Beruflich Dokumente

Kultur Dokumente

Statement of Guidance Loans

Hochgeladen von

Logan's LtdCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Statement of Guidance Loans

Hochgeladen von

Logan's LtdCopyright:

Verfügbare Formate

St. Vincent and the Grenadines International Financial Services Authority Statement of Guidance No.

3

Loan Classification Criteria Provisioning Guidelines Treatment of Interest on Loans Write off Procedures Restructured Loans

This guidance is made in exercise of the authority conferred on the International Financial Services Authority (IFSA or the Authority) by section 30 of the International Banks Act Chapter 99 of the Revised Laws of Saint Vincent and the Grenadines, 2009 (the Act)1. 1. Statement of objectives To provide guidance to international banks licensed under the Act relating to the minimum standards for the administration and monitoring of and the methodology for evaluating and classifying loans and other assets held, and the applicable procedures to effect same. To set the minimum provisioning requirements that should be applied and provides guidance for the treatment of interest on loans, the treatment of restructured loans and write off of loans classified as a loss. 2. Definitions: (i) Restructured Loans and Advances These are credit facilities which have been refinanced, rolled over, rescheduled or otherwise changed to more favourable terms and conditions than the debt that was previously arranged for the borrower with his/her agreement because of weaknesses in the borrowers financial condition and which the Bank would not otherwise consider;

These credit guidelines are based upon international prudential standards which have been adopted and usedwidelybyinternationalandregionalregulators.

(ii) Non-Performing Loans and Other Interest Bearing Assets (a) Principal or interest is due and continues to accrue interest2 and has not been paid for ninety (90) days or more based on the repayment terms that were established. The same will apply if Principal and interest are outstanding; Interest payments are equal to ninety days or more have been capitalized3, refinanced or delayed by agreement; Loans which have been placed on nonaccrual i.e. loans which have been placed on a cash basis for accounting and reporting purposes. Interest is no longer accrued on the books of the licensee and is recorded as earned income only when payments are collected from the borrower; Overdrafts and other credit facilities without pre-established repayment terms are considered non performing when deposits are insufficient to cover the interest capitalized for ninety days or more. The principal balance outstanding and not the amount of delinquent payments is used in calculating the aggregate amount of non-performing loans;

(b)

(c)

(d)

(iii) Other Assets are overdrafts and other credit facilities or any other asset that does not have pre-established repayment terms. 3. Requirements: A Classification System Introduction: Loan classification refers to the process used to review loans and other assets and assign same to categories based on the perceived risk and other relevant characteristics of the loans/assets. Financial Institutions operating within St. Vincent and the Grenadines are required to conduct an annual review4 of all its credit portfolio. This should represent at least 70% of the portfolio and should include:

Accrual of interest a term used to describe the accounting method where interest receivable has been recognized, but has not yet been received. Accrued interest occurs as the result of the difference in timingofcashflowsandthemeasurementofthesecashflows. Theprocessofaddinguncollectedinteresttotheprincipalbalanceofaloanoradvance.Capitalizationof interest also includes unpaid interest which is refinanced or rolled over into a new bank credit. Future interestthusaccruesonthisnewprincipal. Performedeveryfinancialyear.

All large credits i.e. large relative to the institution; Past due loans i.e. a loan on the Banks books that has passed its maturity date; Restructured Loans and Advances as previously defined in 2. (i) above; Non-Performing Loans and other Interest bearing Assets as previously defined in 2.(ii) above; Other Problem Credits and Assets - excluding those stated above.

The information reviewed would include but are not limited to the following: (a) The original amount of the loan/advance, the terms such as its duration, the interest rate, the current balance and status of the disbursements in keeping with the purpose of the loan/advance; (b) The nature of business of the borrower, balance sheets, cash flows and other financial data both on the business and the guarantors; (c) Where applicable an evaluation of the project being financed; (d) The security/collateral taken, including up to date appraisals, legal assignments, insurances, etc; (e) Track record of the borrower including the servicing of previous borrowings; (f) If part of a group, the performance of loans/advances to other members of the group. The financial institution, based on the criteria detailed below should assign classifications of its loans and advances following the annual review of the portfolio and apply the required provision. In addition, all recoveries, charge-offs and rescheduled loans for the period should be reported. The process of continual review and classification enables financial institutions to monitor the quality of their asset portfolio and where necessary take remedial action to counter further deterioration in the credit quality of the portfolios. Loan Classification Criteria: There are five categories to be used to classify loans and other assets as follows: (a) Pass (b) Special mention (c) Substandard (d) Doubtful (e) Loss

(a) Pass (All of the following): o o o o Loan repayments current or not more than 30 days in arrears; Financial condition of the borrower is sound; Adequate credit documentation to support borrowings; Collateral for loan is unimpaired;

3

o Loans which are fully secured by cash or investment grade government securities; o Overdrafts operating within the approved limits and showing good fluctuations. (b) Special Mention (Any one or more of the following): o Currently up to date but objective evidence suggests that certain factors could in the future affect the borrowers ability to service the loan properly or impair the collateral; o Inadequate credit documentation to support borrowings or other deviation from prudent lending practices; o Loan repayments in arrears, for between 30 90 days and/or non-compliance with other terms of the loan; o Collateral not fully in place or loan up-to-date but inadequately secured; o Overdraft exceeds the approved limit for short periods5; o Loans that could deteriorate because of market conditions affecting the sector; o Rescheduled or refinanced loans that are up-to-date and adequately secured, for a minimum of 1 year after scheduling. (c) Substandard (Any one or more of the following): o Well defined credit weakness e.g. borrowers cash flow insufficient to service the debt as arranged, several renewals with capitalization or interest; o Loans at least 90 days and more in arrears (non-performing loans); o Primary source of repayment insufficient to service debt and bank has to look at secondary sources, such as collateral or refinancing, for repayment; o Adequately secured6 overdraft, continuously in excess of the approved limit; o Adequately secured overdraft, with a hardcore7 and fluctuations which do not conform to the business cycle; o Portion of doubtful debt that is fully secured; o Non-performing loans fully secured by Government or Government securities or cash. (d) Doubtful (All the weaknesses of substandard plus any one or more of the following): o Loans at least 180 days in arrears, unless fully secured; o Collection of the debt in full, highly probable; o Possibility of loss, but some factors exist which could improve the situation;

This will be based on specifics of the financial institution and the overdraft facility but the period should be withinoneyear. Adequatelysecuredmeansthatthesecuritypledgedissufficienttoprotectthefinancialinstitutionfromloss ofprincipalandinterestfollowingdisposalinaforcedsalesituation. Overdraftwithahardcoreisthatleveloftheoverdraftborrowingthatitdoesnotfallbelow.

o Overdraft continuously in excess of limit, minimum activity in the account and security insufficient to cover outstandings. (e) Loss (Any one or more of the following): o Loans considered uncollectible; o Loans at least 365 days in arrears unless fully secured; o Loans which may have some recovery value but it is neither practical nor desirable to defer write-off. 4. Provisioning Guidelines Generally accepted accounting practices require that loans be recognized as impaired and the necessary provisions be made thereto if collection on all amounts due is unlikely and or other weaknesses are observed in the loan, according to the contractual terms of the loan agreement. Loan loss provisioning is thus a method used to recognize a reduction in the book value of loans. A specific provision for loan losses should be given for all classified credit, using the percentages provided below. This represents a minimum provision assigned to each of the loan classification categories, following the annual review of the loan portfolio. The following minimum levels of provisions are provided for use for St. Vincent and the Grenadines international banks: -Classification Pass Special Mention Substandard (Loans and advances Government securities or by cash) Substandard (Other) Doubtful Loss Level of Provision 0% 0% 0% 10% 50% 100%

fully

secured

by

Unclassified Credit In addition a 1% general provision should be provided for the percentage of the portfolio not reviewed to cover losses that are known to exist but cant be directly addressed to individual loans. Reporting of Classification and Provisioning (1) As mentioned previously, loan classification reviews should be conducted by the licensees at least annually based on the financial year. (2) A list of all classified facilities should be reported by each licensee to the Authority on the attached Bank Return, Annual (Financial Year) Classification of Loans and Advances.

5

5. Treatment of Interest on Loans Loans and other interest bearing assets on which principal and interest payments are being made according to the scheduled terms, may be reported on an accrual basis in the absence of facts and circumstances suggesting otherwise. Interest should not be accrued on loans classified as non-performing unless such loans are adequately secured and full collection is expected within three months. Neither should interest be accrued on overdrafts when the approved limit has been reached and/or when credits to the account are insufficient to cover interest accruals for at least a three-month period. Interest on loans collateralized by Government securities or by cash, would continue to accrue interest up to the limit of the guarantee or up to the market value of the collateral. Whenever a loan or other interest-bearing asset is placed on non-accrual status, all accrued and unpaid interest is to be reversed from income. Subsequent payments or collections received by the licensee shall be applied first to principal and then to loan interest due even if a balloon8 loan. A non-accrual loan may be restored to accrual status only when all arrears of principal and interest have been paid or when it otherwise becomes well secured and is in the process of collection. In addition, payment performance should be sustained for a reasonable time after the loan repayments have been brought up to date. In the case of overdrafts, accrual status is restored when the account is operating within the limit and all interest arrears have been cleared or when it otherwise becomes well secured and is in the process of collection. Accrued, uncollected interest should be reflected in an interest in suspense account on the balance sheet.

A long term loan that has one large payment, the balloon payment which is due upon maturity; interest paymentsaremadeoverthelifeoftheloan.

Capitalization of Interest (1) Capitalization of interest shall be permitted only when the borrower has the ability to repay the loan or other obligation in the normal course of business. A decision to capitalize interest on a particular loan or other interest-bearing asset for accounting purposes must be based primarily upon the credit-worthiness of the borrower, including an evaluation of a variety of credit-related factors. For overdrafts and other credit facilities without pre-established repayment terms where interest is typically capitalized to the account, deposits to the account during the interest period shall be sufficient to cover interest for that period. (2) The capitalization of interest on loans or other adversely classified assets is not permitted. (3) Interest which has been inappropriately capitalized shall be reversed immediately. (4) Loans shall not be granted solely for the purpose of paying outstanding interest. Write off Procedures Loans must be written off to a memorandum account, three months after being classified as a loss. 6. Treatment of Restructured Loans Loans should only be refinanced under the following conditions: o The borrower has the ability to service the loan on time and in full under the revised terms and conditions. o Loans classified doubtful or loss (for less than 3 months) should not be renegotiated unless an upfront cash payment is made or there is an improvement in the security taken. o Commercial loans should not be renegotiated more than twice over the life of the original loan and mortgage and personal loans not more than twice in a five year period. o Renegotiated loans should not be reclassified upward for at least one year following the new arrangements. o Restructured non performing loans should not be classified as Pass for a minimum of six months following modification of the credit agreement. o The security for renegotiated loans inclusive of capitalized interest should cover the full amount of the renegotiated loan.

St. Vincent and the Grenadines International Financial Services Authority International Banks Act Chapter 99, of the Revised Laws of Saint Vincent and the Grenadines, 2009 ANNUAL (FINANCIAL YEAR) CLASSIFICATION OF LOAN ADVANCES9

NAME OF BANK: __________________________________________________________ YEAR ENDING ________________ USD$000s CLASSIFICATION Pass Special Mention Substandard Doubtful Loss TOTAL NO. OF ACCOUNTS AMOUNT STANDING LOAN LOSS PROVISION $

ITEM Recoveries Charge-offs Rescheduled Loans

NO. OF ACCOUNTS

AMOUNT $

General Loan Loss Provisions Specific Loan Loss Provision

*TOTAL

These items should coincide with items 13, 5, 5.1-5.3 (a) and (b) on the Form IBS/1 for the corresponding reporting period and be at least equal to the provision made in the audited financial statements.

Tobesubmittedthree(3)monthsaftertheendofthefinancialyear

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- COPYRIGHT FRANCE ® U3S61B7 - Logo - Logan's Corporation LTDDokument1 SeiteCOPYRIGHT FRANCE ® U3S61B7 - Logo - Logan's Corporation LTDLogan's LtdNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Logan's LTD 5832Dokument1 SeiteLogan's LTD 5832Logan's LtdNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Reviewing The OECD Harmful Tax Initiative: The St. Vincent and The Grenadines Perspective by Louise MitchellDokument16 SeitenReviewing The OECD Harmful Tax Initiative: The St. Vincent and The Grenadines Perspective by Louise MitchellLogan's LtdNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- 15th January, 2003 - Introduction To The Offshore Insurance Sector SVG Insurance Sector - Author Grenville A. John, Commissioner of Int'l InsuranceDokument3 Seiten15th January, 2003 - Introduction To The Offshore Insurance Sector SVG Insurance Sector - Author Grenville A. John, Commissioner of Int'l InsuranceLogan's LtdNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Mark ZuckerbergDokument1 SeiteMark ZuckerbergLogan's LtdNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- 24th May 2002 - USA Patriot Act Author Louise MitchellDokument5 Seiten24th May 2002 - USA Patriot Act Author Louise MitchellLogan's LtdNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Logan's LTDDokument1 SeiteLogan's LTDLogan's LtdNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Logan's LTD 1936Dokument1 SeiteLogan's LTD 1936Logan's LtdNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Logan's LTD 195Dokument1 SeiteLogan's LTD 195Logan's LtdNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Logan's LimitedDokument1 SeiteLogan's LimitedLogan's LtdNoch keine Bewertungen

- 8th April 2003 - Anti-Money Laundering Training Seminar For Prosecutors, Public Legal Attorney General's Speech - Author AG Judith Jones-MorganDokument5 Seiten8th April 2003 - Anti-Money Laundering Training Seminar For Prosecutors, Public Legal Attorney General's Speech - Author AG Judith Jones-MorganLogan's LtdNoch keine Bewertungen

- 7th September 2005 - Do Offshore Financial Centres Still Offer Confidentiality Offshore Confidentiality - Author Louise MitchellDokument10 Seiten7th September 2005 - Do Offshore Financial Centres Still Offer Confidentiality Offshore Confidentiality - Author Louise MitchellLogan's LtdNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- United Nations Anti-Terrorism Measures Act 2002Dokument16 SeitenUnited Nations Anti-Terrorism Measures Act 2002Logan's LtdNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Amendment To Proceeds of Crime and Money Laundering (Prevention) ActDokument14 SeitenAmendment To Proceeds of Crime and Money Laundering (Prevention) ActLogan's LtdNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- St. Vincent Building and Loan Assoc. Rules 2000Dokument48 SeitenSt. Vincent Building and Loan Assoc. Rules 2000Logan's LtdNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Capital Adequcay GuidelinesDokument5 SeitenCapital Adequcay GuidelinesRavi Shanker PandeyNoch keine Bewertungen

- Registered Agent and Trustee License Application - Schedule ADokument2 SeitenRegistered Agent and Trustee License Application - Schedule ALogan's LtdNoch keine Bewertungen

- Statement of Guidance Large ExposuresDokument3 SeitenStatement of Guidance Large ExposuresLogan's LtdNoch keine Bewertungen

- Registered Agent & Trustee Licensing Statutory Rules and Orders 1996Dokument26 SeitenRegistered Agent & Trustee Licensing Statutory Rules and Orders 1996Logan's LtdNoch keine Bewertungen

- Registered Agent & Trustee Licensing Amendments 1996 & 2004Dokument5 SeitenRegistered Agent & Trustee Licensing Amendments 1996 & 2004Logan's LtdNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Proceeds of Crime (Money Laundering) Regulations 2002Dokument14 SeitenProceeds of Crime (Money Laundering) Regulations 2002Logan's LtdNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Registered Agent & Trustee Licensing Act Chapter 105 of The Revised Laws of Saint Vincent and The Grenadines, 2009Dokument21 SeitenRegistered Agent & Trustee Licensing Act Chapter 105 of The Revised Laws of Saint Vincent and The Grenadines, 2009Logan's LtdNoch keine Bewertungen

- Personal Questionnaire - Registered Agent & Trustee License ApplicationDokument5 SeitenPersonal Questionnaire - Registered Agent & Trustee License ApplicationLogan's LtdNoch keine Bewertungen

- Registered Agent & Trustee License ApplicationDokument7 SeitenRegistered Agent & Trustee License ApplicationLogan's LtdNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Proceeds of Crime (Amendment) Regulations 2002Dokument2 SeitenProceeds of Crime (Amendment) Regulations 2002Logan's LtdNoch keine Bewertungen

- Mutual Funds Checklist Jan-2012Dokument7 SeitenMutual Funds Checklist Jan-2012Logan's LtdNoch keine Bewertungen

- Proceeds of Crime and Money Laundering (Prevention) Act 2001Dokument90 SeitenProceeds of Crime and Money Laundering (Prevention) Act 2001Logan's LtdNoch keine Bewertungen

- Personal Questionnaire - International Banking License ApplicationDokument5 SeitenPersonal Questionnaire - International Banking License ApplicationLogan's LtdNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Mutual Funds Regulations 1999Dokument89 SeitenMutual Funds Regulations 1999Logan's LtdNoch keine Bewertungen

- Fee Information Document: Service Fee General Account ServicesDokument7 SeitenFee Information Document: Service Fee General Account ServicesAndreea SaftaNoch keine Bewertungen

- Credit Card StatementDokument4 SeitenCredit Card Statementsaeed shamiNoch keine Bewertungen

- 13 Overdraft SchemeDokument17 Seiten13 Overdraft SchemeShaurya SinghNoch keine Bewertungen

- Wells Fargo Combined Statement of AccountsDokument6 SeitenWells Fargo Combined Statement of AccountsTheNoch keine Bewertungen

- In Re Clifton J SpearsDokument9 SeitenIn Re Clifton J SpearswstNoch keine Bewertungen

- A Comparative Study of Recruitment Process Between HDFC Bank and Sbi Bank at Moradabad RegionDokument86 SeitenA Comparative Study of Recruitment Process Between HDFC Bank and Sbi Bank at Moradabad RegionbuddysmbdNoch keine Bewertungen

- MetaBank Deposit Account AgreementDokument31 SeitenMetaBank Deposit Account AgreementNarcara HarvilleNoch keine Bewertungen

- Standard Charted - SaadiqDokument16 SeitenStandard Charted - SaadiqkirshanlalNoch keine Bewertungen

- Indian Banking SystemDokument67 SeitenIndian Banking SystemTejas MakwanaNoch keine Bewertungen

- RAKBANK Credit Cards Terms & Conditions SummaryDokument52 SeitenRAKBANK Credit Cards Terms & Conditions SummaryRome AdolNoch keine Bewertungen

- Bank Appeal LetterDokument2 SeitenBank Appeal LetterCorvette Vittorio Vendetto50% (4)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Board Resolution For Opening Bank AccountDokument2 SeitenBoard Resolution For Opening Bank Accountnrlegal75% (4)

- Bank Reconciliation Statement NumericalDokument6 SeitenBank Reconciliation Statement NumericalTejas RajNoch keine Bewertungen

- Basic Instructions For A Bank Reconciliation StatementDokument4 SeitenBasic Instructions For A Bank Reconciliation StatementMary100% (14)

- Bank Reconciliation StatementsDokument6 SeitenBank Reconciliation StatementsTawanda Tatenda Herbert0% (1)

- Vaishnavi Dandekar - Financial Performance Commercial BankDokument67 SeitenVaishnavi Dandekar - Financial Performance Commercial BankMitesh Prajapati 7765Noch keine Bewertungen

- Barclays Bank statement transactionsDokument4 SeitenBarclays Bank statement transactionsAli RAZA100% (1)

- Knecht vs. United Cigarette CorpDokument17 SeitenKnecht vs. United Cigarette CorpVern Villarica CastilloNoch keine Bewertungen

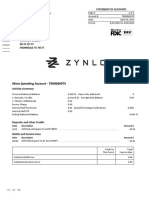

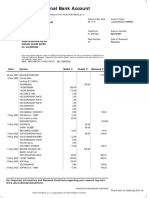

- Zynlo Bank April 2023 Statement for Account 7000060975Dokument2 SeitenZynlo Bank April 2023 Statement for Account 7000060975mrs merle westonNoch keine Bewertungen

- DH 0222Dokument14 SeitenDH 0222The Delphos HeraldNoch keine Bewertungen

- Check, DefinedDokument17 SeitenCheck, DefinedMykee NavalNoch keine Bewertungen

- Business Studies Finance and Accounting Unit 5 Chapter 26Dokument38 SeitenBusiness Studies Finance and Accounting Unit 5 Chapter 26Krishna Das ShresthaNoch keine Bewertungen

- Standard Accounts: IntroducingDokument24 SeitenStandard Accounts: IntroducingsathishNoch keine Bewertungen

- View Your Credit Union Account StatementDokument5 SeitenView Your Credit Union Account StatementZheng YangNoch keine Bewertungen

- Bank Reconciliation StatementDokument3 SeitenBank Reconciliation StatementZoie JulienNoch keine Bewertungen

- Entoto polytechnic savings plan moduleDokument13 SeitenEntoto polytechnic savings plan moduleembiale ayaluNoch keine Bewertungen

- Indian Overseas Bank ..BranchDokument6 SeitenIndian Overseas Bank ..Branchanwarali1975Noch keine Bewertungen

- Wells Fargo Everyday Checking: Important Account InformationDokument3 SeitenWells Fargo Everyday Checking: Important Account Informationbreanne100% (3)

- 2nd August 2022Dokument8 Seiten2nd August 2022Lucas PaixaoNoch keine Bewertungen

- Plastic MoneyDokument13 SeitenPlastic MoneyMaliha IrshadNoch keine Bewertungen

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (82)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouVon EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouNoch keine Bewertungen

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- Sacred Success: A Course in Financial MiraclesVon EverandSacred Success: A Course in Financial MiraclesBewertung: 5 von 5 Sternen5/5 (15)