Beruflich Dokumente

Kultur Dokumente

Poloz Remarks 190613

Hochgeladen von

ericaalini0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

348 Ansichten6 SeitenStephen Poloz on business confidence

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenStephen Poloz on business confidence

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

348 Ansichten6 SeitenPoloz Remarks 190613

Hochgeladen von

ericaaliniStephen Poloz on business confidence

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

Not for publication before 19 June 2013

12:25 Eastern Time

Remarks by Stephen S. Poloz

Governor of the Bank of Canada

Oakville Chamber of Commerce

Burlington, Ontario

19 June 2013

Reconstruction: RebuiIding Business

Confidence in Canada

Introduction

Thank you for that introduction and to all of you for coming today. It is a pleasure

to deliver my first public speech as Governor of the Bank of Canada here in the

heart of southern Ontario, especially since we are just down the road from my

hometown of Oshawa.

This region is a historic centre of Canadian industry and commerce. It is home to

some of Canada's most storied businesses and prestigious centres of learning.

Many of the firms that made this region and Canada strong were on the front

lines as the global financial crisis pushed the Canadian economy into recession.

As our economy continues to expand, it will be the performance of the business

sector here and across Canada over the coming while that we will be watching

with great interest.

That's because what happens to business in Canada matters for the Bank of

Canada. Not just because we carewhich, let me assure you, we do. But in

order for us to do our job properly, in order for us to promote the economic and

financial welfare of Canadians, we need to understand all the dynamics that feed

into the Canadian economy.

The Bank aims to keep inflation low, stable and predictable. Our flexible

inflation-targeting framework is the best contribution monetary policy can make

so that Canadian households and businesses can make decisions about their

financial futures with confidence.

Over the past couple of decades, the average rate of inflation has been very

close to our 2 per cent target. Even during the global economic and financial

crisis, our commitment did not waver. The inflation target is sacrosanct to us and

has become a credible anchor for the inflation expectations of Canadians.

Moreover, the target is symmetrical: we care just as much about inflation falling

below as we do about it rising above the target. When inflation falls below the

target and interest rates are correspondingly low, there is little room for

conventional monetary policy to respond to negative shocks. When inflation is

above target, the erosion of purchasing power becomes significant and

- 2 -

uncertainty about future prices makes it hard for households and businesses to

make good financial decisions.

Further, the framework has built-in flexibility with respect to the amount of time it

takes to return inflation to target after a shock. Years of successful inflation

targeting have given the Bank the credibility to use this flexibility during periods of

economic stress. A flexible exchange rate is also key to achieving our inflation

targets over time.

The recent turmoil showed us the value of the credibility we have earned. Like

others, to address the stresses of the crisis, we put the flexibility of our regime to

work. Nonetheless, throughout the recession and since, the inflation expectations

of Canadians have remained well anchored at the target, proving that our

framework is secure and working.

This past downturn was different from previous recessions. Even though Canada

performed better than our G-7 peers, the Great Recession put many companies

out of business, especially small and exporting firms. Many of those that survived

dramatically reduced their operations, shuttering plants and dismantling

equipment.

These actions hurtbadlyin terms of job losses and lost output. While both

have recoveredin fact, surpassed their pre-recession peaksthe structural

damage caused by the crisis lingers. Indeed, our recovery has been primarily

driven by higher household spending, while exports have lagged behind.

Rather than a recovery in the usual sense, this looks more like a postwar

reconstruction. Or, if you will allow me to slide into more academic language for a

moment and refer to the Schumpeterian process of "creative destruction, we've

certainly had the destruction. But the creation side of the equation has been

delayed by numerous unusual risks, heightened uncertainty, and a lack of

confidence.

This is what I want to talk about today. I want to discuss the impact of the crisis

on Canadian business and how the firms that have survived have changed and

are responding. We need business confidence to continue to heal. This matters

very much to the Bank of Canada.

Our understanding of these issues will be part of the rigorous distillation of

information that drives our policy decisions. As part of the process, we meet, we

talk, we argue and do our best to understand the significant forces driving the

economy. With our next policy decision on 17 July, we are now at the early stage

of this round.

Standard macroeconomic models can only go so far in capturing today's

dynamics, and especially when uncertainty is greater than normal, it is important

to supplement the models with insights directly from business.

My messages today will be relevant for companies across Canada, but they

resonate particularly in this region. As a native of Oshawa, I understand that well.

I have seen the impact of the crisis and the recession on the auto sector in my

hometown. I have heard about it from the manufacturers and exporters in this

region. And the Bank has heard about it from the financial community on Bay

- 3 -

Street and from all types of business leaders in southern Ontario who participate

in the Bank's quarterly business outlook surveys.

Worst Recession Since the Depression

probably don't need to tell anyone in this room that the recent global recession

was the worst downturn experienced since the Great Depression. In very short

order, global GDP fell more than 3 per cent and millions upon millions of jobs

were lost. In Canada, 432,000 jobs were lost and GDP fell 4.2 per cent. The

unemployment rate spiked to 8.7 per cent.

The severity of the global economic and financial crisis delivered a direct, sharp

blow to Canadian business. Canada experienced a particularly deep contraction

of investment and exports.

The trauma was severe and long-lasting. Its impact was felt by businesses

across the country, businesses that saw their markets dwindle and their balance

sheets deteriorate. In a downturn that lasts, say, nine months, a bank will likely

let its clients ride out the recession. But in a prolonged crisis, the story is more

complex. Credit can become tough to find. Anecdotally, we know that otherwise

solvent and creditworthy firms were left with considerably less credit than they

needed. In too many cases, temporary plant shutdowns were not sufficient to

match the fall in demand or the decline in financing. Some firms reduced their

operations. Others simply closed their doors.

Let's look at some of the facts. During a normal growth period in Canada, there is

a steady increase in the number of businesses in operation. In short, creative

destruction results in the net creation of new firms. But since the onset of the

recession, there has been limited net creation of businesses. Canada's exporters

have been particularly hard hit. The group most profoundly affected has been

manufacturing exporters, whose ranks have continued to shrink.

Canada is not alone in this regard. In the United States, the dynamics were

similar but even more dramatic. The net number of new establishments fell for

three years in a row until 2011, when, finally, the trend turned around.

The Reconstruction Challenge

Perhaps there should be no surprise, then, given the decline in global demand,

the drop in the number of American companies to trade with, and the related

drop in the number of Canadian exporters, that Canada's export sector has

lagged. It is the only component of Canada's GDP that remains below its pre-

recession peak. Our annual exports are more than $100 billion lower than would

be typical at this point in a recovery cycle.

Regaining the lost output of companies that have disappeared or downsized will

require that existing firms boost their production, that they invest to expand their

capacity, and that the net creation of new firms resumes a higher growth path.

The good news is that the balance sheets of corporate Canada are healthy and

the capacity to invest exists.

We could see that the recession was causing a significant structural change in

the Canadian economy at the time. The Bank acknowledged that this destruction

of potential was happening in its quarterly Monetary Policy Report in April 2009.

- 4 -

Reflecting its best judgment, the Bank reduced its estimates of potential output

growth in each of the years from 2009 to 2011.

Nonetheless, we were relatively fortunate in Canada. In the immediate aftermath

of the crisis, stimulative monetary and fiscal policies proved highly effective in

maintaining domestic demand, particularly household expenditures. Household

spending was supported by strong growth in borrowing, which resulted in record-

high debt-to-income levels.

Given the circumstances, it was a good thing that households had the capacity to

expand their spendingthis provided a necessary cushion from the worst effects

of the global contraction. The Bank has been careful to remind people that

interest rates will rise at some point. We have urged homeowners and other

borrowers to do the arithmetic to ensure that they will be able to manage their

debts at more normal interest rates. I am confident that this is exactly what

people are doing.

This growth model has been effective, but its limits are clear. In fact, while recent

data are choppy, we continue to see a constructive evolution of activity in the

housing sector. What needs to happen next is for export momentum to build and

business investment to recover while the household sector settles into a more

balanced and sustainable growth path.

For all of this to happen will require the rebuilding of Canada's economic

potential. That is what makes this recovery cycle unique.

Automotive sector

Let me use some cases studies to illustrate this. The structural transformation of

the auto sector has been dramatic. The 70-per cent decline in production from

peak to trough was brutal. Machinery was boxed up and sent overseas. Plants

closed. These were very hard times for this sector and those who make their

living from it.

The crisis in the auto sector prompted the federal government to step in with

extraordinary financial support. That support helped save thousands of jobs

throughout southern Ontario.

The firms that survived have lowered their cost structures. We are seeing more

innovative processes and accelerated new product development. These

elements improve the competitiveness of Canadian firms and position them well

to go head-to-head with U.S. and global parts-sector firms. They also help

Canada to gain a foothold in global supply chains.

The recovery of auto sales in the United States is clearly under waythe first

essential ingredient. But it remains to be seen how the reconstruction process

've discussed today will play out for this important sector.

Forestry

I could tell a similar story about Canada's forestry sector, whichlike the auto

sectoris much smaller than before. In 2012, the Canadian forestry industry

accounted for about 1.2 per cent of total GDP, down from around 1.6 per cent in

2007. During the same period, almost 60,000 workersabout 20 per cent of the

forestry workforcewere displaced. Here, too, the recovery in U.S. housing and

- 5 -

the building of new relationships in fast-growing markets, such as China, are

contributing to improved confidence.

I could describe similar stories for other sectors including ICT (information and

communications technology) and biotechnology. These are all stories that we

need to keep watching.

What businesses are telling us

From the frequent conversations the Bank has with business leaders, we know

that the entrepreneurial spirit is alive and well in Canada. Some of the decline in

exports reflects the ingenuity of Canadian firms, including firms in this region, in

responding to the U.S. slowdown by pivoting their products and marketing to the

faster-growing segments of the Canadian economy. Others became more

competitive through restructuring or finding a niche adjacent to their traditional

market.

Such insights feed importantly into the Bank's understanding of the workings of

the Canadian economy, and thus into the policy deliberations of the Bankand I

strongly believe that, especially in these unusual times, as we work to

understand the undercurrents of the recovery, this kind of dialogue with the

private sector is critical.

Confidence

To realize the economic growth that Canada is looking fora return to self-

sustaining, self-generating growthwe need to see the rebuilding of capacity,

through both the expansion of existing companies and the creation of new ones.

This will require growing confidence among existing businesses and

entrepreneurs.

The gathering momentum in foreign demand, especially in the United States,

should help lift the confidence of Canada's exporters. This is critical for Canadian

firms to boost their investment to expand their productive capacity. The sequence

we can anticipate is the following: foreign demand will build; our exports will

strengthen further; confidence will improve; existing companies will expand;

companies will invest to increase capacity; and new ones will be created.

This sequence may already be underway.

Conclusion

To conclude: In monetary policy, actions are critically important. The Bank is

absolutely committed, as I mentioned earlier, to keeping inflation predictable,

stable and on target so firms can make longer-term decisions in an environment

of confidence. But words, too, matter a great deal. By explaining the cross-

currents at work in our economy, our projections for what's ahead, and our

monetary policy response, we can help to heal business confidence. And in order

to expand our understanding of what's happening in the real economy, we listen

to businesses, to labour groups and to industry associations.

Beneath our economic and financial statistics and analysis are real people,

making real decisions. Those decisions are hard to make at any time, but when

uncertainty is high and confidence low, they can be even more difficult.

- 6 -

I am optimistic that the signs are there that the process is under way. Right now,

what we need most is stability and patience.

To help nurture confidence, an active engagement with Canadians must remain

a cornerstone of the policy of the Bank of Canada. So thank you for being here

today. 'm keen to hear your views, and I would be pleased to take your

questions.

Das könnte Ihnen auch gefallen

- Ben Bernanke - Frequently Asked QuestionsDokument9 SeitenBen Bernanke - Frequently Asked QuestionsJohn SutherlandNoch keine Bewertungen

- David Dodge: The Bank of Canada and Monetary Policy: Future DirectionsDokument4 SeitenDavid Dodge: The Bank of Canada and Monetary Policy: Future DirectionsAnonymous pb0lJ4n5jNoch keine Bewertungen

- Artisan Autumn 2012Dokument6 SeitenArtisan Autumn 2012Arthur SalzerNoch keine Bewertungen

- The Outlook For Recovery in The U.S. EconomyDokument13 SeitenThe Outlook For Recovery in The U.S. EconomyZerohedgeNoch keine Bewertungen

- Globalisation, Financial Stability and EmploymentDokument10 SeitenGlobalisation, Financial Stability and EmploymentericaaliniNoch keine Bewertungen

- 2012Q3 - Newsletter October 2012 - PDF Single PageDokument4 Seiten2012Q3 - Newsletter October 2012 - PDF Single PagePacifica Partners Capital ManagementNoch keine Bewertungen

- Ben BernankeDokument9 SeitenBen BernankeManu_Bhagat_6345Noch keine Bewertungen

- Patient Capital Management IncDokument6 SeitenPatient Capital Management Incricher jpNoch keine Bewertungen

- Should We Blame Immigration For Canada's Economic WoesDokument152 SeitenShould We Blame Immigration For Canada's Economic Woesmohit01krishanNoch keine Bewertungen

- Marion Williams: The Global Financial Crisis - Can We Withstand The ShockDokument8 SeitenMarion Williams: The Global Financial Crisis - Can We Withstand The ShockRatihGizaJogjaNoch keine Bewertungen

- 8 Markets MythsDokument18 Seiten8 Markets MythsVicente Manuel Angulo GutiérrezNoch keine Bewertungen

- Janet Yell en 1110Dokument14 SeitenJanet Yell en 1110ZerohedgeNoch keine Bewertungen

- Sarthak Joshi July2022Dokument3 SeitenSarthak Joshi July2022SarthakNoch keine Bewertungen

- The Pensford Letter - 7.2.12Dokument5 SeitenThe Pensford Letter - 7.2.12Pensford FinancialNoch keine Bewertungen

- The Pensford Letter - 7.2.12Dokument5 SeitenThe Pensford Letter - 7.2.12Pensford FinancialNoch keine Bewertungen

- Canada's Federal Budget 2022Dokument304 SeitenCanada's Federal Budget 2022National PostNoch keine Bewertungen

- Debt, Profits, Canada & More .: Nvestment OmpassDokument4 SeitenDebt, Profits, Canada & More .: Nvestment OmpassPacifica Partners Capital ManagementNoch keine Bewertungen

- Hide and Seek: U.S. Economy UncertainDokument12 SeitenHide and Seek: U.S. Economy UncertainCanadianValueNoch keine Bewertungen

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDokument10 SeitenDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNoch keine Bewertungen

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDokument10 SeitenDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNoch keine Bewertungen

- Speech Discours EngDokument19 SeitenSpeech Discours EngJoe RaymentNoch keine Bewertungen

- Glenn Stevens: The Economic Outlook in 2002: The US Business CycleDokument8 SeitenGlenn Stevens: The Economic Outlook in 2002: The US Business CycleFlaviub23Noch keine Bewertungen

- The Pensford Letter - 7.2.12Dokument5 SeitenThe Pensford Letter - 7.2.12Pensford FinancialNoch keine Bewertungen

- Recession Full Data Report and Financial and Market Analysis DoneDokument46 SeitenRecession Full Data Report and Financial and Market Analysis Doneamitsaini03Noch keine Bewertungen

- Economic Challenges and OpportunitiesDokument3 SeitenEconomic Challenges and OpportunitiesAsif Khan ShinwariNoch keine Bewertungen

- Top Ten Investments to Beat the Crunch!: Invest Your Way to Success even in a DownturnVon EverandTop Ten Investments to Beat the Crunch!: Invest Your Way to Success even in a DownturnNoch keine Bewertungen

- World Economy Forecast 2016Dokument8 SeitenWorld Economy Forecast 2016nsbmuraliNoch keine Bewertungen

- Is There A Double Dip Recession in The Making AC - FinalDokument2 SeitenIs There A Double Dip Recession in The Making AC - FinalPremal ThakkarNoch keine Bewertungen

- The Big Question: Business ArgusDokument1 SeiteThe Big Question: Business Argusapi-120443862Noch keine Bewertungen

- RecessionDokument20 SeitenRecessionTejas WaghuldeNoch keine Bewertungen

- September 2012 NewsletterDokument2 SeitenSeptember 2012 NewslettermcphailandpartnersNoch keine Bewertungen

- Current Issue in Canadian Business EnvironmentDokument13 SeitenCurrent Issue in Canadian Business EnvironmentChris KabilingNoch keine Bewertungen

- Eagle Capital Management, LLC: April 2010Dokument3 SeitenEagle Capital Management, LLC: April 2010azharaqNoch keine Bewertungen

- Understanding EconomicDokument4 SeitenUnderstanding Economicmustafa-ahmedNoch keine Bewertungen

- Current Issues in Financial MarketsDokument5 SeitenCurrent Issues in Financial Marketsreb_nicoleNoch keine Bewertungen

- MMB 13092010Dokument3 SeitenMMB 13092010admin866Noch keine Bewertungen

- Cash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityVon EverandCash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityNoch keine Bewertungen

- HHRG 112 BA00 WState JDimon 20120619Dokument4 SeitenHHRG 112 BA00 WState JDimon 20120619DinSFLANoch keine Bewertungen

- FES EEA 2023 enDokument141 SeitenFES EEA 2023 enrhodalwyNoch keine Bewertungen

- Deutsche Bank - Five Years After Subprime: Lending Trends in Europe and The USDokument2 SeitenDeutsche Bank - Five Years After Subprime: Lending Trends in Europe and The USkentselveNoch keine Bewertungen

- Transcript of 10/15/12 Speech: William Dudley, President of The Federal Reserve Bank of New YorkDokument12 SeitenTranscript of 10/15/12 Speech: William Dudley, President of The Federal Reserve Bank of New YorkLani RosalesNoch keine Bewertungen

- Cerberus LetterDokument5 SeitenCerberus Letterakiva80100% (1)

- Newsletter 1Dokument4 SeitenNewsletter 1sserifundNoch keine Bewertungen

- Our Strategy To Drive GrowthDokument36 SeitenOur Strategy To Drive GrowthjbsNoch keine Bewertungen

- Janet Yell en 0323Dokument14 SeitenJanet Yell en 0323ZerohedgeNoch keine Bewertungen

- Dollar Tree, Inc. Presents at Goldman Sachs 28th Annual Global Retailing Conference, Sep-10-2021 09 - 10 AMDokument13 SeitenDollar Tree, Inc. Presents at Goldman Sachs 28th Annual Global Retailing Conference, Sep-10-2021 09 - 10 AMRaghav MittalNoch keine Bewertungen

- A DECADE OF SQUANDERED OPPORTUNITY by JM MinorDokument55 SeitenA DECADE OF SQUANDERED OPPORTUNITY by JM MinorDesmond Sullivan100% (1)

- Summer ForecastDokument2 SeitenSummer Forecastkatdoerr17Noch keine Bewertungen

- July 222010 PostsDokument107 SeitenJuly 222010 PostsAlbert L. PeiaNoch keine Bewertungen

- Marking The 11th Hour - Corona Associates Capital Management - Year End Investment Letter - December 24th 2015Dokument13 SeitenMarking The 11th Hour - Corona Associates Capital Management - Year End Investment Letter - December 24th 2015Julian ScurciNoch keine Bewertungen

- Why Would It Be Useful To Examine A Country's Balance-Of-Payments Data?Dokument2 SeitenWhy Would It Be Useful To Examine A Country's Balance-Of-Payments Data?Picasales, Frenzy M.Noch keine Bewertungen

- Picton MahoneyDokument3 SeitenPicton Mahoneyderailedcapitalism.comNoch keine Bewertungen

- Prepare The Following Based On This Topic: Inflation and Juan Dela Cruz. Statement of The ProblemDokument4 SeitenPrepare The Following Based On This Topic: Inflation and Juan Dela Cruz. Statement of The ProblemFrencis A. EsquierdoNoch keine Bewertungen

- September 22, 2010 PostsDokument543 SeitenSeptember 22, 2010 PostsAlbert L. PeiaNoch keine Bewertungen

- Made in America 2.0: 10 Big Ideas for Saving the United States of America from Economic DisasterVon EverandMade in America 2.0: 10 Big Ideas for Saving the United States of America from Economic DisasterNoch keine Bewertungen

- The Economi of Success: Twelve Things Politicians Don't Want You to KnowVon EverandThe Economi of Success: Twelve Things Politicians Don't Want You to KnowNoch keine Bewertungen

- Acknowled Gement: Impact of Recent Recession On India and UsDokument60 SeitenAcknowled Gement: Impact of Recent Recession On India and Uskashifsecret9003Noch keine Bewertungen

- Myanmar: Rice ExportDokument88 SeitenMyanmar: Rice Exportericaalini100% (1)

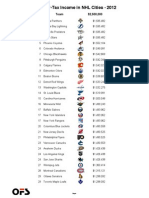

- Net After-Tax Income in NHL Cities - 2013: Team $2,500,000Dokument2 SeitenNet After-Tax Income in NHL Cities - 2013: Team $2,500,000ericaaliniNoch keine Bewertungen

- NHL 2013-2012Dokument1 SeiteNHL 2013-2012ericaaliniNoch keine Bewertungen

- NHL 2013-2012Dokument1 SeiteNHL 2013-2012ericaaliniNoch keine Bewertungen

- NHL 2012Dokument1 SeiteNHL 2012ericaaliniNoch keine Bewertungen

- Speech From The ThroneDokument24 SeitenSpeech From The ThroneCPAC TV0% (1)

- Globalisation, Financial Stability and EmploymentDokument10 SeitenGlobalisation, Financial Stability and EmploymentericaaliniNoch keine Bewertungen

- DramaturgyDokument4 SeitenDramaturgyThirumalaiappan MuthukumaraswamyNoch keine Bewertungen

- Ciplaqcil Qcil ProfileDokument8 SeitenCiplaqcil Qcil ProfileJohn R. MungeNoch keine Bewertungen

- Odysseus JourneyDokument8 SeitenOdysseus JourneyDrey MartinezNoch keine Bewertungen

- Region 12Dokument75 SeitenRegion 12Jezreel DucsaNoch keine Bewertungen

- Greek Mythology ReviewerDokument12 SeitenGreek Mythology ReviewerSyra JasmineNoch keine Bewertungen

- ACR Format Assisstant and ClerkDokument3 SeitenACR Format Assisstant and ClerkJalil badnasebNoch keine Bewertungen

- Implications - CSR Practices in Food and Beverage Companies During PandemicDokument9 SeitenImplications - CSR Practices in Food and Beverage Companies During PandemicMy TranNoch keine Bewertungen

- ECONOMÍA UNIT 5 NDokument6 SeitenECONOMÍA UNIT 5 NANDREA SERRANO GARCÍANoch keine Bewertungen

- Binder PI T4 Weber July 2017Dokument63 SeitenBinder PI T4 Weber July 2017Nilesh GaikwadNoch keine Bewertungen

- Project Initiation Document (Pid) : PurposeDokument17 SeitenProject Initiation Document (Pid) : PurposelucozzadeNoch keine Bewertungen

- UntitledDokument9 SeitenUntitledRexi Chynna Maning - AlcalaNoch keine Bewertungen

- Risk AssessmentDokument11 SeitenRisk AssessmentRutha KidaneNoch keine Bewertungen

- Donralph Media Concept LimitedDokument1 SeiteDonralph Media Concept LimitedDonRalph DMGNoch keine Bewertungen

- He Hard Truth - If You Do Not Become A BRAND Then: Examples Oprah WinfreyDokument11 SeitenHe Hard Truth - If You Do Not Become A BRAND Then: Examples Oprah WinfreyAbd.Khaliq RahimNoch keine Bewertungen

- Development of Modern International Law and India R.P.anandDokument77 SeitenDevelopment of Modern International Law and India R.P.anandVeeramani ManiNoch keine Bewertungen

- The Lightworker's HandbookDokument58 SeitenThe Lightworker's HandbookEvgeniq Marcenkova100% (9)

- Nurlilis (Tgs. Bhs - Inggris. Chapter 4)Dokument5 SeitenNurlilis (Tgs. Bhs - Inggris. Chapter 4)Latifa Hanafi100% (1)

- The New Rich in AsiaDokument31 SeitenThe New Rich in AsiaIrdinaNoch keine Bewertungen

- Uboot Rulebook v1.1 EN PDFDokument52 SeitenUboot Rulebook v1.1 EN PDFUnai GomezNoch keine Bewertungen

- Aims of The Big Three'Dokument10 SeitenAims of The Big Three'SafaNoch keine Bewertungen

- E Commerce AssignmentDokument40 SeitenE Commerce AssignmentHaseeb Khan100% (3)

- Case2-Forbidden CItyDokument10 SeitenCase2-Forbidden CItyqzbtbq7y6dNoch keine Bewertungen

- Term Paper Air PollutionDokument4 SeitenTerm Paper Air Pollutionaflsnggww100% (1)

- A2 UNIT 2 Extra Grammar Practice RevisionDokument1 SeiteA2 UNIT 2 Extra Grammar Practice RevisionCarolinaNoch keine Bewertungen

- Total Gallium JB15939XXDokument18 SeitenTotal Gallium JB15939XXAsim AliNoch keine Bewertungen

- Leander Geisinger DissertationDokument7 SeitenLeander Geisinger DissertationOrderPapersOnlineUK100% (1)

- Sharmila Ghuge V StateDokument20 SeitenSharmila Ghuge V StateBar & BenchNoch keine Bewertungen

- Country in A Box ProjectDokument6 SeitenCountry in A Box Projectapi-301892404Noch keine Bewertungen

- 3 Longman Academic Writing Series 4th Edition Answer KeyDokument21 Seiten3 Longman Academic Writing Series 4th Edition Answer KeyZheer KurdishNoch keine Bewertungen

- Abhiraj's Data Comm - I ProjectDokument15 SeitenAbhiraj's Data Comm - I Projectabhirajsingh.bscllbNoch keine Bewertungen