Beruflich Dokumente

Kultur Dokumente

International Trade and Balance of Payment

Hochgeladen von

Versatile Vethri IICopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

International Trade and Balance of Payment

Hochgeladen von

Versatile Vethri IICopyright:

Verfügbare Formate

International trade and balance of payment Introduction Malaysias international trade experienced tremendous growth throughout the last

3 decades and it plays a large role in Malaysian economy. Malaysia has managed to maintain a positive trade balance, exporting more goods than it imports even during the recession in 1997 and 1998.In 2011, Malaysia post a trade balance of RM120.32 billion. It was the second highest ever recorded. The highest was recorded prior to global recession in 2008 at RM143.21 billion. international trade is the exchange of products, services, and money across national borders; essentially trade between countries. When consumers in the U.S. purchase Swiss-made watches, Guatemalan-grown fruits, Chinese-made toys and electronics, and Japanese-manufactured automobiles, they experience the end result of international trade. Also known as foreign trade, international trade has been maintained since the dawn of time. Trading goods were transported on the backs of tradesmen across tribal boundaries, and bartered and sold among neighboring, and, hopefully, accommodating tribesmen. The Silk Road between Europe and Asia is one example of the sometimes beneficial, sometimes troubling essentials of international trade. Asian silks and spices were traded for European technology and weapons, with varying benefits and consequences. Domestic trade is the purchase and sale of products and services within a particular nations borders, and is inherently limiting to a modern national economy. International trade, conversely, raises national gross domestic product (GDP) by providing vastly expanded economic opportunity. It is, therefore, incumbent upon the global economic community to promote fair trade between nations. In addition, the ability of nations to trade freely with all others is also vital for profits. Free trade, fair trade, and profits are the cornerstones of global economic well-being.

The roles of international trade on Malaysian economy

Imports goods are regarded as imports when they are brought into the country either directly or into bonded warehouses, irrespective of whether such goods are for consumption, to be processed, use in manufacturing or subsequent re-exports to other countries. It is also termed as `general imports'. Exports Goods (locally produced or manufactured or imported for subsequent re-exports) are regarded as exports when they are taken out of the country. It is also termed as `general exports'. Re-exports Goods are regarded as re-exports when they are taken out of the country in the same form as they were imported without any transformation. Re-packing, sorting or grading processes are not considered as part of the transformation process.

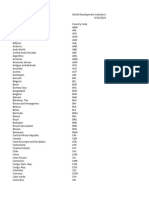

Analysis international trade trend

Year

Total Exports

Total Imports

Trade Balance

Total Trade

(RM Billion) (RM Billion) (RM Billion) (RM Billion)

1980 1985 1990 1995 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 28.01 37.58 77.46 179.49 193.13 218.7 281.26 373.27 334.28 357.43 397.88 481.25 536.23 588.97 604.3 663.01 552.51 638.82 694.55 22.78 28.69 70.37 179.39 182.97 207.36 247.9 311.46 280.23 303.09 316.54 399.63 432.87 478.15 502.04 519.8 434.67 528.83 574.23 5.24 8.88 7.09 0.1 10.15 11.34 33.36 61.81 54.05 54.34 81.35 81.62 103.36 111.09 102.26 143.21 117.85 109.99 120.32 50.79 66.27 147.83 358.88 376.10 426.06 529.16 684.73 614.51 660.52 714.42 880.88 969.10 1067.12 1106.34 1182.81 987.18 1167.65 1268.78

Balance of payment Balance of Payments is a statistical statement that summarizes transactions between residents and nonresidents during a period. The balance of payments comprises the current account, the capital account, and the financial account. "Together, these accounts balance in the sense that the sum of the entries is conceptually zero. The balance of trade is the difference between the value of exports and imports. When exports exceed imports it is recorded as a surplus while a deficit is registered when imports exceed exports. Balance of Payment can be used as an indicator of economic and political stability. For e.g. if a country has a consistently positive BOP, it would mean that there is significant foreign investment within that country. It also includes the trade balance, foreign investments and investments by foreigners.

Balance of Payments in Malaysia from 2005 to 2009 is as follows: Balance of Payments Ringgi 2005 t Malaysia in Million (RM in Million) Goods (net) Services and income (net) Current account balance Capital and financial account balance 128,892 -33,555

2006

2007

2008

2009

134,558 -24,202

127,673 -11,520

170,116 -23,131

108,10 3 -11,474

78,367 -36,991

93,504 -43,488

100,410 -37,710

129,936 123,596

80,003 -

Overall balance Central Bank international Reserves

13,550 265,240

25,158 290,399

45,296 335,695

-18,250 317,445

Months of retained 7.7 imports

7.8

8.4

7.6

Problem and Prospect

International trade is characterised by the following special problems or prospect. 1. Distance: Due to long distance between different countries, it is difficult to establish quick and close trade contacts between traders. Buyers and sellers rarely meet one another and personal contact is rarely possible. There is a great time lag between placement of order and receipt of goods from foreign countries. Distance creates higher costs of transportation and greater risks. 2. Different languages: Different languages are spoken and written in different countries. Price lists and catalogues are prepared in foreign languages. Advertisements and correspondence also are to be done in foreign languages. A trader wishing to buy or sell goods abroad must know the foreign language or employ somebody who knows that language. 3. Difficulty in transportation and communication: Dispatch and receipt of goods takes a longer time and involves considerable expenses. During the war and natural calamities, transportation of goods becomes even more difficult. Similarly, the costs of sending or receiving information are very high. 4. Risk in transit: Foreign trade involves much greater risk than home trade. Goods have to be transported over long distances and they are exposed to perils of the sea. Many of these risks can be covered through marine insurance but increases the cost of goods. 5. Lack of information about foreign businessmen:

In the absence of direct and close relationship between buyers and sellers, special steps are necessary to verify the creditworthiness of foreign buyers. It is difficult to obtain reliable information concerning the financial position and business standing of the foreign traders. Therefore, credit risk is high. 6. Import and export restrictions: Every country charges customs duties on imports to protect its home industries. Similarly, tariff rates are put on exports of raw materials. Importers and exporters have to face tariff restrictions. They are required to fulfil several customs formalities and rules. Foreign trade policy, procedures, rules and regulations differ from country to country and keep on changing from time to time. 7. Documentation: Both exporters and importers have to prepare several documents which involve expenditure of time and money. 8. Study of foreign markets: Every foreign market has its own characteristics. It has requirements, customs, weights and measures, marketing methods, etc., of its own. An extensive study of foreign markets is essential for success in foreign trade. It is very difficult to collect accurate and up to date information about foreign markets. 9. Problems in payments: Every country has its own currency and the rate at which one currency can be exchanged for another (called exchange rate) keeps on fluctuating change in exchange rate create additional risk. Remittance of money for payments in foreign trade involves much time and expense. Due to wide time gap between dispatch of goods and receipt of payment, there is greater risk of bad debts. 10. Frequent market changes: It is difficult to anticipate changes in demand and supply conditions abroad. Prices in international markets may change frequently. Such changes are due to entry of new competitors, changes in buyers' preferences, changes in import duties and freight rates, fluctuations in exchange rates, etc. 11. Investment for longer period: There is longer time gap between supply of goods and receipt of payment. Therefore, the exporter's capital remains locked up over a longer period. 12. Intense competition:

Traders who want to sell goods abroad have to face severe competition from different countries. Considerable market research is necessary to ensure suitability of product in foreign markets. Heavy expenditure on advertising and sales promotion may be necessary

Malaysia's international trade experienced tremendous growth throughout the last 3 decades. The Malaysian government welcomed export-oriented industries, created a very positive investment environment in the country, and fostered close relations between government and private businesses. The government established a few barriers on the importation of goods and services, although it often opted for selective intervention and for protecting some sectors of the national economy. Over 5 years, Malaysia more than doubled its exports from US$29.416 billion in 1990 to US$74.037 billion in 1995. After the 1997 regional financial turmoil, Malaysia experienced economic recession, although this recession was much smaller and less destructive than that in South Korea or in Indonesia. Due to tough economic measures, Malaysia's exports recovered and reached US$83.5 billion in 1999. Historically, the United States has long been one of Malaysia's largest trading partners, its exports to the United States reaching 21.9 percent in 1999, a year in which it was the United States' 12th largest trading partner. Trade between these 2 countries consisted mainly of assembled electrical goods and manufactured electronic products. Neighboring Singapore is traditionally the second-largest export market, with the proportion of goods to Singapore reaching 16.5 percent and dominated by electrical and electronic equipment, machinery, metals, and mineral fuels. Japan is in third place at 11.6 percent, and, once again, exports are dominated by electrical and electronic equipment, machinery and mineral fuels. Other export destinations are the Netherlands, Taiwan, and Hong Kong. Japan, the United States, and Singapore are also the 3 largest sources of imports. Most Malaysian imports originate from Japan, with the Japanese share of imported products reaching 20.8 percent in 1999, and consisting mainly of electrical and electronic equipment and machinery. The second most important source of imports is the United States, totaling 17.4 percent and dominated by electrical and electronic equipment and transportation equipment. Malaysia was the United States' 17th largest export market in 1999. Malaysia's third most important source of imports is Singapore, totaling 14.0 percent. During the last 3 decades, Malaysian exports shifted from the sale of agricultural products, raw and processed natural resources, and labor-intensive manufactured goods (including clothing,

footwear, and textiles) to the sale of skill-intensive products, including electrical and electronic equipment and parts, and services. The proportion of exported electrical machinery, appliances, and partsincluding semiconductors, electronic equipment, and electrical appliancesreached almost 56 percent in 1998. The other important export products were commodities, chemicals and chemical products, manufactured metal products, and textiles, clothing, and footwear. Malaysia has managed to maintain a positive trade balance, exporting more goods than it imports. Even during the recession of 1997 and 1998, the country had a large trade surplus of US$4.0 billion in 1997 and US$17.7 billion in 1998. In the mid-1990s Malaysia faced growing competition from neighboring Indonesia, the Philippines, and Thailand, which could offer cheaper labor and larger and growing domestic markets. However, recent political and economic uncertainty in the region, especially military conflicts and terrorist activities in Indonesia and the Philippines has undermined the attractiveness of those markets. This has given an advantage to politically and economically stable Malaysia, although its government has often been criticized for the undemocratic measures used to maintain stability and political balance within the country. Although Malaysia's industrialization and economic growth is highly dependent on international trade, the Malaysian government was less supportive of full economic liberalization than neighboring Singapore. Malaysia's leadership was quite reluctant to support free trade within the Asia Pacific Economic Co-operation (APEC) region, arguing that developing countries need more time to prepare for lifting all trade barriers. Additionally, the Malaysian prime minister, Dr. Mahathir, suggested setting up a new regional body, the East Asian Economic Caucus (EAEC), in order to strengthen the negotiating power of East-Asian countries with regard to the North American Free-Trade Agreement (NAFTA) and the European Union.

Das könnte Ihnen auch gefallen

- International BusinessDokument11 SeitenInternational BusinessJoynul Abedin100% (2)

- International Trade and AgreementDokument119 SeitenInternational Trade and AgreementAirah Golingay100% (1)

- Export and Import ManagementDokument29 SeitenExport and Import Managementcatchrekhacool100% (6)

- Term Foreign Trade Defination:: Goods and ServicesDokument77 SeitenTerm Foreign Trade Defination:: Goods and ServicesIam Amy100% (1)

- TariffDokument38 SeitenTariffjainaashiNoch keine Bewertungen

- Special Economic ZoneDokument17 SeitenSpecial Economic Zonehimanshu_choudhary_2Noch keine Bewertungen

- CMAPart1C (InternationalBusinessEnvironment)Dokument29 SeitenCMAPart1C (InternationalBusinessEnvironment)St Dalfour CebuNoch keine Bewertungen

- International BusinessDokument115 SeitenInternational BusinessSakshi Relan100% (1)

- International TradeDokument28 SeitenInternational TradeVaishnavi KrushakthiNoch keine Bewertungen

- Incoterms 2010Dokument78 SeitenIncoterms 2010Jon Gilbert MagnoNoch keine Bewertungen

- Problems in International TradeDokument4 SeitenProblems in International TradeDhananjay KumarNoch keine Bewertungen

- International Economic NotesDokument57 SeitenInternational Economic NotesAamale KhanNoch keine Bewertungen

- International Trade: IntroductionDokument17 SeitenInternational Trade: IntroductionDevyani RathoreNoch keine Bewertungen

- Economice SS3 Second Term NoteDokument42 SeitenEconomice SS3 Second Term NotenwabuezecnwosuNoch keine Bewertungen

- Final PRJCT EcoDokument42 SeitenFinal PRJCT EcoHitesh MoreNoch keine Bewertungen

- Handout 1 International TradeDokument3 SeitenHandout 1 International TradeKatherine EspirituNoch keine Bewertungen

- International Trade: Difference Between Trade and CommerceDokument22 SeitenInternational Trade: Difference Between Trade and CommerceAfad KhanNoch keine Bewertungen

- Int EconomicsDokument182 SeitenInt EconomicsK ANoch keine Bewertungen

- Export and Import Management 1Dokument32 SeitenExport and Import Management 1Sri Ganesh ComputersNoch keine Bewertungen

- Economics Garade 12Dokument45 SeitenEconomics Garade 12Barzala CarcarNoch keine Bewertungen

- Module 4Dokument4 SeitenModule 4vipin kpNoch keine Bewertungen

- International Economics UniversityDokument183 SeitenInternational Economics UniversityRahul sahuNoch keine Bewertungen

- BM (Unit 5) NotesDokument15 SeitenBM (Unit 5) NotesMohd asimNoch keine Bewertungen

- Definition of International TradeDokument7 SeitenDefinition of International TradeSinta YuliawatiNoch keine Bewertungen

- BE 3 Unit Globlization StrategiesDokument15 SeitenBE 3 Unit Globlization StrategiesHasrat AliNoch keine Bewertungen

- Itbp - 01Dokument19 SeitenItbp - 01UJJWAL SHARMANoch keine Bewertungen

- Module 1 IfmDokument17 SeitenModule 1 IfmAYISHA BEEVI UNoch keine Bewertungen

- Research Paper On International Trade in IndiaDokument8 SeitenResearch Paper On International Trade in Indiapdtgpuplg100% (1)

- Ibiv FTP 2Dokument382 SeitenIbiv FTP 2Srinivasa KirankumarNoch keine Bewertungen

- International Trade-Written ReportDokument18 SeitenInternational Trade-Written ReportKyotNoch keine Bewertungen

- 2ND Term S1 CommerceDokument21 Seiten2ND Term S1 CommerceJudith NgeneNoch keine Bewertungen

- IntroductionDokument22 SeitenIntroductionADHADUK RONS MAHENDRABHAINoch keine Bewertungen

- International BusinessDokument27 SeitenInternational BusinessRizsNoch keine Bewertungen

- 2 Why Do Nation TradeDokument4 Seiten2 Why Do Nation TradeAfrina JannatNoch keine Bewertungen

- TradeDokument12 SeitenTradeQarsam IlyasNoch keine Bewertungen

- Nazeer Trade Barriers AsgnmntsDokument8 SeitenNazeer Trade Barriers AsgnmntsNazeeruddin MohammedNoch keine Bewertungen

- Chapter 1 SolutionDokument2 SeitenChapter 1 SolutionRicha Joshi100% (1)

- Aditi Project FCDokument23 SeitenAditi Project FCraoraneaditi0Noch keine Bewertungen

- International Trade 2 - Week 3Dokument15 SeitenInternational Trade 2 - Week 3Ahmad Dwi Syaiful AmriIB102Noch keine Bewertungen

- International Business I&iiDokument36 SeitenInternational Business I&iilakshman rajNoch keine Bewertungen

- Chap 2,5Dokument16 SeitenChap 2,5Trâm PhạmNoch keine Bewertungen

- Recent Trends in Indias Foreign TradeDokument25 SeitenRecent Trends in Indias Foreign TradePiYaSaiNiNoch keine Bewertungen

- IRL 3109 - Lecture 3 (2020-11-19)Dokument6 SeitenIRL 3109 - Lecture 3 (2020-11-19)nolissaNoch keine Bewertungen

- European Union Mercosur: From Wikipedia, The Free EncyclopediaDokument3 SeitenEuropean Union Mercosur: From Wikipedia, The Free EncyclopediaTricia DazaNoch keine Bewertungen

- What Is Foreign TradeDokument2 SeitenWhat Is Foreign Tradeviswaprakash_vNoch keine Bewertungen

- The 20 To The 21 Century First World War: TH STDokument11 SeitenThe 20 To The 21 Century First World War: TH STNiekyVegaMoscosoNoch keine Bewertungen

- The Structures of GlobalizationDokument4 SeitenThe Structures of GlobalizationGerald Jaboyanon MondragonNoch keine Bewertungen

- Lecture Note 1 On IcfDokument16 SeitenLecture Note 1 On IcfdemolaojaomoNoch keine Bewertungen

- Introduction To International EconomicsDokument316 SeitenIntroduction To International EconomicsabcdNoch keine Bewertungen

- MGT107 IBT Midterm ReviewerDokument15 SeitenMGT107 IBT Midterm ReviewerMary Grace AlzateNoch keine Bewertungen

- GE 5 Contempo (Prelim Reviewer)Dokument4 SeitenGE 5 Contempo (Prelim Reviewer)RothNoch keine Bewertungen

- Technological University of The Philippines: Taguig CampusDokument46 SeitenTechnological University of The Philippines: Taguig CampusXyramhel AcirolNoch keine Bewertungen

- Bock 1 MS 97 Unit 1Dokument18 SeitenBock 1 MS 97 Unit 1vinivasu06Noch keine Bewertungen

- International Trade Practices and PoliciesDokument12 SeitenInternational Trade Practices and Policieshoneyyy beeNoch keine Bewertungen

- Group 6 International Trade Written ReportDokument6 SeitenGroup 6 International Trade Written ReportFionalyn Mel ValenzuelaNoch keine Bewertungen

- Economic SystemDokument7 SeitenEconomic SystemHabib ur RehmanNoch keine Bewertungen

- 1 India Foreign Trade FeautresDokument12 Seiten1 India Foreign Trade Feautresvanshii100% (1)

- 1 India Foreign Trade FeautresDokument12 Seiten1 India Foreign Trade FeautresvanshiiNoch keine Bewertungen

- CP 102 Unit 5Dokument55 SeitenCP 102 Unit 5Kumardeep SinghaNoch keine Bewertungen

- Exercise No. 1 Econimic System: Market, DirectivesDokument16 SeitenExercise No. 1 Econimic System: Market, DirectivesCristi YssayNoch keine Bewertungen

- International Trade PDFDokument4 SeitenInternational Trade PDFanto juaNoch keine Bewertungen

- Global EconomyDokument4 SeitenGlobal EconomyKarinaNoch keine Bewertungen

- B321 L07 L08 Trade ProtectionismDokument24 SeitenB321 L07 L08 Trade ProtectionismEunice JadeNoch keine Bewertungen

- Main Types of Foreign Exchange RatesDokument4 SeitenMain Types of Foreign Exchange RatesMir AqibNoch keine Bewertungen

- Unit-6 Global Business EnvironmentDokument35 SeitenUnit-6 Global Business EnvironmentCHANDANI YADAVNoch keine Bewertungen

- Activity 4 Global EconomyDokument1 SeiteActivity 4 Global EconomyMark Vincent Z. PadillaNoch keine Bewertungen

- Explaining Rapid Inter Nationalization Process - Suzlon CaseDokument81 SeitenExplaining Rapid Inter Nationalization Process - Suzlon CaseMathias ThamhainNoch keine Bewertungen

- Introduction To Customs and Excise DutyDokument11 SeitenIntroduction To Customs and Excise Dutykrishna kumar rNoch keine Bewertungen

- SSRN Id3924952Dokument4 SeitenSSRN Id3924952李宁0% (1)

- Chapter 10 - International Business FinanceDokument5 SeitenChapter 10 - International Business FinanceNicole Feliz InfanteNoch keine Bewertungen

- Incoterms - 2020 - Overview (Chart)Dokument1 SeiteIncoterms - 2020 - Overview (Chart)arabsniperNoch keine Bewertungen

- Chapter - 6 Regional Economic GroupingsDokument9 SeitenChapter - 6 Regional Economic Groupingskirthi nairNoch keine Bewertungen

- PPTDokument43 SeitenPPTNilesh PrajapatiNoch keine Bewertungen

- Bangladesh and International TradeDokument21 SeitenBangladesh and International TradeFiroj AhmedNoch keine Bewertungen

- International Financial Management: Power Points by Aditi RodeDokument52 SeitenInternational Financial Management: Power Points by Aditi RodevijayrajawatNoch keine Bewertungen

- CH 01 International BusinessDokument17 SeitenCH 01 International BusinessSaima MunawarNoch keine Bewertungen

- Chapter 8 Government Intervention in International BusinessDokument6 SeitenChapter 8 Government Intervention in International BusinessdivyaNoch keine Bewertungen

- Term Paper On Trade War Between USA and China-Implications For BangladeshDokument28 SeitenTerm Paper On Trade War Between USA and China-Implications For BangladeshMusabbir AhmedNoch keine Bewertungen

- The US China Trade WarDokument12 SeitenThe US China Trade WarNGUYET NGUYEN NGOC NHUNoch keine Bewertungen

- Mbe SyllabusDokument47 SeitenMbe SyllabussanyasamNoch keine Bewertungen

- International Finance Question PaperDokument1 SeiteInternational Finance Question PaperHema LathaNoch keine Bewertungen

- 2a1f7d8b61dd52f01454b9fc2ffa8fc1Dokument17 Seiten2a1f7d8b61dd52f01454b9fc2ffa8fc1Qarsam Ilyas100% (1)

- Types of Trade BlocksDokument1 SeiteTypes of Trade BlocksCEMA2009Noch keine Bewertungen

- IEL Course Outline 2019Dokument5 SeitenIEL Course Outline 2019wurliNoch keine Bewertungen

- API BX - Klt.dinv - CD.WD Ds2 en Excel v2 5872141Dokument74 SeitenAPI BX - Klt.dinv - CD.WD Ds2 en Excel v2 5872141Mihalciuc VladNoch keine Bewertungen

- Ge03 2023 1st Semester Midterm ExamDokument3 SeitenGe03 2023 1st Semester Midterm ExamBernadette BuenafeNoch keine Bewertungen

- Principles of The Trading System - WtoDokument3 SeitenPrinciples of The Trading System - WtoJoan Pablo100% (1)

- Buying & Selling Exchange Rates of Commercial BanksDokument6 SeitenBuying & Selling Exchange Rates of Commercial BanksJehan Jacob FernandoNoch keine Bewertungen