Beruflich Dokumente

Kultur Dokumente

Tds 80c 80cc 80d For The Year 2012 2013

Hochgeladen von

Velayudham ThiyagarajanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tds 80c 80cc 80d For The Year 2012 2013

Hochgeladen von

Velayudham ThiyagarajanCopyright:

Verfügbare Formate

Section 80C Deductions Section 80C of the Income Tax Act [1] allows certain investments and expenditure

to be deducted from total income up to the maximum of 1 lac. The total limit under this section is 100,000 ) which can be any combination of the below: Contribution to Provident Fund or Public Provident Fund. PPF provides 8.6% [6] return compounded annually. Maximum limit to contribute in it is 100,000 for each year. It is a long term investment with complete withdrawal not possible till 15 years though partial withdrawal is possible after 5 years. Besides, there is employee providend fund which is deducted from the salary of the person. This is about 10% to 12% of the BASIC salary component. Recent changes are being discussed regarding reducing the instances of withdrawal from EPF especially when one changes the job. EPF has the option of full settlement on leaving the job, taking VRS, retirement after 58. It also has options of withdrawal for certain expenses related to home, marriage or medical. EPF contribution includes 12% of basic salary from employee and employer. It is distributed in ratio of 8.33:3.67 in Pension fund and Providend fund Payment of life insurance premium. It is allowed on premium paid on self, spouse and children even if they are not dependent on father or mother(Tax On Maturity of LIfe Insurance Policy Investment in pension Plans. National Pension Scheme is meant to save money for the post retirement which invests money in different combination of equity and debt. depending upon age up to 50% can go in equity. Annuity payable after retirement is dependent upon age. NPS has six fund managers. Individual can make minimum contribution of Rs6000/- . It has 22 point of purchase (banks). Investment in Equity Linked Savings schemes (ELSS) of mutual funds. Among other investment opportunities, ELSS has the least lock-in period of 3 years. However, one should note that after the Direct Tax Code is in place, ELSS will no longer be an investment for 80C deduction. Investment in National Savings Certificates (interest of past NSCs is reinvested every year and can be added to the Section 80 limit) Tax saving Fixed Deposits provided by banks for a tenure of 5 years. Interest is also taxable. Payments towards principal repayment of housing loans. Also any registration fee or stamp duty paid.(Read more about House Loan deduction 80C Payments towards tuition fees for children to any school or college or university or similar institution (Only for 2 children)Read read FAQ about Tuition Fees Post office investments The investment can be from any source and not necessarily from income chargeable to

tax. [edit]Section 80CCF: Investment in Infrastructure Bonds From April, 1 2011, a maximum of 20,000 is deductible under section 80CCF provided that amount is invested in infrastructure bonds. This is in addition to the 100,000 deduction allowed under Section 80C. However this deduction has not been extended to Financial year 2012-13. Good bye to 80CCF bonds from Fy 2012-13 AY 2013-14 [edit]Section 80D: Medical Insurance Premiums Health insurance, popularly known as Mediclaim Policies, provides a deduction of up to 35,000.00 ( 15,000.00 for premium payments towards policies on self, spouse and 15,000.00 for premium payment towards non20,000.00 for premium payment towards senior 1,00,000 savings under IT deductions children and (read as in addition to) senior citizen dependent parents or

citizen dependent). This deduction is in addition to

clause 80C. For consideration under a senior citizen category, the incumbent's age should be 65 years during any part of the current fiscal, e.g. for the fiscal year 2010-11, the incumbent should already be 65 as on March 31, 2011), This deduction is also applicable to the cheques paid by proprietor firm. This Deduction is not available if Paid through CASH.read more [edit]Interest on Housing Loans Section For self occupied properties, interest paid on a housing loan up to Rs 150,000 per year is exempt from tax. This deduction is in addition to the deductions under sections 80C, 80CCF and 80D. However, this is only applicable for a residence constructed within three financial years after the loan is taken and also the loan if taken after April 1, 1999. If the house is not occupied due to employment, the house will be considered self occupied. For let out properties, the entire interest paid is deductible under section 24 of the Income Tax act. However, the rent is to be shown as income from such properties. 30% of rent received and municipal taxes paid are available for deduction of tax. The losses from all properties shall be allowed to be adjusted against salary income at the source itself. Therefore, refund claims of T.D.S. deducted in excess, on this count, will no more be necessary.[7]

Das könnte Ihnen auch gefallen

- Aptitude Tests For EmploymentDokument29 SeitenAptitude Tests For EmploymentVelayudham ThiyagarajanNoch keine Bewertungen

- Icai Differences Between Ifrss and Ind AsDokument21 SeitenIcai Differences Between Ifrss and Ind AsdhuvadpratikNoch keine Bewertungen

- Psychometric Tests PDFDokument7 SeitenPsychometric Tests PDFMarshall MahachiNoch keine Bewertungen

- Project ReportDokument9 SeitenProject ReportVelayudham ThiyagarajanNoch keine Bewertungen

- Custom Duty CalculetorDokument2 SeitenCustom Duty CalculetorVelayudham ThiyagarajanNoch keine Bewertungen

- Balance Sheet As Per New Schedule ViDokument11 SeitenBalance Sheet As Per New Schedule ViVelayudham ThiyagarajanNoch keine Bewertungen

- Academics: o o o o o o oDokument4 SeitenAcademics: o o o o o o oVelayudham ThiyagarajanNoch keine Bewertungen

- MM+T+Codes SAPDokument4 SeitenMM+T+Codes SAPVelayudham ThiyagarajanNoch keine Bewertungen

- Keys Combination Functions Control CombinationsDokument8 SeitenKeys Combination Functions Control CombinationsVelayudham ThiyagarajanNoch keine Bewertungen

- Tax Touch Up: Which Is That Amt DepositedDokument5 SeitenTax Touch Up: Which Is That Amt DepositedVelayudham ThiyagarajanNoch keine Bewertungen

- ATC Enrolment Fee Structure ICAIDokument4 SeitenATC Enrolment Fee Structure ICAIVelayudham ThiyagarajanNoch keine Bewertungen

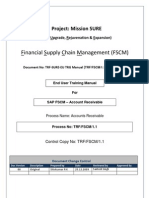

- End User Guide To Accounts Receivable in Sap FiDokument82 SeitenEnd User Guide To Accounts Receivable in Sap FiVelayudham ThiyagarajanNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Quali ExamDokument15 SeitenQuali ExamDexell Mar MotasNoch keine Bewertungen

- Labor Act, 2006Dokument10 SeitenLabor Act, 2006Subarna BiswasNoch keine Bewertungen

- Assignment On International Business (The Current Business Environment of India)Dokument15 SeitenAssignment On International Business (The Current Business Environment of India)Aman Bhattacharya100% (1)

- 09 - Marginal AnalysisDokument35 Seiten09 - Marginal AnalysisLyka Garcia100% (1)

- CH 02Dokument7 SeitenCH 02Arian MorinaNoch keine Bewertungen

- Employee Travel ReimbursementDokument16 SeitenEmployee Travel ReimbursementAnonymous XTPMQENoch keine Bewertungen

- Profit and LossDokument11 SeitenProfit and LossAsif AhmedNoch keine Bewertungen

- Flybe Group PLC Annual Report 2012 13Dokument55 SeitenFlybe Group PLC Annual Report 2012 13djokouwmNoch keine Bewertungen

- Paper 10Dokument111 SeitenPaper 10Muralidhar SusvaramNoch keine Bewertungen

- Melamine Tableware Manufacturing Rs. 7.05 Million Dec 2014Dokument19 SeitenMelamine Tableware Manufacturing Rs. 7.05 Million Dec 2014Musa KhanNoch keine Bewertungen

- Question BankDokument900 SeitenQuestion BankJack Leitch100% (1)

- Marketing Plan: F&F ClothingDokument14 SeitenMarketing Plan: F&F ClothingMuhammad Faraz HasanNoch keine Bewertungen

- Commissioner vs. Algue 158 SCRA 9Dokument6 SeitenCommissioner vs. Algue 158 SCRA 9eieipayadNoch keine Bewertungen

- MCQ AccountancyDokument10 SeitenMCQ AccountancyKunal ThapaNoch keine Bewertungen

- 22nd Annual Report 2015 16Dokument274 Seiten22nd Annual Report 2015 16ayush tiwariNoch keine Bewertungen

- BIR FORM 1902 - Application For RegistrationDokument1 SeiteBIR FORM 1902 - Application For RegistrationJenny Racadio100% (1)

- TX10 - Other Percentage TaxDokument15 SeitenTX10 - Other Percentage TaxKatzkie Montemayor GodinezNoch keine Bewertungen

- 2012 Book of AccountsDokument27 Seiten2012 Book of AccountsChrismand CongeNoch keine Bewertungen

- BSRMDokument42 SeitenBSRMPushpa BaruaNoch keine Bewertungen

- 2012 Annual Report AcerinoxDokument142 Seiten2012 Annual Report Acerinoxaniket_ghoseNoch keine Bewertungen

- Feasibility Study TemplateDokument9 SeitenFeasibility Study TemplateAli Azeem RajwaniNoch keine Bewertungen

- Deloitte: Doing Business in China-Final-July 2012Dokument94 SeitenDeloitte: Doing Business in China-Final-July 2012jwatt17Noch keine Bewertungen

- TCS Health Insurance - Hospitalisation Claim Reimbursement Guidelines PDFDokument1 SeiteTCS Health Insurance - Hospitalisation Claim Reimbursement Guidelines PDFBalaNoch keine Bewertungen

- Entrepreneurship ProjectDokument46 SeitenEntrepreneurship ProjectSheikh BabarNoch keine Bewertungen

- Form GST ITC 04 NewDokument2 SeitenForm GST ITC 04 NewAjay DayalNoch keine Bewertungen

- Partnership OperationsDokument12 SeitenPartnership Operationsninny ragayNoch keine Bewertungen

- Annual Report 2020-21Dokument73 SeitenAnnual Report 2020-21ChaviNoch keine Bewertungen

- Activity Based ManagementDokument75 SeitenActivity Based ManagementDonna KeeNoch keine Bewertungen

- Republic vs. Lopez DigestDokument2 SeitenRepublic vs. Lopez DigestHailin QuintosNoch keine Bewertungen

- Shankarlal Agrawal College of Management Studies Gondia (M.S.)Dokument86 SeitenShankarlal Agrawal College of Management Studies Gondia (M.S.)Ravi JoshiNoch keine Bewertungen