Beruflich Dokumente

Kultur Dokumente

Corporate Finance

Hochgeladen von

Donna JacobsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corporate Finance

Hochgeladen von

Donna JacobsCopyright:

Verfügbare Formate

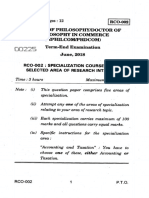

2011 Anna University Chennai M.B.A Finance Corporate finance Question paper Course: M.B.A M.B.

A Finance University/board: Anna University Chennai

Mba degree examination november/december 2011 corporate finance part A(10*2=20) 1.what is debenture financing? 2.how would you compute cost of equity? 3.define'net working capital' 4.what is the role of cash in working capital management? 5.what is a risk adjusted discount method? 6.what is an uneven cash flow? 7. what purpose does simulation serve? 8.what is the difference between cash inadequacy and inslovency? 9.discuss the need for corporate governance? 10.explain the salient observations of cadbury committee part B-(5*16=80 marks) 11)a) what are the basic problems of industrial finance in India? how can these be addressed? or B)when is a firm considered sick? what are the sources of finance for rehabilitating a firm? 12.a)write short notes o a)public deposits b)inter corporate investments. 0r b)how is working capital requirement assessed? what is the need for assessing working capital requirements? 13)a) i)write short notes on sensitivity analysis?

ii)A company is considered projects X and Y with the following information project XY Received NPV 60,000 2,27,000 Standard deviation 40,000 1,35,000 which projects will you recommend? will your answer change if you use coefficient of variation as a measure of risk instead of standard deviation? which is more appropriate? explain. 0r b) A business man has an option of selling a product in domestic market or in export market. The available relevant data are given below. items export market domestic market probability of selling 0.6 1.0 probability of keeping delivery schedule 0.8 0.9 penalty of not meeting delivery schedule 50,000 10,000 selling price(Rs) 9,00,000 8,00,000 cost of third party inspection(Rs) 30,000 Nil probability of collection of sale amount 0.9 0.9 if the product is not sold in export market, it can always be sold in domestic market. there are bo other implication like interest and time. i) draw the decision tree using the data given above ii)should the business man go for selling the product in the export market? justify your answer. 14)a) write short notes on: i) option pricing model ii)agency costs (8+8) 0r b)what are the practical considerations in determination of capital structure ?

15) a)explain the salient points emphasized by SEBI guidelines in the context of good corporate governance? or b) explain why ethics and professionalism are considered important for financial viability if organisation. give two examples to substantiate your answers.

Das könnte Ihnen auch gefallen

- MEFA Important QuestionsDokument14 SeitenMEFA Important Questionstulasinad123Noch keine Bewertungen

- Mefa Imp+ Arryasri Guide PDFDokument210 SeitenMefa Imp+ Arryasri Guide PDFvenumadhavNoch keine Bewertungen

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Dokument202 SeitenMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaNoch keine Bewertungen

- Question Paper With Model Answers For Online Examination - Inter/P10-CMFM/S1Dokument11 SeitenQuestion Paper With Model Answers For Online Examination - Inter/P10-CMFM/S1Hemmu sahuNoch keine Bewertungen

- MEFA Important Questions JWFILESDokument14 SeitenMEFA Important Questions JWFILESEshwar TejaNoch keine Bewertungen

- Business Administration Past PapersDokument35 SeitenBusiness Administration Past PapersBilal Hussain0% (3)

- QuesDokument12 SeitenQuesRajesh UsNoch keine Bewertungen

- QBDokument34 SeitenQBAadeel NooraniNoch keine Bewertungen

- Sri Sai Ram Institute of Technology: Sai Leo Nagar, West Tambaram, Chennai - 44. Tel: 044 - 22512333 / 22512111Dokument2 SeitenSri Sai Ram Institute of Technology: Sai Leo Nagar, West Tambaram, Chennai - 44. Tel: 044 - 22512333 / 22512111baranidharan .kNoch keine Bewertungen

- Celibacy and Spiritual LifeDokument12 SeitenCelibacy and Spiritual LifeDebi Prasad SahooNoch keine Bewertungen

- Third Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BDokument18 SeitenThird Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BTHE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’Noch keine Bewertungen

- EME Quiz and QuestionsDokument15 SeitenEME Quiz and QuestionsAmeer FaisalNoch keine Bewertungen

- Paper 3,2010Dokument6 SeitenPaper 3,2010kakeroteNoch keine Bewertungen

- MEFA Unit Wise Imp QuestionsDokument6 SeitenMEFA Unit Wise Imp QuestionsSatya KumarNoch keine Bewertungen

- BCom VI Analysis of Financial StatementsDokument3 SeitenBCom VI Analysis of Financial StatementsVaibhav BanjanNoch keine Bewertungen

- Tutorial Question (New) - Sem1, 2024Dokument20 SeitenTutorial Question (New) - Sem1, 202422070825Noch keine Bewertungen

- Sri Sai Ram Institute of Technology: Sai Leo Nagar, West Tambaram, Chennai - 44. Tel: 044 - 22512333 / 22512111Dokument2 SeitenSri Sai Ram Institute of Technology: Sai Leo Nagar, West Tambaram, Chennai - 44. Tel: 044 - 22512333 / 22512111baranidharan .kNoch keine Bewertungen

- Dms All Subjects Questions 2016Dokument6 SeitenDms All Subjects Questions 2016mstfahmed76Noch keine Bewertungen

- Unit-I: BA7024 Corporate FinanceDokument5 SeitenUnit-I: BA7024 Corporate FinanceHaresh KNoch keine Bewertungen

- Part A (Long Answer Type Questions) : (15×2 30 Marks)Dokument9 SeitenPart A (Long Answer Type Questions) : (15×2 30 Marks)Kulshrestha Shwta SNoch keine Bewertungen

- Tutorial Question (New) - Sem1, 2024Dokument20 SeitenTutorial Question (New) - Sem1, 2024phamminhngoc2k4Noch keine Bewertungen

- The Institute of Cost Accountants of India (Statutory Body Under An Act of Parliament)Dokument30 SeitenThe Institute of Cost Accountants of India (Statutory Body Under An Act of Parliament)kalyanikamineniNoch keine Bewertungen

- BA7024 CorporateFinancequestionbankDokument5 SeitenBA7024 CorporateFinancequestionbankNorman MberiNoch keine Bewertungen

- Ba 4202 FM Important QuestionsDokument6 SeitenBa 4202 FM Important QuestionsRishi vardhiniNoch keine Bewertungen

- Futures Price 180 Day BAB Yield Now in One MonthDokument2 SeitenFutures Price 180 Day BAB Yield Now in One Monthchau_vic4126Noch keine Bewertungen

- 1st Sem PapersDokument66 Seiten1st Sem PapersJanvi 86 sec.BNoch keine Bewertungen

- BA7202-Financial Management Question BankDokument10 SeitenBA7202-Financial Management Question BankHR HMA TECHNoch keine Bewertungen

- Question Bank Sem VDokument23 SeitenQuestion Bank Sem VVivek Kumar'c' 265Noch keine Bewertungen

- Security Analysis & Portfolio ManagementDokument2 SeitenSecurity Analysis & Portfolio ManagementGunamoy Hazra100% (1)

- Acr AssignmentDokument3 SeitenAcr AssignmentlindaaranNoch keine Bewertungen

- MEFA Imp QuestionsDokument5 SeitenMEFA Imp QuestionsSunilKumarNoch keine Bewertungen

- Management Programme Term-End Examination) June, 2013 Ms-4: Accounting and Finance For ManagersDokument5 SeitenManagement Programme Term-End Examination) June, 2013 Ms-4: Accounting and Finance For ManagersviswanathNoch keine Bewertungen

- MEFA Most Important QuestionsDokument2 SeitenMEFA Most Important QuestionsNARESHNoch keine Bewertungen

- MEFA Most Important QuestionsDokument15 SeitenMEFA Most Important Questionsapi-26548538100% (5)

- FinancialDokument29 SeitenFinancialkedirmahammed8Noch keine Bewertungen

- Re: Mba Model PapersDokument8 SeitenRe: Mba Model PapersAshish KumarNoch keine Bewertungen

- Economics Sample Paper 1Dokument3 SeitenEconomics Sample Paper 1L IneshNoch keine Bewertungen

- Question Bank Sem IIDokument16 SeitenQuestion Bank Sem IIPrivate 4uNoch keine Bewertungen

- Pid6012 MBMDokument4 SeitenPid6012 MBMSukumar ManiNoch keine Bewertungen

- Mba Part 1 Mbad Financial Management 13415 2020Dokument3 SeitenMba Part 1 Mbad Financial Management 13415 2020Panchu HiremathNoch keine Bewertungen

- Uganda Advanced Certificate of Education: Kiira College ButikiDokument2 SeitenUganda Advanced Certificate of Education: Kiira College ButikiEriza RazakNoch keine Bewertungen

- MBA 2nd SemDokument6 SeitenMBA 2nd Semhimanshu04870% (1)

- Unit - I Part-A (2 Marks)Dokument6 SeitenUnit - I Part-A (2 Marks)dhirajsingh_avitNoch keine Bewertungen

- Que Bank PFMDokument5 SeitenQue Bank PFMAmit KesharwaniNoch keine Bewertungen

- Sub Ia 602Dokument9 SeitenSub Ia 602Qausain AliNoch keine Bewertungen

- Objective Questions and Answers of Financial ManagementDokument22 SeitenObjective Questions and Answers of Financial ManagementGhulam MustafaNoch keine Bewertungen

- Galaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii TrimesterDokument5 SeitenGalaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii Trimesteralbinus1385Noch keine Bewertungen

- Important Questions: Unit 1Dokument4 SeitenImportant Questions: Unit 1Nageswara Rao ThotaNoch keine Bewertungen

- L2018027 Homework 1 I. Single Choice QuestionsDokument6 SeitenL2018027 Homework 1 I. Single Choice QuestionsmohammedNoch keine Bewertungen

- Answer ALL Questions A (10 × 2 20 Marks)Dokument3 SeitenAnswer ALL Questions A (10 × 2 20 Marks)Vem Baiyan CNoch keine Bewertungen

- 1044 Question PaperDokument2 Seiten1044 Question PaperPacific TigerNoch keine Bewertungen

- FinancialManagement MB013 QuestionDokument31 SeitenFinancialManagement MB013 QuestionAiDLo50% (2)

- Financial MGMT McqsDokument64 SeitenFinancial MGMT McqsSonuNoch keine Bewertungen

- s.6 Entrepreneurship Paper 1 Revision Questions (Past Papers)Dokument5 Seitens.6 Entrepreneurship Paper 1 Revision Questions (Past Papers)Nabalema Molly100% (1)

- s.6 Entrepreneurship Paper 1 Revision Questions (Past Papers)Dokument5 Seitens.6 Entrepreneurship Paper 1 Revision Questions (Past Papers)Nabalema Molly100% (3)

- Financial Soundness Indicators for Financial Sector Stability in Viet NamVon EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNoch keine Bewertungen

- Model answer: Launching a new business in Networking for entrepreneursVon EverandModel answer: Launching a new business in Networking for entrepreneursNoch keine Bewertungen

- Chapter 4 Virtual ClassDokument24 SeitenChapter 4 Virtual ClassMariola AlkuNoch keine Bewertungen

- Financial Management by SaumyaDokument59 SeitenFinancial Management by Saumyasaumyaranjanbiswal92Noch keine Bewertungen

- A.K 47Dokument98 SeitenA.K 47SrinivasaRaoGortiNoch keine Bewertungen

- 05 Cash Management - LectureDokument31 Seiten05 Cash Management - LectureChelsea ManuelNoch keine Bewertungen

- PE - L4 - Examples On Financial AnalysisDokument3 SeitenPE - L4 - Examples On Financial AnalysisSajal SinghalNoch keine Bewertungen

- Analysis and Interpretation of Financial Statements: What's NewDokument16 SeitenAnalysis and Interpretation of Financial Statements: What's NewJanna Gunio50% (2)

- A W C M BPCL: A Summer Internship Project Report OnDokument82 SeitenA W C M BPCL: A Summer Internship Project Report OnIshaan YadavNoch keine Bewertungen

- Flour MillDokument58 SeitenFlour Millshani2773% (15)

- 5-Funds Flow StatementDokument40 Seiten5-Funds Flow StatementBhagaban DasNoch keine Bewertungen

- Ratio Analysis SampleDokument16 SeitenRatio Analysis SampleRitoshree paulNoch keine Bewertungen

- Kohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Dokument54 SeitenKohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Sohail AdnanNoch keine Bewertungen

- MASDokument2 SeitenMASKristine WaliNoch keine Bewertungen

- B. Cash Flow StatementDokument6 SeitenB. Cash Flow Statementrahul jambagiNoch keine Bewertungen

- Ratio, FFS, CFS, ComparativeDokument56 SeitenRatio, FFS, CFS, ComparativeBalasaranyasiddhuNoch keine Bewertungen

- FABM2 Module 6 SLMDokument27 SeitenFABM2 Module 6 SLMJaypee AsoyNoch keine Bewertungen

- Multiple Choice Questions: Introduction To Corporate FinanceDokument9 SeitenMultiple Choice Questions: Introduction To Corporate FinanceThu UyênNoch keine Bewertungen

- Financial Statement Analysis: Learning ObjectivesDokument24 SeitenFinancial Statement Analysis: Learning Objectiveshesham zakiNoch keine Bewertungen

- Quiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsDokument6 SeitenQuiz 5 Chapter 15: Working Capital and Current Asset Management Quiz InstructionsKyle EspinozaNoch keine Bewertungen

- Working Capital Management: Download Free Books atDokument49 SeitenWorking Capital Management: Download Free Books atMarion Macarius De Guzman0% (1)

- Summer Internship Report (Sanket Yadav) PDFDokument54 SeitenSummer Internship Report (Sanket Yadav) PDFtejasNoch keine Bewertungen

- Balance Sheet & Ratio AnalysisDokument102 SeitenBalance Sheet & Ratio AnalysisAshokkumar MadhaiyanNoch keine Bewertungen

- Horizantal Verticle NOTESDokument4 SeitenHorizantal Verticle NOTESKrishna TejaNoch keine Bewertungen

- Galaxy Surfactants Limited: Niranjan Arun KetkarDokument41 SeitenGalaxy Surfactants Limited: Niranjan Arun KetkarparthchillNoch keine Bewertungen

- Sandeep MaheshwariDokument56 SeitenSandeep MaheshwarisandeephedaNoch keine Bewertungen

- IBI Interview and Resume GuideDokument63 SeitenIBI Interview and Resume GuideHendrik Joof Sturgeon100% (2)

- RWJ Chapter 16Dokument11 SeitenRWJ Chapter 16Sohini Mo BanerjeeNoch keine Bewertungen

- Assessment and Computation of Working Capital Requirements Numerical QuestionsDokument6 SeitenAssessment and Computation of Working Capital Requirements Numerical QuestionsNazreena MukherjeeNoch keine Bewertungen

- Project ODYSSIA NewDokument96 SeitenProject ODYSSIA Newmanesh100% (2)

- Marginal AnalysisDokument10 SeitenMarginal AnalysiscompheenaNoch keine Bewertungen

- An Introduction To The Financial Statement AnalysisDokument39 SeitenAn Introduction To The Financial Statement AnalysisAlbu GabrielNoch keine Bewertungen