Beruflich Dokumente

Kultur Dokumente

Taxpayer Information

Hochgeladen von

Lecel LlamedoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Taxpayer Information

Hochgeladen von

Lecel LlamedoCopyright:

Verfügbare Formate

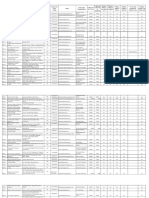

FOR SELF-EMPLOYED AND MIXED INCOME INDIVIDUALS Tax Form BIR Form 1901- Application for Registration for

Self-Employed and Mixed Income Individuals, Estates/Trusts Documentary Requirements

For single proprietors, mixed income earners Photocopy of Mayors Business Permit (or duly received Application for Mayors Business Permit, if the former is still in process with the LGU) and/or PTR issued by the LGU

For Professionals where PTR is not required (e.i. Consultants, Agents, Artist, Underwriters & the like): a) Occupational Tax Receipt (OTR)/ Professional Tax Receipt (PTR); b) Birth Certificate; c) Marriage Contract, if applicable;

d) Contract/Company Certification. Other documents for submission only if applicable: a) b) c) d) Contract of Lease; DTI Certificate of Registration Business Name, if business trade name shall be used; Certificate of Authority if Barangay Micro Business Enterprises (BMBE) registered entity; Proof of Registration/Permit to Operate with Board of Investment (BOI/Board of Investment for Autonomous Region for Muslim Mindanao (BOI-ARMM), Philippine Export Zone Authority (PEZA), Bases Conversion Development Authority (BCDA) and Subic Bay Metropolitan Authority (SBMA); Franchise Agreement; Sworn Statement of Capital; Working Permit for non-resident; Waiver of husband to claim additional exemption; Marriage Contract; and NSO Certified Birth Certificate of declared dependents.

e) f) g) h) i) j)

In the case of registration of branch/Facility type: a) b) c) Copy of the COR of the Head office for facility type to be used by the Head office and COR of the branch for facility type to be used by a particular branch; Mayors Permit or duly received Application for Mayors Business Permit, if the former is still in process with the LGU; DTI Certificate of Registration of Business Name, if a business trade name shall be used, if applicable; and

d) Contract of Lease, if applicable.

Documentary Requirements for new application of Authority to Print (ATP) BIR form 1906 together with the following:

Job order Final & clear sample Photo copy of COR/paid ARF of TP & Printer Printers Certificate of Delivery (PCD)

Documentary Requirements for new Registration of Books of Accounts BIR form 1905 together with the following: New sets of books of accounts Photocopy of COR & paid current ARF (for immediate verification and in case of systems downtime)

Procedures

a) Accomplish BIR Form 1901 and submit the same together with the documentary requirements to the RDO having jurisdiction over the place where the head office and branch, respectively. Pay the Annual Registration Fee (P500.00) at the Authorized Agent Banks (AABs) of the concerned RDO. Pay Documentary Stamp Tax (DST) (loose DST / BIR Form 2000* for DST on Contract of Lease, etc). Present proofs of payment. Submit requirements for ATP and registration of books of accounts.

b)

c) d)

e) Attend the taxpayers initial briefing to be conducted by the RDO concerned for new registrants in order to apprise them of their rights and duties/responsibilities. f) The RDO shall then issue the Certificate of Registration (Form 2303) together with the Ask for Receipt notice, Authority to Print and Books of Accounts.

Deadline

All Individuals engaged in trade or business shall accomplish and file the application on or before the commencement of business, it shall be reckoned from the day when the first sale transaction occurred or within thirty (30) calendar days from the issuance of Mayor's Permit/Professional Tax Receipt (PTR) by LGU, which ever comes earlier

Das könnte Ihnen auch gefallen

- International Taxation In Nepal Tips To Foreign InvestorsVon EverandInternational Taxation In Nepal Tips To Foreign InvestorsNoch keine Bewertungen

- Bir COR Application RequirementsDokument3 SeitenBir COR Application RequirementsJaemar FajardoNoch keine Bewertungen

- Requirements and Procedure For BIR RegDokument3 SeitenRequirements and Procedure For BIR ReglifemandrinkNoch keine Bewertungen

- Application For Taxpayer Identification Number (TIN)Dokument5 SeitenApplication For Taxpayer Identification Number (TIN)iamjan_101Noch keine Bewertungen

- Primary Registration Index For Application For Taxpayer Identification Number (TIN)Dokument43 SeitenPrimary Registration Index For Application For Taxpayer Identification Number (TIN)Chit ComisoNoch keine Bewertungen

- TAX 103-Topic 1 - Registration & EBIR FormsDokument11 SeitenTAX 103-Topic 1 - Registration & EBIR Formsmarialynnette lusterioNoch keine Bewertungen

- BIRDokument111 SeitenBIRAllied RandzNoch keine Bewertungen

- Tax LawDokument58 SeitenTax LawChit ComisoNoch keine Bewertungen

- BIR Registration Guide for Tax ProfessionalsDokument95 SeitenBIR Registration Guide for Tax ProfessionalsKristofer DomagosoNoch keine Bewertungen

- TAX BRIEFING-NEW RegistrantsDokument57 SeitenTAX BRIEFING-NEW RegistrantsPcl Nueva Vizcaya100% (3)

- BIR Registration Requirements for IndividualsDokument19 SeitenBIR Registration Requirements for IndividualsKristarah HernandezNoch keine Bewertungen

- Basic Requirements and Procedure in Registering A Sole Proprietor BusinessDokument4 SeitenBasic Requirements and Procedure in Registering A Sole Proprietor BusinessAyumi Xuie MontefalcoNoch keine Bewertungen

- Legal AspectsDokument11 SeitenLegal AspectsIsaiah CruzNoch keine Bewertungen

- Investment Requirements For A Food Truck BusinessDokument10 SeitenInvestment Requirements For A Food Truck BusinessYna Paulite100% (1)

- 1901 For Self-Employed, Professional, & Single ProprietorshipDokument11 Seiten1901 For Self-Employed, Professional, & Single ProprietorshipbirtaxinfoNoch keine Bewertungen

- The SolopreneurDokument6 SeitenThe Solopreneurjun junNoch keine Bewertungen

- Bir Frontline ServicesDokument0 SeitenBir Frontline ServicesMyla EbilloNoch keine Bewertungen

- Basic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationDokument1 SeiteBasic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationReyLouiseNoch keine Bewertungen

- BIR RegistrationDokument3 SeitenBIR Registrationcara sophiaNoch keine Bewertungen

- Steps in Registering Sole ProprietorshipDokument5 SeitenSteps in Registering Sole ProprietorshipMarjorie Treceñe AlconesNoch keine Bewertungen

- Corporation - BIR Registration Process in The PhilippinesDokument4 SeitenCorporation - BIR Registration Process in The PhilippinesPineNoch keine Bewertungen

- RMC No 37-2016Dokument6 SeitenRMC No 37-2016sandra100% (1)

- Starting A Business in Davao PDFDokument6 SeitenStarting A Business in Davao PDFLRMNoch keine Bewertungen

- Capital Gains Tax LAW 101Dokument41 SeitenCapital Gains Tax LAW 101Chit ComisoNoch keine Bewertungen

- Tax 102 Module 2Dokument4 SeitenTax 102 Module 2Jennie KimNoch keine Bewertungen

- Philippine Business Registration Requirements GuideDokument2 SeitenPhilippine Business Registration Requirements Guiderenz riveraNoch keine Bewertungen

- DTI, SEC, BSP and BOI RequirementsDokument22 SeitenDTI, SEC, BSP and BOI Requirementsni_kai2001Noch keine Bewertungen

- Activity 02Dokument4 SeitenActivity 02HaruNoch keine Bewertungen

- Updated BIR Citizen's Charter ServicesDokument40 SeitenUpdated BIR Citizen's Charter Servicesfightingmaroon0% (2)

- Assignment No.1 AmgetubigDokument10 SeitenAssignment No.1 AmgetubigAllison GetubigNoch keine Bewertungen

- EO 98 - How To Apply TINDokument7 SeitenEO 98 - How To Apply TINPeterSalas100% (1)

- Awareness On Business Registration, Invoicing and BookkeepingDokument70 SeitenAwareness On Business Registration, Invoicing and BookkeepingRonald Allan Valdez Miranda Jr.Noch keine Bewertungen

- Revenue Memorandum 23-2012Dokument2 SeitenRevenue Memorandum 23-2012Ruth CepeNoch keine Bewertungen

- Handouts Basic Requirements For Registering Sole ProprietorDokument7 SeitenHandouts Basic Requirements For Registering Sole ProprietorAinne Tan100% (1)

- One Person CorporationDokument7 SeitenOne Person CorporationBenedict IloseoNoch keine Bewertungen

- I. Documentary Requirements A. DTI Business Name Registration System - SOLE Proprietorship RegistrationDokument4 SeitenI. Documentary Requirements A. DTI Business Name Registration System - SOLE Proprietorship RegistrationAdi CruzNoch keine Bewertungen

- Closing A Business-DtiDokument4 SeitenClosing A Business-DtiSimon WolfNoch keine Bewertungen

- txtn502 Part2Dokument21 Seitentxtn502 Part2Sandra Mae Cabuenas100% (1)

- Application For Closure of Business/Cancellation of Tin A. VenueDokument9 SeitenApplication For Closure of Business/Cancellation of Tin A. VenueMa. Roa DellomasNoch keine Bewertungen

- POGO licensees BIR clearance requirementsDokument2 SeitenPOGO licensees BIR clearance requirementsAceGun'nerNoch keine Bewertungen

- Taxation For Construction IndustryDokument32 SeitenTaxation For Construction IndustryFrances Marie TemporalNoch keine Bewertungen

- SSS Employer Data Change Request Form R-8Dokument2 SeitenSSS Employer Data Change Request Form R-8Jolas E. Brutas50% (2)

- What Are The Accreditation Requirements For New ImDokument6 SeitenWhat Are The Accreditation Requirements For New ImLeo Cj PalmonisNoch keine Bewertungen

- Bir RegistrationDokument11 SeitenBir RegistrationArielle CabritoNoch keine Bewertungen

- Business Permit ApplicationDokument2 SeitenBusiness Permit Applicationtine delos santosNoch keine Bewertungen

- Dissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - LguDokument2 SeitenDissolution of Comp. Docs - Requirements.sss .Bir .Pagibig - Lgujaciem100% (1)

- Permit ProcessDokument9 SeitenPermit ProcessBiz MakerNoch keine Bewertungen

- A Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)Dokument5 SeitenA Step-By-Step Guide To Land Title Transferring in The Philippines (INFOGRAPHIC)May YellowNoch keine Bewertungen

- Fernandez Mary Lei M. Bsais 2a Technopreneurship Assignment 1Dokument5 SeitenFernandez Mary Lei M. Bsais 2a Technopreneurship Assignment 1francis dungcaNoch keine Bewertungen

- Closure of Business With BirDokument2 SeitenClosure of Business With Birjohn allen MarillaNoch keine Bewertungen

- Guide in Business OpenningDokument3 SeitenGuide in Business OpenningRomer LesondatoNoch keine Bewertungen

- An Easy Guide To Taxation For Startup EntrepreneursDokument16 SeitenAn Easy Guide To Taxation For Startup EntrepreneursChristine P. ToledoNoch keine Bewertungen

- BIR Registration GuideDokument2 SeitenBIR Registration GuideDanhilson VivoNoch keine Bewertungen

- Step-By-Step Corporate RegistrationDokument3 SeitenStep-By-Step Corporate Registrationjen mikeNoch keine Bewertungen

- BIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsDokument107 SeitenBIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsEdward Gan100% (1)

- BirDokument6 SeitenBirbge5Noch keine Bewertungen

- How To Register A PartnershipDokument35 SeitenHow To Register A PartnershipCastro MariaNoch keine Bewertungen

- SEC, BIR registration guide for representative companyDokument8 SeitenSEC, BIR registration guide for representative companyGabriel CarumbaNoch keine Bewertungen

- Setting up a Representative Company in the PhilippinesDokument8 SeitenSetting up a Representative Company in the PhilippinesGabriel CarumbaNoch keine Bewertungen

- Steps and Requirements For Registering With The BIRDokument2 SeitenSteps and Requirements For Registering With The BIRDonita Maigue RocasNoch keine Bewertungen

- Affidavit of Co-OwnershipDokument1 SeiteAffidavit of Co-OwnershipMarlon Gonzaga100% (1)

- Affidavit of EmploymentDokument1 SeiteAffidavit of EmploymentLecel LlamedoNoch keine Bewertungen

- Affidavit Car AccidentDokument2 SeitenAffidavit Car AccidentLecel Llamedo100% (4)

- ACOP FormDokument3 SeitenACOP FormSoc Sagum100% (1)

- Statement of Management ResponsibilityDokument1 SeiteStatement of Management ResponsibilityLecel Llamedo100% (1)

- 10 People You Meet in LawDokument4 Seiten10 People You Meet in LawLecel LlamedoNoch keine Bewertungen

- Affidavit Non-Filing Income TaxDokument1 SeiteAffidavit Non-Filing Income TaxLecel Llamedo100% (3)

- Affidavit of Delayed Registration of BirthDokument1 SeiteAffidavit of Delayed Registration of BirthLecel LlamedoNoch keine Bewertungen

- Notarized ID AcknowledgmentDokument1 SeiteNotarized ID AcknowledgmentTorni JoNoch keine Bewertungen

- Birth Registration AffidavitDokument1 SeiteBirth Registration AffidavitLecel Llamedo100% (3)

- Proof of Surviving Legal HeirsDokument3 SeitenProof of Surviving Legal HeirsLecel Llamedo0% (1)

- Civil Registry RequirementsDokument5 SeitenCivil Registry RequirementsmasterfollowNoch keine Bewertungen

- DBM Joint Memo Circular 2014-1 jmc2014-1 LdrrmosDokument11 SeitenDBM Joint Memo Circular 2014-1 jmc2014-1 Ldrrmosapi-280102701100% (5)

- Job Aid For The Use of Offline eBIRForms Package PDFDokument32 SeitenJob Aid For The Use of Offline eBIRForms Package PDFJeremy SaileNoch keine Bewertungen

- Promissory NoteDokument3 SeitenPromissory NoteLecel Llamedo50% (2)

- 11 Easy Home Remedies For The Treatment of VertigoDokument4 Seiten11 Easy Home Remedies For The Treatment of VertigoLecel LlamedoNoch keine Bewertungen

- Gift Passing GamesDokument25 SeitenGift Passing GamesLecel Llamedo100% (1)

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDokument3 SeitenEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- MC 22 S. 2013Dokument3 SeitenMC 22 S. 2013Jonalyn Laroya ReoliquioNoch keine Bewertungen

- DBM Rules on Uniform AllowanceDokument5 SeitenDBM Rules on Uniform AllowanceRojan Alexei Granado67% (3)

- Personal Data SheetDokument4 SeitenPersonal Data SheetLeonil Estaño100% (7)

- Common Objections: Page 1 of 2Dokument2 SeitenCommon Objections: Page 1 of 2Lecel LlamedoNoch keine Bewertungen

- Philippine Water Districts Information by RegionDokument1 SeitePhilippine Water Districts Information by RegionLecel LlamedoNoch keine Bewertungen

- CSC Resolution No. 1500088 Sworn Statement of Assets FormDokument4 SeitenCSC Resolution No. 1500088 Sworn Statement of Assets Formwyclef_chin100% (6)

- Perhaps LoveDokument2 SeitenPerhaps LoveLecel LlamedoNoch keine Bewertungen

- Luna Vs IacDokument7 SeitenLuna Vs IacLecel LlamedoNoch keine Bewertungen

- Philippines Inter-Country Adoption RulesDokument26 SeitenPhilippines Inter-Country Adoption RulesFernand Son Dela CruzNoch keine Bewertungen

- Ra 9262 Anti-Violence Against Women ActDokument14 SeitenRa 9262 Anti-Violence Against Women Actapi-250425393Noch keine Bewertungen

- MC 22 S. 2013Dokument3 SeitenMC 22 S. 2013Jonalyn Laroya ReoliquioNoch keine Bewertungen

- INTERPRETATION OF WORDS AND PHRASES - PPTX VDokument69 SeitenINTERPRETATION OF WORDS AND PHRASES - PPTX VJhay CarbonelNoch keine Bewertungen

- A Level (General Paper) : Essay Topic - Capital PunishmentDokument51 SeitenA Level (General Paper) : Essay Topic - Capital PunishmentVidya PrabNoch keine Bewertungen

- Natural Resources and Environmental Law With Land, Titles and Deeds (Part 1)Dokument66 SeitenNatural Resources and Environmental Law With Land, Titles and Deeds (Part 1)Katherine Mae AñonuevoNoch keine Bewertungen

- Building Collapse in BangladeshDokument4 SeitenBuilding Collapse in BangladeshhafizaltecNoch keine Bewertungen

- Arabic Grammar HAALDokument2 SeitenArabic Grammar HAALIfrah IbrahimNoch keine Bewertungen

- 30 Chichester PL Apt 62Dokument4 Seiten30 Chichester PL Apt 62Hi TheNoch keine Bewertungen

- Republic Vs EstenzoDokument1 SeiteRepublic Vs EstenzoGian Tristan MadridNoch keine Bewertungen

- G.R. No. L-22320Dokument3 SeitenG.R. No. L-22320Kyle AgustinNoch keine Bewertungen

- NEAJ Article on AraquioDokument4 SeitenNEAJ Article on AraquioChristian Edezon LopezNoch keine Bewertungen

- MERALCO liable for damages due to disconnection without noticeDokument2 SeitenMERALCO liable for damages due to disconnection without noticeLaw CoNoch keine Bewertungen

- Rohit Shekhar Vs Shri Narayan Dutt Tiwari & Anr PETITIONER PDFDokument50 SeitenRohit Shekhar Vs Shri Narayan Dutt Tiwari & Anr PETITIONER PDFBhava SharmaNoch keine Bewertungen

- Wilder v. MWS CAPITAL Court of Appeals Appellant Brief (File Stamped)Dokument36 SeitenWilder v. MWS CAPITAL Court of Appeals Appellant Brief (File Stamped)Tonkawa of Texas NationNoch keine Bewertungen

- Sergeants Miniatures Game - Game ManualDokument24 SeitenSergeants Miniatures Game - Game Manualncguy001Noch keine Bewertungen

- Sengoku Basara 4 Inscriptions & FusionDokument8 SeitenSengoku Basara 4 Inscriptions & FusionAlex McCreaNoch keine Bewertungen

- Patliputra University PatnaDokument3 SeitenPatliputra University PatnaAvinash KumarNoch keine Bewertungen

- The Top / The Bottom At/on/in (Time) In/at/on (Places)Dokument4 SeitenThe Top / The Bottom At/on/in (Time) In/at/on (Places)dashaNoch keine Bewertungen

- CommunicationDokument2 SeitenCommunicationkiran dara100% (1)

- St. John's E.M High School: Class: IVDokument5 SeitenSt. John's E.M High School: Class: IVsagarNoch keine Bewertungen

- 01 - Larin vs. Executive Secretary, 280 SCRA 713, G.R. No. 112745 October 16, 1997Dokument22 Seiten01 - Larin vs. Executive Secretary, 280 SCRA 713, G.R. No. 112745 October 16, 1997Galilee RomasantaNoch keine Bewertungen

- Name - : Psalm 118:22Dokument9 SeitenName - : Psalm 118:22quangxvuNoch keine Bewertungen

- Tipu SultanDokument3 SeitenTipu SultanRohit KumarNoch keine Bewertungen

- Difference Between Cheque and Bill of Exchange: MeaningDokument6 SeitenDifference Between Cheque and Bill of Exchange: MeaningDeeptangshu KarNoch keine Bewertungen

- CVs LT Col Asif JameelDokument3 SeitenCVs LT Col Asif JameelTayyab Ilyas100% (1)

- Fsic - Valenzuela - 1 - 2023 - FsicDokument1 SeiteFsic - Valenzuela - 1 - 2023 - FsicJanice MatiasNoch keine Bewertungen

- Sunstein, Cass Holmes, Stephen - The Cost of Rights - 1 ParteDokument60 SeitenSunstein, Cass Holmes, Stephen - The Cost of Rights - 1 Parteh3nry0100% (2)

- Aydin Adnan Menderes University Engineering Faculty: Internship Application FormDokument2 SeitenAydin Adnan Menderes University Engineering Faculty: Internship Application FormSehidtvNoch keine Bewertungen

- Corporate Computer Security Chapter 1Dokument9 SeitenCorporate Computer Security Chapter 1a128128Noch keine Bewertungen

- 10 Rel. Clause-3Dokument1 Seite10 Rel. Clause-3TC Melis ERNoch keine Bewertungen

- Reinterpreting Popular Images of Christ in Philippine ContextDokument4 SeitenReinterpreting Popular Images of Christ in Philippine Contextsir_vic2013Noch keine Bewertungen

- Motion For Correction of Transcript of Stenographic NotesDokument5 SeitenMotion For Correction of Transcript of Stenographic Notesmisyeldv0% (1)