Beruflich Dokumente

Kultur Dokumente

CIR V John Gotamco

Hochgeladen von

Karenliambrycejego RagragioOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CIR V John Gotamco

Hochgeladen von

Karenliambrycejego RagragioCopyright:

Verfügbare Formate

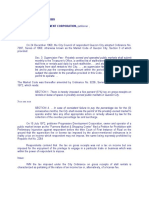

CIR v. John Gotamco P: Yap, J. COMMISSIONER OF INTERNAL REVENUE, petitioner, vs. JOHN GOTAMCO & SONS, INC.

and THE COURT OF TAX APPEALS, respondents.

Facts: The World Health Organization (WHO), an international organization exempt from all direct and indirect taxes under its Host Agreement with the Philippine Government concluded on July 22, 1951, decided to have a building constructed to house its offices in the Philippines. Pursuant to this, it entered into an additional agreement with the Philippines government, and part of the agreement granted the WHO permission to import into the country materials and fixtures required for the construction free from all duties and taxes and stipulated that the WHO was not to utilize any portion of the international reserves of the Government. The construction contract was awarded to respondent John Gotamco & Sons, Inc. (Gotamco for short) on February 10, 1958 for the stipulated price of P370,000.00, but when the building was completed the price reached a total of P452,544.00. In May 1958, the BIR released an opinion that the receipts of Gotamco derived from the construction of the WHO office building was exempt under the 1951 Host Agreement. In June of that year, however, the BIR reversed its opinion and claimed that the 3% contractor's tax was in the nature of an excise tax, which is a charge imposed upon the performance of an act, the enjoyment of a privilege or the engaging in an occupation. The BIR claimed that the contractors tax is not a direct nor an indirect tax on the WHO, but a tax that is primarily due from the contractor, and was thus not exempted. On January 2, 1960, the WHO issued a certification reiterating the prior opinion of the BIR in exempting the construction from any tax, and asserted that their construction contract with Gotamco should be exempted. Nevertheless, the BIR sent Gotamco a demand letter on January 17, 1961 for P 16,970.40, representing the 3% contractor's tax plus surcharges. On appeal, the Court of Tax Appeals rendered a decision reversing the CIR decision and ruled in favor of Gotamco.

Issues (relevant to tax): Is the contractors tax an excise tax payable by the contractor alone, and not a direct/indirect tax on the WHO?

Held/Ratio: No, the contractors tax is not an excise tax. Although the contractors tax is paid by the contractor, it is a burden that can be shifted to WHO as a matter of business practice. An indirect tax is defined as a tax demanded in the first instance from one person in the expectation and intention that he can shift the burden to someone else. This is exactly how the contractors tax operates. Being thus exempt from direct and indirect taxes under the Host Agreement, the construction contract should thus be exempt from taxes. The petitioners reliance on Philippine Acetylene Company versus Commissioner of Internal Revenue, et al. is misplaced. In that case, the tax in question was a sales tax, which by law must be paid specifically by the manufacturer or the producer. Even if the manufacturer or producer adds the value of the tax to the sale price, such addition does not convert the sales tax into a tax on the purchaser. It is therefore not analogous to a contractors tax.

Disposition: Petition is DISMISSED, decision appealed from is AFFIRMED

Das könnte Ihnen auch gefallen

- 10 - Over The Top Player EU PDFDokument137 Seiten10 - Over The Top Player EU PDFVicky Cornella SNoch keine Bewertungen

- Case 59 CS Garments Vs CirDokument3 SeitenCase 59 CS Garments Vs CirJulian Guevarra0% (1)

- SAMPLE Motion To Expunge With Motion To ResolveDokument5 SeitenSAMPLE Motion To Expunge With Motion To ResolveKarenliambrycejego RagragioNoch keine Bewertungen

- Ing Bank v. CIR / G.R. No. 167679 / July 22, 2015Dokument1 SeiteIng Bank v. CIR / G.R. No. 167679 / July 22, 2015Mini U. Soriano100% (1)

- CIR v. Tours Specialist Inc.Dokument2 SeitenCIR v. Tours Specialist Inc.Gyrsyl Jaisa GuerreroNoch keine Bewertungen

- Sec of Finance v. LazatinDokument10 SeitenSec of Finance v. Lazatinana abayaNoch keine Bewertungen

- Smart Communications, Inc. v. City of DavaoDokument3 SeitenSmart Communications, Inc. v. City of DavaoluckyNoch keine Bewertungen

- Strategic Assignment FullDokument50 SeitenStrategic Assignment FullFitriana AnnisaNoch keine Bewertungen

- 67 CIR V Procter GambleDokument2 Seiten67 CIR V Procter GambleNaomi QuimpoNoch keine Bewertungen

- Republic vs. Salud v. HizonDokument2 SeitenRepublic vs. Salud v. HizonGyelamagne EstradaNoch keine Bewertungen

- TAX DigestDokument18 SeitenTAX DigestBerna BadongenNoch keine Bewertungen

- ITAD Ruling No 018-09Dokument11 SeitenITAD Ruling No 018-09Peggy SalazarNoch keine Bewertungen

- Caltex Vs CoaDokument1 SeiteCaltex Vs CoaAnonymous 5MiN6I78I0Noch keine Bewertungen

- CIR v. Arnoldus CarpentryDokument2 SeitenCIR v. Arnoldus CarpentryJakie CruzNoch keine Bewertungen

- CM Hoskins DigestDokument2 SeitenCM Hoskins DigestkarlonovNoch keine Bewertungen

- Misamis Oriental Vs CEPALCO, 181 SCRA 38Dokument2 SeitenMisamis Oriental Vs CEPALCO, 181 SCRA 38Ron LaurelNoch keine Bewertungen

- Marubeni Corp V CirDokument3 SeitenMarubeni Corp V CirTintin CoNoch keine Bewertungen

- Ledger Ledger On The Wall - Presentation-V4Dokument38 SeitenLedger Ledger On The Wall - Presentation-V4Hans KolbeNoch keine Bewertungen

- Commissioner of Internal Revenue vs. MarubeniDokument1 SeiteCommissioner of Internal Revenue vs. Marubenimwaike100% (1)

- Tax-Digest 1-5Dokument16 SeitenTax-Digest 1-5Royalhighness18Noch keine Bewertungen

- CIR V Toledo (2015)Dokument2 SeitenCIR V Toledo (2015)Anonymous bOncqbp8yiNoch keine Bewertungen

- Questionnaire Consumer Perception On Online ShoppingDokument5 SeitenQuestionnaire Consumer Perception On Online Shoppingrkpreethi75% (8)

- CD - 81. Allied Banking v. Quezon CityDokument2 SeitenCD - 81. Allied Banking v. Quezon CityCzarina CidNoch keine Bewertungen

- 3-Cir VS LealDokument3 Seiten3-Cir VS LealRenEleponioNoch keine Bewertungen

- Garrison v. CADokument5 SeitenGarrison v. CAMuslimeenSalamNoch keine Bewertungen

- Ing N.V. Metro Manila Branch Vs Cir DigestDokument2 SeitenIng N.V. Metro Manila Branch Vs Cir Digestbrian jay hernandezNoch keine Bewertungen

- CIR Vs Enron SubicDokument2 SeitenCIR Vs Enron SubicArnold JoseNoch keine Bewertungen

- TASK 2 - BSBMGT517 Manage Operational Plan TASK 2 - BSBMGT517 Manage Operational PlanDokument14 SeitenTASK 2 - BSBMGT517 Manage Operational Plan TASK 2 - BSBMGT517 Manage Operational PlanVioleta Hoyos Lopez68% (19)

- Introduction For UPSDokument19 SeitenIntroduction For UPSteju_690% (1)

- San Juan vs. CastroDokument2 SeitenSan Juan vs. CastroMyla RodrigoNoch keine Bewertungen

- BIR Ruling (DA-029-08) January 23, 2008Dokument3 SeitenBIR Ruling (DA-029-08) January 23, 2008Sha ShaNoch keine Bewertungen

- Chapter 7 The Aircraft (Ac) and Civil Aviation (Ca) : Applicable LawsDokument9 SeitenChapter 7 The Aircraft (Ac) and Civil Aviation (Ca) : Applicable LawsAurora IbanezNoch keine Bewertungen

- Bim WhitepaperDokument21 SeitenBim WhitepaperpeterhwilliamsNoch keine Bewertungen

- Pepsi Cola vs. Municipality of Tanauan, Leyte (Digest)Dokument2 SeitenPepsi Cola vs. Municipality of Tanauan, Leyte (Digest)Bam BathanNoch keine Bewertungen

- Chevron Vs CIRDokument2 SeitenChevron Vs CIRKim Lorenzo CalatravaNoch keine Bewertungen

- St. Stephen's Association V CIRDokument3 SeitenSt. Stephen's Association V CIRPatricia GonzagaNoch keine Bewertungen

- Caltex V COA DigestDokument2 SeitenCaltex V COA DigestMichael SanchezNoch keine Bewertungen

- Province of Bulacan vs. Court of AppealsDokument1 SeiteProvince of Bulacan vs. Court of AppealsElaine HonradeNoch keine Bewertungen

- PROSPECTIVITY OF LAWS - Commissioner of Internal Revenue vs. AcostaDokument2 SeitenPROSPECTIVITY OF LAWS - Commissioner of Internal Revenue vs. AcostaKath LeenNoch keine Bewertungen

- Commissioner of Internal Revenue Vs The Court of Appeals, The Court of Tax Appeals and Ateneo de Manila UniversityDokument2 SeitenCommissioner of Internal Revenue Vs The Court of Appeals, The Court of Tax Appeals and Ateneo de Manila UniversityRae Angela GarciaNoch keine Bewertungen

- Verification and CNFS - SampleDokument1 SeiteVerification and CNFS - SampleKarenliambrycejego RagragioNoch keine Bewertungen

- CIR v. American Express PHIL. BranchDokument2 SeitenCIR v. American Express PHIL. BranchJaypoll DiazNoch keine Bewertungen

- GROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanDokument4 SeitenGROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanJoatham GenovisNoch keine Bewertungen

- COMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Dokument1 SeiteCOMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Charles Roger Raya100% (1)

- Affidavit of No Relation - SampleDokument1 SeiteAffidavit of No Relation - SampleKarenliambrycejego Ragragio100% (1)

- CIR V Cebu Portland CementDokument4 SeitenCIR V Cebu Portland CementCecille Therese PedregosaNoch keine Bewertungen

- G.R. No. L-36081 April 24, 1989 Progressive Development Corporation, Petitioner, QUEZON CITY, RespondentDokument3 SeitenG.R. No. L-36081 April 24, 1989 Progressive Development Corporation, Petitioner, QUEZON CITY, RespondentMary Anne100% (1)

- Pilmico-Maurifoodcorp Cir Ctano.6151Dokument3 SeitenPilmico-Maurifoodcorp Cir Ctano.6151Nathallie CabalunaNoch keine Bewertungen

- DIGEST Philippine Acetylene V.Dokument2 SeitenDIGEST Philippine Acetylene V.Rhenfacel ManlegroNoch keine Bewertungen

- 14d G.R. No. L-18330 July 31, 1963 de Borja Vs GellaDokument2 Seiten14d G.R. No. L-18330 July 31, 1963 de Borja Vs GellarodolfoverdidajrNoch keine Bewertungen

- 22-TAX-Supreme Transliners v. BPIDokument2 Seiten22-TAX-Supreme Transliners v. BPIGrezyl AmoresNoch keine Bewertungen

- CIR Vs ST Luke S Medical CenterDokument6 SeitenCIR Vs ST Luke S Medical CenterOlan Dave LachicaNoch keine Bewertungen

- 160 Scra 560 (GR L-66838) Cir vs. Procter and GambleDokument37 Seiten160 Scra 560 (GR L-66838) Cir vs. Procter and GambleRuel FernandezNoch keine Bewertungen

- Handouts Lung Center of The Philippines vs. Quezon CityDokument2 SeitenHandouts Lung Center of The Philippines vs. Quezon CityStephNoch keine Bewertungen

- Villanueva Vs City of IloiloDokument7 SeitenVillanueva Vs City of IloilocharmssatellNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Toledo Power Company, 775 SCRA 709, December 02, 2015Dokument52 SeitenCommissioner of Internal Revenue vs. Toledo Power Company, 775 SCRA 709, December 02, 2015Jane BandojaNoch keine Bewertungen

- Case Digests No. 45-52Dokument9 SeitenCase Digests No. 45-52Auvrei MartinNoch keine Bewertungen

- Fisher v. Trinidad G.R. No. L-17518 October 30, 1922Dokument10 SeitenFisher v. Trinidad G.R. No. L-17518 October 30, 1922aNoch keine Bewertungen

- Mun of San Fernando Vs Sta RomanaDokument1 SeiteMun of San Fernando Vs Sta RomanaKara AgliboNoch keine Bewertungen

- CIR v. Vda de PrietoDokument3 SeitenCIR v. Vda de Prietoevelyn b t.Noch keine Bewertungen

- Digest Villanueva vs. City of IloiloDokument2 SeitenDigest Villanueva vs. City of IloiloPrecious AnneNoch keine Bewertungen

- DIAZ and TIMBOL Vs Sec of Finance and CIRDokument2 SeitenDIAZ and TIMBOL Vs Sec of Finance and CIRBrylle Deeiah TumarongNoch keine Bewertungen

- Conwi v. Cir, 213 Scra 83Dokument4 SeitenConwi v. Cir, 213 Scra 83Anonymous iOYkz0wNoch keine Bewertungen

- Case Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasDokument1 SeiteCase Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasAJMordenoNoch keine Bewertungen

- 1 Conwi vs. Commissioner, 213 SCRA 83Dokument7 Seiten1 Conwi vs. Commissioner, 213 SCRA 83Anne Marieline BuenaventuraNoch keine Bewertungen

- 3.G.R. No. 103092Dokument5 Seiten3.G.R. No. 103092Lord AumarNoch keine Bewertungen

- Tax Review Case DigestsDokument10 SeitenTax Review Case DigestsTina MarianoNoch keine Bewertungen

- Case Digest - CIR v. Fitness by Design (Tax II)Dokument1 SeiteCase Digest - CIR v. Fitness by Design (Tax II)Nin BritanucciNoch keine Bewertungen

- CIR Vs Gotamco & Sons GR No. 31092Dokument4 SeitenCIR Vs Gotamco & Sons GR No. 31092Kimberly SendinNoch keine Bewertungen

- Republic of The Philippines Manila First Division: Supreme CourtDokument4 SeitenRepublic of The Philippines Manila First Division: Supreme CourtJil Mei IV100% (1)

- Article - Dismantling 15 July 2020Dokument2 SeitenArticle - Dismantling 15 July 2020Karenliambrycejego RagragioNoch keine Bewertungen

- Article - Kobayashi Maru 03 June 2020Dokument1 SeiteArticle - Kobayashi Maru 03 June 2020Karenliambrycejego RagragioNoch keine Bewertungen

- #6 - All Reelectionist Senators Will Run For Senator AgainDokument2 Seiten#6 - All Reelectionist Senators Will Run For Senator AgainKarenliambrycejego RagragioNoch keine Bewertungen

- Article - Hail To The ChiefDokument1 SeiteArticle - Hail To The ChiefKarenliambrycejego RagragioNoch keine Bewertungen

- Numbers GameDokument2 SeitenNumbers GameKarenliambrycejego RagragioNoch keine Bewertungen

- CS Form No. 32 Oath of OfficeDokument1 SeiteCS Form No. 32 Oath of OfficeKarenliambrycejego RagragioNoch keine Bewertungen

- Unidroit Principles of International Commercial Contracts 2010Dokument3 SeitenUnidroit Principles of International Commercial Contracts 2010Karenliambrycejego RagragioNoch keine Bewertungen

- Principles On Choice of Law in International Commercial Contracts PDFDokument84 SeitenPrinciples On Choice of Law in International Commercial Contracts PDFKarenliambrycejego RagragioNoch keine Bewertungen

- Ireland Soaking Tub Prices September 2017Dokument2 SeitenIreland Soaking Tub Prices September 2017DerekSashaNoch keine Bewertungen

- Brazil Key Player in Beauty and Personal CareDokument45 SeitenBrazil Key Player in Beauty and Personal CaregabrielraoniNoch keine Bewertungen

- Midterm - Chapter 4Dokument78 SeitenMidterm - Chapter 4JoshrylNoch keine Bewertungen

- DRB 2019Dokument261 SeitenDRB 2019Ratna TazulazharNoch keine Bewertungen

- Overview of Ind As 1201Dokument97 SeitenOverview of Ind As 1201vishaljoshi28Noch keine Bewertungen

- Xylia's Xylia's Cup Cup Hunt Hunt: Racing RoyaltyDokument64 SeitenXylia's Xylia's Cup Cup Hunt Hunt: Racing RoyaltyadamdobbinNoch keine Bewertungen

- RetailersDokument11 SeitenRetailersrakshit1230% (1)

- DerivativesDokument16 SeitenDerivativesMukul Kr Singh ChauhanNoch keine Bewertungen

- MANACCDokument22 SeitenMANACCNadine KyrahNoch keine Bewertungen

- Module Name: Assignment Name-INTRODUCTION TO Media and Communication IndustriesDokument8 SeitenModule Name: Assignment Name-INTRODUCTION TO Media and Communication IndustriesAmrita HaldarNoch keine Bewertungen

- L6 (Resources Bank + Handout)Dokument28 SeitenL6 (Resources Bank + Handout)nhiemnguyen8369Noch keine Bewertungen

- Jack Monroe On Twitter - Woke Up This Morning To The RadioDokument9 SeitenJack Monroe On Twitter - Woke Up This Morning To The RadioToni PrugNoch keine Bewertungen

- Building and Managing Successfully Businesses in The Middle EastDokument12 SeitenBuilding and Managing Successfully Businesses in The Middle EastbooksarabiaNoch keine Bewertungen

- Student Online - MDCATDokument1 SeiteStudent Online - MDCATAmna HaniaNoch keine Bewertungen

- MIS Module 1Dokument43 SeitenMIS Module 1Raghavendra.K.ANoch keine Bewertungen

- CRM DouglasDokument14 SeitenCRM Douglasandrescamilo7Noch keine Bewertungen

- Research Paper - Sample SimpleDokument15 SeitenResearch Paper - Sample Simplewarblade_02Noch keine Bewertungen

- 28c4fcase Study On Performance ManagementDokument2 Seiten28c4fcase Study On Performance ManagementRomil Singh80% (5)

- Combinepdf 2Dokument6 SeitenCombinepdf 2saisandeepNoch keine Bewertungen

- Import Export DivisionDokument5 SeitenImport Export DivisionSanskar TiwariNoch keine Bewertungen

- Summer Training Red Project Report CocacolaDokument84 SeitenSummer Training Red Project Report Cocacolagurunathambabu100% (2)

- Three Rivers DC Data Quality StrategyDokument11 SeitenThree Rivers DC Data Quality StrategyJazzd Sy GregorioNoch keine Bewertungen

- Accounting AssmntDokument11 SeitenAccounting AssmntasadNoch keine Bewertungen