Beruflich Dokumente

Kultur Dokumente

Thesun 2009-04-14 Page17 South Korea Wary of Chinas Rise To Economic Power

Hochgeladen von

Impulsive collectorOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Thesun 2009-04-14 Page17 South Korea Wary of Chinas Rise To Economic Power

Hochgeladen von

Impulsive collectorCopyright:

Verfügbare Formate

theSun | TUESDAY APRIL 14 2009 17

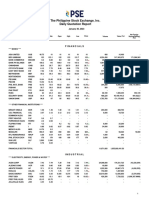

business KLCI

STI

941.41

1,876.77

0.03

48.26

Nikkei

TSEC

8,924.43

5,857.64

39.68

75.68

Hang Seng CLOSED KOSPI 1,338.26 2.22

SCI 2,513.70 69.48 S&P/ASX200 CLOSED

Competition

South Korea wary with China

is expected

to intensify in

such export

markets as Latin

briefs

Report: BT to slash

of China’s rise to

America and 10,000 jobs

Asia because LONDON: British telecoms operator BT

China’s recent will cut 10,000 jobs when it reveals its

currency swap preliminary results next month, reports

arrangements said Sunday.

will enable BT will also make a £1.5 billion (RM8.25 China eyes new stimulus to

economic power

SEOUL: South Korea yesterday expressed its

yuan to be

used in trade

settlements.”

its giant neighbour in global markets and should

billion) writedown in its under-fire Global Services

division and slash its dividend by about 60%, ac-

cording to the Daily Telegraph’s website.

The job losses are expected to be spread

across the company’s 160,000-strong global

workforce.

BT’s results are likely to be among the worst

boost spending: State media

SHANGHAI: China is drawing up a fresh

economic stimulus aimed at boosting con-

sumption, state media reported yesterday,

on top of a previous multi-billion-dollar plan

targeting investment.

concern about China’s rise as a global economic therefore focus its diplomatic and economic since it was privatised in 1984, the Telegraph and The move comes as the government looks

power in a rare note that said the ascent of its capabilities in select areas where it excels. the Sunday Times reported. to increase personal spending due to plum-

powerful neighbour could harm its own economic “China would pay much higher prices than Its poor financial performance in the face of meting exports amid the global financial

growth. the market value when acquiring energy projects

the global economic slowdown is compounded meltdown.

The Ministry of Strategy and Finance said in abroad, so (South Korea) can’t compete with it,”

by the cost of trying to plug its huge pension Beijing will continue to drive economic

an eight-page “reference material” that China’s said Park Bun-soon, a senior fellow at Samsung

deficit. growth with fiscal spending, the China Se-

growing clout was likely to intensify competition Economic Research Institute.

A BT spokesman said the reports of 10,000 curities Journal reported, citing Gao Huiqing,

between the two countries especially in export “If China has ‘hard power’, we have to think

job cuts were “speculative numbers.” of the economic forecast department at the

markets and energy diplomacy. about utilising ‘soft power’,” he said, referring to

“The company is focusing on cost reductions,” State Information Centre, a government

That contrasted with the past practice of South Korea’s non-government organisations and

he said. – AFP think tank. – AFP

describing China’s economic growth as an oppor- corporate networks.

tunity for South Korea to keep producing export The finance ministry’s statement also came af-

goods for other markets using cheap labour, as ter South Korea’s efforts to secure more offshore

well as a threat to its own exports.

“Competition with China is expected to in-

energy supplies hit a snag early this year after

Nigeria cancelled exploration rights at oilfields

US directs GM to prepare for bankruptcy filing

tensify in such export markets as Latin America first awarded in 2005. WASHINGTON: The US Treasury Department is the automaker can be a viable company.

and Asia because China’s recent currency swap South Korea, which lacks natural resources, directing General Motors to lay the groundwork Quoting sources who had been briefed on the

arrangements will enable yuan to be used in trade has relied heavily on exports to power its rise for a bankruptcy filing by June 1, even though the GM plans, the Times said the goal was to prepare

settlements,” the ministry said in the statement. from the rubble of the 1950-53 Korean War to automaker has publicly stated it could reorganise for a fast “surgical” bankruptcy.

China has grabbed the media headlines around become the world’s 13th-largest economy. outside of court, The New York Times reported on The newspaper said preparations are aimed

the world in the past for its fast emergence as But Chinese industry, with its abundance of Sunday. at assuring a GM bankruptcy filing is ready if

a driver of global economic growth and more cheap labour and strong backing from the com- GM is operating under emergency US govern- the company is unable to reach agreement with

recently as the potential saviour of the global munist government, has emerged as a strong ment loans. It has been told by the Obama admin- bondholders to exchange roughly US$28 billion

economy mired in the worst recession in many rival in key export markets for products ranging istration’s task force overseeing its bailout that it (RM105 billion) in debt into equity in GM and with

decades. from clothes to consumer electronics, sparking must cut costs and reduce its debts in order to the United Automobile Workers union.

In response to the spreading ‘Beijing Consen- concerns it could jeopardise South Korea’s ef- continue to receive aid. A plan under consideration would create a new

sus’, our country also needs to adopt pre-emptive forts to catch up with the world’s most developed The White House-appointed autos task force company that would buy the “good” assets of GM

external economic policy,” the finance ministry economies. has given GM 60 days to come up with a restruc- after the carmaker files for bankruptcy, the Times

said, referring to a phrase used to describe Chi- China, with which Seoul normalised diplomatic turing plan and it is trying to determine whether said. – AFP

na’s growing influence. ties in 1992, has become South Korea’s biggest

Analysts in Seoul said South Korea lacked the trade partner and main investment destination.

economic scale or resources to compete with – Reuters

China begins long campaign

for yuan greatness

BEIJING: China is pushing aggressively for the emerging economies.

wider use of its currency abroad, but it will likely Brazilian President Luiz Inacio Lula da Silva

take decades before it assumes a truly global role said this month he had proposed to his Chinese

and challenges the US dollar, analysts say. counterpart, Hu Jintao, conducting bilateral trade

The drive has seen a series of currency swap through each country’s local currency.

agreements in the past few months, while public It could be the beginning of growing South-

criticism of the dollar-based global system by the South collaboration to chip away at a dollar

central bank governor has given China’s recent supremacy that seldom arouses enthusiasm in

actions a more ambitious-looking edge. the less-developed parts of the world.

“It’s evident that the weight of the yuan on “If the US dollar framework remained un-

the international market is growing,” said Zhang changed, the emerging markets would have no

Taowei, a finance professor at Beijing’s Tsinghua channel to have a bigger say,” said Lu Zhengwei, a

University. Shanghai-based economist with Industrial Bank.

The yuan so far plays only a minor role globally, Alongside the swaps and other small-scale

partly because it is not convertible on the capital practical steps, China has also launched a more

account, which makes it harder to remit money direct rhetorical challenge to the US dollar.

in and out of China. Central bank governor Zhou Xiaochuan last

However, Chinese thinking on the issue looks month published an essay on his bank’s website

to be gradually changing, not least because of a calling for a replacement of the US dollar as the

weakened faith in the greenback brought on by global reserve currency.

the global economic crisis. “Theoretically, it’s a good idea. But in reality, it

Premier Wen Jiabao last month warned he would be very difficult to implement,” said Lu of

was concerned about China’s huge investment Industrial Bank.

in dollar-denominated assets. “It could be a direction for open discussion.

As a first step for the yuan, China since De- But in the foreseeable future, that’s not going

cember has signed six currency swap contracts to happen.”

totalling 650 billion yuan (RM345.6 billion), with Any major global role for the yuan might be as

Hongkong, South Korea, Malaysia, Belarus, Indo- long as 10 years to 30 years away, China’s state-

nesia and Argentina. run Xinhua news agency reported.

The agreements make it possible for overseas The agency quoted Chen Yulu, a finance

importers of Chinese goods to borrow yuan from professor and vice president at the People’s

their central banks, reducing their exposure to University of China, as laying out a three-decade

volatility in the US dollar. timetable for yuan greatness.

But apart from the concrete purposes they First China would need 10 years to expand

serve, the agreements fit into a broader pattern the yuan’s use in neighbouring countries, then

of experimenting with new uses of the currency, another decade to bolster its role in Asia and a

including trial schemes for yuan trade settlement final 10 years to make it a reserve currency, the

between Hongkong and south China. Beijing-based professor told Xinhua.

“The facts on the ground suggest the central “Currencies don’t become popular until they

bank would like to see the yuan more popularly are widely adopted and transaction costs are

used as an offshore trade settlement currency,” low and there is some sense that you can use

said Ben Simpfendorfer, Honkong-based China this currency to buy things in any country,” said

economist for Royal Bank of Scotland. Simpfendorfer.

“That won’t happen overnight. It will take “It is (a question of reaching a critical mass),

years, but nonetheless, it may happen faster than and in that respect China has an advantage in

people expect.” being a very large trading country. But we need to

China is not alone in promoting the yuan, and see a stronger domestic demand, more Chinese

has seen a measure of support from other major buying goods from abroad.” – AFP

Das könnte Ihnen auch gefallen

- Power Markets and Economics: Energy Costs, Trading, EmissionsVon EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNoch keine Bewertungen

- Thesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomDokument1 SeiteThesun 2009-10-23 Page15 Australia Set For Decades-Long Mining BoomImpulsive collectorNoch keine Bewertungen

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDokument1 SeiteThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthDokument1 SeiteThesun 2009-04-08 Page14 World Bank China Stimulus To Sustain Asias GrowthImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisDokument1 SeiteTheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisImpulsive collectorNoch keine Bewertungen

- IndiaMorningBrief 15dec2023Dokument10 SeitenIndiaMorningBrief 15dec2023Deepul WadhwaNoch keine Bewertungen

- Fundamental Analysis: Company NameDokument8 SeitenFundamental Analysis: Company NameJack and Master of AllNoch keine Bewertungen

- Thesun 2009-08-13 Page17 Rio Employees Formally ArrestedDokument1 SeiteThesun 2009-08-13 Page17 Rio Employees Formally ArrestedImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpDokument1 SeiteTheSun 2008-11-14 Page28 Global Stocks Tumble As Bad News Stacks UpImpulsive collectorNoch keine Bewertungen

- Thesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneDokument1 SeiteThesun 2009-07-09 Page17 China Holds Rio Tinto Exec As Spy Iron Ore Deal Said DoneImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-10 Page18 Middle East Buyers Eye Malaysian Property MarketDokument1 SeiteTheSun 2008-12-10 Page18 Middle East Buyers Eye Malaysian Property MarketImpulsive collectorNoch keine Bewertungen

- Thesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskDokument1 SeiteThesun 2009-10-22 Page17 Brewery Sector To Improve Next Year Says OskImpulsive collectorNoch keine Bewertungen

- Spark Research 18 June 2018 PDFDokument37 SeitenSpark Research 18 June 2018 PDFAdroit WaterNoch keine Bewertungen

- 20151201aa001101 PDFDokument1 Seite20151201aa001101 PDFbosudipta4796Noch keine Bewertungen

- Thesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingDokument1 SeiteThesun 2009-06-24 Page15 Asian Shares Dive On Global Recovery Fears Profit TakingImpulsive collectorNoch keine Bewertungen

- Thesun 2009-08-25 Page17 Market SummaryDokument1 SeiteThesun 2009-08-25 Page17 Market SummaryImpulsive collectorNoch keine Bewertungen

- 21SM089576-R - Shadab TextileDokument3 Seiten21SM089576-R - Shadab TextileFaisal AliNoch keine Bewertungen

- TheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Dokument1 SeiteTheSun 2009-07-30 Page15 Carlsberg Msia To Acquire Spore Ops For Rm370Impulsive collector100% (2)

- 2020-02-20 PCMDokument20 Seiten2020-02-20 PCMthehraoNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report August 18, 2020Dokument9 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report August 18, 2020kalboNoch keine Bewertungen

- Thesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Dokument1 SeiteThesun 2009-06-10 Page12 Regional Airlines To See Recovery As Early As 2010Impulsive collectorNoch keine Bewertungen

- Thesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementDokument1 SeiteThesun 2009-06-03 Page15 Asean and South Korea Sign Free Trade AgreementImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDokument1 SeiteThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNoch keine Bewertungen

- TheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaDokument1 SeiteTheSun 2009-05-15 Page15 Us Currency Bill Tempts Protectionism ChinaImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDokument1 SeiteThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNoch keine Bewertungen

- Weekly Market Blueprint 24 Septemberto 28 September 18Dokument4 SeitenWeekly Market Blueprint 24 Septemberto 28 September 18bertovalenNoch keine Bewertungen

- Stockquotes 02222023Dokument13 SeitenStockquotes 02222023Jonathan M.Noch keine Bewertungen

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDokument1 SeiteTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNoch keine Bewertungen

- Stockquotes 03012023Dokument13 SeitenStockquotes 03012023Jonathan M.Noch keine Bewertungen

- Thesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaDokument1 SeiteThesun 2009-07-15 Page15 China Stonewalling As Spy Probe Widens AustraliaImpulsive collectorNoch keine Bewertungen

- Iex 20200831 Mosl Ic PG038Dokument38 SeitenIex 20200831 Mosl Ic PG038Jagannath DNoch keine Bewertungen

- IndiaMorningBrief 7jul2023Dokument11 SeitenIndiaMorningBrief 7jul2023Ranjan JainNoch keine Bewertungen

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDokument1 SeiteThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNoch keine Bewertungen

- Kotak India - Daily 20200326Dokument70 SeitenKotak India - Daily 20200326abhinavsingh4uNoch keine Bewertungen

- Reclass of GST For Rental - Motor VehicleDokument3 SeitenReclass of GST For Rental - Motor VehicletiyanlelasNoch keine Bewertungen

- 28october 2020 India DailyDokument169 Seiten28october 2020 India DailyPraveen MathewNoch keine Bewertungen

- TheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankDokument1 SeiteTheSun 2009-10-16 Page15 Ocbc Buys Ings Asian Private BankImpulsive collectorNoch keine Bewertungen

- Stockquotes 02012023Dokument13 SeitenStockquotes 02012023Jonathan M.Noch keine Bewertungen

- Financial AnalysisDokument4 SeitenFinancial AnalysisMorshedDenarAlamMannaNoch keine Bewertungen

- Info Memo Telkom Fy2008Dokument18 SeitenInfo Memo Telkom Fy2008prakososantosoNoch keine Bewertungen

- Market Update 12th Sept 2018Dokument1 SeiteMarket Update 12th Sept 2018Anonymous FnM14a0Noch keine Bewertungen

- BESCOM Annual Report 2009 10 (Audited)Dokument96 SeitenBESCOM Annual Report 2009 10 (Audited)Puneeth ArNoch keine Bewertungen

- CSC Steel Berhad: 1QFY12/10 Results To Beat Expectations - 30/04/2010Dokument2 SeitenCSC Steel Berhad: 1QFY12/10 Results To Beat Expectations - 30/04/2010Rhb InvestNoch keine Bewertungen

- PMT FeasibilityDokument7 SeitenPMT FeasibilityAli Akber HamidNoch keine Bewertungen

- Stockquotes 07082020 PDFDokument9 SeitenStockquotes 07082020 PDFMarlon DNoch keine Bewertungen

- TheSun 2008-12-12 Page30 TNB Seeks Govt Help To Raise Financing For Bakun ProjectDokument1 SeiteTheSun 2008-12-12 Page30 TNB Seeks Govt Help To Raise Financing For Bakun ProjectImpulsive collectorNoch keine Bewertungen

- Stockquotes 01302023Dokument13 SeitenStockquotes 01302023Jonathan M.Noch keine Bewertungen

- Quotation Cosmax New Werehouse - Bogor 1111Dokument3 SeitenQuotation Cosmax New Werehouse - Bogor 1111ICEDA HumNoch keine Bewertungen

- Informal Trading Tariffs PricesDokument4 SeitenInformal Trading Tariffs PricesJim Buti Jim Buti MohlalaNoch keine Bewertungen

- Thesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessDokument1 SeiteThesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessImpulsive collectorNoch keine Bewertungen

- Bca VistaDokument18 SeitenBca VistaSaputra SaputraNoch keine Bewertungen

- Today'S Turnover of Shares - 582,794,744: CompanyDokument2 SeitenToday'S Turnover of Shares - 582,794,744: Companymuzzammil17Noch keine Bewertungen

- Thesun 2009-02-24 Page16 Us May Take Big Stake in Citi As Crisis RagesDokument1 SeiteThesun 2009-02-24 Page16 Us May Take Big Stake in Citi As Crisis RagesImpulsive collectorNoch keine Bewertungen

- 65th Avenue - 20-20 Payment PlanDokument1 Seite65th Avenue - 20-20 Payment Plangautam bajajNoch keine Bewertungen

- Axiata Group Berhad: Mixed Outlook For Regional Cellcos-22/04/2010Dokument4 SeitenAxiata Group Berhad: Mixed Outlook For Regional Cellcos-22/04/2010Rhb InvestNoch keine Bewertungen

- RFQ-001-2023 Supply of ICT Equipment - PDF - EA Data HandlersDokument1 SeiteRFQ-001-2023 Supply of ICT Equipment - PDF - EA Data HandlersMoreen WachukaNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018Dokument9 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018hezeNoch keine Bewertungen

- Cost Sheet For Parag Sir Near PVRDokument1 SeiteCost Sheet For Parag Sir Near PVRgautam bajajNoch keine Bewertungen

- Thesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataDokument1 SeiteThesun 2009-06-09 Page17 Global Airlines To Lose Us$9b This Year Says IataImpulsive collectorNoch keine Bewertungen

- Unisem Berhad: Strong 2Q Earnings But Remain Cautious - 02/08/2010Dokument3 SeitenUnisem Berhad: Strong 2Q Earnings But Remain Cautious - 02/08/2010Rhb InvestNoch keine Bewertungen

- KPMG CEO StudyDokument32 SeitenKPMG CEO StudyImpulsive collectorNoch keine Bewertungen

- Global Talent 2021Dokument21 SeitenGlobal Talent 2021rsrobinsuarezNoch keine Bewertungen

- Coaching in OrganisationsDokument18 SeitenCoaching in OrganisationsImpulsive collectorNoch keine Bewertungen

- Islamic Financial Services Act 2013Dokument177 SeitenIslamic Financial Services Act 2013Impulsive collectorNoch keine Bewertungen

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDokument5 SeitenIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorNoch keine Bewertungen

- Global Added Value of Flexible BenefitsDokument4 SeitenGlobal Added Value of Flexible BenefitsImpulsive collectorNoch keine Bewertungen

- HayGroup Job Measurement: An IntroductionDokument17 SeitenHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Emotional or Transactional Engagement CIPD 2012Dokument36 SeitenEmotional or Transactional Engagement CIPD 2012Impulsive collectorNoch keine Bewertungen

- Hay Group Guide Chart - Profile Method of Job EvaluationDokument27 SeitenHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- HayGroup Rewarding Malaysia July 2010Dokument8 SeitenHayGroup Rewarding Malaysia July 2010Impulsive collectorNoch keine Bewertungen

- Stanford Business Magazine 2013 AutumnDokument68 SeitenStanford Business Magazine 2013 AutumnImpulsive collectorNoch keine Bewertungen

- Futuretrends in Leadership DevelopmentDokument36 SeitenFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDokument15 SeitenHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNoch keine Bewertungen

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDokument4 SeitenHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDokument117 SeitenCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Managing Conflict at Work - A Guide For Line ManagersDokument22 SeitenManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNoch keine Bewertungen

- Developing An Enterprise Leadership MindsetDokument36 SeitenDeveloping An Enterprise Leadership MindsetImpulsive collectorNoch keine Bewertungen

- Flexible Working Good Business - How Small Firms Are Doing ItDokument20 SeitenFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorNoch keine Bewertungen

- Megatrends Report 2015Dokument56 SeitenMegatrends Report 2015Cleverson TabajaraNoch keine Bewertungen

- Compensation Fundamentals - Towers WatsonDokument31 SeitenCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- 2016 Summer Strategy+business PDFDokument116 Seiten2016 Summer Strategy+business PDFImpulsive collectorNoch keine Bewertungen

- Strategy+Business - Winter 2014Dokument108 SeitenStrategy+Business - Winter 2014GustavoLopezGNoch keine Bewertungen

- Strategy+Business Magazine 2016 AutumnDokument132 SeitenStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- 2012 Metrics and Analytics - Patterns of Use and ValueDokument19 Seiten2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorNoch keine Bewertungen

- Deloitte Analytics Analytics Advantage Report 061913Dokument21 SeitenDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNoch keine Bewertungen

- 2015 Summer Strategy+business PDFDokument104 Seiten2015 Summer Strategy+business PDFImpulsive collectorNoch keine Bewertungen

- Talent Analytics and Big DataDokument28 SeitenTalent Analytics and Big DataImpulsive collectorNoch keine Bewertungen

- HBR - HR Joins The Analytics RevolutionDokument12 SeitenHBR - HR Joins The Analytics RevolutionImpulsive collectorNoch keine Bewertungen

- IBM - Using Workforce Analytics To Drive Business ResultsDokument24 SeitenIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorNoch keine Bewertungen

- TalentoDokument28 SeitenTalentogeopicNoch keine Bewertungen

- Secrets of Successful Forex Gold Trading - Advanced ForexDokument3 SeitenSecrets of Successful Forex Gold Trading - Advanced ForexMudasir MuhdiNoch keine Bewertungen

- Stanley Black DeckerDokument9 SeitenStanley Black Deckerarnabkp14_7995349110% (1)

- Lteif Anthony E03g - ExpensesDokument2 SeitenLteif Anthony E03g - ExpensesSaiid GhimrawiNoch keine Bewertungen

- Regd Office: Unit No. 2, First Floor, 3A Pollock Street, Kolkata: 700 001, West BengalDokument6 SeitenRegd Office: Unit No. 2, First Floor, 3A Pollock Street, Kolkata: 700 001, West BengalCA Pallavi KNoch keine Bewertungen

- Ar 2019 # Samindo-4 PDFDokument271 SeitenAr 2019 # Samindo-4 PDFpradityo88100% (1)

- Case#14 Analysis Group10Dokument7 SeitenCase#14 Analysis Group10Mohammad Aamir100% (1)

- My Affidavit For LawyerDokument4 SeitenMy Affidavit For LawyerJohn GuillermoNoch keine Bewertungen

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Dokument24 SeitenKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- #5 PFRS 5Dokument3 Seiten#5 PFRS 5jaysonNoch keine Bewertungen

- Salas Vs CADokument4 SeitenSalas Vs CAHiroshi Carlos100% (1)

- Pyq - Mat112 - Jun 2019Dokument5 SeitenPyq - Mat112 - Jun 2019isya.ceknua05Noch keine Bewertungen

- Acc 411 Principles of AuditingDokument95 SeitenAcc 411 Principles of Auditingbenard kibet legotNoch keine Bewertungen

- ID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanDokument8 SeitenID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanLinda UtariNoch keine Bewertungen

- YTL Buys Rival Lafarge Malaysia: Corporate NewsDokument3 SeitenYTL Buys Rival Lafarge Malaysia: Corporate NewsSatesh KalimuthuNoch keine Bewertungen

- HP-10BII Financial Calculator Guide 0904Dokument24 SeitenHP-10BII Financial Calculator Guide 0904srigopNoch keine Bewertungen

- BPD AssignmentDokument2 SeitenBPD AssignmentSoniya ShahuNoch keine Bewertungen

- TA DA RulesDokument54 SeitenTA DA RulesSheikh InayatNoch keine Bewertungen

- Project On Indian Financial MarketDokument44 SeitenProject On Indian Financial MarketParag More85% (13)

- Nism PGPSM Placements Batch 2012 13Dokument24 SeitenNism PGPSM Placements Batch 2012 13P.A. Vinay KumarNoch keine Bewertungen

- Indian Accounting StandardsDokument9 SeitenIndian Accounting StandardsAman Singh0% (1)

- IB ChallanDokument1 SeiteIB ChallanPrasad HiremathNoch keine Bewertungen

- Financial Statement AnalysisDokument28 SeitenFinancial Statement AnalysisbillyNoch keine Bewertungen

- UnderwriterDokument9 SeitenUnderwritermittaldivya167889Noch keine Bewertungen

- Washington Consensus ChapterDokument12 SeitenWashington Consensus ChapterBropa-sond Enoch KategayaNoch keine Bewertungen

- Master Thesis Maarten VD WaterDokument92 SeitenMaster Thesis Maarten VD WaterkennemerNoch keine Bewertungen

- Form 43Dokument1 SeiteForm 43ShobhnaNoch keine Bewertungen

- 08 InvestmentquestfinalDokument13 Seiten08 InvestmentquestfinalAnonymous l13WpzNoch keine Bewertungen

- Lincoln Park Retiree LawsuitDokument64 SeitenLincoln Park Retiree LawsuitJessica StrachanNoch keine Bewertungen

- 10 - Consolidations - Changes in Ownership InterestsDokument42 Seiten10 - Consolidations - Changes in Ownership InterestsLukas PrawiraNoch keine Bewertungen

- CORRECTION OF ERRORS Theories PDFDokument7 SeitenCORRECTION OF ERRORS Theories PDFJoy Miraflor AlinoodNoch keine Bewertungen