Beruflich Dokumente

Kultur Dokumente

Additional Duties of Excise

Hochgeladen von

biswajit6864Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Additional Duties of Excise

Hochgeladen von

biswajit6864Copyright:

Verfügbare Formate

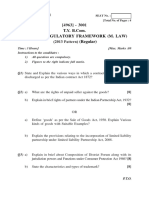

ADDITIONAL DUTIES OF EXCISE (GOODS OF SPECIAL IMPORTANCE) ACT, 1957 (58 OF 1957) 24th December, 1957 An Act to provide

for the levy and collection of additional duties of excise on certain goods and for the distribution of a part of the net proceeds thereof among the States in pursuance of the principles of distribution formulated and the recommendations made by the Finance Commission in its second report dated the 18th December, 1990. BE it enacted by Parliament in the Eighth Year of the Republic of India as follows: 1. Short title and extent. (1) This Act may be called the Additional Duties of Excise (Goods of Special Importance) Act,1957. (2) It extends to the whole of India. 2. Definitions. In this Act, (a) "additional duties" means the duties of excise levied and collected under sub-section (1) of Section 3; (b) "State" does not include a Union territory; (c) Omitted. 3. Levy and collection of Additional Duties. (1) There shall be levied and collected in respect of the goods described in column (3) of the First Schedule produced or manufactured in India and on all such goods lying in stock within the precincts of any factory, warehouse or other premises where the said goods were manufactured, stored or produced, or in any premises appurtenant thereto duties of excise at the rate or rates specified in column (4) of the said Schedule. (2) The duties of excise referred to in sub-section (1) in respect of the goods specified therein shall be in addition to the duties of excise chargeable on such goods under the Central Excise Act, 1944 (1 of 1944), or any other law for the time being in force. (3) The provisions of the Central Excise Act, 1944 (1 of 1944), and the rules made thereunder, including those relating to refunds, exemptions from duty, offences and penalties, shall, so far as may be, apply in relation to the levy and collection of the additional duties as they apply in relation to the levy and collection of the duties of excise on the goods specified in sub-section (1) 4. Distribution of additional duties among States. During each financial year, there shall be paid out of the Consolidated Fund of India to the States in accordance with the provisions of the Second Schedule such sums, representing a part of the net proceeds of the additional duties levied and collected during that financial year, as are specified in that Schedule. 5. Expenditure to be charged on the Consolidated Fund of India. Any expenditure under the provisions of this Act shall be expenditure charged on the Consolidated Fund of India. 6. Powers to make rules.(1) The Central Government may, by notification in the Official Gazette, make rules providing for the time at which and the manner in which any payments under the provisions of this Act, are to be made, for the making of adjustments between one financial year and another and for any other incidental or ancillary matters. (2) Every rule made under this section shall be laid as soon as may be after it is made, before each House of Parliament while it is in session for a total period of thirty days which may be comprised in one

session or in two or more successive sessions, and if, before the expiry of the session immediately following the session or the successive sessions aforesaid, both Houses agree in making any modification in the rule, or both Houses agree that the rule should not be made, the rule shall thereafter have effect only in such modified form or be of no effect, as the case may be; so however that any such modification or annulment shall be without prejudice to the validity of anything previously done under that rule. 7. Declaration of certain goods to be of special importance in inter-State trade or commerce. Repealed by Act No. 31 of 1958, s. 12 (w.e.f. 1-10-1958).

THE ADDITIONAL DUTIES OF EXCISE (GOODS OF SPECIAL IMPORTANCE) ACT, 1957. No.58 OF 1957. [24th December, 1957] An Act to provide for the levy and collection of additional duties of excise on certain goods and for the distribution of a part of the net proceeds thereof among the States in pursuance of the principles of distribution formulated and the recommendations made by the Finance Commission in its report dated the 30th day of September, 1957, and to declare those goods to be of special importance in interState trade or commerce. Contents

1.Short title 2.Definitions 3.Levy and collection of additional duties 4.Distribution of additional duties among States 5.Expenditure to be charged on the Consolidated Fund of India 6.Power to make rules 7.Declaration of certain goods to be of special importance in interState trade or commerce THE FIRST SCHEDULE THE SECOND SCHEDULE

BE it enacted by Parliament in the Eighth Year of the Republic of India as follows : -

1.Short title

:- (1) This Act may be called the Additional Duties of Excise (Goods of Special Importance) Act, 1957. (2) It extends to the whole of India.

2.Definitions

:- In this Act, (a) "additional duties" means the duties of excise duties levied and collected under sub-section (1) of section 3 ; (b) "State" does not include a Union territory; (c) the words and expressions "sugar", "tobacco", "cotton fabrics", "rayon or artificial silk fabrics" and "woolen fabrics" shall have the meanings respectively assigned to them in Items Nos.8, 9, 12, 12A and 12B of the First Schedule to the Central Excises and Salt Act, 1944(1 of 1944).

3.Levy and collection of additional duties

:- (1) There shall be levied and collected in respect of the following goods, namely, sugar, tobacco, cotton fabrics, rayon or artificial silk fabrics and woollen fabrics produced or manufactured in India and on all such goods lying in stock within the precincts of any factory, warehouse or other premises where the said goods were manufactured, stored or produced, or in any premises appurtenant thereto, duties of excise at the rate or rates specified in the First Schedule to this Act . (2) The duties of excise referred to in sub-section (1) in respect of the goods specified therein shall be in addition to the duties of excise chargeable on such goods under the Central Excises and Salt Act, 1944(1 of 1944), or any other law for the time being in force. (3) The provisions of the Central Excises and Salt Act, 1944, and the rules made thereunder, including those relating to refunds and exemptions from duty, shall, so far as may be, apply in relation to the levy and collection of the additional duties as they apply in relation to the levy and collection of the duties of excise on the goods specified in sub-section (1).

4.Distribution of additional duties among States

:- During each financial year, there shall be paid out of the Consolidated Fund of India to the States in accordance with the provisions of the Second Schedule such sums, representing a part of the net proceeds of the additional duties levied and collected during that financial year, as are specified in that Schedule.

5.Expenditure to be charged on the Consolidated Fund of India

:- Any expenditure under the provisions of this Act shall be expenditure charged on the Consolidated Fund of India.

6.Power to make rules

:- (1) The Central Government may, by notification in the Official Gazette, make rules providing for the time at which, and the manner in which, any payments under the provisions of this Act are to be made, for the making of adjustments between one financial year and another and for any other incidental or ancillary matters. (2) All rules made under this section shall, as soon as may be after they are made, be laid for not less than thirty days before each House of Parliament and shall be subject to such modifications as Parliament may make during the session in which they are so laid or the session immediately following.

7.Declaration of certain goods to be of special importance in inter-State trade or commerce

:- It is hereby declared that the following goods namely, sugar, tobacco, cotton fabrics, rayon or artificial silk fabrics and woollen fabrics are of special importance in inter-State trade or commerce and every sales tax law of a State shall, in so far as it imposes or authorises the imposition of a tax on the sale or purchase of the declared goods, be subject as from the 1st day of April, 1958, to the restrictions and conditions specified in section 15 of the Central Sales Tax Act, 1956(74 of 1956) .

THE FIRST SCHEDULE

[See section 3(1) ] ____________________________________________________________________ ______________ Item No. in the First Schedule to the Rate of additional duty Central Excises and Salt Act, 1944.

Description of goods

(1) (2) (3) _____________________________________________________________________ _____________

8.SUGARThree rupees and thirty-one naye paise per cwt. 9.TOBACCO I.Unmanufactured tobacco per lb.

(1) if flue cured and used in the manufacture of cigarettes containing ( i ) more 60 per cent, weight of imported tobaccoNil. ( ii ) more than 40 per cent, but not more than 60 per cent, weight of imported tobaccoNil . ( iii ) more than 20 per cent, but not more than 40 per cent, weight of imported tobaccoNil . ( iv)20 per cent, or less than 20 per cent, weight of imported tobaccoNil. ( v )no imported tobaccoNil. (2) if flue cured and used for the manufacture of smoking mixtures for pipes and cigarettes.Fifty naye paise. (3) if flue cured and not otherwise specifiedTwenty five naye paise. (4) if other than flue cured and used for the manufacture of (a) cigarettes of (b) smoking mixturesNil for pipes and cigarattes. (5) if not flue cured and not actually used for the manufacture of (a) cigarattes or (b) smoking mixtures for pipes and cigarattes : ( i ) stems of tobacco larger than 1/4 " and stems} of tobacco not larger than 1/16 " in size.} } ( ii )dust of tobacco.} } ( iii ) granule ('rawa') of tobacco not larger than} Three naye paise. 1/16 " in size.} } ( iv ) tobacco cured in whole leaf form and } packed or tied in bundles, hanks or bunches} or in the form of twists or coils.} (6) if other than flue cured and not otherwise specified Twenty naye paise. (7) if used for agricultural purposesNil.

(8) stalks

One naya paise. Per hundred.

II.Manufactured tobacco -

(1) Cigars and cheroots of which the value ( i ) exceeds Rs.30 a hundredThree rupees. ( ii ) exceeds Rs.25 a hundred but does notTwo rupees and fifty exceed Rs.30 a hundrednaye paise. ( iii ) exceeds Rs.20 a hundred but does notTwo rupees. exceed Rs.25 a hundred. ( iv ) exceeds Rs.15 a hundred but does notOne rupee and fifty exceed Rs.20 a hundred. ( v ) exceeds Rs.10 a hundred but does notOne rupee. exceed Rs.15 a hundred. ( vi ) exceeds Rs.5 a hundred but does notFifty naye paise. exceed Rs.10 a hundred. ( vii ) exceeds Rs.2-8-0 a hundred but does notTwenty-five naye paise. exceed Rs.5 a hundred. ( viii ) exceeds Rs.1-4-0 a hundred but does notTen naye paise. exceed Rs.2-8-0 a hundred. ( ix ) exceeds 14 annas a hundred but does notFive naye paise. exceed Rs.1-4-0 a hundred. (2) Cigarettes of which the value Per thousand.

( i )exceeds Rs.50 a thousandEight rupees and sixty naye paise. ( ii ) exceeds Rs.35 a thousand but does notSeven rupees and sixty exceed Rs.50 a thousandnaye paise. ( iii ) exceeds Rs.30 a thousand but does notFour rupees and twenty exceed Rs.35 a thousandnaye paise. ( iv ) exceeds Rs.25 a thousand but does notThree rupees and eighty exceed Rs.30 a thousandnay paise. ( v ) exceeds Rs.20 a thousand but does notTwo rupees and sixty exceed Rs.25 a thousandnaye paise. ( vi ) exceeds Rs.15 a thousand but does not Two rupees and twenty exceed Rs.20 a thousandnay paise.

( vii ) exceeds Rs.10 a thousand but does notOne rupee and ten naye exceed Rs.20 a thousandpaise. ( viii ) exceeds Rs.7-8-0 a thousand but does notSixty naye paise. exceed Rs.10 a thousand. ( ix ) does not exceed Rs.7-8-0 a thousandForty naye paise.

(3) Biris in the manufacture of which any processSixty naye paise. has been conducted with the aid of machines operated with or without the aid of power. 12.COTTON FABRICS (1) Cotton fabrics, superfine.Thirteen naye paise per square yard. (2) Cotton fabrics, fineEight naye paise per square yard. (3) Cotton fabrics, mediumFour naye paise per square yard. (4) Cotton fabrics, coarseThree naye paise per square yard. 12ARAYON OR ARTIFICIAL SILK FABRICSThree naye paise per square yard. 12BWOOLLEN FABRICSFive per cent ad valorem. _____________________________________________________________________ _____________

THE SECOND SCHEDULE

(See section 4) PART I Distribution of additional duties on sugar. 1.In this Part, (a) "net proceeds", as respects any financial year, means the net proceeds of the additional duties in respect of sugar levied and collected during that financial year; (b) "Table" means the Table at the end of this Part.

2.During each of the financial years commencing on or after the 1st April, 1958, there shall be paid (a) to the State of Jammu and Kashmir a sum equal to 1.25 per cent.of the net proceeds ; and (b) to each of the States specified in the first column of the Table ( i ) a sum equal to such percentage of one-fourth of the net proceeds as is specified against that State in the second column of the Table; ( ii ) a sum equal to the difference between the sum specified against that State in third column of the Table and the sum payable to that State under sub -clause ( i ) ; and ( iii ) if the total of the sums payable to all the States under the preceding provisions of this paragraph is less than 99 per cent.of the net proceeds by any amount, a further sum equal to such percentage of that amount as is specified against that State in the fourth column of the Table: Provided that if during that financial year there is levied and collected in any State specified in the Table a tax on the sale or purchase of sugar by or under any law of that State, no sums shall be payable to that State under sub-clause ( ii ) or sub-clause ( iii ) of clause (b) in respect of that financial year, unless the Central Government by special order otherwise directs. 3.In respect of the financial year ending on the 31st March, 1958, the provisions of paragraph 2 (excluding the proviso) shall apply for the distribution of a part of the net proceeds, subject to the modification that each of the sums specified in the third column of the Table shall be deemed to have been replaced by one-fourth of that sum. TABLE _____________________________________________________________________ ______________________ 1 2 3 4 _____________________________________________________________________ ______________________ (Rupees in lakhs) Andhra Pradesh9.38406.65 Assam3.46152.55 Bihar Bombay 245 20.17 Kerala3.84203.03 Madhya Pradesh7.46407.67 Madras7.56607.43 Mysore6.52255.13 Orissa4.46202.87

10.57308.20 12.17

Punjab4.59507.21 Rajasthan4.71254.81 Uttar Pradesh 15.94 112 15.69 West Bengal7.59368.65 _____________________________________________________________________ _____________ PART II Distribution of additional duties on tobacco. 4.The provisions of paragraphs 2 and 3 shall apply for the distribution of a part of the net proceeds of the additional duties on tobacco levied and collected during each financial year as they apply for the distribution of a part of net proceeds of the additional duties on sugar, subject to the modification that the references therein to the Table shall be construed as references to the Table below : TABLE _____________________________________________________________________ _____________ 1 2 3 4 _____________________________________________________________________ _____________ (Rupees in lakhs) Andhra Pradesh9.387510.47 Assam3.4630 2.98 Bihar 10.5720 8.90 Bombay 12.17 11517.41 Kerala3.8437 3.43 Madhya Pradesh7.4632 7.10 Madras7.5657 9.53 Mysore6.5227 5.58 Orissa4.4615 3.21 Punjab4.5930 4.36 Rajasthan4.7115 3.59 Uttar Pradesh 15.946316.13 West Bengal7.5940 7.31 _____________________________________________________________________ _________________ PART III Distribution of additional duties on textiles. 5.In this Part, -

(a) "net proceeds", as respects any financial year, means the net proceeds of the additional duties in respect of cotton fabrics, rayon or artificial silk fabrics and woollen fabrics levied and collected during that financial year; (b) "Table" means the Table at the end of this Part. 6.During each of the financial years commencing on or after the 1st April, 1958, there shall be paid (a) to the State of Jammu and Kashmir a sum equal to 1.25 per cent.of the net proceeds; (b) to each of the States specified in the first column of the Table ( i ) such sum as is specified against that State in the second column of the Table; and ( ii ) if the total of the sums payable to all the States under the preceding provisions of this paragraph is less than 99 per cent.of the net proceeds by any amount, a further sum equal to such percentage of that amount as is specified against that State in the third column of the Table: Provided that if during that financial year, there is levied and collected in any State specified in the Table a tax on the sale or purchase of cotton fabrics, rayon or artificial silk fabrics or woollen fabrics by or under any law of that State, no sums shall be payable to that State under clause (b) in respect of that financial year, unless the Central Government by special order otherwise directs. 7.In respect of the financial year ending on the 31st March, 1958, the provisions of paragraph 2 (excluding the proviso) shall apply for the distribution of a part of the net proceeds, subject to the modification that each of the sums specified in the second column of the Table shall be deemed to have been replaced by one-fourth of that sum. TABLE _____________________________________________________________________ ___________________ 1 2 3 _____________________________________________________________________ ___________________ (Rupees in lakhs) Andhra Pradesh120 7.38 Assam 40 2.72 Bihar 8011.19 Bombay60016.46 Kerala 38 3.10 Madhya Pradesh 83 6.97 Madras168 7.26 Mysore 48 4.98 Orissa 50 3.32

Punjab 95 5.56 Rajasthan 50 4.36 Uttar Pradesh40018.19 West Bengal204 8.51 _________________________________________________________________

n the Indian tax structure, there are a lot of taxes that people pay for different reasons. Income tax, sales tax,

entertainment tax, value added tax etc. All these taxes are existent because in some way or the other it impacts and helps the economy. One such tax that is prevalent in any manufacturing sector is the excise duty. What is excise duty? An excise or excise tax (sometimes called an excise duty) is a type of tax charged on goods produced within the country (as opposed to customs duties, charged on goods from outside the country). It is a tax on the production or sale of a good. This tax is now known as the Central Value Added Tax (CENVAT). Though the collection of tax is to augment as much revenue as possible to the government to provide public services, over the years it has been used as an instrument of fiscal policy to stimulate economic growth. Thus it is one of the socio-economic objectives. What are the types of excise duty? There are three different types of central excise duties which exist in India which are as follows: Basic - Excise Duty, imposed under section 3 of the 'Central Excises and Salt Act' of 1944 on all excisable goods other than salt produced or manufactured in India, at the rates set forth in the schedule to the Central Excise tariff Act, 1985, falls under the category of basic excise duty in India. Additional - Section 3 of the 'Additional Duties of Excise Act' of 1957 permits the charge and collection of excise duty in respect of the goods as listed in the schedule of this act. This tax is shared between the central and state governments and charged instead of sales tax. Special - According to Section 37 of the Finance Act, 1978, Special Excise Duty is levied on all excisable goods that come under taxation, in line with the Basic Excise Duty under the Central Excises and Salt Act of 1944. Therefore, each year the Finance Act spells out that whether the Special Excise Duty shall or shall not be charged, and eventually collected during the relevant financial year. Which goods are excisable goods?

The term 'excisable goods' means the goods which are specified in the first schedule and the second schedule to the Central Excise Tariff Act, 1985, as being subject to a duty of excise and includes salt. Who is liable to pay excise duty? The liability to pay tax excise duty is always on the manufacturer or producer of goods. There are three types of parties who can be considered as manufacturers:

Those who personally manufacture the goods in question Those who get the goods manufactured by employing hired labour Those who get the goods manufactured by other parties

Is it mandatory to pay duty on all goods manufactured? Yes, it is mandatory to pay duty on all goods manufactured, unless exempted. For example, duty is not payable on the goods exported out of India. Similarly exemption from payment of duty is available, based on conditions such as kind of raw materials used, value of turnover (clearances) in a financial year, type of process employed etc. What is the consequence of evading payment of excise duty? Under the different sections of the central excise act, the fines for evading tax can range from twenty-five to fifty per cent of the amount of duty evaded. When you look at the amount of excise you may have to pay, this is a rather large amount and along with the financial repercussions, you also have to encounter a tarnished image.

Das könnte Ihnen auch gefallen

- ABAP DebuggerDokument20 SeitenABAP DebuggerHem HemesNoch keine Bewertungen

- SAP SD Configuration GuideDokument363 SeitenSAP SD Configuration Guiderajendrakumarsahu94% (52)

- Business Information Warehouse Reporting & Analysis: Funds Management (FM) & Budget Control Systems (BCS)Dokument62 SeitenBusiness Information Warehouse Reporting & Analysis: Funds Management (FM) & Budget Control Systems (BCS)biswajit6864Noch keine Bewertungen

- Sap Abap - A Step-By-step Guide - Learn SapDokument24 SeitenSap Abap - A Step-By-step Guide - Learn SapShahid_ONNoch keine Bewertungen

- Sap Abap Tutorial PDFDokument179 SeitenSap Abap Tutorial PDFasdfNoch keine Bewertungen

- Sap Abap - A Step-By-step Guide - Learn SapDokument24 SeitenSap Abap - A Step-By-step Guide - Learn SapShahid_ONNoch keine Bewertungen

- Kieron Dowling Proj Sys Ch04Dokument24 SeitenKieron Dowling Proj Sys Ch04nong191Noch keine Bewertungen

- 165 Scen Overview en CNDokument6 Seiten165 Scen Overview en CNbiswajit6864Noch keine Bewertungen

- T CodesDokument149 SeitenT Codesbiswajit6864Noch keine Bewertungen

- FI FM 003 PresentationDokument72 SeitenFI FM 003 Presentationbiswajit6864Noch keine Bewertungen

- Cost CenterDokument47 SeitenCost Centerkunaruba89% (9)

- Line Item Display Option For These AccountsDokument1 SeiteLine Item Display Option For These Accountsbiswajit6864Noch keine Bewertungen

- Sap Abap - A Step-By-step Guide - Learn SapDokument24 SeitenSap Abap - A Step-By-step Guide - Learn SapShahid_ONNoch keine Bewertungen

- Monthly Remittance of Excise Duty and Service TaxDokument2 SeitenMonthly Remittance of Excise Duty and Service Taxbiswajit6864Noch keine Bewertungen

- 165 Scen Overview en CNDokument6 Seiten165 Scen Overview en CNbiswajit6864Noch keine Bewertungen

- TaxationDokument10 SeitenTaxationbiswajit6864Noch keine Bewertungen

- Tax TableDokument3 SeitenTax Tablebiswajit6864Noch keine Bewertungen

- Sap Fico PDFDokument4 SeitenSap Fico PDFmsaadnaeemNoch keine Bewertungen

- Controlling To BeDokument38 SeitenControlling To Bebiswajit6864Noch keine Bewertungen

- Accounts Payable Invoice Processing Workflows: Process OverviewDokument53 SeitenAccounts Payable Invoice Processing Workflows: Process OverviewkammynNoch keine Bewertungen

- A Study of Risk Management by State Bank of India For Small and Medium Scale IndustriesDokument90 SeitenA Study of Risk Management by State Bank of India For Small and Medium Scale Industriesbiswajit6864Noch keine Bewertungen

- FI MM SDintegration PDFDokument25 SeitenFI MM SDintegration PDFGopa Kambagiri SwamyNoch keine Bewertungen

- AdiDokument4 SeitenAdirashmitabcetNoch keine Bewertungen

- FICO Cash Journal 3Dokument31 SeitenFICO Cash Journal 3biswajit6864Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Business StructureDokument9 SeitenBusiness StructureSuharthi SriramNoch keine Bewertungen

- Activity 1 Wih AnswersDokument2 SeitenActivity 1 Wih AnswersDianna Tercino IINoch keine Bewertungen

- Business Regulatory Framework (M. Law) (Regular)Dokument127 SeitenBusiness Regulatory Framework (M. Law) (Regular)Yogesh SaindaneNoch keine Bewertungen

- Agoda General Terms and ConditionsDokument37 SeitenAgoda General Terms and ConditionsLelaNoch keine Bewertungen

- I B A G: Nternational Usiness in AN Ge of LobalizationDokument16 SeitenI B A G: Nternational Usiness in AN Ge of LobalizationrajivaminranaNoch keine Bewertungen

- Supply VATDokument25 SeitenSupply VATwakemeup143Noch keine Bewertungen

- 2208238376Dokument1 Seite2208238376NEW GENERATIONSNoch keine Bewertungen

- GHHHGDokument2 SeitenGHHHGDiana ElenaNoch keine Bewertungen

- Allowances and Guidelines For Scholarships 2012 - FinalDokument19 SeitenAllowances and Guidelines For Scholarships 2012 - FinalmoemoenzNoch keine Bewertungen

- Oragadam Payslip 5C Aug-22-101Dokument1 SeiteOragadam Payslip 5C Aug-22-101Yogith SharmaNoch keine Bewertungen

- SRC Income Tax Drop Off FormDokument2 SeitenSRC Income Tax Drop Off FormArvind MishraNoch keine Bewertungen

- 22nd Annual Report 2015 16Dokument274 Seiten22nd Annual Report 2015 16ayush tiwariNoch keine Bewertungen

- Agenda Packet For Caddo Commission Meeting Dec. 9, 2021Dokument224 SeitenAgenda Packet For Caddo Commission Meeting Dec. 9, 2021Curtis HeyenNoch keine Bewertungen

- ITR Acknowledgement T Durga PrasadDokument1 SeiteITR Acknowledgement T Durga PrasadEdu KondaluNoch keine Bewertungen

- PESTLE Analysis: Strategy SkillsDokument26 SeitenPESTLE Analysis: Strategy SkillsCát TườngNoch keine Bewertungen

- Municipal Corporation of Delhi Tax Payment Checklist For The Year (2022-2023)Dokument1 SeiteMunicipal Corporation of Delhi Tax Payment Checklist For The Year (2022-2023)Zinnia SharmaNoch keine Bewertungen

- Accounts SolDokument337 SeitenAccounts SolPiyush GoyalNoch keine Bewertungen

- Narrative Report - AdrianDokument8 SeitenNarrative Report - AdrianTimpug Crystal JeanNoch keine Bewertungen

- GSTDokument59 SeitenGSTkeval Chavan88% (8)

- Uber Skokie ComplaintDokument17 SeitenUber Skokie ComplaintCrainsChicagoBusinessNoch keine Bewertungen

- 2nd Batch Cases TaxDokument16 Seiten2nd Batch Cases TaxRay John Arandia DorigNoch keine Bewertungen

- Assessment Task 2 - BSBHRM513Dokument44 SeitenAssessment Task 2 - BSBHRM513Xavar Xan0% (3)

- March BIR RulingsDokument13 SeitenMarch BIR Rulingscarlee014Noch keine Bewertungen

- Validate Print HelpDokument2 SeitenValidate Print HelpGaurav AgarwalNoch keine Bewertungen

- Cash Flow Management PDFDokument366 SeitenCash Flow Management PDFTijanaKnezevic85100% (1)

- 2015 AtcDokument27 Seiten2015 Atcmilanfan1984Noch keine Bewertungen

- Chapter 1: The Role of Accounting and FinanceDokument8 SeitenChapter 1: The Role of Accounting and FinanceMonica MedinaNoch keine Bewertungen

- GST in India - An IntroductionDokument24 SeitenGST in India - An IntroductionMehak KaushikkNoch keine Bewertungen

- Certificate of Indian Exemption For Certain Property or Services Delivered On A ReservationDokument2 SeitenCertificate of Indian Exemption For Certain Property or Services Delivered On A Reservationvikas_ojha54706Noch keine Bewertungen

- National Saving CertificatesDokument11 SeitenNational Saving Certificatesaabc12345Noch keine Bewertungen