Beruflich Dokumente

Kultur Dokumente

DailyTechnical Report 06.05.2013

Hochgeladen von

Angel BrokingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DailyTechnical Report 06.05.2013

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Daily Technical Report

May 06, 2013

Sensex (19576) / NIFTY (5944)

On Friday, indices opened on a flat note and traded in between Thursdays trading range with extreme volatility to close with a loss of nearly 1%. For the session Banking, Auto and Realty counters ended on a losing side whereas Metal and Capital Goods stocks ended with gains. The advance to decline ratio was in favor of declining counters (A=1027 D=1339) (Sourcewww.bseindia.com)

Exhibit 1: Nifty Daily Chart

Formation

The 20-week EMA and the 20-day EMA are placed at 19090/ 5784 and 19120/ 5801 levels, respectively. The 89-day EMA and the 200-day SMA are placed at 19105/ 5787and 18750 / 5685, respectively. The weekly ADX (9) indicator and the RSI-Smoothened oscillator have signaled a positive crossover. The 78.60%Fibonacci retracement levels of the fall from 20204 / 6112 to 18144 / 5477 is placed at 19762 / 5976.

Source: Falcon:

Trading strategy:

For the third consecutive week, our benchmark indices have closed in the positive territory. During the week, indices managed to sneak beyond the 78.60% Fibonacci retracement level of 19762 / 5976. This has negated the Lower Top Lower Bottom formation seen in the weekly chart. However, indices have registered a weekly closing below this level. Similar to last week, the price action seen in the last trading session of this week can be termed as an Inside Day pattern. This candlestick formation occurs when the entire price range of a given day falls within the price range of the previous day. The pattern signals indecisiveness in the market because neither the bulls nor the bears are able to send the price beyond the range of the previous day. The said pattern will be confirmed below Thursdays low of 19451 / 5910.

Actionable points:

View Expected Target Resistance Levels Bearish Below 5930 5880 5867 5973 - 5958

In this scenario, indices may correct towards 19250 19120 / 5860 5800 levels in the coming few sessions. With all the policy events out of the way and major quarterly results already declared, the lack of fresh triggers will be a concern for the bulls. Conversely, the weekly ADX (9) indicator and the RSI-Smoothened oscillator are signaling a positive crossover. Hence, any move beyond this weeks high of 19792 / 6020 would push indices higher to test the 52week high of 20204 / 6112.

www.angelbroking.com

Daily Technical Report

May 06, 2013

Bank Nifty Outlook - (12394)

On Friday, Bank Nifty opened on a flat note and traded with extreme volatility on account of RBI monetary policy to close with a loss of 2.49%. We are witnessing that the index is taking support on the gap formed on April 22, 2013 from the past few sessions. Further correction in the index is likely to continue only if it falls below the 12313 mark. In this case the index is likely to drift towards 12241 12117 levels. On the upside 12574 12694 levels are likely to act as resistance for the day.

Exhibit 2: Bank Nifty Daily Chart

Actionable points:

View Expected Target Resistance levels Bearish Below 12313 12241 12117 12574 12694 Source: Falcon:

www.angelbroking.com

Daily Technical Report

May 06, 2013

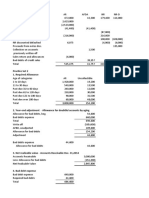

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM ASIANPAINT AXISBANK BAJAJ-AUTO BANKBARODA BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL GRASIM HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INDUSINDBK INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT LUPIN M&M MARUTI NMDC NTPC ONGC PNB POWERGRID RANBAXY RELIANCE RELINFRA SBIN SESAGOA SUNPHARMA TATAMOTORS TATAPOWER TATASTEEL TCS ULTRACEMCO S2 19,419 5,888 12,165 1,189 182 4,644 1,439 1,759 679 306 186 393 298 392 312 224 1,985 326 2,897 732 837 669 1,570 93 566 1,093 146 449 2,258 327 298 73 699 1,510 691 924 1,638 124 156 317 725 109 442 783 364 2,150 154 951 278 93 296 1,385 1,846 S1 19,497 5,916 12,279 1,208 185 4,670 1,457 1,783 689 312 189 398 301 396 315 228 1,993 331 2,921 741 846 675 1,591 96 569 1,111 149 458 2,283 329 308 74 711 1,540 698 942 1,652 125 158 321 734 111 446 792 377 2,182 158 968 282 93 303 1,402 1,866 PIVOT 19,621 5,958 12,479 1,242 190 4,704 1,485 1,824 702 322 192 407 305 404 318 234 2,007 339 2,950 749 854 685 1,608 97 573 1,141 153 467 2,303 331 315 76 720 1,562 706 958 1,676 127 160 326 751 113 451 804 391 2,238 161 979 288 94 309 1,425 1,885 R1 19,699 5,986 12,593 1,261 194 4,730 1,503 1,848 712 327 194 412 307 408 321 238 2,015 343 2,974 758 863 690 1,628 100 576 1,159 155 477 2,329 333 325 77 731 1,592 713 977 1,689 128 162 329 760 114 455 813 404 2,269 164 995 292 95 317 1,441 1,905 R2 19,823 6,028 12,793 1,294 199 4,765 1,531 1,889 725 337 197 420 311 416 323 244 2,028 351 3,003 766 871 700 1,645 101 580 1,189 160 486 2,349 336 331 79 740 1,614 720 992 1,713 130 164 334 777 117 459 825 418 2,325 167 1,006 298 96 322 1,464 1,923

www.angelbroking.com

Daily Technical Report

May 06, 2013

Research Team Tel: 022 - 30940000 E-mail: advisory@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Ankur Lakhotia Head Technicals Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

www.angelbroking.com

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Tutorial 6 AnswersDokument5 SeitenTutorial 6 AnswersMaria MazurinaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Chapter 12Dokument11 SeitenChapter 12Kim Patrice NavarraNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Multi-Level Trading-Recovery Trading: ND RDDokument11 SeitenMulti-Level Trading-Recovery Trading: ND RDAkram BoushabaNoch keine Bewertungen

- 1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDokument7 Seiten1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDin Rose Gonzales50% (2)

- Sheraton Yilan Investment Memorandum 2010Dokument3 SeitenSheraton Yilan Investment Memorandum 2010Sky Yim100% (1)

- Mymaxicare Rates 2021Dokument2 SeitenMymaxicare Rates 2021Ariane ComboyNoch keine Bewertungen

- Namkeen Farsan Manufacturing SchemeDokument2 SeitenNamkeen Farsan Manufacturing SchemeYogesh ShivannaNoch keine Bewertungen

- Od 226180983725961000Dokument2 SeitenOd 22618098372596100021Keshav C7ANoch keine Bewertungen

- PMS Reckoner SeptDokument7 SeitenPMS Reckoner SeptsendtokrishmunNoch keine Bewertungen

- 28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDokument4 Seiten28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteMatías PierottiNoch keine Bewertungen

- Source of Funds Questionnaire V.20191212Dokument1 SeiteSource of Funds Questionnaire V.20191212Tanıl SarıkayaNoch keine Bewertungen

- On Kingfisher AirwaysDokument22 SeitenOn Kingfisher AirwaysPratik Sukhani100% (5)

- INTERROGATIVES Depositions For DisclosureDokument6 SeitenINTERROGATIVES Depositions For Disclosureolboy92Noch keine Bewertungen

- Week 4 Solutions To ExercisesDokument5 SeitenWeek 4 Solutions To ExercisesBerend van RoozendaalNoch keine Bewertungen

- Afcqm QB 2013 PDFDokument99 SeitenAfcqm QB 2013 PDFHaumzaNoch keine Bewertungen

- Difference Between Accounts & FinanceDokument4 SeitenDifference Between Accounts & Financesameer amjadNoch keine Bewertungen

- Practice Set 1Dokument6 SeitenPractice Set 1moreNoch keine Bewertungen

- Zero To IPO: Lessons From The Unlikely Story ofDokument44 SeitenZero To IPO: Lessons From The Unlikely Story ofoutlook.krishnaNoch keine Bewertungen

- (C501) (Team Nexus) Assignment 1Dokument14 Seiten(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimNoch keine Bewertungen

- How To Know Fraud in AdvanceDokument6 SeitenHow To Know Fraud in AdvanceMd AzimNoch keine Bewertungen

- International Trading Regulation Hannan Aminatami AlkatiriDokument11 SeitenInternational Trading Regulation Hannan Aminatami AlkatiriAlyssa Khairafani GandamihardjaNoch keine Bewertungen

- Ready, Steady,: ForexDokument25 SeitenReady, Steady,: ForexSrini VasanNoch keine Bewertungen

- HR Functions and ProceduresDokument7 SeitenHR Functions and ProceduresSandeep KumarNoch keine Bewertungen

- Sip Project Template Final RevisedDokument21 SeitenSip Project Template Final RevisedMonnu montoNoch keine Bewertungen

- Liberty Media Corporation Annual Report Proxy Statement BookmarkedDokument232 SeitenLiberty Media Corporation Annual Report Proxy Statement BookmarkedWillNoch keine Bewertungen

- (Lecture Notes) Module 6 - Equity Valuation ModelsDokument28 Seiten(Lecture Notes) Module 6 - Equity Valuation Modelscourse shtsNoch keine Bewertungen

- The Impact of Firm Growth On Stock Returns of Nonfinancial Firms Listed On Egyptian Stock ExchangeDokument17 SeitenThe Impact of Firm Growth On Stock Returns of Nonfinancial Firms Listed On Egyptian Stock Exchangealma kalyaNoch keine Bewertungen

- Assertions of Compliance With Accountability RequirementsDokument2 SeitenAssertions of Compliance With Accountability RequirementslouvelleNoch keine Bewertungen

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Dokument3 SeitenInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiNoch keine Bewertungen

- AccountingDokument5 SeitenAccountingMaitet CarandangNoch keine Bewertungen