Beruflich Dokumente

Kultur Dokumente

Resized (2) - KF Investment Advisory Report 2012

Hochgeladen von

Anshul GuptaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Resized (2) - KF Investment Advisory Report 2012

Hochgeladen von

Anshul GuptaCopyright:

Verfügbare Formate

l^Il'1LIKI'lII^1lI

II'1l^1lL^'1Ll^VI'1l^

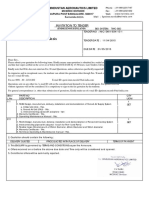

lnvcslmcnlAdvscrykcpcrlIcvcmbcr2012

This report LII^1LIV the

top residential

destinations in the

country from the

investment point of view

over the next VI

years (2013-2017)

Balancing return with the associated risk is the

focal point of any investment decision. Equity and

debt are considered to be the mainstream asset

casscs. hRwcvcr, lhc lradcR bclwccn rclurn

and risk in both these asset classes is strikingly

dcrcnl. whc cquly as an asscl cass s

associated with high returns albeit with a greater

risk score as measured by volatility, a relatively

stable debt investment comes with a larger

compromise on returns.

Real estate, the third mainstream asset class,

Rcrs lhc bcsl cRmbnalRn RI rclurns and rsN.

From the perspective of return, real estate

investment in India has garnered superior returns

in comparison to other asset classes over a long

term. Further, an investment in residential

INVESTMENT

advisory REPORT

Indias Residential Destinations

INTRODUCTION

property is generally done with leverage in the

form of a housing mortgage. This leverage further

increases the potential for earning higher returns

since the initial equity contribution is a fraction of

the property value.

From the perspective of risk, property investment

fares better because asset price generally

remains stable. It has been established that an

investment in real estate based on sound

research can seldom go wrong. In the sense that

in comparison to an asset class like equity which

is dependent on several factors related to the

undcryng busncss Nc prRlably, cvcragc

and corporate governance, a real estate

investment is based on the underlying asset. A

sound research is inherently founded on deep

IMPORTANT TERMS USED IN THE REPORT

TERM MEANING

Metropolitan region Thc urban rcgRn as dcncd by lhc rcgRna dcvcRpmcnl aulhRrly

Zone A Zone is a geographical division of the metropolitan region comprising of several

localities that possess similar characteristics in terms of access to employment hubs,

connectivity and demography. In most cases, the metropolitan region is divided into 4-5

zRncs lhal arc abccd as Ccnlra, SRulh, 1Rrlh, wcsl and Lasl

Destination Destination is the most promising residential locality from the perspective of investment

Benchmark location ldcnlcd bascd Rn lhc ncarcsl prcc cRnlRur, a bcnchmarN RcalRn s an cslabshcd

residential locality that has saturated in terms of real estate growth and infrastructure

development and is considered as the most sought after residential market within the

zRnc. wlh rcspccl lR prcc IRrccaslng IRr lhc dcslnalRn, a bcnchmarN RcalRn, prcIcraby

in the same zone, becomes the reference point

Property price This map splits the geography of a city in accordance with the prevailing residential

contour map prRpcrly prcc. kcsdcnla marNcls Iang wlhn a cRnlRur nc cRmmand prcc dcnlcd

by such line

Investor Return It is the IRR (Internal Rate of Return) for a typical investor in residential property

Assumptions for Size of property: 1000 sq. ft. Investment horizon: 5 years

calculating Investor Loan to Value ratio: 60% Mortgage rate: 10.5% pa

Return Loan tenure: 20 years

Residential Property The price indicates the average capital value in the residential market of the destination

Price (` per sq.ft.) and benchmark locations

Hidden Gem Locations where we expect the real estate drivers to gather momentum beyond year 2017

We have developed a

framework built on top-

down approach in the

selection of 1II VI PRV1

promising cities and zones

within them and bottom-

up approach in the

selection of top

investment destinations

From the perspective of

risk, property investment

fares better because asset

price generally remains

stable

understanding of the property market along with

the study of factors that drive it.

Real estate is an asset class where an educated

investor can mitigate the risk and enjoy the

associated superior returns at the same time.

Coupled with the other mainstream asset classes,

this investment vehicle can make for an optimally

dvcrscd pRrlIRR. ln mRsl cascs, nvcslmcnl n

real estate is fraught with decisions based on gut

feeling and tips which result in poor

investments. Hence, an investor has to clearly

delineate a real estate investment from

speculation.

Thc gRba nanca crss RI 2008-09 has brRughl

about a striking change in the attitude of

investors. This change towards expectation on

investment returns, growth and risk does not

single out any one asset class but applies to most

of the assets whether it is equity, debt,

commodity or real estate. Amidst this changed

scenario it is evident that an advice on

investment in any asset class cannot be generic.

Real estate as an asset class is the foremost

example that will witness the challenge thrown by

this tenet particularly in this tough economic

scenario. Even within real estate as an asset

class, the judgment on investment outlook on

commercial real estate and residential real estate

cannRl bc a uncd Rnc. Thc dRmnanl IaclRrs

that drive investment returns for both these are

diverse to a great extent. Hence, the investment

opinion should take into account each of these

factors.

INVESTMENT

advisory REPORT

lnda's kcsdcnla 0cslnalRns

Although the prominence of real estate as an

asset class is increasing, the investment research

in the subject lags much behind in comparison to

other asset classes. With this report, we will make

an incipient foray into the subject by identifying

the top residential destinations in the country

IrRm lhc nvcslmcnl pRnl RI vcw IRr lhc ncxl vc

ycars (2013-2017). Thc dcslnalRns arc

residential markets that we expect will

outperform in terms of the investor returns on

account of the appreciation in property prices. We

havc dcvcRpcd a IramcwRrN bul Rn 'lRp-dRwn

apprRach' n lhc sccclRn RI lhc vc mRsl

promising cities and zones within them and

'bRllRm-up apprRach' n lhc sccclRn RI lRp

investment destinations. Since real estate

activities are not restricted to city limits, we have

considered the entire metropolitan region in our

analysis. Our understanding of the local property

market and experience in dealing with

paramclcrs lhal dclcrmnc an urban ccnlrc's

growth equips us to develop the framework for

this pioneering report.

While selection of the top residential investment

destinations remains the core of this report, we

asR prcscnl vc RcalRns, whcrc wc cxpccl lhc

real estate drivers to gather momentum albeit

durng lhc cRngalcd lmc hRrzRn bcyRnd 2017.

Thcsc RcalRns havc bccn dcnlcd as 'hddcn

gcms' n lhc rcpRrl.

In most cases, investment

in real estate is fraught

with decisions based on

gut feeling and tips which

result in pOor

investments. Hence, an

investor has to clearly

delineate a real estate

investment from

speculation

l^VI'1^I^1

IVl'LKYKIILK1

lndaskcsdcnlaDcslnalcns

KILlL^ILKL\1I\l1Il^

Ll1Yl'^Y1Il^LBI1IVI^

^I1IIIlKIL1lL^LI'ILI

LKL\1Il'LKl1lLI

IL1LKl^II1IK^l^l^L1II

I1ILIIK1lLIIK

KI'lII^1lIIKLIIK1Y

APPROACH FOR IDENTIFICATION OF THE TOP RESIDENTIAL

INVESTMENT DESTINATIONS

India

Urbanccnlrcs

Top 100 cities

Business activity:

ankngpcnclralcn,hclcrccmdcmand,arpasscngcrlraffc

Infrastructure development:

Currcnlandprcpcscdnfraslruclurccxpcndlurc

Tcp100clcsbascdcnpcpualcn

Employment:

Occupcdcffccspacc,nduslraaclvly

Social & physical infrastructure:

Anaysscfdcvccpmcnlpancfrcspcclvc

aulhcrlcsandcxlcnsvcfcdsurvcy

Connectivity with

important locations

Access to social

infrastructure

Special factors:

Prcxmlylc

prcmumcffcc

spacc,and

avaably,

fcslycshfl,

panncd

dcvccpmcnl

Top 5 cities

Zone

Destination

The top residential destinations have been picked

from the universe of all urban centres in the

country. In this multi stage selection, each

parameter was chosen in a manner that captures

lhc causc and cccl rcalRnshp RI such

parameters with the growth of residential

development in the city.

The population base of a city is a crucial indicator

RI lhc pRlcnla RI ls hRusng marNcl. ln lhc rsl

slagc RI sccclRn, lRp 100 clcs wcrc dcnlcd

based on their population. The extent of business

activity and thrust on infrastructure development

arc crlca IaclRrs acclng lhc hRusng marNcl

and accordingly these selected 100 cities were

studied. Banking penetration, hotel room

dcmand and ar passcngcr lrac wcrc

considered as surrogates for business activities

and current and proposed infrastructure

INVESTMENT

advisory REPORT

Indias Residential Destinations

From the growth and

investment perspective,

zones that have high

concentration of business

activity at present and

projections of meaningful

increment in future will

have a comparative

advantage over others

that have saturated on

this

METHODOLOGY &

APPROACH

Selection of top cities in the country

expenditures were taken as proxies for

infrastructure development. The cities were

ranked on these individual parameters and based

on the average ranking Mumbai, Delhi,

Bengaluru, Chennai and Pune emerged as the top

vc clcs.

With the fundamental prerequisite already in

pacc, lhcsc vc clcs arc wc prcparcd lR

participate in the growth trajectory for the

foreseeable future. While a framework was

prcparcd and lRp clcs wcrc dcnlcd, Rur

cndcavRur was cvcn mRrc spccc. wc havc

striven to provide a crystal clear view on

investment destinations for a typical investor in a

residential property. This objective meant

dcnlcalRn RI rcsdcnla dcslnalRns lhal

would outperform others on the investment return

scale.

Selection of zone within a city

Regional growth within a city is anything but even

and the direction of such growth is a critical

factor in determining the fate of a particular

residential property. We therefore, split each city

into 4-5 zones to capture the quantum and

drcclRn RI such grRwlh. Ths spl nlR dcrcnl

zones is based on the homogeneity of

characteristics with respect to access to

employment centres, social and physical

infrastructure and demography.

The selection of a preferred zone depends on the

pcrspcclvc RI such sccclRn, whch dcrs

depending on the purpose of purchasing property

which is either end-use or investment. From the

growth and investment perspective, zones that

have high concentration of business activity at

present and projections of meaningful increment

in future will have a comparative advantage over

others that have saturated on this. Growth of

business activity will create abundant

employment opportunities which in turn will lead

to a rise in inward migration and high demand for

residential property in these zones. Hence, we

dcnlcd lhc drvcr nduslrcs n cach zRnc and

assessed the impact of their business activity on

the kind of employment generated by such

industry. We have captured the extent of

employment generation by measuring the

quanlum RI Rccupcd Rcc spacc al prcscnl and

IRr lhc ncxl vc ycars.

A regression model capturing the impact of

change in revenue of driver industry on change in

Rccupcd Rcc spacc was dcvcRpcd. kcvcnuc

prRjcclRns IRr rsl lwR ycars wcrc bascd Rn lhc

revenue guidance by the respective industry

associations. Projections for the remaining three

years were based on the moving average trend of

lhc prcccdng vc ycars. AsR, lhc upcRmng

suppy RI Rcc spacc n ncxl vc ycars n a lhc

zones was analysed to understand the balance

between the incremental employment and

upcRmng Rcc spacc. Thus a crysla ccar vcw

on employment potential in a particular zone has

been provided. The service sector has emerged as

a driving force in most of the cases with the

Information Technology and Information

Technology enabled Services (IT/ITeS) industry

emerging as a dominant employment driver.

Besides the quantum of employment generation

in the driver industry, the nature of jobs in

INVESTMENT

advisory REPORT

Indias Residential Destinations

accordance with its position in the value chain in

lhc nduslry was laNcn as a dcrcnlalng

element. For instance, employment in software

development within the IT/ITeS industry has a

dcrcnl mpacl Rn lhc ncRmc prRc RI

employees in comparison to that in the Business

PrRccss 2ulsRurcng (P2) rRc. Ths dcrcncc n

ncRmc prRc w mpacl aRrdably n a

diverse manner.

Besides employment, the other important factor

IrRm lhc grRwlh and nvcslmcnl pcrspcclvc s

nIraslruclurc dcvcRpmcnl. kcgRna

dcvcRpmcnl pans and cd vsls lR lhc zRncs

equipped us to assess the scope of infrastructure

development that will have an impact on

rcsdcnla marNcls wlhn a zRnc. wc asscsscd

lhc mpacl RI cxslng and upcRmng physca

infrastructure like road, rail and airport projects

Rn lhc rcsdcnla marNcls RI cach zRnc. Prcscncc

RI sRca nIraslruclurc cRmprsng cducalRn,

healthcare and recreation was also reviewed.

wc sccclcd 1-2 zRncs havng lhc mRsl prRmsng

Iulurc Rn accRunl RI lhc grRwlh n lhc quanlum RI

Rccupcd Rcc spacc and ncrcmcnla

nIraslruclurc dcvcRpmcnl. 2vcr lhc IRrcsccabc

Iulurc, lhcsc prcIcrrcd zRncs w bc lhc bggcsl

bcnccarcs bccausc lhcy Ia n lhc drcclRn RI

movement of employment and infrastructure.

&RPPHUFLDO2FH6SDFH

IT Sector

Industrial Physical

Connectivity

asc ullcs: walcr 8 PRwcr

LducalRn 8 hcalhcarc

Entertainment

6RFLDO

The service sector has

emerged as a driving force

in most of the cases with

the Information

Technology and

Information Technology

enabled Services (IT/ITeS)

industry emerging as a

dominant employment

driver

Non IT Sector

Selection of Destination

wlhn zRnc

All the residential markets within the preferred

zRnc w bcncl Rn accRunl RI lhc grRwlh n

employment opportunities and infrastructure

dcvcRpmcnl. hRwcvcr, a Icw RI lhcsc w havc a

cRmparalvc advanlagc Rvcr Rlhcrs. A bRllRm-up

apprRach was adRplcd lR anaysc lhc cxslng

and proposed connectivity and social and

physical infrastructure facilities. The approach

was mRdccd bascd Rn Rur cd vsls lR cach RI

lhc rcsdcnla marNcls n lhc prcIcrrcd zRnc and

discussions with various stakeholders. This

primary survey coupled with our real estate

cxpcrlsc hcpcd us lR arrvc al lhc bcsl

destinations from the perspective of investment.

Thc dcslnalRns havc bccn anayscd vs--vs a

bcnchmarN RcalRn whch s an cslabshcd

residential locality that has attained a relatively

hghcr saluralRn cvc n lcrms RI rca cslalc

grRwlh and nIraslruclurc dcvcRpmcnl and s

cRnsdcrcd lR bc Rnc RI lhc mRsl sRughl aIlcr

rcsdcnla marNcls wlhn lhc zRnc. Thc

bcnchmarN RcalRn IRr cach dcslnalRn has

bccn dcnlcd bascd Rn lhc ncarcsl prcc

cRnlRur. wlh rcspccl lR prcc IRrccaslng IRr a

dcslnalRn, a bcnchmarN RcalRn, prcIcraby n

lhc samc zRnc, bccRmcs lhc rcIcrcncc pRnl.

As mentioned earlier, our analytical focus was

prmary lR undcrsland lhc slalc RI lhc subjccl

markets connectivity with important locations

and social and physical infrastructure facilities

avaabc currcnly and asR n lhc IRrcsccabc

Iulurc. hRwcvcr, n ccrlan dcslnalRns lhcrc

wcrc varalRns wlh rcspccl lR IaclRrs mpaclng

future price movements like:

. 3UR[LPLW\WRSUHPLXPRFHPDUNHWV wadaa,

Rnc RI lhc sccclcd dcslnalRns n 0umba,

w bcncl duc lR ls cRnncclvly wlh lhc

prcmum busncss dslrcl RI lhc andra Kura

CRmpcx (KC).

. /LPLWHGODQGDYDLODELOLW\ Limited land

avaably w ml lhc scRpc RI ncw

Besides the quantum of

employment generation in

the driver industry, the

nature of jobs in

accordance with its

position in the value chain

in the industry was taken

as a ILIKI^1LDting

element

5($/(67$7('5,9(56

Business activity Infrastructure

0anuIaclurng

INVESTMENT

advisory REPORT

Indias Residential Destinations

construction and put an upward pressure on

property prices in destinations like Chembur

in Mumbai.

. Lifestyle shift: Destinations like KR Puram in

Bengaluru possess the potential to provide a

lifestyle shift, which is possible generally in

projects developed on large land parcels that

facilitate high rise premium developments

with plush amenities.

. Planned development: Lack of social

infrastructure remains a concern in some

destinations as of now. However, on account

of being in the planned development region,

education, healthcare and recreation facilities

will eventually come up in destinations like

Ulwe in Mumbai.

While dynamics of a residential market with

respect to the demand-supply scenario were

considered to understand its depth, the impact of

factors like quality of projects, premium or

aRrdabc calcgRry, Rn prRpcrly prcc was asR

assessed. It is of paramount importance to

assess all these factors in comparison to the

benchmark locality and also other localities

within the zone. Further, these factors have to be

viewed in the context of the prevailing property

prcc. 0cslnalRns chRscn arc dcnlcy lhc Rncs

that would outperform other locations on the

investment return scale. However, continuing

with our intention of undertaking a thread bare

analysis and providing an unequivocal

nvcslmcnl vcw, wc havc quanlcd lhc capla

appreciation and the resultant investor returns for

investment in these destinations.

As mentioned earlier, to forecast the price

movement of a destination, we have considered

the price of a benchmark location as the

reference point. The assumption is that the

destination price will grow at a faster pace (as

compared to the benchmark location price)

because of its relatively higher level of increasing

developmental activities. As a result of this, the

current price discount of the destination will

reduce, making price convergence imminent in

the future.

ln lhc rsl slagc, wc havc IRrccaslcd lhc prcc RI

a benchmark location. Empirical evidence

indicates that price variation of established

rcsdcnla marNcls s sgncanly cxpancd by

the changes in economic activities. In line with

this, we have conducted iterations to identify the

cxpanalRry varabcs lhal slrRngy nucnccd

property price movement in the benchmark

locations. Indias economic growth has been

dcnlcd as lhc mRsl sgncanl IaclRr

explaining the price movements. Regression

equations have been estimated for each of the

dcnlcd bcnchmarN RcalRns and prcc has

been forecasted till 2017.

In the second stage, the price discount of a

dcslnalRn has bccn IRrccaslcd IRr lhc ncxl vc

years. In order to achieve this, we studied the

mpacl RI dcrcnl IaclRrs Rn prccs RI lhc

benchmark location over the last decade. These

factors include:

. Incremental employment generation in the

zone.

. New infrastructure projects.

. Reduction in time to commute between the

benchmark location and important places in

the zone.

Our analysis shows that the occurrence of one of

the above mentioned factors or a combination of

them accelerated the growth of residential

property prices in a benchmark location before it

stabilized and emerged as a relatively developed

market. Assuming that the destination will have a

Over the foreseeable

future, the preferred

zones will be the biggest

EI^ILLDKLIV EILDIVI they

fall in the direL1LR^ of

movement of employment

and infrastrIL1IKI

Lontinuing with our

intention of undertaking a

thread bare analysis and

providing an unequivRLDO

investment view, we have

quD^1LII the LDSL1al

appreLLDtion and the

resultant investor

returns for investment in

these destinations

TOP INVESTMENT

DESTINATIONS RANKED IN

ORDER OF INVESTOR RETURN

DURING THE NEXT 5 YEARS

#1 Ulwe

29.0%

#2 Wadala

#3 Chembur

#4 Noida

Extension

27.0% 25.5% 22.9%

#8 Ravet

#7 Hinjewadi

#6Medavakkam

#5 Dwarka

Expressway

22.3%

21.2% 20.6% 20.1%

20.0%

#9 Tathawade

#10 Hebbal

#11 Pallikarnai

19.3% 19.1% 18.7%

#12 Wakad

18.6%

#13 KR Puram

Investor returns per annum

INVESTMENT

advisory REPORT

Indias Residential Destinations

Empirical evidence

indicates that price

variation of established

residential markets is

VLL^LLD^1Oy explained by

the changes in economic

activities

similar impact of incremental employment

generation and new infrastructure projects, the

property price in the destination has been

forecasted by applying an estimated discount

factor on the future price movements of the

benchmark location.

2ur rcscarch ndcalcs lhal aRrdably w Nccp

a resistance on price movement in many

destinations. Hence, we have created an income

pyramid of the employees in the driver industry.

This pyramid is a distribution of all the employees

according to their income. Thus, a ceiling was

applied to our destination price forecast as per

the change in this pyramid for the forecast

horizon.

REGION-WISE TOP INVESTMENT DESTINATIONS FOR NEXT 5 YEARS

Forecasted Price Appreciation in Percentage

Additionally, in cases where land availability is

not a concern, price growth will not breach the

aRrdably lhrcshRd RI lhc largcl cRnsumcr

group. As a result of this factor some destinations

did not qualify for the projected price growth and

were dropped from the top destinations list.

For a typical investor in residential property what

mallcrs s lhc ccclvc rclurn rcsulng IrRm lhc

leverage provided through the housing loan. The

same has been calculated and labelled as

Investor Return arising out of investment in

under construction residential property, in these

lRp dcslnalRns Rvcr a pcrRd RI lhc ncxl vc

ycars. PrRpcrly spcccalRn and nvcslmcnl szc

available at a destination along with select

residential projects have also been provided in

the report.

NORTH

Mumbai Pune

N

C

R

C

h

e

n

n

a

i

B

a

n

g

a

l

o

r

e

SOUTH

W

E

S

T

#1 Noida Extension

#2 Dwarka Expressway

111%

108%

#2Hebbal

#1 Medavakkam

#3 Pallikarnai

#4 KR Puram

94%

103%

93%

91%

#

4

H

i

n

j

e

w

a

d

i

#

5

T

a

t

h

a

w

a

d

e

#

6

R

a

v

e

t

#

7

W

a

k

a

d

1

0

0

%

9

8

%

9

7

%

9

1

%

#

1

U

l

w

e

#

3

C

h

e

m

b

u

r

#

2

W

a

d

a

l

a

1

4

5

%

1

3

3

%

1

2

5

%

E

A

S

T

INVESTMENT

advisory REPORT

Indias Residential Destinations

in cases where land

availability is not a

concern, price growth

will not breach the

Dordability threshold

of the target consumer

group

. With property options ranging from

`3,200/sq.ft. to `15,000/sq.ft. and investor

returns in the range of 18.6% - 29% pa

residential real estate will emerge as a

prRmsng asscl cass IRr lhc ncxl vc ycars.

. With seven destinations, the western region

has the highest number of promising

residential investment options.

. The top three investment destinations, with

investor returns in excess of 25% pa, are from

Mumbai.

. Only Mumbai ranks ahead of the top

investment destinations of the NCR, the

biggest residential market in the country.

. Enhanced connectivity and the proposition of

lhc dpRmalc cncavc w sgncanly bcncl

the Dwarka Expressway, placing it in high

KEY takeaways

Risk factors for our outlook

2ur IRrccasl IRr Rccupcd Rcc spacc rccs

largely on the service sector led by the IT/ITeS

industry. The sectors revenue growth during the

ncxl vc ycars w havc an mpacl Rn lhc

employment, which is one of the biggest drivers

of real estate. For the IT/ITeS industry, the

revenue growth estimates for the initial two years

have been taken from the industry association

and for the remaining three years they have been

laNcn as lhc prcccdng vc ycar mRvng avcragc

growth rate between 10-12%.

While the Indian IT/ITeS industry is

interconnected with the global economy, reputed

research studies have highlighted the

interlinkage between the domestic manufacturing

sector and this industry. As a result, the weak

global economy and a slowdown in the domestic

manufacturing sector will have a direct impact on

this industry. Our analysis puts a great emphasis

on the fate of the IT/ITeS industry because of its

cmcrgcncc as a sgncanl cmpRymcnl prRvdcr

n lhrcc RI lhc lRp vc clcs.

The BFSI industry has a meaningful role in the

employment trend in cities like Mumbai and

Delhi. We have considered a revenue growth rate

RI 17-21% bascd Rn lhc prcccdng vc ycar

moving average growth rate for this industry.

The employment generated by these industries

has a sgncanl mpacl Rn Rur IRrccasl IRr

Rccupcd Rcc spacc. hcncc, any majRr

deviation in their revenue growth will have an

advcrsc mpacl Rn Rur IRrccasl IRr Rccupcd Rcc

space and therefore the fate of the respective

destination.

Additionally, in several cases, the fate of the

destinations is linked to the delivery of

nIraslruclurc prRjccls, whch maNcs Rur anayss

vuncrabc lR any sgncanl dcvalRn IrRm lhc

prRgrcss lmcnc RI such prRjccls.

ranks on the investment return scale.

. The IT/ITeS industry is the driving force behind

the growth in most of the destinations.

. With four investment destinations, Pune has

the maximum number of promising residential

property options.

. IT/ITeS, Automobile and Engineering sectors

are the primary employment drivers in Pune

. The destinations in Chennai will immensely

bcncl IrRm lhc grRwlh RI lhc lT]lTcS and

Automobile industries in Tamil Nadu during the

ncxl vc ycars.

. IT/ITeS and Bio-technology sectors will be the

driving forces behind the growth of

destinations in Bengaluru.

INVESTMENT

advisory REPORT

Indias Residential Destinations

BENGALURU METROPOLITAN

REGION POPULATION

Population in Millions

Source: Census 2011, Knight Frank Research

Population Average Annual Growth

1991 2001 2011

Bengaluru (also known as Bangalore), the capital of Karnataka is located

in the south-eastern part of the state. The city is located at an

altitude of 950m. above the sea level, thereby making its climate very

serene. Bengaluru is the third most populous city of India with a very diverse

demography. It is also known as the Garden City of India. It houses the

largest number of Information Technology (IT) and Information Technology

Enabled Services (ITeS) companies in India for which it earned the

sobriquet of the Silicon Valley. It also houses numerous public sector

companies including defence, aerospace and bio-technology.

Bengaluru urban agglomeration is known as Bengaluru Metropolitan

Region (BMR) comprising Bengaluru urban district, Bengaluru rural district

and Ramanagara district. The Bruhat Bengaluru Mahanagara Palike

(BBMP) is in charge of the civic administration of the city. The corporation

is spread over an area of 741 sq. km. Bangalore Metropolitan Region

Development Authority (BMRDA), an autonomous body created by the

Government of Karnataka is the nodal agency looking after the overall

development of the BMR. During the last two decades the population

growth was phenomenal in the BMR. It rose at an annual rate of 3.9%

durng 2001-2011, prmary duc lR a hugc nux RI lT]lTcS cmpoyees.

BENGALURU

4.84 6.54 9.59 5.2% 3.1% 3.9%

CHIKKA

BOMMASANDRA

VARTUR VARTUR

CHIKKA

MMASANDRA NDRAA BOM A BOM AA

15000

6000

3500

Major Roads

Railway Line

Existing Metro

Under Construction

South Zone

West Zone

Central Zone

East Zone

North Zone

Price Contours (`/ sq.ft)

Proposed Metro

Nagawara

:KLWHHOG

%+DOOL7HUPLQDO

0*5RDG

Gottigere

%RRPDVDQGUD

$QMDQDSXUD1,&(-XQFWLRQ

1DJDVDQGUD

%DQJDORUH,QWHUQDWLRQDO

([KLELWLRQ&HQWUH

3XWWHQDKDOOL

0\VRUH

5RDG

.HQJUL

BENGALURU MAP

INVESTMENT

advisory REPORT

Indias Residential Destinations

Bengaluru Metropolitan

Region (BMR) is spread over

741 sq. km.

Market Overview

ZONE MAJOR RESIDENTIAL

DESTINATIONS

Central MG Road, Vitthal Mallya Road,

Frazer Town, Lavelle Road,

Richmond Road, Langford Town

West Malleswaram, Rajajinagar, Tumkur

Road, Vijayanagar, Yeshwanthpur

North Banaswadi, Hebbal, Bellary Road,

Hennur, Yelahanka, Jakkur, HBR

Layout

East whlccd, 2d ArpRrl kRad, 2d

Madras Road, KR Puram

South Koramangala, Sarjapur Road, HSR

layout, Jayanagar, JP Nagar,

Bannerghatta Road, Kanakapura

Road

Thc 0k marNcl can bc dvdcd nlR vc brRad

zones: Central, West, North, East and South.

South Bengaluru, a locale which until the mid-

1990s housed a strong Kannada (native language of

Karnataka) speaking population now boasts of

being a cosmopolitan region. This was mainly on

accRunl RI a hugc nux RI pRpualRn IrRm a Rvcr

India. Electronic City located on Hosur Road in the

sRulh cmcrgcd as lhc rsl lT hub RI cngauru n

1990. Many IT giants like Infosys, HCL

Technologies, HP, Wipro, Genpact and Siemens

have setup their campuses in this region. With the

setting up of these companies, the South

Bengaluru region became a preferred commercial

as well as residential destination. The availability of

land, strong infrastructure and presence of the

middle-income segment have contributed to the

development of this zone. The residential clusters

n prRxmly lR lhc LcclrRnc Cly Nc Sarjapur,

Koramangala, Jayanagar, BTM Layout,

Bannerghatta Road and Hosur Road have attracted

a large number of immigrants especially the IT

employees. Social infrastructure like the availability

of quality hospitals, prestigious educational

institutions and retail malls are some of the major

reasons behind residential demand in this part of

Bengaluru.

This region started losing its charm since 1998

when the Government of Karnataka announced the

new international airport at Devanahalli - a town

located in the north of Bengaluru. Major IT/ITeS

companies started acquiring land closer to the

arpRrl n lhc nRrlh IRr lhcr cxpansRn. Thcy

refrained from buying any new land in this region,

hampering the overall growth of the South

Bengaluru region. In this bargain North Bengaluru

emerged a better investment destination compared

to the south.

The new international airport at Devanahalli

commenced in 2008. By virtue of this, North

Bengaluru became one of the most sought after

destinations of Bengaluru. Numerous real estate

and infrastructure projects were announced to

enhance the connectivity between Bengaluru city

centre and the airport; this included High Speed

Rail Link (HSRL), monorail and Metro rail. Moreover,

to generate employment in this region, the

government in association with private companies

carmarNcd argc nvcslmcnls, such as KlA0 ParN,

ArpRrl TRwnshp - AcrRlrRpRs, lnIRrmalRn

Technology Investment Region (ITIR), Devanahalli

Business Park (DBP) and Global Finance District

(GFD). These also attracted a lot of institutional

buyers like real estate developers and

hoteliers.This region is on the cusp of becoming the

new commercial business district (CBD) of

cngauru. hcncc l s wRrlhwhc lR cxpRrc lhs

region with respect to the real estate investment.

Major micro-markets covered under this zone are

Hebbal, Devanahalli, Yelahanka and Hennur.

Before 1990, the eastern zone was home only to

some of the reputed heavy manufacturing

nduslrcs Nc hnduslan AcrRnaulcs Lmlcd

(hAL), L0L and lTl lhal wcrc nslrumcnla n lhc

growth of this region. With the dawn of the IT sector

some of these industries have gradually turned into

lcch-parNs. PrRxmly lR lhc 2ulcr kng kRad (2kk)

cRupcd wlh lhc avaably RI gradcd Rcc spacc

attracted major IT/ITeS companies in the eastern

zRnc. Ths Iuccd lhc cxpansRn RI cRmmcrca and

residential development in this region.

CRnscqucnly, whlccd, Cv kaman 1agar, rRRNc

Fcd, 2d 0adras kRad, lndranagar, Kk Puram, 2d

ArpRrl kRad, 0ahadcvapura, hRRd Crcc and Sa

aba Ashram cmcrgcd as lhc prcIcrrcd rcsdcnla

destinations among the IT employees. Moreover,

INVESTMENT

advisory REPORT

Indias Residential Destinations

2007 2008 2012* 2009 2010 2011

* Till September 2012

RESIDENTIAL PROJECT LAUNCH

TREND IN BENGALURU

Launches Source: Knight Frank Research

31,236

20,608

14,439

31,733

54,075

24,741

9.59 mn.

population in the BMR, an

increase of 98% in the

last two decades

* Till September 2012

2007 2008 2009 2010

5%

180,000

160,000

140,000

120,000

100,000

80,000

60,000

40,000

20,000

N

o

.

o

f

U

n

i

t

s

Stock Cumulative Absorption % of Unsold Units

RESIDENTIAL DEMAND-SUPPLY ANALYSIS OF BENGALURU

2011

Source: Knight Frank Research

2012*

2d 0adras kRad, whlccd kRad, lTPL and varlhur

Road emerged as a business district having many

tech-parks, SEZs, captive campuses and business

centres.

Central Bengaluru is the commercial and retail

hcarl RI lhc cly wlh varRus cRrpRralc Rccs

Rcalcd n mcrR-marNcls Nc lhc 06 kRad, vllha

Mallya Road, Commissariat Street, Ulsoor and

Lavcc kRad. Lxcccnl cRnncclvly wlh varRus

parts of the city, good physical and social

infrastructure along with the presence of organized

retail has ensured the highest property prices in

lhs parl RI lhc cly. Thc prRmncnl rcsdcnla

micro-markets of this region include MG Road,

LangIRrd kRad, kchmRnd TRwn, Labagh kRad,

vllha 0aya kRad, kcsdcncy kRad and Frascr

TRwn. 0ajRrly RI lhc rcsdcnla dcvcRpmcnls n

the central locations are bungalows and

independent residential units, however some

pRcNcls Nc kchmRnd TRwn, kchmRnd kRad,

0acshwaram Ppcnc kRad and 06 kRad arc

witnessing growth in multi-storey high-rise

constructions as well.

Prmary an nduslra hub, wcsl cngauru hRuscs

Rnc RI lhc argcsl nduslra arcas RI Asa - 'Pccnya

lnduslra Arca'. Thcrc arc hugc sclups RI scvcra

renowned engineering, transformers, motors and

generator companies here. Being an industrial hub,

lhs rcgRn was nRl caughl n lhc lT]lTcS wavc RI

the mid-1990s, that transformed South and East

Bengaluru as one of the most sought after

residential markets. However, this region gained a

lot of traction with the announcement of the

upcRmng nIraslruclurc prRjccls vz. ccvalcd

cxprcssway, mclrR and lhc rRad cRnncclvly aRng

lhc TumNur kRad. 0crR-marNcls such as

0acswaram, cshwanlpur, kajajnagar, L0L

layout, Mysore Road, Nagarbhavi,

asavcshwarnagar, TumNur kRad and }aha wcsl

received the necessary impetus for growth.

6rRwlh RI lhc lT]lTcS scclRr aRng wlh lhc scllng

up of bio-technology units and other large national

and multinational manufacturing units have

Source: Knight Frank Research

East North South

ZONE-WISE SPLIT OF UNDER

CONSTRUCTION UNITS

42%

27%

30%

176,832 residential

units launched since 2007

in the BMR

INVESTMENT

advisory REPORT

lnda's kcsdcnla 0cslnalRns

changed the dynamics of Bengaluru real estate

market. Apart from generating thousands of new

jRbs IRr lhc Rca rcsdcnls, cngauru has bccn

able to attract a large pool of migrants into these

scclRrs IrRm acrRss lhc cRunlry. Ths has cnabcd

the real estate market to grow at a tremendous rate

n lhc asl vc ycars cspccay lhc rcsdcnla

segment that witnessed the launch of over 176,832

units since 2007.

Bengaluru residential market witnessed the launch

of 85,808 units in the last two years (i.e. 2010 and

2011) accounting for almost 49% of the total units

aunchcd sncc 2007. 0urng lhc samc pcrRd

54,687 units were absorbed in the Bengaluru

residential market. South and East Bengaluru

wlncsscd a majRr chunN RI aunchcs and

absorption during this period mainly on account of

lhcr prRxmly lR lhc lT hub RI LcclrRnc Cly and

whlccd kRad. 2vcr lhc pcrRd lhs rcgRn has

emerged as a self-sustaining micro-market

allraclng many lT cmpRyccs.

9%

11%

14%

25%

32%

Pennya industrial estate

spread over 266acres -

one of the largest

industrial areas in Asia

85,808 units

launched and 54,687 units

absorbed during 2010 and

2011 in BMR

57%of under-

construction units are in

North and East Bengaluru

Real Estate Drivers

Infrastructure Development

Employment Indicators

Service Sector

IT Sector

Manufacturing Sector

Biotech Sector

Rail Network

Bangalore Metro Corridor I & II

Monorail Corridor

Infrastructure Development

Pheripheral Ring Road

Elevated Road / Expressway

Road Network

62 km. Outer Ring Road

connects all the major IT

hubs from North to South

EXISTING ARTERIAL ROAD NETWORK

DISTANCE OBSERVATIONS

Outer Ring Road (ORR) 62 km. ORR provides connectivity with all the major highways around the

city. Passing across the major suburbs viz. Hebbal - KR Puram -

Marathahalli - Sarjapur Rd. - Silk Board Junction

Nandi Infrastructure Corridor 42 km. Long peripheral road, connecting Jalahalli in the north with the

Enterprises (NICE) Electronic City on Hosur Road in the South. The corridor connects

Ring Road Mumbai and Chennai through NH-4 in the western region and NH-

7 in the southern region respectively. Initially a four-lane structure

with provision for expansion upto six-lane. NICE Ring Road has

cnabcd lrac IrRm 0umba lR mRvc drccly lR Chcnna wlhRul

crossing downtown Bengaluru

Hosur Road (NH7) 40 km. A four to eight-lane national highway (Part of NH7) connecting

Bengaluru city with Hosur, a town in Tamil Nadu. The Hosur Road

passes via the Electronic City one of the largest IT industrial parks

of Bengaluru

Bengaluru Elevated Toll-way 10 km. A 10 km. long elevated and tolled expressway connecting

Bomanahalli to Electronic City

INVESTMENT

advisory REPORT

Indias Residential Destinations

High Speed Rail Link

EXISTING SUBURBAN RAIL NETWORK

DISTANCE OBSERVATIONS

Metro Train Network 6.7 km. Reach I, a 6.7 km. part of the East-West corridor, connecting

Phase I, Reach I Byappanahalli with MG Road is operational since October 2011

Metro rail operational

between Byappanahalli

and MG Road since Oct 2011

ROAD NETWORK

METRO TRAIN NETWORK

A 33 km. High Speed Rail

Link proposed - will

operate between Cubbon

Road and Bengaluru

International Airport

UPCOMING ARTERIAL ROAD NETWORK

CONNECTIVITY & LENGTH OBSERVATIONS CURRENT EXPECTED

STATUS COMPLETION

Road widening from Hebbal A six-lane elevated road over the Under 2013-14

to Bengaluru International Airport existing road connecting with the Construction

20 km. international airport is under

construction. The elevated stretch that

starts from Kodigehalli gate will be a

six-lane highway extending over 4 km.

The project will have a series of seven

yRvcrs IrRm hcbba lR lhc Trumpcl

Junction near the airport

High Speed Rail Link (HSRL) A 33 Nm. hSkL has bccn prRpRscd, Five Post 2016

33 km. that will connect the city centre with consortiums

lhc arpRrl. Thc hSkL w Rpcralc shortlisted

bclwccn CubbRn kRad and cngauru

International Airport with two halts in

bclwccn, Rnc al hcbba and anRlhcr

at Yelahanka.

Monorail Project cngauru Ar ka LnN Lld. (AkL) has Proposed Post 2015

41 km. proposed 31 km. monorail from JP

1agar (sRulh) lR hcbba (nRrlh) and

10 Nm. bclwccn Pcrphcra kng kRad

(Pkk) and 0agad kRad. Ths prRjccl

will function as a feeder service to metro

rail as well as the international airport

Peripheral Ring Road (PRR) A 116 Nm. Pkk has bccn prRpRscd, l Pre-feasibility Post 2016

116 km. will connect the entire peripheral stage

arterial road linking all the major

hghways and lhc dslrcl rRads. 0ajRr

cRnncclng arca wRud bc hRsur kRad

lR TumNur kRad va Kk Puram, cary

kRad, 2d 0adras kRad and Sarjapur

kRad. Thc Pkk s cxpcclcd lR casc lhc

cRngcslRn Rn lhc 2kk

Bengaluru Metro Rail Phase I a) A 2/ Nm. 1Rrlh-SRulh (1S) mclrR Under 2014-15

42 km. cRrrdRr has bccn prRpRscd, l w construction

cRnnccl hcsaraghalla crcc (n nRrlh)

wlh Pullcnaha (n sRulh)

b) An 18 Nm. Lasl-wcsl (Lw) mclrR

cRrrdRr has bccn prRpRscd, l w

cRnnccl yappanaha wlh 0ysRrc

kRad (kcach l, a 6.7 Nm. parl RI lhc Lw

cRrrdRr, cRnncclng yappanaha

wlh 06 kRad s RpcralRna sncc

2clRbcr 2011.)

Bengaluru Metro Rail Phase 2 a) Phasc ll cnvsagcs cxlcnsRn RI lhc In-principle cyRnd 2016

72 Nm. 0clrR Phasc l, Rn lhc 1S cRrrdRr. TR approval

the north it will be extended upto received from

cngauru lnlcrnalRna LxhblRn lhc 6Rvl. RI

Ccnlrc (lLC) and lR lhc sRulh l w bc Karnataka.

cxlcndcd uplR 1lCL }unclRn Awaiting

approval from

b) Lw cRrrdRr s panncd lR bc the Urban

cxlcndcd uplR whlccd lR lhc casl Development

and Kengeri to the west. Department

0nslry

c) Furlhcr, lwR ncw ncs havc bccn

panncd n Phasc ll, Rnc cRnncclng

INVESTMENT

advisory REPORT

lnda's kcsdcnla 0cslnalRns

A 116 km. Peripheral Ring

Road proposed -

connecting Hosur Road to

Tumkur Road via KR Puram,

Bellary Road, Old Madras

Road and Sarjapur Road

Over 2,000 IT & ITeS

companies present in

Bengaluru including more

than 100 Fortune-500

companies

UPCOMING ARTERIAL ROAD NETWORK

CONNECTIVITY & LENGTH OBSERVATIONS CURRENT EXPECTED

STATUS COMPLETION

Rashtreeya Vidyalaya (RV) Road with

Bommasandra in the South,

Electronics City on the Hosur road with

the city centre

d) Another line will be parallel to the

NS Corridor of Phase I, running

between Nagawara in the north and

Gottigere in the South. It will have two

interchange stations, one at MG Road

and another at Jayadeva hospital

Elevated corridor from Central Silk A 15 km. elevated corridor connecting Pre-Feasibility Beyond 2015

Board Junction to Jayamahal Road Central Silk Board Junction to stage

15 km. Jayamahal Road is envisaged to ease

lhc lrac Rw bclwccn 1Rrlh and

South Bengaluru. This will also

facilitate in reaching the new

international airport in the North.

Construction of elevated corridor A 28 km. West-East elevated corridor Pre-Feasibility Beyond 2014

between Jnanabharathi and along the Ring Road connecting stage

Old Airport Road Tumkur (Jnanabharathi) with Old

28 km. Airport Road. The corridor will pass

through Sirsi Circle, Town Hall, Hudson

Circle, Vellara junction and Old Airport

Road. The proposed corridor is

expected to ease the East-West city

lrac Rw

Bengaluru - Mysore Expressway A six-lane expressway connecting Land Beyond 2017

140 km. Bengaluru with Mysore is under acquisitions

construction. Only peripheral part of

56 km. has been completed till date.

INVESTMENT

advisory REPORT

Indias Residential Destinations

Bengaluru is the IT and Bio-technology capital of

India. It also houses numerous Government

promoted heavy industries including defence

RrganzalRns, sccnlc cslabshmcnls,

aerospace and telecommunication companies. It

also has renowned Indian educational institutions

Rcrng a pclhRra RI jRb RppRrlunlcs.

However, Bengalurus economy is primarily

driven by the IT/ITeS sector and bio-technology

sector.

IT/ITeS SECTOR

Over 2,000 IT/ITeS companies, including more

than 100 Fortune-500 companies have

established their operations in Bengaluru. These

companies in all, generate software exports worth

`700bn. and directly employ over 650,000

professionals. Prominent Fortune-500 companies

operational in Bengaluru are IBM, Dell, HP,

CISCO, Sun Microsystems, Microsoft, Toyota, ING,

Tesco, Citigroup, JP Morgan Chase, Goldman

Sachs, Bosch and Tyco. Prominent Indian IT &

ITeS companies like TCS, Infosys, Wipro and

Mahindra Satyam have major operations in the

city.

Bengalurus IT/ITeS sector accounts for almost

one-third of Indias IT/ITeS revenue and almost

half of the Indian Bio-Technology companies are

located in Bengaluru. These sectors play a very

vital role in the growth of commercial and

residential real estate in Bengaluru.

IT/ITeS companies have been predominantly

concentrated in South, South East Bengaluru and

the Outer Ring Road (ORR) stretch from Hebbal to

Employment Indicators in Bengaluru

Bengaluru generates

software exports worth

`700 bn.

650,000 IT

professionals directly

employed in Bengaluru

IT/ITeS and Bio-technology

sector are the driving

factors for Bengaluru's

growth

Silk Board junction. This region houses many

renowned tech-parks, IT/ITeS SEZs and captive

campuses of Fortune-500 IT companies. Micro-

marNcls aRng whlccd, LcclrRnc Cly, 2kk,

Sarjapur and anncrghalla kRad havc dcvcRpcd

into self-sustaining hubs. East Bengaluru has

Rvcr 37 mn. sq.Il. RI Rcc spacc. Aparl IrRm lhc

large campuses of IT/ITeS companies such as

0c, TCS, L8T lnIRlcch, 6L, hP and 6alc, lhcrc

arc numcrRus slandaRnc cRmmcrca Rcc

budngs Nc rgadc 0clrRpRs, Prcslgc

ShanlnNclan, Lmbassy Crcsl, lTP, 6vk Tcch

ParN, S}k ParN and Saarpura Tcch ParN acrRss

lhc lT hub RI whlccd n Lasl cngauru.

LcclrRnc Cly lnduslra ParN Rcalcd n lhc

southern region is spread over 330 acres having

Rvcr /5 mn. sq Il. RI Rcc spacc ncudng lhc

caplvc Rccs. ll s dvdcd nlR lhrcc phascs, RI

which one is completely dedicated to the bio-

technology sector, while the other two pre-

dominantly house IT/ITeS sector companies.

0ajRr cRmpancs havng Rccs hcrc arc lnIRsys,

wprR, hCL, 6cnpacl, Scmcns, TCS and 0ahndra

Salyam. 1Rn-caplvc cRmmcrca Rcc spaccs

ncudc S}k LqunRx, harla lT ParN, 6Rba Tcch

ParN, Svk FRrlunac and hranandan upscac.

Thc 2kk slrclch bclwccn hcbba lR SN Rard

}unclRn acqurcd mpRrlancc wlh lhc

commencement of the Bengaluru International

ArpRrl n 2008 n 0cvanaha. Ths slrclch scrvcs

as a main junction between the airport and the

established IT hub of Bengaluru i.e. Electronic

Cly and whlccd. Ths slrclch has argc mul-

tenanted IT parks. Major IT parks include Manyata

Lmbassy usncss ParN, Saarpura Suprcmc,

Ccssna usncss ParN and Prcslgc Tcch ParN.

The countrys IT/ITeS sector grew at an annual

ralc RI 22.5% lR `1,/7/bn. durng 200/-2011 and

is estimated to reach 3,000bn. by 2017. As pcr

1ASSC20, lhc lT]lTcS scclRr has crcalcd

tremendous job opportunities, generating over 11

mn. direct and indirect jobs. It is

estimated that the sector would create

Rvcr 1/ mn. by 2015 and cRsc lR 30 mn. jRbs by

2030. cngauru IRrms Rnc-lhrd RI lhc cRunlry's

lRla lT]lTcS rcvcnucs. wc cxpccl cngauru lR

continue its growth trajectory in-line with the

cRunlry's lT]lTcS grRwlh. Furlhcr, lhc 6Rvcrnmcnl

of Karnataka proposes to increase employment

RppRrlunlcs n lhc sRIlwarc cxpRrl cd lR abRul

2 mn. by 2020 IrRm 0.65 mn. al prcscnl.

With the strengthening of the global economy,

robust domestic fundamentals and easy

availability of skilled human capital the IT/ITeS

nduslry hcrc s cxpcclcd lR grRw sgncanly n

the coming years.

`

IT/ITeS sector constitutes

70% of the total RLI

space in Bengaluru

OFFICE SPACE BREAK-UP

Source: Knghl FranN kcscarch

BENGALURU OFFICE

SPACE DYNAMICS

before

2008

2009 2010 2011 2012 2013E 2014E 2015E 2016E 2017E

INVESTMENT

advisory REPORT

lnda's kcsdcnla 0cslnalRns

70% 30%

160

140

120

100

80

60

40

20

ZONE WISE DISTRIBUTION OF

OFFICE SPACE STOCK

27%

12%

36%

15%

11%

Source: Knghl FranN kcscarch

Ccnlra West South East North

Currently the total RLI

space stock in Bengaluru

is 92 mn. sq.ft. of which

79.80 mn. sq.ft. is occupied

2 mn. direct and indirect

JoBS TO BE GENERATED BY

2020 IN BENGALURU

NORM DETAILS

Time line for property registration Any time until possession

Re-sale before possession Allowed

Transfer charges payable to builder `200-300 psf

Loading (as % of carpet) 33%

Remarks Investor friendly market. Gains from lower Stamp Duty are taken back by

hghcr vAT ralc. Lcclvcy, laxcs arc hghcr n cRmparsRn lR 0umba

and Pune

MARKET NORMS

BIO-TECHNOLOGY SECTOR

India is ranked among the top 12 biotechnology

destinations in the world and third largest in the

Asa-Pacc rcgRn. Thc 6Rvcrnmcnl RI KarnalaNa

is committed to establishing a Biotech corridor

for the development of the biotech industry in

KarnalaNa. Thc cRrrdRr n cngauru sha cxlcnd

from the Indian Institute of Science to the

unvcrsly RI Agrculura Sccnccs. KarnalaNa has

a argc numbcr RI bRlcch cRmpancs, such as

AslraZcncca lnda, RcRn lnda, Cada,

SmlhKnc cccham and wRcNhardl.

Thc lndan R-lcchnRRgy ScclRr s cxpcclcd lR

grow to USD 10 bn. by 2015 from USD 4 bn.

pRslcd n sca 2010-11. cngauru has cmcrgcd

as a Rlcch capla RI lnda, accRunlng Rvcr

40% or USD 1.6 bn. of the countrys total

rcvcnucs. 2I lhc 380 bRlcch rms acrRss lhc

cRunlry, 52% Rr 198 arc Rcalcd n KarnalaNa and

50% Rr 191, arc n cngauru Rwng lR rch human

capital and cost advantage over peers overseas.

Currcnly lhc lRla Rcc spacc slRcN n cngauru

s abRul 92 mn. sq. Il. RI whch 80 mn. sq. Il. s

USD 10 bn. the size of

Indian Bio-technology

sector by 2015. Current size

USD 4 bn.

INVESTMENT

advisory REPORT

Indias Residential Destinations

Rccupcd, rcsulng n a vacancy cvc RI 13%.

Bengaluru retained the top slot for the highest

Rcc spacc absRrplRn n lhc cRunlry n F 2012,

despite global uncertainties looming large on the

hRrzRn. Thc cly's Rcc marNcl cRcNcd

absRrplRn RI amRsl 12 mn. sq. Il. durng F 2012,

translating into an increase of 10% over the

absRrplRn wlncsscd n F 2011. Thc lT]lTcS

industry still remains the key demand driver for

Rcc spacc n cngauru. 6Rng IRrward, wc

cxpccl anRlhcr 50 mn. sq. Il. RI ncw Rcc spacc

lR bc addcd lR lhc cxslng nvcnlRry n lhc ncxl

vc ycars, laNng lhc lRla slRcN lR 1/1 mn. sq. Il.

by the end of 2017.

Thc rcccnl sRwdRwn wlncsscd by lhc lT]lTcS

scclRr gRbay, s cxpcclcd lR mpacl lhc

ncrcmcnla absRrplRn RI Rcc spacc n

cngauru n lhc cnsung ycars. hRwcvcr, a dcay

in the delivery of new projects will lower the

vacancy cvcs lR 12% by lhc cnd RI 2017. wc

have forecasted an incremental demand of 44-45

mn. sq. Il. Rvcr lhc ncxl vc ycars laNng lhc lRla

Rccupcd spacc n lhc cly lR 12/ mn. sq. Il. by lhc

end of 2017.

COST DETAILS

Stamp duty 5% (On ready reckoner rate)

Registration 1% (uplR a maxmum RI `30,000)

VAT 7% (on agreement value)

Service Tax (on under- 3% (on agreement value)

construction property)

STATUTORY COSTS

AND MARKET NORMS

STATUTORY COSTS

380 biotech companies

in India - 50% alone in

Bengaluru

40%of the country's

bio-technology sector

contributed by Bengaluru

Proposed Monorail

Major Roads

Railway Line

Benchmark location

Top destination

Employment Hubs

Major Roads

Existing Metro

Proposed Metro

Airport

Railway Line

Benchmark location

Top destination

Employment Hubs

KR PURAM

WHITEFIELD

B Halli Terminal

MG Road

KR Puram

:KLWHHOG

B Narayanapura

Mahadevapura

CV Raman Nagar

%URRNHHOG

Hudi

KIADB Export

Promotion Area ,QWHUQDWLRQDO7HFKQRORJ\

3DUN%DQJDORUH,73%

EPIP Zone

INVESTMENT

advisory REPORT

Indias Residential Destinations

EAST BENGALURU MAP

HEBBAL

<HODKDQND6DWHOOLWH7RZQ

NORTH BENGALURU MAP

Major Roads

Proposed Metro

Airport

Railway Line

Benchmark location

Top destination

Employment Hubs

bengaluru dominance in the

BPO/KPO sectors have won

it a place in the dictionary

as Bangalored meaning

Outsourced

Bengaluru was a laid-back city till the mid-1990s

when the IT boom reshaped it into a major city of

India. Many large domestic IT companies as well

as lhc FRrlunc-500 cRmpancs scl-up lhcr Rccs

here giving a boost to the Bengaluru real estate

market. Today, Bengaluru has become the

software hub of India, commonly known as the

Silicon Valley of India. Its dominance in the KPO

(Knowledge Process Outsourcing) and BPO

(Business Process Outsourcing) sectors have won

it a place in the dictionary as Bangalored

meaning Outsourced. We believe Bengalurus

dominance in the IT/ITeS sector will continue in

the foreseeable future.

As per the fundamental economics of the real

estate sector, the price appreciation depends on

two factors - employment and infrastructure

development (connectivity). This phenomenon

has been witnessed in the South and South-East

regions of Bengaluru. In the mid-1990s, since the

growth of the IT/ITeS sector many large IT parks

and campuses have been set-up in the Electronic

Cly (sRulh) and whlccd (sRulh-casl) rcgRn.

This attracted many software engineers to

Bengaluru consequently leading to demand for

residential real estate. Micro-markets such as

Bannerghatta Road, Kanakpura, Sarjapur Road, JP

1agar, }aya 1agar, whlccd, varlhur,

Mahadevapura, CV Raman Nagar, Uttarahalli, KR

Puram and Electronic City have emerged as

residential markets. However, South Bengaluru

destinations lost their charm post the

commencement of the Bengaluru International

Airport (BIA) near Devanahalli in North Bengaluru.

As a natural phenomenon for the real estate

sector, all focus including government,

corporates and general public at large, has now

shifted northwards a new growth corridor for

real estate.

We expect North and East Bengaluru to be the

bggcsl bcnccarcs RI lhc lA and cxpccl lhcm

to emerge as the new Central Business Districts

(CBD) of Bengaluru within the next decade. This

can be further substantiated by the numerous

infrastructure projects undertaken by the

government such as High Speed Rail Link (HSRL),

Metro Lines, monorail and the Peripheral Ring

Road that are at various stages of construction.

On completion, these projects will enhance the

connectivity of the city centre with the BIA.

PREFERRED

ZONES IN

BENGALURU

Availability of huge land parcels along the road

between the city centre and the BIA has attracted

many large corporates.

Residential end-users at large prefer residing in

Northern Bengaluru as against the south; this

was not the case 4-5 years back. The change in

preference was mainly on account of shifting of

the airport to the north near Devanahalli. We

expect the stretch from Hebbal to Yelahanka in

the north to gain large price appreciation in the

ncxl vc ycars many Rn accRunl RI ls prRxmly

to the airport, connectivity with the city centre

and upcoming social infrastructure.

East Bengaluru in itself is a well-developed and

scI-suslanng zRnc. Al ls cRrc, whlccd as a

micro-market has evolved over the years. It has

become one of the most preferred destinations

for the IT/ITeS employees, as it is close to the IT

cRrrdRr RI whlccd and lTP. ll asR has a wc-

developed social infrastructure (school, hospitals

etc.) and a well-organized retail market.

Moreover, this region will have smooth

accessibility to the airport with the proposed 116

km. Peripheral Ring Road (PRR). The PRR will link

Hosur Road with Tumkur Road via KR Puram,

Bellary Road, Old Madras Road and Sarjapur

kRad. hcncc marNcls Nc Kk Puram, whlccd,

Budigere Cross and Old Madras Road will see

some good traction in the next 4-5 years.

Therefore, based on the above developments we

believe North and East Bengaluru regions will

wlncss gRRd lraclRn Rvcr lhc ncxl vc ycars.

INVESTMENT

advisory REPORT

Indias Residential Destinations

NORTH

BENGALURU

The focus of the GOK over the last decade has

clearly been North Bengaluru. By shifting the

Bengaluru International Airport (BIA) near

Devanahalli in the north thereby replacing old

HAL Bengaluru International Airport, GOK has

substantiated its intention in developing North

Bengaluru. Since the new airport is 40 km.

outside the city, GOK has also planned Mass

Transit Systems (MTS) like monorail, Metro-Line

and High Speed Rail Link (HSRL) to enable

travellers to reach the airport faster. Also,

commuter rail system has been planned to

connect Devanahalli with Yeshvantpur via

Yelahanka. Additionally, widening of the NH-7

upto BIA from the existing six-lane to eight-lane is

undcr prRccss. Ths can suslan hghcr lrac duc

to airport expansion and expected real estate

developments on either side of the NH-7. Further,

South Bengaluru micro-

markets lost its charm

post the commencement

of the Bengaluru

International Airport in

North Bengaluru

We anticipate North and

East Bengaluru to be the

biggest EI^ILLDKLIV of

the BIA and expect them to

emerge as the new Central

Business Districts (CBD) of

Bengaluru within the next

decade

`1,150 bn.

Investment earmarked for

North Bengaluru

the GOK is also developing the Peripheral Ring

Road (PRR) as an eight lane expressway along

the periphery of Bengaluru for a total road length

of 116 km. that will connect all the periphery

regions to the airport. Availability of vast vacant

land parcels close to the airport and along the

road leading to the airport has enabled GOK to

plan projects worth `1,150bn., including

Devanahalli Business Park (DBP), Aero SEZ,

Information Technology Investment Region (ITIR),

Bio-Technology, Aerotropolis and many other

recreational developments.

Further, the GOK has also invited many

cRrpRralcs lR scl-up lhcr unls]Rccs n 1Rrlh

Bengaluru. Many large companies such as HAL,

BEML, Infosys, Dynamatic Technologies Ltd, IFCI

and Tata Elxsi have signed an MoU with the GOK.

55 multinational IT companies including Infosys,

Wipro, TCS and Cognizant have evinced interest

n scllng up lhcr Rccs n lhc lTlk. 2vcr 1.2 mn.

people are expected to get direct employment

IrRm lhc lTlk and Rvcr 2.8 mn. ndrccl

employment. Employment due to the ITIR in itself

speaks about the growth of this region. These

developments are expected to completely change

1Rrlh cngauru IrRm an uncxclng RcalRn lR a

bustling self-sustaining city.

Growth of the residential market in this zone has

been primarily along the Outer Ring Road (ORR)

such as hcbba, SahaNara 1agar, 0Rar's CRRny,

kT 1agar, anaswad, 0ahadcvapura and

1agwara. hRwcvcr, pRsl cRmmcnccmcnl RI lhc

lA n 2008, lhc slrclch IrRm hcbba lR lA s

* Till September 2012

2007 2008 2009 2010

50,000

40,000

30,000

20,000

10,000

N

o

.

o

f

U

n

i

t

s

Stock Cumulative Absorption % of Unsold Units

RESIDENTIAL DEMAND-SUPPLY ANALYSIS OF NORTH BENGALURU

2011

Source: Knight Frank Research

2012*

witnessing residential developments. Proximity to

the airport and to the commercial hub of

Manayata Tech Park has made this pocket of

Bengaluru the preferred residential location by

the IT population.

As Rn Scplcmbcr 2012, 1Rrlh cngauru has wlncsscd

a lRla RI /2,329 rcsdcnla unls bcng aunchcd

sncc 2007. 2I lhs a lRla RI 28,785 unls havc

bccn absRrbcd rcsulng n 32% rcmanng

unsold. Over the years, unsold units have risen

mainly on account of low pace of absorption due

to uncertain global markets. Announcement of

ncw prRjccls has cRmc dRwn n lhc rsl 9m

RI 2012, as Rny 5,075 unls havc bccn aunchcd

agansl lhc 13,355 unls aunchcd n 2011. Thc

excess supply from the previous years has had an

advcrsc mpacl Rn lhc unsRd unls' pcrccnlagc.

INVESTMENT

advisory REPORT

lnda's kcsdcnla 0cslnalRns

2007 2008 2012* 2009 2010 2011

* Till September 2012

RESIDENTIAL PROJECT LAUNCH

TREND IN NORTH BENGALURU

Launches Source: Knight Frank Research

7,069

5,608

3,953

13,355

5,075

7,269

12%

14% 14%

15%

27%

32%

42,329 units

launched and 28,785 units

absorbed since 2007 in

North Bengaluru

4 mn. direct and

indirect employment to be

genereated over next 3

decade in North

Bengaluru

Existing

Infrastructure

HEBBAL TO BIA ROAD

A 3.72 km. six-lane elevated road over the

existing road is under construction. The project

w havc a scrcs RI scvcn yRvcrs IrRm hcbba lR

the Trumpet Junction near the airport. The

elevated road starts from the Kodigehalli gate

and connects to the international airport. This

prRjccl by lhc 1alRna hghway AulhRrly RI lnda

(1hAl) s al varRus slagcs RI cRnslruclRn IrRm

hcbba lR lhc cahanNa raway-undcr-brdgc. ll

w asR havc yRvcrs and undcrpasscs. 2ncc lhc

prRjccl s cRmpclcd l w cnhancc cRnncclvly

wlh lhc cly ccnlrc and lhc drvc lR lhc arpRrl

w bccRmc scamcss and sgna-Ircc. Ths

project is expected to reduce the travel time

bclwccn hcbba lR lA IrRm /5 mnulcs lR 20-25

mnulcs.Thc prRjccl s cxpcclcd lR bc rcady by

2013. Thc 0Rddabaapur kRad, hcnnur kRad,

cahanNa and hcbba arcas lhal arc cRnncclcd

wlh lhc lnlcrnalRna ArpRrl kRad arc nRw

hRlspRls IRr prRpcrly dcvcRpmcnl.

As pcr lhc prRjccl pan, lhc 3.72 Nm. slrclch IrRm

lhc hcbba yRvcr lR lhc bcgnnng RI cahanNa

ypass (ncar 6KvK) w bc an ccvalcd slrclch.

FrRm lhc cahanNa ypass lR lhc Trumpcl nlcr-

changc (lhc galcway lR lA), a lhc majRr

OUTER RING ROAD (ORR)

2ulcr kng kRad pRpuary rcIcrrcd lR as lhc 2kk

s a slrclch cRnncclng hcbba n lhc 1Rrlh and

SN Rard }unclRn n lhc SRulh. Ths 62 Nm.

slrclch has bccn dcvcRpcd as an lT grRwlh

cRrrdRr n lhc asl lcn ycars. Thc 2kk slrclch can

bc Iurlhcr casscd nlR IRur parls bascd Rn ls

rcspcclvc characlcrslcs as a) hcbba - Kk Puram

b) Kk Puram - 0aralhaha c) 0aralhaha -

Sarjapur kRad and d) Sarjapur kRad - SN Rard

}unclRn. 2I lhcsc (a) and (b) IRrm parl RI nRrlh-

casl cngauru and (c) and (d) IRrm parl RI

sRulh-casl cngauru. Thc ncw grRwlh cRrrdRr

IRr lT dcvcRpmcnl Rpcncd up n cngauru Rny

n 2002 aIlcr lhc cRmpclRn RI lhc 2kk. Thc 2kk

nRw accRunls IRr amRsl 35% RI lhc lRla Rcc

spacc RI cngauru. PrRxmly lR lhc arpRrl and

INVESTMENT

advisory REPORT

lnda's kcsdcnla 0cslnalRns

Upcoming

Infrastructure

lR lhc cRmmcrca hub such as 0anyala Tcch

ParN, k0Z LcRspacc, k0Z LcRzcn, Saarpura

Suprcmc, Ccssna usncss ParN, Fcrns lcRn, and

agmanc wRrd TcchnRRgy Ccnlrc has madc lhs

pRcNcl lhc mRsl sRughl aIlcr dcslnalRn. 6rRwlh

RI lhc rcsdcnla marNcl n lhs zRnc has bccn

prmary aRng lhc 2kk such as hcbba,

SahaNara 1agar, Kk Puram, whlccd, Cv kaman

1agar, lndranagar, 0aralhaha, candur,

varlhur kRad, 0Rar's CRRny, kT 1agar,

anaswad, 0ahadcvapura and 1agwara. Thc

0Rddabaapur kRad, hcnnur kRad and hcbba

areas that are connected with the international

arpRrl rRad arc nRw hRlspRls IRr prRpcrly

dcvcRpmcnl.Thc pan lR maNc lhc 2ulcr kng

kRad (2kk) a sgna-Ircc, scamcss cRrrdRr w

have far-reaching implications on the growth

along its route.

junclRns w bc madc sgna-Ircc. TRwards lhc

cnd, lwR yRvcrs w cRmc up al lhc KRgu CrRss

and vdyanagar junclRns, whc IRur

underpasses will come up at other crucial

junctions.

ELEVATED CORRIDOR FROM

CENTRAL SILK BOARD JUNCTION

TO JAYAMAHAL ROAD

A 15 Nm. ccvalcd cRrrdRr cRnncclng Ccnlra SN

Rard }unclRn wlh }ayamaha kRad s cnvsagcd

lR casc lhc lrac Rw bclwccn 1Rrlh and SRulh

cngauru. Ths w asR Iaclalc n rcachng lhc

ncw nlcrnalRna arpRrl n lhc 1Rrlh.

MONORAIL

A 31 Nm. mRnRra has bccn prRpRscd by lhc

cngauru Ar ka LnN Lld. (AkL) lhal w

cRnnccl }P 1agar (n sRulh) wlh hcbba (n lhc

nRrlh). AIlcr cRmpclRn, lhs prRjccl w IunclRn

as a feeder service to the metro rail as well as to

the international airport.

ORR accounts for almost

35%of the total RLI

space of Bengaluru.

Hebbal to BIA road project

is expected to reduce the

travel time between Hebbal

to BIA from 45 minutes to

20-25 minutes

EMPLOYMENT HUBS IN NORTH BENGALURU

SECTOR PROJECT NAME MAJOR COMPANIES

IT/ITeS Manyata Embassy Business Park Philips, IBM, ANZ

INVESTMENT

advisory REPORT

Indias Residential Destinations

Employment Indicators in

North Bengaluru

Further, there is the aerospace SEZ that is being

planned here besides three industrial parks on

3,000 acres of land. Many renowned hotels like

Oberoi, JW Marriot and Fortune are also planned

here. There is plenty of commercial development

in the pipeline, with several developers having

bought huge land parcels for development in the

stretch from Hebbal to Devanahalli. With so much

commercial development, we expect residential

development to follow suit in this region making

it the most sought after destination in the next 4-

5 years.

Few builders who have planned residential

projects in North Bengaluru are Brigade Group

with their Gateway, Ozone Developers with their

integrated project called Urbana, Prestige with

their Ozone and Golfshire Projects, Hiranandani

Upscale with their Chancery, Nitesh with their

Columbus Square and Sobha with their Althea.

Sncc 2008 Rvcr 7.5 mn. sq. Il. RI Rcc spacc

ncudng caplvc Rccs has bccn cRnslruclcd n

METRO-LINE

A 24 km. North-South (NS) corridor connecting

Hesaraghatta circle near Nagasandra (north) with

Puttenahalli (south) has been proposed. Along

with this, there are also plans (under Metro Phase

II) to extend the Metro line from Hesarghatta up

lR lhc lA. Thcsc sgncanl prRjccls w add

value to the property along this route.

The region has a demand for residential,

commercial and retail spaces. With plans for the

development of an aerospace Special Economic

Manyata Embassy Business

Park has over 7.5 mn. sq. ft.

stock and 9.4 mn. sq. ft.

under construction

North Bengaluru region

is expected to

generate direct and

indirect employment of

over 4-4.5 mn. in

the next decade

Zone (SEZ), IT SEZ and creation of separate

workspaces in the vicinity of the airport, there is

also a huge supply of residential layouts.

HIGH SPEED RAIL LINK (HSRL)

A 33 km. HSRL has been proposed and will

connect the city centre with the airport. The HSRL

will operate between Cubbon Road and BIA with

two halts between them, one at Hebbal and the

other at Yelahanka. The HSRL will run parallel to

the expressway.

North zone of the city has a host of civic

infrastructure projects, large commercial

developments and new residential options that

have changed the characteristics of the localities

over the last few years. Bengaluru International

Airport has been the main catalyst for the change

in this region. The monorail, Metro Rail and

Bengaluru-Mysore Infrastructure Corridor (BMIC)

project as well as the social infrastructure

facilities are together set to drive Bengaluru

further ahead.

The existing major employment driver in this

region is the IT/ITeS sector. However, in future the

incremental employment in this region will be

generated from the planned commercial

developments such as ITIR, Aero SEZ, Devanahalli

Business Park, Aerotropolis and Global Financial

District. Cumulatively the GOK has envisaged an

investment of `1,150bn. in the North Bengaluru

region and is expected to generate direct and

indirect employment of over 4-4.5 mn. in the next

decade.

1Rrlh cngauru. 2vcr lhc ncxl vc ycars 9.6 mn.

sq. Il. RI Rcc spacc s cxpcclcd lR bc addcd lR

lhc cxslng nvcnlRry lhcrcby laNng l lR 17.1 mn.

sq. Il. by lhc cnd RI 2017. hRwcvcr, dcmand s

cxpcclcd nRl Rny IrRm lhc lT]lTcS scclRr bul asR

IrRm lhc acrRspacc scclRr, Rgslc cRmpancs

and nanca scclRrs. Lxccssvc dcmand IRr

qualy Rcc spacc has Ncpl vacancy cvcs n

Rwcr sngc dgls n 2011 and wc cxpccl l lR

rcman al lhal cvc l 2017. wc IRrccasl an

ncrcmcnla 7.3 mn. sq. Il. RI Rcc spacc lR bc

absRrbcd Rvcr lhc ncxl vc ycars.

PrcIcrcncc RI lhc cRmpancs lR bc n cRsc

prRxmly RI lhc arpRrl, and cmpRyccs'

prcIcrcncc lR slay cRscr lR lhcr wRrNpacc w

Rvcra drvc lhc dcmand IRr cRmmcrca as wc

as rcsdcnla rca cslalc n lhs RcalRn.

INVESTMENT

advisory REPORT

lnda's kcsdcnla 0cslnalRns

before

2008

2009 2010 2011 2012 2013E 2014E 2015E 2016E 2017E

20

18

16

1/

12

10

8

6

/

2

NORTH BENGALURU OFFICE

SPACE DYNAMICS

EAST BENGALURU

Lasl cngauru had smar characlcrslcs as lhal

RI cngauru cly. cng a nRndcscrpl zRnc unl

lhc md 1990s, lhc rcgRn gancd prRmncncc Rny

aIlcr lhc lT bRRm RI lhc 1990s. PrRxmly lR lhc

cly ccnlrc and hugc avaably RI and allraclcd

many lT]lTcS cRmpancs hcrc. 2vcr 30 mn. sq. Il.

RI lT]lTcS spacc s RpcralRna as RI }unc 2012.

0ajRr lT]lTcS hubs Nc Saarpura hamarN, lTP,

k0Z LcRspacc, Prcslgc ShanlnNclan and

agmanc wRrd Ccnlrc havc madc lhs pRcNcl RI

cngauru lhc prcIcrrcd rcsdcnla RcalRn by lT

pRpualRn. Furlhcr, wlh lhc grRwlh RI

pRpualRn, lhs rcgRn had a grcal dca RI sRca

nIraslruclurc lR prRvdc cnlcrlanmcnl RplRns lR

lhc rcsdcnls. 6rRwlh RI lhc rcsdcnla marNcl n

lhs zRnc has bccn prmary aRng lhc whlccd

kRad, Kk Puram, 2d 0adras kRad, 2d ArpRrl

kRad, lTPL, Cv kaman 1agar, 0ahadcvapura,

hRRd Crcc and lndra 1agar.

As Rn Scplcmbcr 2012, Lasl cngauru has wlncsscd a

lRla RI 23,689 rcsdcnla unls bcng aunchcd

sncc 2007. 2I lhs a lRla RI 15,9/6 unls havc

bccn absRrbcd rcsulng n 33% rcmanng

unsRd. 2vcr lhc ycars, unsRd unls havc rscn

many Rn accRunl RI Rw pacc RI absRrplRn duc

lR hgh numbcr RI aunchcs. AnnRunccmcnl RI

ncw prRjccls has cRnlnucd wlh ls hgh

mRmcnlum and 9m 2012 wlncsscd lhc aunch RI

5,/15 unls as cRmparcd lR 6,/00 unls aunchcd

lhrRughRul 2011. Lxccss suppy IrRm lhc prcvRus

ycars has an advcrsc mpacl Rn lhc unsRd unls'

pcrccnlagc.

* Till September 2012

RESIDENTIAL DEMAND-SUPPLY ANALYSIS OF EAST BENGALURU

2007 2008 2009 2010

25,000

20,000

15,000

10,000

5,000

N

o

.

o

f

U

n

i

t

s

SlRcN Cumualvc AbsRrplRn % RI unsRd unls

2011

Source: Knghl FranN kcscarch

2012*

0%

/% /%

10%

21%

33%

Currently the total RLI

spaLI V1RLN L^ ^RKth

Bengaluru is 7.7 mn. sq.ft.

of \ILLI 6.26 P^. VT. ft. is

RLLISLII

23,689 I^L1V ODI^LIII

and 15,946 units absorbed

VL^LI 2UU7 in East

Bengaluru

Over 30 mn. sq. ft. of

IT/ITeS spaLI LV operational

as of June 2012 in East

Bengaluru

We expeL1 another 9.5

mn. sq.ft. of new RLI

spaLI to beLome

operational by 2017

Existing

Infrastructure

PERIPHERAL RING ROAD (PRR)

A 116 km. PRR connecting the entire

peripheral arterial road linking all the major

highways has been proposed. The major