Beruflich Dokumente

Kultur Dokumente

Financial Managment

Hochgeladen von

Moeenuddin HashimCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Managment

Hochgeladen von

Moeenuddin HashimCopyright:

Verfügbare Formate

INTRODUCTION Telecard Limited Company was incorporated in Pakistan on October 29, 1992 as a Public Limited Company.

The shares of the Company are listed on the Karachi and Islamabad Stock Exchanges. The Company itself and through its Subsidiary is licensed to provide fully integrated telecommunication services, including basic wireless telephony, long distance and international services and payphones. Telecard Limited is belongs to telecommunications sector. Telecard is constantly adding value added products to its portfolio. Telecard has successfully launched WLL service (GO CDMA) based on CDMA2000 1 X technology that provided the unique combination of voice and data/internet for the first time in Pakistan. Telecard is one of the WLL service providers in Pakistan also.

CAPITAL STRUCTURE

DEBT POSITION:

Both long term and short term debts were taken: -Short term running finances were taken in all 5 years apart from 2008, figures for the other years are given below:2007- Rs 200,000 from various commercial banks. 2009- Rs.400, 000 from various commercial banks. 2010- Rs 400,000 from various commercial banks. 2011- Rs 292,735 from various commercial banks. Moreover short term borrowings were also done, in years listed below: 2007- Rs 168,331 from banks and Rs 37,500 from investment bank 2010- Rs 35,500 from a related party 2011- Rs 17,000 from a related party, it was repaid fully during the current year. Only one long term debt was taken, and that in 2004 of $ 2.4 billion. MAIN SOURCES OF DEBT

The main source is long term financing. The company has taken one major loan of $2.4 billion in 2004. Due to the companys inability to pay they have asked their lenders to extend the due date, which they have agreed to. LIABILITY AS A PERCENTAGE OF TOTAL ASSETS

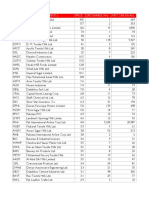

NON-CURRENT LIABILIT IES Long term loans redeemable capital Liabilities against assets Advance s long term deposits deferred liabilities due to employees deferred taxation other dues

2007 0.060701345 0.171588022 0.007496564 0 0.005205947 0.007184207 0 0 0.165028529 0.425950606 0.160863771 0.006143018 0.073403857 0.019574362 0.028216234 0.236350006

2008 0.080872518 0.116061323 0.002366499 0.063586789 0.008025517 0.002263607 0.005041671 0.017697294 0.13231814 0.428542031 0.123160819 0.013993209 0.00658504 0.10752135 0.091676098 0.263710258

2009 0.048008466 0.057725611 0.000173177 0.026630749 0.006349817 0.002212815 0.003367327 0.021454685 0.137386954 0.303444295 0.126034251 0.010198191 0 0.037714066 0.100538772 0.274677699

2010 0.521540062 0.08074922 0 0.054630593 0.006347555 0.183662851 0.002185224 0 0 0.379916753 0.193860562 0.007700312 0.027991675 0.001768991 0.034651405 0.266077003

2011 0.022835719 0.054078618 0 0.06703022 0.006703022 0.202567598 0 0 0 0.356169052 0.147012043 0.012837991 0.033174279 0 0.058963872 0.252329016

C URRENT LIABILITIES T rade and other payables Accrued interest/Markup short term borrowings short te rm finance s curre nt maturitie s of long te rm finance s

As presented in the chart above, long term loans have reduced in 2009 by a very high amount, this is mainly due to bullet repayments which were done in this year. Moreover in year 2010, long term loans has increased a lot, however short term finances has reduced this is because of loan restructuring which was done by the company. Thereby outstanding markup merged with outstanding principal resulting in the new principal. SHAREHOLDER AND OWNER SHIP POSITION:

Common stock shares have been issued. OWNERSHIP STRUCTURE OF THE COMPANY

On an average the ownership structure of the company has been given below:

As it is a public listed company all outstanding shares are available for trade in the general public. TRENDS AND CHANGES OF STRUCTURE OVER THE FIVE YEARS

5000 4000 3000 2000 1000 0 2007 2008 2009 2010 2011 SHARE CAPITAL & RESERVES ISSUED SUBSCRIBED PAID UP

Equity capital remained the same throughout the 5 years i.e. share capital and reserves 4000,000 and issued, subscribed paid up 3000,000. The reason given was that Issue of capital rules (ICR) of 1996 governs the right issues. The conditions applied by ICR were difficult to meet. Another reason given was that there was lack of need and they issue shares keeping the economy in sight.

12000 10000 8000 Non-current liabities 6000 4000 2000 0 2007 2008 2009 2010 2011 Current Liabilities Total liabilities

The non- current liabilities such as long term loans rise in 2007-08 as the management invested in Supernet as it considered this investment as strategic and believed that the subsidiary Company would be able to achieve its full potential and would make adequate profit and generate positive cash flows. Also in 2008, long term loans were taken to finance the acquisition of various licenses from Pakistan Telecommunication Authority (PTA) and the construction and installation of network assets.

The borrowings were given mostly by investment companies and commercial banks as mentioned above in sources of debts. In 2007, The Company has entered into finance lease agreements worth 72,825,000 with various leasing companies and commercial banks, in respect of payphones and ancillary equipment, wireless local loop equipment and vehicles, which decreased to 0 in 2011. Other dues include the due to PTA taken in 2005 in respect of license and related frequencies acquired by the company which were paid in 2009. Also in 2009, 2010 and 2011 bonuses were also given to employees. The long term loans show a decreasing trend as there were bullet repayments ( explain bullet!)in the last 3 years. The trend of short term loans also show that when long term loans were taken in 2008 there were less short term loans in 2008-09. In fact they were no short term loans taken on 2009. The current maturity of long term finances rises rapidly in 2009 as there were some loans with the maturity of 12 months taken in 2008. (where is the trend??? If you want her to see it frm balance sheet then state it!) The overall trend of liabilities has been decreasing because of bullet repayments of loans and less investment in the past 3 years as can be seen in the attached balance sheet of showing the trend of 5 years. The capital structure is kept consistent at 50% equity and 50% debt throughout the 5 years. Mr. Hashim told us that they will continue this policy because of 2 reasons: 1. Telecard Limited took a cellular license worth 291 mn dollars in early 2000 and took a loan of 2.4 billion in 2004. Therefore their priority is to repay those loans. 2. Due to increased competition from cellular services companies, Telecards growth was not in accordance to what was expected. The following factors were involved in following a consistent capital structure: Limited mobility Decline in call prices and reduction in demand for payphone services, the Company was not able to increase its revenues from the relevant markets Competition Revenues less then cost incurred. Repayment of loans. They shifted their focus from retailers to wholesale corporates.

Mr. Hashim Ali told us that telecard limited is growing in line with its competitors like Worldcall and there capital structure is better than its competitors in terms of the areas in which

they operate. Supernet and Arfeen, its subsidiaries are all making money and are listed in KSC index. Also they were the only one to give dividends in a year when none of the competitors gave.

Dividend Policy

The company has not been consistent in paying dividends to its stockholders from 2007 to 2011. It paid dividends in 2010 just to comply with the terms of a listed company. Therefore, Telecard does not have ha any particular dividend policy, they paid dividends just to be safe themselves from getting to default list. Although the company faced a loss in years 2008, 2007 and 2006, it still did not pay dividends in 2009 and 2011. Telecard limited had a net income of Rs. 44.068 million in 2009, 74.41 million in 2011 but due to the cumulative losses and in view of challenges ahead, the directors did not recommend dividends and decided to retain all its dividends. In 2010, it paid dividends of Rs. 0.10 to its shareholders which make the dividend total amount to Rs. 30,000 as there are 300,000 shares. The net loss/profit of the company from year 2007 to 2011 is shown in the table below:

2011 2010 2009 ------- (Rupees in 000) ------NET PROFIT / (LOSS) FOR THE YEAR

2008

2007

74,410

698,462 44,068

(542,536)

(444,962)

CONCLUSIONS AND RECOMMENDATIONS Telecard does not plan to have any kind of specific dividend policy for at least next five years. They are focusing on how to improve their financial conditions of the company at the moment. Telecards finance general manager authenticate that they are satisfied with current financing mix. Telecard and lenders have confidence in each others abilities therefore Telecard is not looking out for any other sources or options. Company is fighting several lawsuits currently. The major one is against PTA. If that case is decided in Telecards favor then according to finance manager, company would be able to cover all its cost. Telecard should invest in products which are in accordance with the market demand and not invest in products which have high costs than their competitors.

Das könnte Ihnen auch gefallen

- All Share ListDokument11 SeitenAll Share ListMoeenuddin HashimNoch keine Bewertungen

- Tariff Rationalisation ListDokument25 SeitenTariff Rationalisation ListMoeenuddin HashimNoch keine Bewertungen

- HBL 3Q2021 Results Call InvitationDokument1 SeiteHBL 3Q2021 Results Call InvitationMoeenuddin HashimNoch keine Bewertungen

- Ethics Report - Ethics of SanctionsDokument42 SeitenEthics Report - Ethics of SanctionsMoeenuddin HashimNoch keine Bewertungen

- Defaulter ListDokument3 SeitenDefaulter ListMoeenuddin HashimNoch keine Bewertungen

- Dairy IndustryDokument19 SeitenDairy IndustryMoeenuddin HashimNoch keine Bewertungen

- A Nonconsenus Take On Coronavirus in PakistanDokument3 SeitenA Nonconsenus Take On Coronavirus in PakistanMoeenuddin HashimNoch keine Bewertungen

- Non Consensus Take On COVID-19 in Pakistan (Revised)Dokument9 SeitenNon Consensus Take On COVID-19 in Pakistan (Revised)Moeenuddin HashimNoch keine Bewertungen

- ETHICS - Cyber EthicsDokument18 SeitenETHICS - Cyber EthicsMoeenuddin Hashim100% (1)

- Cement IndustryDokument15 SeitenCement IndustryMoeenuddin HashimNoch keine Bewertungen

- Pizzahut Vs NandosDokument10 SeitenPizzahut Vs NandosMoeenuddin HashimNoch keine Bewertungen

- Marketing ReportDokument9 SeitenMarketing ReportMoeenuddin HashimNoch keine Bewertungen

- 2892011114550-Keller - SBM3 - Casenotes For The TeachersDokument91 Seiten2892011114550-Keller - SBM3 - Casenotes For The TeachersMoeenuddin HashimNoch keine Bewertungen

- 2892011114550-Keller - SBM3 - Casenotes For The TeachersDokument91 Seiten2892011114550-Keller - SBM3 - Casenotes For The TeachersMoeenuddin HashimNoch keine Bewertungen

- IGI Report 2012Dokument132 SeitenIGI Report 2012Moeenuddin HashimNoch keine Bewertungen

- Engro Corp Annual Report 2012Dokument188 SeitenEngro Corp Annual Report 2012Khurram AbbasNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledMoeenuddin HashimNoch keine Bewertungen

- PACKAGES Report 2009Dokument52 SeitenPACKAGES Report 2009Moeenuddin HashimNoch keine Bewertungen

- Clifford BobDokument10 SeitenClifford BobMoeenuddin HashimNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Ramesh Dargond Shine Commerce Classes NotesDokument11 SeitenRamesh Dargond Shine Commerce Classes NotesRajath KumarNoch keine Bewertungen

- Bravo Jr. v. BorjaDokument2 SeitenBravo Jr. v. BorjaMaria AnalynNoch keine Bewertungen

- Assignment 3-WEF-Global Competitive IndexDokument3 SeitenAssignment 3-WEF-Global Competitive IndexNauman MalikNoch keine Bewertungen

- Topic 8 - Managing Early Growth of The New VentureDokument11 SeitenTopic 8 - Managing Early Growth of The New VentureMohamad Amirul Azry Chow100% (3)

- C++ Project On Library Management by KCDokument53 SeitenC++ Project On Library Management by KCkeval71% (114)

- 8086 ProgramsDokument61 Seiten8086 ProgramsBmanNoch keine Bewertungen

- Plusnet Cancellation FormDokument2 SeitenPlusnet Cancellation FormJoJo GunnellNoch keine Bewertungen

- Case Study 1Dokument2 SeitenCase Study 1Diana Therese CuadraNoch keine Bewertungen

- AMA Manual 10th Edition PDFDokument1.014 SeitenAMA Manual 10th Edition PDFKannan Fangs S100% (2)

- PeripheralDokument25 SeitenPeripheralMans FansNoch keine Bewertungen

- Isha Hatha Yoga - Program Registration FormDokument2 SeitenIsha Hatha Yoga - Program Registration FormKeyur GadaNoch keine Bewertungen

- It - Unit 14 - Assignment 2 1Dokument8 SeitenIt - Unit 14 - Assignment 2 1api-669143014Noch keine Bewertungen

- A Business Development PlanDokument90 SeitenA Business Development PlanRishabh Sarawagi100% (1)

- 14.marifosque v. People 435 SCRA 332 PDFDokument8 Seiten14.marifosque v. People 435 SCRA 332 PDFaspiringlawyer1234Noch keine Bewertungen

- ThumbDokument32 SeitenThumbdhapraNoch keine Bewertungen

- I Could Easily FallDokument3 SeitenI Could Easily FallBenji100% (1)

- 14 XS DLX 15 - 11039691Dokument22 Seiten14 XS DLX 15 - 11039691Ramdek Ramdek100% (1)

- BSP Memorandum No. M-2022-035Dokument1 SeiteBSP Memorandum No. M-2022-035Gleim Brean EranNoch keine Bewertungen

- TIA Portal v11 - HMI ConnectionDokument4 SeitenTIA Portal v11 - HMI ConnectionasdasdasdasdasdasdasadaNoch keine Bewertungen

- Operations Management Dr. Loay Salhieh Case Study #1: Students: Hadil Mosa Marah Akroush Mohammad Rajab Ousama SammawiDokument6 SeitenOperations Management Dr. Loay Salhieh Case Study #1: Students: Hadil Mosa Marah Akroush Mohammad Rajab Ousama SammawiHadeel Almousa100% (1)

- Toyota TPMDokument23 SeitenToyota TPMchteo1976Noch keine Bewertungen

- LEGAL STATUs of A PersonDokument24 SeitenLEGAL STATUs of A Personpravas naikNoch keine Bewertungen

- Something About UsDokument18 SeitenSomething About UsFercho CarrascoNoch keine Bewertungen

- Module 1: Overview of Implementation of The NSTP (Activities)Dokument3 SeitenModule 1: Overview of Implementation of The NSTP (Activities)RonnelNoch keine Bewertungen

- Metabolic Pathway of Carbohydrate and GlycolysisDokument22 SeitenMetabolic Pathway of Carbohydrate and GlycolysisDarshansinh MahidaNoch keine Bewertungen

- Mech Course HandbookDokument20 SeitenMech Course Handbookbrody lubkeyNoch keine Bewertungen

- Lecture1 SEODokument24 SeitenLecture1 SEOUsman AnwarNoch keine Bewertungen

- Trends Interiors Architecture Fashion Lifestyle: 6 Spring 2013 Collector's EditionDokument116 SeitenTrends Interiors Architecture Fashion Lifestyle: 6 Spring 2013 Collector's EditionFernanda RaquelNoch keine Bewertungen

- No-Vacation NationDokument24 SeitenNo-Vacation NationCenter for Economic and Policy Research91% (54)

- Linear RegressionDokument56 SeitenLinear RegressionRanz CruzNoch keine Bewertungen