Beruflich Dokumente

Kultur Dokumente

Is Your Family Owned Business Ready For The Next Generation?

Hochgeladen von

Bill TaylorCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Is Your Family Owned Business Ready For The Next Generation?

Hochgeladen von

Bill TaylorCopyright:

Verfügbare Formate

Enterprising Rural Families

An Online Newsletter May, 2013

This newsletter is an instrument of the Enterprising Rural Families: Making It Work program of University of Wyoming Extension. For further information concerning the Enterprising Rural Families program or on-line course contact information@eRuralFamilies.org or go to http://eRuralFamilies.org/.

TM

Volume IX,

Issue 5

Is your Family owned business ready for the next generation?

By Hannah Swanbom, University Of Wyoming Community Development Educator

ongratulations! You have managed to build your business from scratch and are now looking forward to retiring and plan to leave the business to be run by a successor. As you begin to think of all the things you are WRITING A BUSINESS PLAN going to do during retirement, an important question should be askedhave you done everything necessary to prepare the business for your retirement? A business plan outlines the basics of a If you have not created a succession plan, you are putting not only the business business concept: the businesss missuccess in jeopardy but potentially putting the health of your community at risk. sion, objectives, products or services, management, and the basic marketing According to the literature, business succession planning is an important financial and financial plan. It is the document tool for the successful continuation of family-owned and operated businesses as designed to reveal whether or not a well as the health of rural communities (Smith, 2010). Rural communities in parbusiness idea is workable. ticular are more likely to be affected by businesses closing than urban towns that Doing the research itself to complete have a higher volume of businesses located in town and in the surrounding area. the business plan can be eye opening and help you make many decisions, If you have not created a succession plan for your business yet, you are including avoiding mistakes and pitnot alone. According to a survey conducted in 2006, 25 percent of the family busifalls. Here are some of the things readers of ness stakeholders who are entering their senior years have not a business plan will look for: completed or taken the necessary steps that are involved in develop Is the business idea viable? ing a succession plan (Rojeck, Are its products or services new, 2006). Succession planning, when unique, or in some way better done effectively and thoroughly, than current offerings? helps to eliminate the loss of ex Does the business create or cater pertise and knowledge within the to a new market? business, as well as keeping jobs in Are the cash flow and sales projecthe community by keeping the tions realistic? business open, and saving time Can the business be profitable and effort of recruiting new emand service its debt? ployees. Furthermore, succession Does the business truly underplanning helps to maintain client stand and place priority on cusrelationships and saves time while helping the business remain financially statomer needs? ble. Is the business concept clear, focused, and intelligently presentSo where do you start? ed? There are many important factors to consider when preparing a business Is the business concept based on sound research and analysis? to take on new management. The most important step in the planning process is to start early; it is never too early to start thinking about what needs to be done to the business to ensure its continuation after your departure. In addition, to

TIP OF THE MONTH:

PAGE 2

E NTERP R IS I NG R UR A L F AMI LI ES TM

V OLU ME IX, ISSU E 5

making the necessary business arrangements to guarantee the longevity of the business, it is vital that a successor is groomed and prepared to take over the business prior to your departure. In order to prepare your successor, whether it is a family member or an employee, it is essential to include them in the various business (financial, legal, and employee) decisions that are made. While developing your plan, it is also important that you communicate your expectations for them, as well as those of the business. Furthermore, when developing your succession plan, it is imperative to establish clear goals and objectives for the business. When developing these goals and objectives, be sure to include your successor, so they too are on board and can contribute their goals and objectives. Once goals and objectives have been illuminated for the business, you, the creator of the business, should identify how much involvement you want to maintain within the business upon retirement (Rojeck, 2006). Not only will this help eliminate confusion or anxiety amongst your successor and yourself, it will set boundaries and expectations to follow during the transitional period and in the future. This allows the business to run smoothly and embrace the new change in management. Clear communication is a vital component in creating a smooth transition from one owner to another. In addition, to communicating with your successor and employees, it is also important to communicate with stakeholders about their roles during the transition. Literature indicates that, by keeping constituents aware of the changes taking place within the business, not only will they will feel supportive about your decision to retire, they will also remain confident in the business and new management. Remember, if you are planning to retire and leave the business to be operated by a successor, start planning and preparing the business for changes early on. Through early planning efforts and the creation of a succession plan, you, as the creator of the business, can enjoy retirement knowing that you prepared your business and successor for future success.

References

Rojeck, R. (2006, March 8). Smart succession-planning. Retrieved from http://www.entrepreneur.com/article/83806

Smith, S. (2010). Succession planning for family-owned businesses is critical for rural america. Retrieved from http://www.rurdev.usda.gov/rbs/pub/ju110/legal.htm

Enterprising Rural FamiliesTM May, 2013 Volume IX, Issue 5

Das könnte Ihnen auch gefallen

- Better BylawsDokument58 SeitenBetter BylawsBill TaylorNoch keine Bewertungen

- Board EvaluationDokument41 SeitenBoard EvaluationBill Taylor100% (1)

- Further Vision For The Black HillsDokument3 SeitenFurther Vision For The Black HillsBill TaylorNoch keine Bewertungen

- Disinheritance PDFDokument4 SeitenDisinheritance PDFBill TaylorNoch keine Bewertungen

- A Walk Through Wyoming ProbateDokument12 SeitenA Walk Through Wyoming ProbateBill TaylorNoch keine Bewertungen

- Advance Health Care DirectivesDokument12 SeitenAdvance Health Care DirectivesBill TaylorNoch keine Bewertungen

- After A Death: What Steps Are Needed?Dokument12 SeitenAfter A Death: What Steps Are Needed?Bill TaylorNoch keine Bewertungen

- Introduction To Wyoming Estate PlanningDokument8 SeitenIntroduction To Wyoming Estate PlanningBill TaylorNoch keine Bewertungen

- Guardianships and ConservatorshipsDokument7 SeitenGuardianships and ConservatorshipsBill TaylorNoch keine Bewertungen

- Estate Planning ChecklistDokument8 SeitenEstate Planning ChecklistBill TaylorNoch keine Bewertungen

- Durable Power of AttorneyDokument7 SeitenDurable Power of AttorneyBill TaylorNoch keine Bewertungen

- Wyoming WillsDokument11 SeitenWyoming WillsBill TaylorNoch keine Bewertungen

- Choosing A Personal RepresentativeDokument4 SeitenChoosing A Personal RepresentativeBill TaylorNoch keine Bewertungen

- Personal Property MemorandumDokument6 SeitenPersonal Property MemorandumBill TaylorNoch keine Bewertungen

- Death CertificatesDokument4 SeitenDeath CertificatesBill TaylorNoch keine Bewertungen

- Management Succession: Where Are We?Dokument3 SeitenManagement Succession: Where Are We?Bill TaylorNoch keine Bewertungen

- Why Prepare A Will?Dokument3 SeitenWhy Prepare A Will?Bill TaylorNoch keine Bewertungen

- Kasl Weston County Extension Report Bill Taylor 5/7/13 Plant CombinationsDokument3 SeitenKasl Weston County Extension Report Bill Taylor 5/7/13 Plant CombinationsBill TaylorNoch keine Bewertungen

- Chairing A Difficult MeetingDokument3 SeitenChairing A Difficult MeetingBill TaylorNoch keine Bewertungen

- Creating An Ethical Culture in Your Small BusinessDokument3 SeitenCreating An Ethical Culture in Your Small BusinessBill TaylorNoch keine Bewertungen

- Inventory and Assigment of Personal PropertyDokument4 SeitenInventory and Assigment of Personal PropertyBill TaylorNoch keine Bewertungen

- Guardians and ConservatorsDokument4 SeitenGuardians and ConservatorsBill TaylorNoch keine Bewertungen

- Is A Will Enough?Dokument4 SeitenIs A Will Enough?Bill TaylorNoch keine Bewertungen

- Copreneurs: Mixing Business and LoveDokument3 SeitenCopreneurs: Mixing Business and LoveBill TaylorNoch keine Bewertungen

- Responsibilities of A GuardianDokument4 SeitenResponsibilities of A GuardianBill TaylorNoch keine Bewertungen

- Requirements For A Wyoming WillDokument4 SeitenRequirements For A Wyoming WillBill TaylorNoch keine Bewertungen

- Who Gets My Personal Stuff? (Part 1)Dokument6 SeitenWho Gets My Personal Stuff? (Part 1)Bill TaylorNoch keine Bewertungen

- Who Gets My Personal Stuff (Part 2)Dokument4 SeitenWho Gets My Personal Stuff (Part 2)Bill TaylorNoch keine Bewertungen

- Spring Lawn CareDokument3 SeitenSpring Lawn CareBill TaylorNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDokument4 SeitenConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveAmer Lucman IIINoch keine Bewertungen

- VP Director Distribution Operations in Dallas FT Worth TX Resume Reginald DavisDokument3 SeitenVP Director Distribution Operations in Dallas FT Worth TX Resume Reginald DavisReginaldDavisNoch keine Bewertungen

- Viraj Exports Employee Absenteeism ReportDokument108 SeitenViraj Exports Employee Absenteeism ReportMichael WellsNoch keine Bewertungen

- Contractor Design and Standard Form ContractsDokument14 SeitenContractor Design and Standard Form ContractskuvjNoch keine Bewertungen

- Volume 2 - Part 2 - BoQ - 10 February 2014Dokument317 SeitenVolume 2 - Part 2 - BoQ - 10 February 2014Abdul RahumanNoch keine Bewertungen

- Comprehensive Youth Health PlanDokument13 SeitenComprehensive Youth Health PlanMicky Morante100% (1)

- Pay For Performance Incentive RewardsDokument21 SeitenPay For Performance Incentive RewardsReza100% (1)

- Cover Letters: A Guide For StudentsDokument2 SeitenCover Letters: A Guide For StudentsFawad ShahNoch keine Bewertungen

- Ashley Dwarshuis - Resume 2018Dokument2 SeitenAshley Dwarshuis - Resume 2018api-398855744Noch keine Bewertungen

- GDPR Privacy Notice For DHL International UK LTD PDFDokument4 SeitenGDPR Privacy Notice For DHL International UK LTD PDFnnigeltaylorNoch keine Bewertungen

- Organizational Study at Hil (India) LimiedDokument90 SeitenOrganizational Study at Hil (India) LimiedAnonymous pMk86esb0JNoch keine Bewertungen

- Product Development in An Export HouseDokument76 SeitenProduct Development in An Export HouseHimanshu ShekharNoch keine Bewertungen

- CV - Site Civil EngineerDokument3 SeitenCV - Site Civil EngineerEngr. Abdul HafeezNoch keine Bewertungen

- Application Cover LetterDokument5 SeitenApplication Cover LetterMd.tanvir Ibny GiasNoch keine Bewertungen

- 2002 August - Steve Davies - Waste Management Workers Take Action On Three ContinentsDokument34 Seiten2002 August - Steve Davies - Waste Management Workers Take Action On Three ContinentsSusanne Namer-WaldenstromNoch keine Bewertungen

- HSE Structure and ResponsibilityDokument2 SeitenHSE Structure and ResponsibilitymoxezaNoch keine Bewertungen

- Jessica ResumeDokument3 SeitenJessica Resumeapi-440538294Noch keine Bewertungen

- How Personnel Administration evolved to Human Resources Management in the PhilippinesDokument4 SeitenHow Personnel Administration evolved to Human Resources Management in the PhilippinesWhil WilsonNoch keine Bewertungen

- PPC QuestionsDokument4 SeitenPPC Questionssumedhasajeewani100% (1)

- Employment Documentation Form: American Culinary FederationDokument1 SeiteEmployment Documentation Form: American Culinary FederationALMusriALSudaniNoch keine Bewertungen

- Training DesignDokument5 SeitenTraining DesignVicky CatubigNoch keine Bewertungen

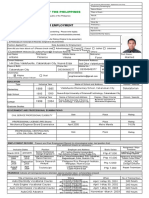

- Application For Employment: 1995 1989 SalutatorianDokument3 SeitenApplication For Employment: 1995 1989 Salutatoriangemma antonioNoch keine Bewertungen

- HRM Case Study On "Travails of A Training Manager"Dokument11 SeitenHRM Case Study On "Travails of A Training Manager"Ashish KattaNoch keine Bewertungen

- Strategic Training in OrganisationsDokument44 SeitenStrategic Training in Organisationsreema mohantyNoch keine Bewertungen

- Cathay Pacific CaseDokument20 SeitenCathay Pacific CaseArpit GargNoch keine Bewertungen

- HSE Training Plan Rev - ADokument16 SeitenHSE Training Plan Rev - AYamegrNoch keine Bewertungen

- Entrepreneurial BehaviorDokument23 SeitenEntrepreneurial BehaviorSushil Kumar Pant100% (1)

- Uganda Human Development Report 2015Dokument180 SeitenUganda Human Development Report 2015jadwongscribdNoch keine Bewertungen

- EA Coats Manila Bay Vs Ortega FCDokument9 SeitenEA Coats Manila Bay Vs Ortega FCenarguendoNoch keine Bewertungen

- EduBridge NewsletterDokument8 SeitenEduBridge NewsletterMAINAKNoch keine Bewertungen