Beruflich Dokumente

Kultur Dokumente

DB Corp 4Q FY 2013

Hochgeladen von

Angel BrokingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DB Corp 4Q FY 2013

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

4QFY2013 Result Update | Media May 17, 2013

DB Corp

Performance Highlights

Quarterly Results (Consolidated)

(` cr) Revenue EBITDA OPM (%) PAT 4QFY13 398 94 23.6 55 4QFY12 353 73 20.6 45 % yoy 12.7 29.4 304bp 21.8 3QFY13 439 119 27.2 71 % qoq (9.3) (21.1) (355)bp (21.9)

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Media 4,502 (79) 0.4 261/181 28,051 10 20,286 6,187 DBCL.BO DBCL@IN

`246 `285

12 Months

Source: Company, Angel Research

For 4QFY2013, DB Corp (DBCL) reported a robust performance on the earnings front, registering a 21.8% yoy growth to `55cr (in-line with our expectations), aided by reduction in losses in emerging editions from `18.5cr in 4QFY2012 to `5.8cr in 4QFY2013. Key highlights for the quarter: For 4QFY2013, DBCL posted healthy 12.7% yoy growth in its top-line to `398cr. Advertising revenue grew by 13.1% yoy to `298cr, primarily driven by higher yields. Sectors such as lifestyle, FMCG, real-estate and automobile, among others, have contributed to strong growth in advertising. National advertising, which has been subdued in last few quarters, has also grown by ~12% yoy (due to increase in government advertising). The company also reported strong growth of 18.2% yoy in circulation revenue to `73cr (driven by both cover price hike as well as increase in circulation). Among the other segments, the companys radio business reported a robust advertising revenue growth of 24.2% yoy to `19cr. At the operating level, EBITDA grew by 29.3% yoy to `94cr on account of reduction in losses of emerging editions as well as cost rationalization measures such as improving ad edit ratio, and pagination efficiency, among others. Consequently, the OPM expanded by 304bp yoy to 23.6% and net profit grew by 21.8% yoy to `55cr. Outlook and valuation: At the current market price, DBCL is trading at 14.6x FY2015E consolidated EPS of `16.8. We maintain our Buy view on the stock with a revised target price of `285, based on 17x FY2015E EPS, benchmarking it to our print media sector valuations (which are at ~15% premium to our Sensex target valuation multiple). The downside risks to our estimates include 1) sharp rise in newsprint prices in INR terms, and 2) higher-than-expected losses/increase in the breakeven period of the new launches.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 75.0 5.5 14.5 5.1

Abs. (%) Sensex DBCL

3m 4.0 2.8

1yr 26.6 24.6

3yr 20.5 3.3

Key financials (Consolidated)

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA margin (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) FY2012 1,451 15.2 202 (21.9) 23.2 11.0 22.3 4.9 23.0 24.7 3.1 13.3 FY2013E 1,593 9.8 219 8.2 23.7 11.9 20.6 4.4 22.4 25.5 2.8 11.8 FY2014E 1,750 9.9 261 19.2 25.1 14.2 17.3 3.8 23.4 27.6 2.5 9.9 FY2015E 1,925 10.0 308 18.1 26.6 16.8 14.6 3.2 23.4 28.8 2.2 8.3

Amit Patil 022-39357800 Ext: 6839 amit.patil@angelbroking.com

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

DB Corp | 4QFY2013 Result Update

Exhibit 1: Quarterly Performance (Consolidated)

Y/E March (` cr) Net Sales Consumption of RM (% of Sales) Operating Expense (% of Sales) Staff Costs (% of Sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (% of Sales) Provision for Taxation (% of PBT) Minority Interest Recurring PAT PATM Exceptional items Reported PAT Equity shares (cr) FDEPS (`)

Source: Company, Angel Research

4QFY13 398 134 33.6 101 25.4 69 17.4 304 94 23.6 2 15 9 86 21.6 31 35.7 0 55 14 0 55 18.3 3.0

4QFY12 353 130 36.8 89 25.3 61 17.3 281 73 20.6 2 13 11 68 19.3 23 33.7 0 45 13 0 45 18.3 2.5

% yoy 12.7 2.7 13.2 13.4 8.4 29.4 (8.5) 15.9 (15.8) 26.0 33.3

3QFY13 439 145 33.0 103 23.4 72 16.5 320 119 27.2 2 15 4 106 24.2 35 33.2 (0)

% qoq (9.3) (7.6) (1.3) (4.4) (4.9) (21.1) 16.8 140.3 (19.0) (12.9)

FY2013 1,592 545 34.2 392 24.6 280 17.6 1,216 376 23.6 8 58 21 331 20.8 113 34.2 0

FY2012 1,451 508 35.0 364 25.1 243 16.7 1,115 336 23.2 9 51 24 301 20.7 98 32.7 (0) 202 14 202 18.3 11.0

% chg 9.7 7.2 7.7 15.1 9.1 11.8

14.8 (11.3) 10.3 15.1

21.8

71 16 0

(21.9)

218 14 0

8.0

21.9 21.8

71 18.3 3.9

(21.8) (21.9)

218 18.3 11.9

8.0 8.0

May 17, 2013

DB Corp | 4QFY2013 Result Update

Top-line driven by strong advertising growth

For 4QFY2013, DBCL posted healthy 12.7% yoy growth in its top-line to `398cr. Advertising revenue grew by 13.1% yoy to `298cr, primarily driven by higher yields. Sectors such as lifestyle, FMCG, real-estate and automobile, among others, have contributed to strong growth in advertising. National advertising which has been subdued in last few quarters has also grown by ~12% yoy, due to increase in government advertising. The proportion of local advertising to national advertising is 65:35. However, upcoming state elections are expected to boost government advertising, which may boost overall share of national advertising. Among the other segments, the companys radio business reported a robust advertising revenue growth of 24.2% yoy to `19cr.

Exhibit 2: Top-line growth in-line with expectations

500

450 400 18.0 16.6 13.4 11.3 7.8

11.2

12.7

20.0

18.0 16.0

350

300

11.3

6.2

14.0

12.0

(` cr)

200 150

353 352 351 395 374 439

353 378

8.0 6.0

398

100 50

4.0 2.0

4Q11 1Q12 2Q12 3Q12 1Q13 3Q13

4Q12 2Q13 4Q13

Top line (LHS)

yoy growth (RHS)

Source: Company, Angel Research

Circulation revenue grew by robust 18.2% yoy

The company reported strong growth of 18.2% yoy in circulation revenue to `73cr (driven by both cover price hike as well as increase in circulation). In spite of cover price hike of ~5% yoy to `2.6, its lowest among its peers.

Exhibit 3: Strong growth in advertising revenue

350

300 30.8 16.6 6.8 2.8 10.9 13.1

Exhibit 4: Price hike inches up circulation revenue

35.0

30.0 25.0 20.0

80 70 60 50

( ` cr) (%)

12.8

17.3

11.5

14.0 12.8

16.1

20.0 13.9 18.0

16.0 14.0 12.0 8.0 6.0 4.0

5.4

(0.2)

10.9

250

( ` cr)

200 150

12.9

14.9

15.0

10.0 5.0

30 20 10 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13

45 60 40 56 45 41 49 71 55

100

250 271 275 287 263 270 283 318

50

298

2.0

4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13

(5.0)

Advertising revenue (LHS)

yoy growth (RHS)

Adjusted PAT (LHS)

NPM (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

May 17, 2013

(%)

40

10.0

(%)

250

10.0

DB Corp | 4QFY2013 Result Update

Gross margin and OPM expands yoy

The fall in newsprint prices and cost rationalization measures such as improving ad edit ratio, and pagination efficiency, among others led to 326bp yoy increase in gross margin to 66.4%. EBITDA grew by 29.3% yoy to `94cr aided by reduction in losses of emerging editions (`5.8cr loss in 4QFY2013 vs a loss of `18.5cr in corresponding quarter last year). Consequently, the OPM expanded by 304bp yoy to 23.6% and net profit grew by 21.8% yoy to `55cr.

Exhibit 5: OPM expands 303bp yoy

80.0 70.0

60.0 50.0 63.2 66.4

Exhibit 6: Adjusted PAT grew by 21.8%

80

64.4 64.8 67.0

64.5

65.8

63.2

66.4

17.3

12.8 11.5

14.0 12.8

70 60 50

( ` cr)

16.1

20.0 13.9 18.0

16.0 14.0 12.0 8.0 6.0 4.0

10.9

12.9

(%)

40.0 30.0 20.0 20.6

28.1

19.8

24.1

20.6

19.7

22.8

27.2

23.6

30 20 10 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13

45 60 40 56 45 41 49 71 55

10.0 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13

2.0

4Q13

EBITDA

OPM

Adjusted PAT (LHS)

NPM (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 7: Reduction in losses of emerging editions

(` cr) Revenue EBITDA (incl other income) EBITDA margin (%)

Source: Company, Angel Research

Mature Editions 352 108.5 31

Emerging Editions 377 (5.8) (15.4)

Radio Business 18.5 6.9 37

Akola edition to be launched

Although DB Corp has put major launches on backburner, due to slowdown in economy, it is still going ahead with launch of Akola edition. The management is bullish on advertising market (especially local advertising) in Maharashtra. Therefore, they are also considering more launches in other tier-2 cities such as Nanded, Latur and Amravati.

May 17, 2013

(%)

40

10.0

DB Corp | 4QFY2013 Result Update

Investment rationale

Well-planned aggression in business edges DBCL over peers: DBCL, though a dominant No. 2 player in the overall regional print space (trailing behind Jagran Prakashan), enjoys a premium valuation to its peers - Jagran Prakashan (flagship daily Dainik Jagran) and Hindustan Media Ventures (flagship daily Hindustan). We attribute the reason for this trend to DBCLs business model (which is primarily driven by ad revenue) and well thought-out launches in new markets. We believe the companys continuous endeavor to diversify its print business coupled with aggressive expansion into new markets (urban towns beyond metros) backed by exhaustive market research and focus on achieving leadership are the key factors differentiating the company from its peers. The company has been successful in executing its expansion plans with launches in Maharashtra and Jharkhand.

Outlook and valuation

At the current market price, DBCL is trading at 14.6x FY2015E consolidated EPS of `16.8. We maintain our Buy view on the stock with a revised target price of `285, based on 17x FY2015E EPS, benchmarking it to our print media sector valuations (which are at ~15% premium to our Sensex target valuation multiple). The downside risks to our estimates include 1) sharp rise in newsprint prices in INR terms, and 2) higher-than-expected losses/increase in the breakeven period of the new launches.

May 17, 2013

DB Corp | 4QFY2013 Result Update

Exhibit 8: Peer valuation

Company HT Media Jagran DB Corp Reco Buy Buy Buy Mcap (` cr) 2,317 2,974 4,500 CMP (`) 99 94 246 TP (`) 117 121 285 Upside (%) 19 29 16 P/E (x) FY13E 11.9 12.8 17.3 FY14E 10.8 11.2 14.6 EV/Sales (x) FY13E 0.7 1.8 2.5 FY14E 0.6 1.6 2.2 ROE(%) FY13E 11.5 26.7 23.4 FY14E 11.4 26.8 23.4 CAGR # Sales 7.8 12.4 9.9 PAT 13.0 13.7 18.6

Source: Company, Angel Research Note:# denotes CAGR for FY2013-15

Exhibit 9: Angel vs consensus estimates

Top-line (` cr) Angel estimates Consensus Diff (%)

Source: Company, Angel Research

FY2014E 1,750 1,785 (1.9)

FY2015E 1,925 1,965 (2.0)

EPS (`) Angel estimates Consensus Diff (%)

FY2014E 14.2 14.5 (1.9)

FY2015E 16.8 17.1 (1.8)

Exhibit 10: Return of DB Corp vs Sensex

200%

Exhibit 11: One-year forward P/E band

350 300

12x 15x 18x 21x

180%

160% 140% 120% 100%

Sensex

DB Corp

80%

60%

40%

20%

Jun-11

Aug-11

Jun-12

Aug-12

Apr-11

Oct-10

Oct-11

Oct-12

Feb-11

Feb-12

Dec-10

Dec-11

Dec-10

Aug-10

Aug-12

Aug-11

Dec-12

Dec-11

Source: Company, Angel Research

Source: Company, Angel Research

Company Background

DB Corp is one of the largest print media companies in India that publishes 8 newspapers with 65 editions, and 199 sub editions in 4 multiple languages across 13 states in India. The companys flagship newspaper Dainik Bhaskar, Divya Bhaskar and Saurashtra Samachar have a combined average daily readership of ~19 million, making them one of the most widely read newspaper groups in India with presence in Madhya Pradesh, Chhattisgarh, Rajasthan, Haryana, Punjab, Chandigarh, Himachal Pradesh, Uttrakhand, Delhi, Gujarat, Maharashtra and Jammu. The companys other noteworthy newspaper brands are Dainik Divya Marathi, Business Bhaskar, DB Gold, DB Star and DNA on a franchise basis.

Dec-12

Feb-12

Feb-13

Feb-11

Jun-10

Jun-11

Apr-10

Apr-11

Apr-12

Jun-12

Oct-11

Oct-12

Oct-10

Apr-13

Feb-13

Apr-13

Apr-12

0%

Share Price (`)

250

200 150

100

May 17, 2013

DB Corp | 4QFY2013 Result Update

Profit and loss Statement (Consolidated)

Y/E March (` cr) Gross sales Less: Excise duty Net Sales Total operating income % chg Total Expenditure Cost of Materials SG&A Expenses Personnel Others EBITDA % chg (% of Net Sales) Depreciation & Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Share in profit of Associates Recurring PBT % chg Prior Period & Extra Exp/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earn. of assoc. Less: Minority interest (MI) PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg

previous year numbers

FY2010 FY2011 FY2012 FY2013 FY2014E FY2015E 1,058 1,058 1,058 10.4 720 328 249 132 12 338 133.8 31.9 38 300 159.7 28.4 25 5 1.9 281 258.9 0 280 106 37.6 175 (8) 183 183 283.5 17.3 10.1 10.0 283.9 1,260 1,260 1,260 19.1 862 383 279 185 16 398 17.7 31.5 43 354 18.1 28.1 15 19 5.4 359 27.9 2 357 98 27.4 259 0.3 259 260 42.2 20.6 14.1 14.1 41.4 1,451 1,451 1,451 15.2 1,115 508 350 243 15 336 (15.4) 23.2 51 286 (19.4) 19.7 9 24 8.0 300 (16.2) 300 98 32.7 202 0 202 202 (22.4) 13.9 11.0 11.0 (21.9) 1,593 1,593 1,593 9.8 1,216 540 392 280 5 377 12.1 23.7 58 318 11.5 20.0 8 21 6.4 332 10.5 332 113 34.2 219 219 219 8.2 13.7 11.9 11.9 8.2 1,750 1,750 1,750 9.9 1,310 568 415 312 16 440 16.8 25.1 63 377 18.5 21.6 8 19 4.9 389 17.2 389 128 33.0 261 261 261 19.2 14.9 14.2 14.2 19.2 1,925 1,925 1,925 10.0 1,412 597 456 343 16 513 16.5 26.6 69 444 17.6 23.1 6 21 4.6 459 18.1 459 152 33.0 308 308 308 18.1 16.0 16.8 16.8 18.1

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with

May 17, 2013

DB Corp | 4QFY2013 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Share Capital suspense a/c Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Other long term liablities Long term provisions Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Long term loans and adv. Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets

previous year numbers

FY2010 FY2011 FY2012 182 1 466 649 4 321 61 183 3 643 829 0 172 69 26 3 1,035 660 112 547 61 39 21 561 193 103 266 207 354 13 1,035 1,100 783 149 634 41 33 16 63 557 173 71 313 255 302 10 1,100 183 5 739 927 2 180 75 30 4 1,216 906 191 715 45 33 46 87 610 136 106 367 329 281 9 1,216

FY2013E 183 844 1,028 1 137 83 33 1,282 996 250 746 55 37 81 85 622 119 65 438 349 273 6 1,282

FY2014E 183 1,019 1,202 1 127 83 33 1,447 1,080 312 768 86 37 106 99 690 187 76 427 346 344 6 1,447

FY2015E 183 1,241 1,424 1 97 83 33 1,639 1,188 381 807 95 37 128 99 822 259 94 469 356 466 6 1,639

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with

May 17, 2013

DB Corp | 4QFY2013 Result Update

Cash flow (Consolidated)

Y/E March (` cr) Profit before tax Depreciation Change in Working Cap. Interest / Dividend (Net) Direct taxes paid Others Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Interest / Dividend (Net) Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances

previous year numbers

FY2010 FY2011 FY2012 281 38 (14) 25 101 2 229 (38) 3 (34) 251 (242) 42 13 (48) 147 45 193 359 43 (24) 15 98 0 295 (103) 4.22 (99) 2 (149) 69 1 (216) (20) 193 173 300 51 (73) 9 98 0 189 (127) (29.73) (157) 0.55 8 80 (2) (69) (36) 173 136

FY2013E 332 58 (44) 8 113 0 241 (99) (34.69) (134) (43) 86 (4) (125) (18) 136 119

FY2014E 389 63 (17) 8 128 (12) 301 (117) (25.00) (142) (10) 86 (4) (92) 68 119 187

FY2015E 459 69 (51) 6 152 (11) 321 (117) (22.00) (139) (30) 86 (6) (110) 72 187 259

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with

May 17, 2013

DB Corp | 4QFY2013 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.)

previous year numbers

FY2010 24.6 20.2 6.9 0.8 4.4 13.7 4.5 10.1 10.0 12.2 2.0 35.7 28.4 0.6 1.3 22.4 0.0 1.0 45.7 31.4 35.6 40.3 1.6 25 67 59 56 0.2 0.3 12.2

FY2011 FY2012 17.4 14.9 5.5 1.3 3.5 11.2 4.0 14.1 14.1 16.5 3.2 44.7 28.1 0.7 1.4 29.1 0.0 0.1 31.2 33.2 38.3 35.0 1.6 21 70 22 55 (0.0) (0.0) 23.7 22.3 17.8 4.9 1.5 3.1 13.3 3.7 11.0 11.0 13.8 3.7 50.1 19.7 0.7 1.5 19.2 0.0 (0.0) 19.0 24.7 26.5 23.0 1.6 30 62 27 57 (0.0) (0.0) 31.0

FY2013E FY2014E FY2015E 20.6 16.2 4.4 1.6 2.8 11.8 3.5 11.9 11.9 15.1 4.0 55.7 20.0 0.7 1.4 18.7 0.0 (0.0) 18.1 25.5 27.4 22.4 1.6 30 63 22 55 (0.1) (0.2) 40.8 17.3 13.9 3.8 1.6 2.5 9.9 3.0 14.2 14.2 17.6 4.0 65.2 21.6 0.7 1.4 20.9 0.0 (0.1) 18.8 27.6 30.0 23.4 1.6 26 63 25 53 (0.1) (0.4) 49.4 14.6 11.9 3.2 1.6 2.2 8.3 2.6 16.8 16.8 20.5 4.0 77.3 23.1 0.7 1.5 22.5 0.0 (0.2) 18.7 28.8 32.2 23.4 1.6 26 63 24 58 (0.2) (0.6) 76.0

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with

May 17, 2013

10

DB Corp | 4QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

DB Corp. No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

May 17, 2013

11

Das könnte Ihnen auch gefallen

- Collection Agency Revenues World Summary: Market Values & Financials by CountryVon EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- DB Corp.: Performance HighlightsDokument11 SeitenDB Corp.: Performance HighlightsAngel BrokingNoch keine Bewertungen

- DB Corp: Performance HighlightsDokument11 SeitenDB Corp: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GSK Consumer: Performance HighlightsDokument9 SeitenGSK Consumer: Performance HighlightsAngel BrokingNoch keine Bewertungen

- DB Corp, 1Q FY 2014Dokument11 SeitenDB Corp, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Persistent, 29th January 2013Dokument12 SeitenPersistent, 29th January 2013Angel BrokingNoch keine Bewertungen

- DB Corp: Performance HighlightsDokument11 SeitenDB Corp: Performance HighlightsAngel BrokingNoch keine Bewertungen

- DB Corp Result UpdatedDokument10 SeitenDB Corp Result UpdatedAngel BrokingNoch keine Bewertungen

- HT Media: Performance HighlightsDokument11 SeitenHT Media: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Infosys: Performance HighlightsDokument15 SeitenInfosys: Performance HighlightsAtul ShahiNoch keine Bewertungen

- Satyam 4Q FY 2013Dokument12 SeitenSatyam 4Q FY 2013Angel BrokingNoch keine Bewertungen

- GSK Consumer Result UpdatedDokument9 SeitenGSK Consumer Result UpdatedAngel BrokingNoch keine Bewertungen

- Marico: Performance HighlightsDokument12 SeitenMarico: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Godrej Consumer Products: Performance HighlightsDokument11 SeitenGodrej Consumer Products: Performance HighlightsajujkNoch keine Bewertungen

- Jagran Prakashan, 1Q FY 2014Dokument10 SeitenJagran Prakashan, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Infosys Result UpdatedDokument14 SeitenInfosys Result UpdatedAngel BrokingNoch keine Bewertungen

- Jagran Prakashan Result UpdatedDokument11 SeitenJagran Prakashan Result UpdatedAngel BrokingNoch keine Bewertungen

- TCS 4Q Fy 2013Dokument14 SeitenTCS 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Persistent Systems Result UpdatedDokument11 SeitenPersistent Systems Result UpdatedAngel BrokingNoch keine Bewertungen

- L&T 4Q Fy 2013Dokument15 SeitenL&T 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- HT Media, 1Q FY 2014Dokument11 SeitenHT Media, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Dishman 2QFY2013RUDokument10 SeitenDishman 2QFY2013RUAngel BrokingNoch keine Bewertungen

- HCL Technologies: Performance HighlightsDokument15 SeitenHCL Technologies: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Mphasis: Performance HighlightsDokument13 SeitenMphasis: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GCPL, 4th February, 2013Dokument11 SeitenGCPL, 4th February, 2013Angel BrokingNoch keine Bewertungen

- Colgate Result UpdatedDokument10 SeitenColgate Result UpdatedAngel BrokingNoch keine Bewertungen

- Infosys: Performance HighlightsDokument15 SeitenInfosys: Performance HighlightsAngel BrokingNoch keine Bewertungen

- TCS, 1Q Fy 2014Dokument14 SeitenTCS, 1Q Fy 2014Angel BrokingNoch keine Bewertungen

- Infosys: Performance HighlightsDokument15 SeitenInfosys: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Dabur India, 31st January 2013Dokument10 SeitenDabur India, 31st January 2013Angel BrokingNoch keine Bewertungen

- PAGE Industries 4Q FY 2013Dokument13 SeitenPAGE Industries 4Q FY 2013Angel BrokingNoch keine Bewertungen

- KPIT Cummins: Performance HighlightsDokument13 SeitenKPIT Cummins: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hexaware 1Q CY 2013Dokument13 SeitenHexaware 1Q CY 2013Angel BrokingNoch keine Bewertungen

- HCLTech 3Q FY13Dokument16 SeitenHCLTech 3Q FY13Angel BrokingNoch keine Bewertungen

- Motherson Sumi Systems Result UpdatedDokument14 SeitenMotherson Sumi Systems Result UpdatedAngel BrokingNoch keine Bewertungen

- Infosys 4Q FY 2013, 12.04.13Dokument15 SeitenInfosys 4Q FY 2013, 12.04.13Angel BrokingNoch keine Bewertungen

- Dabur India: Performance HighlightsDokument10 SeitenDabur India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Tech Mahindra 4Q FY13Dokument12 SeitenTech Mahindra 4Q FY13Angel BrokingNoch keine Bewertungen

- Persistent, 1Q FY 2014Dokument12 SeitenPersistent, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Jagran Prakashan 4Q FY 2013Dokument10 SeitenJagran Prakashan 4Q FY 2013Angel BrokingNoch keine Bewertungen

- GSK Consumer, 21st February, 2013Dokument10 SeitenGSK Consumer, 21st February, 2013Angel BrokingNoch keine Bewertungen

- Mahindra Satyam 2QFY2013RUDokument12 SeitenMahindra Satyam 2QFY2013RUAngel BrokingNoch keine Bewertungen

- Cera Sanitaryware: Increasing Brand Visibility To Be Key DriverDokument14 SeitenCera Sanitaryware: Increasing Brand Visibility To Be Key DriverTirthajit SinhaNoch keine Bewertungen

- Godrej Consumer Products: Performance HighlightsDokument11 SeitenGodrej Consumer Products: Performance HighlightsAngel BrokingNoch keine Bewertungen

- CeraSanitaryware 1QFY2014RU - PDF 110713Dokument15 SeitenCeraSanitaryware 1QFY2014RU - PDF 110713nit111Noch keine Bewertungen

- Idea, 31st January 2013Dokument11 SeitenIdea, 31st January 2013Angel BrokingNoch keine Bewertungen

- KPIT Cummins, 30th January 2013Dokument13 SeitenKPIT Cummins, 30th January 2013Angel BrokingNoch keine Bewertungen

- GSK ConsumerDokument10 SeitenGSK ConsumerAngel BrokingNoch keine Bewertungen

- Persistent Systems: Performance HighlightsDokument12 SeitenPersistent Systems: Performance HighlightsAngel BrokingNoch keine Bewertungen

- LNT, 25th JanuaryDokument15 SeitenLNT, 25th JanuaryAngel BrokingNoch keine Bewertungen

- Hexaware Result UpdatedDokument13 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- Tech Mahindra, 7th February, 2013Dokument12 SeitenTech Mahindra, 7th February, 2013Angel BrokingNoch keine Bewertungen

- Colgate: Performance HighlightsDokument10 SeitenColgate: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Mahindra Satyam, 4th February, 2013Dokument12 SeitenMahindra Satyam, 4th February, 2013Angel BrokingNoch keine Bewertungen

- Infosys Result UpdatedDokument15 SeitenInfosys Result UpdatedAngel BrokingNoch keine Bewertungen

- Idea 1Q FY 2014Dokument12 SeitenIdea 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Marico 4Q FY 2013Dokument11 SeitenMarico 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Tata Consultancy Services Result UpdatedDokument15 SeitenTata Consultancy Services Result UpdatedAngel BrokingNoch keine Bewertungen

- Britannia, 18th February, 2013Dokument10 SeitenBritannia, 18th February, 2013Angel BrokingNoch keine Bewertungen

- Infosys Result UpdatedDokument14 SeitenInfosys Result UpdatedAngel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Weekly Timesheet Template ExcelDokument10 SeitenWeekly Timesheet Template ExceltajudinNoch keine Bewertungen

- Liability For Payment. - X X X: It Shall Not Allow Unless The Commissioner Has Certified That The Taxes ImposedDokument31 SeitenLiability For Payment. - X X X: It Shall Not Allow Unless The Commissioner Has Certified That The Taxes ImposedShaiNoch keine Bewertungen

- LLPDokument15 SeitenLLPAnkit JainNoch keine Bewertungen

- CV VorreakouDokument3 SeitenCV VorreakouioavorreakouNoch keine Bewertungen

- Infographic: The Modernization of The Data WarehouseDokument1 SeiteInfographic: The Modernization of The Data WarehouseInam Ullah BukhariNoch keine Bewertungen

- Internship Report On Money LaunderingDokument51 SeitenInternship Report On Money LaunderingMasum sajibNoch keine Bewertungen

- Erp QuestionnaireDokument3 SeitenErp Questionnaireviji_kichuNoch keine Bewertungen

- BOM and Yes Bank..Dokument23 SeitenBOM and Yes Bank..kunalclad41Noch keine Bewertungen

- Implementation of BCG Matrix in Malaysia CompanyDokument21 SeitenImplementation of BCG Matrix in Malaysia CompanyMisz Azzyati75% (4)

- College of Accountancy Final Examination Acctg 207A InstructionsDokument5 SeitenCollege of Accountancy Final Examination Acctg 207A InstructionsCarmela TolinganNoch keine Bewertungen

- Sources of Information PDFDokument91 SeitenSources of Information PDFworseukNoch keine Bewertungen

- ESP Akun Ch1 Reading Intro To Business 1Dokument2 SeitenESP Akun Ch1 Reading Intro To Business 1Diva Salsabilaa45Noch keine Bewertungen

- Office Fit-Out GuideDokument4 SeitenOffice Fit-Out Guidebulsemberutu100% (1)

- BondsDokument12 SeitenBondsGelyn Cruz100% (1)

- ISO 9001 & 14001 Revisions - What Will Change and WhyDokument53 SeitenISO 9001 & 14001 Revisions - What Will Change and WhySergio Javier Martinez RamirezNoch keine Bewertungen

- Project Rubrics EconomicsDokument2 SeitenProject Rubrics EconomicsYummy Chum23Noch keine Bewertungen

- AP 300Q Quizzer On Audit of Liabilities ResaDokument13 SeitenAP 300Q Quizzer On Audit of Liabilities Resaryan rosalesNoch keine Bewertungen

- HDB Financial Services FY2019 Update PDFDokument8 SeitenHDB Financial Services FY2019 Update PDFCharu BhattNoch keine Bewertungen

- Ferramentas para Home OfficeDokument37 SeitenFerramentas para Home OfficeTreinamentos Conlog S.A.Noch keine Bewertungen

- Ek AkuntansiDokument74 SeitenEk AkuntansiEsa SulyNoch keine Bewertungen

- CFA 1 Financial Reporting & AccountingDokument92 SeitenCFA 1 Financial Reporting & AccountingAspanwz Spanwz100% (1)

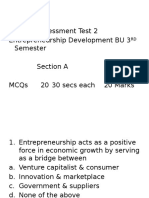

- Internal Assessment Test on Entrepreneurship ConceptsDokument28 SeitenInternal Assessment Test on Entrepreneurship ConceptsRam Krishna KrishNoch keine Bewertungen

- Sales: Chapter 1 - Nature and Form of The ContractDokument22 SeitenSales: Chapter 1 - Nature and Form of The ContractGeanelleRicanorEsperonNoch keine Bewertungen

- Effect of Price Change on Substitute GoodsDokument10 SeitenEffect of Price Change on Substitute GoodsDrishika Mahajan100% (1)

- Navarro2019HowMNEsGovRelAreasOperateinBrazil BM1904 050Dokument14 SeitenNavarro2019HowMNEsGovRelAreasOperateinBrazil BM1904 050Newhame DagneNoch keine Bewertungen

- Lesson #02 - CUSTOMER NEEDS AND EXPECTATIONSDokument3 SeitenLesson #02 - CUSTOMER NEEDS AND EXPECTATIONSThomasaquinos msigala JrNoch keine Bewertungen

- Gov Uscourts Mad 246980 61 0Dokument102 SeitenGov Uscourts Mad 246980 61 0bruhNoch keine Bewertungen

- Assignment of HRM 370Dokument25 SeitenAssignment of HRM 370tahseenthedevil100% (1)

- Assignment One Name: Hussein Abdulkadir Ibrahim (Allauun)Dokument2 SeitenAssignment One Name: Hussein Abdulkadir Ibrahim (Allauun)Hussein Abdulkadir IbrahimNoch keine Bewertungen

- MKT Definitions VaranyDokument15 SeitenMKT Definitions VaranyVarany manzanoNoch keine Bewertungen