Beruflich Dokumente

Kultur Dokumente

Soluz 7

Hochgeladen von

Angates1Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Soluz 7

Hochgeladen von

Angates1Copyright:

Verfügbare Formate

Part I.

The fundamental information of Walt Disney The Walt Disney Company, a diversified international company operated entertainment and recreational complexes, produced motion picture and television features, developed community real estate projects, and sold consumer products. The company was founded in 1938 as a successor to the animated motion picture business established by Walt and Roy Disney in 1923.

The company operated the Disneyland amusement theme park in Anaheim, California, and the Walt Disney World destination resort in Orlando, Florida. In addition to the domestic entertainment and recreation revenues from Disneyland and Walt Disney World, the company received royalties, paid in yen, on certain revenues generated by Tokyo Disneyland. Owned and operated by an unrelated Japanese corporation, Tokyo Disneyland was opened to the public on April 15, 1983. In year 1984, the consolidated revenues for The Walt Disney Company and its subsidiaries increased by almost 27% to $1.7 billion. Total entertainment and recreation revenues, including royalties from Tokyo Disneyland, increased by 6% to $1.1 billion in the fiscal year ended September 30, 1984. Net income totaled $97.8 million in 1984, an increase of 5% from 1983. During fiscal 1984, yen royalty receipts had been just over 8 billion, however, Disney foresaw a constant further growth at 10% to 20% per year over next few years. At the same time, there were volatile fluctuations in the yen/dollar exchange rate. Yen has depreciated almost 8% last year, which indicated a shrink in royalty receipts in yen. Rolf Anderson, the director of finance at The Walt Disney was considering various ways of hedging the exposure. Besides, considering the increased interest costs on high level of borrowing and excessive short-term loan and commercial paper, the company planned to reduce such short-term debts.

Part II. Should Disney hedge its yen royalty cash flow? Why or why not? Disney should hedge its yen royalty cash flow. During fiscal 1984, yen royalty receipts had been just over 8 billion, however, Disney foresaw a constant further growth at 10% to 20% per year over next few years. At the same time, there were volatile fluctuations in the yen/dollar exchange rate. The current spot rate of 248 yen/dollar represented almost an 8% depreciation in the value of the yen from 229.70 just over a year ago, indicating a shrink in royalty receipts in yen.

The benefits of hedging: Hedging can help smooth the royalty receipts in dollar, eliminating the operating exposure. Thus Disney could be able to focus more on the operation, rather than distracting by the exchange rate fluctuation. Hedging can help to reduce the translation exposure. As an international corporation, the fluctuation in the exchange rate can affect the earnings in the consolidated Income Statement. Some potential problems with hedging: Hedging might introduce other uncertainties, especially when Disney chooses to enter into some obligation, for example, forward, future and swap. The hedging is based on the forecast that the company will keep receiving increasing yen cash flows in the future years. However such forecast may not be guaranteed. Just consider the following situation: Disney has entered into a forward contract to hedge its yen income, while for some reasons, the income from Japan decreased or ceased to come. At the same time, yen is appreciating against dollar. Then Disney could lose a great amount of money for entering into the hedge. All the above, Disney should hedge its royalty receipts in yen, but with more cautious evaluation of different situation.

Part III. Hedging techniques available to the treasurer: 1. FX futures Advantage: Foreign exchange future is an open market and its liquidity is good. Disadvantage: Firstly, the maturity is often two years or less which causes a mismatch between the period in which Disney want to hedge the fluctuations in the yen/dollar spot rate and the period of futures. Secondly, futures will not produce any cash flow to reduce short-term debt. Thirdly, future is an obligation, which could induce some potential risks given Disneys inaccurate forecast. 2. Long-dated forwards Advantage: Forward is more customer-tailed and its maturity can be long enough to satisfy Disney. Disadvantage: FX forwards will be considered by banks as a part of their total exposure to Disney, so the valuable credit line will be tied up. And it provides no cash flow to cover short-term

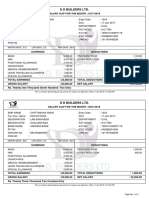

debt. Whats more, it is also an obligation as futures. 3. FX options: Advantage: FX options have an open market with easy access. The most important thing is that option is a right, rather than an obligation, which can keep Disney from the potential risks that will be induced by future or forward. Disadvantage: Disney has to pay a premium to obtain the right. The costs could be significant. 4. Convert existing dollar debt into yen liability: Advantage: It is a comparably cheap method to hedge. Disadvantage: The hedge would be short-term since Disneys Eurodollar issue matured in one to four years. The arrangement neither provides any additional cash nor reduces its short-term debt. 5. Issue a long maturity Eurodollar debt which can be swapped into yen Advantage: The costs are probably low. Disadvantage: Disney has recently issued Eurodollar note and has temporarily high debt ratio, which make it difficult to employ this approach. 6. Issue Euroyen bond Advantage: It will incur low transaction cost, only front-end fees. Disadvantage: Disney has no intention to issue Euroyen bond under the current Japanese strict finance guidelines. 7. Create a yen liability through a term loan from a Japanese bank Advantage: The Japanese bank can provide a loan with ten years maturity. The company can reduce short-term debt by converting short-term debt to long-term debt. Disadvantage: The loan could decrease the Disneys credit and induce cut in its credit line with banks. And Disneys credit rate in Japan is single A, which makes it harder and more expensive to take loans from local banks. The last strategy is the one proposed by the Disney and we can calculate this methods all -in cost with the information provided in the paper: Yen liability through a term loan from a Japanese bank | Principal | JPY 15 million | Term | 10 years | Interest payment | 7.5% |

Front-end | 0.75% | Underwriting fees | 2.000% | Additional expense | $75000 | Exchange rate($/ECU) | 0.7420 | Sinking payment(6th -10th year) | (21.840) |

Further data about the cash flow of the yen liability: Period | Cash flow(billion) | 0 | 14.8875 | 1 | (0.5625) | 2 | (0.5625) | 3 | (0.5625) | 4 | (0.5625) | 5 | (0.5625) | 6 | (0.5625) | | (0.5625) | 19 | (0.5625) | 20 | (15.5625) |

All-in cost of JPY liability is calculated as follows: i=120CFi1+IRRi=0 Use the data in the above chart, we can figure out that: (in billion) 14.8875-i=1200.56251+IRRi-15.56251+IRR20=0 IRR= 3.80423% (semiannually) Thus, the annual all-in cost is (1+3.80423%)^2-1=7.75319%

Part IV. Evaluate Goldmans proposal for an ECU bond issue accompanied by an ECU/Yen swap. a) What is the 'all-in' cost of the proposed ECU bond before executing the currency swap? The details of issuing ECU bond are listed in the table: 10-year ECU Eurobonds before swap |

Par value | ECU 80 million | Term | 10 years | Price | ECU 80.2 million | Coupon rate | 9.125% | Underwriting fees | 2.000% | Additional expense | $75000 | Exchange rate($/ECU) | 0.7420 | Sinking payment(6th -10th year) | (21.840) | Disneys cash flow from ECU bond: Period | Cash flow(million) | 0 | 78.499 | 1 | (7.300) | 2 | (7.300) | 3 | (7.300) | 4 | (7.300) | 5 | (7.300) | 6 | (23.300) | 7 | (21.840) | 8 | (20.380) | 9 | (18.920) | 10 | (17.460) | Therefore to calculate the all-in cost of the ECU bond issue, the following equation has to be met: (In million) 78.499=80*100.25%-80*2.000%-0.0750.7420 78.499=i=157.31+ri+23.3001+r6+21.8401+r7+20.3801+r8+18.9201+r9+17.4601+r10 IRR=9.7427% Thus the annual all in cost equals to 9.4727%. b) What is currently (as of 1985) the French utilitys borrowing costs in ECU and Yen? From the Exhibit 8, we can have a look at the summary of the French Utilitys outstanding publicly traded Eurobonds. The French Utility has an ECU 75 million Eurobond with 9.7 years remained,

which is close to 10 years and its YTM is 9.37%. Similarly, the French Utility can borrow 20,000 million Yen at 6.83% with 9.6 years remained. Those two rates should be close to the actual borrowing rate, though we dont have sufficient information on the front-end fees. c) The French utility has an absolute advantage to borrow in either currency. Why would the French utility nevertheless consider swapping debt obligations with Disney? For Disney: The borrowing costs of JPY loan is 7.75319%, according to question 2. Similarly, according to question 3(a), the borrowing costs of 10-year ECU bond for Disney is 9.4727%. For the French utility: the borrowing costs of 10-year ECU bond is 9.37%, according to question 3(b).And the borrowing costs of 10-year Yen liability is 7.010%. Referring to Exhibit 7, the cash flow of the French utilitys 10-year loan is as following:

Period | Cash flow(million) | 0 | 14,445.153 | 1 | (483.226) | | () | 9 | (483.226) | 10 | (1.808.141) | 11 | (1,764.650) | 12 | (1,721.160) | 13 | (1,677.670) | 14 | (1,634.179) | 15 | (1,590.689) | 16 | (1,547.199) | 17 | (1,503.708) | 18 | (1,460.218) | 19 | (1,416.728) | 20 | (1,520.450) |

14,445.15=i=19483.2261+ri+1.808.1411+r10+1,764.651+r11+1,721.161+r12+1,677.671+r13+1,6

34.1791+r14+1,590.6891+r15+1,547.1991+r16+1,503.7081+r17+1,460.2181+r18+1,416.7281+r 19+1,520.451+r20 IRR= 3.446% (semiannually) Annual all-in cost: (1+ 3.446%) ^2-1=7.010% The following are the comparisons of the borrowing cost for Disney and the French Utility for Yen and ECU: | Disney | French Utility | Spread | ECU | 9.4727% | 9.3700% | 0.1026% | JPY | 7.7532% | 7.0100% | 0.7432% | From the table, we can see that in either currency, the French Utility has a lower borrowing rate that Disney does. However, Disney has a comparative advantage in the ECU Eurobond market. With the aid of swap, the French utility can obtain ECU debt at an even lower cost. According to Exhibit 7, we can get the AIC of ECU for the French utility after entering into swap. French utilitys ECU cash flow after entering into the swap: Period | Cash flow(million) | 0 | 80.000 | 1 | (7.350) | 2 | (7.350) | 3 | (7.350) | 4 | (7.350) | 5 | (7.350) | 6 | (23.350) | 7 | (21.880) | 8 | (20.410) | 9 | (18.940) | 10 | (17.470) |

80.000=i=157.3501+ri+23.3501+r6+21.8801+r7+20.4101+r8+18.9401+r9+17.4701+r10 The AIC is 9.19%, which is lower than 9.37%. Thus it is beneficial for the French utility entering into the swap. Whats more, its difficult for the French utility to issue ECU bond. And the swap can tackle the

currency mismatch between its debt and profit. In mid-1985, the utilitys outstanding debt in yen equaled to ECU 108,686,200. That amount is almost equal to its total outstanding debt in ECU. Given its natural cash flow is in ECU, the French utility had to hedge its exchange rate exposure. As a result, the utility can get benefit by entering the swap. d) What is the 'all-in' cost of the ECU Eurobond swapped into yen for Disney? For the French utility? How well does IBJ make out? Express the gains for all parties in terms of basis points.

Year | Yen swap flow of Disney Received from/(paid to) IBJ | ECU swap flow of French utility Received from/(paid to) IBJ | 1985/1/1 | 14445.153 | 80.000 | 1985/7/1 | (483.266) | | 1986/1/1 | (483.266) | (7.350) | 1986/7/1 | (483.266) | | 1987/1/1 | (483.266) | (7.350) | 1987/7/1 | (483.266) | | 1988/1/1 | (483.266) | (7.350) | 1988/7/1 | (483.266) | | 1989/1/1 | (483.266) | (7.350) | 1989/7/1 | (483.266) | | 1990/1/1 | (1808.141) | (7.350) | 1990/7/1 | (1764.650) | | 1991/1/1 | (1721.160) | (23.350) | 1991/7/1 | (1677.670) | | 1992/1/1 | (1634.179) | (21.880) | 1992/7/1 | (1590.689) | | 1993/1/1 | (1547.199) | (20.410) | 1993/7/1 | (1503.708) | | 1994/1/1 | (1460.218) | (18.940) | 1994/7/1 | (1416.728) | | 1995/1/1 | (1520.450) | (17.470) |

The 'all-in' cost of the ECU Eurobond swapped into JPY for Disney is 7.010%. Through this SWAP, Disney could gain 74 basis points on the cost compared with JPY loan (7.7532%). The 'all-in' cost of the JPY Eurobond swapped into ECU for the French Utility is 9.19%. For French Utility, it could gain 18 basis points on the cost compared with 9.37% of JPY loan. The gain for IBJ in terms of basis points is 50 basis points. e) What is the origin of these gains? The origin of these gains is the comparative-advantage. The French Utility has an absolute advantage in both currencies debt, but Disney has a comparative advantage in ECU. If Disney borrows in ECU and the French Utility borrows in JPY, they pay less combined interest than if Disney borrows in JPY and the French Utility borrows in ECU. This reduction in total interest can be shared by Disney and the French Utility.

Das könnte Ihnen auch gefallen

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Dokument25 SeitenIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420Noch keine Bewertungen

- Problem 11.3Dokument1 SeiteProblem 11.3SamerNoch keine Bewertungen

- WrigleyDokument28 SeitenWrigleyKaran Rana100% (1)

- MBF14e Chap06 Parity Condition PbmsDokument23 SeitenMBF14e Chap06 Parity Condition PbmsKarl100% (18)

- Case StudyDokument4 SeitenCase StudylifeisyoungNoch keine Bewertungen

- Team 14 - Star River Electronics LTDDokument9 SeitenTeam 14 - Star River Electronics LTDKukyong Lee50% (2)

- MBF14e Chap05 FX MarketsDokument20 SeitenMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- BUS322Tutorial8 SolutionDokument10 SeitenBUS322Tutorial8 Solutionjacklee1918100% (1)

- Case StudyDokument7 SeitenCase StudyTasnova Haque Trisha100% (1)

- MBF14e Chap02 Monetary System PbmsDokument13 SeitenMBF14e Chap02 Monetary System PbmsKarlNoch keine Bewertungen

- Rosario Acero SA Case StudyDokument12 SeitenRosario Acero SA Case Study__myself100% (1)

- Presentation V2Dokument20 SeitenPresentation V2tintin50100% (1)

- Walt Disney Yen FinancingDokument10 SeitenWalt Disney Yen FinancingAndy100% (2)

- Disney Hedging Yen Royalty Cash Flow RiskDokument6 SeitenDisney Hedging Yen Royalty Cash Flow RiskSonal Choudhary100% (1)

- Mergers & AcquisitionsDokument2 SeitenMergers & AcquisitionsRashleen AroraNoch keine Bewertungen

- Case Study - Star River Electronic LTDDokument12 SeitenCase Study - Star River Electronic LTDNell Mizuno100% (2)

- Pay - Slip Oct. & Nov. 19Dokument1 SeitePay - Slip Oct. & Nov. 19Atul Kumar MishraNoch keine Bewertungen

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDokument27 SeitenForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- Case 26 An Introduction To Debt Policy ADokument5 SeitenCase 26 An Introduction To Debt Policy Amy VinayNoch keine Bewertungen

- Kota Fibres IncDokument20 SeitenKota Fibres IncMuhamad FudolahNoch keine Bewertungen

- Solutions Chapter 9 Special Finanancing VehiclesDokument8 SeitenSolutions Chapter 9 Special Finanancing VehiclesRuchit GandhiNoch keine Bewertungen

- Foreign Exchange Hedging Strategies at General MotorsDokument6 SeitenForeign Exchange Hedging Strategies at General MotorsMelania PenzaNoch keine Bewertungen

- Rosario FinalDokument13 SeitenRosario FinalDiksha_Singh_6639Noch keine Bewertungen

- Summary of Five-Year Eurobond Terms Available To R.J. ReynoldsDokument8 SeitenSummary of Five-Year Eurobond Terms Available To R.J. ReynoldsRyan Putera Pratama ManafeNoch keine Bewertungen

- Star River PembahasanDokument8 SeitenStar River PembahasanGloria Lisa SusiloNoch keine Bewertungen

- Refinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenDokument6 SeitenRefinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenJeffNoch keine Bewertungen

- CARREFOUR S.A. Case SolutionDokument3 SeitenCARREFOUR S.A. Case SolutionShubham PalNoch keine Bewertungen

- BUS322Tutorial5 SolutionDokument20 SeitenBUS322Tutorial5 Solutionjacklee191825% (4)

- TN38 Carrefour S ADokument6 SeitenTN38 Carrefour S AFeeling_so_fly100% (2)

- Urbanization and Rural-Urban Migration: Theory and PolicyDokument42 SeitenUrbanization and Rural-Urban Migration: Theory and PolicyJunaid AhmedNoch keine Bewertungen

- Carrefour SA International Business Finance 13013Dokument14 SeitenCarrefour SA International Business Finance 13013nadiafloreaNoch keine Bewertungen

- The Walt Disney Company's Yen FinancingDokument25 SeitenThe Walt Disney Company's Yen FinancingAbhishek Prasad100% (2)

- Case StudyDokument2 SeitenCase StudybombyĐNoch keine Bewertungen

- Chapter 7Dokument10 SeitenChapter 7rcraw87Noch keine Bewertungen

- Porsche's FX Hedging and VW Acquisition StrategyDokument2 SeitenPorsche's FX Hedging and VW Acquisition StrategyRavi Patel100% (1)

- Investment Opportunities in Bosnia and Herzegovina 2016Dokument69 SeitenInvestment Opportunities in Bosnia and Herzegovina 2016Elvir Harun Ibrovic100% (1)

- Disney CaseDokument25 SeitenDisney Casejustinbui85Noch keine Bewertungen

- Walt DisneyDokument10 SeitenWalt DisneystarzgazerNoch keine Bewertungen

- FINA 410 - Exercises (NOV)Dokument7 SeitenFINA 410 - Exercises (NOV)said100% (1)

- Decko Co Is A U S Firm With A Chinese Subsidiary ThatDokument1 SeiteDecko Co Is A U S Firm With A Chinese Subsidiary ThatM Bilal SaleemNoch keine Bewertungen

- Case Background: Kaustav Dey B18088Dokument9 SeitenCase Background: Kaustav Dey B18088Kaustav DeyNoch keine Bewertungen

- Case 3 Dupont AnalysisDokument13 SeitenCase 3 Dupont AnalysisJannine Mae67% (12)

- Tiffany and CoDokument2 SeitenTiffany and Comitesh_ojha0% (2)

- Chapter 7 BVDokument2 SeitenChapter 7 BVprasoonNoch keine Bewertungen

- Cost of Capital for Foreign InvestmentsDokument11 SeitenCost of Capital for Foreign InvestmentsyuliNoch keine Bewertungen

- CH 18Dokument4 SeitenCH 18Ahmed_AbdelkariemNoch keine Bewertungen

- Gemi RJRDokument6 SeitenGemi RJRAjeng NurulNoch keine Bewertungen

- Case 03Dokument9 SeitenCase 03Sajieda FuadNoch keine Bewertungen

- Measuring Exposure to Exchange Rate FluctuationsDokument6 SeitenMeasuring Exposure to Exchange Rate Fluctuationsgeorgeterekhov100% (1)

- BioTron Medical Foreign Exchange Risk AnalysisDokument19 SeitenBioTron Medical Foreign Exchange Risk AnalysisQurratul Asmawi100% (2)

- FC options vs futures; Nick Leeson's unauthorized trading at Barings BankDokument5 SeitenFC options vs futures; Nick Leeson's unauthorized trading at Barings BankMohd Hafeez NizamNoch keine Bewertungen

- KKTiwari - 18214263 - Worldwide Paper Company-2016Dokument5 SeitenKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNoch keine Bewertungen

- Chap08 Pbms SolutionsDokument25 SeitenChap08 Pbms SolutionsDouglas Estrada100% (1)

- Week 3 Tutorial ProblemsDokument6 SeitenWeek 3 Tutorial ProblemsWOP INVESTNoch keine Bewertungen

- The Walt Disney CompanyDokument11 SeitenThe Walt Disney CompanyNarinderNoch keine Bewertungen

- THE WALT DISNEY COMPANY - EditedDokument11 SeitenTHE WALT DISNEY COMPANY - EditedNarinderNoch keine Bewertungen

- Walt Disney Yen Financing-Kelompok 1Dokument25 SeitenWalt Disney Yen Financing-Kelompok 1michelleruthnNoch keine Bewertungen

- Disney's Yen Hedging TechniquesDokument6 SeitenDisney's Yen Hedging TechniquesFlavia Angelina WitarsahNoch keine Bewertungen

- SM Multinational Financial Management ch09Dokument5 SeitenSM Multinational Financial Management ch09ariftanur100% (1)

- DISNEY CAPITAL BUDGET PLANDokument17 SeitenDISNEY CAPITAL BUDGET PLANKeerat KhoranaNoch keine Bewertungen

- Module 4 - ValuationDokument29 SeitenModule 4 - ValuationKishore JohnNoch keine Bewertungen

- Chapter 5: Bond: BY: PN Azlida Binti AbdullahDokument44 SeitenChapter 5: Bond: BY: PN Azlida Binti Abdullahazlida abdullahNoch keine Bewertungen

- Valuation of BondsDokument30 SeitenValuation of BondsRuchi SharmaNoch keine Bewertungen

- SSC Registration DetailsDokument3 SeitenSSC Registration DetailsAngates1Noch keine Bewertungen

- Maths Class 4Dokument2 SeitenMaths Class 4Angates1Noch keine Bewertungen

- Rai LicDokument3 SeitenRai LicAngates1Noch keine Bewertungen

- Analytic Geometry Formulas PDFDokument4 SeitenAnalytic Geometry Formulas PDFKaranbir RandhawaNoch keine Bewertungen

- Aaa PDFDokument1 SeiteAaa PDFAngates1Noch keine Bewertungen

- 14 Thevening With Dependent SourcesDokument2 Seiten14 Thevening With Dependent SourcesJamal AlshaweshNoch keine Bewertungen

- Common Recruitment Process For Recruitment of Clerks in Participating Organisations (CRP Clerks-Viii) 00Dokument4 SeitenCommon Recruitment Process For Recruitment of Clerks in Participating Organisations (CRP Clerks-Viii) 00Angates1Noch keine Bewertungen

- Recoommend by BJ SirDokument1 SeiteRecoommend by BJ SirAngates1Noch keine Bewertungen

- Ajay Kumar CV - Electronics Engineer NepalDokument2 SeitenAjay Kumar CV - Electronics Engineer NepalAngates1Noch keine Bewertungen

- Jabra Freeway Web Manual RevD - EN - EMEA - Voice Control PDFDokument20 SeitenJabra Freeway Web Manual RevD - EN - EMEA - Voice Control PDFAngates1Noch keine Bewertungen

- Electronics EngineeringDokument3 SeitenElectronics EngineeringNipun SinhaNoch keine Bewertungen

- Griffiths EPR BellInequality ExcerptDokument24 SeitenGriffiths EPR BellInequality ExcerptsonamonuNoch keine Bewertungen

- Jee Main 2013 Answers KeyDokument1 SeiteJee Main 2013 Answers KeyMehak AhluwaliaNoch keine Bewertungen

- CAcT HomePageDokument7 SeitenCAcT HomePageAngates1Noch keine Bewertungen

- Commission StructureDokument2 SeitenCommission StructureAngates1Noch keine Bewertungen

- Psa Reply3 2014 2Dokument1 SeitePsa Reply3 2014 2Angates1Noch keine Bewertungen

- IRCTC Registration FormDokument1 SeiteIRCTC Registration FormAngates1Noch keine Bewertungen

- Electronics EngineeringDokument3 SeitenElectronics EngineeringNipun SinhaNoch keine Bewertungen

- Types of Wallet For Money TransferDokument2 SeitenTypes of Wallet For Money TransferAngates1Noch keine Bewertungen

- PlayDokument4 SeitenPlayAngates1Noch keine Bewertungen

- Final Report of AAPDokument33 SeitenFinal Report of AAPAngates1Noch keine Bewertungen

- NM Interview QuesDokument3 SeitenNM Interview QuesAngates1Noch keine Bewertungen

- Rajesh ResumeDokument4 SeitenRajesh ResumeAngates1Noch keine Bewertungen

- The Notes On Air Force MuseumDokument2 SeitenThe Notes On Air Force MuseumAngates1Noch keine Bewertungen

- Survey QuestionnaireDokument4 SeitenSurvey QuestionnaireAngates10% (1)

- Ayushi InterviewDokument2 SeitenAyushi InterviewAngates1Noch keine Bewertungen

- Building Mathematical AbilityDokument37 SeitenBuilding Mathematical AbilityAngates1Noch keine Bewertungen

- CVD DeepakDokument4 SeitenCVD DeepakAngates1Noch keine Bewertungen

- Amit KumarDokument1 SeiteAmit KumarAngates1Noch keine Bewertungen

- Simulations in PSPICE For Circuit Analysis of Semiconductor DevicesDokument14 SeitenSimulations in PSPICE For Circuit Analysis of Semiconductor DevicesAngates1Noch keine Bewertungen

- Liquidity RatioDokument3 SeitenLiquidity RatioJodette Karyl NuyadNoch keine Bewertungen

- Agricultural Mechanisation Investment Potential in TanzaniaDokument2 SeitenAgricultural Mechanisation Investment Potential in Tanzaniaavinashmunnu100% (3)

- Soft Power by Joseph S NyeDokument19 SeitenSoft Power by Joseph S NyemohsinshayanNoch keine Bewertungen

- StopfordDokument41 SeitenStopfordFarid OmariNoch keine Bewertungen

- Basel III: Bank Regulation and StandardsDokument13 SeitenBasel III: Bank Regulation and Standardskirtan patelNoch keine Bewertungen

- Farmers, Miners and The State in Colonial Zimbabwe (Southern Rhodesia), c.1895-1961Dokument230 SeitenFarmers, Miners and The State in Colonial Zimbabwe (Southern Rhodesia), c.1895-1961Peter MukunzaNoch keine Bewertungen

- Rethinking Monetary Policy After the CrisisDokument23 SeitenRethinking Monetary Policy After the CrisisAlexDuarteVelasquezNoch keine Bewertungen

- Funskool Case Study - Group 3Dokument7 SeitenFunskool Case Study - Group 3Megha MarwariNoch keine Bewertungen

- RenatoPolimeno Resume 2010 v01Dokument2 SeitenRenatoPolimeno Resume 2010 v01Isabela RodriguesNoch keine Bewertungen

- Find payment channels in Aklan provinceDokument351 SeitenFind payment channels in Aklan provincejhoanNoch keine Bewertungen

- ACC 690 Final Project Guidelines and RubricDokument4 SeitenACC 690 Final Project Guidelines and RubricSalman KhalidNoch keine Bewertungen

- Information Technology Telecommunications and Information ExchangeDokument48 SeitenInformation Technology Telecommunications and Information Exchangescribd4tavoNoch keine Bewertungen

- Blkpay YyyymmddDokument4 SeitenBlkpay YyyymmddRamesh PatelNoch keine Bewertungen

- Marketing Plan - NikeDokument32 SeitenMarketing Plan - NikeHendra WijayaNoch keine Bewertungen

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Dokument2 SeitenIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)Anonymous Pog15DNoch keine Bewertungen

- Case Study 2 (Indigo) PDFDokument3 SeitenCase Study 2 (Indigo) PDFDebasish SahooNoch keine Bewertungen

- Comparative Analysis of Broking FirmsDokument12 SeitenComparative Analysis of Broking FirmsJames RamirezNoch keine Bewertungen

- Translation To The Presentation Currency/translation of A Foreign OperationDokument1 SeiteTranslation To The Presentation Currency/translation of A Foreign OperationdskrishnaNoch keine Bewertungen

- SBI Statement 1.11 - 09.12Dokument2 SeitenSBI Statement 1.11 - 09.12Manju GNoch keine Bewertungen

- ABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFDokument18 SeitenABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFamitsh20072458Noch keine Bewertungen

- Final Exam - Module 2: Smooth Chin Device CompanyDokument16 SeitenFinal Exam - Module 2: Smooth Chin Device CompanyMuhinda Fredrick0% (1)

- Tour Guiding Introduction to the Tourism IndustryDokument13 SeitenTour Guiding Introduction to the Tourism Industryqueenie esguerraNoch keine Bewertungen

- 43-101 Bloom Lake Nov 08Dokument193 Seiten43-101 Bloom Lake Nov 08DougNoch keine Bewertungen

- SEC Application of Perkins Coie TWB Investment Partnerships SEC 2008Dokument6 SeitenSEC Application of Perkins Coie TWB Investment Partnerships SEC 2008Beverly TranNoch keine Bewertungen

- Social Science Class Viii WORKSHEET-1-Map WorkDokument2 SeitenSocial Science Class Viii WORKSHEET-1-Map WorkChahal JainNoch keine Bewertungen

- Common Rationality CentipedeDokument4 SeitenCommon Rationality Centipedesyzyx2003Noch keine Bewertungen

- Green HolidaysDokument5 SeitenGreen HolidaysLenapsNoch keine Bewertungen