Beruflich Dokumente

Kultur Dokumente

Financial Ratios of Liberty

Hochgeladen von

Hafsa MemonOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Ratios of Liberty

Hochgeladen von

Hafsa MemonCopyright:

Verfügbare Formate

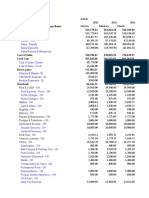

Financial Ratios Liquidity Ratios Ratio Current Ratio Number 0.

958 Interpretation This indicates that Liberty has Rs. 0.958 in short-term resources to service each ruppee of current debt. This is a low number indicating liquidity issues. In the case of Liberty the Net Working Capital is negative, represented by slow moving or obsolete inventory and past due accounts. Liberty will have difficulty paying its bills without having to sell inventory. This doesn't necessarily mean they face short term liquidity constraints. But businesses usually do not plan to keep their cash and cash equivalent at level with their current liabilities because they can use a portion of idle cash to generate profits. This means that a normal value of cash ratio is somewhere below 1.00. But Liberty has too low a cash ratio. Libertys liquid assets relative to its needs are very low.

Net Working Capital Quick Ratio Cash Ratio

Rs. (17,371, 000) 0.164 0.07

Net Working 0.0016 Capital to Sales Ratio Activity Ratios Ratio Accounts Receivables Turnover Inventory Turnover Number 8.94

6.08

Asset Turnover

1.358

Fixed Assets Turnover

5.99

Interpretation The number indicates that LIBERTY has Rs. 8.94 in short term resources to service every ruppee of current debt. This is a fairly high number by most standards and would be considered very strong. The number of 6.08 indicates that goods were bought and sold about 6.08 times in the year. Generally, the higher the number the better. The less time goods spend in inventory the better the return the company is able to earn from funds tied up in inventory. A large stale inventory can distort the asset position of the company and should be monitored for that reason also. This indicates that LIBERTY with a ratio of 1.358 is generating about 1.358 Rs. for every ruppee invested in assets. A high level of return suggests that corporate resources are being well managed and that the firm is able to realize high level of sales from its asset investments. Liberty is using its fixed assets efficiently.

Leverage Measures

Ratio Debt to Equity Ratio

Number 0.137

Times Interest Earned

2.689

Interest Coverage Ratio

2.69

Interpretation This is a measure used to identify companies who run the risk of defaulting on loans, and is therefore helpful in assessing a stock's exposure. Liberty with a ratio of .137 ruppee of debt in capital structure for every ruppee of equity This is an indication of the companys ability to meet interest expense. The Liberty number of 2.689 indicates that there is Rs. 2.689 to cover every ruppee of interest expense. Libertys number indicates reason for concern. The company is able to cover its interest expenses 2.69 times over using earnings which is a healthy number.

Profitability Ratios Ratio Net Profit Margin Return on Equity Return on Assets Gross Profit Margin Operating Profit Margin Sales Growth Number Interpretation 0.04 Liberty reports a decimal fraction of .04 or 4%, that is, the company's return is roughly 4 cents on every ruppee. 0.148 The company earned 14.8% on its asset investments. As a rule the higher the ROA the more profitable a company but Libertys number is very low. 0.057 ROE shows the annual payoff to investors, which in the case of LIBERTY amounts to .057 cents for every ruppee of equity. Libertys falling ROE could spell trouble later on. 0.122 Rs. 0.122 is left for every rupee of sales after cost of goods sold. 0.083 31.32 Rs. 0.083 is left for every rupee of sales after operating expenses. Sales grew from last year by 31.32%

Common Stock Ratios Ratio Earnings Per Share Annual Sales per Share Dividend per Share Price Earnings Ratio Price to Sales Ratio Number Interpretation 18.90 Each share earned Rs. 18.90 in 2012. 45.22 Liberty generates Rs. 45.22 for every share. 1.50 9.68 4.047 Liberty declared Rs. 1.50 for every sharein 2012. An investor pays Rs. 9.68 for every 1 dollar the company earns. In the case of EMC the PSR is 4.047, an indication that the market price of the stock is 4.047 times the annual sales per share. It represents the difference between total assets and total liabilities.

Book Value per Share

131.44

Price to Book Ratio Price Earnings to Growth Ratio Payout Ratio Divided Yield

1.392 7.58 0.08 0.007

This is a convenient way to relate the book value of a company to the market price of its stock. This shows that the stock is overvalued at the current price. The payout ratio of company is 8%. Comparing it to interest rates in Pakistan, the return is not very attractive to investors.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- LKP Spade - Torrent Pharma - 7octDokument3 SeitenLKP Spade - Torrent Pharma - 7octpremNoch keine Bewertungen

- Financial Markets and Institutions: 13 EditionDokument35 SeitenFinancial Markets and Institutions: 13 EditionTherese Grace PostreroNoch keine Bewertungen

- A Joint VentureDokument38 SeitenA Joint Venturesweety7677Noch keine Bewertungen

- Just Us! CafeDokument3 SeitenJust Us! CafeAditya WibisanaNoch keine Bewertungen

- How To Calculate Your Hourly RateDokument3 SeitenHow To Calculate Your Hourly RateERIC GARCHITORENANoch keine Bewertungen

- 8 Step GemDokument5 Seiten8 Step GemDhananjay YarrowsNoch keine Bewertungen

- Chua vs. CA and Valdes-ChoyDokument2 SeitenChua vs. CA and Valdes-ChoyMark Soriano BacsainNoch keine Bewertungen

- MOU With DCB Bank 9may16Dokument10 SeitenMOU With DCB Bank 9may16Sainik AddaNoch keine Bewertungen

- Introduction To DerivativesDokument34 SeitenIntroduction To Derivativessalil1285100% (2)

- Business Plan Strategic Plan 2022 Template2Dokument44 SeitenBusiness Plan Strategic Plan 2022 Template2scorpionrockNoch keine Bewertungen

- McLeod CH08Dokument46 SeitenMcLeod CH08RichaMaehapsari CahKeraton100% (1)

- FranchiseDokument4 SeitenFranchiseJane DizonNoch keine Bewertungen

- JOHANSSON - ChapDokument38 SeitenJOHANSSON - Chaplow profileNoch keine Bewertungen

- Finacial Accounting & ManagementDokument200 SeitenFinacial Accounting & ManagementmesfinNoch keine Bewertungen

- A Study On Investor S Perception Towards Online Trading (Srinivalula Reddy)Dokument30 SeitenA Study On Investor S Perception Towards Online Trading (Srinivalula Reddy)DowlathAhmedNoch keine Bewertungen

- Ashish Gupta: EducationDokument2 SeitenAshish Gupta: EducationBrexa QuantsNoch keine Bewertungen

- Cost New Suggested IanDokument609 SeitenCost New Suggested IanSuZan DhaMiNoch keine Bewertungen

- MGT 210Dokument19 SeitenMGT 210FAYAZ AHMEDNoch keine Bewertungen

- Financial and Management Reporting SystemsDokument7 SeitenFinancial and Management Reporting SystemsJanelAlajasLeeNoch keine Bewertungen

- Description of Assessment - HRM533 ODL 20212Dokument3 SeitenDescription of Assessment - HRM533 ODL 20212AdrinaG-bNoch keine Bewertungen

- Awais Ahmed Awan BBA 6B 1711267 HRM Project On NestleDokument11 SeitenAwais Ahmed Awan BBA 6B 1711267 HRM Project On NestleQadirNoch keine Bewertungen

- Unique Features of E-Commerce TechnologyDokument4 SeitenUnique Features of E-Commerce TechnologySonu Tandukar100% (4)

- For Sample MCQ ISCADokument19 SeitenFor Sample MCQ ISCAsaraNoch keine Bewertungen

- Finance Thesis TopicDokument9 SeitenFinance Thesis TopicMAk Khan33% (3)

- Advanced Level Test Automation EngineerDokument3 SeitenAdvanced Level Test Automation EngineerImprovindo MajuNoch keine Bewertungen

- Case Study Project Income Statement BudgetingDokument186 SeitenCase Study Project Income Statement BudgetingKate ChuaNoch keine Bewertungen

- WeyAP 11e PPT Ch07Dokument45 SeitenWeyAP 11e PPT Ch07Rami BadranNoch keine Bewertungen

- Situational Judgement Test 318 - Sample Situations and Questions - Canada - CaDokument1 SeiteSituational Judgement Test 318 - Sample Situations and Questions - Canada - CaMaysa BlatchfordNoch keine Bewertungen

- TAX Ch01Dokument10 SeitenTAX Ch01GabriellaNoch keine Bewertungen

- Business PlanDokument6 SeitenBusiness PlanAshley Joy Delos ReyesNoch keine Bewertungen