Beruflich Dokumente

Kultur Dokumente

Master of Business Administration

Hochgeladen von

Shubham MathurCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Master of Business Administration

Hochgeladen von

Shubham MathurCopyright:

Verfügbare Formate

Master of Business Administration- MBA Semester 4 MU0015 Compensation Benefits - 4 Credits (Book ID: B1336) Assignment (60 Marks)

Q1. Discuss the elements of compensation package. Answer: Compensation refers to money and money-related extras. Thus, in addition to a persons base pay, compensation can include bonuses, merit increases, variable pay, and long-term Incentives. Benefits include the remaining things, such as healthcare, pension plans, stock options, and legal services. An organisations compensation program sends a message to employees about its commitment to encouraging, recognising, and rewarding employee performance. While money should certainly never be the only motivator, it is definitely important. To be successful, a compensation program must linkemployee performance with business performance. Employees have to understand what the company expects of them, why the company expects it and the possible rewards when performance expectations are met. Taking this approach in preparing the pay structure provides an ownership context for employees, knowing they are important to the ongoing success of the organisation, and that if they do their part well, they will share in the rewards generated by that success.

Elements of compensation Let us first discuss the elements of compensation and later we shall discuss what goes into benefits.

The primary elements of a compensation package are:

Base pay: Base pay is the fixed rate of compensation that an employee receives for performing the standard duties and assignment of a job. Employers need to ensure that base-pay programs are designed to reveal market practices within their identified competitor group. To achieve this, organisations must first identify their competitive market. This can be achieved by considering different factors, including the nature of the industry, geographic location, total employment and annual revenue. Next, they need to conduct an assessment of market pay practices for similar jobs

2 The employee recruitment and retention handbook by Diane Arthur within the recognised competitor group. This assessment should involve the duties, skills, and impact levels of each job evaluated that is, each job of similar size and scope.

Then a pay structure for managing the competitive base-pay levels for the jobs throughout the organisation should be developed. Pay structures typically consist of a series of pay ranges or bands that reveal competitive rates of pay for specific jobs, as well as allowing room for salary growth.

Jobs of similar value from both the market point of view and an internal point of view are grouped together. Then a competitive pay range is developed around the market rates for the particular jobs.

Variable pay: Performance-based variable pay continues to achieve momentum as a more successful way to identify and reward employee performance. Also known as pay-perperformance, variable pay is popular in todays corporate world. By including a percentage of variable pay in the compensation plan, organisations ensure that two people with different efficiency levels do not get the same benefits. By doing this, the company rewards productivity and hard work and motivates the under-performers to work hard. Once limited to senior management levels, these incentive or bonus plans are being redesigned to reward the achievement of specific company or employee performance objectives. In a variable pay plan, the size of the award varies among employees and from one performance period to another, based on levels of achievement measured, as well as against pre established company and employee performance targets. Amounts are usually calculated as a percentage of base pay depending on job category and position. Rewards are normally paid in cash on an annual, semi annual or quarterly basis depending on the plan design. Plan designs range from sales-commission types to individual incentive or bonus plans to team awards. The main idea of these programs is to reward innovation and hard work and to discourage mediocrity in performance.

Skill and competency-based pay: Skill-based pay offers employees extra compensation when they have new skills specially recognised by the company as essential to achieve a competitive advantage. Skill-based pay can be particularly useful for employees who like their current jobs but are looking for new challenges. Competency-based pay is more widespread than skill-based pay because the criteria cover not only measurable skills but also knowledge, performance behaviours and personal attributes. It helps out employees to grow in the company and helps them to close the knowledge gaps needed for creative moves.

Long-term incentive compensation: Long-term incentive compensation vehicles, such as stock-option plans and other deferred-compensation plans, which are not usually used to reward performance, are achieving desirability among employees. These long term incentive compensation plans appreciate employees based on company performance over a long term that is typically three to five years. Stock-option plans are a common form of

long-term compensation at public organisations. In most private companies, incentives that reflect stock plans are used for key employees. Long-term compensation plans can be valuable preservation tools for the success of an organisation. They help to focus on driving and improving the key employees to achieve the financial performance of the company over a longer term.

Elements of benefits Company benefits can include a wide range of offerings from standard medical insurance to more modern benefits like prepaid legal services, and applicants who are comparing job offers often narrow their choices down to those that offer the most generous benefits package. Applicants and new employees checking their choices of benefit plans often feel confused and overwhelmed as the terminology used can be difficult to recognise and understand. While the different plans are typically designed to deal with the health and welfare of the employee population, understanding them can be a difficult task. Further complicating matters, some companies share the costs of these benefits with the employees, in an effort to help make up for the significant expenses connected with broad benefit plans. Some of the benefits are discussed below:

Training: For most of the employees, training means more than money. For example, according to one survey of HR executives conducted by the American Management Association, technical and employability training were rated considerably higher than pay-for-performance or bonuses. Companies typically answer to this interest by sending workers to outside conferences and seminars, repaying employees for tuition, offering managerial training and supporting employees in degree programs.

Health care: The benefits that get the most attention from employers today are health care benefits because of the high costs involved in getting goodhealthcare facilities and the increasing concern about staying healthy. In the past, health insurance plans included only medical, surgical and hospital expenses. However, today employers include prescribed drugs and dental, optical and mental healthcare benefits in the package they offer their workers. Typically, an employer offers employees some form of group healthinsurance or set amount to spend on healthcare or personal insurance plans each year. Employees may be offered insurance after working for a specified period of time, and the level of coverage is usually linked to employment status, with part time employees receiving fewer benefits. Depending on the company's plan, employees may have to select thehealthcare plan, paying a small fee while the company pays the remaining amount of the premium or the employer may cover all insurance-related costs. In group benefits, employees can have access to different types ofhealthcare plans, including insurance plans, under which people pay for services at the time of availing

them, and submit a bill to the insurance company for reimbursement. Managed healthcare plans like providing services from health maintenance organisations (HMOs) and preferred provider organisations (PPOs), which offer care through a network of providers are also getting immensely popular.

Pensions: Employees have ranked retirement or pension plans as second to medical coverage. However, many employers offer no pension coverage to their employees. Approximately half of the private-sector workforce is not covered for pension by the employer. There are two main types of pension plans: defined benefit and defined contribution. In defined benefit plans, the benefits are calculated as a percent of the last few or the highest years of earnings multiplied by years of service. They are then paid in the form of life pensions. These plans are adjusted towards those who are expected to work for the same company throughout their career.

Defined contribution plans generally apply to younger workers. This type of pension plan permits workers to save directly from some selected assets of their own choice.

Stock options: Stock options give employees a chance to buy stock in their company at a predetermined price during a limited time period. In todays strong economy, employers have found it increasingly essential to provide stock options to attract the most valued workers. For example, more than 70 percent of technical workers now have stock options and 7 to 12 percent of U.S. companies offer stock option plans to all employees, usually allowing from one hundred to two hundred option shares annually, or an amount based on a percentage of salary.

Generally there are two types of stock options: Discounted stock options: This type of plan permits an employee to buy the companys stock at a price below the market value.

Index options: Some companies issue stock options with employed prices joined to the Standard and Poors 500 Index or other peer group stock index. With this method, if the stock price outperforms the index then the exercise price will be less than the fair market value. If the index outperforms the market, the exercise price will be more than the fair market value.

Q2. List and explain various economic theories of wages.

Das könnte Ihnen auch gefallen

- English Quiz 1 Q 3 WordDokument2 SeitenEnglish Quiz 1 Q 3 WordMelinda RafaelNoch keine Bewertungen

- Solving Multiple Choice and Word Problems in MathDokument5 SeitenSolving Multiple Choice and Word Problems in MathAlfredo L. CariasoNoch keine Bewertungen

- Atmospheric Chemistry and Climate ChangeDokument65 SeitenAtmospheric Chemistry and Climate ChangephilipmeshackNoch keine Bewertungen

- Math ExamDokument4 SeitenMath ExamBenturaNoch keine Bewertungen

- Physics CapsuleDokument33 SeitenPhysics CapsulepranodanNoch keine Bewertungen

- Stoichiometry Calculations for Chemical ReactionsDokument17 SeitenStoichiometry Calculations for Chemical ReactionsYui AlmiñanaNoch keine Bewertungen

- Physics (Solution)Dokument8 SeitenPhysics (Solution)Ankit GuptaNoch keine Bewertungen

- English Quiz - Topic: Family MembersDokument2 SeitenEnglish Quiz - Topic: Family MembersVictoriaNoch keine Bewertungen

- SYLLABUS FOR ASSISTANT PROFESSOR RECRUITMENT EXAMDokument3 SeitenSYLLABUS FOR ASSISTANT PROFESSOR RECRUITMENT EXAMak86Noch keine Bewertungen

- Prof. Rohan Shenoy's Test-Series For MHT-CET Biology - 2009 - Archived Question Paper For PracticeDokument3 SeitenProf. Rohan Shenoy's Test-Series For MHT-CET Biology - 2009 - Archived Question Paper For PracticeBiologyForMHTCETNoch keine Bewertungen

- Free Online Mock Test For MHT-CET BIOLOGY PDFDokument28 SeitenFree Online Mock Test For MHT-CET BIOLOGY PDFBiologyForMHTCET75% (8)

- Cox, Henderson Administration StaffDokument9 SeitenCox, Henderson Administration StaffMcKenzie StaufferNoch keine Bewertungen

- Files2 BiologyDocuments Biology of CottonDokument50 SeitenFiles2 BiologyDocuments Biology of CottonanamikashikhaNoch keine Bewertungen

- BiologyDokument222 SeitenBiologypNoch keine Bewertungen

- PPT MFG Chapter39 FinalDokument32 SeitenPPT MFG Chapter39 FinalSeçkin DilekNoch keine Bewertungen

- Grammar and Modal Verbs WorksheetDokument1 SeiteGrammar and Modal Verbs WorksheetMarie Grace Cusi SuarezNoch keine Bewertungen

- Saeed Book Bank: S.# Isbn/Tag Author Title Cur. PriceDokument11 SeitenSaeed Book Bank: S.# Isbn/Tag Author Title Cur. PriceHassan Ali BhuttaNoch keine Bewertungen

- Exam Practice Math 2107Dokument3 SeitenExam Practice Math 2107wylenaNoch keine Bewertungen

- Business Administration NVQ Level 3Dokument2 SeitenBusiness Administration NVQ Level 3agathavigo100% (1)

- ALT Quiz in English 8Dokument1 SeiteALT Quiz in English 8Cath Casaway100% (1)

- Supercharger: From Wikipedia, The Free EncyclopediaDokument12 SeitenSupercharger: From Wikipedia, The Free EncyclopediaSesan FesobiNoch keine Bewertungen

- Highschool ChemistryDokument9 SeitenHighschool Chemistrystarskyhutch0000Noch keine Bewertungen

- Taming The Power GridDokument20 SeitenTaming The Power Gridlisused100% (1)

- Che 323 Problem Set 6: Electrochemistry March 12, 2014 Engr. May V. Tampus ConceptsDokument1 SeiteChe 323 Problem Set 6: Electrochemistry March 12, 2014 Engr. May V. Tampus ConceptsLouie G NavaltaNoch keine Bewertungen

- Cell Division - Key PointsDokument10 SeitenCell Division - Key PointssivarajeshwarNoch keine Bewertungen

- VP Director Operations Semiconductor in San Francisco Bay CA Resume Joel CamardaDokument3 SeitenVP Director Operations Semiconductor in San Francisco Bay CA Resume Joel CamardaJoelCamardaNoch keine Bewertungen

- PPT-2 Modeling and Simulation Brief IdeaDokument26 SeitenPPT-2 Modeling and Simulation Brief IdeaGurjeet SinghNoch keine Bewertungen

- ChemistryDokument8 SeitenChemistryRachel LewisNoch keine Bewertungen

- Grade 10 Physics Test Questions on Momentum, Forces and MotionDokument4 SeitenGrade 10 Physics Test Questions on Momentum, Forces and Motionsmoabayomi3575Noch keine Bewertungen

- Softcopy Iitneet Kvpy Olympiad 6th 7th 8th 9th 10th Material Editable Softcopy of Bansal Resonance Fiitjee StudymaterialDokument6 SeitenSoftcopy Iitneet Kvpy Olympiad 6th 7th 8th 9th 10th Material Editable Softcopy of Bansal Resonance Fiitjee Studymaterialstudysteps.inNoch keine Bewertungen

- Ethics and Values in Engineering Profession PDFDokument15 SeitenEthics and Values in Engineering Profession PDFdamu33% (3)

- ChemistryDokument18 SeitenChemistryLex FrancisNoch keine Bewertungen

- Intro To Chemistry Digital Unit TemplateDokument4 SeitenIntro To Chemistry Digital Unit Templateapi-418394062Noch keine Bewertungen

- CNC Machining Solutions Company PresentationDokument13 SeitenCNC Machining Solutions Company PresentationGhiță SfîraNoch keine Bewertungen

- The Completely Unofficial River City Quiz Book by Paul EnglishDokument17 SeitenThe Completely Unofficial River City Quiz Book by Paul EnglishBlack & White Publishing0% (1)

- OPG maintenance policy flaws could cause damagesDokument3 SeitenOPG maintenance policy flaws could cause damagesIbra TutorNoch keine Bewertungen

- Unsustainable Energy Production and Daily PracticesDokument2 SeitenUnsustainable Energy Production and Daily Practicesbarat3786100% (3)

- 18.1.8 DNA Replication WorksheetDokument2 Seiten18.1.8 DNA Replication WorksheetJose Barrera GaleraNoch keine Bewertungen

- Jib 221 Microbiology: The Main Themes of MicrobiologyDokument47 SeitenJib 221 Microbiology: The Main Themes of MicrobiologyNazzNoch keine Bewertungen

- Embedded Systems in Industrial Application PDFDokument46 SeitenEmbedded Systems in Industrial Application PDFnavabnavab786Noch keine Bewertungen

- Sbtet Ap C-14 Syllabus Dmet C-14Dokument211 SeitenSbtet Ap C-14 Syllabus Dmet C-14thirukumarNoch keine Bewertungen

- The Four Major Organ Systems of the Human BodyDokument5 SeitenThe Four Major Organ Systems of the Human BodyXyramhel AcirolNoch keine Bewertungen

- DocumentDokument37 SeitenDocumentSAMIKSHA SHINDE100% (1)

- Regression Analysis For Non-Linear Load Growth (Load Forecasting)Dokument9 SeitenRegression Analysis For Non-Linear Load Growth (Load Forecasting)Muhammad Sohaib ShahidNoch keine Bewertungen

- Physics Paper II Exam ReviewDokument12 SeitenPhysics Paper II Exam ReviewSoniyaKanwalG100% (1)

- Kwekwe Polytechnic: Engineering DivisionDokument3 SeitenKwekwe Polytechnic: Engineering DivisionSimbarashe MakanyireNoch keine Bewertungen

- BiologyDokument4 SeitenBiologynylatsirc0% (1)

- Optimal Protection Coordination For MicrogridsDokument7 SeitenOptimal Protection Coordination For MicrogridsAbhishek KumarNoch keine Bewertungen

- Course Outline Switching and RoutingDokument4 SeitenCourse Outline Switching and RoutingRussell F Phiri100% (1)

- MKC1200 - Practice Exam PaperDokument3 SeitenMKC1200 - Practice Exam PaperAltovistaNoch keine Bewertungen

- Exam in SF2862 and SF2863 Systems Engineering Monday June 3, 2013Dokument4 SeitenExam in SF2862 and SF2863 Systems Engineering Monday June 3, 2013tswiftxoxoNoch keine Bewertungen

- PestleDokument3 SeitenPestleKrishna SahuNoch keine Bewertungen

- V.K.A Roshan Indika: Mobile: +97433297130Dokument4 SeitenV.K.A Roshan Indika: Mobile: +97433297130Osama AbbassNoch keine Bewertungen

- Er Ged RlaDokument2 SeitenEr Ged Rlamyanmar lover tamuNoch keine Bewertungen

- Biomolecules Types Functions EngineeringDokument16 SeitenBiomolecules Types Functions Engineeringnavneet664Noch keine Bewertungen

- Assignment of Human Resource Management (HRM)Dokument7 SeitenAssignment of Human Resource Management (HRM)Haroon KhanNoch keine Bewertungen

- Employee CompensationDokument75 SeitenEmployee CompensationGitu SinghNoch keine Bewertungen

- Compensation Management Strategies for Attracting and Retaining TalentDokument4 SeitenCompensation Management Strategies for Attracting and Retaining TalentVikas JhaNoch keine Bewertungen

- Compensation ManagementDokument5 SeitenCompensation ManagementmibshNoch keine Bewertungen

- Compensation Systems, Job Performance, and How to Ask for a Pay RaiseVon EverandCompensation Systems, Job Performance, and How to Ask for a Pay RaiseNoch keine Bewertungen

- Chapter 5 Newton's Laws of MotionDokument13 SeitenChapter 5 Newton's Laws of MotionPremNoch keine Bewertungen

- RSRTC e-ticket for Jodhpur to Jaipur tripDokument1 SeiteRSRTC e-ticket for Jodhpur to Jaipur tripShubham MathurNoch keine Bewertungen

- BP 14 Operational Definitions of Q6 Q7 Draft01Dokument9 SeitenBP 14 Operational Definitions of Q6 Q7 Draft01Shubham MathurNoch keine Bewertungen

- BP 14 Operational Definitions of Q6 Q7 Draft01Dokument9 SeitenBP 14 Operational Definitions of Q6 Q7 Draft01Shubham MathurNoch keine Bewertungen

- MU0016 Assignment Spring 2013Dokument1 SeiteMU0016 Assignment Spring 2013Sny Kumar DeepakNoch keine Bewertungen

- RSRTC e-ticket for Jodhpur to Jaipur tripDokument1 SeiteRSRTC e-ticket for Jodhpur to Jaipur tripShubham MathurNoch keine Bewertungen

- Varsha JainDokument3 SeitenVarsha JainShubham MathurNoch keine Bewertungen

- Time Table of ExecutiveDokument1 SeiteTime Table of ExecutiveShobhit BirlaNoch keine Bewertungen

- Foskett V McKeown (2000) # All ER 97Dokument34 SeitenFoskett V McKeown (2000) # All ER 97AaronAlwynNoch keine Bewertungen

- Assignment Ins200Dokument2 SeitenAssignment Ins200Miaa Meor33% (9)

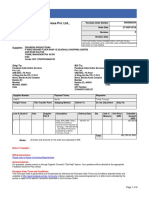

- Facebook India Online Services Pvt. LTD., Purchase Order: SupplierDokument9 SeitenFacebook India Online Services Pvt. LTD., Purchase Order: SupplierVamsheeNoch keine Bewertungen

- Loan Applicant Details (To Be Filled by The Applicant) : Single SingleDokument6 SeitenLoan Applicant Details (To Be Filled by The Applicant) : Single SingleVaibhav DafaleNoch keine Bewertungen

- Underpinning and Repair of Subsidence DamageDokument71 SeitenUnderpinning and Repair of Subsidence DamageALABIADESINA100% (1)

- Net Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaDokument9 SeitenNet Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaPrannoyChakrabortyNoch keine Bewertungen

- Staffing in International ContextDokument22 SeitenStaffing in International Contextrichagoel.2725130% (1)

- Forbes Global 2000 List 2023Dokument27 SeitenForbes Global 2000 List 2023nathaliaq626Noch keine Bewertungen

- Tender Documents - BPDB - Mymensingh PDFDokument674 SeitenTender Documents - BPDB - Mymensingh PDFashish sahaNoch keine Bewertungen

- 10 092022 Proof of Defrayal of Funeral ExpensesDokument1 Seite10 092022 Proof of Defrayal of Funeral ExpensesRomeo RarangolNoch keine Bewertungen

- Philippine Law On Household HelpersDokument3 SeitenPhilippine Law On Household Helpersroyax1100% (1)

- Time and AttendanceDokument5 SeitenTime and AttendancekgnmatinNoch keine Bewertungen

- Tourism: Questions and Topics For DiscussionDokument13 SeitenTourism: Questions and Topics For DiscussionTimi F.Noch keine Bewertungen

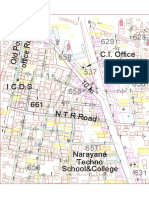

- Nandigama RS No. 661 - Survey Boundry-ModelDokument1 SeiteNandigama RS No. 661 - Survey Boundry-Modelnnp townplanningNoch keine Bewertungen

- JAIIB - Principles - Unit 6: Role & Functions of Mutual FundsDokument7 SeitenJAIIB - Principles - Unit 6: Role & Functions of Mutual Fundskamalray75_188704880Noch keine Bewertungen

- UCPB GEN Brief HistoryDokument3 SeitenUCPB GEN Brief HistoryJoshua ChavezNoch keine Bewertungen

- Ramsey Williams Case 83: The Broken Employment Contract? 2/16/05 Human Resource Management Shawn KeoughDokument4 SeitenRamsey Williams Case 83: The Broken Employment Contract? 2/16/05 Human Resource Management Shawn KeoughRamsey WilliamsNoch keine Bewertungen

- Prerana PreviewDokument16 SeitenPrerana PreviewParinShahNoch keine Bewertungen

- 2016 The Institutes Full CatalogDokument40 Seiten2016 The Institutes Full CatalogJeremy JarvisNoch keine Bewertungen

- A Study on Perception of Customers towards Life Insurance with Special Reference to Birla Sun LifeDokument63 SeitenA Study on Perception of Customers towards Life Insurance with Special Reference to Birla Sun Lifeharjot singhNoch keine Bewertungen

- UntitledDokument224 SeitenUntitledlesliebrodieNoch keine Bewertungen

- Arif Khan Icici ProjectDokument82 SeitenArif Khan Icici ProjectArif KhanNoch keine Bewertungen

- GA502263-Tax Invoice (Client Copy) PDFDokument1 SeiteGA502263-Tax Invoice (Client Copy) PDFNelly HNoch keine Bewertungen

- Jack Welch's Leadership StyleDokument12 SeitenJack Welch's Leadership StyleRÓBINSON ANTONIO CASTRO PEINADONoch keine Bewertungen

- Passingitonchapter7d TrustsDokument12 SeitenPassingitonchapter7d TrustsEyog VictoriaNoch keine Bewertungen

- Insurance Code RevDokument13 SeitenInsurance Code RevPaterno S. Brotamonte Jr.Noch keine Bewertungen

- AFFINMAX-AutoPay Template - OkDokument17 SeitenAFFINMAX-AutoPay Template - OkPohYeeLiewNoch keine Bewertungen

- St. Pious X P.G. (Mba) College For Women: A Project Report ONDokument102 SeitenSt. Pious X P.G. (Mba) College For Women: A Project Report ONAvinash SriRamNoch keine Bewertungen

- PolicyDokument21 SeitenPolicymanishsngh24Noch keine Bewertungen

- Chapter I12Dokument39 SeitenChapter I12DrellyNoch keine Bewertungen