Beruflich Dokumente

Kultur Dokumente

AirAsia's India Entry To Mark Arrival of Truly Low-Cost Airline May Face de

Hochgeladen von

Bighnesh SamalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AirAsia's India Entry To Mark Arrival of Truly Low-Cost Airline May Face de

Hochgeladen von

Bighnesh SamalCopyright:

Verfügbare Formate

AirAsia's India entry to mark arrival of truly low-cost airline; may face delay in clearances - The Economic Times

10 MAR, 2013, 04.22AM IST, BINOY PRABHAKAR,ET BUREAU

AirAsia's India entry to mark arrival of truly low-cost airline; may face delay in clearances

4 in Share

14

Recommend

0 Tweet

Flying into India is a feast for the eyes. Depending on which part of the world a traveller enters from, the country's diverse natural splendour unfolds through a succession of mountain peaks, snaking rivers and swathes of pristine-green plains. Then, it is time to land. The spectacular imagery from the clouds is replaced on the ground by a succession of planes, snaking queues and swathes of security personnel.

The ambition of AirAsia, Malaysia's biggest low-cost carrier, to launch an airline venture in India is a bit similar. From afar, India looks a promising aviation market; rewards seem certain thanks to its immense growth potential and the yearning of its growing middle class to travel by air. Up close, something ugly is lurking due to the regulatory maze, absurdly high costs and competitors that embody the Darwinian concept of survival. AirAsia, which partnered the Tatas and Arun Bhatia of Telstra Tradeplace last month for the airline venture, cleared the first hurdle last week when it received permission from the Foreign Investment Promotion Board, the nodal agency for investments from abroad. But the road ahead is tricky, to say the least. Media reports point to the aviation ministry officials and competitors squirming at the prospect of its entry. Mark Martin of Martin Consulting Inc, an aviation consultancy based in Dubai, says AirAsia's potential entry marks the arrival of a serious player in the Indian aviation market. "It will bring back maturity into the market." AirAsia India would be occupying a space left vacant by Vijay Mallya's Kingfisher Airlines BSE 4.81 % . The existing five carriers are far too few for a huge country like India and there is enough business for all to compete on many routes. The aviation ministry's tepid reaction to AirAsia's entry the airline was reminded about procedures, yes, procedures, as if it needed a reminder, given India's notoriously excessive regulations is surprising due to these realities. It is easier to see why India's carriers are unnerved: they are grappling with an alarming fall in passenger traffic and spiralling costs (airports fees, fuel prices and tax rates). One more competitor is the last thing they need.

True-blue Low-cost Carrier Tony Fernandes, Group CEO, AirAsia, has already got a taste of things to come. "My one tweet which was to show the world what great people there are in India was twisted by our competitors," he revealed in an email response, refusing to elaborate further. Fernandes says the people in India are dying for a real low-cost airline. Indeed. India does have low-cost carriers IndiGo and SpiceJet BSE 2.78 % are good

http://economictimes.indiatimes.com/articleshow/18884761.cms?prtpage=1[3/10/2013 9:14:11 AM]

AirAsia's India entry to mark arrival of truly low-cost airline; may face delay in clearances - The Economic Times

examples. Yet, in aviation parlance, low-cost carriers and low fares are said in the same breath. By that measure, Indian carriers do not fit the low-cost bill. No doubt, they try to keep a lid on costs, but their prices would make even full-service competitors blush, never mind the recent fare cuts. (Passenger numbers are declining seriously?) AirAsia, in striking contrast, is renowned for low fares. Though its fares are not as dirt-cheap as those of Europe's no-frills carriers, notably Ryanair, the difference is that customers are not treated like riffraff. (Here's what Ryanair CEO Michael O'Leary had to say about passengers who forget to print their boarding pass: "We think they should pay e60 for being so stupid."). Yet, AirAsia offers fares that rivals seldom match, simply by embracing a business model that keeps costs ridiculously low (see Truly Low Cost) . To understand how, one has to look closely at its operations. The airline is famous for keeping its planes almost continuously in air due to its efficiency in turning planes around at airports. Most full-service airlines take nearly an hour to exit an airport; AirAsia does it in half the time. Result: the frequency of a bus service. (AirAsia flies up to 13 times each between Kuala Lumpur and Singapore and Bangkok and Phuket and eight times between Bangkok and Singapore.) Businessmen and executives, from say, Hyderabad can hop onto flights, arrive in Chennai for a meeting and be back by late afternoon for a round of golf.

This model was pioneered by America's Southwest Airlines in the 1970s. AirAsia follows the same rulebook. It flies one type of aircraft Airbus A320s which are efficient, easier to manage and cut training costs. Again, like Southwest, AirAsia flies point to point (non-stop between airports), avoiding the traditional huband-spoke model. This eliminates the need for crew and infrastructure at transits. The carrier also saves on distribution costs by avoiding travel agents for bookings. If these strategies save money, the airline is also relentlessly focused on making money. A cornerstone of this strategy is the ancillary charges for meals, extra luggage, more legroom etc. Aggressive marketing tactics too help. AirAsia is one of the few airlines in the world that makes money through advertisements in its in-flight magazine. The planes resemble a giant billboard in motion, with a raft of brands jostling for every inch. Southwest is the world's only airline that consistently makes profits, but AirAsia hasn't fared badly either. Three affiliates AirAsia Malaysia, Thai AirAsia and Indonesia AirAsia are money-spinners. The original business in Malaysia was the stellar performer in 2012, with its 23% operating profit margin one of the highest among airlines, according to aviation consultancy Capa. Two offshoots it launched in the Philippines and Japan in 2012 incurred losses, but these are early days. India Game Plan In India, AirAsia will obviously replicate its hugely successful global business model. To start with, the carrier plans to negotiate a good deal for lease of aircraft, according to a person familiar with the matter. All strategies 95% of aircraft returning to the base to avoid transportation and hotel costs, a crew of not more than four in aircraft and the like that together have helped trim costs in other markets will be followed in India, says the person, who is closely involved with establishing AirAsia's Indian operations, requesting anonymity. (The Indian operations will be shepherded by Bo Lingam, Chief of Operations and Planning of AirAsia and a confidant of Fernandes, and R Venkat, who works in former Tata Group boss Ratan Tata's office in Mumbai). Charles Dhanaraj, associate professor of management, Kelley School of Business in the US, says one can transplant an efficient business model irrespective of the location. "All it needs is the leadership that will bring energy and focus." Suitable Market

http://economictimes.indiatimes.com/articleshow/18884761.cms?prtpage=1[3/10/2013 9:14:11 AM]

AirAsia's India entry to mark arrival of truly low-cost airline; may face delay in clearances - The Economic Times

It helps that India is tailor-made for some of AirAsia's core practices. Nearly 80% of Indian flights operate on a point-to-point network, save for long-haul routes such as Delhi-Kochi and Mumbai-Chennai. "We would aim for high frequencies by deploying at least three aircraft on each route," says the person, adding that Delhi-Agra fits the bill because there is no operator on the route. AirAsia India, according to this person, has no plans to eat into the market of competitors. "We will create a new market. We've done it in other markets."

Craig Jenks, president of Airline/Aircraft Projects Inc, an airline consultancy based in New York, says AirAsia has consistently generated traffic where other airlines assumed was not possible. "Even in the low-cost sector in India, the tendency of private airlines has been to focus mostly on existing non-stop routes and markets. AirAsia [in contrast] may focus on developing new non-stops." The airline will also stimulate the market, says the person familiar with its strategy. One way would be to offer "free" tickets (passengers will still have to pay taxes and fuel surcharge). In 2009, AirAsia gave away a million "free" tickets to destinations in India, China, Indonesia, Taiwan, and Thailand. "Tony [Fernandes] is particular about the mission statement: 'Now Everyone Can Fly'." He does so by providing affordable fares." India, in this context, is ideal, says the person. "The market saw low fares between 2005 and 2008. Since 2009, the fares have turned expensive." All the same, fares would be attuned to the cost of operations to make a route profitable. To cite an example, AirAsia would fix, say, a fare of Rs 3,500. Bookings would open six months in advance and the first set of possibly 20 tickets on a flight would be given free. The following set would cost Rs 999, the next Rs 1,999 and so on. On the day before takeoff, the remaining tickets would be sold at Rs 6,999. "Assuming there are 180 passengers in an aircraft and a 90% load factor [occupancy] is the target, nearly 70% of the load factor would pay a price above the average fare," says the person quoted above. In the first year of operations, AirAsia plans to use five aircraft. It will shun major airports as it has elsewhere. Fernandes has already said he is skittish about the Delhi and Mumbai airports due to their exorbitant fees. So south it is, though it is yet to decide on Bangalore or Chennai as the hub. Turbulence Ahead In any case, AirAsia does not see much potential in the north. Delhi and Mumbai apart, other sectors in the north offer little passenger base, says the AirAsia associate. "In the south, all the four cities Bangalore, Chennai, Hyderabad and Kochi hold a vibrant passenger traffic. Besides, smaller airports like Visakhapatnam and Kozhikode are also flourishing," he says.

http://economictimes.indiatimes.com/articleshow/18884761.cms?prtpage=1[3/10/2013 9:14:11 AM]

AirAsia's India entry to mark arrival of truly low-cost airline; may face delay in clearances - The Economic Times

South offers better options. "In Bangalore, for instance, people pay Rs 1,200-2,000 to travel on Volvo buses to Kerala. The journey takes 8 hours. By paying a little extra in our flights, they could reach their destinations in two hours." Nevertheless, AirAsia will have its work cut out in India. The first big impediment could be the authorities themselves. Aviation minister Ajit Singh has said he would have preferred a venture with the Tatas at the helm. On March 1, Ratan Tata met Singh, not surprising given the minister's halfhearted comments (Ratan Tata's visit and Venkat's presence indicate that the former Tata chairman will steer the airline venture). At the FIPB, opposition came from none other than the aviation ministry, which cited a commerce ministry note that purportedly allowed foreign investments in only existing Indian carriers. Five days after Tata's visit, Singh said the venture could face procedural problems. In a telephonic conversation with ET Magazine, Singh strongly denied his opposition to the venture. "If I said I preferred the Tatas should have launched an airline on their own, can that be construed as I am opposed to AirAsia?" Singh says he welcomes the airline. "That said, they have to meet regulations. Procedure is procedure. I am sure they can take care of it." An aviation analyst who did not want to be named says the minister's statements do not inspire confidence. "They [AirAsia] could face delays in security clearances. There could also be delays in aircraft acquisition approvals." The venture has to apply for operating permits from the regulator Directorate General of Civil Aviation next. AirAsia would also have to contend with stiff opposition from existing players. The history of aviation is replete with stories of rivals trying to scuttle new players. Virgin Atlantic's Richard Branson has often spoken about how British Airways tried to sabotage his airline in the beginning. Southwest faced bigger problems: it faced boycotts and litigations from airports while rivals tried to drive it out of business by offering cheaper fares.

AirAsia has already had disappointments in India. It has struggled on overseas routes from India. Its aversion to local distribution networks might again prove costly because travel agents still account for most bookings in India. Another hurdle could be India's expensive operating environment, particularly airports fees. Giorgio De Roni, CEO, GoAir, says the decrease in demand since April is due to the high fuel costs and taxation. "India is the second most expensive aviation market in the world after Bangladesh. If we include excise duty and octroi, tax would rise to 40%." Dhanaraj of the Kelley School of Business says operating a reasonably profitable airline in India will require a unique business model. "Purely being a low-cost player is suicidal. The costs are a given. What really matters is the ability to run a smooth operation, saving on a thousand small things which make an airline profitable." Yet, what makes AirAsia a formidable player in aviation is its ability to adapt. "What's worked for the carrier is that it is flexible with its model," says Martin. Versatile Model The flexibility comes from the top. Martin says Tony (Fernandes) is a smart strategist and knows what the customer wants. "He will bring a practical aviation model to India. Expect a great deal of automation in the operating model, passenger services, flights and maintenance. There could also be plenty of innovations: passengers could buy tickets through ATMs, pay through mobile phones etc." Fernandes is a hands-on chief, famous for working alongside his staff in the cabin or to handle luggage. He is equally famous for his contrarian streak. When carriers sharply reduce capacity and cut routes, AirAsia typically adds destinations. AirAsia is also unlike Indian carriers that say they are forced to pass on high costs onto passengers. In 2012, average fares at its Thailand and Indonesia offshoots rose only 2% compared with a 7% increase in costs from a year ago, according to Capa.

http://economictimes.indiatimes.com/articleshow/18884761.cms?prtpage=1[3/10/2013 9:14:11 AM]

AirAsia's India entry to mark arrival of truly low-cost airline; may face delay in clearances - The Economic Times

Dhanaraj says most Indian airline passengers crave a highly reliable service, for which they are willing to pay marginally more. The carrier also has a strong and reliable partner in the Tatas. Taken together, it means Air Asia has a good chance in India, says Dhanaraj. "Along with IndiGo, I think it will redefine domestic travel in India."

Page 1 of 5

Prev Next

Download ET's mobile applications for iPad, iPhone, Android, BlackBerry, Nokia and Windows Phone to track news as it happens, live stock quotes, monitor portfolio, get market stats like gainers, losers and movers & much more. To check out free Economic Times apps , Click here

http://economictimes.indiatimes.com/articleshow/18884761.cms?prtpage=1[3/10/2013 9:14:11 AM]

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Island Resort Kakkathuruthu Project Feasibility Report: Promoted byDokument34 SeitenIsland Resort Kakkathuruthu Project Feasibility Report: Promoted byIan BachNoch keine Bewertungen

- Banyan Tree Case StudyDokument21 SeitenBanyan Tree Case StudyMarinda KardionoNoch keine Bewertungen

- EO 111 and DAO 2013-19Dokument79 SeitenEO 111 and DAO 2013-19Leira Romero0% (1)

- NISM-Series-V-A Mutual Fund Distributors Certification ExaminationDokument5 SeitenNISM-Series-V-A Mutual Fund Distributors Certification ExaminationinvestorfirstNoch keine Bewertungen

- The Securities Contracts (Regulation) Rules, 1957 (Notification No - SRO 576, Dated 21-2-1957)Dokument34 SeitenThe Securities Contracts (Regulation) Rules, 1957 (Notification No - SRO 576, Dated 21-2-1957)Bipluv ChaudryNoch keine Bewertungen

- Derivatives 100128112108 Phpapp02Dokument152 SeitenDerivatives 100128112108 Phpapp02savla_jayNoch keine Bewertungen

- Dynamics of Market StructureDokument37 SeitenDynamics of Market StructureBighnesh SamalNoch keine Bewertungen

- Theme Paper On Digital Payment SystemsDokument103 SeitenTheme Paper On Digital Payment SystemsBighnesh Samal100% (1)

- Cloud Computing: A Collection of Working PapersDokument33 SeitenCloud Computing: A Collection of Working Papersashishkumar777Noch keine Bewertungen

- A Comparative View of Mutual FundsDokument2 SeitenA Comparative View of Mutual FundsBighnesh SamalNoch keine Bewertungen

- MidtermDokument5 SeitenMidtermFloriejoy LibresNoch keine Bewertungen

- Jurnal Pariwisata Pesona: Kajian Pola Pergerakan Wisatawan Di Daya Tarik Wisata Alam Kabupaten Malang Myrna SukmaratriDokument13 SeitenJurnal Pariwisata Pesona: Kajian Pola Pergerakan Wisatawan Di Daya Tarik Wisata Alam Kabupaten Malang Myrna SukmaratriCapt. BlackFoxNoch keine Bewertungen

- Sabah Malaysian Borneo March 2008Dokument28 SeitenSabah Malaysian Borneo March 2008Sabah Tourism Board100% (3)

- Bono Hotel Mercure Koh Samui Beach ResortDokument1 SeiteBono Hotel Mercure Koh Samui Beach ResortEmilio Fernández MartínezNoch keine Bewertungen

- Timeshare in IndiaDokument7 SeitenTimeshare in IndiaRavi SinghNoch keine Bewertungen

- Conceptualizing Special Interest Tourism - Frameworks For AnalysisDokument19 SeitenConceptualizing Special Interest Tourism - Frameworks For AnalysisNurulpraNoch keine Bewertungen

- Interchange Level 2 ScopeSequenceDokument4 SeitenInterchange Level 2 ScopeSequencezavijavaNoch keine Bewertungen

- Legal and Illegal Tourism Workers of Banaue: Inclusive Growth for AllDokument17 SeitenLegal and Illegal Tourism Workers of Banaue: Inclusive Growth for AllEulalie D. DulnuanNoch keine Bewertungen

- Phuket - 3d2n Fullboard Tour (Nov13-Mar14)Dokument2 SeitenPhuket - 3d2n Fullboard Tour (Nov13-Mar14)Orangutan SolutionsNoch keine Bewertungen

- Assessment& ChallengesDokument9 SeitenAssessment& ChallengesrtkobNoch keine Bewertungen

- Euro Eco 2018Dokument5 SeitenEuro Eco 2018David TsiramuaNoch keine Bewertungen

- Merge 1Dokument48 SeitenMerge 1Dilwali DeepaNoch keine Bewertungen

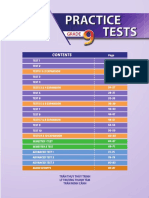

- Tests 1-10 and Expansions Contents and SummariesDokument5 SeitenTests 1-10 and Expansions Contents and SummariesMaiNoch keine Bewertungen

- Case Study TourismDokument3 SeitenCase Study TourismMiguel Oubiña SánchezNoch keine Bewertungen

- The World's Best Place To Travel and Visit: by John Warren / ABC News Travel Editor - (Published) 3:03 PMDokument6 SeitenThe World's Best Place To Travel and Visit: by John Warren / ABC News Travel Editor - (Published) 3:03 PMJohnNoch keine Bewertungen

- Swot Analysis of Backwater Tourism With Special Reference To Alappuzha DistrictDokument5 SeitenSwot Analysis of Backwater Tourism With Special Reference To Alappuzha DistrictInternational Journal of Application or Innovation in Engineering & ManagementNoch keine Bewertungen

- Tourism in Swanage Geography CourseworkDokument6 SeitenTourism in Swanage Geography Courseworkf634dexc100% (2)

- Potential of Tourism in Southeast BangladeshDokument22 SeitenPotential of Tourism in Southeast BangladeshSayed Saeed AhmadNoch keine Bewertungen

- ConferenceDokument8 SeitenConferenceravi.gold1Noch keine Bewertungen

- Falmouth Labadee FlyerDokument2 SeitenFalmouth Labadee Flyerdonna3915Noch keine Bewertungen

- Oefc 00 Ab Tourism 3 ListeniDokument38 SeitenOefc 00 Ab Tourism 3 ListeniLaura Treviño Ruiz100% (1)

- Challenge 3 Actitivity 6 and Communicative Task 3 Description - Saturday GroupDokument3 SeitenChallenge 3 Actitivity 6 and Communicative Task 3 Description - Saturday GroupKaroll Tatiana Cortes MartínNoch keine Bewertungen

- Philippine EIA System Assesses Project ImpactsDokument7 SeitenPhilippine EIA System Assesses Project ImpactsRosemarie AngelesNoch keine Bewertungen

- History of Santa Praxedes CagayanDokument5 SeitenHistory of Santa Praxedes CagayanLisa MarshNoch keine Bewertungen

- My Holiday in BaliDokument2 SeitenMy Holiday in BaliyurimizunoNoch keine Bewertungen

- Hotel Director - Food and Beverage DirectorDokument5 SeitenHotel Director - Food and Beverage Directorapi-792419400% (1)

- Live Free Vacation Tracker Excel Template 2023 BlankDokument104 SeitenLive Free Vacation Tracker Excel Template 2023 Blankelmore kakaNoch keine Bewertungen