Beruflich Dokumente

Kultur Dokumente

Tender of Payment Laws Here in Georgia, GREAT

Hochgeladen von

David Jeremiah IIOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tender of Payment Laws Here in Georgia, GREAT

Hochgeladen von

David Jeremiah IICopyright:

Verfügbare Formate

To: Oni Holley From: Chantel C.

Espaillat Re: Mortgage Analysis Group Client Matter #: Date: February 28, 2011 INTEROFFICE MEMO Under what circumstances can a promissory note be dishonored. Under U.C.C. Sec. 3-502 (a) Dishonor of a note is governed by the following rules: o (1) If the note is payable on demand, the note is dishonored if presentment is duly made to the maker and the note is not paid on the day of presentment. o (2) If the note is not payable on demand and is payable at or through a bank or the terms of the note require presentment, the note is dishonored if presentment is duly made and the note is not paid on the day it becomes payable or the day of presentment, whichever is later. o (3) If the note is not payable on demand and paragraph (2) does not apply, the note is dishonored if it is not paid on the day it becomes payable. o (e) In any case in which presentment is otherwise required for dishonor under this section and presentment is excused under Section 3-504, dishonor occurs without presentment if the instrument is not duly accepted or paid. Under U.C.C. Sec. 3-501 (a) "Presentment" means a demand made by or on behalf of a person entitled to enforce an instrument (i) to pay the instrument made to the drawee or a party obliged to pay the instrument or, in the case of a note or accepted draft payable at a bank, to the bank, or (ii) to accept a draft made to the drawee. Under U.C.C. Sec. 3-505 (a) The following are admissible as evidence and create a presumption of dishonor and of any notice of dishonor stated: o (1) a document regular in form as provided in subsection (b) which purports to be a protest; o (2) a purported stamp or writing of the drawee, payor bank, or presenting bank on or accompanying the instrument stating that acceptance or payment has been refused unless reasons for the refusal are stated and the reasons are not consistent with dishonor; o (3) a book or record of the drawee, payor bank, or collecting bank, kept in the usual course of business which shows dishonor, even if there is no evidence of who made the entry. o (b) A protest is a certificate of dishonor made by a United States consul or vice consul, or a notary public or other person authorized to administer oaths by the law of the place where dishonor occurs. It may be made upon information satisfactory to that person. The protest must identify the instrument and certify either that presentment has been made or, if not made, the reason why it was not made, and that the instrument has been dishonored by nonacceptance or nonpayment. The protest may also certify that notice of dishonor has been given to some or all parties.

ANALYSIS: The note can be dishonored when not paid on the day of presentment, if there is no presentment, then it can be dishonored when the note is not paid on the day it becomes payable.

What happens if the debtor tenders full payment of the amount of the note to the noteholder, but the noteholder fails or refuses to accept the payment?

Under U.C.C. Sec. 3-603 (a) If tender of payment of an obligation to pay an instrument is made to a person entitled to enforce the instrument, the effect of tender is governed by principles of law applicable to tender of payment under a simple contract. o (b) If tender of payment of an obligation to pay an instrument is made to a person entitled to enforce the instrument and the tender is refused, there is discharge, to the extent of the amount of the tender, of the obligation of an indorser or accommodation party having a right of recourse with respect to the obligation to which the tender relates. o (c) If tender of payment of an amount due on an instrument is made to a person entitled to enforce the instrument, the obligation of the obligor to pay interest after the due date on the amount tendered is discharged. If presentment is required with respect to an instrument and the obligor is able and ready to pay on the due date at every place of payment stated in the instrument, the obligor is deemed to have made tender of payment on the due date to the person entitled to enforce the instrument. In addition to this, under O.C.G.A. 13-4-24, a tender properly made may be equivalent to performance. The tender must be certain and unconditional, except for a receipt in full or delivery of the obligation, and may be made by an agent and to an agent authorized to receive. The tender must be in full payment of the specific debt, and not in part, and may be made at any time before trial. If tender is rejected on grounds unrelated to informality, informality cannot afterward be raised in objection to the tender. o Lanier v. Mandeville Mills, 183 Ga. 716 (Ga. 1936) - Where a creditor refuses to accept a proper tender, the claim is not extinguished, nor is the debtor harmed by the refusal . . . But where the creditor has collateral, mortgage, or other form of security upon the property of the debtor, the failure to accept a legal tender discharges the lien which was intended to secure payment . . . The creditor may indeed decline to receive what is due, but he can not couple with his declination a refusal to cancel the lien or surrender that which thereafter belongs to the debtor free from the incumbrance . . . The creditor by refusing to accept does not forfeit his right to the thing tendered [money], but he does lose all collateral benefits or securities. o Lanier v. Romm, 131 Ga. App. 531, 535-536 (Ga. Ct. App. 1974) - upon the proper tender being made, while the original debt may continue, the lienor is entitled to a satisfaction of the lien or to be restored to possession of the property. One of the ways for enforcing this right is the provision that the refusal of a proper tender discharges the lien. The debt continues, 'but the tender is equivalent to payment as to all things which are incidental or accessorial to the debt. The creditor by refusing to accept does not forfeit his right to the thing

tendered [money], but he does lose all collateral benefits or securities.' Tiffany v. St. John, 5 N. Y. 314; [*536] McCalla v. Clark, 55 Ga. 53." Anderson v. Barron, 208 Ga. 785, 793 (Ga. 1952) A tender properly made is the equivalent of performance. [***17] Code, 20-1105. And where payment is refused when legally tendered, such tender satisfies the statutory requirement of payment. Forrester v. Lowe, 192 Ga. 469 (15 S. E. 2d, 719).

ANALYSIS: If payment of tender is refused or not accepted, then the noteholder/creditor loses collateral benefits or securities, but does not lose his right to what has been tendered (money). Refusal of payment if there is collateral, mortgage, or other form of security upon debtors property, would allow the debtor to discharge / satisfaction of the lien or obtain possession of the property.

Das könnte Ihnen auch gefallen

- UCC IRS Form For Discharge of Estate Tax Liens f4422Dokument3 SeitenUCC IRS Form For Discharge of Estate Tax Liens f4422Anonymous 23VuLx100% (23)

- Notice To Cease and Desist RedactDokument2 SeitenNotice To Cease and Desist Redactmellowjohnny100% (15)

- CreditsDokument5 SeitenCreditscholericmiss100% (4)

- Private Bond For Set-Off, Non-Negotiable Value of Bond Is: 100 Trillion DolsDokument1 SeitePrivate Bond For Set-Off, Non-Negotiable Value of Bond Is: 100 Trillion DolsKonan Snowden100% (24)

- Bill of Exchange and ChecksDokument8 SeitenBill of Exchange and ChecksSmurf82% (17)

- Surety Bond TemplateDokument10 SeitenSurety Bond TemplateJohn Ox95% (22)

- What Is A Dollar-Conditional Acceptance-Offer To PayDokument11 SeitenWhat Is A Dollar-Conditional Acceptance-Offer To Paylyocco188% (8)

- Sec of State Letter Property CustodianDokument5 SeitenSec of State Letter Property CustodianFAQMD285% (20)

- 50 State Ucc LawDokument102 Seiten50 State Ucc Lawpwilkers3695% (22)

- Inalienable RightsDokument7 SeitenInalienable Rightsali93% (27)

- Cash Process WebinarDokument83 SeitenCash Process Webinartechcert89% (9)

- Letter of RogatoryDokument5 SeitenLetter of Rogatoryali83% (23)

- Charge Back Secretary Treasury TemplateDokument1 SeiteCharge Back Secretary Treasury TemplateNotarys To Go82% (11)

- Declaration of Ownership SanitizedDokument1 SeiteDeclaration of Ownership Sanitizedrazcomm91% (11)

- Declaration of CitizenshipDokument1 SeiteDeclaration of Citizenshipblueskygal122080% (10)

- A4V EndorsementsDokument1 SeiteA4V Endorsementsapi-3744408100% (9)

- Matrix NoticeDokument1 SeiteMatrix Noticemellowjohnny100% (16)

- Foreclosure Remedies HandoutsDokument14 SeitenForeclosure Remedies HandoutsBaqi-Khaliq Bey100% (4)

- I Am One Stupid American-RDDokument6 SeitenI Am One Stupid American-RDjvonmeier92% (13)

- Notice of Default Discharge of Obligation Demand For Re Conveyance To Donna Carpenter For First American Title Inter Lac Hen LNDokument4 SeitenNotice of Default Discharge of Obligation Demand For Re Conveyance To Donna Carpenter For First American Title Inter Lac Hen LNPieter Panne100% (5)

- Revised UCC Article 9 SummaryDokument11 SeitenRevised UCC Article 9 SummaryJason Henry100% (2)

- Notarial Protest ManualDokument183 SeitenNotarial Protest ManualGreg Meanwell100% (20)

- Sample Discharge of Mortgage To LendersDokument2 SeitenSample Discharge of Mortgage To LendersZIONCREDITGROUP100% (12)

- Registration and TitleDokument2 SeitenRegistration and TitleLukeCarter100% (8)

- Letter To The JudgeDokument10 SeitenLetter To The Judgeali96% (45)

- Voucher Sample DC Ins#2C1BFBDokument1 SeiteVoucher Sample DC Ins#2C1BFBOlympus6969100% (8)

- Banker S Right of Set Off - Explained - BankExamsTodayDokument4 SeitenBanker S Right of Set Off - Explained - BankExamsTodayHimanshu Panchpal100% (3)

- Traffic Stop Practice ScriptDokument3 SeitenTraffic Stop Practice ScriptHTMssm100% (25)

- Certificate of AuthorityDokument1 SeiteCertificate of Authoritybob100% (15)

- Sample Student Loan Debt Validation LetterDokument3 SeitenSample Student Loan Debt Validation LetterNotarys To Go100% (12)

- US Internal Revenue Service: I1040 - 1995Dokument84 SeitenUS Internal Revenue Service: I1040 - 1995IRS67% (3)

- LETTER ROGATORY-Bankrupcy CourtDokument1 SeiteLETTER ROGATORY-Bankrupcy Courtrazcomm100% (6)

- Certified Fee Schedule 12-03-2012Dokument8 SeitenCertified Fee Schedule 12-03-2012designsforliving100% (11)

- Connecting The Dots Social Security To The Queen of England To The VaticanDokument5 SeitenConnecting The Dots Social Security To The Queen of England To The Vaticandesignsforliving83% (6)

- Labor Is Your Private PropertyDokument2 SeitenLabor Is Your Private PropertyKonan Snowden100% (18)

- A Collection of Thoughts Concerning Accepted For Value (AFV) or (A4V)Dokument5 SeitenA Collection of Thoughts Concerning Accepted For Value (AFV) or (A4V)Julian Williams©™60% (5)

- Soc118HumanRightsNatural and Legal RightsDokument15 SeitenSoc118HumanRightsNatural and Legal RightsChrisna May Lagata100% (2)

- Debt Letter GenericDokument2 SeitenDebt Letter Generictaesbey86% (7)

- US Internal Revenue Service: 042307fDokument6 SeitenUS Internal Revenue Service: 042307fIRSNoch keine Bewertungen

- Affidavit of Service - MortgageDokument1 SeiteAffidavit of Service - MortgageZIONCREDITGROUP100% (1)

- The Center of The BibleDokument1 SeiteThe Center of The Biblejgsellers100% (2)

- Notice To Agent Is Notice To Principal LENDERDokument2 SeitenNotice To Agent Is Notice To Principal LENDERZIONCREDITGROUP100% (3)

- How To Make A Bill Into A Money OrderDokument1 SeiteHow To Make A Bill Into A Money OrderJohn Wallace40% (5)

- Foreign Status Letter 2015Dokument3 SeitenForeign Status Letter 2015Anonymous nYwWYS3ntV100% (10)

- Solution in CommerceDokument2 SeitenSolution in Commerceapi-1973110993% (14)

- Why The Ucc Filing Enslavement of The American People by LawyersDokument125 SeitenWhy The Ucc Filing Enslavement of The American People by LawyersGemini Research95% (43)

- What Is The Solution To ALL Your Problems (Update)Dokument75 SeitenWhat Is The Solution To ALL Your Problems (Update)Michael Kovach96% (27)

- A4V ALL ExamplesDokument8 SeitenA4V ALL ExamplesTom Harkins95% (20)

- Basic Accounting For Credit and Savings SchemesDokument103 SeitenBasic Accounting For Credit and Savings SchemesOxfam100% (1)

- 31 USC 5118 D 2 - US CODE Title 31Dokument2 Seiten31 USC 5118 D 2 - US CODE Title 31Freeman Lawyer100% (5)

- How To Guide: Conduct Discovery in A Limited Civil Case - CEBDokument2 SeitenHow To Guide: Conduct Discovery in A Limited Civil Case - CEBBaqi-Khaliq Bey0% (1)

- How To Be Debt Free in 100 DaysDokument123 SeitenHow To Be Debt Free in 100 DaysJo Jo96% (48)

- Pree-Offset Notice - ABH-122009-PON101 PDFDokument1 SeitePree-Offset Notice - ABH-122009-PON101 PDFAllen-nelson of the Boisjoli family100% (8)

- 4 - Notice of DenialDokument2 Seiten4 - Notice of DenialJahi100% (5)

- Affidavit of Coporate Denial: Registered Mail#Dokument2 SeitenAffidavit of Coporate Denial: Registered Mail#roquemore1100% (2)

- Tender InstructionsDokument4 SeitenTender InstructionsHerbert Stout100% (73)

- Debt's Dominion: A History of Bankruptcy Law in AmericaVon EverandDebt's Dominion: A History of Bankruptcy Law in AmericaBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Where Credit is Due: Bringing Equity to Credit and Housing After the Market MeltdownVon EverandWhere Credit is Due: Bringing Equity to Credit and Housing After the Market MeltdownNoch keine Bewertungen

- (Nego Questions FINALS RecitDokument10 Seiten(Nego Questions FINALS RecitBoomBoom100% (2)

- Defending Against Maritime JurisdictionDokument4 SeitenDefending Against Maritime JurisdictionDavid Jeremiah II100% (2)

- Expatriation Repatriation InstructionsDokument2 SeitenExpatriation Repatriation InstructionsDavid Jeremiah II100% (1)

- 2-A-Notice of Fault-Oppurtunity To CureDokument3 Seiten2-A-Notice of Fault-Oppurtunity To CureDavid Jeremiah IINoch keine Bewertungen

- Declaration and Notice of Expatriation TexasDokument3 SeitenDeclaration and Notice of Expatriation TexasDavid Jeremiah IINoch keine Bewertungen

- Jury Summons Response LetterDokument2 SeitenJury Summons Response LetterDavid Jeremiah IINoch keine Bewertungen

- When A County Clerk Refuses To RecordDokument5 SeitenWhen A County Clerk Refuses To RecordDavid Jeremiah II100% (10)

- Memorandum of Law and Points of Authority in SupportDokument2 SeitenMemorandum of Law and Points of Authority in SupportDavid Jeremiah II100% (1)

- Notice To County ClerkDokument1 SeiteNotice To County ClerkDantes Kebreau100% (1)

- HJR 192 Redemption PolicyDokument3 SeitenHJR 192 Redemption PolicyDavid Jeremiah II100% (2)

- Letter To Bureau of Public Debt TemplateDokument2 SeitenLetter To Bureau of Public Debt Templatennpnscribe100% (7)

- Proclaimation 2038Dokument2 SeitenProclaimation 2038David Jeremiah IINoch keine Bewertungen

- Commercial LiensDokument62 SeitenCommercial LiensDave HallittNoch keine Bewertungen

- Notary Certificate of Dishonor and Non-ResponseDokument1 SeiteNotary Certificate of Dishonor and Non-ResponseDavid Jeremiah II100% (13)

- Positive Law Vs Administrative LawDokument1 SeitePositive Law Vs Administrative LawDavid Jeremiah IINoch keine Bewertungen

- Mecanica Moderna Del Dinero PDFDokument50 SeitenMecanica Moderna Del Dinero PDFHarold AponteNoch keine Bewertungen

- Certificate of AcknowledgmentDokument2 SeitenCertificate of AcknowledgmentDavid Jeremiah II100% (1)

- Bible-Based Maxims of LawDokument20 SeitenBible-Based Maxims of LawDavid Jeremiah II100% (6)

- Acceptance To Contract-John DoeDokument7 SeitenAcceptance To Contract-John DoeDavid Jeremiah IINoch keine Bewertungen

- Sonata No. 1 in F - Tuba & Piano - F Major - MN0167772Dokument12 SeitenSonata No. 1 in F - Tuba & Piano - F Major - MN0167772ThatKidNoch keine Bewertungen

- Filipinas Vs Nava May 20, 1966Dokument1 SeiteFilipinas Vs Nava May 20, 1966Alvin-Evelyn GuloyNoch keine Bewertungen

- American Jurisprudence Volume 2 of 5Dokument27 SeitenAmerican Jurisprudence Volume 2 of 5Angel Mendiola100% (7)

- Week 8-9-Tutorial Questions AnswersDokument4 SeitenWeek 8-9-Tutorial Questions AnswersAvisha SinghNoch keine Bewertungen

- Pre TestDokument5 SeitenPre TestDiana Faye CaduadaNoch keine Bewertungen

- Chapter 6 (Intellectual Property)Dokument8 SeitenChapter 6 (Intellectual Property)ella1261996Noch keine Bewertungen

- American President Lines V ClaveDokument2 SeitenAmerican President Lines V ClaveVal Peralta-NavalNoch keine Bewertungen

- Step-By-Step Trademark Registration Process in India - Compressed-1587132596Dokument13 SeitenStep-By-Step Trademark Registration Process in India - Compressed-1587132596ramya xNoch keine Bewertungen

- Comprehensive-person-report-George T MolchanyDokument20 SeitenComprehensive-person-report-George T MolchanyDilawer HussainNoch keine Bewertungen

- Agency & PartnershipDokument17 SeitenAgency & PartnershipJack Huang100% (1)

- Mortgage and Pledge - Legal FormsDokument36 SeitenMortgage and Pledge - Legal FormsRM MallorcaNoch keine Bewertungen

- Mercantile Insurance Co VsDokument3 SeitenMercantile Insurance Co VsBuenavista Mae BautistaNoch keine Bewertungen

- Module 1Dokument5 SeitenModule 1Justine Kaye PorcadillaNoch keine Bewertungen

- Batch 6 Consolidated Case DigestDokument74 SeitenBatch 6 Consolidated Case DigestASGarcia24100% (1)

- In The United States Bankruptcy Court For The Southern District of Texas Houston DivisionDokument870 SeitenIn The United States Bankruptcy Court For The Southern District of Texas Houston DivisionOsko PayNoch keine Bewertungen

- Republic Planters Bank Vs CADokument4 SeitenRepublic Planters Bank Vs CAMarkJobelleMantillaNoch keine Bewertungen

- Guaranty AGREEMENTDokument2 SeitenGuaranty AGREEMENTRoy PersonalNoch keine Bewertungen

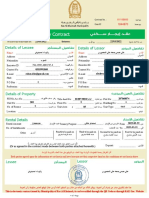

- العقد الموثقDokument3 Seitenالعقد الموثقZodiacNoch keine Bewertungen

- Denny Mott and Dickson LTD V James B FraserDokument2 SeitenDenny Mott and Dickson LTD V James B FraserTimishaNoch keine Bewertungen

- Contract of LeaseDokument3 SeitenContract of LeaseCarolina VillenaNoch keine Bewertungen

- HDFC Letter of Subrogation 1Dokument4 SeitenHDFC Letter of Subrogation 1navinder dhimanNoch keine Bewertungen

- Lease Contract DalangDokument3 SeitenLease Contract DalangJusan BorjaNoch keine Bewertungen

- Alex Jones Personal BankruptcyDokument21 SeitenAlex Jones Personal BankruptcyGMG EditorialNoch keine Bewertungen

- Form 02Dokument2 SeitenForm 02Sathya MandyaNoch keine Bewertungen

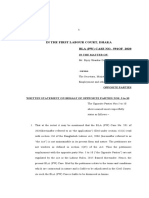

- In The First Labour Court, Dhaka BLA (PW) CASE NO. 591OF 2020Dokument6 SeitenIn The First Labour Court, Dhaka BLA (PW) CASE NO. 591OF 2020Abir Al Mahmud KhanNoch keine Bewertungen

- COMCAST / XFINITY United States For Morocco General Services Creditor Bond 5 - 21 - 2023Dokument14 SeitenCOMCAST / XFINITY United States For Morocco General Services Creditor Bond 5 - 21 - 2023akil kemnebi easley elNoch keine Bewertungen

- Study Unit 13 Discussion Questions and AnswersDokument4 SeitenStudy Unit 13 Discussion Questions and AnswersArap KimalaNoch keine Bewertungen

- SKF H 318 SpecificationDokument3 SeitenSKF H 318 SpecificationOsamaNoch keine Bewertungen

- The Recto LawDokument7 SeitenThe Recto LawTimothyNoch keine Bewertungen

- Brochure Ipr Software Protection enDokument16 SeitenBrochure Ipr Software Protection enBobby MorinNoch keine Bewertungen