Beruflich Dokumente

Kultur Dokumente

Factors Affecting The Magnitude of Price Elasticity of Demand

Hochgeladen von

Sachin SahooOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Factors Affecting The Magnitude of Price Elasticity of Demand

Hochgeladen von

Sachin SahooCopyright:

Verfügbare Formate

Factors affecting the magnitude of price elasticity of demand

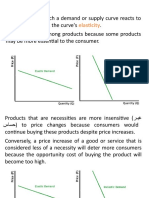

Elasticity of demand differs from commodity to commodity. Not only that, elasticity of demand of the same commodity may be different for different persons. These differences in elasticity of demand are due to various causes, which are discussed below: 1. Price level: Generally, the demand for very costly and very cheap goods is elastic. Very costly goods are demanded by the rich people and hence their demand is not affected much by changes in prices. For example, increase in the price of Maruti Car from Rs. 3, 00,000 to Rs. 3, 20,000 will not make any noticeable difference in its demand. Similarly, the changes in the price of very cheap goods (such as salt) will not have any effect on their demand, for a very small part of income is spent on such commodities. 2. Availability of Substitutes: The demand for a commodity will be very elastic if some other commodities can be used for it. A small rise in the price of such a commodity will induce consumers to use its substitutes. For example gas, kerosene oil, coal etc. will be used more as fuel if the price of wood increases. On the other hand, the demand of such commodities is inelastic which have no substitutes such as salt. 3. Time period: Longer is the time period more elastic is the demand. In the short period if price of a commodity like petrol is increased, its demand will not fall immediately and hence it would be inelastic or less elastic. But if period is longer alternative sources of energy can be developed and hence demand would be elastic. 4. Proportion of total expenditure spent on the product: If a small proportion of total expenditure is spent on a commodity, its demand will be inelastic such as demand for salt. On the other hand, if a major portion of total expenditure is spent on a commodity, its demand will be more or highly elastic such as demand for luxuries. 5. Habits: Some products which are not essential for some individuals are essential for others. If individuals are habituated of some commodities the demand for such commodities will be usually inelastic, because they will use them even when their prices go up. A smoker generally does not smoke less when the price of cigarette goes up.

6. Nature of the commodities: Generally, the demand for necessaries is inelastic and that for comforts and luxuries of life elastic. This is so because certain goods which are essential to life will be demanded at any price, whereas goods meant for luxuries and comforts can be dispensed with easily if they appear to be costly. 7. Various uses: Generally, a commodity which has several uses will have an elastic demand such as milk, wood etc. On the other hand, a commodity having only one use will have inelastic demand. 8. Postponement: Usually the demand for such commodities whose use can be postponed for some time is elastic. For example, the demand for V.C.R. is elastic because its use can be postponed for some time if its price goes up, but the demand for rice and wheat is inelastic because their use cannot be postponed when their prices increase.

The overriding factor in determining PED is the willingness and ability of consumers after a price change to postpone immediate consumption decisions concerning the good and to search for substitutes ("wait and look").[24] A number of factors can thus affect the elasticity of demand for a good:[25]

Availability of substitute goods: the more and closer the substitutes available, the higher the elasticity is likely to be, as people can easily switch from one good to another if an even minor price change is made;[25][26][27] There is a strong substitution effect.[28] If no close substitutes are available the substitution of effect will be small and the demand inelastic.[28] o Breadth of definition of a good: the broader the definition of a good (or service), the lower the elasticity. For example, Company X's fish and chips would tend to have a relatively high elasticity of demand if a significant number of substitutes are available, whereas food in general would have an extremely low elasticity of demand because no substitutes exist.[29] Percentage of income: the higher the percentage of the consumer's income that the product's price represents, the higher the elasticity tends to be, as people will pay more attention when purchasing the good because of its cost;[25][26] The income effect is substantial.[30] When the goods represent only a negligible portion of the budget the income effect will be insignificant and demand inelastic,[30] Necessity: the more necessary a good is, the lower the elasticity, as people will attempt to buy it no matter the price, such as the case of insulin for those that need it.[10][26] Duration: for most goods, the longer a price change holds, the higher the elasticity is likely to be, as more and more consumers find they have the time and inclination to search for substitutes.[25][27] When fuel prices increase suddenly, for instance, consumers may still fill up their empty tanks in the short run, but when prices remain high over several years, more consumers will reduce their demand for fuel by switching to carpooling or public transportation,

investing in vehicles with greater fuel economy or taking other measures.[26] This does not hold for consumer durables such as the cars themselves, however; eventually, it may become necessary for consumers to replace their present cars, so one would expect demand to be less elastic.[26] Brand loyalty: an attachment to a certain brandeither out of tradition or because of proprietary barrierscan override sensitivity to price changes, resulting in more inelastic demand.[29][31] Who pays: where the purchaser does not directly pay for the good they consume, such as with corporate expense accounts, demand is likely to be more inelastic

Das könnte Ihnen auch gefallen

- Summary Of "Principles Of Economics" By Alfred Marshall: UNIVERSITY SUMMARIESVon EverandSummary Of "Principles Of Economics" By Alfred Marshall: UNIVERSITY SUMMARIESNoch keine Bewertungen

- Factors affecting price elasticity of demandDokument9 SeitenFactors affecting price elasticity of demandVijay Singh Kumar VijayNoch keine Bewertungen

- Papua New Guinea: A Land of Diversity in the South PacificDokument15 SeitenPapua New Guinea: A Land of Diversity in the South PacificMiss Quixzy100% (1)

- Impact of Information Technology Investment To Financial Performance On Banking SectorDokument6 SeitenImpact of Information Technology Investment To Financial Performance On Banking SectorHendra GunawanNoch keine Bewertungen

- Chapter 1 - Hospitality Industry PDFDokument19 SeitenChapter 1 - Hospitality Industry PDFMelwin MejanNoch keine Bewertungen

- Skeptisme Mendeteksi KecuranganDokument24 SeitenSkeptisme Mendeteksi KecuranganRIZKYNoch keine Bewertungen

- Determinants of Elasticity of DemandDokument4 SeitenDeterminants of Elasticity of DemandNoor NabiNoch keine Bewertungen

- Assignment 2Dokument7 SeitenAssignment 2Art EastNoch keine Bewertungen

- Project On Elasticity of DemandDokument11 SeitenProject On Elasticity of Demandjitesh82% (50)

- Elasticity Continued : Determinants of Price Elasticity of DemandDokument24 SeitenElasticity Continued : Determinants of Price Elasticity of Demandfoyzul 2001Noch keine Bewertungen

- Factors Affecting Price Elasticity of DemandDokument3 SeitenFactors Affecting Price Elasticity of DemandUnnat ChuriNoch keine Bewertungen

- ElasticityDokument9 SeitenElasticitysania HashmiNoch keine Bewertungen

- Aasignment - Elasticity of DemandDokument15 SeitenAasignment - Elasticity of Demandacidreign100% (1)

- Q1. Demand Function, Elasticity of Demand & Determinants of Elasticity of DemandDokument22 SeitenQ1. Demand Function, Elasticity of Demand & Determinants of Elasticity of DemanddiasroshanNoch keine Bewertungen

- Elasticity of DemandDokument17 SeitenElasticity of DemandDental Sloss100% (1)

- Eco ProjectDokument22 SeitenEco ProjectShashiRaiNoch keine Bewertungen

- The Economics of Demand: Explaining the Law of Demand and ElasticityDokument17 SeitenThe Economics of Demand: Explaining the Law of Demand and ElasticityDIANNAKATE ORTENCIONoch keine Bewertungen

- ECONOMICS Unit Notes 2Dokument19 SeitenECONOMICS Unit Notes 2Megha ChoudharyNoch keine Bewertungen

- Economics NotesDokument75 SeitenEconomics NotesLoverofAliNoch keine Bewertungen

- Elasticity of DemandDokument21 SeitenElasticity of DemandNitika AggarwalNoch keine Bewertungen

- 9 Factors That Determine Demand ElasticityDokument4 Seiten9 Factors That Determine Demand ElasticityPinkuProtimGogoiNoch keine Bewertungen

- I 4 0 EC Introduction-Elasticity-UtilityDokument39 SeitenI 4 0 EC Introduction-Elasticity-UtilityDaliah Abu JamousNoch keine Bewertungen

- Demand AnalysisDokument25 SeitenDemand AnalysisSharanya RameshNoch keine Bewertungen

- 2nd ASSIGMENT MICRO ECONOMICSDokument3 Seiten2nd ASSIGMENT MICRO ECONOMICS06Andreas Joseph Hans ImmanuelNoch keine Bewertungen

- Demand: Group Members: Agam Saxena Akshay Akshita Gupta Eshika Singhal Lakshay GoyalDokument19 SeitenDemand: Group Members: Agam Saxena Akshay Akshita Gupta Eshika Singhal Lakshay GoyalAkshita GuptaNoch keine Bewertungen

- Econ124 Chapter 5Dokument5 SeitenEcon124 Chapter 5Piola Marie LibaNoch keine Bewertungen

- ELASTICITY Is A Measure of A Variable's Sensitivity To A Change in Another Variable. in Business andDokument1 SeiteELASTICITY Is A Measure of A Variable's Sensitivity To A Change in Another Variable. in Business andJessie J.Noch keine Bewertungen

- Demand NotesDokument10 SeitenDemand Notessara.chaudharyNoch keine Bewertungen

- Chap 2-DemandDokument20 SeitenChap 2-DemandBhavina Joshi IPSANoch keine Bewertungen

- Demand AnalysisDokument62 SeitenDemand Analysissaritha tejavathNoch keine Bewertungen

- Managerial Economics Ch3Dokument67 SeitenManagerial Economics Ch3Ashe BalchaNoch keine Bewertungen

- ELASTICITY of DemandDokument16 SeitenELASTICITY of DemandKyla TorcatosNoch keine Bewertungen

- Lesson 6 AnswersDokument7 SeitenLesson 6 AnswersAbegail BlancoNoch keine Bewertungen

- Time Affecting The Price Elasticity of Demand and SupplyDokument5 SeitenTime Affecting The Price Elasticity of Demand and SupplyAbdulahi olaadNoch keine Bewertungen

- MB0042 EconomicsDokument33 SeitenMB0042 EconomicsRati BhanNoch keine Bewertungen

- Demand Supply CurveDokument13 SeitenDemand Supply CurveQNoch keine Bewertungen

- Understanding the Law of Demand and its ExceptionsDokument12 SeitenUnderstanding the Law of Demand and its ExceptionsmussaiyibNoch keine Bewertungen

- CONCEPT of ELASTICITYDokument60 SeitenCONCEPT of ELASTICITYBjun Curada LoretoNoch keine Bewertungen

- Understanding the Law of Demand and Its DeterminantsDokument16 SeitenUnderstanding the Law of Demand and Its DeterminantsDivya GuptaNoch keine Bewertungen

- Appreciating Elasticity ConceptsDokument72 SeitenAppreciating Elasticity ConceptsBSA 2 Rick Allen FloresNoch keine Bewertungen

- Managerial EconomicsDokument31 SeitenManagerial EconomicsRaj88% (8)

- Eco GRP - 2 PresentationDokument9 SeitenEco GRP - 2 PresentationFaraz ShahidNoch keine Bewertungen

- BEFA UNIT II NOTES.Dokument31 SeitenBEFA UNIT II NOTES.pramod rockzNoch keine Bewertungen

- Industry Demand and Company DemandDokument20 SeitenIndustry Demand and Company DemandTouseef ShagooNoch keine Bewertungen

- Factors Determining Price Elasticity of DemandDokument2 SeitenFactors Determining Price Elasticity of DemandUmmu KhashiaNoch keine Bewertungen

- Economics (Complete 2set)Dokument53 SeitenEconomics (Complete 2set)Shantibhusan SrivastavaNoch keine Bewertungen

- DemandDokument7 SeitenDemandPranshuNoch keine Bewertungen

- Understanding DemandDokument80 SeitenUnderstanding DemandMohit SoniNoch keine Bewertungen

- Eabd Demand CsDokument4 SeitenEabd Demand CsSHUBHAM singhNoch keine Bewertungen

- Economics Analysis of Demand & SupplyDokument8 SeitenEconomics Analysis of Demand & Supply0302038Noch keine Bewertungen

- Elasticity - : Price Elasticity of DemandDokument5 SeitenElasticity - : Price Elasticity of DemandSaagar ChitkaraNoch keine Bewertungen

- Managerial Economics: AssignmentDokument17 SeitenManagerial Economics: Assignmentsejal chowhanNoch keine Bewertungen

- Park 7e SM ch04Dokument16 SeitenPark 7e SM ch04AndreaAndradeNoch keine Bewertungen

- Determinants of Elasticity of Demand and SupplyDokument4 SeitenDeterminants of Elasticity of Demand and SupplyKaren IgnacioNoch keine Bewertungen

- Understanding Elasticity in EconomicsDokument6 SeitenUnderstanding Elasticity in EconomicsJoyce ballescas100% (1)

- 2 Eng Economics NotesDokument18 Seiten2 Eng Economics Notesdangerzonebeware20Noch keine Bewertungen

- Maritime Economics Chapter 1.2Dokument9 SeitenMaritime Economics Chapter 1.2manoj kumarNoch keine Bewertungen

- The Price Elasticity of Demand Measures The Responsiveness of Consumers To Changes in Price-4Dokument3 SeitenThe Price Elasticity of Demand Measures The Responsiveness of Consumers To Changes in Price-4Raxilla MaxillaNoch keine Bewertungen

- Inferior Goods-A Product That's Demand Is Inversely Related To Consumer Income. in Other WordsDokument5 SeitenInferior Goods-A Product That's Demand Is Inversely Related To Consumer Income. in Other WordsJasmine AlucimanNoch keine Bewertungen

- Understanding Price Elasticity of DemandDokument2 SeitenUnderstanding Price Elasticity of DemandJasmine Shamsi AzharNoch keine Bewertungen

- Mark DistributionDokument1 SeiteMark DistributionSachin SahooNoch keine Bewertungen

- EtcDokument3 SeitenEtcSachin SahooNoch keine Bewertungen

- Front CompressedDokument2 SeitenFront CompressedSachin SahooNoch keine Bewertungen

- Resident Certificate PDFDokument2 SeitenResident Certificate PDFsandeep0% (1)

- Mpil Project TitleDokument5 SeitenMpil Project TitleErik LopezNoch keine Bewertungen

- Engineering Economics & Costing AssignmnetDokument1 SeiteEngineering Economics & Costing AssignmnetSachin SahooNoch keine Bewertungen

- BANKING COMMITTEESDokument4 SeitenBANKING COMMITTEESSachin SahooNoch keine Bewertungen

- Kurukshetra June-14Dokument53 SeitenKurukshetra June-14PranNath100% (1)

- Gsi NotesDokument66 SeitenGsi NotesHexaNotesNoch keine Bewertungen

- Selectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudyDokument1 SeiteSelectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudySachin SahooNoch keine Bewertungen

- ApplicationForm PDFDokument2 SeitenApplicationForm PDFkeerthiNoch keine Bewertungen

- List of Steel Furnitures Industries in OrissaDokument3 SeitenList of Steel Furnitures Industries in OrissaSachin SahooNoch keine Bewertungen

- Bank Board BureauDokument10 SeitenBank Board BureauSachin SahooNoch keine Bewertungen

- DipikaDokument3 SeitenDipikaSachin SahooNoch keine Bewertungen

- 14 Fundamental Principles of Management Formulated by Henry FayoDokument11 Seiten14 Fundamental Principles of Management Formulated by Henry FayoSachin SahooNoch keine Bewertungen

- Banking QuizDokument28 SeitenBanking QuizSachin SahooNoch keine Bewertungen

- MigrationsDokument14 SeitenMigrationsSachin SahooNoch keine Bewertungen

- Calculate BEP and analyze contingenciesDokument7 SeitenCalculate BEP and analyze contingenciesSachin SahooNoch keine Bewertungen

- EntrepreneurshipDokument1 SeiteEntrepreneurshipSachin SahooNoch keine Bewertungen

- IBPS PO SyllabusDokument2 SeitenIBPS PO SyllabusSachin SahooNoch keine Bewertungen

- Migration TopicsDokument3 SeitenMigration TopicsSachin SahooNoch keine Bewertungen

- DR Rojalini SahooDokument5 SeitenDR Rojalini SahooSachin SahooNoch keine Bewertungen

- Ugc Net EconomicsDokument17 SeitenUgc Net EconomicsSachin SahooNoch keine Bewertungen

- Edp QBDokument113 SeitenEdp QBSachin SahooNoch keine Bewertungen

- ECON 201 12/9/2003 Prof. Gordon: Final ExamDokument23 SeitenECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanNoch keine Bewertungen

- Multiple Choice Questions: Source: G. Mankiw, Principles of EconomicsDokument8 SeitenMultiple Choice Questions: Source: G. Mankiw, Principles of EconomicsSachin Sahoo100% (4)

- Advert SingDokument3 SeitenAdvert SingSachin SahooNoch keine Bewertungen

- NCERT Class XI Accountancy Part IIDokument333 SeitenNCERT Class XI Accountancy Part IInikhilam.com67% (3)

- Ugc Net Economics PrintDokument11 SeitenUgc Net Economics PrintSachin SahooNoch keine Bewertungen

- Insurance Digest - V3Dokument88 SeitenInsurance Digest - V3Sachin SahooNoch keine Bewertungen

- N Rivigo Ot - The - 37th - Caste PDFDokument33 SeitenN Rivigo Ot - The - 37th - Caste PDFAbhilash SrivastavaNoch keine Bewertungen

- Dabur Vatika: Submitted ByDokument16 SeitenDabur Vatika: Submitted ByBooleanSinghNoch keine Bewertungen

- Sparkle Knit Composite Ltd. - Meeting 21.08.23Dokument2 SeitenSparkle Knit Composite Ltd. - Meeting 21.08.23shakib nazmusNoch keine Bewertungen

- Philippines E-Commerce GrowthDokument4 SeitenPhilippines E-Commerce GrowthGillie CaparasNoch keine Bewertungen

- Channels of Distribution in RetailDokument30 SeitenChannels of Distribution in RetailAshwin TripathiNoch keine Bewertungen

- Comet ESK14, Maint & Opns. ManualDokument168 SeitenComet ESK14, Maint & Opns. Manualjaganks100% (1)

- Sony Ericsson Joint VentureDokument63 SeitenSony Ericsson Joint VentureSanket Sudhir Pawar100% (2)

- Fashion Conversation Questions - TeflpediaDokument2 SeitenFashion Conversation Questions - TeflpedianikimacmNoch keine Bewertungen

- Nella Smallwares KnivesDokument6 SeitenNella Smallwares KnivesJames SteeleNoch keine Bewertungen

- IG 3.2 QC: High-Performance Interlock Without Restrictions!Dokument2 SeitenIG 3.2 QC: High-Performance Interlock Without Restrictions!praknithNoch keine Bewertungen

- 4 Types of Quality InspectionDokument6 Seiten4 Types of Quality InspectionashrafbookNoch keine Bewertungen

- Market OverviewDokument37 SeitenMarket OverviewBHARGAVINoch keine Bewertungen

- Architectural Thesis: Submittion - 2 SynopsisDokument25 SeitenArchitectural Thesis: Submittion - 2 Synopsischanpreet singhNoch keine Bewertungen

- DescribingDokument3 SeitenDescribingMaria RuizNoch keine Bewertungen

- The Recording Industry at A GlanceDokument12 SeitenThe Recording Industry at A Glancemrk_rlndNoch keine Bewertungen

- What Is LayoutDokument48 SeitenWhat Is LayoutShruti SisodiaNoch keine Bewertungen

- PoM 2Dokument7 SeitenPoM 2Teoh Rou Pei0% (2)

- Bullwhip Effect Supply ChainDokument11 SeitenBullwhip Effect Supply ChainUdayanidhi RNoch keine Bewertungen

- Shahi Unit 9-LibreDokument169 SeitenShahi Unit 9-Libremohinig88Noch keine Bewertungen

- HOUSEKEEPING NC II Terms and Making Up ProceduresDokument9 SeitenHOUSEKEEPING NC II Terms and Making Up ProceduresAmor100% (1)

- أسئلة وأجوبة فى النسيجDokument17 Seitenأسئلة وأجوبة فى النسيجhawNoch keine Bewertungen

- CBI Channel and Segments:: Honey in EuropeDokument5 SeitenCBI Channel and Segments:: Honey in EuropeArjun AhujaNoch keine Bewertungen

- Types of Consumer ProductsDokument6 SeitenTypes of Consumer Productssamuel debebeNoch keine Bewertungen

- Johnson Smith's Fun Catalog #792 (1979)Dokument100 SeitenJohnson Smith's Fun Catalog #792 (1979)MagicMan100% (3)

- Target Electric Blanket InstructionsDokument15 SeitenTarget Electric Blanket Instructionsbritt16110% (1)

- Uniqlo Annual Report 2015 PDFDokument74 SeitenUniqlo Annual Report 2015 PDFdaput37Noch keine Bewertungen

- The 50s Petticoat - Original PDFDokument19 SeitenThe 50s Petticoat - Original PDFЕкатерина РостоваNoch keine Bewertungen

- Sporechicks GrowGuideDokument1 SeiteSporechicks GrowGuideLuvikas Maybe KscNoch keine Bewertungen

- SL MaulDokument7 SeitenSL MaulKieran Karnn HoareNoch keine Bewertungen

- FOI Request (413147) PDFDokument199 SeitenFOI Request (413147) PDFpadrititaNoch keine Bewertungen