Beruflich Dokumente

Kultur Dokumente

Russian Roulette - Doing Business in Russia

Hochgeladen von

Matt BrennanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Russian Roulette - Doing Business in Russia

Hochgeladen von

Matt BrennanCopyright:

Verfügbare Formate

Russian Roulette: Doing business in Russia Matt Brennan Being the largest country on Earth, spanning over two

continents and 9 time zones, Russia is never going to linger too long away from the public eye. This bountiful Baltic nation has often been misunderstood in historys pages, and even the famous Churchill quote doesnt properly capture the murky essence that is at the core of Russian history. Russia is not a mystery as Churchill claims, rather a complex jigsaw where pieces have been purposely withheld by corrupt governments and individuals of years gone by, and not all of these pieces have been able to be put back into place. There are even still some tattered remains of the Iron Curtain, which have largely been kept out of view from the world stage, but these are nonetheless ever present when the data of Russia is viewed more closely.

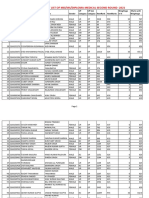

Topic Rankings

Dealing with Construction Permits Getting Electricity Trading Across Borders

DB 2013 Rank 178 184 162 11 143

DB 2012 Rank 180 182 161 12 144

Change in Rank

Enforcing Contracts Index of Economic Freedom

(+2) (-2) (-1) (+1) (+1)

Doing Business (DB) in Russia rankings. Source: World Bank

The Doing Business rankings (above) published by the World Bank, illuminate a gloomy silhouette of the social context of doing business in Russia. The findings are a result of analysing 185 countries worldwide on key business indicators and then comparing each countrys key matrix scores, which are then ranked where number 1 indicates the best performing country in that category. Russia was amongst the nominees in the category of hardest country to obtain electricity for household and commercial use and only in Bangladesh is it harder to obtain electricity (Madagascar came in at 183). Once power difficulties have been overcome, businesses then face the unenviable prospect of dealing with the lengthy delays of Russian construction permits, where the government plays a starring role in deciding what will eventually be built, unless of course businesses themselves have the deep pockets to pay for priority approval. Interestingly enough, Russia scored 11th overall in the ranking of enforcing contracts. This is the cinematic expectation we have of Russians, as the villains who are willing to break any and all of the 206 bones in the human body, if certain conditions of an agreement are not met. This stereotype was engrained for a reason, possibly due to casting convenience as much as historical resemblance, and regardless of whether this overzealous stereotype is still relevant, it serves yet another reminder that the burden of Russias past still weighs heavily on it today. A positive aftertaste from the communist regime is that income equality is actually not as bad as public perception would dictate. The Gini co-efficient is a score between 0 and 100 which represents a countrys income distribution, where 0 is the utopian goal of total equality. Like Golf, the aim is to achieve the lowest score possible, and this global scorecard ranges from countries that place high

value on social welfare such as Australia and Norway with scores of 33 and 25 respectably and tyrannical dictatorships in central Africa with scores of 60+ (without diving too deeply into the functionality of a Lorenz curve, a score of 60 means that the bottom half of the population earns roughly 9% of the nations wealth).* Russia has achieved a respectable par, with a Gini co-efficient of 40 which lies within the middle band of countries in regards to income equality. Investing in Russia is very much like investing in options. Most of what is detailed above are just some of the factors that in aggregate cause an investor to chafe at the thought of buying a stake in Russia. However, these limitations are generally constrained, (ie; the electricity statistic takes into account the whole of Russia, including remote areas, and the problem is unlikely to get any worse), whereas the potential positives of investing in Russia are quite staggering. From a macro-economic perspective, Russia ticks all the boxes of strong growth (4%p.a in the past 3 years within the current economic climate), stable currency and interest rates, downward inflation rates and most recently low unemployment (as depicted below). President Vladimir Putin (change in title from PM occurred after he won the 2012 presidential election) has undergone a raft of micro-economic reform aimed at targeting productivity, particularly in the financial sector, which combined with an increase in utilisation of the Russian workforce, is a leading indicator for future growth. Oil shortages continue to plague Western moral, and Gazprom, Russias leading and government owned (50.01%) oil and gas giant, is set to capitalise on these fears and price spikes for many years to come. Russian Unemployment

Hot to Trotsky: Unemployment has been diminishing for the past four years. Source: (Data Bloomberg, Images - Google Images)

Even a rose has thorns and in the same way Russias painful past must not overshadow its dazzling future. Investing in any of the four growth countries (Brazil, Russia, India and China) will always be riskier and fraught with danger, but there is something irrepressible and striking about Russia in particular which will make it a key hub when all of the jigsaw pieces have been put into place. The song Moscow popularized by German group Khan Dschinghis during Eurovision song contest in 1979 (it even placed #1 in the Australian charts the following year), showcases a hint of the audacious swagger that characterises Russia as much in business as in life: Take Natasha in your arms, you'll be dazzled by her charms, Moscow, Moscow, she will make you understand, that Russia is a wondrous land. *Gini co-efficient data obtained from the official CIA website cia.gov

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The New PoliticsDokument302 SeitenThe New PoliticsJamesGuptaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Jenny Louise Cudd - Motion For Change of VenueDokument37 SeitenJenny Louise Cudd - Motion For Change of VenueLaw&Crime100% (1)

- Inventing Eastern Europe The Map of Civili - Larry WolffDokument436 SeitenInventing Eastern Europe The Map of Civili - Larry WolffGiorgos KyprianidisNoch keine Bewertungen

- Communalism in IndiaDokument6 SeitenCommunalism in Indianikhilmahajan88930% (1)

- Pulp Fiction: The Juicy Tale of The Australian Citrus IndustryDokument2 SeitenPulp Fiction: The Juicy Tale of The Australian Citrus IndustryMatt BrennanNoch keine Bewertungen

- Wall Street Chronicle - November 2013 PDFDokument10 SeitenWall Street Chronicle - November 2013 PDFMatt BrennanNoch keine Bewertungen

- Code Cracking - A Breakdown of The ASX (The Intrepid Investor Series Part 4)Dokument3 SeitenCode Cracking - A Breakdown of The ASX (The Intrepid Investor Series Part 4)Matt BrennanNoch keine Bewertungen

- Youth Policy - The Future of Perth Business Has Never Looked BrighterDokument4 SeitenYouth Policy - The Future of Perth Business Has Never Looked BrighterMatt BrennanNoch keine Bewertungen

- Piñata Investments - The Intrepid Investor Series (Part 3)Dokument3 SeitenPiñata Investments - The Intrepid Investor Series (Part 3)Matt BrennanNoch keine Bewertungen

- 2012 Wall Street ChronicleDokument4 Seiten2012 Wall Street ChronicleMatt BrennanNoch keine Bewertungen

- The Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Dokument3 SeitenThe Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Matt BrennanNoch keine Bewertungen

- Currency SwapDokument3 SeitenCurrency SwapMatt BrennanNoch keine Bewertungen

- Bargain HuntingDokument3 SeitenBargain HuntingMatt BrennanNoch keine Bewertungen

- The Naked Truth: Disrobing The Energy and Clean Tech SectorsDokument2 SeitenThe Naked Truth: Disrobing The Energy and Clean Tech SectorsMatt BrennanNoch keine Bewertungen

- Confessions of A Share Trader - The Intrepid Investor Series (Part 1)Dokument2 SeitenConfessions of A Share Trader - The Intrepid Investor Series (Part 1)Matt BrennanNoch keine Bewertungen

- Bargain HuntingDokument3 SeitenBargain HuntingMatt BrennanNoch keine Bewertungen

- The Truffle KerfuffleDokument2 SeitenThe Truffle KerfuffleMatt BrennanNoch keine Bewertungen

- There's Something About DairyDokument2 SeitenThere's Something About DairyMatt BrennanNoch keine Bewertungen

- MISmanagedDokument3 SeitenMISmanagedMatt BrennanNoch keine Bewertungen

- Cliff Hanger - The US Fiscal CliffDokument2 SeitenCliff Hanger - The US Fiscal CliffMatt BrennanNoch keine Bewertungen

- The Matrix (BCG Edition)Dokument2 SeitenThe Matrix (BCG Edition)Matt BrennanNoch keine Bewertungen

- Mined, Sealed, Withered - WA's Resource Boom Aftermath.Dokument2 SeitenMined, Sealed, Withered - WA's Resource Boom Aftermath.Matt BrennanNoch keine Bewertungen

- Stamp of ApprovalDokument2 SeitenStamp of ApprovalMatt BrennanNoch keine Bewertungen

- Mined, Sealed, Withered - WA's Resource Boom Aftermath.Dokument2 SeitenMined, Sealed, Withered - WA's Resource Boom Aftermath.Matt BrennanNoch keine Bewertungen

- Cliff Hanger - The US Fiscal CliffDokument2 SeitenCliff Hanger - The US Fiscal CliffMatt BrennanNoch keine Bewertungen

- Advice You Can Bank OnDokument2 SeitenAdvice You Can Bank OnMatt BrennanNoch keine Bewertungen

- Cliff Hanger - The US Fiscal CliffDokument2 SeitenCliff Hanger - The US Fiscal CliffMatt BrennanNoch keine Bewertungen

- T5 B64 GAO Visa Docs 1 of 6 FDR - 22 CFR - Revocation of Visas 526Dokument2 SeitenT5 B64 GAO Visa Docs 1 of 6 FDR - 22 CFR - Revocation of Visas 5269/11 Document ArchiveNoch keine Bewertungen

- Individualism vs Government Control in Auden's The Unknown CitizenDokument3 SeitenIndividualism vs Government Control in Auden's The Unknown CitizenIchi BerryNoch keine Bewertungen

- Sex Among Allies ReviewDokument3 SeitenSex Among Allies ReviewlbburgessNoch keine Bewertungen

- 03ron Mccallum SpeechDokument16 Seiten03ron Mccallum Speechpramodn78Noch keine Bewertungen

- The Spanish InquisitionDokument32 SeitenThe Spanish InquisitionGuru PrasadNoch keine Bewertungen

- Francois Quesnay - Father of Physiocratic EconomicsDokument5 SeitenFrancois Quesnay - Father of Physiocratic EconomicsSpider ManNoch keine Bewertungen

- Overview of Drug Registration Requirements in NigeriaDokument6 SeitenOverview of Drug Registration Requirements in NigeriaKush MukherjiNoch keine Bewertungen

- Request FormDokument8 SeitenRequest FormOlitoquit Ana MarieNoch keine Bewertungen

- City Limits Magazine, February 1986 IssueDokument32 SeitenCity Limits Magazine, February 1986 IssueCity Limits (New York)Noch keine Bewertungen

- SHDH2040 Lecture 5Dokument83 SeitenSHDH2040 Lecture 5123 HahahaNoch keine Bewertungen

- Music Role in South AfricaDokument23 SeitenMusic Role in South AfricaAdolph William HarryNoch keine Bewertungen

- Copie de كتاب الاداء المالي وأثره على عوائد الاسهمDokument172 SeitenCopie de كتاب الاداء المالي وأثره على عوائد الاسهمsoumia bouamiNoch keine Bewertungen

- Annie's Wonderland: BandariDokument11 SeitenAnnie's Wonderland: BandariJeff HaoNoch keine Bewertungen

- rtmv3 Ingles02Dokument208 Seitenrtmv3 Ingles02Fabiana MartinsNoch keine Bewertungen

- Global Traffic Technologies v. STCDokument7 SeitenGlobal Traffic Technologies v. STCPriorSmartNoch keine Bewertungen

- 2022 Farewell To The German IdeologyDokument19 Seiten2022 Farewell To The German IdeologyJames BNoch keine Bewertungen

- (1863) The Record of Honourable Clement Laird Vallandigham On Abolition, The Union, and The Civil WarDokument262 Seiten(1863) The Record of Honourable Clement Laird Vallandigham On Abolition, The Union, and The Civil WarHerbert Hillary Booker 2nd100% (1)

- UP MDMS Merit List 2021 Round2Dokument168 SeitenUP MDMS Merit List 2021 Round2AarshNoch keine Bewertungen

- Migration Types, Causes and Consequences - GeographyDokument5 SeitenMigration Types, Causes and Consequences - GeographycrkattekolaNoch keine Bewertungen

- Soal Pas B.inggris Kelas Xii 2021Dokument3 SeitenSoal Pas B.inggris Kelas Xii 2021إيك خليد لوليدNoch keine Bewertungen

- Response To Rep. Jamaal Bowman's Withdrawal of Support For The Israel Relations Normalization ActDokument3 SeitenResponse To Rep. Jamaal Bowman's Withdrawal of Support For The Israel Relations Normalization ActJacob KornbluhNoch keine Bewertungen

- American Stories A History of The United States Combined Volume 1 and 2 1st Edition Brands Solutions ManualDokument24 SeitenAmerican Stories A History of The United States Combined Volume 1 and 2 1st Edition Brands Solutions ManualMichaelKimkqjp100% (49)

- Waves of Feminism and The MediaDokument16 SeitenWaves of Feminism and The MediaYasir HamidNoch keine Bewertungen

- Types of UnemploymentDokument2 SeitenTypes of UnemploymentSwapnil PednekarNoch keine Bewertungen

- Japanese Style Consulting Toolkit by SlidesgoDokument7 SeitenJapanese Style Consulting Toolkit by SlidesgorealsteelwarredNoch keine Bewertungen

- Mini TestDokument2 SeitenMini TestDinh LongNoch keine Bewertungen