Beruflich Dokumente

Kultur Dokumente

Transfer Shares

Hochgeladen von

perumal7Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Transfer Shares

Hochgeladen von

perumal7Copyright:

Verfügbare Formate

Transfer of Shares (Only for physical shares)

Q. 1 I have purchased Hexaware shares. How do I get them registered? How long will it take? The shares for transfer may be lodged with Registrar and Share Transfer Agent (RTA) or the Company at its Registered Office. All transfer requests are processed by the RTA within a period of 15 to 30 days from the date of receipt, if documents are in order in all respect. In case of non-receipt of response from the RTA within 30-35 days of lodging the transfer request, you may contact them with details of documents to find out the current status of shares. Q. 2 I would like to gift some shares to my children/relatives. How do I get them registered in their names? Does it involve stamp duty? The procedure of registration of shares gifted is same as the procedure for a normal transfer. The stamp duty is also applicable in case of gifted shares, and the duty is at 0.5% of the market value prevailing on the date of execution of the transfer deed by the transferee. Q. 3 Where should I send the shares for transfer?

The Registrar and Share Transfer Agent only carry out Registration of Share Transfer. You will have to lodge the shares, either by personal delivery or through post/reputed courier. The address of the RTA is as follows: M/s Sharepro Services (I) Private Limited Unit: Hexaware Technologies Limited Satam Estate, 3rd Floor, Cardinal Gracious Road, Chakala, Andheri (East), Mumbai - 400 099 Tel. : +91 22 28215168/28215169/28329828/28348218 Fax : + 91 22 28375646 E-mail : sharepro@vsnl.com Q. 4 What is the stamp duty on shares? Where do I get these stamps? The stamp duty applicable on share transfer is at 0.5% on the market value on the date of execution of the transfer deed. Share Transfer Stamps can be obtained from the authorized stamp vendors. Your share broker can also help you in this regard. Q. 5 How do I ensure that the Transfer Deed is complete before sending it to the company? Please fill in all the columns of the transfer deed, sign as transferee at appropriate places and affix share transfer stamps at 0.5% of the market value on the date of execution of the transfer deed. Please ensure that the transfer deed is duly filled in and executed as explained, to avoid any discrepancy/objection on lodgment.

Q. 6 I want to add another joint-holder name to my shareholding. What is the procedure that I should follow? You have to execute a transfer deed, duly stamped and submit the same to the Registrar and Share Transfer Agent for transfer. Please note that such addition of name amounts to change in ownership of shares and the procedure for transfer as defined in Q. No. 3 has to be followed.

Q. 7 I have purchased Hexaware shares long back but I forgot to get them transferred in my favor. What is the procedure that I should follow now? A transfer deed is valid for a period of one year from the presentation date indicated in the stamp affixed by the Registrar of Companies on the upper portion of the deed or the closure date of Register of Members immediately after the presentation date, whichever is later. For e.g. suppose the date of presentation as indicated on the transfer deed is 6th December, 2006 and closure date of Register of Member is 15th June, 2007, then in that case transfer deed will be valid upto 5th December, 2007. Please check whether your transfer deed is still valid. If so, submit the transfer deed duly executed and stamped along with share certificates with our Registrar and Transfer Agents, M/s M/s Sharepro Services (I) Private Limited for transfer in your favor. If the validity period of the transfer deed has expired you will have to approach the Registrar of Companies for extending the validity of the transfer deed. Alternatively, you may approach the registered holder/seller whose signatures are appearing on the transfer deed as seller to execute fresh transfer deeds. Thereafter you may submit the fresh/revalidated transfer deed to RTA.

Download Letter Format

Share Transfers.doc

Das könnte Ihnen auch gefallen

- MC QuestionsDokument23 SeitenMC QuestionsBob Sagett0% (5)

- Secreg - Gun Jumping Exam SheetDokument5 SeitenSecreg - Gun Jumping Exam SheetRaj VashiNoch keine Bewertungen

- Transfer of Share in A Private Limited CompanyDokument3 SeitenTransfer of Share in A Private Limited Companyherman gervasNoch keine Bewertungen

- FaqsDokument6 SeitenFaqsavi_jain8Noch keine Bewertungen

- Procedure For Transfer SharesDokument1 SeiteProcedure For Transfer SharesChi Pistis PistevoNoch keine Bewertungen

- Step Wise Process To Transfer Shares Hold in Physical Form PDFDokument4 SeitenStep Wise Process To Transfer Shares Hold in Physical Form PDFParthiv JethiNoch keine Bewertungen

- FAQs For InvestorsDokument15 SeitenFAQs For InvestorsAshitoshNoch keine Bewertungen

- Share Transfer Process in Tanzania MainlandDokument3 SeitenShare Transfer Process in Tanzania MainlandGodfrey OscarNoch keine Bewertungen

- Transfer of SharesDokument7 SeitenTransfer of SharesSacredly YoursNoch keine Bewertungen

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCSDokument3 SeitenArtifact 5a - Guidelines For Filling PF Withdrawal Form TCSAmy Brady100% (3)

- Shareholders Guide-BHIL PDFDokument13 SeitenShareholders Guide-BHIL PDFAMIT MUNOTNoch keine Bewertungen

- Tel-27405041/5002 Fax No.27405058 Email - Skirkase@actrec - Gov.in / Purchase@actrec - Gov.inDokument14 SeitenTel-27405041/5002 Fax No.27405058 Email - Skirkase@actrec - Gov.in / Purchase@actrec - Gov.inDeepak DevarsettiNoch keine Bewertungen

- FrankingDokument6 SeitenFrankingSuresh SharmaNoch keine Bewertungen

- Transfer of SharesDokument12 SeitenTransfer of SharesromaNoch keine Bewertungen

- Procedure With Regards To Transfer of SharesDokument4 SeitenProcedure With Regards To Transfer of SharesKathc AzurNoch keine Bewertungen

- TredsDokument4 SeitenTredssharma_anshu_b_techNoch keine Bewertungen

- Transfer & Transmission of SharesDokument9 SeitenTransfer & Transmission of SharesHanoze ZaveriNoch keine Bewertungen

- Share Gift Transfer 2Dokument2 SeitenShare Gift Transfer 2陳宣芳Noch keine Bewertungen

- Malaysia Incorp ChecklistDokument5 SeitenMalaysia Incorp Checklistku.hariamuNoch keine Bewertungen

- De-Mat and Trading Account Opening Procedure (Back Office Working)Dokument11 SeitenDe-Mat and Trading Account Opening Procedure (Back Office Working)Swapnil MoreNoch keine Bewertungen

- Can Stamp Duty Be Refunded.Dokument3 SeitenCan Stamp Duty Be Refunded.fakesNoch keine Bewertungen

- NomineeDirector Direct From Nominee Director To ClientDokument5 SeitenNomineeDirector Direct From Nominee Director To ClientthelegacylcNoch keine Bewertungen

- CompletionDokument2 SeitenCompletionDina Raiessha Mohamed Hajirin (Zhonghuass)Noch keine Bewertungen

- Profession Tax Registration ProcedureDokument9 SeitenProfession Tax Registration ProcedureParas ShahNoch keine Bewertungen

- Trading Account Segment Activation / DeactivationDokument2 SeitenTrading Account Segment Activation / DeactivationwhitenagarNoch keine Bewertungen

- Dematerialisation: Q. 1 What Is Demat and What Are Its Benefits?Dokument3 SeitenDematerialisation: Q. 1 What Is Demat and What Are Its Benefits?Mohsin KhanNoch keine Bewertungen

- Annexure B-1 - Application For Cancellation of APDokument2 SeitenAnnexure B-1 - Application For Cancellation of APDev Prakash GuptaNoch keine Bewertungen

- FAQs Advance Ruling For Unregistered Dealers (FORM GST ARA-01)Dokument3 SeitenFAQs Advance Ruling For Unregistered Dealers (FORM GST ARA-01)pratikraval102Noch keine Bewertungen

- WWW - Sebi.gov - In: Page 1 of 2Dokument2 SeitenWWW - Sebi.gov - In: Page 1 of 2Anjulika SinghNoch keine Bewertungen

- Faq DLDokument2 SeitenFaq DLrpvaghelaNoch keine Bewertungen

- In Principle ApprovalDokument5 SeitenIn Principle ApprovalMariaNoch keine Bewertungen

- Only SSL-DP Form RevisedDokument10 SeitenOnly SSL-DP Form RevisedDhurandhar BhatavdekarNoch keine Bewertungen

- Chennai Telephones-Transfer ProcedureDokument3 SeitenChennai Telephones-Transfer Procedureuday3040Noch keine Bewertungen

- Application Form VtpfdsDokument12 SeitenApplication Form VtpfdsLarry GarciaNoch keine Bewertungen

- Company Act NotesDokument9 SeitenCompany Act NotesSavoir PenNoch keine Bewertungen

- F&O Trading ActivationDokument2 SeitenF&O Trading Activationsaravanand1983Noch keine Bewertungen

- AP Cancellation Format With Fees Details (MCX & NCDEX)Dokument4 SeitenAP Cancellation Format With Fees Details (MCX & NCDEX)Rakesh ParaliyaNoch keine Bewertungen

- MCX New ApplicationFormDokument30 SeitenMCX New ApplicationFormnaastitvamNoch keine Bewertungen

- Terms & Conditions-JocDokument3 SeitenTerms & Conditions-JocDadaVali NNoch keine Bewertungen

- Change of OwnershipDokument3 SeitenChange of Ownerships2gfxzkw2wNoch keine Bewertungen

- FAQ Main CategoriesDokument5 SeitenFAQ Main CategoriesRoxy ThomasNoch keine Bewertungen

- 27915esb Cajournal Jan2012Dokument5 Seiten27915esb Cajournal Jan2012ratiNoch keine Bewertungen

- Rti ApplicationDokument2 SeitenRti ApplicationGautam Jayasurya0% (1)

- FaqDokument5 SeitenFaqG MNoch keine Bewertungen

- FAQ On ESOPDokument8 SeitenFAQ On ESOPayushgmailNoch keine Bewertungen

- Client Agreement enDokument28 SeitenClient Agreement enAfif KunNoch keine Bewertungen

- Letter of Offer For Employment - Mihir PatelDokument2 SeitenLetter of Offer For Employment - Mihir Patelapi-25966137100% (2)

- Consultancy MandateDokument4 SeitenConsultancy MandateTanmay DeshpandeNoch keine Bewertungen

- Meaning of Transfer of ShareDokument9 SeitenMeaning of Transfer of SharePurav PatelNoch keine Bewertungen

- MVAT ACT, 2002: Who Needs To Register?Dokument14 SeitenMVAT ACT, 2002: Who Needs To Register?CAJigarThakkarNoch keine Bewertungen

- Faq (Driving Licence) : If The Person Obtaining The LicenceDokument2 SeitenFaq (Driving Licence) : If The Person Obtaining The Licencewiki.iiestNoch keine Bewertungen

- Transfer of Ownership Request Form: Existing Owner DetailsDokument2 SeitenTransfer of Ownership Request Form: Existing Owner DetailsLaure Bénie KouassiNoch keine Bewertungen

- Updated Pre-Qualification Questionaiire - BLANKDokument4 SeitenUpdated Pre-Qualification Questionaiire - BLANKIchal Chelsea KasminNoch keine Bewertungen

- BNG Application-EngDokument16 SeitenBNG Application-EngRAMAKRISHNA ANoch keine Bewertungen

- Chapter 4Dokument41 SeitenChapter 4MubeenNoch keine Bewertungen

- Waver Application To Recovery OfficerDokument3 SeitenWaver Application To Recovery Officershahsharada11Noch keine Bewertungen

- Ashokleyland Chennai - 5 5 2016 Matex267 PDFDokument17 SeitenAshokleyland Chennai - 5 5 2016 Matex267 PDFAnwar Hasan KhanNoch keine Bewertungen

- Appointment LetterDokument4 SeitenAppointment Letteromkarkadam161Noch keine Bewertungen

- HR Consul AashrayaDokument2 SeitenHR Consul AashrayaAdmin IllpmNoch keine Bewertungen

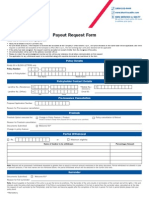

- Payout Request FormDokument2 SeitenPayout Request FormSATHISHLATEST2005100% (11)

- Exam For Managerial AccountingDokument8 SeitenExam For Managerial Accountingសារុន កែវវរលក្ខណ៍Noch keine Bewertungen

- Ch.3-Depositories & CustodiansDokument57 SeitenCh.3-Depositories & Custodiansjaludax100% (1)

- The Future Outlook of Desalination in The GulfDokument63 SeitenThe Future Outlook of Desalination in The GulfChristian D. OrbeNoch keine Bewertungen

- BANK 3009 CVRM Workshop 1 ExercisesDokument3 SeitenBANK 3009 CVRM Workshop 1 Exercisesjon PalNoch keine Bewertungen

- Case Study Report: I. Problems IdentificationDokument3 SeitenCase Study Report: I. Problems IdentificationFeelya MonicaNoch keine Bewertungen

- I. Using The Capital Asset Pricing Model II. Estimating K For Comparable Dividend-Paying Stocks in Their IndustryDokument6 SeitenI. Using The Capital Asset Pricing Model II. Estimating K For Comparable Dividend-Paying Stocks in Their IndustryAhad SultanNoch keine Bewertungen

- Dhanu UniliverDokument8 SeitenDhanu Uniliverdhanu26101990Noch keine Bewertungen

- On Presston Engineering CorporationDokument21 SeitenOn Presston Engineering CorporationPreethi Pavana100% (1)

- Chap 5 ComputationDokument6 SeitenChap 5 ComputationAileen Mifranum IINoch keine Bewertungen

- In Company 3.0 ESP Investment: Glossary (By Unit)Dokument11 SeitenIn Company 3.0 ESP Investment: Glossary (By Unit)LUISA CASTRO CUNEONoch keine Bewertungen

- Depreciation and AppreciationDokument2 SeitenDepreciation and AppreciationBobbyNicholsNoch keine Bewertungen

- Insurance Vs Mutual FundDokument105 SeitenInsurance Vs Mutual FundLalit Kumar100% (1)

- PRNCaseStudiesBook PDFDokument21 SeitenPRNCaseStudiesBook PDFDiana Teodora ȘtefanoviciNoch keine Bewertungen

- CEO List LahoreDokument2 SeitenCEO List Lahorehelping handNoch keine Bewertungen

- Nestle Multinational CompanyDokument3 SeitenNestle Multinational CompanyShebel AgrimanoNoch keine Bewertungen

- Winter InternshipDokument47 SeitenWinter InternshipMinhans SrivastavaNoch keine Bewertungen

- FIIDokument73 SeitenFIIArun PrakashNoch keine Bewertungen

- Working Capital and Current Assets Management: Learning GoalsDokument2 SeitenWorking Capital and Current Assets Management: Learning GoalsKristel SumabatNoch keine Bewertungen

- MACDDokument2 SeitenMACDJEAN MARCO CAJA ALVAREZNoch keine Bewertungen

- International Business EnvironmentDokument29 SeitenInternational Business EnvironmentNardsdel RiveraNoch keine Bewertungen

- A Study On Volatality in BSE SensexDokument101 SeitenA Study On Volatality in BSE SensexSrinivasan Ponnurangan100% (1)

- FCCBDokument20 SeitenFCCBHitesh MulaniNoch keine Bewertungen

- RSB Position Paper April 26Dokument14 SeitenRSB Position Paper April 26JehanzebNoch keine Bewertungen

- Heritage Works: The Use of Historic Buildings in RegenerationDokument32 SeitenHeritage Works: The Use of Historic Buildings in RegenerationmnaiseNoch keine Bewertungen

- CUTN Brochure 2016-17Dokument42 SeitenCUTN Brochure 2016-17dkmaurya456Noch keine Bewertungen

- Sentix Indicator of Global Investor ConfidenceDokument1 SeiteSentix Indicator of Global Investor ConfidenceEduardo PetazzeNoch keine Bewertungen

- Bacos, Romelito D. 201111820 Engr. Roslyn Peňa, Ce 20 January 2014Dokument6 SeitenBacos, Romelito D. 201111820 Engr. Roslyn Peňa, Ce 20 January 2014Rommell BacosNoch keine Bewertungen

- Notes To Finacial Statements: Question 6-1Dokument23 SeitenNotes To Finacial Statements: Question 6-1Kim FloresNoch keine Bewertungen