Beruflich Dokumente

Kultur Dokumente

Miswin Mahesh of Barclays PLC

Hochgeladen von

veluthamOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Miswin Mahesh of Barclays PLC

Hochgeladen von

veluthamCopyright:

Verfügbare Formate

MUMBAI | MONDAY, 29 APRIL 2013

MARKETS 3

<

EQUITY OUTLOOK

CRUDE OIL OUTLOOK

The anxious road to recovery

NICK PAULSON-ELLIS When I last wrote this column in November, I argued for a more constructive outlook, seeing 15 per cent upside over a year, but warning the rise was unlikely to be linear. Today, the market is up five per cent, having scaled 20,000, only to fall below 18,500 as worries returned. So, why has the market been so skittish this year? Broadly because the data has largely been disappointing (GDP or gross domestic product growth at 4.5 per cent, CAD or current account deficit at 6.7 per cent, etc) and fears about political risk. Policy signals were enough to drive markets in 2012, without any improvement in fundamentals. But investors are now more impatient for signs of a turn in the fundamentals. It is hard to call the inflection point, but we think the next six months will see the start of a gradual economic and earnings recovery. This wont be a V-shaped recovery, given the macro imbalances. But India should benefit from a number of cyclical improvements. The fiscal deficit is under control, with a five per cent realistic figure for FY14, inflation is finally falling, with 5.96 per cent in March, and core inflation at 3.4 per cent. This gives room for the Reserve Bank of India to cut repo rates over FY14 by 100 basis points. That leaves two thorny cyclical issues; CAD and growth. The CAD at 5.1 per cent of GDP has meant financing a $95-billion bill. Whilst not a problem this year, it needs to be brought under control. There was much talk of falling gold imports as prices corrected, but demand in the second half was strong. Besides cultural attractions, gold is a hedge against inflation and a volatile rupee. Gold demand might correct by, say five per cent in FY14, given the recent

Prices to rebound in second half

If this fails to hold in the near term, until we see an improvement in fundamentals approaching the tail end of Q2, the second layer of support is likely to come through market expectations surrounding comfort levels for OPEC producers to continue producing above their target. Finally, the third layer of support is expected to come from cost curves, which once again are unlikely to be brushed until the $90 per barrel mark is touched. However, the likelihood of such an extreme weakness can be ruled out for now, in our view. The window for testing these layers of support is restricted to the end of Q2, as the weakness in fundamentals is very transient, and we do not see prices remaining below $100 a barrel for the rest of the year. Progressing through the tail end of Q2 and into the second half of 2013, we see strong indications for demand growth developing, which will keep the call on crude oil elevated. In the Pacific, we are seeing strong indications of growth in the smaller non-OECD Asia Pacific countries, along with China and India providing a healthy level of support. In the Atlantic, we see strong demand growth coming from Latin America. Overall, we are likely to see a healthy retracement of prices by the tail end of Q2. Going into Q3, we feel the oil market will be balanced on a higher wire, with absolute global demand crossing 90 million barrels a day, and the supply system gearing itself to match this requirement, while geopolitical risks that have now faded from the headlines continue to lurk in the background.

The author is a commodities strategist at Barclays Bank Plc in London, covering crude oil & refined products market

It is hard to call the inflection point, but we think the next six months will see the start of a gradual economic and earnings recovery

volatility, but dont expect more. Oil demand should moderate, rising only four per cent assuming relatively stable global oil prices, and the benefits of price reforms in petroleum products. Add to that a mild recovery in exports (up four per cent in

dollar terms in January-March), and CAD MISWIN MAHESH should see a slight improvement, but the range is quite wide, between four and five Recently, the front-month Brent crude per cent. oil contract slipped below the $100 per Growth is the hardest to call. We think barrel level for the first time since July 25, recovery to a six per cent type growth rate 2012. For the OPEC crude basket, the remains likely, given rate cuts, some break below this level was statistically improvement in domestic business confisignificant, given that it was the longest dence and a mild recovery in global stretch in history that prices had growth. But the most important factor to remained above $100 a barrel (191 days). watch is success in accelerating project The physical crude oil markets were clearances. Currently, lead indicators for facing pressure from a combination of the capex cycle look bleak core infrafactors. Firstly, close to eight per cent of structure output is negative, new project refineries globally are offline for mainannouncements falling and stalled projtenance during this period. Besides, marects at best stabilising. But the Cabinet gins for refineries have weakened, giving Committee on Investments is them less incentive to run at full showing some success, having utilisation rates. These two seafacilitated approval of projects sonal factors have weighed on worth $14 billion in 2013. the demand side for crude oil. Calling a bottoming in earnOn the supply side, there has ings growth has also been tricky, been an improvement in availMARKET MIND with operating margins stabilisability with the North Sea seeing ing but revenue growth very weak. It an improvement, while previous shortmight still take a quarter or two to falls among the non-OPEC countries reverse, but FY14 earnings growth have also eased. The real trigger for the should recover to the low teens. Given move below $100 a barrel came from the structural impediments we see no reasell-offs in other asset classes, along with son for multiple expansion. But until poor macro economic data from the US the data on both GDP and corporate and China. profitability point more unambiguousWhile prices have recovered now, with ly to a recovery in growth we are likely to Brent hovering above $100 a barrel again, witness periodic bouts of market anxiety we do not expect oil market fundamenand weakness. tals alone to offer catalysts for an immeOur message is familiar maintain a diate upside retracement to the $111 a barquality bias to portfolios; this is not a rel range over April to May. In fact, we climate for trading down to second tier would not rule out further weakness in names. Stocks we like include HDFC the near term. Bank, Federal Bank, M&M Financial Until we see a fundamentals-driven Services, PFC, Max India, L&T, Adani retracement, the pace of the downward Port, Wipro, KPIT Cummins, Bharti, momentum is likely to be slow. We highCipla, Lupin, JSPL and Motherson Sumi. light three layers of immediate support on the fundamentals side that will supThe author is country head India, Espirito port prices. Santo Securities The first level of support is expected to

Until we see a fundamentals-driven retracement, the pace of the downward momentum is likely to be slow

come from consumers, who have been waiting on the sidelines for a better entry point for their hedging programmes. We see a pick-up in hedging activity on the first leg of the downward adjustment from current levels.

Repo rate cut is meaningless

State Bank of India Chairman PRATIP CHAUDHURI tells Manojit Saha a cut in cash reserve ratio (CRR) can take care of liquidity issues, without hurting anyone. Edited excerpts:

Deposit growth has been sluggish over the past couple of years. What will be the strategy to beef up deposit mobilisation?

One thing is sure we will not go for expensive bulk deposits. We will keep focusing on retail deposits. It would also depend on RBI (the Reserve Bank); if it cuts the cash reserve ratio

(CRR), deposit pricing would head lower. Today, bank deposits are at a disadvantageous position as tax-free bonds, liquid mutual fund schemes, etc, get superior treatment. I have been requesting RBI to reduce the minimum fixed deposit tenure to three days from the present seven days. If someone thinks a seven-day deposit is more stable than three days, that is not the case. Why should bank deposits get the worst possible treatment? Due to all these, bank deposits are losing out to other schemes; as a result, the pool of savings is getting

reduced. In addition, with this kind of inflation, it is also time to cut CRR by one per cent. That can take care of so many liquidity issues without hurting anybody.

Why do you think a repo rate cut is not sufficient for a lending rate cut?

ter, we dont see a huge pipeline. It could be about ~3,000 crore. Our restructured book is much lower than other banks, because we never had exposure to state electricity boards.

liquidity. Once that gets absorbed, we will be very comfortable in terms of margins. PRATIP CHAUDHURI

Chiarman, SBI

Is there any concern on the asset quality of retail credit?

A repo rate cut is meaningless; for example, a one per cent cut in CRR will release ~12,000 crore for us, and allow me to cut the lending rate by 20 bps, while a similar cut in repo rate cut will affect the lending rate by two to three bps. A cut in CRR will send out a signal of more benign interest rates. Thats what the economy needs very badly.

Your cost-income ratio is on the higher side. How do you plan to address that?

Banks had a tough time with their exposure to Kingfisher Airlines. What about your exposure to other airlines?

So far as Kingfisher is concerned, we are in the recovery mode, not in revival mode. We have exposure to Jet Airways and Air India both are doing fine. Now that Jet has brought in significant equity, there is a possibility that it might pay back some high-cost debt.

What kind of net interest margin do you see in 2012-13 and what is the expectation for this financial year?

We have not seen any adverse impact on asset quality in the home loan portfolio. Non-performing assets in this category is about 1.3 per cent. The moment we give a Sarfaesi notice, an individual does everything possible to protect his home.

What kind of capital requirement will the bank?

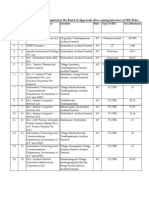

INDIA'S CALL FOR A RATING UPGRADE MAY NOT BE UNJUSTIFIED

India has sought a better sovereign rating on improving economic climate, both domestically and globally. Though the countrys twin deficits current account and fiscal have been a cause of concern, a comparison with some of the key countries (both developed and emerging) suggests that the call for an upgrade may be justified. Below are some of the key ratios that influence sovereign ratings of a country

(In $ bn) SOVEREIGN RATING* Moodys S & P Date Public debt Trade Import Forex (% of GDP) balance cover (mths) reserves Date Budget balance as % of GDP @

Our biggest challenge will be the cost-to-income ratio, which is at 48 per cent. We have to improve the ratio by increasing the volumes, since it will be difficult to shrink the cost. That is because you cut down on services if you shrink cost and you may economise on risk and compliance.

What kind of loan recast pipeline do you expect?

Since a lot of clearance h a p pened l a s t quar-

Margins are expected to be healthy. We had given a guidance of 3.7-3.75 per cent. We still hold on to that. This financial year, too, we will give a guidance of 3.7 per cent. But it needs to be seen how the margins from international operations pan out. If we get long-term assets from our foreign offices, the margins will be good. But short-term interest in overseas market is very low. Therefore, short-term assets are not very remunerative. Overall, we still have ~40,000-50,000 crore of extra

We expect to close the previous financial year with 10 per cent capital adequacy ratio. The government holding is 63 per cent. If there is a huge demand, only we will need additional capital. There are a number of options. We can go for a rights issue, we can go for a follow-on offer.

What is the plan regarding merging one of the associate banks?

We will look into the issue in the second quarter. Capital raising and a subsidiary merger should be seen in context. Subsidiary merger costs ~1,200-2,000 crore, depending on the size of the bank, because the salaries and the pension provisions for employees have to be brought up to the level of SBI.

Brazil China France Germany India Japan Russia UK US

Baa2 Aa3 Aa1 Aaa Baa3 Aa3 Baa1 Aa1 Aaa

BBB AAAA+u AAAu AA-u BBB AAAu AA+u

Aug 3, 12 Jan 23, 13 Mar 4, 13 May 29, 12 Feb 13, 13 Jun 27, 12 Apr 19, 13 Jan 17, 13

BBB-u Nov 22, 12

54.9 12 31.7 274 89.9 -86 81.7 245 51.9 -196 214.3 -83 12.2 185 88.7 -54 73.6 -478

19.6 22.3 3.6 2.9 7.2 20.5 18.8 1.7 0.7

370 3,440 199 289 295 1,254 532 105 152

Feb 13, 13 Mar 31, 13 Jan 31, 13 Apr 19, 13 Apr 19, 13 Mar 31, 13 Jan 31, 13 Jan 31, 13 Mar 31, 13

-2.6 -1.1

-3.4

0.2 -5.8 -9.9 -0.2 -6.3 -6.5

*Foreign currency long term The import cover has been derived by converting the local currency for the respective country at its latest exchange rate Russia's monthly exports & imports for 12 months to February 2013 have been combined to arrive at annual figures @ as on Dec 31, 2012, except for the US which is as on Mar 31, 2013 Standard & Poor's Ratings Services separately identifies unsolicited credit ratings with either a subscript or a notation. The "u" indicates that the rating is initiated without the request of the issuer The above list compares India with other BRIC countries as well as the top developed economies Ratings are expressed as letter grades. For example, S&P gives grades from AAA to D to communicate the agencys opinion of relative level of credit risk. 'AAA indicates extremely strong capacity to meet financial commitments. Highest rating. This rating is followed by 'AA', 'A', 'BBB' and 'BBB-', which is where India stands. 'BBB-' is considered the lowest investment grade by market participants. There are seven more ratings below this, with the lowest being 'D' which indicates payment default on financial commitments Source: Bloomberg, tradingeconomics.com Compiled by BS Research Bureau

MONEY MARKET OUTLOOK

Yields expected to fall Losing a (ring) digit further; ~ may firm up Get ready for three-digit gold

BS REPORTER

Mumbai, 28 April

Government bond yields are expected to fall further this week on hopes of a repo rate cut in the annual monetary policy for 2013-14 on Friday. The Street is expecting the Reserve Bank of India (RBI) to cut the repo rate by at least 25 basis points. The yield on the 10-year benchmark government bond 8.15 per cent 2022 closed at 7.75 per cent on Friday, compared with the previous close of 7.77 per cent. According to government bond dealers, this week the yield could drop to 7.70 per cent before the policy. If RBI cuts the repo rate and the guidance is about further rate cuts, then the yield would drop to 7.65 per cent. Repo rate (the rate at which banks borrow from RBI) is currently at 7.50 per cent. The expectations of a rate cut had

built up after the wholesale price index (WPI)-based inflation for March rose 5.96 per cent, after an annual uptick to 6.84 per cent in February. The other comforting factor was that the current account deficit (CAD), which had widened to a record high in the quarter-ended December 31 is expected to narrow down in the fourth quarter. The CAD rose to a record high of 6.7 per cent of GDP in the December quarter on account of heavy oil and gold imports, besides muted exports. CAD had been 5.4 per cent of GDP in the previous quarter and 4.4 per cent in the third quarter of last year. The rupee is expected to appreciate this week, as the Street expects RBI to announce further easing of export credit norms in the policy. It ended at ~54.38 on Friday, compared with the previous close of ~54.22, due to month-end dollar demand by importers.

Get ready for three-digit gold. Bullion may have bounced after its recent fall, and in the short term its price may remain volatile. But golds plunge is a sign of the departure of investors. A fall below $1,000 is possible this year or next. Investors, not jewellers, are the driver of the gold price. Annual investor demand, whether for gold in bars and

coins or exchange-traded funds, trebled between 2004 and 2010, according to the World Gold Council. In 2005, just 19.5 per cent of global demand for gold was from investors; by 2011, that percentage had risen to 37 per cent. The first sign of a decline in appetite was a 9.7 per cent fall in investor demand in 2012. That was a warning.

Though gold has retraced some of its drop, the sudden loss of over 10 percent of its value in a few trading days this month probably heralds a sustained investor retreat. Unless there is a fresh economic emergency, such as a U.S. economic collapse that would radically change expectations about Federal Reserve policy, it is hard to see gold demand

returning strongly. averaged 1,928 The impression tonnes per year - 22 that newly enriched percent below the Indian and Chinese average for the prebuyers may fill the ceding six years. gap is misleading. Technology Indian gold demand demand is stable at fell by 12 per cent in close to 400 tonnes BY IAN CAMPBELL 2012 on a year earlier annually, less than and Chinese 10 percent of total demand was flat. bullion demand. Jewellery demand has been True, central banks have priced out. It started to slump changed their behaviour and in 2009 when the gold price will support gold somewhat. pierced $1,000. Between 2009 From 2003 to 2009 they were and 2012, jewellery demand substantial net sellers, but in

2011 and 2012 their acquisitions averaged 496 tonnes per year. The central banks sold gold cheap and have been buying high. Thats unwise but some, such as South Korea and Russia, may well continue doing so this year. The gold price may have to lose a digit to bring support from the ring fingers back. But for now jewellery buyers, like investors, may prove reluctant to grasp at a falling knife, even when its a golden one.

Cool bonds

Apple iOUs may need to be as desirable as iPhones

Apple may need to make its iOUs as desirable as iPhones. Right now, money managers are gaga for the companys bonds even before they have made their market debut. But the scale of issuance that could come from the tech giant is on a par with huge borrowers like banks. To be sustainable, that would call for some of Apples magic. Debt from cash-rich US technology companies used to be exceedingly rare. But low interest rates have changed that. Borrowing cheaply is a better financial bet than repatriating cash earned overseas and paying tax on it. Microsoft tested the waters in 2009 and has raised nearly $15 billion since then, according to Thomson Reuters data. But Apple could be looking to borrow more than that every year. The company recently expanded its budget for dividends and stock buybacks to $100 billion by the end of 2015. Assuming $45 billion of its cash pile is onshore a figure consistent with what the company has said and ignoring new inflows, that means borrowing $55 billion in less than three years, according to research firm CreditSights, or nearly $20 billion a year. That would put Apple in the

same issuance ballfixed income fund park as large banks managers may want like Bank of America to feel like the cool and Citigroup and kids for once. A comother big financial pany with lots of firms. And many of cash, even if its those are mostly refitrapped overseas, is nancing old debt. a godsend for those The iPhone maker who simply dont would be asking BY AGNES T CRANE want to worry about more of investors default. Apple has since it would be looking for garnered a AA-plus rating from new money each time. Standard & Poors, one notch Most companies would have down from AAA. Microsoft, a to pay lenders a premium to rare top-rated company, will borrow so much. Apple is dif- pay less than 2.5 per cent interferent, and not just because est on the $1 billion of 10-year

bonds it sold on Thursday. If its bonds keep on marching to market, however, Apples novelty as a borrower will wear off and the company will need to keep investors engaged. Innovation could help. Just as Apple visionary Steve Jobs seemingly knew what people wanted before they did, the company may be able to use its brand and perhaps innovative structures to create a category of bonds investors suddenly cant do without. If Apple manages it right, iOUs could be the next big thing.

The authors are Reuters Breakingviews columnists. The opinions expressed are their own. For further commentary see www.breakingviews.com

Das könnte Ihnen auch gefallen

- Unofficial Solutions Manual To R.A Gibbon's A Primer in Game TheoryDokument36 SeitenUnofficial Solutions Manual To R.A Gibbon's A Primer in Game TheorySumit Sharma83% (23)

- Market Ratios - Practice QuestionsDokument16 SeitenMarket Ratios - Practice QuestionsOsama Saleem0% (1)

- Ulrich Bindseil - Monetary Policy Operations and The Financial System (2014, Oxford University Press) - Libgen - LiDokument337 SeitenUlrich Bindseil - Monetary Policy Operations and The Financial System (2014, Oxford University Press) - Libgen - LiOlivia Saa100% (1)

- Executive Summary: We Are Sri Lanka Rupee Bulls'Dokument8 SeitenExecutive Summary: We Are Sri Lanka Rupee Bulls'Amal SanderatneNoch keine Bewertungen

- The Commodity Investor S 102885050Dokument33 SeitenThe Commodity Investor S 102885050Parin Chawda100% (1)

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDokument61 SeitenC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNoch keine Bewertungen

- Document 1254342 1670403957426Dokument5 SeitenDocument 1254342 1670403957426enricopaloma99100% (1)

- RBI Rate Hike A GivenDokument2 SeitenRBI Rate Hike A GivenMuana Lal Thla JAfNoch keine Bewertungen

- U.S. Market Update August 12 2011Dokument6 SeitenU.S. Market Update August 12 2011dpbasicNoch keine Bewertungen

- Nuvama Weekender 17 Nov 2023Dokument9 SeitenNuvama Weekender 17 Nov 2023Amber GuptaNoch keine Bewertungen

- Market Review Future Outlook Feb2012-SbiDokument6 SeitenMarket Review Future Outlook Feb2012-SbiSaurav MandhotraNoch keine Bewertungen

- RBIPolicy CRISIL 170912Dokument4 SeitenRBIPolicy CRISIL 170912Meenakshi MittalNoch keine Bewertungen

- Contrarian CapDokument8 SeitenContrarian CapjamesbrentsmithNoch keine Bewertungen

- The Ageing RupeeDokument2 SeitenThe Ageing RupeeAniket PallavNoch keine Bewertungen

- Fixed Income - Investment Strategy - November 2011Dokument20 SeitenFixed Income - Investment Strategy - November 2011ganesha8Noch keine Bewertungen

- ASK India Select - CommentaryDokument5 SeitenASK India Select - CommentarySNEHA SHETTYNoch keine Bewertungen

- Weekly Trends: The Boc Cuts Rates AgainDokument4 SeitenWeekly Trends: The Boc Cuts Rates AgaindpbasicNoch keine Bewertungen

- BARCLAYS - Global Credit Outlook 2016 - An Aging CycleDokument206 SeitenBARCLAYS - Global Credit Outlook 2016 - An Aging CyclenoobcatcherNoch keine Bewertungen

- PL Top LargeCap MidCap StocksDokument60 SeitenPL Top LargeCap MidCap StocksYakub PashaNoch keine Bewertungen

- Equity and Debt Markets: Present Tense But Future Perfect, As On DateDokument5 SeitenEquity and Debt Markets: Present Tense But Future Perfect, As On DatesatishonlysatishNoch keine Bewertungen

- JANUARY 2012: "We Wish You All A Prosperous New Year"Dokument8 SeitenJANUARY 2012: "We Wish You All A Prosperous New Year"Bharath Kumar JNoch keine Bewertungen

- Eagle Capital Management, LLC: April 2010Dokument3 SeitenEagle Capital Management, LLC: April 2010azharaqNoch keine Bewertungen

- Quarter Ended Sep 2018Dokument6 SeitenQuarter Ended Sep 2018Abhinav VermaNoch keine Bewertungen

- Six Hot Questions For Emerging Markets: Key InsightsDokument10 SeitenSix Hot Questions For Emerging Markets: Key Insightsapi-167354334Noch keine Bewertungen

- Winter 2016Dokument3 SeitenWinter 2016Amin KhakianiNoch keine Bewertungen

- Ambit - Highest Conviction Buys & Sells From AmbitDokument11 SeitenAmbit - Highest Conviction Buys & Sells From Ambitmaamir2000Noch keine Bewertungen

- Bullish Under The Hood December Policy TakeawaysDokument3 SeitenBullish Under The Hood December Policy Takeawaysvishal_lal89Noch keine Bewertungen

- Ip Newhighs Finalv2Dokument4 SeitenIp Newhighs Finalv2Anonymous Feglbx5Noch keine Bewertungen

- Macro Update Paper v0Dokument4 SeitenMacro Update Paper v0tonidadaNoch keine Bewertungen

- SEB Report: Asian Recovery - Please Hold The LineDokument9 SeitenSEB Report: Asian Recovery - Please Hold The LineSEB GroupNoch keine Bewertungen

- Winter 2015: Patiently Creating WealthDokument4 SeitenWinter 2015: Patiently Creating WealthCanadianValue0% (1)

- Rbi Bulletin August 2015Dokument74 SeitenRbi Bulletin August 2015Accounting & Taxation100% (1)

- Canary or Phoenix Balancing The Key Drivers of Credit in 2016 Mar 2016Dokument10 SeitenCanary or Phoenix Balancing The Key Drivers of Credit in 2016 Mar 2016satish sNoch keine Bewertungen

- Crisil Sme Connect Dec09Dokument32 SeitenCrisil Sme Connect Dec09Rahul JainNoch keine Bewertungen

- Helping You Spot Opportunities: Investment Update - October, 2012Dokument56 SeitenHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNoch keine Bewertungen

- Bank Loans: Market Dynamics Poised To Deliver Attractive Risk-Adjusted ReturnsDokument6 SeitenBank Loans: Market Dynamics Poised To Deliver Attractive Risk-Adjusted ReturnsSabin NiculaeNoch keine Bewertungen

- Australian Interest Rates - OI #33 2012Dokument2 SeitenAustralian Interest Rates - OI #33 2012anon_370534332Noch keine Bewertungen

- Equity Strategy: The 5 Top Picks For FebruaryDokument26 SeitenEquity Strategy: The 5 Top Picks For Februarymwrolim_01Noch keine Bewertungen

- Market Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesDokument14 SeitenMarket Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesrohitNoch keine Bewertungen

- UBS Weekly Guide: Help WantedDokument13 SeitenUBS Weekly Guide: Help Wantedshayanjalali44Noch keine Bewertungen

- Economy Report Oct 2009Dokument17 SeitenEconomy Report Oct 2009PriyankaNoch keine Bewertungen

- When The Gap Between Perception and Reality Is The Maximum, Price Is The Best''Dokument20 SeitenWhen The Gap Between Perception and Reality Is The Maximum, Price Is The Best''sukujeNoch keine Bewertungen

- Pid 14 MT23 160412Dokument20 SeitenPid 14 MT23 160412Amol ChavanNoch keine Bewertungen

- Market Outlook Market Outlook: Dealer's DiaryDokument14 SeitenMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- India 2013 Picks - StocksDokument71 SeitenIndia 2013 Picks - StocksganeshtskNoch keine Bewertungen

- The Money Navigator April 2016Dokument36 SeitenThe Money Navigator April 2016JhaveritradeNoch keine Bewertungen

- 8 Markets MythsDokument18 Seiten8 Markets MythsVicente Manuel Angulo GutiérrezNoch keine Bewertungen

- Small could be better now: +1 σ Avg PE -1 σDokument3 SeitenSmall could be better now: +1 σ Avg PE -1 σChandan AgarwalNoch keine Bewertungen

- GS Market Know How 1Q2015Dokument20 SeitenGS Market Know How 1Q2015asdfgh132Noch keine Bewertungen

- 2 Grand Central Tower - 140 East 45 Street, 24 Floor - New York, NY 10017 Phone: 212-973-1900Dokument6 Seiten2 Grand Central Tower - 140 East 45 Street, 24 Floor - New York, NY 10017 Phone: 212-973-1900Yui ChuNoch keine Bewertungen

- Letter One Must ReadDokument2 SeitenLetter One Must ReadSecure PlusNoch keine Bewertungen

- U.S. Real Estate: A Storm Is Brewing: PIMCO AlternativesDokument6 SeitenU.S. Real Estate: A Storm Is Brewing: PIMCO AlternativesForeclosure FraudNoch keine Bewertungen

- ASK IEP - Commentary - June 2020Dokument4 SeitenASK IEP - Commentary - June 2020Manish TandaleNoch keine Bewertungen

- ASK India Vision - Commentary - June 2020Dokument5 SeitenASK India Vision - Commentary - June 2020Manish TandaleNoch keine Bewertungen

- Einhorn Letter Q1 2021Dokument7 SeitenEinhorn Letter Q1 2021Zerohedge100% (4)

- RBI Review of Economy Jan 2013Dokument4 SeitenRBI Review of Economy Jan 2013Amit MishraNoch keine Bewertungen

- Chaanakya 5 - 10Dokument22 SeitenChaanakya 5 - 10Apoorv JhudeleyNoch keine Bewertungen

- HghlightsDokument2 SeitenHghlightsM RajuNoch keine Bewertungen

- Commodities Current Rally Is Likely To Be Limited Business Standard March 23, 2016Dokument1 SeiteCommodities Current Rally Is Likely To Be Limited Business Standard March 23, 2016Dr Vidya S SharmaNoch keine Bewertungen

- 2010 Saudi Arabia YearbookDokument114 Seiten2010 Saudi Arabia Yearbookmmjbaig32Noch keine Bewertungen

- 2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateVon Everand2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateNoch keine Bewertungen

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataVon EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataBewertung: 2 von 5 Sternen2/5 (1)

- 1,067,012. Patented July 8, 1913,: E, FaberDokument4 Seiten1,067,012. Patented July 8, 1913,: E, FaberGalo YambayNoch keine Bewertungen

- Bearing BookDokument199 SeitenBearing Bookhaseeb jameel100% (1)

- CRM EDHEC Case GMNotesDokument32 SeitenCRM EDHEC Case GMNotesSASNoch keine Bewertungen

- القيمة الزمنية للنقودDokument1 Seiteالقيمة الزمنية للنقودMohammad Talal Ramini0% (1)

- RoCond Theories and Procedures Webinar Region XDokument180 SeitenRoCond Theories and Procedures Webinar Region Xnhiyzhar monimoNoch keine Bewertungen

- Contemporary WorldDokument35 SeitenContemporary WorldtabiNoch keine Bewertungen

- PEB4102 Chapter 1Dokument21 SeitenPEB4102 Chapter 1demure claw19Noch keine Bewertungen

- e-StatementBRImo 714201036008532 Dec2023 20231227 164433Dokument5 Seitene-StatementBRImo 714201036008532 Dec2023 20231227 164433umiyahraditNoch keine Bewertungen

- 2000 - VAICTM-an Accounting Tool For IC Management - Ante PulicDokument13 Seiten2000 - VAICTM-an Accounting Tool For IC Management - Ante PulicIklima RahmaNoch keine Bewertungen

- Prepare Financial Report IbexDokument13 SeitenPrepare Financial Report Ibexfentahun enyewNoch keine Bewertungen

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDokument3 SeitenMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- Project ReportDokument15 SeitenProject ReportAshish KhadakhadeNoch keine Bewertungen

- RTGSFormat1709722636 45107024084Dokument1 SeiteRTGSFormat1709722636 45107024084thirupathiindustries22Noch keine Bewertungen

- LP Philco Enero27 22Dokument38 SeitenLP Philco Enero27 22jose floresNoch keine Bewertungen

- Ibt Midterms OutlineDokument11 SeitenIbt Midterms Outlinetimothee chalametNoch keine Bewertungen

- GE3 NotesDokument4 SeitenGE3 NotesPhyNoch keine Bewertungen

- List of Formal Approval SEZDokument34 SeitenList of Formal Approval SEZsampuran.das@gmail.comNoch keine Bewertungen

- High Value Crops Development Unit: (Vegetable, Banana, Citrus, Cacao, Mango, Coffee, Mango, Rootcrops)Dokument4 SeitenHigh Value Crops Development Unit: (Vegetable, Banana, Citrus, Cacao, Mango, Coffee, Mango, Rootcrops)Kent AlpayNoch keine Bewertungen

- Company Name Buyer/Supplier/Both Company Email: Ganesan.v@vgindustries - Co.inDokument13 SeitenCompany Name Buyer/Supplier/Both Company Email: Ganesan.v@vgindustries - Co.inzoheb jafriNoch keine Bewertungen

- Solbridge IBS 301 Spring 2024 Course Syllabus Tuesday SectionDokument13 SeitenSolbridge IBS 301 Spring 2024 Course Syllabus Tuesday SectionNgân Hà ĐỗNoch keine Bewertungen

- Burton (2015) Organizational Design BDokument22 SeitenBurton (2015) Organizational Design BCarol Viviana Zanetti DuranNoch keine Bewertungen

- Containment ZonesDokument25 SeitenContainment ZoneslilprofcragzNoch keine Bewertungen

- Semester V (Finance) 2018-19Dokument51 SeitenSemester V (Finance) 2018-19anurag chaurasiaNoch keine Bewertungen

- t1229 Fill 23eDokument2 Seitent1229 Fill 23eShiblee Khalid AhmodNoch keine Bewertungen

- Deviz, Ateriale Vopsitorie STBDokument3 SeitenDeviz, Ateriale Vopsitorie STBGeorge MironNoch keine Bewertungen

- Indian Villages – Our Strength or WeaknessDokument2 SeitenIndian Villages – Our Strength or WeaknessJAY SolankiNoch keine Bewertungen

- Topic 1 EcmdDokument15 SeitenTopic 1 EcmdDalili KamiliaNoch keine Bewertungen