Company has taken various initiatives during the year viz. developing new products offering insurance cum savings to the rural segment and to extend technology to rural policy issuance, etc. NEW PRODUCTS During the year, the Company launched 7 new products Aviva Young Scholar, LifeShield Plus, Pension Elite, Sachin Century Plan, Lifeline, Aviva Health Plus and Secure Pension. Aviva Young Scholar is a best in class child plan in the savings category. Aviva Life Shield Plus is among the cheapest term plans available in the market today. The new products have received positive reviews by the media community. FUND PERFORMANCE The performance of various funds (Compounded Annual Growth Rate) as on 31st March 2009 is given below: As on Life UL Life UL Life UL Pension UL Pension Pension Life UL Life Life Debt Protector 9-Mar Inception Date 27-Jan-04 6-Jun-02 27-Jan-04 3-Mar-05 11-Feb-03 3-Mar-05 2-Jan-08 29-Jan-08 6-Feb-08 11-Jul-06 NAV Performance 8.32% 18.24% 17.13% 8.08% 15.03% 11.35% -42.25% -25.77% 11.67% 7.32% Benchmark 5.32% 11.09% 10.11% 6.46% 9.55% 9.14% -43.09% -31.64% 4.50% 6.58% Performance * Benchmark return has been computed by applying benchmark weightage on CRISIL Gilt Index, CRISIL AAA Index, CRISIL CP Index & NIFTY

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

Aviva Life Insurance Company India Limited (Registration Code: 0122) EXECUTIVE SUMMARY

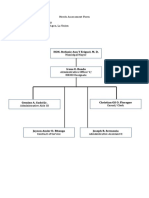

CORPORATE GOVERNANCE Audit Committee The Audit Committee of the Company is constituted by the Board, comprising of six Directors. Presently, all members are nonexecutive Directors. During the year, the Committee met four times to deliberate on various matters. The Committee reviewed the interim financial statements, accounts and Auditors Report thereon, internal audit reports and control environment and compliance with Regulations. Investment Committee The Investment Committee comprises of three non-executive Directors, Managing Director, Director Finance & Actuarial, Chief Investment Officer and the Appointed Actuary. During the year, the Committee met four times to deliberate on various matters. The Committee periodically monitors investment performance, investment policy, ensures compliance with the Investment Regulations issued by the Regulator from time to time. CORPORATE RESPONSIBILTY The Company takes corporate responsibility very seriously and has identified Education for underprivileged children as its key focus area. In that respect, the Company has extended its support for education of underprivileged children. HUMAN RESOURCES Aviva has continued its strong employee focus in all its people policies during the year. The Company is pleased to inform that in a study by The Economics Times and Great Place to Work Institute, India it has been ranked 4th amongst all India and the No.1 financial services Company in Indias Best Companies to Work for the Year 2009.

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

FORM L-1-A-RA Name of the Insurer: Aviva Life Insurance Company India Limited Registration No. 122 with the IRDA, dated 14 May 2002 REVENUE ACCOUNT FOR THE YEAR ENDED 31 MARCH 2009 Policyholders Account (Technical Account) Particulars Schedule Linked Par Individual Life (Rs. 000's) Premiums earned net (a) Premium (b) Reinsurance ceded (c) Reinsurance accepted Sub Total Income from Investments (a)Interest, Dividends and Rent Gross (b) Profit on sale/redemption of investments (c) (Loss) on sale/ redemption of investments (d) Transfer/Gain on revaluation/change in fair value Linked Par Pension (Rs. 000's) Linked Non Par Individual Life (Rs. 000's) For the year ended 31 March 2009 Linked Non Par Linked Non Par Pension Group (Rs. 000's) (Rs. 000's) Non Linked Group (Rs. 000's) Non Linked Life Total

(Rs. 000's)

(Rs. 000's)

L-4

149,119 (3,143) 145,976 82,773 8,438 (9,985) (638)

17,033 17,033 12,139 2,026 (1,397) (1,207)

14,804,443 (128,882) 14,675,561 1,063,137 175,845 (222,696) (4,270,901)

4,278,036 4,278,036 286,043 23,285 (50,286) (1,035,490)

279,650 (22,492) 257,158 55,332 10,162 (40,525) (7,584)

107,003 107,003 7,953 120 (37) -

293,383 (3,475) 289,908 16,640 4,372 -

19,928,667 (157,992) 19,770,675 1,524,017 224,248 (324,926) (5,315,820)

Sub Total Other Income (a) Contribution from the Shareholders' A/c TOTAL (A) Commission Operating Expenses related to Insurance Business Provision for Doubtful debts Bad debts written off Provision for Tax (Fringe Benefit Tax) Provisions (other than taxation) (a) For diminution in the value of investments (Net) (b) Others TOTAL (B) Benefits Paid (Net) Interim Bonuses Paid Change in valuation of liability in respect of life policies (a) Gross (b) Amount ceded in Reinsurance (c) Amount accepted in Reinsurance Total C SURPLUS/(DEFICIT) (D)=(A)-(B)-(C) APPROPRIATIONS Transfer to Shareholders Account Transfer to Other Reserves Balance being Funds for Future Appropriations (Refer Note 1.3.6 of Schedule 16, Part C) TOTAL (D) The break up of Total surplus is as under: (a) Interim Bonuses Paid: (b) Allocation of Bonus to policyholders: (c) Surplus shown in the Revenue Account: (d) Total Surplus: ((a)+(b)+(c)): Significant Accounting Policies and Notes to the Accounts L-5 L-6

80,588 226,564 5,952 9,484 72 15,508 L-7 135,885 3,433

11,561 28,594 162 1,088 8 1,258 47,301 1,745

(3,254,615) 2,588,360 14,009,306 1,164,648 4,864,617 36,937 6,066,202 1,423,370 -

(776,448) 2,266,510 5,768,098 334,564 2,344,074 17,798 2,696,436 304,105 -

17,385 29,334 303,877 (2,261) 138,594 1,051 137,384 29,943 -

8,036 9,065 124,104 1,078 52,432 401 53,911 68,675 -

21,012 305,147 616,067 15,506 328,725 2,496 346,727 2,290 -

(3,892,481) 5,198,416 21,076,610 1,519,649 7,739,014 58,763 9,317,426 2,011,569 5,178

23,049 (258) 162,109 48,947

(27,239) 21,807 5,529

6,084,561 (11,804) 7,496,127 446,977

2,639,419 2,943,524 128,138

136,550 166,493 -

27,825 (26,307) 70,193 -

267,744 (694) 269,340 -

9,151,909 (39,063) 11,129,593 629,591

4,449 44,498 48,947

881 4,648 5,529

446,977 446,977

128,138 128,138

5,330 624,261 629,591

3,433 36,607 48,947 88,987 16

1,745 6,180 5,529 13,454

446,977 446,977

128,138 128,138

5,178 42,787 629,591 677,556

As required by Section 40 B(4) of the Insurance Act, 1938 we certify that all expenses of Management in respect of life insurance business transacted in India by the company have been fully debited to the Policyholders' Revenue Account as expenses, unless specifically instructed by IRDA to do otherwise. The schedules referred to herein form an integral part of the Policyholders' account Per our report attached to the Balance Sheet For A. F. Ferguson Associates Chartered Accountants For J C Bhalla & Co. Chartered Accountants For and on behalf of the Board of Directors

Partner Membership no.

Rajesh Sethi Partner Membership no. 85669

Mohit Burman Chairman

T R Ramachandran CEO and Managing Director

Director

Director

Director-Finance & Actuarial

Company Secretary

Place : New Delhi Date :

Place : New Delhi Date :

Place : London Date :

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

FORM L-1-A-RA Name of the Insurer: Aviva Life Insurance Company India Limited Registration No. 122 with the IRDA, dated 14 May 2002 REVENUE ACCOUNT FOR THE YEAR ENDED 31 MARCH 2008 Policyholders Account (Technical Account) Particulars Schedule Linked Par Individual Life (Rs. 000's) Premiums earned net (a) Premium (b) Reinsurance ceded (c) Reinsurance accepted Sub Total Income from Investments (a)Interest, Dividends and Rent Gross (b) Profit on sale/redemption of investments (c) (Loss) on sale/ redemption of investments (d) Transfer/Gain on revaluation/change in fair value Sub Total Other Income (a) Contribution from the Shareholders' A/c TOTAL (A) Commission Operating Expenses related to Insurance Business Provision for Doubtful debts Bad debts written off Provision for Tax (Fringe Benefit Tax) Provisions (other than taxation) (a) For diminution in the value of investments (Net) (b) Others TOTAL (B) Benefits Paid (Net) Interim Bonuses Paid Change in valuation of liability in respect of life policies (a) Gross (b) Amount ceded in Reinsurance (c) Amount accepted in Reinsurance Total C SURPLUS/(DEFICIT) (D)=(A)-(B)-(C) APPROPRIATIONS Transfer to Shareholders Account Transfer to Other Reserves Balance being Funds for Future Appropriations (Refer Note 1.3.6 of Schedule 16, Part C) TOTAL (D) The break up of Total surplus is as under: (a) Interim Bonuses Paid: (b) Allocation of Bonus to policyholders: (c) Surplus shown in the Revenue Account: (d) Total Surplus: ((a)+(b)+(c)): Significant Accounting Policies and Notes to the Accounts 2,664 33,336 61,005 97,005 16 467 6,506 10,845 17,818 138,638 138,638 49,043 49,043 32 32 3,163 39,842 259,531 302,536 4,000 57,005 61,005 775 10,070 10,845 138,638 138,638 49,043 49,043 4,775 254,756 259,531 37,977 (259) 180,718 61,005 (5,875) 28,332 10,845 8,276,872 (9,835) 9,616,300 138,638 2,760,449 2,966,028 49,043 422,840 446,859 17,860 65,709 41,268 (13,842) 29,794 11,551,391 (23,936) 13,333,740 259,531 L-5 L-6 Linked Par Pension (Rs. 000's) Linked Non Par Individual Life (Rs. 000's) For the year ended 31 March 2008 Linked Non Par Linked Non Par Pension Group (Rs. 000's) (Rs. 000's) Non Linked Group (Rs. 000's) Non Linked Life Total

(Rs. 000's)

(Rs. 000's)

L-4

175,167 (3,258) 171,909 72,780 4,658 (14,738) 18,695 81,395 253,304 4,522 7,015 44 11,581

25,848 25,848 12,368 1,084 (3,183) 4,226 14,495 40,343 336 823 7 1,166 33,740 467

14,727,699 (89,052) 14,638,647 715,609 327,551 (29,273) 120,627 1,134,514 799,359 16,572,520 1,996,666 4,780,134 40,782 6,817,582 1,349,263 -

3,497,117 3,497,117 159,607 65,382 (5,210) (16,853) 202,926 1,144,565 4,844,608 178,707 1,636,687 14,143 1,829,537 205,579 -

432,750 (31,080) 401,670 22,198 5,360 (52) 3,017 30,523 169,510 601,703 (3,723) 157,210 1,357 154,844 24,019 -

93,846 93,846 6,055 25 (20) 6,060 287 100,193 90 34,087 307 34,484 47,849 -

29,114 (1,305) 27,809 2,720 1 (3) 2,718 147,734 178,261 3,115 144,119 1,233 148,467 2,336 32

18,981,541 (124,695) 18,856,846 991,337 404,061 (52,479) 129,712 1,472,631 2,261,455 22,590,932 2,179,713 6,760,075 57,873 8,997,661 1,803,122 3,163

L-7

140,336 2,664

As required by Section 40 B(4) of the Insurance Act, 1938 we certify that all expenses of Management in respect of life insurance business transacted in India by the company have been fully debited to the Policyholders' Revenue Account as expenses, unless specifically instructed by IRDA to do otherwise. The schedules referred to herein form an integral part of the Policyholders' account Per our report attached to the Balance Sheet

For A. F. Ferguson Associates Chartered Accountants

For J C Bhalla & Co. Chartered Accountants

For and on behalf of the Board of Directors

Partner Membership no.

Rajesh Sethi Partner Membership no. 85669

Mohit Burman Chairman

T R Ramachandran CEO and Managing Director

Director

Director

Director-Finance & Actuarial

Company Secretary

Place : New Delhi Date :

Place : New Delhi Date :

Place : London Date :

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

FORM L-2-A-PL Name of the Insurer: Aviva Life Insurance Company India Limited Registration No. 122 with the IRDA, dated 14 May 2002 PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 MARCH 2009 Shareholders Account (Non-technical Account) Particulars Schedule For the year ended 31 March 2009 (Rs. 000's) 5,330 289,479 7,476 (2,096) 300,189 52,290 2,588,360 2,266,510 29,334 9,065 305,147 5,250,706 (4,950,517) (4,950,517) For the year ended 31 March 2008 (Rs. 000's) 4,775 241,211 9,143 (972) 254,157

Amount transferred from Policyholders Account (Technical Account) Income From Investments (a) Interest, Dividends and Rent Gross (b) Profit on sale/redemption of investments (c) (Loss) on sale/ redemption of investments Other Income TOTAL (A) Expense other than those directly related to the insurance business Bad debts written off Provisions (Other than taxation) (a) For diminution in the value of investments (net) (b) Provision for doubtful debts (c) Others Contribution to the Policyholders Account (Technical Account) Linked Participating - Life Linked Participating - Pension Linked Non Participating - Life Linked Non Participating - Pension Linked Non Participating - Group Non Linked Group Non Linked Life TOTAL (B) Profit/ (Loss) before tax Provision for Taxation Profit / (Loss) after tax APPROPRIATIONS (a) Balance at the beginning of the year (b) Interim dividends paid during the year (c) Proposed final dividend (d) Dividend distribution on tax (e) Transfer to reserves/ other accounts Profit/ (Loss) carried forward to the Balance Sheet Earnings per equity share Weighted average number of equity shares outstanding Basic and diluted earnings per equity share (Face value of Rs. 10 per share) Significant Accounting Policies and Notes to the Accounts 16

17,563 799,359 1,144,565 169,510 287 147,734 2,279,018 (2,024,861) (2,024,861)

(6,674,942) (11,625,459)

(4,650,081) (6,674,942)

1,217,725,205 (4.07)

802,614,754 (2.52)

The schedules referred to above and the notes form an integral part of the Shareholders Account

Director

Director

Place : New Delhi Date :

Place : New Delhi Date :

Place : London Date :

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

FORM L-3-A-BS Name of the Insurer: Aviva Life Insurance Company India Limited Registration No. 122 with the IRDA, dated 14 May 2002 BALANCE SHEET AS AT 31 MARCH 2009

Particulars

Schedule

As at 31 March 2009 (Rs. 000's)

As at 31 March 2008 (Rs. 000's)

SOURCES OF FUNDS SHAREHOLDERS FUNDS: SHARE CAPITAL RESERVES AND SURPLUS CREDIT/[DEBIT] FAIR VALUE CHANGE ACCOUNT Sub-Total BORROWINGS POLICYHOLDERS FUNDS: CREDIT/[DEBIT] FAIR VALUE CHANGE ACCOUNT POLICY LIABILITIES Linked Non Participating - Individual Life Linked Non Participating - Pension Linked Non Participating - Group Non Linked Group Non Linked Life INSURANCE RESERVES PROVISION FOR LINKED LIABILITIES Linked Participating - Individual Life Linked Participating - Pension Linked Non Participating - Individual Life Linked Non Participating - Pension Linked Non Participating - Group Sub-Total FUNDS FOR FUTURE APPROPRIATIONS TOTAL APPLICATION OF FUNDS INVESTMENTS - Shareholders - Policyholders Assets held to cover linked liabilites LOANS FIXED ASSETS CURRENT ASSETS Cash & Bank Balance Advances And Other Assets Sub-Total (A) CURRENT LIABILITIES PROVISIONS Sub-Total (B) NET CURRENT ASSETS (C) = (A B) MISCELLANEOUS EXPENDITURE (to the extent not written off or adjusted) DEBIT BALANCE IN PROFIT AND LOSS ACCOUNT (Shareholders Account) TOTAL Significant Accounting Policies and Notes to the Accounts The schedules referred to herein form an integral part of the balance sheet Director Director 16 L-21 L-19 L-20 L-11 L-8,L-9 L-10 14,918,000 14,918,000 266,972 22,281 2,587 82,244 319,586 883,970 111,919 24,593,195 7,103,707 810,052 34,196,513 1,107,998 50,222,511 10,045,000 10,045,000 276,094 22,399 2,584 80,726 52,536 861,179 139,158 18,511,316 4,464,170 673,505 25,083,667 483,737 35,612,404

L-12 L-13 L-14 L-15 L-16

3,516,219 1,629,738 33,692,489 527,722

2,534,830 962,115 24,796,290 544,053

L-17 L-18

994,787 1,146,706 2,141,493 2,797,764 112,845 2,910,609 (769,116) 11,625,459 50,222,511

1,756,736 1,457,255 3,213,991 2,976,232 137,585 3,113,817 100,174 6,674,942 35,612,404

Place : New Delhi Date : AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

Place : New Delhi Date :

Place : London Date :

Place : London Date : 6

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-4-PREMIUM SCHEDULE PREMIUM For the year ended 31 March 2009 Linked Non Par Linked Non Par Non Linked Group Pension Group (Rs. 000's) 2,142,156 2,030,252 105,628 4,278,036 (Rs. 000's) 232,283 47,367 279,650 (Rs. 000's) 28,991 77,730 282 107,003

Particulars

Linked Par Individual Life (Rs. 000's)

Linked Par Pension (Rs. 000's) 250 16,783 17,033

Linked Non Par Individual Life (Rs. 000's) 4,320,175 10,344,593 139,675 14,804,443

Non Linked Life (Rs. 000's) 62,862 16,585 213,936 293,383

Total

(Rs. 000's) 6,786,067 12,683,079 459,521 19,928,667

First year premiums Renewal premiums Single premiums TOTAL PREMIUM Note: Premium Income is Gross of Service Tax Premium Income from business written : In India Outside India TOTAL PREMIUM

(650) 149,769 149,119

149,119 149,119

17,033 17,033

14,804,443 14,804,443

4,278,036 4,278,036

279,650 279,650

107,003 107,003

293,383 293,383

19,928,667 19,928,667

Particulars

Linked Par Individual Life

Linked Par Pension

Linked Non Par Individual Life

For the year ended 31 March 2008 Linked Non Par Linked Non Par Non Linked Group Pension Group

Non Linked Life

Total

(Rs. 000's) First year premiums Renewal premiums Single premiums TOTAL PREMIUM Note: Premium Income is Gross of Service Tax Premium Income from business written : In India Outside India TOTAL PREMIUM 175,167 175,167 (1,788) 176,940 15 175,167

(Rs. 000's) 130 25,708 10 25,848

(Rs. 000's) 7,256,945 7,362,296 108,458 14,727,699

(Rs. 000's) 2,585,991 838,990 72,136 3,497,117

(Rs. 000's) 432,750 432,750

(Rs. 000's) 77,324 16,522 93,846

(Rs. 000's) 10,665 7,477 10,972 29,114

(Rs. 000's) 10,362,017 8,411,411 208,113 18,981,541

25,848 25,848

14,727,699 14,727,699

3,497,117 3,497,117

432,750 432,750

93,846 93,846

29,114 29,114

18,981,541 18,981,541

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-5 - COMMISSION SCHEDULE COMMISSION EXPENSES For the year ended 31 March 2009 Linked Non Linked Non Linked Non Participating Participating Participating Individual Life Pension Group (Rs. 000's) (Rs. 000's) (Rs. 000's) 783,478 404,591 3,236 1,191,305 (26,657) 1,164,648 299,951 32,503 2,110 334,564 334,564 76 1 77 (2,338) (2,261)

Particulars

Linked Participating Individual Life (Rs. 000's)

Linked Participating Pension (Rs. 000's) 10 152 162 162

Non Linked Group (Rs. 000's) 1,078 1,078 1,078

Non Linked Life

Total

(Rs. 000's) 12,580 849 2,077 15,506 15,506

(Rs. 000's) 1,097,241 443,782 7,423 1,548,446 (28,797) 1,519,649

Commission Paid Direct - First year premiums - Renewal premiums - Single premiums Total (A) Add : Commission on Re-insurance Accepted Less : Commission on Re-insurance Ceded* Net Commission Commission Expenses Agents Brokers Corporate Agency Referral fee Total (B)

68 5,686 5,754 198 5,952

1,448 (161) 1,153 3,314

97 1 20 44

289,886 84,487 107,787 709,145

38,818 2,336 16,887 276,523

77 77 -

1,078 1,078 -

6,541 342 743 7,880 15,506 -

337,945 87,005 126,590 996,906 1,548,446 -

5,754 162 1,191,305 334,564 * Represents profit commmission on final determination of reinsurance profits for the calendar year 2008 (Refer note 3.6 of schedule 16 Part B).

Particulars

Linked Participating Individual Life (Rs. 000's)

Linked Participating Pension (Rs. 000's) 9 327 336 336

For the year ended 31 March 2008 Linked Non Linked Non Linked Non Participating Participating Participating Individual Life Pension Group (Rs. 000's) (Rs. 000's) (Rs. 000's) 1,677,026 346,118 2,164 2,025,308 (28,642) 1,996,666 163,228 13,481 1,998 178,707 178,707 (3,850) (3,723) 129 (2) 127

Non Linked Group (Rs. 000's) 91 (2) 1 90 90

Non Linked Life (Rs. 000's) 716 349 2,050 3,115 3,115

Total (Rs. 000's) 1,840,325 367,029 6,213 2,213,567 (33,854) 2,179,713

Commission Paid Direct - First year premiums - Renewal premiums - Single premiums Total (A) Add : Commission on Re-insurance Accepted Less : Commission on Re-insurance Ceded* Net Commission Commission Expenses Agents Brokers Corporate Agency Referral fee Total (B)

(874) 6,758 5,884 (1,362) 4,522

1,587 50 1,596 2,651 5,884

133 3 158 42 336

409,354 105,192 112,864 1,397,898 2,025,308

43,533 3,162 33,310 98,702 178,707

127 127

90 90

3,017 28 (12) 82 3,115

457,841 108,435 147,916 1,499,375 2,213,567

* Represents profit commmission on final determination of reinsurance profits for the calendar year 2007 (Refer note 3.6 of schedule 16 Part B).

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-6-OPERATING EXPENSES SCHEDULE OPERATING EXPENSES RELATED TO INSURANCE BUSINESS Particulars Linked Participating Individual Life (Rs. 000's) 1,361 50 1 812 15 87 286 275 6 387 790 282 3,973 223 192 112 144 488 9,484 Linked Participating Pension (Rs. 000's) 174 6 1 92 2 10 33 30 2 44 105 32 426 25 22 13 15 56 1,088 Linked Non Participating Individual Life (Rs. 000's) 1,945,827 244,350 94,179 504,401 5,478 66,868 196,312 104,905 11,209 1,964 68 170 790,677 18,141 102,933 316,983 94,154 81,093 47,350 60,139 177,416 4,864,617 For the year ended 31 March 2009 Linked Non Linked Non Non Linked Participating Participating Group Pension Group (Rs. 000's) (Rs. 000's) (Rs. 000's) 1,082,513 142,205 56,633 211,909 1,648 21,965 76,654 32,985 6,830 589 20 51 437,139 5,235 31,077 86,458 32,211 27,743 16,199 20,643 53,367 2,344,074 69,501 9,493 3,875 9,761 28 402 2,928 714 474 11 1 28,001 610 549 8,258 954 821 480 811 922 138,594 27,739 3,814 1,556 3,948 12 171 1,194 295 190 4 11,255 63 229 405 390 336 196 250 385 52,432 Non Linked Life (Rs. 000's) 89,092 7,677 2,152 53,725 875 11,447 25,239 16,129 200 312 12 28 35,000 1,095 16,389 1,110 13,279 11,437 6,678 8,510 28,339 328,725 Total (Rs. 000's) 3,216,207 407,595 158,397 784,648 8,058 100,950 302,646 155,333 18,903 2,888 100 250 1,302,503 26,039 151,491 417,613 141,236 121,644 71,028 90,512 260,973 7,739,014

Employees remuneration and welfare benefits Travel, conveyance and vehicle running expenses Training expenses Rents, rates and taxes Repairs Printing and stationery Communication expenses Legal and professional charges Medical fees Auditors' fees, expenses etc a) as auditor b) as adviser or in any other capacity, in respect of (i) Taxation matters (ii) Insurance matters (iii) Management services; and c) in any other capacity (Tax Audit) Advertisement and publicity Interest and bank charges Information technology and related expenses Service tax on premium Others a) Office maintenance b) Electricity c) Recruitement d) Miscellaneous expenses Depreciation TOTAL

Particulars

Linked Participating Individual Life (Rs. 000's)

Linked Participating Pension (Rs. 000's) 281 20 5 64 8 23 53 15 1 19 118 56 30 22 27 3 78 823

Linked Non Participating Individual Life (Rs. 000's) 1,804,041 312,554 144,293 160,155 16,422 95,970 180,900 34,561 26,679 2,034 113 1,352,787 65,588 117,808 60,768 87,647 65,423 78,192 9,669 164,530 4,780,134

For the year ended 31 March 2008 Linked Non Linked Non Non Linked Participating Participating Group Pension (Rs. 000's) 641,510 116,933 55,467 37,728 3,872 25,024 48,081 8,599 10,566 480 26 534,787 19,394 27,774 24,599 18,361 21,944 2,770 38,772 1,636,687 Group (Rs. 000's) 61,498 11,998 5,864 1,049 128 1,022 2,338 368 1,159 16 1 58,518 1,765 915 4,815 1,555 1,161 1,386 375 1,279 157,210 12,673 2,470 1,205 250 30 226 511 83 237 3 12,002 70 214 2,897 333 248 298 38 299 34,087

Non Linked Life (Rs. 000's) 48,630 4,959 1,521 14,998 1,456 8,288 14,292 2,830 95 181 10 5,371 757 10,461 5,696 4,252 5,082 641 14,599 144,119

Total

(Rs. 000's) 2,570,313 449,048 208,377 214,662 21,967 130,697 246,515 46,554 38,736 2,721 150 1,963,513 88,417 157,593 70,454 120,055 89,612 107,104 13,518 220,069 6,760,075 9

Employees remuneration and welfare benefits Travel, conveyance and vehicle running expenses Training expenses Rents, rates and taxes Repairs Printing and stationery Communication expenses Legal and professional charges Medical fees Auditors' fees, expenses etc a) as auditor b) as adviser or in any other capacity, in respect of (i) Taxation matters (ii) Insurance matters (iii) Management services; and c) in any other capacity (Tax Audit) Advertisement and publicity Interest and bank charges Information technology and related expenses Service tax on premium Others a) Office maintenance b) Electricity c) Recruitement d) Miscellaneous expenses Depreciation TOTAL AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

1,680 114 22 418 51 144 340 98 6 29 725 365 1,974 195 145 175 22 512 7,015

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-7-BENEFITS PAID SCHEDULE BENEFITS PAID [NET] For the year ended 31 March 2009 Linked Non Linked Non Participating Participating Pension (Rs. 000's) 17,876 28,800 (3,042) 260,471 304,105 Group (Rs. 000's) 159 43,206 (13,422) 29,943

Particulars

Linked Participating Individual Life (Rs. 000's)

Linked Participating Pension (Rs. 000's) 164 14,361 32,776 47,301

Linked Non Participating Individual Life (Rs. 000's) 173,320 1,230 (2,392) 1,285,081 (33,869) 1,423,370

Non Linked Group (Rs. 000's) 67,338 1,337 68,675

Non Linked Life (Rs. 000's) 3,688 25 4 380 (1,807) 2,290

Total

(Rs. 000's) 274,142 46,791 43,206 (5,430) 1,714,289 (61,429) 2,011,569

Insurance Claims (a) Claims by Death, (b) Claims by Maturity, (c) Annuities/Pension payment (d) Other benefits - Riders - Surrender (Amount ceded in reinsurance): (a) Claims by Death, (b) Claims by Maturity, (c) Annuities/Pension payment (d) Other benefits - Riders - Surrender Amount accepted in reinsurance : (a) Claims by Death, (b) Claims by Maturity, (c) Annuities/Pension payment (d) Other benefits - Riders - Surrender TOTAL Benefits paid to claimants: In India Outside India Total Benefits paid (Net)

11,597 2,375 134,244 (12,331) 135,885

135,885 135,885

47,301 47,301

1,423,370 1,423,370

304,105 304,105

29,943 29,943

68,675 68,675

2,290 2,290

2,011,569 2,011,569

Particulars

Linked Participating Individual Life (Rs. 000's) 5,769 619 1 134,179 (232) 140,336 140,336 140,336

Linked Participating Pension (Rs. 000's) 234 156 33,350 33,740 33,740 33,740

Linked Non Participating Individual Life (Rs. 000's) 140,381 182 1,995 1,232,149 (25,444) 1,349,263 1,349,263 1,349,263

For the year ended 31 March 2008 Linked Non Linked Non Participating Participating Pension Group (Rs. 000's) (Rs. 000's) 8,928 (48) 196,699 205,579 205,579 205,579 294 36,935 (13,210) 24,019 24,019 24,019

Non Linked Group (Rs. 000's) 47,324 525 47,849 47,849 47,849

Non Linked Life (Rs. 000's) 3,448 31 7 (1,150) 2,336 2,336 2,336

Total (Rs. 000's) 206,378 988 37,460 1,948 1,596,384 (40,036) 1,803,122 1,803,122 1,803,122

Insurance Claims (a) Claims by Death, (b) Claims by Maturity, (c) Annuities/Pension payment (d) Other benefits - Riders - Surrender (Amount ceded in reinsurance): (a) Claims by Death, (b) Claims by Maturity, (c) Annuities/Pension payment (d) Other benefits - Riders - Surrender Amount accepted in reinsurance : (a) Claims by Death, (b) Claims by Maturity, (c) Annuities/Pension payment (d) Other benefits - Riders - Surrender TOTAL Benefits paid to claimants: In India Outside India Total Benefits paid (Net)

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

10

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-8-SHARE CAPITAL SCHEDULE SHARE CAPITAL Particulars As at 31 March 2009 (Rs. 000's) 25,000,000 As at 31 March 2008 (Rs. 000's) 25,000,000

Authorised Capital 2,500,000,000 (Previous Year 2,500,000,000) Equity shares of Rs 10 each Issued, Subscribed and Called up Capital 1,491,800,000 (Previous Year 1,004,500,000) Equity shares of Rs 10 each, fully paid up * Less : Calls unpaid Add : Shares forfeited (Amount originally paid up) Less: Par value of Equity Shares bought back Less: Preliminery expenses Expenses including commission or brokerage or underwriting or subscription of shares. TOTAL

14,918,000

10,045,000

14,918,000 10,045,000

*1,103,932,000 equity shares (Previous year 743,330,000) are held in the name of Partners, who are holding these shares on behalf of Dabur Invest Corp. (Partnership Firm). During the year 487,300,000 equity shares (Previous Year 246,300,000) of Rs. 10 each were alloted, at par value.

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

11

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-9-PATTERN OF SHAREHOLDING SCHEDULE PATTERN OF SHAREHOLDING [As certified by the Management] Shareholder Promoters - Indian - Foreign Others TOTAL As at 31 March 2009 Number of Shares % of Holding 1,103,932,000 387,868,000 1,491,800,000 74% 26% 100% As at 31 March 2008 Number of Shares % of Holding 743,330,000 261,170,000 1,004,500,000 74% 26% 100%

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

12

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-10-RESERVES AND SURPLUS SCHEDULE RESERVES AND SURPLUS Particulars As at 31 March 2009 (Rs. 000's) Capital Reserve Capital Redemption Reserve Share Premium Revaluation Reserve General Reserves Less: Debit balance in Profit and Loss Account, if any Less: Amount utilized for Buy-back Catastrophe Reserve Other Reserves Balance of profit in Profit and Loss Account TOTAL As at 31 March 2008 (Rs. 000's) -

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

13

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-11-BORROWINGS SCHEDULE BORROWINGS Particulars As at 31 March 2009 (Rs. 000's) Debentures/ Bonds Banks Financial Institutions Others TOTAL As at 31 March 2008 (Rs. 000's) -

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

14

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-12-INVESTMENTS SHAREHOLDERS SCHEDULE INVESTMENTS-SHAREHOLDERS Particulars LONG TERM INVESTMENTS Government Securities and Government guaranteed bonds Including Treasury Bills (Market value (Rs '000) Current Year 109,304 Previous Year 155,489 (Refer to note 1 below) Other Approved Securities Other Investments (a) Shares (aa) Equity (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/ Bonds (e) Other Securities (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector Non Convertible Debentures (Market value (Rs '000) Current Year 396,016 ,Previous Year 96,290 ) Other than Approved Investments Debentures/ Bonds As at 31 March 2009 (Rs.000's) 107,473 As at 31 March 2008 (Rs.000's) 158,930

383,638

96,840

SHORT TERM INVESTMENTS Government Securities and Government guaranteed bonds including Treasury Bills Government Securities (Market value(Rs '000) Current Year 76,555 , Previous Year NIL)

76,533

Treasury Bills (Market value (Rs '000) Current Year1,977,923, Previous Year 1,674,418) Other Approved Securities Other Investments (a) Shares (aa) Equity (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/ Bonds (e) Other Securities (Commercial Papers and Certificate of Deposits) (Market value (Rs '000) Current Year 447,381 , Previous Year Nil) (e) Other Securities (Reverse Repo) (Market value (Rs '000) Current Year 162,000 , Previous Year Nil) (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector Non Convertible Debentures (Market value (Rs '000) Current Year 366,498, Previous Year 603,815) Other then Approved Investments Mutual Funds TOTAL INVESTMENTS In India Outside India TOTAL

1,977,923

1,674,418

447,381 162,000 361,271

604,642

3,516,219 3,516,219 3,516,219

2,534,830 2,534,830 2,534,830

Note: 1. Includes Rs. 100,649 ( Previous year Rs. 104,462) invested in Government Securitites , pursuant to Section 7 of the Insurance Act 1938 AVIVA LIFE INSURANCE COMPANY INDIA LIMITED 15

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-13-INVESTMENTS POLICYHOLDERS SCHEDULE INVESTMENTS-POLICYHOLDERS Particulars As at 31 March 2009 (Rs.000's) LONG TERM INVESTMENTS Government Securities and Government guaranteed bonds Including Treasury Bills (Market value (Rs '000) Current Year 195,108, Previous Year 51,138 ) Other Approved Securities Other Investments (a) Shares (aa) Equity (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/ Bonds (e) Other Securities (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector Non Convertible Debentures (Market value (Rs '000) Current Year 264,220, Previous Year 82,662 ) As at 31 March 2008 (Rs.000's)

187,097

52,748

252,774

82,647

Other than Approved Investments SHORT TERM INVESTMENTS Government Securities and Government guaranteed bonds including Treasury Bills Treasury Bills (Market value (Rs '000) Current Year 638,141 , Previous Year 449,897 ) Other Approved Securities (a) Shares (aa) Equity (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/ Bonds (e) Other Securities (Term Deposit and Certificate of Deposits) (Market value (Rs '000) Current Year 294,741 , Previous Year 137,680 ) (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector Non Convertible Debentures (Market value (Rs '000) Current Year 174,248 , Previous Year 193,752 ) Other than Approved Investments Balances in bank Other Current assets (net) TOTAL INVESTMENTS In India Outside India TOTAL 6,616 78,116 1,629,738 800 44,422 962,115

638,141

449,897

294,741 172,253

137,680 193,921

1,629,738 1,629,738

962,115 962,115

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

16

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-14-ASSETS HELD TO COVER LINKED LIABILITIES SCHEDULE INVESTMENTS - ASSETS HELD TO COVER LINKED LIABILITIES As at 31 March 2009 Linked Non Par Linked Non Par Individual Life Pension (Rs.000's) (Rs.000's) 5,540,765 1,820,038

Particulars

Linked Par Individual Life (Rs.000's) -

Linked Par Pension (Rs.000's)

Linked Non Par Group Funds (Rs.000's) 193,052

Total (Rs.000's) 7,553,855

LONG TERM INVESTMENTS Government Securities and Government guaranteed bonds Including Treasury Bills * Linked Par (Ind Life) Nil PY 86,714, Linked Par (Pension) Nil PY 12,193 * Linked Non Par (Ind Life) 5,548,742, PY 3,931,825, Linked Non Par (Pension) 1,833,557 PY 1,012,453 * Linked Non Par (Group) 188,463,PY 202,906 Other Approved Securities (a) Shares (aa) Equity * Linked Par (Ind Life) 4,592 PY 7.921, Linked par (Pension) 729 PY1,486 * Linked Non Par (Ind Life) 9,440,215 PY 5,480,446, Linked Non Par (Pension) 3,058,247 PY 1,392,121 * Linked Non Par (Group) 33,675 PY 82,241 (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/Bonds * Linked Par (Ind Life) Nil ,PY Nil Linked Par (Pension) Nil PY Nil * Linked Non Par (Ind Life) 16,841 PY 150,336, Linked Non Par (Pension) 988 PY 8,870 * Linked Non Par (Group) 2,469, PY 6,200 (e) Other Securities (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector : Non Convertible Debentures * Linked Par (Ind Life) 19,071 PY86303 , Linked Par (Pension) 8,934, PY 14,881 * Linked Non Par (Ind Life) 1,622,448,PY 1,251,586, Linked Non Par (Pension) 449,041,PY318,520 * Linked Non Par (Group) 36,022, PY 31.360 Other then approved Investments (a) Equity Shares * Linked Par (Ind Life) 277 PY 277, Linked par (Pension) 330, PY 404 * Linked Non Par (Ind Life) 3,887,202, PY2,038,901,Linked Non Par (Pension) 995,691, PY455,162 * Linked Non Par (Group) 14,753 PY 32,872 (b) Debentures/Bonds

6,755

1,002

7,463,756

2,424,983

27,473

9,923,969

16,969

996

2,488

20,453

19,964

9,353

1,666,645

463,013

37,411

2,196,386

1,684

232

2,756,358

679,608

11,673

3,449,555

SHORT TERM INVESTMENTS Government Securities and Government guaranteed bonds Including Treasury Bills Government Securities and Government guaranteed bonds * Linked Par (Ind Life) Nil, PY Nil , Linked Par (Pension) Nil, PY Nil * Linked Non Par (Ind Life) Nil, PY Nil ,Linked Non Par (Pension) Nil, PY Nil * Linked Non Par (Group) Nil, PY Nil Treasury Bills * Linked Par (Ind Life) 566,743, PY 479,986, Linked Par (Pension) 77216, PY 81,883 * Linked Non Par (Ind Life) 375836, PY 411,921 ,Linked Non Par (Pension) 51976, PY 295,982 * Linked Non Par (Group) 22,296, PY 134,821 Other Approved Securities (a) Shares (aa) Equity (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/ Bonds * Linked Par (Ind Life) Nil PY 10000,Linked Non Par (Ind Life) Nil PY Nil * Linked Non Par (Ind Life) 81,547 PY 133,149 ,Linked Non Par (Pension) 7881, PY 391 * Linked Non Par (Group) 5,393 PY 7 (e) Other Securities (Certificate of Deposit and Term Deposits) * Linked Par (Ind Life) 186,757, PY 89,996 ,Linked Par (Pension) 25,742 PY 15,402

* Linked Non Par (Ind Life) 3,240,355, PY 2,214,092, Linked Non Par (Pension) 694,260,PY 554,249

592,794

80,108

375,973

52,028

22,340

1,123,243

76,538

8,254

5,392

90,184

193,195

26,594

3,305,002

711,162

380,642

4,616,595

* Linked Non Par (Group) 361,100 PY 40,761 (e) Other Securities (Reverse Repo) * Linked Par (Ind Life) 1900, PY Nil ,Linked Par (Pension) Nil PY Nil * Linked Non Par (Ind Life) 1,99,260, PY Nil, Linked Non Par (Pension) 492,800PY Nil * Linked Non Par (Group) 40,300 PY Nil (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector * Linked Par (Ind Life) 214,691,PY 187,545 ,Linked Par (Pension) 19,487 PY 29,170 * Linked Non Par (Ind Life) 934,363,PY 724,480, Linked Non Par (Pension) 228,158 PY 20,013 * Linked Non Par (Group) 20,512 PY Nil Other then approved Investments Debentures/Bonds Mutual Funds * Linked Par (Ind Life) Nil PY Nil,Linked Par (Pension) Nil PY Nil * Linked Non Par (Ind Life) Nil PY 300,500 ,Linked Non Par (Pension) Nil PY 82,500 * Linked Non Par (Group) Nil PY 41,500 Balances in Bank Other Current Assets (net) TOTAL INVESTMENTS In India TOTAL * Historical Cost CY (Rs '000) AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

1,900

1,990,260

492,800

40,300

2,525,260

219,895

19,804

949,983

231,876

20,678

1,442,236

280 9,683 1,046,150

872 1,420 139,385

16,001 434,945 24,593,195

22,924 196,025 7,103,707

804 67,799 810,052

40,881 709,872 33,692,489

1,046,150 1,046,150

139,385 139,385

24,593,195 24,593,195

7,103,707 7,103,707

810,052 810,052

33,692,489 33,692,489

17

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-14-ASSETS HELD TO COVER LINKED LIABILITIES SCHEDULE INVESTMENTS - ASSETS HELD TO COVER LINKED LIABILITIES As at 31 March 2008 Linked Non Par Linked Non Par Individual Life Pension (Rs.000's) (Rs.000's) 11,312 3,840,098 992,720

Particulars

Linked Par Individual Life (Rs.000's) 80,420

Linked Par Pension (Rs.000's)

Linked Non Par Group Funds (Rs.000's) 201,667

Total (Rs.000's) 5,126,217

LONG TERM INVESTMENTS Government Securities and Government guaranteed bonds Including Treasury Bills * Linked Par (Ind Life) Nil PY 86,714, Linked Par (Pension) Nil PY 12,193 * Linked Non Par (Ind Life) 5,548,742, PY 3,931,825, Linked Non Par (Pension) 1,833,557 PY 1,012,453 * Linked Non Par (Group) 188,463,PY 202,906 Other Approved Securities (a) Shares (aa) Equity * Linked Par (Ind Life) 4,592 PY 7.921, Linked par (Pension) 729 PY1,486 * Linked Non Par (Ind Life) 9,440,215 PY 5,480,446, Linked Non Par (Pension) 3,058,247 PY 1,392,121 * Linked Non Par (Group) 33,675 PY 82,241 (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/Bonds * Linked Par (Ind Life) Nil ,PY Nil Linked Par (Pension) Nil PY Nil * Linked Non Par (Ind Life) 16,841 PY 150,336, Linked Non Par (Pension) 988 PY 8,870 * Linked Non Par (Group) 2,469, PY 6,200 (e) Other Securities (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector : Non Convertible Debentures * Linked Par (Ind Life) 19,071 PY86303 , Linked Par (Pension) 8,934, PY 14,881 * Linked Non Par (Ind Life) 1,622,448,PY 1,251,586, Linked Non Par (Pension) 449,041,PY318,520 * Linked Non Par (Group) 36,022, PY 31.360 Other then approved Investments (a) Equity Shares * Linked Par (Ind Life) 277 PY 277, Linked par (Pension) 330, PY 404 * Linked Non Par (Ind Life) 3,887,202, PY2,038,901,Linked Non Par (Pension) 995,691, PY455,162 * Linked Non Par (Group) 14,753 PY 32,872 (b) Debentures/Bonds

22,201

4,469

6,557,185

1,502,749

85,372

8,171,976

144,259

8,983

6,215

159,457

86,625

14,805

1,247,766

318,100

31,369

1,698,665

2,223

374

2,252,870

455,197

35,422

2,746,086

SHORT TERM INVESTMENTS Government Securities and Government guaranteed bonds Including Treasury Bills Government Securities and Government guaranteed bonds * Linked Par (Ind Life) Nil, PY Nil , Linked Par (Pension) Nil, PY Nil * Linked Non Par (Ind Life) Nil, PY Nil ,Linked Non Par (Pension) Nil, PY Nil * Linked Non Par (Group) Nil, PY Nil Treasury Bills * Linked Par (Ind Life) 566,743, PY 479,986, Linked Par (Pension) 77216, PY 81,883 * Linked Non Par (Ind Life) 375836, PY 411,921 ,Linked Non Par (Pension) 51976, PY 295,982 * Linked Non Par (Group) 22,296, PY 134,821 Other Approved Securities (a) Shares (aa) Equity (bb) Preference (b) Mutual Funds (c) Derivative Instruments (d) Debentures/ Bonds * Linked Par (Ind Life) Nil PY 10000,Linked Non Par (Ind Life) Nil PY Nil * Linked Non Par (Ind Life) 81,547 PY 133,149 ,Linked Non Par (Pension) 7881, PY 391 * Linked Non Par (Group) 5,393 PY 7 (e) Other Securities (Certificate of Deposit and Term Deposits) * Linked Par (Ind Life) 186,757, PY 89,996 ,Linked Par (Pension) 25,742 PY 15,402

* Linked Non Par (Ind Life) 3,240,355, PY 2,214,092, Linked Non Par (Pension) 694,260,PY 554,249

492,140

82,808

416,433

299,404

135,089

1,425,874

9,881

136,349

407

146,644

90,002

15,418

2,279,004

562,444

41,240

2,988,108

* Linked Non Par (Group) 361,100 PY 40,761 (e) Other Securities (Reverse Repo) * Linked Par (Ind Life) 1900, PY Nil ,Linked Par (Pension) Nil PY Nil * Linked Non Par (Ind Life) 1,99,260, PY Nil, Linked Non Par (Pension) 492,800PY Nil * Linked Non Par (Group) 40,300 PY Nil (f) Subsidiaries (g) Investment Properties-Real Estate Investments in Infrastructure and Social Sector * Linked Par (Ind Life) 214,691,PY 187,545 ,Linked Par (Pension) 19,487 PY 29,170 * Linked Non Par (Ind Life) 934,363,PY 724,480, Linked Non Par (Pension) 228,158 PY 20,013 * Linked Non Par (Group) 20,512 PY Nil Other then approved Investments Debentures/Bonds Mutual Funds * Linked Par (Ind Life) Nil PY Nil,Linked Par (Pension) Nil PY Nil * Linked Non Par (Ind Life) Nil PY 300,500 ,Linked Non Par (Pension) Nil PY 82,500 * Linked Non Par (Group) Nil PY 41,500 Balances in Bank Other Current Assets (net) TOTAL INVESTMENTS In India TOTAL * Historical Cost CY (Rs '000) AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

187,714

29,290

742,751

19,969

979,724

300,500

82,500

41,500

424,500

647 14,420 986,273

262 2,288 161,026

241,876 352,225 18,511,316

254,765 (33,068) 4,464,170

6,587 89,037 673,505

504,137 424,902 24,796,290

986,273 986,273

161,026 161,026

18,511,316 18,511,316

4,464,170 4,464,170

673,505 673,505

24,796,290 24,796,290

18

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-15-LOANS SCHEDULE LOANS Particulars As at 31 March 2009 (Rs. 000's) Security-Wise Classification Secured (a) On mortgage of property (aa) In India (bb) Outside India (b) On Shares, Bonds, Govt. Securities etc (c) Loans against policies (d) Others (to be specified) Unsecured TOTAL BORROWER-WISE CLASSIFICATION (a) Central and State Governments (b) Banks and Financial Institutions (c) Subsidiaries (d) Companies (e) Loans against policies (f) Others TOTAL PERFORMANCE-WISE CLASSIFICATION (a) Loans classified as standard (aa) In India (bb) Outside India (b) Non-standard loans less provisions (aa) In India (bb) Outside India TOTAL MATURITY-WISE CLASSIFICATION (a) Short Term (b) Long Term Total As at 31 March 2008 (Rs. 000's)

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

19

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM 16-FXED ASSETS SCHEDULE (Rs. 000's) FIXED ASSETS

Particulars Balance as on 1 April,2008 Goodwill Intangibles - Software Tangibles Leasehold Improvements Buildings Furniture & Fittings Information Technology Equipment Vehicles Office Equipment Sub Total Capital Work In Progress - (including capital advances) TOTAL PREVIOUS YEAR 27,114 300,247 150,817 469,489

Cost/ Gross Block Additions during the year 1,482 93,833 11,808 129,524 Deductions Balance as on 31 March 2009 28,596 380,345 159,743 570,056 Balance as on 1 April,2008 14,208 110,524 59,541 301,906

Depreciation For the year Sales/ Adjustments 13,735 2,882 28,849 Balance as on 31 March 2009 22,408 164,387 86,596 413,750

Net Block As at 31 March 2009 6,188 215,958 73,147 156,306 As at 31 March 2008 12,906 189,723 91,276 167,583

13,735 2,882 28,957

8,200 67,598 29,937 140,693

3,897 93,032 1,044,596

73 15,152 251,872

2,350 47,924

1,620 108,184 1,248,544

2,670 76,797 565,646

544 14,002 260,974

2,192 47,658

1,022 90,799 778,962

598 17,385 469,582 58,140

1,227 16,235 478,950 65,103

1,044,596 511,805

251,872 534,000

47,924 1,209

1,248,544 1,044,596

565,646 346,716

260,974 220,069

47,658 1,139

778,962 565,645

527,722 544,053

544,053

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

20

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-17-CASH AND BANK BALANCE SCHEDULE CASH AND BANK BALANCES Particulars As at 31 March 2009 (Rs. 000's) Cash (including cheques,drafts and stamps) Bank Balances (a) Deposit Accounts (aa) Short-term (due within 12 months of the date of balance sheet) (bb) Others Current Accounts 398,954 As at 31 March 2008 (Rs. 000's) 405,344

509,308 ok 2,734 83,791 ok

885,912

(b)

465,480

(c) Others Money at Call and Short Notice (a) With Banks (b) With other Institutions Others TOTAL Includes balances with non-scheduled banks. CASH AND BANK BALANCES In India Outside India TOTAL

994,787 -

1,756,736 -

994,787 994,787

1,756,736 1,756,736

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

21

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-18-ADVANCE AND OTHER ASSETS SCHEDULE ADVANCES AND OTHER ASSETS Particulars As at 31 March 2009 (Rs. 000's) ADVANCES Reserve deposits with ceding companies Application money for investments Prepayments Advances to Directors/Officers Advance tax paid and taxes deducted at source (Net of provision for taxation) Others (includes vendor, travel advances & salary recoverable) TOTAL (A) OTHER ASSETS Income accrued on investments Outstanding Premiums Agents Balances Foreign Agencies Balances Due from other entities carrying on insurance business (including reinsurers) Reinsurance claims/balances receivable Deposit with Reserve Bank of India (In Pursuant to Sec 7 of Insurance Act, 1938) (Refer Note 12 of Schedule 16 Part C) Others -Refundable Security Deposits -Service Tax Unutilised Credit TOTAL (B) TOTAL (A+B) As at 31 March 2008 (Rs. 000's)

22,834 8,595 20,054 51,483

ok

14,339 388,960 403,299

ok

46,752 803 18,050 65,457 -

ok ok

ok

64,101 1,011 17,678 75,076 -

324,123 640,038 1,095,223 1,146,706 ok 284,287 611,803 1,053,956 1,457,255

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

22

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-19-CURRENT LIABILITIES SCHEDULE CURRENT LIABILITIES Particulars As at 31 March 2009 (Rs. 000's) Agents Balances Balances due to other insurance companies Deposits held on re-insurance ceded Premiums received in advance Unallocated premium Sundry creditors Micro, Small & Medium Enterprises Others Accrual for expenses Due to subsidiaries/ holding company Claims Outstanding Annuities Due Due to Directors/Officers Others: Due to funds Proposal deposits not yet underwritten Premium/ proposal deposits,to be refunded Others (includes statutory dues payable and payables to employees) Service Tax payable TOTAL 351,555 98,192 12,183 36,932 51 145,542 939,549 59,766 746,101 20,094 143,386 242,416 ok ok ok ok ok As at 31 March 2008 (Rs. 000's) 309,100 104,133 15,310 66,158 161,847 1,081,963 57,395 704,190 176,365 92,948 196,101 10,722 2,976,232

ok ok

ok ok ok

1,997 ok 2,797,764

FORM L-20-PROVISIONS SCHEDULE PROVISIONS Particulars As at 31 March 2009 (Rs. 000's) For taxation (less payments and taxes deducted at source) For proposed dividends For dividend distribution tax Others: Provision for Gratuity Provision for Leave Encashment Provision for Other Long Term Benefits Provision for Other Employee Benefits (Refer Note 22 of Schedule 16, Part C) TOTAL AVIVA LIFE INSURANCE COMPANY INDIA LIMITED 11,943 32,817 18,974 49,111 As at 31 March 2008 (Rs. 000's) 5,016 23,988 25,910 30,010 52,661

112,845

137,585 23

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-21-MISC EXPENDITURE SCHEDULE MISCELLANEOUS EXPENDITURE (To the extent not written off or adjusted)

Particulars

As at 31 March 2009 (Rs. 000's)

As at 31 March 2008 (Rs. 000's) -

Discount Allowed in issue of shares/ debentures Others TOTAL

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

24

Aviva Life Insurance Company India Limited (Registration Code: 0122) SCHEDULES FORMING PART OF FINANCIAL STATEMENTS FORM L-22 Analytical Ratios Analytical Ratios*

S.No.

Particulars

As at 31 March 2009

As at 31 March 2008

1 New business premium income growth rate - segment wise Linked Par Individual Life Linked Par Pension Linked Non Par Individual Life Linked Non Par Pension Linked Non Par Group Non Linked Group Non Linked Life 2 Net Retention Ratio 3 Expense of Management to Gross Direct Premium Ratio 4 Commission Ratio (Gross commission paid to Gross Premium) 5 Ratio of policy holder's liabilities to shareholder's funds 6 Growth rate of shareholders' fund 7 Ratio of surplus to policyholders' liability 8 Change in net worth in ('000) 9 Profit after tax/Total Income 10 (Total real estate + loans)/(Cash & invested assets) 11 Total investments/(Capital + Surplus) 12 Total affiliated investments/(Capital+ Surplus) 13 Investment Yield (Gross) Policyholders Funds: Non-Linked: R1. PAR R2. Non-PAR R3.Sub-TOTAL Linked: R4. PAR R5. Non-PAR R6. Sub-TOTAL R7.Grand Total Shareholders Funds Investment Yield (Net) Policyholders Funds: Non-Linked: R1. PAR R2. Non-PAR R3.Sub-TOTAL Linked: R4. PAR R5. Non-PAR R6. Sub-TOTAL R7.Grand Total Shareholders Funds 14 Conservation Ratio Linked Par Individual Life Linked Par Pension Linked Non Par Individual Life Linked Non Par Pension Linked Non Par Group Non Linked Group Non Linked Life 15 Persistency Ratio (by numbers) For 13th month For 25th month For 37th month For 49th Month for 61st month Persistency Ratio (by premium) For 13th month For 25th month For 37th month For 49th Month for 61st month 16 NPA Ratio 17 Gross NPA Ratio 18 Net NPA Ratio Equity Holding Pattern for Life Insurers (a) No. of shares (in lakhs) (b) Percentage of shareholding (Indian / Foreign) ( c) %of Government holding (in case of public sector insurance companies) (a) Basic and diluted EPS before extraordinary items (net of tax expense) (b) Basic and diluted EPS after extraordinary items (net of tax expense) (iv) Book value per share (Rs) AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

-64% 72% -41% -18% -47% -68% 1205% 99% 47% 8% 1072% (2.30) 2% (77,513) -31% NA 11.80 NA

-198% -84% 22% 199% 76% NA 43% 99% 47% 12% 759% 14.94 1% 438,139 -10% NA 8.40 NA

0% 9% 9% 8% -14% -14% -13% 9%

NA NA NA NA NA NA NA NA

0% 0% 0% 0% -18% -17% -17% 0% 84% 63% 69% 57% 11% 85% 58% 60% 52% 42% NA NA 68% 63% 47% NA NA NA NA NA

NA NA NA NA NA NA NA NA 74% 75% 76% 68% 0% NA 9% 62% 56% 58% NA NA 75% 69% NA NA NA NA NA NA

14918 74% / 26% Nil (4.07) (4.07) 2.21

10045 74% / 26% Nil (2.52) (2.52) 3.35 25

Aviva Life Insurance Company India Limited (Registration Code: 0122) Registered on 14 May 2002

FORM L-23-RECEIPT AND PAYMENTS SCHEDULE For the year ended 31 March 2009 (Rs. 000's) I Cash flows from operating activities Cash receipts from customers Premium receipts (Gross of service tax) Cash paid towards operating activities Reinsurance Payments Expenses Claims paid Commission paid Advances and Deposits Taxes Paid Net cash from operating Activities II Cash flows from investing activities Purchase of Fixed Assets Sale of Fixed Assets Investments Purchase of Investment Sale/redemption of Investment Interest, dividend and rent received Profit/(Loss) on sale/redemption of investment Net cash from investing activities III Cash flows from financing activities Proceeds from issuance of share capital Net cash from financing activities Net increase/(decrease) in cash and cash equivalent (I+II+III) Cash and cash equivalent at beginning of the year Cash and cash equivalent at the end of the year Break up as follows : Cash and Bank Balances (Refer to Note 1 below) Bank balances (Policyholder's - Schedule 8A and 8B) 8A & 8B Note 1 Cash and Bank Balances Fixed Deposits with maturity more than 3 months Cash and Bank Balances as per Schedule 11 4,873,000 4,873,000 (1,031,117) 1,620,760 589,643 2,463,000 2,463,000 (2,613) 1,623,373 1,620,760 (226,077) 1,802 (525,935) 287 For the year ended 31 March 2008 (Rs. 000's)

19,790,690

18,816,096

(154,315) (7,682,779) (2,014,375) (1,486,292) 292,341 (72,370) 8,672,900

(120,630) (5,773,515) (1,781,441) (2,160,856) (838,666) (52,857) 8,088,131

(317,472,107) 301,453,867 1,760,796 (95,298) (14,577,017)

(57,438,397) 46,490,943 559,605 359,753 (10,553,744)

542,146 47,497 (0) 542,146 452,641 994,787 0

1,115,824 504,936 9,377,797 1,115,824 640,912 1,756,736 -

Per our report attached to the Balance Sheet Director-Finance & Actuarial Place : Date : AVIVA LIFE INSURANCE COMPANY INDIA LIMITED Place : Date : Place : Date : 26 Company Secretary

Aviva Life Insurance Company India Limited (Registration Code: 0122)

FORM L-24

Valuation of net liabiltiies (Rs in Lakhs) Valuation of net liabiltiies

Sl.No. 1 a b c d 2 a b c d

Particular Linked Life General Annuity Pension Health Non-Linked Life General Annuity Pension Health

As at 31 March 2009 264,958 584 72,379 4,020 14 10 -

As at 31 March 2008 202,800 420 46,257 1,358 -

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

27

Aviva Life Insurance Company India Limited (Registration Code: 0122) For the year ended 31 March 2009 FORM L-25- (i) : Geographical Distribution Channel - Individuals (Rs in Lakhs) Geographical Distribution of Total Business SL. No. State/Union Territory RURAL (Individual) Premium (in Lakh) 466 95 8,955 113 919 6 64 11 808 3,559 399 33 379 102 9 3,611 6,380 2 3,947 2 12,213 16,507 198 245 64 10,720 556 2,176 72,539 67 16 721 4 9 1 1 2 190 157 23 6 49 38 104 242 125 229 1 2,166 452 4 109 9 732 69 98 5,624 Sum Assured (in Lakh) 757 169 8,640 55 248 9 24 7 1,248 2,134 247 57 522 371 890 3,820 2,592 2,612 10 12,889 6,747 57 740 84 9,303 607 1,162 56,001 URBAN (Individual) Premium (in Lakh) 11 15,303 322 7,239 11,081 1,361 2,132 84 42 19,530 741 13,118 12,486 723 775 5,779 10,733 14,477 15,070 27,193 196 220 75 166 13,012 690 12,291 19,587 742 21,374 1,930 18,252 3,246 21,978 271,959 3,744 96 1,066 1,554 494 437 32 19 7,188 334 3,121 4,232 141 161 1,085 3,564 3,198 2,138 6,762 32 45 19 26 2,119 128 4,033 2,838 238 5,767 360 4,168 616 4,463 64,218 Sum Assured (in Lakh) 21 31,888 596 10,633 16,761 3,018 4,376 123 210 42,305 980 25,083 31,155 1,175 1,327 9,073 27,836 25,317 22,773 57,985 187 232 102 237 14,785 1,071 21,840 23,480 1,291 40,759 2,967 30,719 4,583 31,559 486,446 TOTAL (Individual) Premium (in Lakh) 3,811 96 1,082 2,275 498 446 33 19 7,189 336 3,311 4,389 164 167 1,134 3,602 3,302 2,380 6,887 32 45 19 26 2,348 129 6,199 3,290 242 5,876 369 4,900 685 4,561 69,842 Sum Assured (in Lakh) 21 32,645 596 10,802 25,401 3,073 4,624 132 210 42,329 987 26,331 33,289 1,422 1,384 9,595 28,207 26,207 26,593 60,577 187 232 102 237 17,397 1,081 34,729 30,227 1,348 41,499 3,051 40,022 5,190 32,721 542,447

No of Policies 568 142 9,260 154 940 6 68 13 943 4,313 452 34 458 256 447 3,658 6,550 2 4,713 7 12,706 17,665 203 635 77 10,994 567 2,628 78,459

No of lives

No of Policies 11 16,446 340 7,628 12,049 1,536 2,329 86 48 21,830 786 14,338 13,539 762 818 6,215 11,872 15,478 15,996 29,711 211 232 81 172 13,691 772 13,153 20,525 788 24,647 2,061 19,696 3,393 24,489 295,729

No of lives

No of Policies 11 17,014 340 7,770 21,309 1,690 3,269 92 48 21,898 799 15,281 17,852 1,214 852 6,673 12,128 15,925 19,654 36,261 213 232 81 172 18,404 779 25,859 38,190 991 25,282 2,138 30,690 3,960 27,117 374,188

No of lives

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34

Andaman & Nicobar Islands Andhra Pradesh Arunachal Pradesh Assam Bihar Chandigarh Chattisgarh Dadra & Nagrahaveli Daman & Diu Delhi Goa Gujarat Haryana Himachal Pradesh Jammu & Kashmir Jharkhand Karnataka Kerala Madhya Pradesh Maharashtra Manipur Meghalaya Mirzoram Nagaland Orissa Puducherry Punjab Rajasthan Sikkim Tamil Nadu Tripura Uttar Pradesh Uttrakhand West Bengal Grand Total

11 15,769 322 7,334 20,036 1,474 3,051 90 42 19,594 752 13,926 16,045 1,122 808 6,158 10,835 14,486 18,681 33,573 198 220 75 166 16,959 692 24,504 36,094 940 21,619 1,994 28,972 3,802 24,154 344,498

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

28

Aviva Life Insurance Company India Limited (Registration Code: 0122) For the year ended 31 March 2009

FORM L-25- (ii)

: Geographical Distribution Channel - GROUP (Rs in Lakhs) Geographical Distribution of Total Business- GROUP Rural (Group) Urban (Group) Sum Assured (Rs lakhs) 76,453 676 490 77,619 No. of Policies 15 15 10 8 2 12 1 3 2 1 69 No. of Lives Premium (Rs lakhs) 36 135 290 238 150 863 516 104 2 9 250 2,593 Sum Assured (Rs lakhs) 11,548 6,428 48,388 18,969 174 22,040 12,029 16,161 1,111 255 6,004 143,107 No. of Policies 3 Total Business (Group) No. of Lives Premium (Rs lakhs) 57 Sum Assured (Rs lakhs) 84

Sl.No.

State / Union Territory

No. of Policies 11 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 11.00

No. of Lives ( Actual ) 937,017 6,083 4,901 948,001

Premium (Rs lakhs) 21 21

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

Andhra Pradesh Arunachal Pradesh Assam Bihar Chattisgarh Goa Gujarat Haryana Himachal Pradesh Jammu & Kashmir Jharkhand Karnataka Kerala Madhya Pradesh Maharashtra Manipur Meghalaya Mirzoram Nagaland Orissa Punjab Rajasthan Sikkim Tamil Nadu Tripura Uttar Pradesh UttraKhand West Bengal Andaman & Nicobar Islands Chandigarh Dadra & Nagrahaveli Daman & Diu Delhi Lakshadweep Puducherry Total

33,206 7,607 36,386 9,347 321 23,179 12,052 4,706 615 231 3,767 131,417

154,054

2 3

905 4,045

135 290

5 85

899 2,404

238 150 863

1 61

5,807

80

516

1,158 138 4,901

104 2 9

9 1 5

930

250

15

80

1,079,418

2,614

220,726

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

29

Aviva Life Insurance Company India Limited (Registration Code: 0122) FORM L-26-INVESTMENT ASSETS(LIFE INSURERS)-3A PART - A Statement as on: 31st March 2009 Statement of Investment Assets (Life Insurers) (Business within India) Periodicity of Submission: Quarterly Total Application as per Balance Sheet (A) Add (B) Provisions Current Liabilities Less (C ) Debit Balance in P& L A/c Loans Adv & Other Assets Cash & Bank Balance Fixed Assets Misc Exp. Not Written Off Funds available for Investments NON - LINKED BUSINESS

Rs. Lakhs 502,225 Sch-14 Sch-13 1,128 27,978 29,106 116,255 11,467 9,948 5,277 142,947 388,384 SH PH FRSM+ (b) 21,619 21,619 UL-Non Unit Res (c) 5,919 5,919 PAR (d) NON PAR (e) 2,333 2,333 Book Value Actual FVC (SH+PH) % Amount F= [b+c+d+e] 29,872 29,872 5419% 5419% 29,872 29,872 7,449 10,602 0 % as per Reg Not Less than 20% Not Less than 40% Not Exceeding 60% 100% 39,671 2,643 2,787 11,350 1,607 160 4,100 PH NON PAR 55,121 Book Value 100% 11,699 13,550 2123% 2458% 11,699 13,550 55,121 Total Fund 55,530 Market Value 12,010 13,550 29,970 29,970 Total Fund Market Value Reconciliation of Investment Assets Total Investment Assets (as per Balance Sheet) Balance Sheet Value of: A. Life Fund B. Pention & Gen Annuity Fund C. Unit Linked Funds 388,384 51,460 336,925 388,384

Sch-09 Sch-12 Sch-11 Sch-10 Sch-15

A. LIFE FUND

% as per Reg

Balance (a)

Not Less than 1 G. Sec 25% Not Less than 2 G.Sec or Other Approved Securities (incl (i) above) 50% 3 Investment subject to Exposure Norms Not Less than a. Housing & Infrastructure 15% b. i) Approved Investments Not exceeding ii) "Other Investments" not to 35% exceed 15% TOTAL LIFE FUND 100% B. PENSION AND GENERAL ANNUITY FUND 1 G. Sec 2 G.Sec or Other Approved Securities (incl (i) above) 3 Balance in Approved investment TOTAL PENSION, GENERAL ANNUITY FUND LINKED BUSINESS C. LINKED FUNDS

PAR

Actual FVC % Amount

PH Actual % as per Reg Total Fund PAR % NON PAR 11,836 294,148 305,984 9082% 1 Approved Investment Not Less than 75% 2 Other Investments 19 30,922 30,941 918% Not More than 25% TOTAL LINKED INSURANCE FUND 100% 11,855 325,070 336,925 CERTIFICATION: Certified that the information given here in are correct and complete to the best of my knowledge and belief and nothing has been concealed or suppressed. Date:22/06/2009 Note: (+) FRMS refers to 'Funds representing Solvency Margin' Pattern of Investment will apply only to Shareholders (SH) funds representing FRSM ("F") Funds beyond Solvency Margin shall have a separate Custody Account. Other Investments' are as permitted under Secction 27A(2) and 27B(3) of Insurance Act, 1938 Sd/Anil Sahgal Chief Investment Officer

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

30

Aviva Life Insurance Company India Limited (Registration Code: 0122) FORM L-27-UNIT LINKED BUSINESS-3A FORM 3A UNIT LINKED INSURANCE BUSINESS Statement for the period: 31 March 2009

LINK TO ITEM C OF FORM 3A (PART A) Par / Non Par Rs. in lakhs

PARTICULARS Opening Balance (Market Value) Add : Inflow During the Quarter Increase/ Decrease value of Inv (net) Less : Outflow During the Quarter Total Investible Fund (Mkt value)

GROUP SUPERANNUITY & GRATUITY BALANCE FUND 1,132 51 (42) 157 984

GROUP SUPERANNUITY & GRATUITY CASH FUND 3,333 87 49 3,371

GROUP SUPERANNUITY & GRATUITY DEBT FUND 904 824 (50) 493 1,184

GROUP SUPERANNUITY & GRATUITY GROWTH FUND 608 31 (16) 174 449

GROUP SUPERANNUITY & GRATUITY SECURE FUND 1,097 747 (61) 16 1,767

GROUP SUPERANNUITY & PENSION UNIT LINKED INDEX GRATUITY SHORT TERM DEBT FUND FUND 342 3 345 12,663 5,266 586 18,515

INVESTMENT OF UNIT FUND

GROUP SUPERANNUITY & GRATUITY BALANCE FUND Actual Inv. % Actual 62% 0% 8% 16% 3% 0% 0% 88% 0% 2% 0% 0% 1% 4% 0% 0% 0% 0% 6% 0% 0% 0% 6% 0% 0% 6% 100%

GROUP SUPERANNUITY & GRATUITY CASH FUND Actual Inv. 3,391 3,391 (0) 1 1 19 (20) 3,371 % Actual 0% 0% 0% 0% 101% 0% 0% 101% 0% 0% 0% 0% 0% 0% 0% 0% 0% 1% -1% 0% 0% 0% 0% 0% 0% 0% 100%

GROUP SUPERANNUITY & GRATUITY DEBT FUND Actual Inv. 461 152 214 827 15 4 340 1 0 357 1,184 % Actual 39% 0% 13% 0% 18% 0% 0% 70% 0% 1% 0% 0% 0% 29% 0% 0% 0% 0% 30% 0% 0% 0% 0% 0% 0% 0% 100%

GROUP SUPERANNUITY & GRATUITY GROWTH FUND Actual Inv. 172 58 106 69 405 6 0 1 2 (0) 0 0 9 35 35 449 % Actual 38% 0% 13% 24% 15% 0% 0% 90% 0% 1% 0% 0% 0% 0% 0% 0% 0% 0% 2% 0% 0% 0% 8% 0% 0% 8% 100%

GROUP SUPERANNUITY & GRATUITY SECURE FUND Actual Inv. 916 25 232 31 282 1,487 26 1 243 (0) 1 0 270 11 11 1,767 % Actual 52% 1% 13% 2% 16% 0% 0% 84% 0% 1% 0% 0% 0% 14% 0% 0% 0% 0% 15% 0% 0% 0% 1% 0% 0% 1% 100%

GROUP SUPERANNUITY & PENSION UNIT LINKED INDEX GRATUITY SHORT TERM DEBT FUND FUND Actual Inv. 54 56 228 338 6 0 0 0 0 6 345 % Actual 0% 16% 16% 0% 66% 0% 0% 98% 0% 2% 0% 0% 0% 0% 0% 0% 0% 0% 2% 0% 0% 0% 0% 0% 0% 0% 100% Actual Inv. 14,680 399 15,079 (0) 3 203 0 695 401 11 1 488 2,948 2,948 18,515 % Actual 0% 0% 0% 79% 2% 0% 0% 81% 0% 0% 0% 1% 0% 4% 0% 2% 0% 0% 3% 0% 0% 0% 16% 0% 0% 16% 100%

Approved Investments (>=75%) Govt. Bonds Corporate Bonds Infrastructure Bonds Equity Money Market Mutual Funds Deposits with banks Sub Total (A) Current Assets: Accrued Interest Dividend Recievable Bank Balance Receivable for Sale of Investments Other Current Assets (for Investments) Less: Current Liabilities Payable for Investments Fund Mgmt Charges Payable Other Current Liabilities (for Investments) Sub Total (B) Other Investments (<=25%) Corporate Bonds Infrastructure Bonds Equity Money Market Mutual funds Sub Total (C) Total (A + B+C)

605 82 153 25 865 17 0 1 8 38 0 1 0 64 56 56 984

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

31

Company Name & Code: AVIVA LIFE INSURANCE COMPANY INDIA LIMITED, Code: 0122 FORM L-27-UNIT LINKED BUSINESS-3A FORM 3A UNIT LINKED INSURANCE BUSINESS Statement for the period: 31 March 2009

LINK TO ITEM C OF FORM 3A (PART A) Par / Non Par Rs. in lakhs

PARTICULARS Opening Balance (Market Value) Add : Inflow During the Quarter Increase/ Decrease value of Inv (net) Less : Outflow During the Quarter Total Investible Fund (Mkt value)

PENSION UNIT LINKED SECURE FUND 606 206 (33) 61 718

PENSION- UNIT LINKED FUND 13,405 2,201 (500) 784 14,321

PENSION UNIT LINKED GROWTH FUND 31,041 4,680 (830) 198 34,693

PENSION UNIT LINKED PROTECTOR FUND 1,231 1,635 (76) 2,790

PENSION- UNITISED WITH PROFIT FUND 1,480 7 33 126 1,394

UNIT LINKED ENHANCER FUND 913 809 20 14 1,730

UNIT LINEKD DEBT FUND 18 57 (1) 12 62

INVESTMENT OF UNIT FUND

PENSION UNIT LINKED SECURE FUND Actual Inv. % Actual 56% 1% 15% 2% 22% 0% 0% 97% 0% 2% 0% 0% 0% 1% 0% 0% 0% 0% 3% 0% 0% 0% 1% 0% 0% 1% 100%

PENSION- UNIT LINKED FUND

PENSION UNIT LINKED GROWTH FUND Actual Inv. 9,619 5,074 7,698 8,385 30,776 391 3 4 27 804 1 36 0 1,191 2,726 2,726 34,693 % Actual 28% 0% 15% 22% 24% 0% 0% 89% 0% 1% 0% 0% 0% 2% 0% 0% 0% 0% 3% 0% 0% 0% 8% 0% 0% 8% 100%

PENSION UNIT LINKED PROTECTOR FUND Actual Inv. 1,350 429 25 820 2,624 31 0 11 (0) 226 110 2 0 156 9 9 2,790 % Actual 48% 0% 15% 1% 29% 0% 0% 94% 0% 1% 0% 0% 0% 8% 0% 4% 0% 0% 6% 0% 0% 0% 0% 0% 0% 0% 100%

PENSION- UNITISED WITH PROFIT FUND Actual Inv. 801 292 10 266 1,369 14 9 (0) (0) (0) 0 23 2 2 1,394 % Actual 57% 0% 21% 1% 19% 0% 0% 98% 0% 1% 0% 1% 0% 0% 0% 0% 0% 0% 2% 0% 0% 0% 0% 0% 0% 0% 100%

UNIT LINKED ENHANCER FUND Actual Inv. 43 772 569 1,384 1 0 17 90 37 2 0 69 276 276 1,730 % Actual 3% 0% 0% 45% 33% 0% 0% 80% 0% 0% 0% 1% 0% 5% 0% 2% 0% 0% 4% 0% 0% 0% 16% 0% 0% 16% 100%

UNIT LINEKD DEBT FUND

Actual Inv. 7,351 83 1,335 2,260 2,281 13,309 237 0 9 29 165 100 7 0 333 678 678 14,321

% Actual 51% 1% 9% 16% 16% 0% 0% 93% 0% 2% 0% 0% 0% 1% 0% 1% 0% 0% 2% 0% 0% 0% 5% 0% 0% 5% 100%

Actual Inv. 45 11 29 85 1 2 14 0 12 (23) 62

% Actual 73% 0% 18% 0% 46% 0% 0% 137% 0% 1% 0% 3% 0% 0% 0% 22% 0% 19% -37% 0% 0% 0% 0% 0% 0% 0% 100%

Approved Investments (>=75%) Govt. Bonds Corporate Bonds Infrastructure Bonds Equity Money Market Mutual Funds Deposits with banks Sub Total (A) Current Assets: Accrued Interest Dividend Recievable Bank Balance Receivable for Sale of Investments Other Current Assets (for Investments) Less: Current Liabilities Payable for Investments Fund Mgmt Charges Payable Other Current Liabilities (for Investments) Sub Total (B) Other Investments (<=25%) Corporate Bonds Infrastructure Bonds Equity Money Market Mutual funds Sub Total (C) Total (A + B+C)

401 10 111 16 155 693 13 0 2 5 (0) 1 0 19 5 5 718

AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

32

Company Name & Code: AVIVA LIFE INSURANCE COMPANY INDIA LIMITED, Code: 0122 FORM L-27-UNIT LINKED BUSINESS-3A FORM 3A UNIT LINKED INSURANCE BUSINESS Statement for the period: 31 March 2009

LINK TO ITEM C OF FORM 3A (PART A) Par / Non Par Rs. in lakhs

PARTICULARS Opening Balance (Market Value) Add : Inflow During the Quarter Increase/ Decrease value of Inv (net) Less : Outflow During the Quarter Total Investible Fund (Mkt value)

UNIT LINKED SECURE FUND 10,631 1,102 (491) 96 11,145

UNIT LINKED BALANCED FUND 70,081 6,136 (2,233) 239 73,746

UNIT LINKED GROWTH FUND 127,380 26,367 (95) 61 153,591

UNIT LINKED INDEX FUND 1,941 2,282 190 4,413

UNITISED WITH PROFIT FUND 10,251 37 236 62 10,461

UNIT LINKED PROTECTOR FUND 582 699 (37) 1,245

TOTAL 289,297 53,450 (3,310) 2,511 336,925

UNIT LINKED SECURE FUND INVESTMENT OF UNIT FUND Actual Inv. Approved Investments (>=75%) Govt. Bonds Corporate Bonds Infrastructure Bonds Equity Money Market Mutual Funds Deposits with banks Sub Total (A) Current Assets: Accrued Interest Dividend Recievable Bank Balance Receivable for Sale of Investments Other Current Assets (for Investments) Less: Current Liabilities Payable for Investments Fund Mgmt Charges Payable Other Current Liabilities (for Investments) Sub Total (B) Other Investments (<=25%) Corporate Bonds Infrastructure Bonds Equity Money Market Mutual funds Sub Total (C) Total (A + B+C) 7,706 165 1,704 251 869 10,695 261 2 115 (0) 3 0 376 74 74 11,145 % Actual 69% 1% 15% 2% 8% 0% 0% 96% 0% 2% 0% 0% 0% 1% 0% 0% 0% 0% 3% 0% 0% 0% 1% 0% 0% 1% 100%

UNIT LINKED BALANCED FUND Actual Inv. 34,939 765 10,323 11,658 10,925 68,610 1,286 6 63 0 1,066 (0) 21 1 2,400 2,736 2,736 73,746 % Actual 47% 1% 14% 16% 15% 0% 0% 93% 0% 2% 0% 0% 0% 1% 0% 0% 0% 0% 3% 0% 0% 0% 4% 0% 0% 4% 100%

UNIT LINKED GROWTH FUND

UNIT LINKED INDEX FUND

UNITISED WITH PROFIT FUND

UNIT LINKED PROTECTOR FUND Actual Inv. 595 177 15 343 1,129 14 0 2 144 50 1 0 109 6 6 1,245 % Actual 48% 0% 14% 1% 28% 0% 0% 91% 0% 1% 0% 0% 0% 12% 0% 4% 0% 0% 9% 0% 0% 0% 1% 0% 0% 1% 100%

TOTAL FUND

Actual Inv. 15,839 5 13,952 61,575 40,103 131,473 775 23 45 3,034 2,301 117 3 1,456 20,661 20,661 153,591

% Actual 10% 0% 9% 40% 26% 0% 0% 86% 0% 1% 0% 0% 0% 2% 0% 1% 0% 0% 1% 0% 0% 0% 13% 0% 0% 13% 100%

Actual Inv. 3,478 120 3,598 (0) 1 29 199 108 2 1 117 698 698 4,413

% Actual 0% 0% 0% 79% 3% 0% 0% 82% 0% 0% 0% 1% 0% 5% 0% 2% 0% 0% 3% 0% 0% 0% 16% 0% 0% 16% 100%

Actual Inv. 5,928 2,399 68 1,951 10,345 97 3 (0) 0 0 0 100 17 17 10,461

% Actual 57% 0% 23% 1% 19% 0% 0% 99% 0% 1% 0% 0% 0% 0% 0% 0% 0% 0% 1% 0% 0% 0% 0% 0% 0% 0% 100%

Actual Inv. 86,771 1,106 36,386 102,794 71,425 298,483 3,193 37 409 65 7,164 3,122 207 37 7,501 30,941 30,941 336,925

% Actual 26% 0% 11% 31% 21% 0% 0% 89% 0% 1% 0% 0% 0% 2% 0% 1% 0% 0% 2% 0% 0% 0% 9% 0% 0% 9% 100%

Date:22/06/2009

Note: 1. The aggregate of all the above Segregated Unit-Funds should tally with item C of FORM 3A (Part A), for both Par & Non Par Business 2. Details of Item 12 of FORM LB 2 of IRDA (Acturial Report) Regulation, 2000 shall be reconciled with FORM 3A (Part B) 3. Other Investments' are as permitted under Sec 27A(2) and 27B(3) AVIVA LIFE INSURANCE COMPANY INDIA LIMITED

Sd/Anil Sahgal Chief Investment Officer 33

Aviva Life Insurance Company India Limited (Registration Code: 0122)

FORM L-28-ULIP-NAV-3A PART - C Statement for the period: 31 March 2009 Link to FORM 3A (Part B)

N o 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Name of The Scheme Pension Unit linked Growth fund Pension Unit linked Secure fund Grp Superann-Short Term Debt fund# Group Superannuation & Gratuity Balanced Fund Group Superannuation & Gratuity Cash Fund Group Superannuation & Gratuity Debt Fund Group Superannuation & Gratuity Growth Fund Group Superannuation & Gratuity Secure Fund Pension Unit Linked Index Fund Pension Unit Linked Protector Fund Pension Unit Linked Balanced Fund Pension Unitised with Profit fund Unit Linked Debt Fund Unit Linked Enhancer fund Unit Linked Balanced fund Unit Linked Growth Fund Unit Linked Index fund Unit Linked Protector Fund Unit Linked Secure fund Unitised with Profit fund Total

Assets Held on the above date (Rs in lakhs) 34,693 718 345 984 3,371 1,184 449 1,767 18,515 2,790 14,321 1,394 62 1,730 73,746 153,591 4,413 1,245 11,145 10,461 336,925

NAV As on Previous NAV as Per Above Quarter LB 2 Date NAV 16 14 10 12 13 13 11 13 6 11 24 13 11 7 31 23 5 12 15 13 16 14 10 12 13 13 11 13 6 11 24 13 11 7 31 23 5 12 15 13 16 14 N/A 12 13 14 11 14 6 12 24 13 12 7 32 23 5 13 16 13