Beruflich Dokumente

Kultur Dokumente

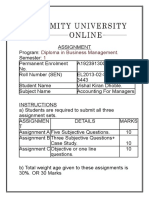

Adjustments FA

Hochgeladen von

Muhammad UmarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Adjustments FA

Hochgeladen von

Muhammad UmarCopyright:

Verfügbare Formate

Al-Syed College of Commerce (ACC)

ADJUSTMENTS AT A GLANCE

S.No. Adjustment Alternative

Outstanding/due/unpaid/ accrued/arrear/ still payable/not yet paid/ owing Prepaid/unexpired/ paid in advance/carry forward to the next year

Adjusting Entry

Effect on Trading or P&L A/c

Added in related item or the Dr. side of Trading or P&L A/c Deducted in related item or the Dr. side of Trading or P&L A/c Added in related item or the Cr. side of Trading or P&L A/c Deducted in related item or the Dr. side of Trading or P&L A/c Dr. Profit & Loss A/c Dr. Profit & Loss A/c Cr. Profit & Loss A/c Dr. Profit & Loss A/c

Effect on Balance Sheet

Liabilities side of the Balance Sheet Assets side of the Balance Sheet Assets side of the Balance Sheet Liabilities side of the Balance Sheet Deduction out of concerned asset in the asset side Added in the capital in the Liability side Deduction out of the capital in the liability side Deduction out of debtors in the asset side Deduction out of debtors in the asset side

Outstanding Expenses

Expense To Outstanding Expenses

Prepaid Expenses

Prepaid Expenses To Expense

Accrued Income

Accrued/Receivable

Accrued Income To Income

Unearned Income

Unearned/Received in Advance/Unexpired

Income To Unearned Income

5 6 7 8

Depreciation

Decrease or reduce in value/write off

Deprecation To Asset Interest on capital To capital

Interest on capital Interest on drawing Provision for bad debts Provision for discount on debtors

------------

------------

Capital/drawings To Interest on drawings

Reserve/allowance for bad debts

Profit & Loss/Bad debts To provision for bad debts Profit & Loss/discount on debtors To provision for discount on debtors Provision for discount on creditors To Profit & Loss/ discount on debtors Closing Stock To Trading Account

Reserve/allowance for discount

Dr. Profit & Loss A/c

10

Provision for discount on creditors

Reserve/allowance for discount

Cr. Profit & Loss A/c

11

Closing Stock

Stock/Inventory

Cr. Trading A/c

Deduction out of the creditors in the liability side Assets side of the Balance Sheet

PRACTICE QUESTION

Prepared by:

Al-Syed College of Commerce (ACC)

The books of the business concern are closed at the end of the calendar year; pass the necessary adjusting entries in the books. When preparing the final accounts on 31 st December, 2009. a) Rs.3000 being the salary of Mr. Adnan for December 2009 has not been paid. b) Rent amounting to Rs.12000 paid on 1st July 2009 for 12 months ending on 30th June 2010. c) Interest on Investment Rs.400 has accrued but not yet received. d) Rs.2000 received in advance from Ali as commission. e) Building at 5%, machinery at 10% are to be depreciated (Building Rs.200000, Machinery Rs.50000) f) Interest on Capital at 6% is to be provided (capital Rs.100000) g) Interest on Drawings at 6% is to be provided (drawings Rs.5000) h) Land at 10% to be appreciated the cost of the Land is Rs.200000 i) Rs.200 proved bad debts at the end of the year. j) Provision for bad debts on debtors is created at the rate of 5% at the end of the year (Debtors amounts Rs.12200) k) Provision for discount on above debtor is created at the rate of 2%. l) Provision for discount on above creditors to be made at the rate of 2% (the amount of the creditors is Rs.10000)

Prepared by:

Das könnte Ihnen auch gefallen

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawVon EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Fundamentals PDFDokument103 SeitenFundamentals PDFDhairya JainNoch keine Bewertungen

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Final AccountsDokument27 SeitenFinal AccountsNafis Siddiqui100% (1)

- Practical Oriented Questions and AnswersDokument11 SeitenPractical Oriented Questions and AnswersAshok dore Ashok doreNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Advanced AccountingDokument13 SeitenAdvanced AccountingprateekfreezerNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- CCP102Dokument22 SeitenCCP102api-3849444Noch keine Bewertungen

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Von EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Noch keine Bewertungen

- Final-Accounts-Q - A P&L ACCDokument31 SeitenFinal-Accounts-Q - A P&L ACCNikhil PrasannaNoch keine Bewertungen

- Jaiib Questions Accounting & Finance Module D Part 1: Current InvestmentsDokument120 SeitenJaiib Questions Accounting & Finance Module D Part 1: Current InvestmentsBiswajit DasNoch keine Bewertungen

- Gls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking CompaniesDokument11 SeitenGls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking Companiessumathi psgcas0% (1)

- ©dr. Chula King All Rights ReservedDokument3 Seiten©dr. Chula King All Rights ReservedstargearNoch keine Bewertungen

- DepreciationDokument27 SeitenDepreciationraj10420Noch keine Bewertungen

- Jaiib Af Mcqs Mod DDokument19 SeitenJaiib Af Mcqs Mod DPooja GarodharaNoch keine Bewertungen

- S A Ipcc Nov 2011 - GR IDokument97 SeitenS A Ipcc Nov 2011 - GR ISaibhumi100% (1)

- Acc PoojaDokument7 SeitenAcc PoojaMemer BabaNoch keine Bewertungen

- Unit 4Dokument33 SeitenUnit 4b21ai008Noch keine Bewertungen

- Kumpulan Kuis AKM 3 UASDokument12 SeitenKumpulan Kuis AKM 3 UASAlya Sufi IkrimaNoch keine Bewertungen

- Bank of India Fund BasedDokument33 SeitenBank of India Fund BasedVandana ChoudharyNoch keine Bewertungen

- Last - 105Dokument10 SeitenLast - 105ricamae saladagaNoch keine Bewertungen

- 2Dokument30 Seiten2MohammedAlmohammedNoch keine Bewertungen

- Problems On PPEDokument8 SeitenProblems On PPEDibyansu KumarNoch keine Bewertungen

- DEATH OF A PARTNER Intro and Sum-6Dokument6 SeitenDEATH OF A PARTNER Intro and Sum-6gankNoch keine Bewertungen

- Unit 2 - Accountingformanager - AnanduDokument52 SeitenUnit 2 - Accountingformanager - Ananducraziestidiot31Noch keine Bewertungen

- Fundamental of Partnership - MCQsDokument11 SeitenFundamental of Partnership - MCQsSanchit GargNoch keine Bewertungen

- Part IIDokument58 SeitenPart IIhaaasaaNoch keine Bewertungen

- Final Accounts PPT APTDokument36 SeitenFinal Accounts PPT APTGaurav gusai100% (1)

- NSE Financial Modeling Exam Questions and Solution - 2Dokument55 SeitenNSE Financial Modeling Exam Questions and Solution - 2rahulnationalite83% (6)

- Report On Sinclair CompanyDokument5 SeitenReport On Sinclair CompanyVictor LimNoch keine Bewertungen

- Accounting Assignment PDFDokument18 SeitenAccounting Assignment PDFMohammed SafwatNoch keine Bewertungen

- ACCT101 2010-2011 TERM1 Sample Final ExamDokument12 SeitenACCT101 2010-2011 TERM1 Sample Final ExamhappystoneNoch keine Bewertungen

- Chapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionDokument4 SeitenChapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionIqra MughalNoch keine Bewertungen

- MCQ4 5Dokument3 SeitenMCQ4 5Maya MaisarahNoch keine Bewertungen

- Retiremnet of A Partner - Ashiq MohammedDokument22 SeitenRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNoch keine Bewertungen

- Mechanics of Accounting - Ledger and Trial BalanceDokument10 SeitenMechanics of Accounting - Ledger and Trial BalanceRonit GuptaNoch keine Bewertungen

- Depreciation Accounting Part 2 PDFDokument37 SeitenDepreciation Accounting Part 2 PDFShihab MonNoch keine Bewertungen

- Question For Manager Test in Ksfe PDFDokument11 SeitenQuestion For Manager Test in Ksfe PDFRajimol RNoch keine Bewertungen

- Which of The Followin Level IVDokument2 SeitenWhich of The Followin Level IVGuddataa Dheekkamaa100% (2)

- Disclaimer: © The Institute of Chartered Accountants of IndiaDokument35 SeitenDisclaimer: © The Institute of Chartered Accountants of IndiajaimaakalikaNoch keine Bewertungen

- APQ3FY12Dokument19 SeitenAPQ3FY12Abhigupta24Noch keine Bewertungen

- ACCOUUNTACYDokument11 SeitenACCOUUNTACYSuraj Singh PatelNoch keine Bewertungen

- 2 Final Accounts - Sole Proprietor - Format - AdjustmentsDokument14 Seiten2 Final Accounts - Sole Proprietor - Format - AdjustmentsSudha Agarwal100% (1)

- DocumentDokument12 SeitenDocumentTanuNoch keine Bewertungen

- Final Account (Satyanath Mohapatra)Dokument38 SeitenFinal Account (Satyanath Mohapatra)smrutiranjan swainNoch keine Bewertungen

- Midterm Exam - Financial Accounting 3 With AnswersDokument11 SeitenMidterm Exam - Financial Accounting 3 With Answersjanus lopezNoch keine Bewertungen

- Section A (20 Marks)Dokument11 SeitenSection A (20 Marks)Taha NasirNoch keine Bewertungen

- 12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Dokument5 Seiten12 Accountancy Accounting For Partnership Firms Fundamentals Impq 3Adam ZakriNoch keine Bewertungen

- Question Paper For The Position: Audit & Accounts Officer TimeDokument2 SeitenQuestion Paper For The Position: Audit & Accounts Officer TimeM A Fazal & Co.Noch keine Bewertungen

- 2 Fundamentals of PartnershipDokument11 Seiten2 Fundamentals of PartnershipKartik JainNoch keine Bewertungen

- Test ID Max Marks: 200 CA CPT December 2014 (Memory Based Paper)Dokument21 SeitenTest ID Max Marks: 200 CA CPT December 2014 (Memory Based Paper)Icaii InfotechNoch keine Bewertungen

- Final AccountsDokument43 SeitenFinal AccountsJincy Geevarghese100% (1)

- The Exam Include 10 Question - Don't Use Red Pen or A Pencil Question 1: Put ( ) or (×) - Make Your Answer in A Table in The Answer SheetDokument4 SeitenThe Exam Include 10 Question - Don't Use Red Pen or A Pencil Question 1: Put ( ) or (×) - Make Your Answer in A Table in The Answer Sheetfade1993100% (1)

- Semester - I Mid - Semester (Make - Up) Examinations (Class of 2007) IBS559 - Accounting For Managers Part - ADokument14 SeitenSemester - I Mid - Semester (Make - Up) Examinations (Class of 2007) IBS559 - Accounting For Managers Part - AIsha ShahNoch keine Bewertungen

- Vishal Kiran Dhoble - Adl01 PDFDokument14 SeitenVishal Kiran Dhoble - Adl01 PDFvishald13Noch keine Bewertungen

- 12 Accountancy Accounting For Partnership Firms FundamentalsDokument6 Seiten12 Accountancy Accounting For Partnership Firms FundamentalsIqra MughalNoch keine Bewertungen

- 12.ffinal Accounts 11 - AfmDokument23 Seiten12.ffinal Accounts 11 - AfmSaloni AggarwalNoch keine Bewertungen

- JAIIB Model Paper (Accouting & Finance)Dokument25 SeitenJAIIB Model Paper (Accouting & Finance)praveenaero3Noch keine Bewertungen

- Ratio Analysis: S Liabilitie Current Assets CurrentDokument8 SeitenRatio Analysis: S Liabilitie Current Assets CurrentMuhammad UmarNoch keine Bewertungen

- Application Form of Hohai University: Please Complete The Form in EnglishDokument2 SeitenApplication Form of Hohai University: Please Complete The Form in EnglishMuhammad UmarNoch keine Bewertungen

- Adjustments at A GlanceDokument1 SeiteAdjustments at A GlanceMuhammad UmarNoch keine Bewertungen

- Important Questions: BC: 402 AuditingDokument2 SeitenImportant Questions: BC: 402 AuditingMuhammad UmarNoch keine Bewertungen

- Frech Cheez Curlies Orange Slanty Salat or Spicy Snakerz Red Waly Patato Sticks... Cheez Ball Bangali Nimko..Dokument1 SeiteFrech Cheez Curlies Orange Slanty Salat or Spicy Snakerz Red Waly Patato Sticks... Cheez Ball Bangali Nimko..Muhammad UmarNoch keine Bewertungen

- 2 AccountingDokument1 Seite2 AccountingMuhammad UmarNoch keine Bewertungen

- Important Short Questions: Compiled byDokument1 SeiteImportant Short Questions: Compiled byMuhammad UmarNoch keine Bewertungen

- Accounting Material For InterviewsDokument53 SeitenAccounting Material For InterviewsMuhammad UmarNoch keine Bewertungen

- Adjustments at A Glance: Practice QuestionDokument2 SeitenAdjustments at A Glance: Practice QuestionMuhammad UmarNoch keine Bewertungen

- Background and Development of Reinforcement TheoryDokument3 SeitenBackground and Development of Reinforcement TheoryMuhammad ShozaibNoch keine Bewertungen

- Research Design FinalDokument28 SeitenResearch Design FinalMuhammad Umar100% (1)