Beruflich Dokumente

Kultur Dokumente

Insurance Subrogation Case Doctrines

Hochgeladen von

Cari Mangalindan MacaalayCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Insurance Subrogation Case Doctrines

Hochgeladen von

Cari Mangalindan MacaalayCopyright:

Verfügbare Formate

INSURANCE - SUBROGATION Coastwise vs CA F: Molasses were to be shipped, and it arrived in bad condition.

Insurer then paid the consignee its claim of P700,000, then insurer sued the carrier. H: Payment by the insurer to the insured operated as an equitable assignment to the former of all remedies which the latter may have against the third party whose negligence or wrongful act caused the loss. The right of subrogation is not dependent upon, nor does it grow out of, any private of contract or upon written assignment of, claim. Maglana vs Consolacion (same doctrine as Malayan below) Cebu Shipyard vs William Lines (same doctrine as Coastwise vs CA above) Pioneer Insurance vs CA F: Lim (insured) bought aircrafts from JDA (payable in installments). Pioneer (insurer) is its surety in its acquisition of aircrafts. Pioneer then had its surety contract reinsured with another insurance company. Upon default, the reinsurer paid Pioneer. H: A reinsurer, on payment of a loss acquires the same rights by subrogation as are acquired in similar cases where the original insurer pays a loss. In this case, Pioneer has no more cause of action against Lim because the reinsurer is subrogated to the rights of Pioneer (insurer) upon payment to Pioneer its claims. Manila Mahogany vs CA F: Insureds car got into an acceded with a San Miguel truck. Insurer paid insureds claim. Insurer then sued San Miguel. Defense of San Miguel: it paid the insured P4,500 and insured executed release of claim in favor of San Miguel. H: should the insured, after receiving payment from the insurer, release the wrongdoer who caused the loss, the insurer loses his rights against the latter. But in such a case, the insurer will be entitled to recover from the insured whatever it has paid to the latter, unless the release was made with the consent of the insurer

Firemans Fund vs Jamila (same doctrine as Coastwise vs CA above) Philamgen vs CA F: Coca-Cola (insured) loaded cases of coke bottled on a vessel owned by Felman. The vessel sank. Philamgen (insurer) paid coke P744,250, then sued Felman. Defense of Felman: the insured breached implied warranty when it stated that ship is seaworthy, when in fact it was not.

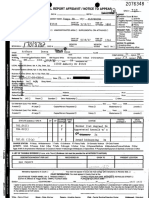

H: Even if the insured breached the implied warranty in the insurance policy that the ship is seaworthy, once the insurer pays the insured, the right of subrogation attaches in favor of the insurer. St. Paul Fire & Marine Insurance vs Macondray F: 218 cartons of meds were to be shipped and was insured with St. Paul. Upon arrival, goods were in bad condition. Hence, insurer paid the consignee its $1,134 claim. Insurer in turn sued the insurance company. H: Insurer, as subrogee, can only recover the amount recoverable by the insured from the carrier. Since the contract of carriage (between insured and carrier) limited the liability of the carrier to P500/package, the insurance company can only recover as much. Malayan Insurance Co vs CA F: In this case of collision between a jeep and a bus, the TC held (1) the owner of jeep, (2) employer of jeepney driver and (3) insurer of jeep solidarily liable to the passenger of the bus. H: TC erred in holding the insurer solidarily liable with the tortfeasors. Solidarily liability means that the entire obligation can be enforced against any of those adjudged which is contrary to the nature of insurance. Fedex vs CA F: Cartons were shipped from US to Mla. Upon arrival, they were in bad condition. Hence, insurer paid the consignee its claim of $39,339. Insurer then sued Fedex, the carrier. H: Insurer cannot recover from carrier Fedex because right of action was barred because neither the insured, nor the insurer filed a written notice/complaint within the period required in the Airway Bill. Lorenzo Shipping vs Chubb & Sons, Inc. F: Steel pipes were to be shipped. Upon arrival, they were in bad condition, hence insurer paid the claim of the consignee of $104,151. Insurer then sued the carrier. Defense of carrier: insurance company is foreign, therefore no capacity to sue as they are not allowed to do business in the Phils. H: While foreign companies are prohibited to maintain actions in Courts, they are not prohibited from doing single acts of business. Hence, they have cause of action in this case arising from 1 insurance policy. FGU vs CA (supra no mention of subrogation here)

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Broker AgreementDokument1 SeiteBroker AgreementCari Mangalindan MacaalayNoch keine Bewertungen

- Broker AgreementDokument1 SeiteBroker AgreementCari Mangalindan MacaalayNoch keine Bewertungen

- Kraft Box Supplier'sDokument4 SeitenKraft Box Supplier'sCari Mangalindan MacaalayNoch keine Bewertungen

- DMCI租赁经纪人合作协议 BROKERS AGREEMENT PDFDokument3 SeitenDMCI租赁经纪人合作协议 BROKERS AGREEMENT PDFlei wangNoch keine Bewertungen

- Aztala - Sales Agency Agreement v09Dokument3 SeitenAztala - Sales Agency Agreement v09ManoyNoch keine Bewertungen

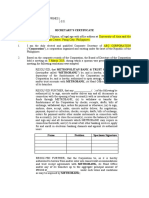

- Sample Sec CertDokument3 SeitenSample Sec CertCari Mangalindan MacaalayNoch keine Bewertungen

- Broker AgreementDokument4 SeitenBroker AgreementCari Mangalindan MacaalayNoch keine Bewertungen

- GSIS Loss of Title CaseDokument5 SeitenGSIS Loss of Title CaseCari Mangalindan MacaalayNoch keine Bewertungen

- Reissuance 2Dokument51 SeitenReissuance 2Cari Mangalindan MacaalayNoch keine Bewertungen

- Rural Bank v. CADokument6 SeitenRural Bank v. CACari Mangalindan MacaalayNoch keine Bewertungen

- Jimmy CoDokument5 SeitenJimmy CoCari Mangalindan MacaalayNoch keine Bewertungen

- Lopez v. Pan American World (1966)Dokument4 SeitenLopez v. Pan American World (1966)Cari Mangalindan MacaalayNoch keine Bewertungen

- Share Tweet: Like 0Dokument16 SeitenShare Tweet: Like 0Cari Mangalindan MacaalayNoch keine Bewertungen

- Jarco Marketing Corp v. CADokument11 SeitenJarco Marketing Corp v. CACari Mangalindan MacaalayNoch keine Bewertungen

- Ilocos Norte Electric CompanyDokument5 SeitenIlocos Norte Electric CompanyCari Mangalindan MacaalayNoch keine Bewertungen

- Cruz Vs Gangan - 143403 - January 22, 2003 - J. Panganiban - en BancDokument5 SeitenCruz Vs Gangan - 143403 - January 22, 2003 - J. Panganiban - en BancCari Mangalindan MacaalayNoch keine Bewertungen

- Case Digest - Lirio v. GenoviaDokument11 SeitenCase Digest - Lirio v. GenoviaCari Mangalindan MacaalayNoch keine Bewertungen

- Quasi-Delict PrimerDokument5 SeitenQuasi-Delict PrimerCari Mangalindan MacaalayNoch keine Bewertungen

- Co Unjieng v. Mabalacat SugarDokument4 SeitenCo Unjieng v. Mabalacat SugarCari Mangalindan MacaalayNoch keine Bewertungen

- Custom Search: Today Is Sunday, April 02, 2017Dokument11 SeitenCustom Search: Today Is Sunday, April 02, 2017Cari Mangalindan MacaalayNoch keine Bewertungen

- SEC - Form Foe E-Mail and Mobile NumberDokument4 SeitenSEC - Form Foe E-Mail and Mobile NumberCari Mangalindan MacaalayNoch keine Bewertungen

- Cristostomo v. CA (25 August 2003) - Missing PlaneDokument6 SeitenCristostomo v. CA (25 August 2003) - Missing PlaneCari Mangalindan MacaalayNoch keine Bewertungen

- Reconstitution 1Dokument26 SeitenReconstitution 1Cari Mangalindan MacaalayNoch keine Bewertungen

- Car Plan AgreementDokument4 SeitenCar Plan AgreementAdoniz Tabucal67% (12)

- Canlas v. CA (2000)Dokument7 SeitenCanlas v. CA (2000)Cari Mangalindan MacaalayNoch keine Bewertungen

- G.R. NoDokument6 SeitenG.R. NoCari Mangalindan MacaalayNoch keine Bewertungen

- Tanongon Vs Samson - 140889 - May 9, 2002 - JDokument6 SeitenTanongon Vs Samson - 140889 - May 9, 2002 - JCari Mangalindan MacaalayNoch keine Bewertungen

- Emmanuel Concepcion, Et AlDokument16 SeitenEmmanuel Concepcion, Et AlCari Mangalindan MacaalayNoch keine Bewertungen

- Caja Vs Nanquil - AM P-04-1885 - September 13, 2004 - JDokument15 SeitenCaja Vs Nanquil - AM P-04-1885 - September 13, 2004 - JCari Mangalindan MacaalayNoch keine Bewertungen

- Bun v. CA (Tortious Intreference)Dokument5 SeitenBun v. CA (Tortious Intreference)Cari Mangalindan MacaalayNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Serapio V. Sandiganbayan G.R. No. 148468 JANUARY 28, 2003 FactsDokument2 SeitenSerapio V. Sandiganbayan G.R. No. 148468 JANUARY 28, 2003 FactsVener MargalloNoch keine Bewertungen

- 83 Order Finding Eric C. Blue in Contempt of Court and Requiring Turnover of Financial Records PDFDokument4 Seiten83 Order Finding Eric C. Blue in Contempt of Court and Requiring Turnover of Financial Records PDFEric GreenNoch keine Bewertungen

- In Order To Prove The Existence or Non-Existence of The Facts in IssueDokument3 SeitenIn Order To Prove The Existence or Non-Existence of The Facts in IssueChandan SinghNoch keine Bewertungen

- 6 Lege Guide SS17 Property RightsDokument2 Seiten6 Lege Guide SS17 Property RightsTPPFNoch keine Bewertungen

- Vi Sem-Ba Pol Sc-Core Course-Modern Political ThoughtDokument66 SeitenVi Sem-Ba Pol Sc-Core Course-Modern Political Thoughtvishal rajputNoch keine Bewertungen

- Ames True Temper v. G-Force BrandsDokument12 SeitenAmes True Temper v. G-Force BrandsPriorSmartNoch keine Bewertungen

- Criminal Report Affidavit Filed E7c6b25f 4ac7 48ed b42c 591521945d01Dokument4 SeitenCriminal Report Affidavit Filed E7c6b25f 4ac7 48ed b42c 591521945d01Jessica McBrideNoch keine Bewertungen

- Portfolio Artifact 2 Teachers Rights and ResponsibilitiesDokument6 SeitenPortfolio Artifact 2 Teachers Rights and Responsibilitiesapi-465708421Noch keine Bewertungen

- Roluna: Marlon T. Bacerra vs. People of The Philippines (G.R. No. 204544, July 3, 2017)Dokument4 SeitenRoluna: Marlon T. Bacerra vs. People of The Philippines (G.R. No. 204544, July 3, 2017)Krisleen AbrenicaNoch keine Bewertungen

- Durable Power Attorney FormDokument4 SeitenDurable Power Attorney FormRichNoch keine Bewertungen

- Complaint: Regional Trial CourtDokument13 SeitenComplaint: Regional Trial CourtJuris Pasion100% (2)

- National Oilwell Varco v. Omron Oilfield & MarineDokument4 SeitenNational Oilwell Varco v. Omron Oilfield & MarinePriorSmartNoch keine Bewertungen

- Presidential Decree No. 2018Dokument2 SeitenPresidential Decree No. 2018Xtine CampuPotNoch keine Bewertungen

- The Individual and The LawDokument5 SeitenThe Individual and The LawnimritNoch keine Bewertungen

- Joanna Rea - Child Labour (Development Education Unit)Dokument47 SeitenJoanna Rea - Child Labour (Development Education Unit)Radwan Ahmet0% (1)

- CARLODokument1 SeiteCARLOCarlo YambaoNoch keine Bewertungen

- Illinois Computer Research, LLC v. Google Inc. - Document No. 127Dokument5 SeitenIllinois Computer Research, LLC v. Google Inc. - Document No. 127Justia.comNoch keine Bewertungen

- William Turner Johnson, Jr. v. John Mueller, Superintendent, Newport News Virginia City Prison Farm, Alton Talbot, Officer Hollis, John Epling, and Nicholas Spanos, 415 F.2d 354, 4th Cir. (1969)Dokument2 SeitenWilliam Turner Johnson, Jr. v. John Mueller, Superintendent, Newport News Virginia City Prison Farm, Alton Talbot, Officer Hollis, John Epling, and Nicholas Spanos, 415 F.2d 354, 4th Cir. (1969)Scribd Government DocsNoch keine Bewertungen

- How and Associates, Inc. V BossDokument2 SeitenHow and Associates, Inc. V BossTrxc MagsinoNoch keine Bewertungen

- Ombudsman Vs DionisioDokument3 SeitenOmbudsman Vs DionisioMaria Recheille Banac KinazoNoch keine Bewertungen

- Heirs of Reganon v. Imperial - G.R. No. L-24434Dokument3 SeitenHeirs of Reganon v. Imperial - G.R. No. L-24434Ann ChanNoch keine Bewertungen

- West Philippine Sea RulingDokument2 SeitenWest Philippine Sea RulingNoreenNoch keine Bewertungen

- Horizon Trial: Witness Statement in Support of Recusal ApplicationDokument12 SeitenHorizon Trial: Witness Statement in Support of Recusal ApplicationNick Wallis100% (1)

- Egle-Aqd-year in Review 2019 686094 7Dokument6 SeitenEgle-Aqd-year in Review 2019 686094 7WDIV/ClickOnDetroitNoch keine Bewertungen

- Baker & McKenzie Attorney, Martin Weisberg, Who Was IEAM's Securities Counsel, Was Indicted 5/27/08Dokument7 SeitenBaker & McKenzie Attorney, Martin Weisberg, Who Was IEAM's Securities Counsel, Was Indicted 5/27/08ValueSearcher70Noch keine Bewertungen

- De La Vina Vs Villareal To Banez Vs BanezDokument7 SeitenDe La Vina Vs Villareal To Banez Vs BanezFrancis Laurence Jake AmodiaNoch keine Bewertungen

- What Is Victimology?: Q.1 Explain The Historical Development of Victimology?Dokument2 SeitenWhat Is Victimology?: Q.1 Explain The Historical Development of Victimology?ankita jain100% (2)

- Unit 2 - Hints On Answering Problem Questions in CAPE LawDokument2 SeitenUnit 2 - Hints On Answering Problem Questions in CAPE LawDaniella Phillip100% (5)

- Report Writing: A RGT PresentationDokument40 SeitenReport Writing: A RGT PresentationMANICANoch keine Bewertungen

- Digest - Re Decision Dated March 17. 2011 in Criminal Case No. SB-28631, People of The Philippines Former Prosecutor Joselito BarrozoDokument2 SeitenDigest - Re Decision Dated March 17. 2011 in Criminal Case No. SB-28631, People of The Philippines Former Prosecutor Joselito BarrozoCourtney TirolNoch keine Bewertungen