Beruflich Dokumente

Kultur Dokumente

Equity Market Outlook Weekly Update-RR Equity Brokers

Hochgeladen von

Rahul SaxenaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Equity Market Outlook Weekly Update-RR Equity Brokers

Hochgeladen von

Rahul SaxenaCopyright:

Verfügbare Formate

Equity Weekly Update Sensex 19760.30 55.97 Nifty 5985.95 2.

40

For the week 3rd June to 7th June 2013 Nifty May Future 5991.00 - 8.90

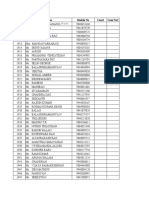

Weekly Outlook: - Manufacturing, services PMI in focus The timing of arrival of monsoon rains on the coast of Kerala and the private survey data providing indications of the strength of factory and services activity for the month of May 2013 will catch investors' attention in the coming week. Markit Economics will unveil HSBC India Manufacturing PMI, which gauges the business activity of India's factories, for May 2013 on Monday, 3 June 2013. Markit Economics will unveil the result of a monthly survey on the performance of India's services sector for May 2013 on Wednesday, 5 June 2013. The HSBC Services Purchasing Managers' Index, based on a survey of around 400 companies, fell to 50.7 in April 2013; its lowest since October 2011. The Central Statistics Office (CSO) will unveil data on inflation based on the combined consumer price index CPI) for urban and rural India and also inflation based on the wholesale price index (WPI), both for May 2013, on 14 June 2013. Weekly Movement of Market Key Indices Nifty Sensex Bank Nifty CNX IT NSE Midcap BSE Auto BSE FMCG BSE Metal BSE Oil & Gas BSE Power BSE PSU BSE Reality Top Gainer/ Loser BSE Britannia Ind. GlaxoSmthcons MphasiS Ltd. GlaxoSmithphr Amara Raja HDIL Jet Airways Jaypee Infra. Suzlon Cipla Global Markets Shanghai Nikkei HangSeng FTSE CAC DAX DJIA NASDAQ Level 5985.95 19760.30 12475.65 6472.05 7821.80 11166.34 6772.13 8503.01 8654.79 1755.12 6655.84 1684.92 Level 723.60 Change 2.40 55.97 -293.70 141.25 1.60 293.32 112.29 -154.34 85.50 8.19 -21.74 -112.70 Change 147.95 Change (%) 0.04 0.28 -2.30 2.23 0.02 1.49 1.69 -1.78 1.00 0.47 -0.33 -6.27 Change (%) 25.70 18.11 11.29 9.98 9.23 -17.34 -15.88 -12.27 -12.12 -10.73 Change (%) 0.53 -5.73 -0.98 -1.07 -0.21 0.52 -1.23 -0.09 Weekly Chart Nifty

5821.90 892.70 484.50 49.15 2507.05 227.55 266.75 22.55 41.95 -8.80 491.50 -92.75 32.90 -4.60 11.75 -1.62 370.45 -44.55 Level Change Asian 2300.60 12.07 13774.54 -837.91 22392.16 -220.52 European 6,583.09 -71.25 3,948.59 -8.20 8,348.84 43.52

US

Technical View: - On the daily chart of nifty we can see nifty unable to sustain above its resistance level of 6120. Currently nifty is trading bellow its 8 days, 13 days, 21 days EMA. Nifty has support at 5960. Investor should wait for any fresh long or short position in nifty. Investor can make short position if nifty break 5960 level in closing basis and buy position above 6120 level of closing basis. Weekly Round up: Market ekes out small gains Key benchmark indices eked out small gains amid volatility as a sharp slide was witnessed on the last trading session of the week in contrast to a rally at the beginning of the week. The S&P BSE Sensex settled below the psychological 20,000 mark after regaining that mark at the onset of the week. The CNX Nifty settled below the psychological 6,000 mark after regaining that mark at the beginning of the week. The market gained in three out of five trading sessions of the week. The S&P BSE Sensex rose 55.97 points or 0.28% to 19,760.30, its lowest closing level since 24 May 2013. The CNX Nifty gained 2.40 points or 0.04% to 5,985.95, its lowest closing level since 24 May 2013. The BSE Mid-Cap index rose 0.04%. The BSE Small- Cap index fell 0.82%. Both these indices underperformed the Sensex.

15,115.57 3,455.91

-187.53 -3.23

RR, All Rights Reserved

Page 1 of 4

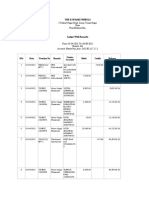

Institutional Activities (Rs Cr) FIIs Monday Tuesday Wednesday Thursday Friday DIIs Monday Tuesday Wednesday Thursday Friday Buy 2525.75 2851.06 2995.56 5826.88 5403.98 Buy 696.51 708.90 620.84 1070.88 1444.31 Sold 2119.72 2139.94 2351.75 5039.41 5908.00 Sold 1212.90 1216.72 928.96 1386.74 1241.30 Net 406.03 711.12 643.81 787.47 -504.02 Net -516.39 -507.82 -308.12 -315.86 203.01

Calls for the Week Stock on the Move: - Bank of India

Technical View: On the daily chart Bank of India we can see stock has broken its rising trend line with good volume. Currently stock is trading bellow 8 days, 13 days and 21 days EMA. Stock can touch 260 levels in lower side, investor should exit from there long position or can make fresh short position in stock with stop loss of 303 for target price of 260.

Highlights of the Week Mallya wants Rs 4,500 cr in damages from KFA lenders, lessors FY13 economic growth at decade-low rate of 5% Religare's banking bid under Ranbaxy cloud

Football clubs set to take a hit on Mallya's funding

DLF sees sales bookings worth Rs 6k cr this year Sun Pharma in talks to buy Sweden's Meda for $5-$6 bn Ranbaxy hires BCG, Mercer for internal strategic project Carlyle, others eyeing HP's MphasiS stake GMR Infrastructure back in black Realty pile-up doubles in NCR, Mumbai, Hyderabad KFA Q4 loss widens even as it stays grounded USFDA warns Hospira over manufacturing violations Aurobindo net flat at Rs 108 cr Madhucon net slips 38% Posco seeks revalidation of environment clearance Glochem fire loss put at Rs 50 crore RBI to have more space for pro-growth policies.

Rupee fall shrinks FY13 GDP size in $ terms Fiscal deficit down at 4.9% of GDP Petrol, diesel prices increased Farm growth at 2-year low of 1.4% Core sector growth plunges to 2.3% in April Rising inventory a bad news for growth story Lanka power link project hits hurdles Retail inflation eases to 10.2% Odisha's new food processing policy offers subsidy for mega food parks E-auction of minerals in Odisha to be delayed NPA additions see sharp fall in Q4 Thomas Mathew appointed interim chairman of LIC New guidelines likely to stress profitability of state-run banks

Derivative Trend

2000.00 1500.00 1000.00 500.00 0.00 1 -500.00 -1000.00 -1500.00

FII's Activity in F&O in previous Ten Sessions Rs cr.

9,000,000 8,000,000 7,000,000 6,000,000 5,000,000

Call Put

10

4,000,000 3,000,000 2,000,000 1,000,000 0 5700 5800 5900 6000 6100 6200

RR, All rights reserved

Page 2 of 4

For Further Details/Clarifications please contact: RR Information & Investment Research Pvt. Ltd. 47, MM Road Jhandewalan New Delhi-110055 (INDIA) Tel: 011-23636362/63 research@rrfcl.com RR Research Products and Services: Online Equity Calls during Market Hours (9:00 AM to 3:30 PM) Online Commodity Calls during Market Hours (10:00 AM to 11:30 PM) Online Currency Calls during Market Hours (10:00 AM to 5:00 IPO / FPO Analysis Mutual Fund Analysis Insurance Analysis Investment Monitor The complete monthly magazine design for Indian investors

Like Us on Facebook- https://www.facebook.com/RRFinancialConsultants Follow Us on Twitter- https://twitter.com/rrfinance1 Follow Us on Google+ https://plus.google.com/102387639341063312684/about Connect with Us on LinkedIn- http://www.linkedin.com/in/rrfinance Like Our Blog- http://rrfinancialconsultants.wordpress.com/

NSE - INB 231219636, INF 231219636 BSE - INB 011219632, NCDEX Membership No: 00635 | MCX Membership No: 28850 | SEBI Registration No: MCX-SX: INE261219636 SEBI Registration No: NSE Currency: INE231219636

About RR Research

RR Research provides unbiased and independent research in Online Share Trading, Equity Brokers, Commodity, Currency, Fixed Deposit Schemes, Fixed Income, Debt Market, Mutual Funds and life Insurance plans in India, General Insurance, Share Brokers in India. The research team consists of more than 10 analysts, most of which are CAs and MBAs from premier business school with experience ranging from 0 to 10 years. The team is equipped with state of the art analysis tools, software. The research team is engaged in almost every activities of the capital market. In the fundament research front, the team is involved in Economic Analysis, Sectoral Analysis, Company Coverage and Updates. In the trading front, dedicated technical team is employed to provide online technical calls, trading tips, derivative strategies to clients. The team is online during the market hours and anyone through our website can chat live with analysts and can solve any investment related query. The team has extensive network of industry contacts and regularly attending analyst meets/ conference calls to get insight of the company. On regular basis, the team shares its view with leading electronic & print media houses.

For More `Updated News about Each Financial Products Please Visit: - http://www.rrfinance.com/ Or Call @ 9540056975, Dial Toll Free - 1800110444

Das könnte Ihnen auch gefallen

- Birla Sun Life Focused Equity Fund-Series 3Dokument4 SeitenBirla Sun Life Focused Equity Fund-Series 3Rahul SaxenaNoch keine Bewertungen

- SREI Infrastructure Finance LTD Secured NCDDokument3 SeitenSREI Infrastructure Finance LTD Secured NCDRahul SaxenaNoch keine Bewertungen

- Systematic Investment Plan (SIP) - RR InvestorsDokument19 SeitenSystematic Investment Plan (SIP) - RR InvestorsRahul SaxenaNoch keine Bewertungen

- Muthoot Finance Secured and Unsecured NCDDokument3 SeitenMuthoot Finance Secured and Unsecured NCDRahul SaxenaNoch keine Bewertungen

- Muthoot Finance Secured NCD!Dokument1 SeiteMuthoot Finance Secured NCD!Rahul SaxenaNoch keine Bewertungen

- SREI Infrastructure Finance LTD Secured NCDDokument3 SeitenSREI Infrastructure Finance LTD Secured NCDRahul SaxenaNoch keine Bewertungen

- IFCI LTD Public Issue of Secured NCDsDokument4 SeitenIFCI LTD Public Issue of Secured NCDsRahul SaxenaNoch keine Bewertungen

- NIFTY Forecast - 9000 by August 2016Dokument1 SeiteNIFTY Forecast - 9000 by August 2016Rahul SaxenaNoch keine Bewertungen

- Weekly Outlook: - Investors Will Focus On Key Q3 December 2013Dokument4 SeitenWeekly Outlook: - Investors Will Focus On Key Q3 December 2013Rahul SaxenaNoch keine Bewertungen

- Indian Railway Finance Corporation LTD Tax Free Bonds-RR InvestorsDokument2 SeitenIndian Railway Finance Corporation LTD Tax Free Bonds-RR InvestorsRahul SaxenaNoch keine Bewertungen

- RR Investors Offers PNB Housing Fixed Deposits SchemesDokument3 SeitenRR Investors Offers PNB Housing Fixed Deposits SchemesRahul SaxenaNoch keine Bewertungen

- Equity Weekly Reports For 6-10 Jan 2014Dokument4 SeitenEquity Weekly Reports For 6-10 Jan 2014Rahul SaxenaNoch keine Bewertungen

- Faq RgessDokument26 SeitenFaq RgessdynamicdhruvNoch keine Bewertungen

- HUDCO Tax Free Secured Redeemable NCD Bond - Tranche IIDokument1 SeiteHUDCO Tax Free Secured Redeemable NCD Bond - Tranche IIRahul SaxenaNoch keine Bewertungen

- Political Developments in The US in FocusDokument4 SeitenPolitical Developments in The US in FocusRahul SaxenaNoch keine Bewertungen

- Equity Report - RBI Tightens Norms For Credit Card Issuers On Minimum DuesDokument4 SeitenEquity Report - RBI Tightens Norms For Credit Card Issuers On Minimum DuesRahul SaxenaNoch keine Bewertungen

- Equity Market - RCom Slashes 8% of User Base, Loses 3rd Position To Idea!Dokument4 SeitenEquity Market - RCom Slashes 8% of User Base, Loses 3rd Position To Idea!Rahul SaxenaNoch keine Bewertungen

- Technical View of Ashok Leyland, Coal India, Indian HotelsDokument4 SeitenTechnical View of Ashok Leyland, Coal India, Indian HotelsRahul SaxenaNoch keine Bewertungen

- Commodity Technical Analysis For 2nd Week September 2013Dokument4 SeitenCommodity Technical Analysis For 2nd Week September 2013Rahul SaxenaNoch keine Bewertungen

- Equity Weekly - Trend in Investment by Foreign Institutional Investors (FIIs)Dokument4 SeitenEquity Weekly - Trend in Investment by Foreign Institutional Investors (FIIs)Rahul SaxenaNoch keine Bewertungen

- Commodity Update - India's Central Bank Is Looking at Ending An Emergency Facility!Dokument4 SeitenCommodity Update - India's Central Bank Is Looking at Ending An Emergency Facility!Rahul SaxenaNoch keine Bewertungen

- Equity Weekly - FII Investment Pattern To Dictate Trend!Dokument4 SeitenEquity Weekly - FII Investment Pattern To Dictate Trend!Rahul SaxenaNoch keine Bewertungen

- Gold Technical ViewDokument2 SeitenGold Technical ViewRahul SaxenaNoch keine Bewertungen

- Commodity Weekly - Gold Fell The Most in 11 Weeks and Silver Had The Biggest Drop in Three MonthsDokument4 SeitenCommodity Weekly - Gold Fell The Most in 11 Weeks and Silver Had The Biggest Drop in Three MonthsRahul SaxenaNoch keine Bewertungen

- Equity Weekly-Macroeconomic Data, Rupee Movement May Dictate TrendDokument5 SeitenEquity Weekly-Macroeconomic Data, Rupee Movement May Dictate TrendRahul SaxenaNoch keine Bewertungen

- Currency Weekly - India's Gross Domestic Product (GDP) Grew at A Slower Rate!Dokument3 SeitenCurrency Weekly - India's Gross Domestic Product (GDP) Grew at A Slower Rate!Rahul SaxenaNoch keine Bewertungen

- Debt Market Headlines For First Week SeptemberDokument3 SeitenDebt Market Headlines For First Week SeptemberRahul SaxenaNoch keine Bewertungen

- Currency Weekly Report - Emerging Asian Currencies Have Been Under PressureDokument3 SeitenCurrency Weekly Report - Emerging Asian Currencies Have Been Under PressureRahul SaxenaNoch keine Bewertungen

- Debt Weekly - Q1 Grew at 4.4% To Rs 13.71 Lakh Crore Against Rs 13.14 Lakh Crore!Dokument3 SeitenDebt Weekly - Q1 Grew at 4.4% To Rs 13.71 Lakh Crore Against Rs 13.14 Lakh Crore!Rahul SaxenaNoch keine Bewertungen

- Equity Weekly - Expiry of Near Month F&O Contracts May Cause VolatilityDokument4 SeitenEquity Weekly - Expiry of Near Month F&O Contracts May Cause VolatilityRahul SaxenaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Security Analysis and Portfolio - S. KevinDokument595 SeitenSecurity Analysis and Portfolio - S. KevinShubham Verma100% (1)

- Specimen Copy of Notice Sent To Members About Forfeiture of Shares Who Failed To Pay Call Money - 13 06 2022Dokument2 SeitenSpecimen Copy of Notice Sent To Members About Forfeiture of Shares Who Failed To Pay Call Money - 13 06 2022i.pmanaseNoch keine Bewertungen

- India Rankings 2017: S.N. Name of The Employer/Company/Organizations Location HR Contact NameDokument4 SeitenIndia Rankings 2017: S.N. Name of The Employer/Company/Organizations Location HR Contact Namedigvijay singhNoch keine Bewertungen

- Majesco To Present at The Aegis Capital Corp. 2016 Growth Conference On September 22, 2016 (Company Update)Dokument2 SeitenMajesco To Present at The Aegis Capital Corp. 2016 Growth Conference On September 22, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Investor's Eye Mar19Dokument6 SeitenInvestor's Eye Mar19RajeshKumarNoch keine Bewertungen

- Securities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTDokument10 SeitenSecurities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTridhiNoch keine Bewertungen

- "High Growth Fintech in Digital Boom": Angel Broking LTD Mcap-3030Cr - CMP-370Dokument7 Seiten"High Growth Fintech in Digital Boom": Angel Broking LTD Mcap-3030Cr - CMP-370upsahuNoch keine Bewertungen

- Geojit BNP ParibasDokument83 SeitenGeojit BNP ParibasMadhu Shankar Gowda100% (1)

- Unit - Ii: Securities MarketsDokument53 SeitenUnit - Ii: Securities MarketsAlavudeen ShajahanNoch keine Bewertungen

- Corporate Governance ChecklistDokument14 SeitenCorporate Governance ChecklistKhalid MahmoodNoch keine Bewertungen

- About Kotak Nifty ETF Scheme FactsDokument3 SeitenAbout Kotak Nifty ETF Scheme FactsImanNoch keine Bewertungen

- SME Opportunity in Indian MarketsDokument31 SeitenSME Opportunity in Indian MarketsAshokkumar MandaNoch keine Bewertungen

- KabirdassdraftDokument176 SeitenKabirdassdraftbenten140Noch keine Bewertungen

- Final DataDokument63 SeitenFinal Dataaurorashiva1Noch keine Bewertungen

- The Kothari Wheels: 2 Tradnet Nagar Road, Arena Viman Nagar Pune Pune, MaharashtraDokument7.064 SeitenThe Kothari Wheels: 2 Tradnet Nagar Road, Arena Viman Nagar Pune Pune, MaharashtraMUKESH PATILNoch keine Bewertungen

- Case Study On Investment Analysis Case StudyDokument8 SeitenCase Study On Investment Analysis Case StudyramakrishnanNoch keine Bewertungen

- An Empirical Analysis of Indian Stock Broking IndustryDokument50 SeitenAn Empirical Analysis of Indian Stock Broking IndustryBalakrishna ChakaliNoch keine Bewertungen

- Mirae Asset Nifty Next 50 Etf - Final PresentationDokument27 SeitenMirae Asset Nifty Next 50 Etf - Final PresentationHetanshNoch keine Bewertungen

- A Project Report On Online Trading Stock Brokers of SharekhanDokument83 SeitenA Project Report On Online Trading Stock Brokers of SharekhaninteljiNoch keine Bewertungen

- Motilal Oswal Specialty Chemicals Sector UpdateDokument10 SeitenMotilal Oswal Specialty Chemicals Sector UpdateMalolanRNoch keine Bewertungen

- Do Fiis Impact Volatility of Indian Stock Market ?: Jatinder LoombaDokument14 SeitenDo Fiis Impact Volatility of Indian Stock Market ?: Jatinder LoombaNidhi KhandelwalNoch keine Bewertungen

- HSBC BankDokument21 SeitenHSBC BankDigi CreditNoch keine Bewertungen

- Stock Market MbaDokument43 SeitenStock Market MbajaspreetsingNoch keine Bewertungen

- EROS Roc Filing VersionDokument399 SeitenEROS Roc Filing VersionDilshad Alam Abdul HaseebNoch keine Bewertungen

- Aprojectreportonequityevaluationoftop3itcompaniesatstockexchange 120808224509 Phpapp02Dokument106 SeitenAprojectreportonequityevaluationoftop3itcompaniesatstockexchange 120808224509 Phpapp02surekha parasurNoch keine Bewertungen

- Pennar Industries Ltd. and Its Subsidiary Pennar Enviro Ltd. Receive Orders Worth Rs. 76 Crores (Company Update)Dokument2 SeitenPennar Industries Ltd. and Its Subsidiary Pennar Enviro Ltd. Receive Orders Worth Rs. 76 Crores (Company Update)Shyam SunderNoch keine Bewertungen

- MCX Vs NseDokument170 SeitenMCX Vs NsepbNoch keine Bewertungen

- Who Is An NRI?: NRI Can Invest in The Following ProductsDokument7 SeitenWho Is An NRI?: NRI Can Invest in The Following ProductsnikmanojNoch keine Bewertungen

- Financial Derivatives Assignment IDokument12 SeitenFinancial Derivatives Assignment IAsif Rajian Khan AponNoch keine Bewertungen