Beruflich Dokumente

Kultur Dokumente

Tax Fee v.5.2.13 CUM OM Brown

Hochgeladen von

marknewgentOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Fee v.5.2.13 CUM OM Brown

Hochgeladen von

marknewgentCopyright:

Verfügbare Formate

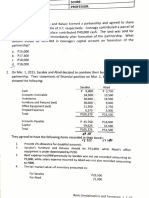

Maryland Tax and Fee Increases: Cumulative Impact: 2007-2018* Tax, fee, toll increases: 40 Cumulative Impact to Tax

Payer: $19.7 billion

*see about this report following tables for methodology

Session

(tax, fee, toll increase by number) 2013 (1)

Increase Handgun licensing fees / registration of other firearms Offshore wind (1) Vehicle registration surcharge (2) Farebox recovery (2) CPI indexing (2) Sales tax (2)

(Items 2-6 above)

Amount

($ millions)

Source

SB 281 fiscal note p. 1

Link

http://mgaleg.maryland.gov/2013RS/fnotes/bil_000 1/sb0281.pdf Direct link not available. Search SB 275 on http://mgaleg.maryland.gov Direct link not available. Search HB 1515 on http://mgaleg.maryland.gov Direct link not available. Search HB 1515 on http://mgaleg.maryland.gov Direct link not available. Search HB 1515 on http://mgaleg.maryland.gov Direct link not available. Search HB 1515 on http://mgaleg.maryland.gov Direct link not available. Search HB 1515 on http://mgaleg.maryland.gov Direct link not available. Search SB 1302 on http://mgaleg.maryland.gov

20

2013 (2) 2013 (3) 2013 (4) 2013 (5) 2013 (6)

432.5

SB 275 fiscal note p. 13 HB 1515 fiscal note p.22 HB 1515 fiscal note p.22 HB 1515 fiscal note p.22 HB 1515 fiscal note p.22

2150.3 1033.3

HB 1515 fiscal note p.2 SB 1302 fiscal note p.4

2012 special session (7)

2012 special session (8)

2012 special session (9)

2012 special session (10)

2012 special session (11)

New income tax rates at 5% and 5.75% at specified income levels Personal income exemption phase out at specified income levels Recordation tax indemnity mortgages. Revenue to counties. Increases rate for specified tobacco products from 15% to70% Death certificate fee - $12 to $24

233.9

SB 1302 fiscal note p.4

Direct link not available. Search SB 1302 on http://mgaleg.maryland.gov

214.2

SB 1302 fiscal note p.16

Direct link not available. Search SB 1302 on http://mgaleg.maryland.gov

29.9

SB 1302 fiscal note p.4

Direct link not available. Search SB 1302 on http://mgaleg.maryland.gov

4.2

SB 1302 fiscal note p.4

Direct link not available. Search SB 1302 on http://mgaleg.maryland.gov

2012 special session (12)

Repeals sales tax exemption on specified product Bay Restoration Flush Tax Doubles fee Storm Water Management Fees Rain Tax Weights and Measures Registration Fee Increase Double Lead Poisoning Prevention Fund Fee Wetland Water Way Program Fee Restructuring Hospital assessment Alcoholic beverages sales tax increase 6% to 9% Vehicle dealer processing charge Vanity plate fee $25 to $50 Certificate of title fee for vehicles was increased from $50 to $100;

(Items 20-22 above)

4.2

SB 1302 fiscal note p.4

Direct link not available. Search SB 1302 on http://mgaleg.maryland.gov

2012 (13)

331.7

90-day report p.K-7

http://mgaleg.maryland.gov/Pubs/LegisLegal/2012r s-90-day-report.pdf http://mgaleg.maryland.gov/2012rs/fnotes/bil_0007 /hb0987.pdf

2012 (14)

2050.8

HB 987 fiscal note p. 7

2012 (15)

1.8

SB 113 fiscal note p.1

Direct link not available. Search SB 113 on http://mgaleg.maryland.gov

2012 (16)

16.2

HB 644 fiscal note p.8

Direct link not available. Search HB 644 on http://mgaleg.maryland.gov

2012 (17)

1.9

HB 1411 fiscal note p.1

Direct link not available. Search HB 1411 on http://mgaleg.maryland.gov http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-90-day-report.pdf Direct link not available. Search HB 1213 on http://mgaleg.maryland.gov

2011 (18) 2011 (19)

390 620

90-day report p. J-1 HB 1213 p.1

2011 (20) 2011 (21) 2011 (22)

90-day report, p. G-1, G-2 90-day report, p. G-1 90-day report, p. G-1

http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-90-day-report.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-90-day-report.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-90-day-report.pdf

2011 2011 (23)

447.3 .329

90-day report, p. G-1 HB 523 fiscal note p.1

2011 (24)

2011 (25) 2011 (26)

2011 (27) 2010 (28)

Out of State Attorney Admission Fee Increase in contractor licensing and renewal fees Birth certificate fee - $12 to $24 Eliminates exemption of premium tax on IWIF (workers compensation) Toll increases Fishing License and Registration Fees Speed monitoring system Millionaire's tax top marginal rate 5.5% to 6.25% (3) Computer services

http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-90-day-report.pdf Direct link not available. Search HB 523 on http://mgaleg.maryland.gov Direct link not available. Search SB 236 on http://mgaleg.maryland.gov http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-90-day-report.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-90-day-report.pdf

SB 236 fiscal note, p.1

28 13.3

90-day report, p. A-21 90-day report, p. A-21

630 3

MDTA 2011 DLS Issue Paper p. 37 2011 DLS Issue Paper p. 37 90-day report, p. B-7

http://www.mdta.maryland.gov/Toll_Increase/Home .html http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf Direct link not available. Search SB 277 on http://mgaleg.maryland.gov http://mgaleg.maryland.gov/Pubs/LegisLegal/2008r s-90-day-report.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r

2009 (29) 2008 (30)

61.2 328.5

2007 (31)

2011 DLS Issue paper pg.

special session 2007 special session (32)

2007 special session (33) 2007 special session (34) 2007 special session (35) 2007 special session (36) 2007 special session (37) 2007 special session (38) 2007 special session (39) 2007 (40)

tax (4) Income tax rates new marginal rates ranging from 4.75% to 5.5% Sales tax 5% to 6% State Corporate Income Tax- 7% to 8.25% Tobacco tax - $1 to $2 per pack cigarettes Vehicle titling tax $23 to $50 Vehicle excise tax increase Electronic gaming tip jar tax Real property transfer tax Captive Real Estate Investment Trusts

1662.4

36 2011 DLS Issue paper pg. 36

s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf

5775.6 1034

2011 DLS Issue paper pg. 36 2011 DLS Issue paper pg. 36 2011 DLS Issue paper pg. 36 2011 DLS Issue paper pg. 36 2011 DLS Issue paper pg. 36 2011 DLS Issue paper pg. 36 2011 DLS Issue paper pg. 36 2011 DLS Issue paper pg. 36

http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf http://mgaleg.maryland.gov/Pubs/LegisLegal/2011r s-Issue-Papers.pdf

1326

229.4 376.8 86.6 116.33 119.1

Total (40)

19744.76

1. 2. 3. 4.

Total net cost to be recovered from rate payers over 20-year period is $1.73 billion. Totals reflect full implementation in FY 18. Assumes congress will not pass internet tax. Millionaires tax in effect through tax years 2008 2010. The computer services tax was repealed and replaced with millionaires tax .

About this report: For the newest measures, those enacted in the 2013 legislative session, DLS fiscal analysts project revenue estimates through FY 2018. However, that is not the case for earlier measures such as the 2007 tax and fee increases. Those revenues are no longer segregated as they were upon final passage. In those instances, four-year cumulative totals were divided by fiscal year to derive an average which was then multiplied by the number of years they will have been in effect. In more recent years, revenues are projected, in many cases, to more recent fiscal years but not necessarily through FY 2018. In those instances, the most recent fiscal year estimate was assumed to be the baseline of revenues the state collects in subsequent years. Some taxes and fees are not subject to standard legislative processes. This includes measures embedded in the BRFA (Budget Reconciliation and Finance Act) and the 2011 toll increases. In these cases, the best available information is used based on available government data.

Das könnte Ihnen auch gefallen

- Maryland Tax and Fee Increases: 2007-2012 Tax, Fee, Toll Increases: 37 Annual Impact To Tax Payer: $3.1 BillionDokument3 SeitenMaryland Tax and Fee Increases: 2007-2012 Tax, Fee, Toll Increases: 37 Annual Impact To Tax Payer: $3.1 BillionmarknewgentNoch keine Bewertungen

- Tax Fee v-2.2 3.21.13Dokument2 SeitenTax Fee v-2.2 3.21.13marknewgentNoch keine Bewertungen

- Transfer and Business Taxation by Ballada Solution ManualDokument5 SeitenTransfer and Business Taxation by Ballada Solution ManualAnonymous aU6BvWTIV20% (1)

- Devon Energy Corporation Form 10-K Table of ContentsDokument182 SeitenDevon Energy Corporation Form 10-K Table of Contentsbmichaud758Noch keine Bewertungen

- The Rockland County Budget Crisis: How It Happened, and Plotting A Course To Fiscal HealthDokument37 SeitenThe Rockland County Budget Crisis: How It Happened, and Plotting A Course To Fiscal HealthNewsdayNoch keine Bewertungen

- Greenbookfull 1 PDFDokument156 SeitenGreenbookfull 1 PDFJuliet LalonneNoch keine Bewertungen

- Division of Minority and Women'S Business Development: Annual Report Fiscal Year 2012-2013Dokument7 SeitenDivision of Minority and Women'S Business Development: Annual Report Fiscal Year 2012-2013Khristopher J. BrooksNoch keine Bewertungen

- Conference Committee Agenda: February 23Dokument20 SeitenConference Committee Agenda: February 23kyamamuraNoch keine Bewertungen

- WSP Operating Budget Request 2012Dokument308 SeitenWSP Operating Budget Request 2012Andrew Charles HendricksNoch keine Bewertungen

- Auditor Galloway Urges Reform To CID Laws After Discovering Pattern of Self-Dealing and Lack of Accountability (MO Auditor 2018)Dokument2 SeitenAuditor Galloway Urges Reform To CID Laws After Discovering Pattern of Self-Dealing and Lack of Accountability (MO Auditor 2018)Grant MillinNoch keine Bewertungen

- Nationstar q1 2013Dokument22 SeitenNationstar q1 2013Jay KabNoch keine Bewertungen

- Report On 2012 SCORE Programs: A Summary of Recycling and Waste Management in MinnesotaDokument43 SeitenReport On 2012 SCORE Programs: A Summary of Recycling and Waste Management in MinnesotaGabriel VenturiniNoch keine Bewertungen

- Philippines Drunk Driving Statistics and LawsDokument5 SeitenPhilippines Drunk Driving Statistics and LawsBetson CajayonNoch keine Bewertungen

- FY 2012-13 Adopted Budget SummaryDokument31 SeitenFY 2012-13 Adopted Budget SummaryBesir AsaniNoch keine Bewertungen

- Finalforposting2015csunpresentation1 150311215838 Conversion Gate01Dokument28 SeitenFinalforposting2015csunpresentation1 150311215838 Conversion Gate01api-213648940Noch keine Bewertungen

- House Hearing, 113TH Congress - Retrospective Review: Have Existing Regulatory Burdens On Small Businesses Been Reduced?Dokument45 SeitenHouse Hearing, 113TH Congress - Retrospective Review: Have Existing Regulatory Burdens On Small Businesses Been Reduced?Scribd Government DocsNoch keine Bewertungen

- Many Taxpayers Are Still Not Complying With Noncash Charitable Contribution Reporting RequirementsDokument43 SeitenMany Taxpayers Are Still Not Complying With Noncash Charitable Contribution Reporting RequirementsCara MatthewsNoch keine Bewertungen

- ManufacturingDokument2 SeitenManufacturingAnonymous Feglbx5Noch keine Bewertungen

- Sandag Ag LetterDokument3 SeitenSandag Ag LetterJbrownie HeimesNoch keine Bewertungen

- SB 12-063: Severance Tax Revenues For Rural Institutions of Higher EducationDokument3 SeitenSB 12-063: Severance Tax Revenues For Rural Institutions of Higher EducationSenator Mike JohnstonNoch keine Bewertungen

- Lakewood - Budget Study Session 06-11-13Dokument102 SeitenLakewood - Budget Study Session 06-11-13Lakewood News ReporterNoch keine Bewertungen

- SIE CY 2004 Volume 1 NewDokument54 SeitenSIE CY 2004 Volume 1 NewShobi DionelaNoch keine Bewertungen

- Leon County District School Board: For The Fiscal Year Ended June 30, 2011Dokument85 SeitenLeon County District School Board: For The Fiscal Year Ended June 30, 2011ChrisNoch keine Bewertungen

- Useful Government Contracting Websites Small Business Issues and Information Via The InternetDokument4 SeitenUseful Government Contracting Websites Small Business Issues and Information Via The Internetsquirrel01Noch keine Bewertungen

- Dalrymple Executive Budget SummaryDokument288 SeitenDalrymple Executive Budget SummaryRob PortNoch keine Bewertungen

- Ebook PDF Byrd Chens Canadian Tax Principles 2019 2020 Edition PDFDokument42 SeitenEbook PDF Byrd Chens Canadian Tax Principles 2019 2020 Edition PDFtony.rodriguez470100% (27)

- Quickstart 2013-14Dokument29 SeitenQuickstart 2013-14Rick KarlinNoch keine Bewertungen

- PA Environment Digest Dec. 10, 2012Dokument27 SeitenPA Environment Digest Dec. 10, 2012www.PaEnvironmentDigest.comNoch keine Bewertungen

- FY 13-14 Fiscal HighlightsDokument144 SeitenFY 13-14 Fiscal HighlightsRepNLandryNoch keine Bewertungen

- CMS ReportDokument30 SeitenCMS ReportRecordTrac - City of OaklandNoch keine Bewertungen

- Authorities Budget Office 2013 Annual ReportDokument43 SeitenAuthorities Budget Office 2013 Annual ReportCara MatthewsNoch keine Bewertungen

- City of Los Angeles Budget Overview Presentation 2012Dokument35 SeitenCity of Los Angeles Budget Overview Presentation 2012Bill RosendahlNoch keine Bewertungen

- Local Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Dokument19 SeitenLocal Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Rushbh PatilNoch keine Bewertungen

- HCG Connection April 2013Dokument10 SeitenHCG Connection April 2013lrbrennanNoch keine Bewertungen

- Full Committee Hearing On Modernizing The Tax Code: Updating The Internal Revenue Code To Help Small Businesses Stimulate The EconomyDokument98 SeitenFull Committee Hearing On Modernizing The Tax Code: Updating The Internal Revenue Code To Help Small Businesses Stimulate The EconomyScribd Government DocsNoch keine Bewertungen

- Mining Royalties, Global Study of Their Impact On Investors, Government, and Civil SocietyDokument320 SeitenMining Royalties, Global Study of Their Impact On Investors, Government, and Civil SocietydaveanthonyNoch keine Bewertungen

- Mar 25, 2014 Antideficiency Act Reports - Fiscal Year 2013 661911Dokument17 SeitenMar 25, 2014 Antideficiency Act Reports - Fiscal Year 2013 661911bdlimmNoch keine Bewertungen

- City of Chattanooga Fuel Key AuditDokument11 SeitenCity of Chattanooga Fuel Key AuditDan LehrNoch keine Bewertungen

- The Annapolis Report: A Review of The 2012 Legislative Session and Special SessionsDokument14 SeitenThe Annapolis Report: A Review of The 2012 Legislative Session and Special SessionsmarknewgentNoch keine Bewertungen

- ACCT567 W2 CaseStudyDokument6 SeitenACCT567 W2 CaseStudyPetra0% (1)

- Brazil: Economy ProfileDokument107 SeitenBrazil: Economy ProfileGaurav SharmaNoch keine Bewertungen

- Oregon Tax Expenditure 2015-17Dokument435 SeitenOregon Tax Expenditure 2015-17arationalactorNoch keine Bewertungen

- 10-21-13 City of Lorain Released From Fiscal WatchDokument1 Seite10-21-13 City of Lorain Released From Fiscal WatchThe News-HeraldNoch keine Bewertungen

- Tax Havens: International Tax Avoidance and Evasion: Digitalcommons@IlrDokument63 SeitenTax Havens: International Tax Avoidance and Evasion: Digitalcommons@IlrSyehabudin ZmNoch keine Bewertungen

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- CAFR DoxDokument2 SeitenCAFR Doxjohn muhanda muNoch keine Bewertungen

- Chevron 10K 2010Dokument208 SeitenChevron 10K 2010Marius-Mihail MihaiNoch keine Bewertungen

- Uthorities Udget Ffice: Annual Report On Public Authorities in New York StateDokument43 SeitenUthorities Udget Ffice: Annual Report On Public Authorities in New York StateRick KarlinNoch keine Bewertungen

- CA Vs Other States Revised 3-23-2010Dokument2 SeitenCA Vs Other States Revised 3-23-2010RichardRiderNoch keine Bewertungen

- Teamsters Local 320 Summer NewsletterDokument8 SeitenTeamsters Local 320 Summer NewsletterForward GallopNoch keine Bewertungen

- Stormwater Magazine EPA Issues 2012 Toxic Release Inventory Data For Pacific Southwest RegionDokument3 SeitenStormwater Magazine EPA Issues 2012 Toxic Release Inventory Data For Pacific Southwest RegionMirunaVasileNoch keine Bewertungen

- Mad Budgets 2004-8 v6 - CedadminDokument8 SeitenMad Budgets 2004-8 v6 - Cedadminres ipsa loquiturNoch keine Bewertungen

- June EDAB eDokument4 SeitenJune EDAB elrbrennanNoch keine Bewertungen

- Pa Taxation ManualDokument113 SeitenPa Taxation ManualVikram rajputNoch keine Bewertungen

- Colgate 2013Dokument130 SeitenColgate 2013Charles GarrettNoch keine Bewertungen

- Economic Outlook and Member Survey 2015Dokument18 SeitenEconomic Outlook and Member Survey 2015doombuggyNoch keine Bewertungen

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionVon EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Trade and Development Issues in CARICOM: Key Considerations for Navigating DevelopmentVon EverandTrade and Development Issues in CARICOM: Key Considerations for Navigating DevelopmentRoger HoseinNoch keine Bewertungen

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- MGM To For Maryland Jobs and SchoolsDokument8 SeitenMGM To For Maryland Jobs and SchoolsmarknewgentNoch keine Bewertungen

- CampaignFinanceReport 5353 132 24061-2 PDFDokument5 SeitenCampaignFinanceReport 5353 132 24061-2 PDFmarknewgentNoch keine Bewertungen

- DGSOPL13Dokument43 SeitenDGSOPL13marknewgentNoch keine Bewertungen

- CASA de Maryland - Monthly Report - Aug-1Dokument10 SeitenCASA de Maryland - Monthly Report - Aug-1marknewgentNoch keine Bewertungen

- MD Race To The Top Data CollectionDokument15 SeitenMD Race To The Top Data CollectionmarknewgentNoch keine Bewertungen

- Sponsorship Agreement Letter Email RavensDokument14 SeitenSponsorship Agreement Letter Email RavensmarknewgentNoch keine Bewertungen

- Sponsorship Agreement Letter Email RavensDokument14 SeitenSponsorship Agreement Letter Email RavensmarknewgentNoch keine Bewertungen

- DGSOPL13Dokument43 SeitenDGSOPL13marknewgentNoch keine Bewertungen

- DGSOPL13Dokument43 SeitenDGSOPL13marknewgentNoch keine Bewertungen

- MDA PIA ComplaintsDokument68 SeitenMDA PIA ComplaintsmarknewgentNoch keine Bewertungen

- Inside The Right Wing Inner CircleDokument24 SeitenInside The Right Wing Inner CirclePatrick AllenNoch keine Bewertungen

- A 03 K 0009Dokument72 SeitenA 03 K 0009marknewgentNoch keine Bewertungen

- MDA PIA ComplaintsDokument68 SeitenMDA PIA ComplaintsmarknewgentNoch keine Bewertungen

- Residential Habilitation Services Under Maryland's Community Pathways Waiver (A-03-12-00203)Dokument18 SeitenResidential Habilitation Services Under Maryland's Community Pathways Waiver (A-03-12-00203)Beverly TranNoch keine Bewertungen

- Department of Health and Mental Hygiene Developmental Disabilities AdministrationDokument47 SeitenDepartment of Health and Mental Hygiene Developmental Disabilities AdministrationmarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Tax Fee v.5.2.13 - CUM - OMDokument3 SeitenTax Fee v.5.2.13 - CUM - OMmarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Expenditure Date Payee Name Address Amount ($) Committee Name Expense PurposeDokument2 SeitenExpenditure Date Payee Name Address Amount ($) Committee Name Expense PurposemarknewgentNoch keine Bewertungen

- Gas Tax-Fund Raid SheetDokument1 SeiteGas Tax-Fund Raid SheetmarknewgentNoch keine Bewertungen

- Citizens in Charge Pcard Mailing PanelDokument2 SeitenCitizens in Charge Pcard Mailing PanelmarknewgentNoch keine Bewertungen

- Division) Case No. 7303. G.R. No. 196596 Stemmed From CTA en Banc Case No. 622 FiledDokument41 SeitenDivision) Case No. 7303. G.R. No. 196596 Stemmed From CTA en Banc Case No. 622 FiledNorjannah MangandogNoch keine Bewertungen

- IFT Question Bank With Answer (Reading Wise) 2017Dokument848 SeitenIFT Question Bank With Answer (Reading Wise) 2017Michael Vilchez100% (10)

- The Holy Grail of TradingDokument55 SeitenThe Holy Grail of TradingMomčilo Ćorsović50% (2)

- AC Milan v. UEFA Europa League BanDokument48 SeitenAC Milan v. UEFA Europa League BanRahasia_NegaraNoch keine Bewertungen

- Head of Finance Operations JD 130416Dokument4 SeitenHead of Finance Operations JD 130416Janani ParameswaranNoch keine Bewertungen

- Financial ControllershipDokument7 SeitenFinancial ControllershipKaye LaborteNoch keine Bewertungen

- 1B - RFP - Jodhpur Romana 15012020 PDFDokument96 Seiten1B - RFP - Jodhpur Romana 15012020 PDFAnkur ChowdharyNoch keine Bewertungen

- MRCE Data Dictionary v1.0Dokument4 SeitenMRCE Data Dictionary v1.0Chandrima DasNoch keine Bewertungen

- Canadian Securities Institute Learning Catalogue: Csi Learning Solutions GuideDokument11 SeitenCanadian Securities Institute Learning Catalogue: Csi Learning Solutions Guidemuhammadanasmustafa0% (1)

- Final Report Aman DwivediDokument48 SeitenFinal Report Aman Dwivediaman DwivediNoch keine Bewertungen

- Cheque AssignmentDokument5 SeitenCheque AssignmentBhokerose MagesaNoch keine Bewertungen

- Real Estate Finance & Investments: (14th Edition)Dokument1 SeiteReal Estate Finance & Investments: (14th Edition)Solutions MasterNoch keine Bewertungen

- Assistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyDokument2 SeitenAssistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyKathrynJaneRipleyNoch keine Bewertungen

- Company Profile: PT. Indofood Sukses Makmur TBKDokument7 SeitenCompany Profile: PT. Indofood Sukses Makmur TBKAtikaFebriyuliaNoch keine Bewertungen

- Think Twice Michael MauboussinDokument5 SeitenThink Twice Michael Mauboussindeepak aagareNoch keine Bewertungen

- PPRA Rules (Amended 09-01-2023)Dokument80 SeitenPPRA Rules (Amended 09-01-2023)M. Aamir SaeedNoch keine Bewertungen

- Mortgagee in Good Faith Doctrine InapplicableDokument3 SeitenMortgagee in Good Faith Doctrine Inapplicablerhodz 88Noch keine Bewertungen

- Loan Disbursement and Recovery Procedures of BKBDokument10 SeitenLoan Disbursement and Recovery Procedures of BKBFarhanChowdhuryMehdiNoch keine Bewertungen

- PPE ACQUISITION COSTDokument4 SeitenPPE ACQUISITION COSTsabina del monteNoch keine Bewertungen

- CFAB - Accounting - QB - Chapter 10Dokument14 SeitenCFAB - Accounting - QB - Chapter 10Huy NguyenNoch keine Bewertungen

- 1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Dokument12 Seiten1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Shasha GuptaNoch keine Bewertungen

- of Ratio AnalysisDokument9 Seitenof Ratio AnalysisAkanksha Rani100% (1)

- FilipinoSariSariStore Draft HMalapitDokument25 SeitenFilipinoSariSariStore Draft HMalapitRomy Wacas100% (2)

- Sicav Annual Report Final Audited and Signed 2021Dokument465 SeitenSicav Annual Report Final Audited and Signed 2021sirinekadhi7Noch keine Bewertungen

- Municipal Tax SystemDokument194 SeitenMunicipal Tax SystemSrini VasuluNoch keine Bewertungen

- Questions Credit Risk Measurement and ManagementDokument199 SeitenQuestions Credit Risk Measurement and ManagementBlack MambaNoch keine Bewertungen

- Predator Creation GuideDokument12 SeitenPredator Creation GuideLuis Guillermo Valdivia RomeroNoch keine Bewertungen

- MCQ PartnershipDokument24 SeitenMCQ Partnershiplou-924Noch keine Bewertungen

- India Fortune 2000 ListDokument2 SeitenIndia Fortune 2000 ListANKIT SINGHNoch keine Bewertungen

- Contracts Cheat SheetDokument2 SeitenContracts Cheat SheetTim Morris50% (2)