Beruflich Dokumente

Kultur Dokumente

Texas Instrument and Hewlett-Packard

Hochgeladen von

Muhammad KamilOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Texas Instrument and Hewlett-Packard

Hochgeladen von

Muhammad KamilCopyright:

Verfügbare Formate

Chapter 13 Case 13-3.

Texas Instruments and Hewlett-Packard Case Overview Texas Instruments (TI) and Hewlett-Packard (HP) are two companies famous for introducing electric and electronic products. Developed, manufactured, and sold hightechnology electric and electronic products. Although competing in similar industries, their strategies are very much different. Texas Instruments had three main lines of business in 1984: component, which include semiconductor integrated circuits, semiconductor subassemblies, and electronic control devices; digital products, which included minicomputers, personal computers, scientific instruments, and calculators; and government electronics, which included radar systems, missile guidance and control systems, and infrared surveillance systems. The three businesses generated 46 percent, 19 percent, and 24 percent, respectively, of TIs sales in 1984. Hewlett-Packard operated in two main lines of business: computer products, which included factory automation computers, engineering workstations, data terminals, personal computers, and calculators; and electronic test and measurement systems, which included instruments that were used to evaluate the operation of electrical equipment against standards, instruments that would measure and display electronic signals, voltmeters, and oscilloscopes. These businesses generated 53 percent and 37 percent, respectively, of HPs 1984 sales. Analysis and Discussion Inferred from the case, I expect some differences in planning and control system between Texas Instruments and Hewlett Packard. Strategic Planning Systems: In term of corporate level strategy, both firms have the same definition of business in which the firm will participate. TI and Hewlett-Packard (HP) are both in high-technology electric and electronics. But, the second aspect of corporate level strategy, which is deployment of resources among the business, may be different for each firm depends on the objectives that they want to achieve and competitive advantages that they have.

TI is well known for its first to entry, stay and try to achieve market leadership by cost leadership strategy. Meanwhile, HP is well known for offering unique, high value, high featured products. In addition, both firms use related diversification as they operate main business lines which connect to each other and may achieve operating synergy. For example, TI's business lines, each business line can act as both suppliers and consumers for others (e.g.: digital products line acts as consumers for component business line and suppliers for the government electronics business line). The same condition may be applied in HP. Budgeting Systems: On Texas Instrument role of the budget is considered as a control tool for the company. Business unit managers have a low impact in preparing the budget, but they have to start from scratch every year and justify the budget as a whole, while at the Hewlett-Packard considered the role of the budget as a means of short-term planning. Manager of the business unit operates in the immediate environment and they have a better knowledge about the environment because they greatly affect the budget. Reporting Systems: TI is more concentrated on reporting issues as the company's operations as the company's main activities such as the operation (manufacturing and assembly). Reporting policy issues are less frequent. Instead, HP is more concentrated on the problem of reporting policy as more companies are engaged in developing new products. Therefore, less frequent reporting of operating issues. Performance Evaluation Systems: On TI, performance standards focus more on shortterm results and use criteria such as cost control, operating income, cash flow from operations. While HP is likely to promote the long-term focus based on market share, new product development, market development, and human resource development. Incentive Compensation Systems: In HP, the company gives special incentives to innovation and the successful market acceptance of new products. In TI, management are likely to be less reliant on bonuses and more on regular salaries and compensation.

Conclusion The HP has a more flexible but higher risk strategy. They require constant innovations to lead the market and these new products demand a premium price. Budget flexible and there is greater dependent in constant updates and reporting. Management performance is measured on long-term, non-financial parameters and they are motivated by higher, but less frequent, special compensations. TI has a more structured, lower risk strategy, they require efficiency and productivity to keep maintain low cost and sell prices. Budgets are very important forms of control and actual performances are expected to adhere to the budget. Management performance is ensured on short-term, financial parameter and they are motivated by more frequent but relatively lower special compensations. Recommendation Recommended the firms to use the management control tools above as they correspond to a build or harvest strategy. The use of these expected control systems are crucial for the strategies of HP and TI to work and for them to achieve their goals.

Das könnte Ihnen auch gefallen

- How Cell Phones WorkDokument12 SeitenHow Cell Phones Workavinash_knitNoch keine Bewertungen

- ABC CostingDokument64 SeitenABC Costingvtnhan@gmail.com100% (1)

- American Woodworker 163 2012-2013 PDFDokument76 SeitenAmerican Woodworker 163 2012-2013 PDFkaskdos100% (1)

- Pharma MarketingDokument55 SeitenPharma MarketingArpan KoradiyaNoch keine Bewertungen

- Case 4-1. Vershire CompanyDokument3 SeitenCase 4-1. Vershire CompanyMuhammad Kamil100% (1)

- Case 2 Nothern DigitalDokument2 SeitenCase 2 Nothern Digitalzzz202xNoch keine Bewertungen

- Air CanadaDokument89 SeitenAir CanadaMuhammad Kamil100% (2)

- BRIDGES - PPT 404 SEMDokument204 SeitenBRIDGES - PPT 404 SEMlokendraNoch keine Bewertungen

- Nutratask Inc Is A Pharmaceutical Manufacturer of Amino Acid Chelated Minerals andDokument3 SeitenNutratask Inc Is A Pharmaceutical Manufacturer of Amino Acid Chelated Minerals andAmit PandeyNoch keine Bewertungen

- Case 13-3Dokument3 SeitenCase 13-3sunhee3521Noch keine Bewertungen

- Manajemen Keuangan - Merger and Acquisition PDFDokument36 SeitenManajemen Keuangan - Merger and Acquisition PDFvrieskaNoch keine Bewertungen

- IPSAS Explained: A Summary of International Public Sector Accounting StandardsVon EverandIPSAS Explained: A Summary of International Public Sector Accounting StandardsNoch keine Bewertungen

- Determinants of Level of Sustainability ReportVon EverandDeterminants of Level of Sustainability ReportNoch keine Bewertungen

- Global InvestorsDokument36 SeitenGlobal InvestorsIda Agustini50% (2)

- Shear Strength in The New Eurocode 2. A Step ForwardDokument10 SeitenShear Strength in The New Eurocode 2. A Step ForwardChineseAssassinNoch keine Bewertungen

- Texas Instruments and Hewlett-PackardDokument20 SeitenTexas Instruments and Hewlett-PackardNaveen SinghNoch keine Bewertungen

- Galvor CompanyDokument27 SeitenGalvor CompanyAbbasgodhrawalaNoch keine Bewertungen

- Case - Ohio Rubber Works Inc PDFDokument3 SeitenCase - Ohio Rubber Works Inc PDFRaviSinghNoch keine Bewertungen

- Materi Persentasi SIA (Semester 4)Dokument3 SeitenMateri Persentasi SIA (Semester 4)Rahmad Bari BarrudiNoch keine Bewertungen

- Kode QDokument11 SeitenKode QatikaNoch keine Bewertungen

- SOAL 14 - 6: Prevention Appraisal Internal Failure External FailureDokument6 SeitenSOAL 14 - 6: Prevention Appraisal Internal Failure External FailureIndra YeniNoch keine Bewertungen

- Reengineering Business Process To Improve Responsiveness: Accounting For TimeDokument17 SeitenReengineering Business Process To Improve Responsiveness: Accounting For TimediahNoch keine Bewertungen

- Pertemuan Asistensi 8 (Performance Measurement)Dokument2 SeitenPertemuan Asistensi 8 (Performance Measurement)Sholkhi ArdiansyahNoch keine Bewertungen

- Kuis Akuntansi ManajemenDokument5 SeitenKuis Akuntansi ManajemenBelinda Dyah Tri YuliastiNoch keine Bewertungen

- Management Control System - Revenue & Expense CenterDokument23 SeitenManagement Control System - Revenue & Expense CenterCitra Dewi Wulansari0% (1)

- Pertanyaan MenstraDokument5 SeitenPertanyaan MenstraAGANoch keine Bewertungen

- Chapter 9Dokument3 SeitenChapter 9Chan ZacharyNoch keine Bewertungen

- Contoh Eliminasi Lap - Keu KonsolidasiDokument44 SeitenContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniNoch keine Bewertungen

- KASUS CUP CorporationDokument7 SeitenKASUS CUP CorporationNia Azura SariNoch keine Bewertungen

- Chapter 15Dokument12 SeitenChapter 15Zack ChongNoch keine Bewertungen

- Tugas Week 10Dokument6 SeitenTugas Week 10Carissa WindyNoch keine Bewertungen

- A. Result Control PT. Kereta Api IndonesiaDokument4 SeitenA. Result Control PT. Kereta Api IndonesiaMukh UbaidillahNoch keine Bewertungen

- Auditing Case Study 2 About Easy CleanDokument9 SeitenAuditing Case Study 2 About Easy CleanKevin henricoNoch keine Bewertungen

- Chapter 2 - Understanding StrategiesDokument31 SeitenChapter 2 - Understanding StrategiesSarah Laras WitaNoch keine Bewertungen

- Industrial Products CorporationDokument4 SeitenIndustrial Products CorporationFahmi A. Mubarok100% (1)

- BEIFANGDokument10 SeitenBEIFANGUmar AzizNoch keine Bewertungen

- Ujian Akhir Semester 2014/2015: Akuntansi InternasionalDokument5 SeitenUjian Akhir Semester 2014/2015: Akuntansi InternasionalRatnaKemalaRitongaNoch keine Bewertungen

- Ch22S ErrorsDokument2 SeitenCh22S ErrorsBismahMehdiNoch keine Bewertungen

- Jawaban Case 5.3Dokument2 SeitenJawaban Case 5.3Ajeng TriyanaNoch keine Bewertungen

- Case 15-5 Xerox Corporation RecommendationsDokument6 SeitenCase 15-5 Xerox Corporation RecommendationsgabrielyangNoch keine Bewertungen

- Bsz263432882inh PDFDokument4 SeitenBsz263432882inh PDFMarsiniNoch keine Bewertungen

- Marden CompDokument6 SeitenMarden CompDesy WulandariNoch keine Bewertungen

- Financial Shenanigans: Dr. Howard M. SchilitDokument15 SeitenFinancial Shenanigans: Dr. Howard M. SchilitAbdullah AdreesNoch keine Bewertungen

- Chapter 13: Risk, Cost of Capital, and Capital Budgeting: Corporate Finance Ross, Westerfield, and JaffeDokument15 SeitenChapter 13: Risk, Cost of Capital, and Capital Budgeting: Corporate Finance Ross, Westerfield, and JaffePháp NguyễnNoch keine Bewertungen

- Case 5-1&5-4Dokument3 SeitenCase 5-1&5-4Tiffany SmithNoch keine Bewertungen

- Solutions/solution Manual15Dokument50 SeitenSolutions/solution Manual15Bea BlancoNoch keine Bewertungen

- Financial Shenanigans-Earning ManipulationDokument23 SeitenFinancial Shenanigans-Earning ManipulationFani anitaNoch keine Bewertungen

- 5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467Dokument152 Seiten5762 10964 IM FinancialManagementandPolicy12e HorneDhamija 9788131754467sukriti2812Noch keine Bewertungen

- Jane Belinda Saranga - CASE 1-3 Xerox CorporationDokument2 SeitenJane Belinda Saranga - CASE 1-3 Xerox CorporationJane Belinda SarangaNoch keine Bewertungen

- Financial Statement Analysis: K R Subramanyam John J WildDokument40 SeitenFinancial Statement Analysis: K R Subramanyam John J WildManusha ErandiNoch keine Bewertungen

- Cadbury Nigeria PLC 2005Dokument29 SeitenCadbury Nigeria PLC 2005Ada TeachesNoch keine Bewertungen

- Question and Answer - 60Dokument31 SeitenQuestion and Answer - 60acc-expertNoch keine Bewertungen

- Soal Kuis Asistensi AK1 Setelah UTSDokument6 SeitenSoal Kuis Asistensi AK1 Setelah UTSManggala Patria WicaksonoNoch keine Bewertungen

- To Take Into Account 2Dokument12 SeitenTo Take Into Account 2Anii HurtadoNoch keine Bewertungen

- 3-3 Rendell Company Study CaseDokument12 Seiten3-3 Rendell Company Study CaseAdinIhtisyamuddinNoch keine Bewertungen

- Problem 2: P 0,14 Significance Level 0,1 X 9 N 40 ̅ 0,225Dokument2 SeitenProblem 2: P 0,14 Significance Level 0,1 X 9 N 40 ̅ 0,225Nurul DiantikaNoch keine Bewertungen

- New Jersey Insurance CompanyDokument4 SeitenNew Jersey Insurance CompanyParth V. PurohitNoch keine Bewertungen

- Case 5 LOD StudycoDokument1 SeiteCase 5 LOD StudycoImeldaNoch keine Bewertungen

- Adopting A Stakeholder OrientationDokument13 SeitenAdopting A Stakeholder OrientationAdy Pratama PutraNoch keine Bewertungen

- Ba 221 Williamson and OliverDokument3 SeitenBa 221 Williamson and OliverAzy Ignacio100% (1)

- Hoffman Discount Drug IncDokument1 SeiteHoffman Discount Drug IncJacky DoanNoch keine Bewertungen

- Solution Manual For Cornerstones of Cost Management 3rd EditionDokument4 SeitenSolution Manual For Cornerstones of Cost Management 3rd EditionIsik JulieNoch keine Bewertungen

- Answers Chapter 4Dokument4 SeitenAnswers Chapter 4Maricel Inoc FallerNoch keine Bewertungen

- The Size of Government: Measurement, Methodology and Official StatisticsVon EverandThe Size of Government: Measurement, Methodology and Official StatisticsNoch keine Bewertungen

- 1st Reading Financial Accounting Versus Cost ManagementDokument6 Seiten1st Reading Financial Accounting Versus Cost ManagementDaniel Cortes GNoch keine Bewertungen

- SSRN Id1672242Dokument39 SeitenSSRN Id1672242Raju RastogiNoch keine Bewertungen

- Chapter 1Dokument28 SeitenChapter 1Adhi WirayanaNoch keine Bewertungen

- Regulations in Cosmetic Industry Related To Animal Testing MethodsDokument4 SeitenRegulations in Cosmetic Industry Related To Animal Testing MethodsMuhammad KamilNoch keine Bewertungen

- CEMEX Enters IndonesiaDokument5 SeitenCEMEX Enters IndonesiaMuhammad KamilNoch keine Bewertungen

- Crown Point CabinetryDokument3 SeitenCrown Point CabinetryMuhammad Kamil100% (1)

- CUP CorporationDokument3 SeitenCUP CorporationMuhammad KamilNoch keine Bewertungen

- Case 5-4. Abrams Company Case OverviewDokument3 SeitenCase 5-4. Abrams Company Case OverviewMuhammad KamilNoch keine Bewertungen

- Yaesu VR 120Dokument44 SeitenYaesu VR 120Chema MelidaNoch keine Bewertungen

- Lexmark-E 321 Service ManualDokument184 SeitenLexmark-E 321 Service ManualRemysNoch keine Bewertungen

- Lecture - 6 EDokument33 SeitenLecture - 6 ETung HoNoch keine Bewertungen

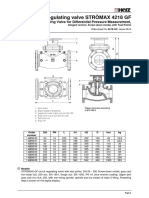

- Circuit Regulating Valve STRÖMAX 4218 GFDokument14 SeitenCircuit Regulating Valve STRÖMAX 4218 GFMario Mô Ri ANoch keine Bewertungen

- ST 010 ISBT 128 Standard Product Description Code Database v6.0.0Dokument34 SeitenST 010 ISBT 128 Standard Product Description Code Database v6.0.0Patrick Ramos100% (1)

- KEDA Quotation of 2 3 4 Inch Mini Gold DredgerDokument3 SeitenKEDA Quotation of 2 3 4 Inch Mini Gold DredgerShane CapstickNoch keine Bewertungen

- MARINO WORLD MAGAZINE July-August IssueDokument52 SeitenMARINO WORLD MAGAZINE July-August IssueNhal LopezNoch keine Bewertungen

- Walk inDokument1 SeiteWalk inCHATHURNoch keine Bewertungen

- NASA MissionsDokument62 SeitenNASA MissionsRoman FlorinNoch keine Bewertungen

- A Project Report On DMRCDokument22 SeitenA Project Report On DMRCRahul Mehrotra100% (1)

- Waterjet CutterDokument4 SeitenWaterjet CutterCarlos RamirezNoch keine Bewertungen

- Theta76PrinterUnit EL V1-0Dokument58 SeitenTheta76PrinterUnit EL V1-0MarcelinoMorillasCecilia100% (1)

- Adnan PDFDokument3 SeitenAdnan PDFmudassarhussainNoch keine Bewertungen

- M2-Cert 22 Prof Dev Plus Exam ST Gd-1Dokument20 SeitenM2-Cert 22 Prof Dev Plus Exam ST Gd-1Khôi Lê100% (1)

- Laboratorio de Microondas - Medicion en Lineas de TX Usando Lineas RanuradasDokument5 SeitenLaboratorio de Microondas - Medicion en Lineas de TX Usando Lineas RanuradasacajahuaringaNoch keine Bewertungen

- Dbms Lab Manual-2013Dokument27 SeitenDbms Lab Manual-2013Arham JainNoch keine Bewertungen

- MSDS - LPGDokument9 SeitenMSDS - LPGPrathamesh ShevaleNoch keine Bewertungen

- Chapter 19 Malicious LogicDokument16 SeitenChapter 19 Malicious LogicAnita Sofia KeyserNoch keine Bewertungen

- Ac-Dc KilnsDokument10 SeitenAc-Dc KilnsPrateek SinghNoch keine Bewertungen

- Lowel LightsDokument80 SeitenLowel LightsSaulo Valley100% (1)

- Society and Culture With Family PlanningDokument7 SeitenSociety and Culture With Family PlanningHope Earl Ropia BoronganNoch keine Bewertungen

- Ecen 607 CMFB-2011Dokument44 SeitenEcen 607 CMFB-2011Girish K NathNoch keine Bewertungen

- Web Service Integration With SAPDokument7 SeitenWeb Service Integration With SAPJoy PatelNoch keine Bewertungen

- 000 139 PDFDokument17 Seiten000 139 PDFtareqcccccNoch keine Bewertungen