Beruflich Dokumente

Kultur Dokumente

Econ A231 Tma02

Hochgeladen von

Ho Kwun LamOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Econ A231 Tma02

Hochgeladen von

Ho Kwun LamCopyright:

Verfügbare Formate

Assignment File

Assignment 2

Due date: 28 June 2013 This assignment carries 50% of the mark for the course. Answer ALL the questions. Total marks: 100 Relevant diagrams are highly recommended. 1 a What is the difference between the short run and long run? Why does the amount of time needed for moving from the short run to the long run vary among different firms? (7 marks) Most of the firms regard labour costs as variable costs. But why do most book publishers regard labour costs as fixed costs? Explain. (8 marks)

Suppose the total cost of producing 10,000 tennis balls is $30,000, and the fixed cost is $10,000. a b Calculate the variable cost. (3 marks)

When output is 10,000, what are the average variable cost (AVC) and the average fixed cost (AFC)? (4 marks) Assuming that the cost curves have the usual shape, calculate the distances, in terms of dollars, between average total cost and average variable cost when the output levels are 10,000 and 30,000. Why are the distances different at the two output levels? (8 marks) At its current level of production a profit-maximizing firm in a competitive market receives $12.50 for each unit of output it produces and faces an average total cost of $10. At the market price of $12.50 per unit, the firms marginal cost curve crosses the marginal revenue curve at an output level of 1,000 units. i ii Is the firm maximizing profit? Why? (3 marks)

What is the firms current profit? Show your steps of calculation. (5 marks) (5 marks)

iii What is likely to occur in this market and why? b i

A student of ECON A231 argues: To maximize profit, a perfectly competitive firm should produce at the output level where the difference between marginal revenue (MR) and marginal cost (MC) is the greatest. Any production beyond this level will reduce the profit made on each additional unit. Agree or Disagree? Explain with a diagram. (7 marks)

ECON A231 Introduction to Microeconomics

ii

Another student of ECON A231 argues: The economic model of perfectly competitive market is very unrealistic because it predicts that firms in a perfectly competitive market earn zero profits in the long run. However, in reality, no firm would stay in business if it earned no profits. Agree or Disagree? Explain. (5 marks)

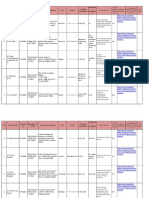

If a monopolist can find a way to reduce his marginal costs, he will not lower down his price. Because he is a monopolist, with lower marginal costs, he can keep the price and quantity unchanged to increase his profits. Agree or Disagree? Explain with a diagram. (8 marks) Suppose a baseball manufacturer has acquired a monopoly on the production of baseballs, and faces demand and cost situation as follows: Price Quantity (per week) $20 19 18 17 16 15 i 15,000 20,000 25,000 30,000 35,000 40,000 Total Marginal Total Revenue Revenue Cost $330,000 365,000 405,000 450,000 500,000 555,000 Marginal Cost

Reconstruct the above table in your answer sheet and fill in the table. (9 marks) If the firm would like to maximise profits, what price should it charge and how many baseballs should it sell? How much profit will it make? (6 marks)

ii

iii Suppose the government now imposes a lump sum tax of $50,000 per week on baseball production. Now what price should the firm charge and how many baseballs should be sold? What is the amount of profits after tax? (7 marks) 5 a HP and Dell are two of the biggest suppliers in the global PC market. They can choose either to cut price or hold the price unchanged. Refer to the following payoff matrix. The first entry in the bracket is the payoffs (in $million) of HP and the second entry is the payoffs of Dell. What is the dominant strategy of HP? What is the dominant strategy of Dell? Explain your answer. (8 marks)

Assignment File

Dells strategies Cut price HPs strategies Cut price Hold price b (+5, +20) (-20, +40) Hold price (+10, -10) (0, 0)

Explain how collusion makes firm better off. Given the incentive to collude, discuss two reasons why some firms cannot successfully form a cartel. (7 marks)

Das könnte Ihnen auch gefallen

- Econ 101 Sample Quiz Ques 4Dokument8 SeitenEcon 101 Sample Quiz Ques 4choppersureNoch keine Bewertungen

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsVon EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNoch keine Bewertungen

- B Micro HA 3 Problem SetDokument13 SeitenB Micro HA 3 Problem SetAzar0% (1)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkVon EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNoch keine Bewertungen

- Solutions: ECO 100Y Introduction To Economics Term Test # 3Dokument10 SeitenSolutions: ECO 100Y Introduction To Economics Term Test # 3examkillerNoch keine Bewertungen

- Microeconomics Principles of Consumer ChoiceDokument18 SeitenMicroeconomics Principles of Consumer ChoiceHashimRaza100% (2)

- ECO 100Y Introduction To Economics Midterm Test # 2: Last NameDokument11 SeitenECO 100Y Introduction To Economics Midterm Test # 2: Last NameexamkillerNoch keine Bewertungen

- ECO610X AssignmentDokument3 SeitenECO610X AssignmentBellindah GNoch keine Bewertungen

- Assignment2 Managerial Economics - Farrukh Wazir Khan - Fall22Dokument5 SeitenAssignment2 Managerial Economics - Farrukh Wazir Khan - Fall22IFRA AFZALNoch keine Bewertungen

- ECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerDokument13 SeitenECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerKathy Chugg0% (1)

- Chapter 8 - Part 3Dokument16 SeitenChapter 8 - Part 3dylanNoch keine Bewertungen

- Economics 310 ExamDokument6 SeitenEconomics 310 ExamMarjser Planta SagarinoNoch keine Bewertungen

- Sample Final S12010Dokument7 SeitenSample Final S12010Danielle CasamentoNoch keine Bewertungen

- Eco100 Pesando Tt2 2010fDokument6 SeitenEco100 Pesando Tt2 2010fexamkillerNoch keine Bewertungen

- BUECO1507 Microeconomics AssignmentDokument6 SeitenBUECO1507 Microeconomics AssignmentAyaan Khan100% (2)

- Perfect Competition Key ConceptsDokument17 SeitenPerfect Competition Key ConceptsFloyd Jason0% (1)

- ECO701 Economics and The Business Environment Coursework 1 May 21 SemesterDokument4 SeitenECO701 Economics and The Business Environment Coursework 1 May 21 SemesterAbhinav P KrishnaNoch keine Bewertungen

- O1Omdh-BUS2105 Exam - Questions Only - T2-2021-22Dokument6 SeitenO1Omdh-BUS2105 Exam - Questions Only - T2-2021-22JOANNA LAMNoch keine Bewertungen

- Econs q2Dokument46 SeitenEcons q2Raj TakhtaniNoch keine Bewertungen

- 2013 ZaDokument4 Seiten2013 ZaShershah KakakhelNoch keine Bewertungen

- Rift Valley University Bole Campus, Post Graduate Program - MBA Assignment For Managerial Economics To Be Submitted Together With Final Exam Answer Sheets (Home Take-Time Limited Exam) QuestionsDokument2 SeitenRift Valley University Bole Campus, Post Graduate Program - MBA Assignment For Managerial Economics To Be Submitted Together With Final Exam Answer Sheets (Home Take-Time Limited Exam) QuestionsMohammed AdemNoch keine Bewertungen

- Long Test 2 Set BDokument2 SeitenLong Test 2 Set BMonica ReyesNoch keine Bewertungen

- Economics 100: AnswersDokument7 SeitenEconomics 100: AnswersexamkillerNoch keine Bewertungen

- Complete Set Tutorial Sheets 1-10Dokument17 SeitenComplete Set Tutorial Sheets 1-10APOORV AGARWALNoch keine Bewertungen

- Tutorial 11, Week 11QDokument4 SeitenTutorial 11, Week 11QKasmira K.Bathu GanesanNoch keine Bewertungen

- Problem Set 8Dokument6 SeitenProblem Set 8Justin LeeNoch keine Bewertungen

- 1 Workshop I Case ModelDokument2 Seiten1 Workshop I Case ModeldejesusericksonNoch keine Bewertungen

- BE Online Midterm Exam 202201Dokument6 SeitenBE Online Midterm Exam 202201ching lamNoch keine Bewertungen

- BB 107 Supplementary Exam Summer 2020 Q (Set A) (Online)Dokument6 SeitenBB 107 Supplementary Exam Summer 2020 Q (Set A) (Online)Brewell CoNoch keine Bewertungen

- 2012 ZaDokument4 Seiten2012 ZaShershah KakakhelNoch keine Bewertungen

- 6103 - 2020 - Managerial EconomicsDokument3 Seiten6103 - 2020 - Managerial EconomicsnikitasahaNoch keine Bewertungen

- 2022 Prelim PyqDokument6 Seiten2022 Prelim PyqRaj TakhtaniNoch keine Bewertungen

- Exam 21082011Dokument8 SeitenExam 21082011Rabah ElmasriNoch keine Bewertungen

- Microeconomics - 1 (Understanding Firms) MBA: Mock Exam Maximum Marks: 60 Time: 90 Minutes Weight: 50%Dokument7 SeitenMicroeconomics - 1 (Understanding Firms) MBA: Mock Exam Maximum Marks: 60 Time: 90 Minutes Weight: 50%Pravesh TiwariNoch keine Bewertungen

- Exam QuestionDokument11 SeitenExam QuestionRicha MahajanNoch keine Bewertungen

- Thapar Institute of Engineering and TechnologyDokument2 SeitenThapar Institute of Engineering and TechnologysahibjotNoch keine Bewertungen

- Assignment For First Sem CMDokument4 SeitenAssignment For First Sem CMnishant khadkaNoch keine Bewertungen

- Est For BTECHDokument2 SeitenEst For BTECHRakesh SharmaNoch keine Bewertungen

- DeVry BUSN 278 Final Exam 100% Correct AnswerDokument8 SeitenDeVry BUSN 278 Final Exam 100% Correct AnswerDeVryHelpNoch keine Bewertungen

- Elasticty and DemandDokument7 SeitenElasticty and DemandNemish RanavatNoch keine Bewertungen

- Uhu081 PDFDokument2 SeitenUhu081 PDFsahibjotNoch keine Bewertungen

- Econ RevisionDokument6 SeitenEcon Revisionelserry.comNoch keine Bewertungen

- PS 7Dokument9 SeitenPS 7Gülten Ece BelginNoch keine Bewertungen

- Econ PotentialExamQuestionsDokument7 SeitenEcon PotentialExamQuestionsSamantha HazellNoch keine Bewertungen

- ECO101 PS8 QuestionsDokument3 SeitenECO101 PS8 Questionschuyue jinNoch keine Bewertungen

- Tutorial SheetDokument5 SeitenTutorial SheetRishav GoyalNoch keine Bewertungen

- Review QuestionsDokument5 SeitenReview QuestionsNahid IbrahimzadeNoch keine Bewertungen

- Practice MCQ (CH 6 To CH 9)Dokument7 SeitenPractice MCQ (CH 6 To CH 9)rhlvajpayeeNoch keine Bewertungen

- Economicanalsys QuestionpaperDokument2 SeitenEconomicanalsys QuestionpaperashishNoch keine Bewertungen

- Review Questions Costs of ProductionDokument3 SeitenReview Questions Costs of ProductionLucas MgangaNoch keine Bewertungen

- 8103-Managerial Economics - Executive MBA - Question PaperDokument4 Seiten8103-Managerial Economics - Executive MBA - Question Papergaurav jainNoch keine Bewertungen

- Introduction To Economics and Finance: MOCK (Spring 2013) Section: B 100 Marks-3hoursDokument5 SeitenIntroduction To Economics and Finance: MOCK (Spring 2013) Section: B 100 Marks-3hoursANoch keine Bewertungen

- Tutorial 5 (1st Tutorial For Micro 2)Dokument6 SeitenTutorial 5 (1st Tutorial For Micro 2)Lindani MenziwaNoch keine Bewertungen

- RVU CMA Work Sheet March 2019Dokument12 SeitenRVU CMA Work Sheet March 2019Henok FikaduNoch keine Bewertungen

- Question Paper 2022 DecDokument3 SeitenQuestion Paper 2022 DecdipinnediyaparambathNoch keine Bewertungen

- FMG 22-IntroductionDokument22 SeitenFMG 22-IntroductionPrateek GargNoch keine Bewertungen

- Tutorial Sheet 5Dokument3 SeitenTutorial Sheet 5YvonneNoch keine Bewertungen

- MicroEconomics 2012 Midterms at IIM KozhikodeDokument5 SeitenMicroEconomics 2012 Midterms at IIM KozhikodeShri DharNoch keine Bewertungen

- Bus b103 Tma2 130Dokument3 SeitenBus b103 Tma2 130Ho Kwun Lam100% (1)

- Bus b103 Tma1 130Dokument5 SeitenBus b103 Tma1 130Ho Kwun LamNoch keine Bewertungen

- HK Toys break-even analysis and e-commerce opportunitiesDokument6 SeitenHK Toys break-even analysis and e-commerce opportunitiesHo Kwun LamNoch keine Bewertungen

- Bis b123 Tma1 130Dokument4 SeitenBis b123 Tma1 130Ho Kwun LamNoch keine Bewertungen

- MBA in PM Strategic ManagementDokument55 SeitenMBA in PM Strategic Managementmohamed aktharNoch keine Bewertungen

- Balaji Traders: Service Operations ManagemnetDokument14 SeitenBalaji Traders: Service Operations ManagemnetMihir PatelNoch keine Bewertungen

- Final PracticeDokument2 SeitenFinal PracticeHuyền TrangNoch keine Bewertungen

- Di PrelimsDokument3 SeitenDi PrelimsBrock LesnerNoch keine Bewertungen

- Value EngineeringDokument18 SeitenValue Engineeringjohnplaya1234100% (1)

- Assessment of The Impact of CSR Implementation Social Investment Using Social Return On Investment (SROI) MethodsDokument15 SeitenAssessment of The Impact of CSR Implementation Social Investment Using Social Return On Investment (SROI) MethodsCho bitzNoch keine Bewertungen

- 2022 Midterm - SolutionDokument6 Seiten2022 Midterm - SolutionwannafadedNoch keine Bewertungen

- Kieso 15e SGV1 Ch09Dokument30 SeitenKieso 15e SGV1 Ch09anilegna99Noch keine Bewertungen

- BAC 111 Final Exams With QuestionsDokument8 SeitenBAC 111 Final Exams With Questionsjanus lopezNoch keine Bewertungen

- CAT 1 Module (NIAT Encoded)Dokument245 SeitenCAT 1 Module (NIAT Encoded)UFO CatcherNoch keine Bewertungen

- Solution To Exercise 3-11 - Financial Statements Preparation (Winner Repair Service Center)Dokument4 SeitenSolution To Exercise 3-11 - Financial Statements Preparation (Winner Repair Service Center)Kim JuanNoch keine Bewertungen

- MM MaggieDokument22 SeitenMM MaggieCommerce StudentNoch keine Bewertungen

- Ch.5 Abc & MGMT: Emphasis. New York: Mcgraw-Hill Irwin (5-4)Dokument15 SeitenCh.5 Abc & MGMT: Emphasis. New York: Mcgraw-Hill Irwin (5-4)Winter SummerNoch keine Bewertungen

- Kode Nama Akun Debet Kredit: Ud. Buana Trial Balance, Per 30 Desember 2020Dokument53 SeitenKode Nama Akun Debet Kredit: Ud. Buana Trial Balance, Per 30 Desember 202010 100100% (1)

- Managerial Accounting 3rd Edition Whitecotton Solutions ManualDokument42 SeitenManagerial Accounting 3rd Edition Whitecotton Solutions Manualsestetto.vitoe.d4rcv4100% (19)

- Fundamental AnalysisDokument24 SeitenFundamental AnalysisNaresh Yadav0% (1)

- 1 - Demomstration On Replacement Theory Part IDokument6 Seiten1 - Demomstration On Replacement Theory Part IAshim SahaNoch keine Bewertungen

- Chapter 01-Introduction Marketing For Hospitality and TourismDokument26 SeitenChapter 01-Introduction Marketing For Hospitality and TourismQuagn TruognNoch keine Bewertungen

- Chapter II Inventory Management SystemDokument29 SeitenChapter II Inventory Management SystemLeandro Sampang76% (34)

- Business Oxford Unit 1Dokument36 SeitenBusiness Oxford Unit 1remaselshazly76Noch keine Bewertungen

- LK Buku Besar PT Home BycicleDokument7 SeitenLK Buku Besar PT Home BycicleFredi Dwi SusantoNoch keine Bewertungen

- The 8 Step Personal Selling ProcessDokument13 SeitenThe 8 Step Personal Selling ProcessAdamZain788Noch keine Bewertungen

- Accounting Ch. 8Dokument61 SeitenAccounting Ch. 8Cheryl LynnNoch keine Bewertungen

- Understanding The Time Value of MoneyDokument13 SeitenUnderstanding The Time Value of MoneyDaniel HunksNoch keine Bewertungen

- 673 Quirino Highway, San Bartolome, Novaliches, Quezon CityDokument4 Seiten673 Quirino Highway, San Bartolome, Novaliches, Quezon CityRodolfo ManalacNoch keine Bewertungen

- Professional Members Directory As On 13-02-2023Dokument532 SeitenProfessional Members Directory As On 13-02-2023Saddam HussainNoch keine Bewertungen

- COMPARISON OF BUSINESS TRANSACTION CYCLESDokument2 SeitenCOMPARISON OF BUSINESS TRANSACTION CYCLESJN Villacruel AbayariNoch keine Bewertungen

- Learning Curve AnalysisDokument15 SeitenLearning Curve AnalysisCharles LaspiñasNoch keine Bewertungen

- Accounting Standards SummaryDokument54 SeitenAccounting Standards Summarynurmaisarahnurazim1Noch keine Bewertungen

- Test Bank Principles of Cost Accounting 16th Edition VanderbeckDokument75 SeitenTest Bank Principles of Cost Accounting 16th Edition VanderbeckNhel AlvaroNoch keine Bewertungen

- Kleptopia: How Dirty Money Is Conquering the WorldVon EverandKleptopia: How Dirty Money Is Conquering the WorldBewertung: 3.5 von 5 Sternen3.5/5 (25)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldVon EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldBewertung: 4 von 5 Sternen4/5 (16)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumVon EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumBewertung: 3 von 5 Sternen3/5 (12)

- Second Class: How the Elites Betrayed America's Working Men and WomenVon EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNoch keine Bewertungen

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesVon EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesBewertung: 4.5 von 5 Sternen4.5/5 (8)

- Look Again: The Power of Noticing What Was Always ThereVon EverandLook Again: The Power of Noticing What Was Always ThereBewertung: 5 von 5 Sternen5/5 (3)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsVon EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsBewertung: 4.5 von 5 Sternen4.5/5 (94)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomVon EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNoch keine Bewertungen

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaVon EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNoch keine Bewertungen

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentVon EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentBewertung: 4.5 von 5 Sternen4.5/5 (92)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyVon EverandChip War: The Quest to Dominate the World's Most Critical TechnologyBewertung: 4.5 von 5 Sternen4.5/5 (227)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationVon EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationBewertung: 4.5 von 5 Sternen4.5/5 (46)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsVon EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsBewertung: 5 von 5 Sternen5/5 (2)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyVon EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyBewertung: 4.5 von 5 Sternen4.5/5 (69)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetVon EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNoch keine Bewertungen

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailVon EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailBewertung: 4.5 von 5 Sternen4.5/5 (237)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistVon EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistBewertung: 4.5 von 5 Sternen4.5/5 (37)

- Kaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineVon EverandKaizen: The Ultimate Guide to Mastering Continuous Improvement And Transforming Your Life With Self DisciplineBewertung: 4.5 von 5 Sternen4.5/5 (36)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyVon EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyBewertung: 4.5 von 5 Sternen4.5/5 (263)

- How an Economy Grows and Why It Crashes: Collector's EditionVon EverandHow an Economy Grows and Why It Crashes: Collector's EditionBewertung: 4.5 von 5 Sternen4.5/5 (102)