Beruflich Dokumente

Kultur Dokumente

Be MCQ

Hochgeladen von

indranil543Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Be MCQ

Hochgeladen von

indranil543Copyright:

Verfügbare Formate

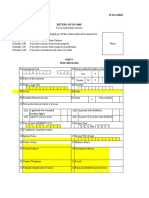

1) Functions of Reserve Bank of India are regulated by A) Ministry of Finance, GOI B) State Bank of India C) Indian Banks Association

D) RBI Act, 1935 2) The Base rate for a bank is decided by The individual banks themselves Reserve Bank of India Indian Banks Association Banking Regulation Act, 1949 3) The capital of State Finance Corporations is contributed by A) Govt of India B) Public deposits C) State Government D) Sponsoring Bank 4) The functions of a merchant banker do not include which one of the following? Financing issuer by way of bridge loan Syndication of loans Preparation of project report Negotiating with SEBI 5) A mutual fund cannot undertake this function A) Accept deposits B) Sell units in existing schemes C) Invest in equity market D) Invest in bonds 6) Identify the wrong statement DICGC will up to a limit A) Only insure bank deposits B) Only guarantee bank advances C) Insure some categories of bank deposits and some category of advances D) Insure bank deposits and guarantee some category of advances 7) Where the offer to subscribe for shares or debentures is made to 50 or more persons, then such an offer or invitation is known as __________________. Public issue Private placement Bonus issue Rights issue 8) At present the following category of treasury bills are issued for short term borrowing by GOI A) 14 and 91 days T bills B) 14, 91 and 182 days T bills C) 14, 91 and 364 days T bills D) 91, 182 and 364 days T bills 9) Which of the following statements is false?

A) B) C) D)

Money market instruments are exposed to reinvestment risk All money market instruments are interest rate-risk free TBs and CPs are exempt from credit rating CPs will not be guaranteed by issuers bank

10) The counter party risk in case of equity trading is assumed by Stock Exchange CDSL or NSDL SEBI Control of Capital Issues 11) Which of the following statements is correct? A) CDs issued by banks mature between 7 days and 1 year B) Discount rate at which CDs are issued are stipulated by RBI C) CDs issued by banks do not rank for determining SLR/CRR D) Bank may permit overdraft on the security of its own CDs 12) Which of the statements regarding RBI REPO is correct? A) Banks may make Repo only with RBI B) RBI may accept Repo deal even from Business companies C) Buyer of securities in the first leg of a Repo makes a reverse repo D) Repo rate is market driven 13) In India, the minimum period of a RBI Repo is A) 1 day B) 3 days C) 14 days D) 7 days excluding non-working days 14) A corporate bond has the following feature. A) All bonds are zero-coupon instruments B) It may carry floating interest rate C) It signifies part ownership in the issuing company D) It conveys limited voting right for the holder 15) Which of the following is true? A) G-secs can be issued also by autonomous Govt. bodies like Electricity Boards B) Coupon on G-secs is always a floating rate C) G-secs can also be issued as Zero-coupon bond D) G-secs can be also issued in foreign currency denominations 18) This security is issued at a discount but redeemed at par. A) Floating rate bonds B) Indexed bonds C) Zero coupon bonds D) Fixed income bonds

19) Identify the correct statement A Certificate of Deposit issued by a FI may have the following term A) Not negotiable

B) Cannot be traded by an individual C) Issued for a maximum period up to 2 years D) Issued for a period of 1-3 years

20) The following is true in case of lending and borrowing operations in interbank call money market. A) Maximum interest permitted is 80% minimum 2% B) Maximum interest permitted is 50% minimum 1% C) Maximum interest permitted is 20% no minimum D) No maximum or minimum interest prescribed 21) The players in the capital market does not include this institution A) Venture capital funds B) Underwriters C) Govt Treasury D) Bank Treasury 22) In case of an IPO, the word green shoe option means Retention of portion of subscription over and above issue size Open without any limits The issue price is not finalized Reserve quota for allotment 23) Debentures issued and allotted publicly are traded in the Secondary market Primary market Share market Auction market 24) Classification under which Securities held by a bank do not fall is A) Held to Maturity B) Held as security for loan advanced C) Held for Sale D) Available for Sale 25) YTM stands for A) Yield to Maturity B) Yield to Mean C) Yield to Market D) Yield to match 26) Price of a bond does not depend upon A) Coupon rate B) Years to maturity C) Yield to maturity

D) Issuers net worth 27) A Bond will quote at A) Discount when required return is higher than coupon rate B) Discount when required return is lower than coupon rate C) Premium when required return is higher than coupon rate D) Par when required return is lower than coupon rate 28) Banks maintain Investment Fluctuation Reserve to hedge against A) Depreciation risk B) Currency risk C) Bankruptcy risk D) Operational risk 30) Offer of public issue by a company shall be kept open for a minimum of A) 3 days B) 7 days C) 7 working days D) 3 working days 31) Minimum offer to public in a share issue is A) Rs.1.25 crores B) Rs.5 crores C) 50% of existing paid-up capital D) As decided by Board of Directors 32) Which of the following is a correct statement? A) Preference shares are those issued to promoters B) Equity share holders rank prior to preference holders for dividend C) Preference holders receive dividend at a floating rate D) Preference holders can vote only in matters of their interests 33) The following is NOT a function of IMF Correcting imbalances in BOP positions of member countries Settling disputes between member countries Allocating SDR quotas to member countries Lending against SDRs to member countries 34) EXIM BANK is a Development Financial Institution Foreign Bank Commercial Bank Regulator for RBI in India 35) In an A) B) C) option trade, European option refers to the right to exercise option only at maturity only after the maturity anytime up to the date of maturity

D) option cannot be exercised 36) When exercise price is equal to the price of the asset at maturity, option is said to be A) At-the-money B) In-the-money C) Out-of-the-money D) With-the-money

37) Exchange rate quoted with home currency as fixed unit and foreign currency unit varying is A) Government administered quotation

B) Indirect quotation C) Direct quotation D) Regular quotation

39) While quoting exchange rate for purchasing a demand export bill, bank A) Deducts exchange margin from forward rate B) Adds exchange margin from forward rate C) Deducts exchange margin from spot rate D) Adds exchange margin from spot rate 40) While retiring a sight import bill, bank applies A) TT buying rate B) TT selling rate C) Bill buying rate D) Bill selling rate

44) If market quotes are Spot USD/Rs = 45.7500 and Spot GBP/USD = 1.3500, exchange rate for Spot GBP/Rs will be A) 33.8900 B) 33.8925 C) 61.7625 D) 61.7650 45) Market regulator for trading in commodities futures is A) SEBI B) RBI C) National Multi Commodity Exchange D) Forward market Commission 46) Marking to Market adopted in futures trading implies A) Revaluing contract based on daily closing prices B) Revaluing contract based on contracted price C) Revaluing contract based on the average of opening and closing prices of the day D) Revaluing contract based on the average of high and low prices of the day

47) The functions of the Treasury department of the bank do not include A) Asset liability management B) Managing Nostro account C) Revising portfolio of securities D) Determining compensation package for employees 48) Open position in Nostro account means A) Overbought or oversold position B) Near zero position C) Account yet to be reconciled D) Transactions suspended pending reconciliation

1) The responsibility of providing appropriate management support is provided to RRBs is of the: A) NABARD B) RBI C) State Government D) Sponsoring banks 2) Reserve Bank of India does not exercise regulatory functions on A) Pension Funds B) Urban Co-operative Banks C) Foreign Banks D) Payment and Settlement Systems 3) Identify the correct statement A) World Bank acts as a lender of last resort for member states in financial distress B) International Monetary Fund aims to provide funding for development projects C) World Trade Organization settles trade disputes and negotiates trade agreements D) World Bank keeps account of international balance of payments of member states. 4) FDI stands for A) Fixed deposit investment B) Fixed demand investment C) Foreign direct investment D) Foreign demand investment 5) Under what circumstances can depositors get insurance cover of DICGC? A) In case of liquidation of the bank B) In case of death C) In case of take- over of the bank by RBI D) In case of merger of a bank with another 6) The fair Bid Price is A) The highest price at which the trader is willing to sell B) The highest price at which the trader is willing to buy C) The lowest price at which the trader is willing to sell D) The lowest price at which the trader is willing to buy 7) Shares of well reputed companies carrying high investment quality are called A) Blue chip shares B) Gilt edged shares

8) A standard asset of a bank is A) a loan account in which neither installment nor interest is under default B) a loan granted to a company whose shares command a premium C) a loan granted on banks benchmark prime rate D) a priority sector loan given against Government guarantee 9) The counter party risk in case equity trading is assumed by A) CDSL and NSDL B) SEBI C) Control of Capital Issues D) Stock Exchange 10) What are securities issued at discount and redeemed at par? A) Securities with Fixed Coupon Rates B) Indexed Bonds C) Zero Coupon Bonds D) Floating Rate Bonds 11) In case of an IPO, the word green shoe option means A) Open without any limits B) The issue price is not finalized C) Reserve quota for allotment D) Retention of portion of subscription over and above issue size 12) Which one of the following can use NDS platform? A) Primary dealers B) Corporates C) Brokers D) Individuals 13) A) B) C) D) 14) A) B) C) D) 15) Which of the following statement is incorrect about FIMMDA? Devises standardized best market practices Functions as an arbitrator for disputes between member institutions Is a regulator for bond, money and derivatives markets Develops benchmark rates and new derivative instruments In case of a call money market, the following is a correct statement. Corporates can borrow Insurance companies and MFs can borrow Bankers and PDs can borrow and lend Co-operatives can only lend In a capital market, quoted share means A) Shares which are listed in stock exchanges and being traded regularly B) Shares which are under purchase deals C) Shares which are under the approved list of a Bank D) Shares that are transferred to the employees of the respective companies Which of the following statements is correct? Discount rate at which CDs are issued are stipulated by RBI CDs issued by banks mature between 7 days and 1 year CDs issued by banks do not rank for determining SLR/CRR Bank may permit overdraft on the security of its own CDs Government Securities are traded through

C) IDRs D) Golden shares

16) A) B) C) D) 17)

A) Clearing Corporation of India Ltd. B) National Securities Clearing Corporation of india C) National Stock Exchange D) National Depository Services Ltd 18) The Forward Market Commission has a role to regulate A) Futures Trading in capital market B) Forward trading in Forex Market C) Futures trading in commodities market D) Options contracts in capital market

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Trendsetter Term SheetPPTDokument16 SeitenTrendsetter Term SheetPPTMary Williams100% (2)

- Auto Buy Sell With SL For Amibroker (AFL)Dokument10 SeitenAuto Buy Sell With SL For Amibroker (AFL)sakthiprimeNoch keine Bewertungen

- Fin 651 Web ProjectDokument8 SeitenFin 651 Web Projectfathazam1Noch keine Bewertungen

- Capital Market Questions BankDokument11 SeitenCapital Market Questions Bankdev12_lokesh100% (1)

- Chuck Akre Interview ROIICDokument6 SeitenChuck Akre Interview ROIICKen_hoangNoch keine Bewertungen

- Shares and Dividend Liable To Be Transferred To IEPF PDFDokument3 SeitenShares and Dividend Liable To Be Transferred To IEPF PDFDhiraj KumarNoch keine Bewertungen

- Online Class (FDRM)Dokument70 SeitenOnline Class (FDRM)Chanchal MisraNoch keine Bewertungen

- Cost of CapitalDokument4 SeitenCost of CapitalNusratJahanHeabaNoch keine Bewertungen

- Complaint Against Blue Ocean CapitalDokument19 SeitenComplaint Against Blue Ocean CapitalthecryptoupdatesNoch keine Bewertungen

- Internship Report Allied Bank Limited NewDokument63 SeitenInternship Report Allied Bank Limited NewMuhammed Bilal AhmadNoch keine Bewertungen

- 11symp DekempanaerDokument58 Seiten11symp DekempanaerStuart BroodNoch keine Bewertungen

- Notes of Written AbilityDokument70 SeitenNotes of Written AbilityMahi GaneshNoch keine Bewertungen

- Budget Memo 2015 PDFDokument2 SeitenBudget Memo 2015 PDFDominic HuniNoch keine Bewertungen

- It 11ga2016Dokument17 SeitenIt 11ga2016shiblu39100% (1)

- Research On TfxiDokument5 SeitenResearch On TfxikNoch keine Bewertungen

- Jarvis Et Al 2018 PDFDokument15 SeitenJarvis Et Al 2018 PDFRicardo Sanchez CarrilloNoch keine Bewertungen

- Strategic Management Analysis of PepsiCoDokument23 SeitenStrategic Management Analysis of PepsiCoFirewing225Noch keine Bewertungen

- Compulsory Winding Up of Companies - GRP 6Dokument36 SeitenCompulsory Winding Up of Companies - GRP 6Anupam SinhaNoch keine Bewertungen

- Percentage in Point (PIP) : MeaningDokument2 SeitenPercentage in Point (PIP) : MeaningMayank ChauhanNoch keine Bewertungen

- Stock ValuationDokument17 SeitenStock Valuationsankha80Noch keine Bewertungen

- 13 MD Theories PDFDokument15 Seiten13 MD Theories PDFIves LeeNoch keine Bewertungen

- The Financial Crisis of 2008Dokument8 SeitenThe Financial Crisis of 2008Chip EvansNoch keine Bewertungen

- Allahabad Bank Recovery Management PolicyDokument246 SeitenAllahabad Bank Recovery Management Policynickeycool100% (2)

- Trimegah FN 20170911 Digital - E-Commerce PerformanceDokument13 SeitenTrimegah FN 20170911 Digital - E-Commerce PerformanceAnonymous XoUqrqyuNoch keine Bewertungen

- Learning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceDokument9 SeitenLearning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceMatt Yu EspirituNoch keine Bewertungen

- Goldman Sachs University of TorontoDokument3 SeitenGoldman Sachs University of TorontoMattNoch keine Bewertungen

- Concept Map (Garcia, Plata, Villamin) PDFDokument6 SeitenConcept Map (Garcia, Plata, Villamin) PDFMinji OhNoch keine Bewertungen

- Finals Member Relations and Office Procedures in Cooperatives ReviewerDokument13 SeitenFinals Member Relations and Office Procedures in Cooperatives ReviewerCarmella BelenNoch keine Bewertungen

- Wisdom of Intelligent Investors Safal Niveshak Jan. 2018Dokument40 SeitenWisdom of Intelligent Investors Safal Niveshak Jan. 2018Sagar KondaNoch keine Bewertungen

- Primary MKTDokument24 SeitenPrimary MKTdanbrowndaNoch keine Bewertungen