Beruflich Dokumente

Kultur Dokumente

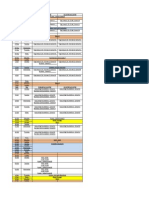

2nd Question

Hochgeladen von

Prithvi SunkuCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2nd Question

Hochgeladen von

Prithvi SunkuCopyright:

Verfügbare Formate

Explain the nature, methodology and limitations of the FDI Confidence Index, Market Potential Index, and Corruption

Perception Index. Clearly state their relevance for the international business firms: Nature, methodology and Limitations of Foreign Direct Investment Confidence Index: Foreign Direct Investment (FDI) Confidence Index is a regular survey of global executives conducted by A.T. Kearney. The index provides a unique look at the present and future prospects for international investments flows. Companies participating in the survey account for more than $2 trillion in annual global revenue. The FDI confidence index influences a businesss future decisions for ventures on foreign soil. A.T. Kearney Inc., a global management consultant firm, researches and constructs the Foreign Direct Investment Confidence Index periodically in order to assist and advise CEOs across the world in multiple markets make the most informed business decisions. Poland has been in the top 20 of this global measure consistently for many years suggesting it is seen as a stable and positive place to invest. The FDI Confidence Index Survey was constructed using primary data from a proprietary survey administered to a selected sample of senior executives of the worlds 1000 largest corporations. The survey was designed to gain insights into likely trends in global FDI flows after the terrorist attacks in the United States on September 11 th. The population was selected from the Global 1000, as determined by 2000 revenues. The participating executives include CEOs, CFOs, board members, and senior corporate strategists from 17 countries and 14 specific industries. The participating companies closely approximate the country and sector coverage of the Global 1000 population and generate over US$1 trillion in annual sales. It is difficult to maintain shareholders confidence as global investors want to hold cash surpluses as they do not want to forgo higher-return growth opportunities overseas. It is difficult to maintain a constant focus on reforms by Government and also there are narrow business interests, Logistics and regulatory barriers. Nature, Methodology and Limitations of Market Potential Index: Market Potential Index is a measure of the market potential of a country using several dimensions, ratings, indexes and percentages. Currently emerging economies comprise more than half of the worlds population account for a large share of world output and have high growth rates, which mean an enormous market potential. Using the market potential index countries are distinguished by the recent progress they have made in economic liberalization using eight dimensions that represent the market potential of a country over a scale of 1 to 100.

The 8 dimensions are market size, market growth rate, market intensity, market consumption capacity, commercial infrastructure, economic freedom, market receptivity and country risk. Each dimension is measured using various indicators and are weighted in determining their contribution to the overall market potential index. Market potential index is an aggregate measure of emerging markets attractiveness and is useful only in the initial stage of qualifying and ranking countries. Much more detailed and in-depth analysis is required for a market entry or establishment. The eight dimensions provide a comprehensive characterisation, however, additional aspects and alternative measures can be considered. The MPI is designed primarily for exporting companies, but for businesses considering other forms of entry such as direct investment and equity ventures need to examine additional variables. Nature, methodology and Limitations of Corruption Perception index: The Corruption Perception index was created in 1995 by Transparency International that measures the perceived levels of public sector corruption in almost 176 countries and territories worldwide. Based on expert opinion, countries are scored from 0 (highly corrupt) to 10 (very clean). Some countries score well, but no country scores a perfect 10. It is ranking of countries according to the extent to which corruption is believed to exist. Developed countries typically rank higher than developing nations due to stronger regulations. The corruption perception index is measured with a different methodology year to year, making yearly comparisons difficult. Because of this, it cannot be used as a tool for measuring the implications of new policies. This subjectivity has led to lot of controversy over the rankings produced by the corruption perception index.

Das könnte Ihnen auch gefallen

- What Is Your UCC Number (GS1, Formerly Known As The Uniform Code Council (UCC)Dokument1 SeiteWhat Is Your UCC Number (GS1, Formerly Known As The Uniform Code Council (UCC)Prithvi SunkuNoch keine Bewertungen

- Agar BattiDokument6 SeitenAgar Battikhurram1435Noch keine Bewertungen

- What Is Your Firm'S "Export-Ability?": Washington State University & U.S. Department of Agriculture CooperatingDokument7 SeitenWhat Is Your Firm'S "Export-Ability?": Washington State University & U.S. Department of Agriculture CooperatingPrithvi SunkuNoch keine Bewertungen

- Executive SummaryDokument1 SeiteExecutive SummaryPrithvi SunkuNoch keine Bewertungen

- Agar BattiDokument6 SeitenAgar Battikhurram1435Noch keine Bewertungen

- The Effect of Social Networking SitesDokument44 SeitenThe Effect of Social Networking SitesShobhit Chandak88% (26)

- RevisedDokument1 SeiteRevisedPrithvi SunkuNoch keine Bewertungen

- Article CritiqueDokument4 SeitenArticle CritiquePrithvi SunkuNoch keine Bewertungen

- Affidavit of SupportDokument1 SeiteAffidavit of SupportPrithvi SunkuNoch keine Bewertungen

- Incense UsaDokument1 SeiteIncense UsaPrithvi SunkuNoch keine Bewertungen

- AbstractDokument1 SeiteAbstractPrithvi SunkuNoch keine Bewertungen

- Dear Manish DhyaniDokument1 SeiteDear Manish DhyaniPrithvi SunkuNoch keine Bewertungen

- Inner Stocks: Si No Names Unit Unitprice Reorder Level Stock MRP Netcontent Subcategory DescriptionDokument1 SeiteInner Stocks: Si No Names Unit Unitprice Reorder Level Stock MRP Netcontent Subcategory DescriptionPrithvi SunkuNoch keine Bewertungen

- 2013Dokument4 Seiten2013Prithvi SunkuNoch keine Bewertungen

- Part 3 Notes and AssignmentDokument6 SeitenPart 3 Notes and AssignmentPrithvi SunkuNoch keine Bewertungen

- Geog Project Guidelines-10Dokument3 SeitenGeog Project Guidelines-10Prithvi SunkuNoch keine Bewertungen

- A. Vertical DifferentiationDokument3 SeitenA. Vertical DifferentiationPrithvi SunkuNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- "Shiksha Se Hi Suraksha": Literacy Campaign WeekDokument4 Seiten"Shiksha Se Hi Suraksha": Literacy Campaign WeekVaishali100% (1)

- Mitochondrial Mechanisms of PhotobiomodulationDokument4 SeitenMitochondrial Mechanisms of PhotobiomodulationGabrielNoch keine Bewertungen

- Head InjuryDokument7 SeitenHead InjuryRoshan Ghimire100% (1)

- (Kre?Imir Petkovi?) Discourses On Violence andDokument610 Seiten(Kre?Imir Petkovi?) Discourses On Violence andGelazul100% (1)

- Sample Internship PPTDokument19 SeitenSample Internship PPTSangeeta JamadarNoch keine Bewertungen

- Ylarde vs. Aquino, GR 33722 (DIGEST)Dokument1 SeiteYlarde vs. Aquino, GR 33722 (DIGEST)Lourdes Loren Cruz67% (3)

- Thesis Committee MeetingDokument7 SeitenThesis Committee Meetingafknojbcf100% (2)

- Sta. Lucia National High School: Republic of The Philippines Region III-Central LuzonDokument7 SeitenSta. Lucia National High School: Republic of The Philippines Region III-Central LuzonLee Charm SantosNoch keine Bewertungen

- Geriatric AnaesthesiaDokument24 SeitenGeriatric Anaesthesiakarl abiaad100% (2)

- WWW - Ib.academy: Study GuideDokument122 SeitenWWW - Ib.academy: Study GuideHendrikEspinozaLoyola100% (2)

- Brain and LanguageDokument3 SeitenBrain and LanguageJasper AngelesNoch keine Bewertungen

- Friedman LawsuitDokument12 SeitenFriedman LawsuitChris GothnerNoch keine Bewertungen

- Interfaces and Inheritance in JavaDokument1 SeiteInterfaces and Inheritance in JavaegdejuanaNoch keine Bewertungen

- ThermodynamicsDokument341 SeitenThermodynamicsjonathan2788100% (4)

- Congental Abdominal Wall DefectsDokument38 SeitenCongental Abdominal Wall DefectsAhmad Abu KushNoch keine Bewertungen

- 38 Page 2046 2159 PDFDokument114 Seiten38 Page 2046 2159 PDFAkansha SharmaNoch keine Bewertungen

- Gothic Revival ArchitectureDokument19 SeitenGothic Revival ArchitectureAlexandra Maria NeaguNoch keine Bewertungen

- Institute of Actuaries of India: Subject CT3-Probability and Mathematical Statistics May 2008 ExaminationDokument10 SeitenInstitute of Actuaries of India: Subject CT3-Probability and Mathematical Statistics May 2008 ExaminationeuticusNoch keine Bewertungen

- Ang Tibay Vs CADokument2 SeitenAng Tibay Vs CAEarl LarroderNoch keine Bewertungen

- Donor S Tax Exam AnswersDokument6 SeitenDonor S Tax Exam AnswersAngela Miles DizonNoch keine Bewertungen

- Carbon Facial Copies of SlidesDokument33 SeitenCarbon Facial Copies of Slides77yr72cdh6Noch keine Bewertungen

- Jesus Christ Was A HinduDokument168 SeitenJesus Christ Was A Hinduhbk22198783% (12)

- Registration - No Candidate Gender Category Rank/Percentage Allotment - Seat Base - Seat Course CollegeDokument166 SeitenRegistration - No Candidate Gender Category Rank/Percentage Allotment - Seat Base - Seat Course CollegeCyber ParkNoch keine Bewertungen

- 1999, 2003 - Purple Triangles - BrochureDokument32 Seiten1999, 2003 - Purple Triangles - BrochureMaria Patinha100% (2)

- Chan Sophia ResumeDokument1 SeiteChan Sophia Resumeapi-568119902Noch keine Bewertungen

- Binding of IsaacDokument10 SeitenBinding of IsaacBraz SouzaNoch keine Bewertungen

- (Paper-2) 20th Century Indian Writing: Saadat Hasan Manto: Toba Tek SinghDokument18 Seiten(Paper-2) 20th Century Indian Writing: Saadat Hasan Manto: Toba Tek SinghApexa Kerai67% (3)

- Chapter Three: Research MethodologyDokument3 SeitenChapter Three: Research MethodologyEng Abdulkadir MahamedNoch keine Bewertungen

- Sri Guru Parampara Stotram CompressDokument14 SeitenSri Guru Parampara Stotram CompressSatishPavurayalaNoch keine Bewertungen

- Aìgas of Bhakti. at The End of The Last Chapter Uddhava Inquired AboutDokument28 SeitenAìgas of Bhakti. at The End of The Last Chapter Uddhava Inquired AboutDāmodar DasNoch keine Bewertungen