Beruflich Dokumente

Kultur Dokumente

Daily Technical Report, 23.05.2013

Hochgeladen von

Angel BrokingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily Technical Report, 23.05.2013

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Daily Technical Report

May 23, 2013

Sensex (20062) / NIFTY (6095)

Yesterday, our benchmark indices opened slightly higher inline with mixed global cues. During the first half, indices oscillated within a very narrow trading range; but post midsession came off very sharply to close well inside the negative territory. For the day FMCG and Health Care stocks were among the major gainers, whereas Capital Goods and Realty sectors ended in the red. The advance to decline ratio was strongly in favor of declining counters. (A=867 D=1449) (Sourcewww.bseindia.com)

Exhibit 1: Nifty Daily Chart

Formation

The 20-week EMA and the 20-day EMA are placed at 19366/ 5875 and 19829/ 6026 levels, respectively. The 89-day EMA and the 200-day SMA are placed at 19354/ 5873 and 18912 / 5749, respectively.

Source: Falcon:

The

weekly

RSI-Smoothened

oscillator

remains

positively poised.

Trading strategy:

The bulls made a valiant attempt to move higher in the first half of yesterdays session. However, post midsession, lowerthan-expected results from the capital goods heavyweight, Larsen & Toubro put pressure on the bulls. In our previous report, we had mentioned a possibility of some weakness below 20048 / 6100. Indices then precisely met with our target of 19955 / 6070, which coincides with the hourly 89 EMA and as expected, found decent support for the day. Going forward, if indices sustain below yesterday's low of 20000 / 6074 then a further correction towards 19870 19760 / 6046 6018 is possible. Conversely, yesterdays high of 20220 / 6148 would act as immediate intraday resistance for our market.

Actionable points:

View Resistance level Support Levels Neutral 6148 6074 6046 6018

www.angelbroking.com

Daily Technical Report

May 23, 2013

Bank Nifty Outlook - (13008)

Yesterday, Bank Nifty opened on a quite note in line with our benchmark indices and traded in a narrow range during first half of the session. However during the second half we witnessed selling pressure in all the banking stocks which led the index to test the mentioned level of 12928. The coming session is likely to be volatile on account of quarterly results for SBI. Thus going forward, a move below 12928 levels would trigger further downside in the index. In this scenario the index is likely to test 12838 12776 levels. On the upside 13160 13225 levels are likely to act as resistance for the day. Actionable points:

Exhibit 2: Bank Nifty Daily Chart

View Resistance Levels Support Levels

Neutral 13160 13225 12928 12838 Source: Falcon:

www.angelbroking.com

Daily Technical Report

May 23, 2013

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM ASIANPAINT AXISBANK BAJAJ-AUTO BANKBARODA BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL GRASIM HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INDUSINDBK INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT LUPIN M&M MARUTI NMDC NTPC ONGC PNB POWERGRID RANBAXY RELIANCE RELINFRA SBIN SESAGOA SUNPHARMA TATAMOTORS TATAPOWER TATASTEEL TCS ULTRACEMCO S2 19,875 6,032 12,795 1,201 181 4,725 1,481 1,816 688 303 199 365 280 409 306 213 2,004 323 3,006 730 889 690 1,617 107 583 1,191 156 481 2,344 326 297 69 753 1,403 748 970 1,662 119 150 312 784 111 424 802 395 2,314 157 959 284 89 298 1,483 1,908 S1 19,969 6,063 12,902 1,210 184 4,780 1,497 1,833 699 307 201 377 284 413 308 220 2,030 327 3,028 737 895 697 1,634 109 584 1,201 158 488 2,365 331 300 71 761 1,459 758 980 1,675 120 153 321 795 112 427 810 402 2,338 159 980 287 90 302 1,491 1,929 PIVOT 20,094 6,106 13,039 1,221 186 4,816 1,514 1,851 720 311 205 391 291 417 311 231 2,052 333 3,064 745 899 704 1,661 110 585 1,214 159 496 2,399 334 305 75 767 1,555 768 993 1,695 122 154 326 813 113 431 822 412 2,370 162 997 293 92 308 1,500 1,949 R1 20,188 6,137 13,145 1,230 188 4,871 1,530 1,868 731 315 207 404 295 421 313 238 2,077 336 3,086 752 905 711 1,677 112 586 1,223 161 503 2,419 339 308 77 774 1,611 779 1,003 1,708 123 156 335 824 113 435 831 418 2,395 163 1,019 297 93 312 1,508 1,970 R2 20,314 6,179 13,282 1,241 190 4,907 1,547 1,886 752 319 210 417 302 426 317 250 2,099 342 3,122 760 909 718 1,705 113 586 1,236 162 511 2,454 342 313 80 781 1,707 789 1,015 1,727 124 158 340 841 114 439 843 428 2,427 166 1,035 302 94 317 1,517 1,990

www.angelbroking.com

Daily Technical Report

May 23, 2013

Research Team Tel: 022 - 30940000 E-mail: advisory@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Ankur Lakhotia Head Technicals Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 30940000

Sebi Registration No: INB 010996539

www.angelbroking.com

Das könnte Ihnen auch gefallen

- Judaism: Pre-Test Directions: Fill in The Blank With The Correct AnswerDokument9 SeitenJudaism: Pre-Test Directions: Fill in The Blank With The Correct AnswerShineeljay TumipadNoch keine Bewertungen

- VLT - Go MS 90Dokument2 SeitenVLT - Go MS 90Raghu Ram100% (3)

- The Taxable Investor's Manifesto: Wealth Management Strategies to Last a LifetimeVon EverandThe Taxable Investor's Manifesto: Wealth Management Strategies to Last a LifetimeNoch keine Bewertungen

- First MassDokument28 SeitenFirst Masstrixie lavigne65% (23)

- MahindraDokument3 SeitenMahindrachiru14310% (1)

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Knecht Vs UCCDokument2 SeitenKnecht Vs UCCXing Keet LuNoch keine Bewertungen

- Mr. Saxena - Reply To DV MatterDokument11 SeitenMr. Saxena - Reply To DV MatterYash SampatNoch keine Bewertungen

- Terre vs. Terre DigestDokument1 SeiteTerre vs. Terre DigestPMVNoch keine Bewertungen

- Jurisdiction of Various Philippine CourtsDokument11 SeitenJurisdiction of Various Philippine CourtsSHEKINAHFAITH REQUINTEL100% (1)

- GR No. 186417 People vs. Felipe MirandillaDokument1 SeiteGR No. 186417 People vs. Felipe MirandillaNadine GabaoNoch keine Bewertungen

- Daily Technical Report, 15.05.2013Dokument4 SeitenDaily Technical Report, 15.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 23.07.2013Dokument4 SeitenDaily Technical Report, 23.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 14.02.2013Dokument4 SeitenDaily Technical Report, 14.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 21.02.2013Dokument4 SeitenDaily Technical Report, 21.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 17.05.2013Dokument4 SeitenDaily Technical Report, 17.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report 20.02.2013Dokument4 SeitenDaily Technical Report 20.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 27.02.2013Dokument4 SeitenDaily Technical Report, 27.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 24.05.2013Dokument4 SeitenDaily Technical Report, 24.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19461) / NIFTY (5898)Dokument4 SeitenDaily Technical Report: Sensex (19461) / NIFTY (5898)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 02.05.2013Dokument4 SeitenDaily Technical Report, 02.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report 15.02.2013Dokument4 SeitenDaily Technical Report 15.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 07.05.2013Dokument4 SeitenDaily Technical Report, 07.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 29.05.2013Dokument4 SeitenDaily Technical Report, 29.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 01.03.2013Dokument4 SeitenDaily Technical Report, 01.03.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 21.06.2013Dokument4 SeitenDaily Technical Report, 21.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 16.05.2013Dokument4 SeitenDaily Technical Report, 16.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 06.06.2013Dokument4 SeitenDaily Technical Report, 06.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 26.02.2013Dokument4 SeitenDaily Technical Report, 26.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 10.05.2013Dokument4 SeitenDaily Technical Report, 10.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 26.07.2013Dokument4 SeitenDaily Technical Report, 26.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 27.06.2013Dokument4 SeitenDaily Technical Report, 27.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 18.02.2013Dokument4 SeitenDaily Technical Report, 18.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 21.05.2013Dokument4 SeitenDaily Technical Report, 21.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 30.05.2013Dokument4 SeitenDaily Technical Report, 30.05.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 09.11.2012Dokument4 SeitenTechnical Format With Stock 09.11.2012Angel BrokingNoch keine Bewertungen

- Technical Report, 24 January 2013Dokument4 SeitenTechnical Report, 24 January 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 30.04.2013Dokument4 SeitenDaily Technical Report, 30.04.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report 20.03.2013Dokument4 SeitenDaily Technical Report 20.03.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 16.08.2013Dokument4 SeitenDaily Technical Report, 16.08.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 02.08.2013Dokument4 SeitenDaily Technical Report, 02.08.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 05.03.2013Dokument4 SeitenDaily Technical Report, 05.03.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report 13.03.2013Dokument4 SeitenDaily Technical Report 13.03.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 13.05.2013Dokument4 SeitenDaily Technical Report, 13.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (18620) / NIFTY (5472)Dokument4 SeitenDaily Technical Report: Sensex (18620) / NIFTY (5472)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 22.03.2013Dokument4 SeitenDaily Technical Report, 22.03.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 29.10.2012Dokument4 SeitenTechnical Format With Stock 29.10.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 18.07.2013Dokument4 SeitenDaily Technical Report, 18.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 26.04.2013Dokument4 SeitenDaily Technical Report, 26.04.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 05.06.2013Dokument4 SeitenDaily Technical Report, 05.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 16.07.2013Dokument4 SeitenDaily Technical Report, 16.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 18.06.2013Dokument4 SeitenDaily Technical Report, 18.06.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 27.11.2012Dokument4 SeitenTechnical Format With Stock 27.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 20.06.2013Dokument4 SeitenDaily Technical Report, 20.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 02.07.2013Dokument4 SeitenDaily Technical Report, 02.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 12.03.2013Dokument4 SeitenDaily Technical Report, 12.03.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 12.07.2013Dokument4 SeitenDaily Technical Report, 12.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 19.07.2013Dokument4 SeitenDaily Technical Report, 19.07.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19223) / NIFTY (5814)Dokument4 SeitenDaily Technical Report: Sensex (19223) / NIFTY (5814)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 23.04.2013Dokument4 SeitenDaily Technical Report, 23.04.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 28.02.2013Dokument4 SeitenDaily Technical Report, 28.02.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 17.06.2013Dokument4 SeitenDaily Technical Report, 17.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19270) / NIFTY (5680)Dokument4 SeitenDaily Technical Report: Sensex (19270) / NIFTY (5680)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 11.10Dokument4 SeitenTechnical Format With Stock 11.10Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 25.02.2013Dokument4 SeitenDaily Technical Report, 25.02.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 08 March 2013Dokument4 SeitenTechnical Format With Stock 08 March 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 12.06.2013Dokument4 SeitenDaily Technical Report, 12.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 07.06.2013Dokument4 SeitenDaily Technical Report, 07.06.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 20.11.2012Dokument4 SeitenTechnical Format With Stock 20.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 05.07.2013Dokument4 SeitenDaily Technical Report, 05.07.2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Shooting An Elephant Marxist Criticism PDFDokument5 SeitenShooting An Elephant Marxist Criticism PDFapi-247731762Noch keine Bewertungen

- Facts:: Villarosa, Joan Cristine 2015-1635Dokument3 SeitenFacts:: Villarosa, Joan Cristine 2015-1635Tin VillarosaNoch keine Bewertungen

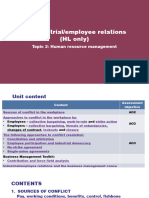

- 2.7 Industrial and Employee RelationDokument65 Seiten2.7 Industrial and Employee RelationadhityakinnoNoch keine Bewertungen

- Price Adaptation Strategies in MarketingDokument17 SeitenPrice Adaptation Strategies in MarketingAlj Kapilongan50% (2)

- Chapter 8Dokument74 SeitenChapter 8Liyana AzizNoch keine Bewertungen

- AEC - 12 - Q1 - 0401 - SS2 Reinforcement - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursDokument5 SeitenAEC - 12 - Q1 - 0401 - SS2 Reinforcement - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursVanessa Fampula FaigaoNoch keine Bewertungen

- Module 9 PDFDokument7 SeitenModule 9 PDFtrixie maeNoch keine Bewertungen

- Bpats Enhancement Training ProgramDokument1 SeiteBpats Enhancement Training Programspms lugaitNoch keine Bewertungen

- First Church of Seventh-Day Adventists Weekly Bulletin (Spring 2013)Dokument12 SeitenFirst Church of Seventh-Day Adventists Weekly Bulletin (Spring 2013)First Church of Seventh-day AdventistsNoch keine Bewertungen

- The Tipster1901, From "Wall Street Stories" by Lefevre, EdwinDokument20 SeitenThe Tipster1901, From "Wall Street Stories" by Lefevre, EdwinGutenberg.orgNoch keine Bewertungen

- BBM 301 Advanced Accounting Chapter 1, Section 2Dokument6 SeitenBBM 301 Advanced Accounting Chapter 1, Section 2lil telNoch keine Bewertungen

- NEW GL Archiving of Totals and DocumentsDokument5 SeitenNEW GL Archiving of Totals and Documentsantonio xavierNoch keine Bewertungen

- Cirrus 5.0 Installation Instructions EnglishDokument62 SeitenCirrus 5.0 Installation Instructions EnglishAleksei PodkopaevNoch keine Bewertungen

- Obituary of Nelson Mandela - Nelson Mandela - A Leader Above All Others (Guardian Editorial)Dokument3 SeitenObituary of Nelson Mandela - Nelson Mandela - A Leader Above All Others (Guardian Editorial)somebody535100% (1)

- Short Term FinancingDokument4 SeitenShort Term FinancingMd Ibrahim RubelNoch keine Bewertungen

- Ami Aptio Afu User Guide NdaDokument32 SeitenAmi Aptio Afu User Guide NdaMarcoNoch keine Bewertungen

- PEER PRESSURE - The Other "Made" Do ItDokument2 SeitenPEER PRESSURE - The Other "Made" Do ItMyrrh PasquinNoch keine Bewertungen

- Al Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Dokument199 SeitenAl Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Islamic Reserch Center (IRC)Noch keine Bewertungen

- ASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After WDokument17 SeitenASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After Wpranav.kunte3312Noch keine Bewertungen

- Background To The Arbitration and Conciliation Act, 1996Dokument2 SeitenBackground To The Arbitration and Conciliation Act, 1996HimanshuNoch keine Bewertungen

- The Marriage of King Arthur and Queen GuinevereDokument12 SeitenThe Marriage of King Arthur and Queen GuinevereYamila Sosa RodriguezNoch keine Bewertungen