Beruflich Dokumente

Kultur Dokumente

1040x2 PDF

Hochgeladen von

olddiggerOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1040x2 PDF

Hochgeladen von

olddiggerCopyright:

Verfügbare Formate

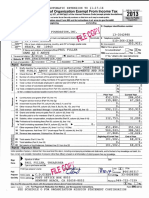

(Rev.

December 2012)

1040X

Form

Amended U.S. Individual Income Tax Return

Information about Form 1040X and its separate instructions is at www.irs.gov/form1040x. 2011

Department of the TreasuryInternal Revenue Service

OMB No. 1545-0074

This return is for calendar year 2012 Other year. Enter one: calendar year

Your first name and initial

or fiscal year (month and year ended):

Last name Your social security number

2010

2009

Paul T.

If a joint return, spouses first name and initial

O'Dowd

Last name

5

5

Apt. no.

5

5

9

8

2

3

6

2

1

5

4

5

9

0

1

9

Spouses social security number Your phone number

Judy

Home address (number and street). If you have a P.O. box, see instructions.

O'Dowd

14965 Guadalupe Drive

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

916 354 1017

Rancho Murieta CA 95683-9428

Foreign country name Foreign province/state/county Foreign postal code

Amended return filing status. You must check one box even if you are not changing your filing status. Caution. In general, you cannot change your filing status from joint to separate returns after the due date.

Single Qualifying widow(er) Married filing jointly Married filing separately Head of household (If the qualifying person is a child but not your dependent, see instructions.)

A. Original amount B. Net change or as previously amount of increase adjusted or (decrease) (see instructions) explain in Part III C. Correct amount

Use Part III on the back to explain any changes Income and Deductions

1 2 3 4 5 6 7 8 9 10 11 12 13 14 Adjusted gross income. If net operating loss (NOL) carryback is included, check here . . . . . . . . . . . . . . . Itemized deductions or standard deduction . . . . . . . . . Subtract line 2 from line 1 . . . . . . . . . . . . . . . Exemptions. If changing, complete Part I on page 2 and enter the amount from line 30 . . . . . . . . . . . . . . . . . Taxable income. Subtract line 4 from line 3 . . . . . . . . . . Tax. Enter method used to figure tax: 6 Credits. If general business credit carryback is included, check here . . . . . . . . . . . . . . . . . . . . . Subtract line 7 from line 6. If the result is zero or less, enter -0- . . . Other taxes . . . . . . . . . . . . . . . . . . . . Total tax. Add lines 8 and 9 . . . . . . . . . . . . . . . Federal income tax withheld and excess social security and tier 1 RRTA tax withheld (if changing, see instructions) . . . . . . . . . . Estimated tax payments, including amount applied from prior years return . . . . . . . . . . . . . . . . . . . . . . Earned income credit (EIC) . . . . . . . . . . . . . . . Refundable credits from Schedule(s) 8812 or M or Form(s) 2439

4136 8885 or 5405 8801 other (specify): 8812 (20092011) 8839 8863

1 2 3 4 5

59,409 14,200 45,209

7,600 37,609

(8165) 0 (8165)

0 (8165)

51,244 14,200 37,044

7,600 29,444

Tax Liability

Table 1,583

(285)

Table 1,298

7 8 9 10

Payments

11 12 13

1583 412 1995

(285) 0 (285)

1298 412 1710

230 2,292

0 (300)

230 1992

14 Total amount paid with request for extension of time to file, tax paid with original return, and additional tax paid after return was filed . . . . . . . . . . . . . . . . . . . . . . . . 16 Total payments. Add lines 11 through 15 . . . . . . . . . . . . . . . . . . . . Refund or Amount You Owe (Note. Allow 812 weeks to process Form 1040X.) Overpayment, if any, as shown on original return or as previously adjusted by the IRS . . . . . . 17 18 Subtract line 17 from line 16 (If less than zero, see instructions) . . . . . . . . . . . . . 19 Amount you owe. If line 10, column C, is more than line 18, enter the difference . . . . . . . . 20 If line 10, column C, is less than line 18, enter the difference. This is the amount overpaid on this return 21 Amount of line 20 you want refunded to you . . . . . . . . . . . . . . . . . . . 22 Amount of line 20 you want applied to your (enter year): estimated tax . 22 15

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 11360L

15 16 17 18 19 20 21

2,522 2,222

227 1,995

285 285

Complete and sign this form on Page 2.

Form 1040X (Rev. 12-2012)

Form 1040X (Rev. 12-2012)

Page 2

Part I

Exemptions

Complete this part only if you are: Increasing or decreasing the number of exemptions (personal and dependents) claimed on line 6d of the return you are amending, or Increasing or decreasing the exemption amount for housing individuals displaced by a Midwestern disaster in 2009. See Form 1040 or Form 1040A instructions and Form 1040X instructions. 23 24 25 26 27 28 Yourself and spouse. Caution. If someone can claim you as a dependent, you cannot claim an exemption for yourself . . . . . . Your dependent children who lived with you . . . . . . . . . Your dependent children who did not live with you due to divorce or separation Other dependents . . . . . . . . . . . . . . . . . . Total number of exemptions. Add lines 23 through 26 . . . . . . Multiply the number of exemptions claimed on line 27 by the exemption amount shown in the instructions for line 28 for the year you are amending . . . . . . . . . . . . . . . . . . . . .

A. Original number of exemptions or amount reported or as previously adjusted

B. Net change

C. Correct number or amount

23 24 25 26 27

28

29

30 31

If you are claiming an exemption amount for housing individuals displaced by a Midwestern disaster, enter the amount from Form 8914, line 6 for 2009 . . . . . . . . . . . . . . . . . . . 29 Add lines 28 and 29. Enter the result here and on line 4 on page 1 of this form 30 List ALL dependents (children and others) claimed on this amended return. If more than 4 dependents, see instructions.

(a) First name Last name (b) Dependents social security number

(c) Dependents

relationship to you

(d) Check box if qualifying child for child tax credit (see instructions)

Part II

Presidential Election Campaign Fund

Checking below will not increase your tax or reduce your refund. Check here if you did not previously want $3 to go to the fund, but now do. Check here if this is a joint return and your spouse did not previously want $3 to go to the fund, but now does. Part III Explanation of changes. In the space provided below, tell us why you are filing Form 1040X. Attach any supporting documents and new or changed forms and schedules.

Sign Here

Remember to keep a copy of this form for your records.

Under penalties of perjury, I declare that I have filed an original return and that I have examined this amended return, including accompanying schedules and statements, and to the best of my knowledge and belief, this amended return is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information about which the preparer has any knowledge.

Your signature

Date

Spouses signature. If a joint return, both must sign.

Date

Paid Preparer Use Only

Preparers signature Print/type preparer's name PTIN

Date

Firms name (or yours if self-employed) Firm's address and ZIP code

Check if self-employed Phone number EIN Form 1040X (Rev. 12-2012)

For forms and publications, visit IRS.gov.

Das könnte Ihnen auch gefallen

- Chase 1099int 2013Dokument2 SeitenChase 1099int 2013Srikala Venkatesan100% (1)

- CH8 EconomicsDokument5 SeitenCH8 EconomicslonlinnessNoch keine Bewertungen

- Benjamin J. Cohen, Bretton Woods SystemDokument11 SeitenBenjamin J. Cohen, Bretton Woods SystemVarun Kundal67% (3)

- Santos Return PDFDokument14 SeitenSantos Return PDFMark Long75% (4)

- 2022 Form W-4 - fw4-22Dokument4 Seiten2022 Form W-4 - fw4-22Gloria FonteNoch keine Bewertungen

- WWW - Irs.gov Pub Irs-PDF f4506tDokument2 SeitenWWW - Irs.gov Pub Irs-PDF f4506tJennifer GonzalezNoch keine Bewertungen

- 2022 Uber 1099-NECDokument2 Seiten2022 Uber 1099-NECmwgageNoch keine Bewertungen

- Importance of Your Tax Withholding: Form 1099Dokument2 SeitenImportance of Your Tax Withholding: Form 1099iceyrosesNoch keine Bewertungen

- F 1040Dokument2 SeitenF 1040Kevin RowanNoch keine Bewertungen

- Submitting Your U.S. Tax Documents: Print, Sign, MailDokument5 SeitenSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDokument3 SeitenNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNoch keine Bewertungen

- Instructions For Form 1120Dokument31 SeitenInstructions For Form 1120A.F. GRANADANoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument2 SeitenU.S. Individual Income Tax Return: Filing StatusRobert M Hamil.Noch keine Bewertungen

- Donors Capital Fund541934032 2007 048EED01SearchableDokument28 SeitenDonors Capital Fund541934032 2007 048EED01Searchablecmf8926Noch keine Bewertungen

- 1099-Div 2021 3350349Dokument1 Seite1099-Div 2021 3350349Adam Clifton0% (1)

- Request For Taxpayer Identification Number and CertificationDokument6 SeitenRequest For Taxpayer Identification Number and Certificationcade chevalierNoch keine Bewertungen

- Request For Taxpayer Identification Number and CertificationDokument4 SeitenRequest For Taxpayer Identification Number and CertificationAnonymous YGChV39tfD100% (1)

- 4506 TDokument3 Seiten4506 TwallerdcNoch keine Bewertungen

- Tax Form 1099nec 20230121Dokument2 SeitenTax Form 1099nec 20230121God Is GreatNoch keine Bewertungen

- Reporting Agent Authorization: Sign HereDokument1 SeiteReporting Agent Authorization: Sign HereSam OziegbeNoch keine Bewertungen

- ss4 PDFDokument4 Seitenss4 PDFЮлия ПNoch keine Bewertungen

- ELA0Request For Transcript of Tax Ret BDokument1 SeiteELA0Request For Transcript of Tax Ret BDavid FreiheitNoch keine Bewertungen

- Credit ApplicationDokument3 SeitenCredit ApplicationShelbyElliottNoch keine Bewertungen

- Form 4506-T (Rev. 11-2021)Dokument1 SeiteForm 4506-T (Rev. 11-2021)keyNoch keine Bewertungen

- 1040 ArmstrongDokument2 Seiten1040 Armstrongapi-458373647Noch keine Bewertungen

- CORRECTED (If Checked) : Payment Card and Third Party Network TransactionsDokument2 SeitenCORRECTED (If Checked) : Payment Card and Third Party Network TransactionsCarter NiselyNoch keine Bewertungen

- fss4 1998Dokument4 Seitenfss4 1998Znsjsh OneNoch keine Bewertungen

- 2017 TaxReturnDokument7 Seiten2017 TaxReturntripsrealplugNoch keine Bewertungen

- Income-Driven Repayment (Idr) Plan RequestDokument10 SeitenIncome-Driven Repayment (Idr) Plan RequestJennifer Revelo VelascoNoch keine Bewertungen

- 1099 Form Year 2021Dokument8 Seiten1099 Form Year 2021Candy Valentine100% (1)

- 9 Keland Cossia 2019 Form 1099-MISCDokument1 Seite9 Keland Cossia 2019 Form 1099-MISCpeter parkinsonNoch keine Bewertungen

- Request For Taxpayer Identification Number and CertificationDokument4 SeitenRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNoch keine Bewertungen

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Dokument1 SeiteW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040)Dokument4 SeitenProfit or Loss From Business: Schedule C (Form 1040)adam burd100% (1)

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDokument1 SeiteEmployer's Annual Federal Unemployment (FUTA) Tax Returnfortha loveofNoch keine Bewertungen

- SFF IRS Form990 2013Dokument27 SeitenSFF IRS Form990 2013Space Frontier FoundationNoch keine Bewertungen

- Form Accepted State 2020Dokument19 SeitenForm Accepted State 2020Cristian BurnNoch keine Bewertungen

- BNI 1120 ReturnDokument5 SeitenBNI 1120 ReturndishaakariaNoch keine Bewertungen

- W9 FormDokument1 SeiteW9 FormChris GreeneNoch keine Bewertungen

- Drivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCDokument8 SeitenDrivewealth, LLC 97 Main ST 2Nd Floor CHATHAM, NJ 07928: For Your Investing Account With Cash App Investing LLCAdib RashidNoch keine Bewertungen

- 2020 1099-INT WellsFargoDokument2 Seiten2020 1099-INT WellsFargosayma kandaf0% (1)

- Shared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputDokument1 SeiteShared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputBlessing Nel GuillaumeNoch keine Bewertungen

- F 1099 MSCDokument8 SeitenF 1099 MSCVenkatapavan SinagamNoch keine Bewertungen

- Request For Taxpayer Identification Number and CertificationDokument4 SeitenRequest For Taxpayer Identification Number and CertificationLogan BairdNoch keine Bewertungen

- LIBRO 9 Derecho RomanoDokument30 SeitenLIBRO 9 Derecho RomanoDomingo VasquezNoch keine Bewertungen

- Information Referral: Section A - Information About The Person or Business You Are ReportingDokument3 SeitenInformation Referral: Section A - Information About The Person or Business You Are ReportingEMV ISLANDNoch keine Bewertungen

- Easiest & Fastest!: Online Scan and Upload Your Form Directly To Your Loan Through Our Online Portal atDokument3 SeitenEasiest & Fastest!: Online Scan and Upload Your Form Directly To Your Loan Through Our Online Portal atBrady-Juice FaucettNoch keine Bewertungen

- Tax HandbookDokument37 SeitenTax HandbookChouchir SohelNoch keine Bewertungen

- Patricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Dokument16 SeitenPatricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Maria Valentina Neira GonzalezNoch keine Bewertungen

- Square 2022 W-2Dokument2 SeitenSquare 2022 W-2Zane CardinalNoch keine Bewertungen

- Tax Checklist REV 2Dokument1 SeiteTax Checklist REV 2Rocka FellaNoch keine Bewertungen

- 2018-09-06 DOC Re Statement of Information (DSJ Real Estate Holdings, LLC)Dokument2 Seiten2018-09-06 DOC Re Statement of Information (DSJ Real Estate Holdings, LLC)Doo Soo KimNoch keine Bewertungen

- 2022-03-07T20 - 48 - 01 - LoanAgreement - 663656 3Dokument11 Seiten2022-03-07T20 - 48 - 01 - LoanAgreement - 663656 3Liliana MendozaNoch keine Bewertungen

- Income Tax Information 2023Dokument4 SeitenIncome Tax Information 2023Village of new londonNoch keine Bewertungen

- 1099 Ssdi 2010Dokument1 Seite1099 Ssdi 2010Gary McclainNoch keine Bewertungen

- Request For A Certificate of Eligibility: Coe Ref. NoDokument3 SeitenRequest For A Certificate of Eligibility: Coe Ref. NoMoyo MitchellNoch keine Bewertungen

- Economic Impact Payments For Social Security and Ssi RecipientsDokument7 SeitenEconomic Impact Payments For Social Security and Ssi RecipientsLeanne Joy RumbaoaNoch keine Bewertungen

- Constitution of the State of Minnesota — 1974 VersionVon EverandConstitution of the State of Minnesota — 1974 VersionNoch keine Bewertungen

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDokument2 SeitenAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNoch keine Bewertungen

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDokument5 SeitenU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNoch keine Bewertungen

- F 1040 SaDokument2 SeitenF 1040 Saljens09Noch keine Bewertungen

- GST Presentation FB SCNDokument26 SeitenGST Presentation FB SCNPallavi ChawlaNoch keine Bewertungen

- Macroeconomic Theory and Policy: Pcpadhan@xlri - Ac.inDokument7 SeitenMacroeconomic Theory and Policy: Pcpadhan@xlri - Ac.inManoranjan DashNoch keine Bewertungen

- America Fast Forward Bonds ProgramDokument2 SeitenAmerica Fast Forward Bonds ProgramMetro Los AngelesNoch keine Bewertungen

- Ch01 International Econ 13th EditionDokument11 SeitenCh01 International Econ 13th EditionSteven AsifoNoch keine Bewertungen

- Budget Statement-Hon Peya MushelengaDokument13 SeitenBudget Statement-Hon Peya MushelengaAndré Le RouxNoch keine Bewertungen

- MCDokument127 SeitenMCMadiha AshrafNoch keine Bewertungen

- BS 4395-2Dokument36 SeitenBS 4395-2ZhivkoDimovNoch keine Bewertungen

- Annuity Calculator: Withdrawal PlanDokument2 SeitenAnnuity Calculator: Withdrawal PlanThanga PandiNoch keine Bewertungen

- Impact of GST On Supply Chains in India: MBA (Logistics & Supply Chain Management)Dokument52 SeitenImpact of GST On Supply Chains in India: MBA (Logistics & Supply Chain Management)Anuj Bali80% (5)

- Sample Computaion of Estate TaxDokument6 SeitenSample Computaion of Estate TaxlheyniiNoch keine Bewertungen

- Petron v. TiangcoDokument2 SeitenPetron v. TiangcoAlmarius CadigalNoch keine Bewertungen

- Superformance Stocks An Investment Strategy For The Individual Investor Based On The 4 Year Political Cycle Richard S LoveDokument128 SeitenSuperformance Stocks An Investment Strategy For The Individual Investor Based On The 4 Year Political Cycle Richard S LovescrewzuckenbergerNoch keine Bewertungen

- CSEC Economics June 2012 P2Dokument5 SeitenCSEC Economics June 2012 P2Sachin BahadoorsinghNoch keine Bewertungen

- AP Macroeconomics 2007 Free-Response Questions Form B: The College Board: Connecting Students To College SuccessDokument3 SeitenAP Macroeconomics 2007 Free-Response Questions Form B: The College Board: Connecting Students To College SuccessnarusegawaNoch keine Bewertungen

- RbiDokument12 SeitenRbiIvy RainaNoch keine Bewertungen

- EC Country Codes and Customer VAT Number FormatsDokument5 SeitenEC Country Codes and Customer VAT Number FormatsJorge MaiaNoch keine Bewertungen

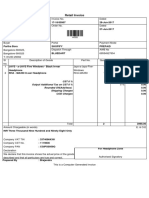

- Invoice of 44500Dokument1 SeiteInvoice of 44500Partho BoraNoch keine Bewertungen

- Fiat Currency - Wikipedia, The Free EncyclopediaDokument8 SeitenFiat Currency - Wikipedia, The Free Encyclopediamarcus100% (3)

- Eschool Ela Career Development Unit 3-Module 1 Assessment - BudgetingDokument2 SeitenEschool Ela Career Development Unit 3-Module 1 Assessment - Budgetingapi-463452419Noch keine Bewertungen

- BrittonDokument26 SeitenBrittonNidhin NalinamNoch keine Bewertungen

- Tugasan CtuDokument7 SeitenTugasan Ctuadriana adlinNoch keine Bewertungen

- 1005 PC JPF Euro Area Governance 01Dokument9 Seiten1005 PC JPF Euro Area Governance 01BruegelNoch keine Bewertungen

- Reserve Bank of India Act 1934 FinalDokument19 SeitenReserve Bank of India Act 1934 FinalBijal GohilNoch keine Bewertungen

- Q. 18. Differences Between Fixed & Floating Exchange RatesDokument1 SeiteQ. 18. Differences Between Fixed & Floating Exchange RatesMAHENDRA SHIVAJI DHENAKNoch keine Bewertungen

- FIN Midterm ExamDokument2 SeitenFIN Midterm ExamCharisa SamsonNoch keine Bewertungen

- Unit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateDokument2 SeitenUnit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateSenthil Kumar GanesanNoch keine Bewertungen

- Local Economic DevelopmentDokument2 SeitenLocal Economic Developmentzamin_bisp100% (1)