Beruflich Dokumente

Kultur Dokumente

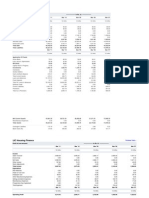

Bhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.

Hochgeladen von

Shavya RastogiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.

Hochgeladen von

Shavya RastogiCopyright:

Verfügbare Formate

Bhel balance sheet

Balance Sheet of Bharat Heavy Electricals

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '0

12 mths

12 mths

12 mths

12 mths

12 mth

Total Share Capital

Equity Share Capital

Share Application Money

Preference Share Capital

Reserves

Revaluation Reserves

Networth

489.52

489.52

0.00

0.00

24,883.69

0.00

25,373.21

489.52

489.52

0.00

0.00

19,664.32

0.00

20,153.84

489.52

489.52

0.00

0.00

15,427.84

0.00

15,917.36

489.52

489.52

0.00

0.00

12,449.29

0.00

12,938.81

489.5

489.5

0.0

0.0

10,284.6

0.0

10,774.2

Secured Loans

Unsecured Loans

Total Debt

Total Liabilities

0.00

123.43

123.43

25,496.64

Mar '12

0.00

163.35

163.35

20,317.19

Mar '11

0.00

127.75

127.75

16,045.11

Mar '10

0.00

149.37

149.37

13,088.18

Mar '09

0.0

95.1

95.1

10,869.3

Mar '0

12 mths

12 mths

12 mths

12 mths

12 mth

Gross Block

Less: Accum. Depreciation

Net Block

9,729.62

5,409.83

4,319.79

8,049.30

4,648.82

3,400.48

6,579.70

4,164.74

2,414.96

5,224.43

3,754.47

1,469.96

4,443.0

3,462.2

980.8

Capital Work in Progress

Investments

1,324.63

461.67

1,762.62

439.17

1,550.49

79.84

1,212.70

52.34

658.4

8.2

Inventories

Sundry Debtors

Cash and Bank Balance

Total Current Assets

Loans and Advances

Fixed Deposits

Total CA, Loans & Advances

Deffered Credit

Current Liabilities

Provisions

Total CL & Provisions

Net Current Assets

13,444.50

26,336.13

6,671.98

46,452.61

14,217.32

0.00

60,669.93

0.00

33,638.01

7,641.37

41,279.38

19,390.55

10,963.03

27,354.62

1,430.15

39,747.80

13,267.07

8,200.00

61,214.87

0.00

31,469.58

15,030.37

46,499.95

14,714.92

9,235.46

20,688.75

865.08

30,789.29

4,801.24

8,925.00

44,515.53

0.00

28,097.73

4,417.98

32,515.71

11,999.82

7,837.02

15,975.50

1,950.51

25,763.03

4,616.67

8,364.16

38,743.86

0.00

23,415.10

4,975.58

28,390.68

10,353.18

5,736.4

11,974.8

1,511.0

19,222.2

7,366.1

6,875.0

33,463.4

0.0

16,632.9

7,608.6

24,241.6

9,221.8

Miscellaneous Expenses

Total Assets

0.00

25,496.64

0.00

20,317.19

0.00

16,045.11

0.00

13,088.18

0.0

10,869.3

2,424.33

2,324.26

2,538.13

2,546.25

1,673.1

Sources Of Funds

Application Of Funds

Contingent Liabilities

Book Value (Rs)

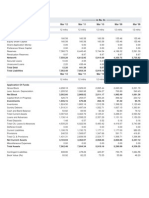

Bharat Heavy Electricals

Previous Years

Standalone Profit & Loss account

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

50,260.81

2,530.22

47,730.59

1,265.55

823.20

49,819.34

44,002.76

1,980.00

42,022.76

1,015.31

127.35

43,165.42

34,613.43

1,387.18

33,226.25

1,085.73

786.65

35,098.63

28,504.05

1,889.69

26,614.36

1,023.88

1,151.54

28,789.78

21,775.60

2,234.52

19,541.08

1,023.12

827.33

21,391.53

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

Total Expenses

25,113.12

510.25

5,465.83

3,830.21

0.00

3,831.25

0.00

38,750.66

Mar '12

19,887.45

402.86

5,396.71

3,482.76

3,939.30

486.30

0.00

33,595.38

Mar '11

17,752.74

337.99

6,449.17

2,980.25

279.72

113.84

0.00

27,913.71

Mar '10

15,587.43

341.82

2,991.27

2,086.06

2,412.22

162.50

0.00

23,581.30

Mar '09

10,400.69

273.07

2,602.30

1,464.58

1,664.57

216.60

0.00

16,621.81

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

9,803.13

8,554.73

6,099.19

4,184.60

3,746.60

PBDIT

Interest

PBDT

Depreciation

Other Written Off

Profit Before Tax

Extra-ordinary items

PBT (Post Extra-ord Items)

Tax

Reported Net Profit

11,068.68

51.28

11,017.40

800.00

0.00

10,217.40

-19.25

10,198.15

3,262.30

7,039.96

9,570.04

54.73

9,515.31

475.61

0.00

9,039.70

79.66

9,119.36

3,088.13

6,011.20

7,184.92

33.50

7,151.42

458.01

0.00

6,693.41

46.47

6,739.88

2,326.35

4,310.64

5,208.48

30.71

5,177.77

334.27

0.00

4,843.50

96.64

4,940.14

1,799.31

3,138.21

4,769.72

35.42

4,734.30

297.21

0.00

4,437.09

-12.69

4,424.40

1,565.06

2,859.34

Total Value Addition

Preference Dividend

Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

13,637.54

0.00

1,566.47

254.12

13,707.93

0.00

1,524.85

249.88

10,160.97

0.00

1,140.58

191.51

7,993.87

0.00

832.18

141.43

6,221.12

0.00

746.52

126.87

Shares in issue (lakhs)

Earning Per Share (Rs)

24,476.00

28.76

4,895.20

122.80

4,895.20

88.06

4,895.20

64.11

4,895.20

58.41

320.00

311.50

233.00

170.00

152.50

Income

Operating Profit

Equity Dividend (%)

Book Value (Rs)

103.67

411.71

325.16

264.32

220.10

Source : Dion Global Solutions Limited

Bharat Heavy Electricals

Previous Years

Key Financial Ratios

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

2.00

6.40

40.05

195.01

-50.00

10.00

31.15

174.35

858.45

401.65

50.00

10.00

23.30

122.49

678.75

315.11

50.00

10.00

17.00

85.43

543.68

254.23

50.00

10.00

15.25

76.54

399.19

209.99

50.00

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Gross Profit Margin(%)

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

Return on Assets Excluding Revaluations

Return on Assets Including Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

20.53

18.37

18.86

15.82

15.82

14.36

14.36

40.27

27.74

27.41

103.67

103.67

40.27

20.30

18.76

19.17

14.72

14.72

13.99

13.99

44.25

29.82

29.01

411.71

411.71

44.25

18.04

16.13

16.66

13.80

13.80

12.55

12.55

41.37

27.08

26.88

325.16

325.16

41.37

15.71

13.93

14.45

12.10

12.10

11.36

11.36

36.95

24.25

23.24

264.32

264.32

36.95

19.17

16.73

17.65

15.59

15.59

13.87

13.87

41.56

26.53

27.07

220.10

220.10

41.56

1.47

1.11

---

1.32

1.03

0.01

0.01

1.37

1.04

0.01

0.01

1.36

1.02

0.01

0.01

1.38

1.09

0.01

0.01

200.25

0.00

215.85

164.27

0.01

172.96

198.19

0.01

211.86

157.51

0.01

168.40

127.55

0.01

135.94

153.89

119.52

143.35

114.07

90.12

3.74

1.78

4.11

1.75

3.77

1.81

3.70

1.90

3.88

1.80

Investment Valuation Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

Debt Coverage Ratios

Interest Cover

Total Debt to Owners Fund

Financial Charges Coverage Ratio

Financial Charges Coverage Ratio Post

Tax

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

3.74

5.07

1.90

2.08

4.11

5.31

2.08

2.31

3.77

5.15

2.09

2.28

3.70

5.20

2.05

2.22

3.88

4.48

1.81

4.48

--146.25

101.42

10.27

126.06

83.34

9.80

130.02

80.96

9.74

140.04

88.75

12.03

169.89

Material Cost Composition

Imported Composition of Raw Materials

Consumed

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

52.61

47.32

53.42

58.56

53.22

32.05

31.26

35.15

27.81

27.73

-30.20

0.99

2.90

1.06

4.71

1.09

6.70

1.22

4.80

Dividend Payout Ratio Net Profit

Dividend Payout Ratio Cash Profit

Earning Retention Ratio

Cash Earning Retention Ratio

AdjustedCash Flow Times

25.86

23.22

73.83

76.53

0.02

29.52

27.35

69.66

71.94

0.03

30.90

27.93

68.88

71.89

0.03

31.02

28.03

67.63

70.87

0.04

30.54

27.66

70.07

72.83

0.03

Mar

'12

Mar '11

Mar '10

Mar '09

Mar '08

28.76

103.67

122.80

411.71

88.06

325.16

64.11

264.32

58.41

220.10

Average Raw Material Holding

Average Finished Goods Held

Number of Days In Working Capital

Profit & Loss Account Ratios

Earnings Per Share

Book Value

Source : Dion Global Solutions Limited

Das könnte Ihnen auch gefallen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Balance Sheet of NTPC: - in Rs. Cr.Dokument15 SeitenBalance Sheet of NTPC: - in Rs. Cr.Ram LakhanNoch keine Bewertungen

- Balance Sheet of Adani Power: - in Rs. Cr.Dokument7 SeitenBalance Sheet of Adani Power: - in Rs. Cr.bpn89Noch keine Bewertungen

- Axis Bank ValuvationDokument26 SeitenAxis Bank ValuvationGermiya K JoseNoch keine Bewertungen

- Balance Sheet of State Bank of IndiaDokument8 SeitenBalance Sheet of State Bank of IndiaJyoti VijayNoch keine Bewertungen

- Balance Sheet of Bharti AirtelDokument7 SeitenBalance Sheet of Bharti Airteltiku_048Noch keine Bewertungen

- Mahindra & Mahindra Financial Services: Previous YearsDokument4 SeitenMahindra & Mahindra Financial Services: Previous YearsJacob KvNoch keine Bewertungen

- Balance Sheet of Bharat Petroleum CorporationDokument4 SeitenBalance Sheet of Bharat Petroleum CorporationPradipna LodhNoch keine Bewertungen

- Balance Sheet of Tata MotorsDokument3 SeitenBalance Sheet of Tata MotorsApoorva GuptaNoch keine Bewertungen

- Balance Sheet of Bharti Airtel - in Rs. Cr.Dokument2 SeitenBalance Sheet of Bharti Airtel - in Rs. Cr.Refakat HussainNoch keine Bewertungen

- Balance Sheet of Bharti AirtelDokument11 SeitenBalance Sheet of Bharti AirtelAmit SachdevaNoch keine Bewertungen

- Financial Management - I (Practical Problems)Dokument9 SeitenFinancial Management - I (Practical Problems)sameer_kini100% (1)

- Balance Sheet of LIC Housing Finance - in Rs. Cr.Dokument10 SeitenBalance Sheet of LIC Housing Finance - in Rs. Cr.Rohit JainNoch keine Bewertungen

- Ratio Analysis Tata MotorsDokument8 SeitenRatio Analysis Tata Motorssadafkhan21Noch keine Bewertungen

- Balance Sheet of Havells IndiaDokument5 SeitenBalance Sheet of Havells IndiaMalarNoch keine Bewertungen

- Ashok LeylandDokument13 SeitenAshok LeylandNeha GuptaNoch keine Bewertungen

- Dabur India Balance SheetDokument5 SeitenDabur India Balance SheetMadhur GumberNoch keine Bewertungen

- Balance Sheet of Tata MotorsDokument10 SeitenBalance Sheet of Tata Motorssarvesh.bhartiNoch keine Bewertungen

- Divis Laboratories: Consolidated Balance Sheet of - in Rs. Cr.Dokument20 SeitenDivis Laboratories: Consolidated Balance Sheet of - in Rs. Cr.cijoseph007Noch keine Bewertungen

- Chettinadu Cment - FinancialsDokument10 SeitenChettinadu Cment - FinancialsvmktptNoch keine Bewertungen

- Standalone Profit & Loss AccountDokument5 SeitenStandalone Profit & Loss AccountTarun BangaNoch keine Bewertungen

- Balance Sheet of State Bank of IndiaDokument1 SeiteBalance Sheet of State Bank of Indiajohn_muellorNoch keine Bewertungen

- Balance Sheet and P&L of CiplaDokument2 SeitenBalance Sheet and P&L of CiplaPratik AhluwaliaNoch keine Bewertungen

- Balance Sheet of Reliance PowerDokument10 SeitenBalance Sheet of Reliance PowerJoe SharmaNoch keine Bewertungen

- Key Financial Ratios of Ultratech Cement: Next Years Previous YearsDokument6 SeitenKey Financial Ratios of Ultratech Cement: Next Years Previous YearsRamana VaitlaNoch keine Bewertungen

- Balance Sheet of Hero Motocorp - in Rs. Cr.Dokument16 SeitenBalance Sheet of Hero Motocorp - in Rs. Cr.Khushboo VishwakarmaNoch keine Bewertungen

- Spreadsheet FMDokument11 SeitenSpreadsheet FMrssardarNoch keine Bewertungen

- Kotak Mahindra Bank Balance Sheet of Last 5 YearsDokument10 SeitenKotak Mahindra Bank Balance Sheet of Last 5 YearsManish MahajanNoch keine Bewertungen

- Cash Flow of Cadbury India: - in Rs. Cr.Dokument6 SeitenCash Flow of Cadbury India: - in Rs. Cr.Somraj RoyNoch keine Bewertungen

- Financial Status of The CompanyDokument5 SeitenFinancial Status of The Companyankit_shri19Noch keine Bewertungen

- Balance Sheet of Reliance IndustriesDokument7 SeitenBalance Sheet of Reliance IndustriesNEHAAA26Noch keine Bewertungen

- Key Ratios of NTPCDokument2 SeitenKey Ratios of NTPCManinder BaggaNoch keine Bewertungen

- Annual Sales Revenue 2009Dokument2 SeitenAnnual Sales Revenue 2009Muthu MarshNoch keine Bewertungen

- Macro Perspective: Pakistan Leasing Year Book 2009Dokument7 SeitenMacro Perspective: Pakistan Leasing Year Book 2009atifch88Noch keine Bewertungen

- PPPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPPDokument12 SeitenPPPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPP PPPPRakesh SharmaNoch keine Bewertungen

- KFA Published Results March 2011Dokument3 SeitenKFA Published Results March 2011Abhay AgarwalNoch keine Bewertungen

- Vas Infrastructure Balance Sheet Sources of FundsDokument20 SeitenVas Infrastructure Balance Sheet Sources of FundsskalidasNoch keine Bewertungen

- Hero Motocorp: Previous YearsDokument11 SeitenHero Motocorp: Previous YearssalimsidNoch keine Bewertungen

- Balance Sheet of Tata MotorsDokument1 SeiteBalance Sheet of Tata MotorsAbhi JainNoch keine Bewertungen

- Airtel RatiosDokument9 SeitenAirtel RatiosakshayuppalNoch keine Bewertungen

- Balance Sheet of Bharat Heavy ElectricalsDokument2 SeitenBalance Sheet of Bharat Heavy ElectricalsratheenaveenNoch keine Bewertungen

- Previous Years: Tata Motor S - in Rs. Cr.Dokument28 SeitenPrevious Years: Tata Motor S - in Rs. Cr.priya4112Noch keine Bewertungen

- Competition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) TurnoverDokument13 SeitenCompetition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) Turnoverchintan61@gmail.comNoch keine Bewertungen

- Balance Sheet of Cipla ADokument1 SeiteBalance Sheet of Cipla ASreerama MurthyNoch keine Bewertungen

- Capital and Liabilities:: ApplicationDokument6 SeitenCapital and Liabilities:: ApplicationKeshav GoyalNoch keine Bewertungen

- NTPCDokument7 SeitenNTPCDivyesh GandhiNoch keine Bewertungen

- Business Asset ValuationDokument8 SeitenBusiness Asset Valuationmanojgurnani78Noch keine Bewertungen

- Balance Sheet of Amara Raja BatteriesDokument11 SeitenBalance Sheet of Amara Raja Batteriesashishgrover80Noch keine Bewertungen

- Yearly Results of Bharti AirtelDokument1 SeiteYearly Results of Bharti AirteljatinkakkarNoch keine Bewertungen

- PanasonicDokument17 SeitenPanasonicAzmi Abdullah KhanNoch keine Bewertungen

- Tata Motors Standalone Balanve SheetDokument4 SeitenTata Motors Standalone Balanve SheetJohn MathewNoch keine Bewertungen

- Accounts AssignmentDokument7 SeitenAccounts AssignmentHari PrasaadhNoch keine Bewertungen

- Archies Financial StatmentsDokument5 SeitenArchies Financial StatmentsShitiz JainNoch keine Bewertungen

- Reliance Industries: Previous YearsDokument6 SeitenReliance Industries: Previous YearsSweta ChakravartyNoch keine Bewertungen

- Balance Sheet of Reliance IndustriesDokument12 SeitenBalance Sheet of Reliance IndustriesMohit Kumar SinghNoch keine Bewertungen

- Parle Product FinanciaDokument14 SeitenParle Product FinanciaAbinash Behera100% (1)

- All Bank of RajasthanDokument7 SeitenAll Bank of RajasthanAnonymous 6TyOtlNoch keine Bewertungen

- Cash FlowDokument25 SeitenCash Flowshaheen_khan6787Noch keine Bewertungen

- in Rs. Cr.Dokument14 Seitenin Rs. Cr.Vaishnavi KrushakthiNoch keine Bewertungen

- Sundiang Notes - InsuranceDokument70 SeitenSundiang Notes - InsuranceJeperson Marco100% (9)

- Ratio & RateDokument2 SeitenRatio & RateWilliam RyandinataNoch keine Bewertungen

- Academic Word List PDFDokument28 SeitenAcademic Word List PDFukchaudharyNoch keine Bewertungen

- The - Faber.report CNBSDokument154 SeitenThe - Faber.report CNBSWilly Pérez-Barreto MaturanaNoch keine Bewertungen

- Bank Guarantee 1Dokument3 SeitenBank Guarantee 1Yomero Romero75% (4)

- Problem 1-1 To 1-3 Intermediate Accounting (Vol 1)Dokument8 SeitenProblem 1-1 To 1-3 Intermediate Accounting (Vol 1)Margarette TumbadoNoch keine Bewertungen

- Mirae Factsheet April2017Dokument16 SeitenMirae Factsheet April2017Dashang G. MakwanaNoch keine Bewertungen

- Rental Agreement TemplateDokument2 SeitenRental Agreement TemplateytrdfghjjhgfdxcfghNoch keine Bewertungen

- Cityam 2011-09-21Dokument36 SeitenCityam 2011-09-21City A.M.Noch keine Bewertungen

- Poblem and SolutionDokument8 SeitenPoblem and SolutionshajiNoch keine Bewertungen

- Miga Professionals Program PDFDokument2 SeitenMiga Professionals Program PDFPaul Ivan Beppe a Yombo Paul IvanNoch keine Bewertungen

- BBA Sem - II Syllabus - 13.112019Dokument28 SeitenBBA Sem - II Syllabus - 13.112019Gaurav BuchkulNoch keine Bewertungen

- InstaSummary Report of Mantra Softech (India) Private Limited - 30-06-2020Dokument10 SeitenInstaSummary Report of Mantra Softech (India) Private Limited - 30-06-2020RajiNoch keine Bewertungen

- Anti-Money Laundering Risks To Financial InstitutionsDokument16 SeitenAnti-Money Laundering Risks To Financial InstitutionsLexisNexis Risk Division100% (7)

- ITR 1 - AY 2023-24 - V1.3.xlsmDokument18 SeitenITR 1 - AY 2023-24 - V1.3.xlsmsrinukkNoch keine Bewertungen

- Mayuga Vs MetroDokument4 SeitenMayuga Vs MetroPaulitoPunongbayanNoch keine Bewertungen

- Pulz ElectronicsDokument37 SeitenPulz ElectronicsBandaru NarendrababuNoch keine Bewertungen

- Ias 2Dokument4 SeitenIas 2mnhammadNoch keine Bewertungen

- Research Paper - MN559990 - Batch35 - PDFDokument17 SeitenResearch Paper - MN559990 - Batch35 - PDFkhushboo sharmaNoch keine Bewertungen

- Certificate in Bookkeeping and Accounting Level 2Dokument38 SeitenCertificate in Bookkeeping and Accounting Level 2McKay TheinNoch keine Bewertungen

- Ms8-Set A Midterm - With AnswersDokument5 SeitenMs8-Set A Midterm - With AnswersOscar Bocayes Jr.Noch keine Bewertungen

- Thank You!: Your Order Number Is: 3I15052725Dokument4 SeitenThank You!: Your Order Number Is: 3I15052725ragireddy swathi sowmyaNoch keine Bewertungen

- Fund Rankings Sovereign Wealth Fund InstituteDokument3 SeitenFund Rankings Sovereign Wealth Fund Institutelohenci_sammyNoch keine Bewertungen

- NIB Annual Report 2015Dokument216 SeitenNIB Annual Report 2015Asif RafiNoch keine Bewertungen

- School Building Valuation in Rural AreasDokument66 SeitenSchool Building Valuation in Rural AreasMurthy BabuNoch keine Bewertungen

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDokument28 SeitenYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNoch keine Bewertungen

- Public Sector Accounting and Finance: Ac403 - Lecture 4Dokument24 SeitenPublic Sector Accounting and Finance: Ac403 - Lecture 4Mcdonald NyatangaNoch keine Bewertungen

- 2307 For EBS Private Individual Percenateg TaxDokument4 Seiten2307 For EBS Private Individual Percenateg TaxAGrace MercadoNoch keine Bewertungen

- Far270 July2022Dokument8 SeitenFar270 July2022Nur Fatin AmirahNoch keine Bewertungen

- Desirable Corporate Governance: A CodeDokument16 SeitenDesirable Corporate Governance: A CodesiddharthanandNoch keine Bewertungen