Beruflich Dokumente

Kultur Dokumente

Business Case - Whitegloves Janitorial Service

Hochgeladen von

Kimberly Rose MallariCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Business Case - Whitegloves Janitorial Service

Hochgeladen von

Kimberly Rose MallariCopyright:

Verfügbare Formate

WHITEGLOVES JANITORIAL SERVICE

A business case Presented to the Accountancy Department

In partial fulfillment of the Course requirements in ACTBAS1

Gutierrez, Patricia Lorenza D. Mallari, Kimberly Rose J. Ramos, Shiela Marie I. V24

10 December 2012

INTRODUCTION

The Financial Recording Standards Council said that Accountancy is a service activity. Its function is to provide quantitative information, primarily financial in nature, about economic entities, that is intended to be useful in making economic decision. Providing quantitative financial information about economic entities will not be possible without accounting.

Mainly, accounting is the language of the business industry. Everything in the business world works with the aid of this body of knowledge that is surely inevitable in such field of work. It enables a company to properly record and report its operational activities to its stakeholders in compliance with the set of rules, guidelines and standards called Generally Accepted Accounting Principles or GAAP which are established by the authorities. At the end of a certain period, the company declares and informs its stakeholders investors, creditors, regulators, customers, etc. on their net income or net loss, and their current financial position, made possible by the presentation of properly-organized, reliable and accurate financial statements.

One thing that is required by GAAP is the construction of adjusting journal entries at the end of every period. Adjusting journal entries are non-standard entries that are made to correct an error in journalizing, ensuring that the book of accounts are in accordance to the GAAP. Some possible errors committed in original journal entries are mathematical inaccuracies, such as transposition and transplacement errors, and poor application of accounting principles. These are and should be corrected with the use of adjusting journal entries. Adjusting journal entries cover the following accounts: accrued expense, accrued revenue, prepaid expense, unearned revenue, depreciation and allowance for doubtful accounts. Adjusting journal entries is important to the modern-day accounting because it helps companies prepare financial

statements that are accurate, reliable and complete, that will, in turn, help them, too, in their operations.

Whitegloves Janitorial Service started two (2) years ago by Nancy Kohl. Since it performed exceptionally, Ms. Kohl decided to expand their operations on July 1, 2012. To fund the expansion, Ms. Kohl acquired a bank loan on that same day for P25 000 at 10% per annum, payable in the following terms: P10 000 on July 1, 2013, and the balance on July 1, 2014. Agreements were made between the two (2) parties. The bank, then, requires Whitegloves Janitorial Service to have P10 000 more current assets than its current liabilities at December 31, 2012. If this is not met, the interest rate will rise up to 15% instead of 10%. On December 31, 2012, Ms. Kohl presented the business Statement of Financial Position, confident that the business was able to meet the terms required. On the contrary, they were not able to meet them. Ms. Kohl presented an erroneous Statement of Financial Position which was prepared and based on a trial balance, not on an adjusted trial balance. With this they have to make adjusting journal entries to be able to present an accurate, reliable and complete Statement of Financial Position to the authorities for their bank loan.

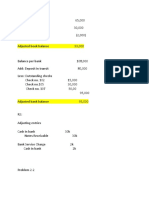

REPORT The following are the adjusted journal entries as of December 31, 2012:

Accounts Receivable Service Income Adjusting Journal Entry

3 700 3 700

Supplies Expense Janitorial Expense Adjusting Journal Entry

2 700 2 700

Insurance Expense Prepaid Insurance Adjusting Journal Entry

1 600 1 600

Miscellaneous Expense Accounts Payable Adjusting Journal Entry

500 500

Interest Expense Interest Payable Adjusting Journal Entry

1 250 1 250

Depreciation Expense Cleaning Equipment Accumulated Depreciation Cleaning Equipment Adjusting Journal Entry Depreciation Expense Transportation Equipment

2000 2 000

5000 5000

Accumulated Depreciation Transportation Equipment Adjusting Journal Entry

Here are the following explanations for each adjusting entry made: 1. 2. 3. 4. 5. 6.

Below is the adjusted report-form Balance Sheet for Whitegloves Janitorial Service as of December 31, 2012:

WHITEGLOVES JANITORIAL SERVICE Statement of Financial Position 31-Dec-12 ASSETS Current Assets Cash Accounts Receivable Prepaid Expenses Total Current Assets Non-current Assets Property, Plant and Equipment TOTAL ASSETS LIABILITIES AND OWNER'S EQUITY Current Liabilities Trade and Other Payables Non-Current Liabilities Note Payable Total Liabilites Owner's Equity Nancy Kohl, Capital TOTAL LIABILITIES AND OWNER'S EQUITY P Note P 1 6 500 12 700 5 700 P 24 900

2 P

49 000 73 900

14 250

15 000 29 250

44 650 73 900

Notes to Financial Statements Note 1 - Prepaid Expenses Janitorial Supplies Prepaid Insurance Total Note 2 - Property, Plant and Equipment Cleaning Equipment Less: Accumulated Depreciation - Cleaning Equipment Transportation Equipment Less: Accumulated Depreciation - Transportation Equipment Total Note 3 - Trade and Other Payables Notes Payable Accounts Payable Interest Payable Total

P P

2 500 3 200 5 700

P P

26 000 6 000 39 000 10 000

20 000

29 000 49 000

10 000 3 000 1 250 14 250

The terms of the bank loan of Whitegloves Janitorial service was met supported by the Balance Sheet above. The current assets exceed the current liabilities by P 10,650 (P 24,900 P 14,250)

Das könnte Ihnen auch gefallen

- Acctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Dokument5 SeitenAcctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Jaya RamirezNoch keine Bewertungen

- Prelim Learning Task 1 Cash and Cash EquivalentsDokument5 SeitenPrelim Learning Task 1 Cash and Cash EquivalentsMigz MigNoch keine Bewertungen

- Stevenson 14e Ch01writingDokument2 SeitenStevenson 14e Ch01writingelvis oheneba manuNoch keine Bewertungen

- Ellen Company Cash Bank ReconciliationDokument8 SeitenEllen Company Cash Bank ReconciliationShaine PacsonNoch keine Bewertungen

- Asia: Singapore, Philippines and ChinaDokument4 SeitenAsia: Singapore, Philippines and ChinaPaulo JavierNoch keine Bewertungen

- Cfas ReviewerDokument2 SeitenCfas ReviewerElaine Ü LubianoNoch keine Bewertungen

- Midterm NotesDokument17 SeitenMidterm NotesCyrus ArmamentoNoch keine Bewertungen

- Accounting concepts and principles quizDokument7 SeitenAccounting concepts and principles quizjessamae gundanNoch keine Bewertungen

- Receivable - Q2Dokument3 SeitenReceivable - Q2Dymphna Ann CalumpianoNoch keine Bewertungen

- Managerial Accounting Exercises Chapter 12Dokument6 SeitenManagerial Accounting Exercises Chapter 12Angelica Lorenz100% (1)

- Financial Accounting 1Dokument17 SeitenFinancial Accounting 1Mellanie SerranoNoch keine Bewertungen

- Accounting 101 - Reviewer (TEST QUIZ)Dokument18 SeitenAccounting 101 - Reviewer (TEST QUIZ)AuroraNoch keine Bewertungen

- 06 - Bank Reconciliation - Problem SolvingDokument6 Seiten06 - Bank Reconciliation - Problem SolvingaragonkaycyNoch keine Bewertungen

- What Are The Opportunities and Risks of China at The Time of The Case?Dokument3 SeitenWhat Are The Opportunities and Risks of China at The Time of The Case?Adam CuencaNoch keine Bewertungen

- Objectives and users of financial reportingDokument2 SeitenObjectives and users of financial reportingChery Sheil Valenzuela0% (2)

- Rich Angelie Muñez - Assignment 4 Adjusting EntriesDokument2 SeitenRich Angelie Muñez - Assignment 4 Adjusting EntriesRich Angelie MuñezNoch keine Bewertungen

- HW 2. Problems Cash and Cash Equivalents - StudentDokument2 SeitenHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroNoch keine Bewertungen

- Markfin - Module 1 ActivitiesDokument2 SeitenMarkfin - Module 1 ActivitiesTricia DimaanoNoch keine Bewertungen

- How films preserve and enrich Filipino cultureDokument2 SeitenHow films preserve and enrich Filipino cultureLovely Jaze SalgadoNoch keine Bewertungen

- Acc 1 - Financial Accounting and Reporting DRILL NO. 5 - Adjusting EntriesDokument1 SeiteAcc 1 - Financial Accounting and Reporting DRILL NO. 5 - Adjusting Entriesnicole bancoroNoch keine Bewertungen

- Chapter 14Dokument10 SeitenChapter 14Stephanie SundiangNoch keine Bewertungen

- EXERCISES 1-Introduction To AccountingDokument4 SeitenEXERCISES 1-Introduction To AccountingAnna Jeramos100% (1)

- Journalizing Exercise 2Dokument1 SeiteJournalizing Exercise 2DZEJLA REYELE PEREZNoch keine Bewertungen

- Quiz - Ppe Cost 2Dokument1 SeiteQuiz - Ppe Cost 2Ana Mae HernandezNoch keine Bewertungen

- Pamantasan NG Lungsod NG Valenzuela: College of AccountancyDokument2 SeitenPamantasan NG Lungsod NG Valenzuela: College of AccountancyPatricia Camille AustriaNoch keine Bewertungen

- Bank Reconciliation PDFDokument3 SeitenBank Reconciliation PDFEunjina MoNoch keine Bewertungen

- LJLDokument11 SeitenLJL靳雪娇Noch keine Bewertungen

- Cash and Cash Equivalents QuizDokument2 SeitenCash and Cash Equivalents QuizMarkJoven Bergantin100% (1)

- October To September Sales Report Movies by GenreDokument3 SeitenOctober To September Sales Report Movies by GenreAngelica Austria-MantalNoch keine Bewertungen

- Kas and KasDokument30 SeitenKas and KasMiko ArniñoNoch keine Bewertungen

- Bank ReconciliationDokument6 SeitenBank Reconciliationclarisse jaramillaNoch keine Bewertungen

- ScriptDokument7 SeitenScriptIvan Matthew SuperioNoch keine Bewertungen

- Far Eastern University - Makati: Discussion ProblemsDokument2 SeitenFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNoch keine Bewertungen

- Basic Accounting Final - QuestionDokument6 SeitenBasic Accounting Final - QuestionEdaNoch keine Bewertungen

- Dualistic-Dependence Thesis ExplainedDokument5 SeitenDualistic-Dependence Thesis Explainedthedoodlbot100% (1)

- CHAPTER 10 Intermediate Acctng 1Dokument49 SeitenCHAPTER 10 Intermediate Acctng 1Tessang OnongenNoch keine Bewertungen

- Petty Cash and Cash Reconciliation ProblemsDokument9 SeitenPetty Cash and Cash Reconciliation ProblemsKenncyNoch keine Bewertungen

- Problem 7 - 28Dokument2 SeitenProblem 7 - 28Jao FloresNoch keine Bewertungen

- Logical and Critical Thinking ExercisesDokument17 SeitenLogical and Critical Thinking ExercisesTrisha Mae SumayopNoch keine Bewertungen

- Programmazione e Controllo Esercizi Capi PDFDokument43 SeitenProgrammazione e Controllo Esercizi Capi PDFHeap Ke XinNoch keine Bewertungen

- Chapter 2 Cash and Cash Equivalents Exercises T3AY2021Dokument7 SeitenChapter 2 Cash and Cash Equivalents Exercises T3AY2021Carl Vincent BarituaNoch keine Bewertungen

- Lesson 1-Preliminaries-Nature and Classes of CorporationsDokument10 SeitenLesson 1-Preliminaries-Nature and Classes of CorporationsAterg MooseNoch keine Bewertungen

- Quiz in ELEC 01 (Inventory Estimation)Dokument3 SeitenQuiz in ELEC 01 (Inventory Estimation)djanine cardinalesNoch keine Bewertungen

- Cost of Production Report for Department BDokument7 SeitenCost of Production Report for Department BNhel AlvaroNoch keine Bewertungen

- St. Columban College College of Business EducationDokument1 SeiteSt. Columban College College of Business EducationRalph Christer MaderazoNoch keine Bewertungen

- Managerial Accounting and Cost ConceptDokument20 SeitenManagerial Accounting and Cost ConceptNavidEhsanNoch keine Bewertungen

- The Burning of Manila, 1946: Fernando Amorsolo Francisca R. AquinoDokument5 SeitenThe Burning of Manila, 1946: Fernando Amorsolo Francisca R. AquinoIsabel MarcelinoNoch keine Bewertungen

- AIS Activity No. 2 Journalizing Using Peachtree and Generation FSDokument2 SeitenAIS Activity No. 2 Journalizing Using Peachtree and Generation FSShaira UntalanNoch keine Bewertungen

- Jhonah Joyce B Lumba ACC111(962) VAT Activity ReportDokument1 SeiteJhonah Joyce B Lumba ACC111(962) VAT Activity ReportJhoyce LumbaNoch keine Bewertungen

- Chapter 3 RizalDokument20 SeitenChapter 3 Rizalkhara teanoNoch keine Bewertungen

- 2 3 2017 ReceivablesDokument4 Seiten2 3 2017 ReceivablesMr. CopernicusNoch keine Bewertungen

- This Study Resource Was: Polytechnic University of The Philippines Mathematics in The Modern WorldDokument4 SeitenThis Study Resource Was: Polytechnic University of The Philippines Mathematics in The Modern WorldLayNoch keine Bewertungen

- Vallix QuestionnairesDokument14 SeitenVallix QuestionnairesKathleen LucasNoch keine Bewertungen

- Cash and Cash Equivalents Mock TestDokument3 SeitenCash and Cash Equivalents Mock Testwednesday addamsNoch keine Bewertungen

- Adjustments Unreleased Check: SM Investments Corporation Had The Following Account Balances at December 31, 2019Dokument3 SeitenAdjustments Unreleased Check: SM Investments Corporation Had The Following Account Balances at December 31, 2019Regina Mae CatamponganNoch keine Bewertungen

- m2.2f Diy MCQ Answer KeyDokument6 Seitenm2.2f Diy MCQ Answer KeyaapNoch keine Bewertungen

- AudtheoDokument3 SeitenAudtheokath grangerNoch keine Bewertungen

- Salas, Charlyn Mae M. BSTM CBM 4 (1495) August 12, 2021Dokument2 SeitenSalas, Charlyn Mae M. BSTM CBM 4 (1495) August 12, 2021CHARLYN MAE SALASNoch keine Bewertungen

- Leslie Company Manufacturing Department Cost of Production Report For January Materials Conversion CostDokument8 SeitenLeslie Company Manufacturing Department Cost of Production Report For January Materials Conversion Costmaica G.Noch keine Bewertungen

- Accounting IC AR ExampleDokument3 SeitenAccounting IC AR Exampleayuadeanggariani96Noch keine Bewertungen

- ParagonsDokument1 SeiteParagonsKimberly Rose MallariNoch keine Bewertungen

- Radicals Exps, Rational Exponents, Set of Complex NosDokument30 SeitenRadicals Exps, Rational Exponents, Set of Complex NosKimberly Rose MallariNoch keine Bewertungen

- Table 4Dokument149 SeitenTable 4DJ EmpleoNoch keine Bewertungen

- Diskriminasyon - Kaspil1Dokument14 SeitenDiskriminasyon - Kaspil1Kimberly Rose MallariNoch keine Bewertungen

- Sets Real Numbers and Operations On Real NumbersDokument64 SeitenSets Real Numbers and Operations On Real NumbersKimberly Rose MallariNoch keine Bewertungen

- Algebraic Expressions & PolynomialsDokument59 SeitenAlgebraic Expressions & PolynomialsKimberly Rose MallariNoch keine Bewertungen

- The Rizal LawDokument45 SeitenThe Rizal LawKimberly Rose MallariNoch keine Bewertungen

- Properties and solutions of inequalitiesDokument21 SeitenProperties and solutions of inequalitiesKimberly Rose MallariNoch keine Bewertungen

- Travels of RizalDokument30 SeitenTravels of RizalKing GilgameshNoch keine Bewertungen

- Studying Earth ScienceDokument12 SeitenStudying Earth ScienceKimberly Rose MallariNoch keine Bewertungen

- Radicals Exps, Rational Exponents, Set of Complex NosDokument30 SeitenRadicals Exps, Rational Exponents, Set of Complex NosKimberly Rose MallariNoch keine Bewertungen

- The Work of StreamsDokument33 SeitenThe Work of StreamsKimberly Rose MallariNoch keine Bewertungen

- MODFIN1 SYLLABUS May2012Dokument6 SeitenMODFIN1 SYLLABUS May2012Kimberly Rose MallariNoch keine Bewertungen

- Works of StreamsDokument10 SeitenWorks of StreamsKimberly Rose MallariNoch keine Bewertungen

- The Solid RockDokument12 SeitenThe Solid RockKimberly Rose MallariNoch keine Bewertungen

- Modfin2 SyllabusDokument5 SeitenModfin2 SyllabusKimberly Rose MallariNoch keine Bewertungen

- Consumer Behavior & Organizational Buying ProcessDokument3 SeitenConsumer Behavior & Organizational Buying ProcessKimberly Rose MallariNoch keine Bewertungen

- SSS Premium Contribution TableDokument1 SeiteSSS Premium Contribution TableKimberly Rose MallariNoch keine Bewertungen

- General Labor StandardsDokument15 SeitenGeneral Labor StandardsKimberly Rose MallariNoch keine Bewertungen

- Obligation and ContractsDokument33 SeitenObligation and ContractsKimberly Rose MallariNoch keine Bewertungen

- Forms and Reformation of ContractsDokument78 SeitenForms and Reformation of ContractsKimberly Rose MallariNoch keine Bewertungen

- Versatile Medical Professional Seeks Career GrowthDokument5 SeitenVersatile Medical Professional Seeks Career GrowthKimberly Rose Mallari63% (8)

- Scholarship Financial Aid Questionnaire Set SY1213Dokument6 SeitenScholarship Financial Aid Questionnaire Set SY1213Kimberly Rose MallariNoch keine Bewertungen

- Galaxy S3 User ManualDokument185 SeitenGalaxy S3 User Manualsuperdavec100% (1)

- Digital Booklet - My DreamDokument10 SeitenDigital Booklet - My DreamKimberly Rose MallariNoch keine Bewertungen

- PermitDokument2 SeitenPermitKimberly Rose MallariNoch keine Bewertungen

- SWOT Analysis of Jubilee Life InsuranceDokument2 SeitenSWOT Analysis of Jubilee Life InsuranceSyed Aun Ali25% (4)

- Electricity Bill: Due Date: 11-07-2011Dokument1 SeiteElectricity Bill: Due Date: 11-07-2011Anjani GroverNoch keine Bewertungen

- Community Reinvestment Act Assessment Area Expansion by CBSI, After ICP CommentsDokument6 SeitenCommunity Reinvestment Act Assessment Area Expansion by CBSI, After ICP CommentsMatthew Russell LeeNoch keine Bewertungen

- ECGCDokument24 SeitenECGCShilpa KhannaNoch keine Bewertungen

- Activity 4Dokument1 SeiteActivity 4Coleen Joy Sebastian PagalingNoch keine Bewertungen

- 03KBH19z-51JH053EH6999 B43a99a8 PDFDokument4 Seiten03KBH19z-51JH053EH6999 B43a99a8 PDFPeter ChanNoch keine Bewertungen

- Current Affairs August 2019 PDF: Awards and HonoursDokument52 SeitenCurrent Affairs August 2019 PDF: Awards and HonoursAli RazaNoch keine Bewertungen

- Audit of Cash Practice ProblemDokument5 SeitenAudit of Cash Practice ProblemMary Rose ArguellesNoch keine Bewertungen

- FAQ - ATM, at The Money OfferingsDokument16 SeitenFAQ - ATM, at The Money Offeringsdajeca7Noch keine Bewertungen

- 1broker Carrier ContractDokument21 Seiten1broker Carrier ContractMihaela MacarencoNoch keine Bewertungen

- Gaap QuizDokument3 SeitenGaap QuizShadab KhanNoch keine Bewertungen

- View your PLDT bill details onlineDokument4 SeitenView your PLDT bill details onlineMelchor Pablo0% (1)

- Employee Satisfaction Kotak MahindraDokument79 SeitenEmployee Satisfaction Kotak MahindraMansi Gauba100% (2)

- OnlineStatement (JanDokument3 SeitenOnlineStatement (JanCarrie DuboisNoch keine Bewertungen

- Asian Terminal Vs First Lepanto - BALLESTADokument1 SeiteAsian Terminal Vs First Lepanto - BALLESTAKim Kenneth PascuaNoch keine Bewertungen

- Mortgage Auditing Report For Mr. and Mrs. Homeowner - Audit-TemplateDokument11 SeitenMortgage Auditing Report For Mr. and Mrs. Homeowner - Audit-TemplateRicharnellia-RichieRichBattiest-Collins100% (1)

- Viswapriya MailerDokument2 SeitenViswapriya MailerChristopher JacobsNoch keine Bewertungen

- Bank Reconciliation StatementDokument14 SeitenBank Reconciliation StatementBharathi RajuNoch keine Bewertungen

- Canara Bank Statement SummaryDokument6 SeitenCanara Bank Statement SummaryM. Lakshmi ManasaNoch keine Bewertungen

- Case No. Rule SecDokument106 SeitenCase No. Rule SecAyen Rodriguez MagnayeNoch keine Bewertungen

- Bike Insurance PolicyDokument2 SeitenBike Insurance PolicyPradeep UnniNoch keine Bewertungen

- Lanka ClearDokument19 SeitenLanka ClearRajithaNoch keine Bewertungen

- COE UnfinishedDokument10 SeitenCOE Unfinishedamanda masolutionNoch keine Bewertungen

- Ais Quiz 2Dokument1 SeiteAis Quiz 2DivineDavisNoch keine Bewertungen

- Bank Quest July September 13Dokument64 SeitenBank Quest July September 13anuvinniNoch keine Bewertungen

- 1000&1250 11 Oltc R1Dokument3 Seiten1000&1250 11 Oltc R1Rohan KallaNoch keine Bewertungen

- Merchant Banking Functions and RegulationsDokument41 SeitenMerchant Banking Functions and RegulationsPooja balwaniNoch keine Bewertungen

- Utmost Good Faith in Insurance ContractsDokument8 SeitenUtmost Good Faith in Insurance ContractsPearl Bajpai100% (1)

- Payables 11i Test ScenariosDokument58 SeitenPayables 11i Test ScenariosyasserlionNoch keine Bewertungen