Beruflich Dokumente

Kultur Dokumente

Annex D Summary Report of Disbursements: Particulars

Hochgeladen von

Jeremiah TrinidadOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Annex D Summary Report of Disbursements: Particulars

Hochgeladen von

Jeremiah TrinidadCopyright:

Verfügbare Formate

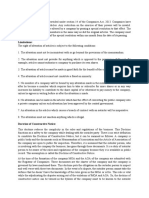

ANNEX D SUMMARY REPORT OF DISBURSEMENTS

For the Quarter Ending ___, CY ______ In Pesos Department : ___________________ Agency/Operating Unit : ___________________ Region/Province/City : ___________________ Fund : ___________________

CURRENT YEAR BUDGET

PARTICULARS

PRIOR YEAR'S BUDGET PS MOOE CO TOTAL

PRIOR YEARS' OBLIGATIONS PS MOOE CO (4) TOTAL

SUBTOTAL PS (5) =2+3+4

TRUST LIABILITIES MOOE ( 6 ) CO TOTAL Others

(7)

GRAND TOTAL PS MOOE CO (8) TOTAL Remarks

(9)

PS

MOOE

CO (2)

TOTAL

(1)

( 3)

FIRST QUARTER

Notice of Cash Allocation MDS Checks Issued Advice to Debit Account Tax Remittance Advices Issued Cash Disbursement Ceiling Non-Cash Availment Authority

TOTAL

SECOND QUARTER

Notice of Cash Allocation MDS Checks Issued Advice to Debit Account Tax Remittance Advices Issued Cash Disbursement Ceiling Non-Cash Availment Authority

TOTAL

THIRD QUARTER

Notice of Cash Allocation MDS Checks Issued Advice to Debit Account Tax Remittance Advices Issued Cash Disbursement Ceiling Non-Cash Availment Authority

TOTAL

FOURTH QUARTER

Notice of Cash Allocation MDS Checks Issued Advice to Debit Account Tax Remittance Advices Issued Cash Disbursement Ceiling Non-Cash Availment Authority TOTAL

GRAND TOTAL

Certified Correct: Certified Correct:

Agency Budget Officer Date: Approved By:

Agency Chief Accountant Date:

Head of Agency or Authorized Representative Date:

INSTRUCTIONS 1. The Summary Report of Disbursements shall: a.) Reflect all the authorized disbursements of the agency/OU by type and by allotment class, showing the totals by quarter. For highly decentralized departments (such as DepEd, DPWH, DA etc.) their lowest operating units (provincial/division/district/field offices) shall submit a copy of their reports to the Regional Office (RO) for consolidation. Subsequently, the RO shall prepare a consolidated report (RO and OUs under its coverage) and submit the same to the Central Office (CO). In turn, the CO shall prepare an overall consolidated report (CO, ROs and all OUs). b.) Prepared by the Chief Accountant/Head of Accounting Unit and approved by Head of Agency/Authorized Representative. c.) Submitted to the Government Accountancy Sector, Commission on Audit (copy furnished the Audit Team Leader) and the Department of Budget and Management (DBM). In submitting their reports to DBM, agencies and OUs under the coverage of DBM Central Office (CO) shall submit their reports directly to the Budget and Management Bureau (BMB) concerned. In the case however of DepEd, DOH, DPWH, TESDA, SUCs and CHED, their ROs and lowest OUs shall submit their reports directly to the DBM RO concerned. The CO of these departments/agencies shall also submit a consolidated department/agency report to the BMB concerned. d.) Due for submission to COA-GAS and DBM within 30 days after the end of the quarter. 2. Columns 1 to 9 shall reflect the following information: Column 1 - type of disbursement authorities and corresponding disbursements made during the quarter covered by the report. - Disbursements againts the Notice of Cash Allocations/Notice of Transfer of Allocations broken down into: * MDS Checks issued for authorized disbursements charged against the current year and prior year's budget (agency regular requirements, RLIP, Special Purpose Funds) as well as trust liabilities. * Advices to Debit Account for authorizations by the agencies/OUs to the MDS-Servicing Banks to directly credit payment to the external creditors' accounts (included in the List of Due and Demandable A/Ps chargeable against the NCAs of departments/agencies covered by the Direct Payment System for A/Ps. - Tax Remittance Advices for remittance of taxes withheld. - Cash Disbursement Ceiling for authorized disbursements charged against income collected and retained by the foreign service posts of DFA and DOLE; Non-Cash Availment Authority for cost of goods and services paid directly by lending institutions to creditors of the agency implementing a foreign-assisted project.

Column 2 - total disbursements made for obligations/expenditures incurred and charged against the current year budget (i.e.,allotments received during the year chargeable against the current year GAA i.e., agency regular budget, RLIP and Special Purpose Funds e.g. TL/RG. Column 3 - total disbursements made for obligations/expenditures incurred during the year but charged against prior year's budget (i.e. allotments received in the previous year which are still valid for obligation during current year as well as, allotment releases during the current year chargeable against prior year's GAA (i.e.,agency regular budget and SPFs). Column 4 - total disbursements made for prior years' obligations/expenditures including obligations per List of Not Yet Due and Demandable Obligations as of the immediately preceding year. Column 5 - sub-total of Columns 2, 3 & 4 i.e., all disbursements for regular operating requirements. Column 6 - total disbursements made for trust liabilities covered by E.O. 338 / DOF-DBM Joint Circular No. 1-97. Column 7 - disbursements charged against other authorities such as Non-Cash Availment Authorities received by the agency/OU. Column 8 - grand total, i.e., Columns 5, 6 & 7 for all types of disbursements by allotment class during the quarter covered by the report.

Column 9 - any additional information relevant to this report.

Das könnte Ihnen auch gefallen

- Report of Disbursement - 1st QuarterDokument2 SeitenReport of Disbursement - 1st Quartertesdaro12Noch keine Bewertungen

- Summary Report of Disbursements 2014 2ndqtrDokument2 SeitenSummary Report of Disbursements 2014 2ndqtrtesdaro12Noch keine Bewertungen

- Annex A: - Date: - DateDokument2 SeitenAnnex A: - Date: - DateJeremiah TrinidadNoch keine Bewertungen

- SAAODB reporting format instructionsDokument2 SeitenSAAODB reporting format instructionsTesa GDNoch keine Bewertungen

- Saaodb 2014 1st QTRDokument2 SeitenSaaodb 2014 1st QTRtesdaro12Noch keine Bewertungen

- Appendix 23 - Instructions - FAR No. 4Dokument1 SeiteAppendix 23 - Instructions - FAR No. 4thessa_starNoch keine Bewertungen

- MRD 2015Dokument191 SeitenMRD 2015Russel SarachoNoch keine Bewertungen

- Quarterly Operations and Financial ReportsDokument7 SeitenQuarterly Operations and Financial ReportsGerfel CabanlitNoch keine Bewertungen

- Budget Execution & Accountability: Key Phases and ReportsDokument18 SeitenBudget Execution & Accountability: Key Phases and ReportsLeila OuanoNoch keine Bewertungen

- R Pcpar Government AccountingDokument11 SeitenR Pcpar Government Accountingdoora keys100% (1)

- BUDGET AND FINANCIAL ACCOUNTABILITY REPORTS (BFARs)Dokument38 SeitenBUDGET AND FINANCIAL ACCOUNTABILITY REPORTS (BFARs)tuffoman100% (1)

- Financial Report: Item Chart of Account AmountDokument4 SeitenFinancial Report: Item Chart of Account AmountbecooooooooolNoch keine Bewertungen

- Summary of Appropriations, Allotments, Obligations and Balances (SAAOBDokument2 SeitenSummary of Appropriations, Allotments, Obligations and Balances (SAAOBthessa_starNoch keine Bewertungen

- Government Accounting SummaryDokument9 SeitenGovernment Accounting SummaryKenVictorino50% (2)

- New Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPDokument56 SeitenNew Government Accounting System (Ngas) : Mr. Antonio P. Retrato, Cpa Chief Accountant Odc, PNPRainier NabarteyNoch keine Bewertungen

- Summary of Prior Year's Obligations, Disbursements and Unpaid Prior Years Obligations 2014 1st QTRDokument2 SeitenSummary of Prior Year's Obligations, Disbursements and Unpaid Prior Years Obligations 2014 1st QTRtesdaro12Noch keine Bewertungen

- Local Government UnitsDokument14 SeitenLocal Government UnitsJennybabe PetaNoch keine Bewertungen

- NGAS: New Government Accounting SystemDokument56 SeitenNGAS: New Government Accounting SystemVenianNoch keine Bewertungen

- Validity of Appropriations, Budget Circulars & Tax Remittance AdviceDokument4 SeitenValidity of Appropriations, Budget Circulars & Tax Remittance AdviceRhea GuchilizNoch keine Bewertungen

- Accounts Payable Are Those AccountsDokument21 SeitenAccounts Payable Are Those AccountsAustin Grace WeeNoch keine Bewertungen

- 20 Government Accounting - ANSWER KEYDokument4 Seiten20 Government Accounting - ANSWER KEYRica ManaloNoch keine Bewertungen

- GlossaryDokument16 SeitenGlossaryEmmanuel AbadNoch keine Bewertungen

- Copy 7 ACP 313 QuickNotes On Government AccountingDokument10 SeitenCopy 7 ACP 313 QuickNotes On Government AccountingRodken VallenteNoch keine Bewertungen

- Government Accounting NotesDokument24 SeitenGovernment Accounting Noteszee abadilla100% (1)

- Common Budget Terminologies & ConceptDokument34 SeitenCommon Budget Terminologies & ConceptCarl MasstownNoch keine Bewertungen

- Budget Execution MonitoringDokument4 SeitenBudget Execution Monitoringimsana minatozakiNoch keine Bewertungen

- Budget Execution, Monitoring and Reporting of Government AccountingDokument13 SeitenBudget Execution, Monitoring and Reporting of Government AccountingKathleenNoch keine Bewertungen

- Appendix 21 - Instructions - FAR No. 2-ADokument2 SeitenAppendix 21 - Instructions - FAR No. 2-Athessa_starNoch keine Bewertungen

- Government Accounting - : ReviewerDokument3 SeitenGovernment Accounting - : ReviewerRich Ann Redondo Villanueva100% (1)

- EFG Chapter 4Dokument13 SeitenEFG Chapter 4Kal KalNoch keine Bewertungen

- GOVERNMENT ACCOUNTING EXAMDokument7 SeitenGOVERNMENT ACCOUNTING EXAMSean AdiarteNoch keine Bewertungen

- COA Cir No. 80-65-A-Submission of FS For AFRDokument3 SeitenCOA Cir No. 80-65-A-Submission of FS For AFRcrizalde m. de diosNoch keine Bewertungen

- Accounting For Budgetary AccountsDokument51 SeitenAccounting For Budgetary Accountsacctg2012Noch keine Bewertungen

- Appendix 20 - Instructions - FAR No. 2Dokument2 SeitenAppendix 20 - Instructions - FAR No. 2thessa_starNoch keine Bewertungen

- Consolidated Financial Statements For Holding Companies-FR Y-9CDokument65 SeitenConsolidated Financial Statements For Holding Companies-FR Y-9CarunNoch keine Bewertungen

- What Is The General Accounting Plan of Government Agencies/units?Dokument2 SeitenWhat Is The General Accounting Plan of Government Agencies/units?Che CoronadoNoch keine Bewertungen

- Module 4Dokument15 SeitenModule 4Jan Mike T. MandaweNoch keine Bewertungen

- AA41023rdHand OutDokument7 SeitenAA41023rdHand OutMana XDNoch keine Bewertungen

- Circular Letter No 2019 7Dokument4 SeitenCircular Letter No 2019 7Romel Ragasa RaqueñoNoch keine Bewertungen

- Accounting For Budgetary AccountsDokument3 SeitenAccounting For Budgetary AccountsRed YuNoch keine Bewertungen

- Group 1 Budget ProcessDokument26 SeitenGroup 1 Budget ProcessCassie ParkNoch keine Bewertungen

- Annex 2-REGISTRY OF BUDGET, COMMITMENTS, PAYMENTS AND BALANCESDokument7 SeitenAnnex 2-REGISTRY OF BUDGET, COMMITMENTS, PAYMENTS AND BALANCESVermon JayNoch keine Bewertungen

- AC316 Module 8Dokument5 SeitenAC316 Module 8Jaime PalizardoNoch keine Bewertungen

- Central Office: Department MemorandumDokument4 SeitenCentral Office: Department MemorandumTIMMY BOYNoch keine Bewertungen

- COA CIRCULAR NO. 96 006 May 2 1996Dokument3 SeitenCOA CIRCULAR NO. 96 006 May 2 1996Marcellanne VallesNoch keine Bewertungen

- BudgetingDokument11 SeitenBudgetingWinnie Ann Daquil LomosadNoch keine Bewertungen

- New Government Accounting SystemDokument2 SeitenNew Government Accounting SystemOwdray CiaNoch keine Bewertungen

- Guide to Local Finance Committees & Budget ProcessDokument3 SeitenGuide to Local Finance Committees & Budget ProcessKei SenpaiNoch keine Bewertungen

- Updates On Accounting and Auditing Reforms PDFDokument85 SeitenUpdates On Accounting and Auditing Reforms PDFkenvysNoch keine Bewertungen

- Government Accounting Exam PhilippinesDokument4 SeitenGovernment Accounting Exam PhilippinesPrince Oliver ArauctoNoch keine Bewertungen

- New Government Accounting System ManualDokument40 SeitenNew Government Accounting System ManualMarry Shane BetonioNoch keine Bewertungen

- NGASDokument4 SeitenNGASelminvaldezNoch keine Bewertungen

- WRUA AuditDokument91 SeitenWRUA Auditthe kingfishNoch keine Bewertungen

- NGAS Manual For Local Government UnitsDokument29 SeitenNGAS Manual For Local Government UnitsChiyobels100% (5)

- Final Consolidated Fiscal Policy - Dec 2014 PDFDokument17 SeitenFinal Consolidated Fiscal Policy - Dec 2014 PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Government AccountingDokument13 SeitenGovernment AccountingReniella Villondo100% (1)

- Coa C99-004Dokument14 SeitenCoa C99-004bolNoch keine Bewertungen

- UntitledDokument8 SeitenUntitledCristel TannaganNoch keine Bewertungen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Annex A Request For Cerrtification UpdatedDokument1 SeiteAnnex A Request For Cerrtification UpdatedJeremiah TrinidadNoch keine Bewertungen

- 2017 Mock Bar - Civil Law SyllabusDokument1 Seite2017 Mock Bar - Civil Law SyllabusJeremiah TrinidadNoch keine Bewertungen

- Kepco's Claim for Tax Refund Dismissed Due to Non-Compliance of Substantiation RequirementsDokument2 SeitenKepco's Claim for Tax Refund Dismissed Due to Non-Compliance of Substantiation RequirementsJeremiah Trinidad100% (2)

- People Vs Marie Teresa Pangilinan GR 152662Dokument13 SeitenPeople Vs Marie Teresa Pangilinan GR 152662Verbosee VVendettaNoch keine Bewertungen

- Court Rules Regional Trial Court Has Jurisdiction Over Bounced Check Case Involving Foreign CurrencyDokument4 SeitenCourt Rules Regional Trial Court Has Jurisdiction Over Bounced Check Case Involving Foreign CurrencyDovahsosNoch keine Bewertungen

- Labor Law 1 PDFDokument129 SeitenLabor Law 1 PDFirditchNoch keine Bewertungen

- Addition Grade 1 Single Digit Rainbow Theme Exercises Worksheet PDFDokument1 SeiteAddition Grade 1 Single Digit Rainbow Theme Exercises Worksheet PDFJeremiah TrinidadNoch keine Bewertungen

- Supreme Court of the Philippines Ruling on Hazing Death CasesDokument30 SeitenSupreme Court of the Philippines Ruling on Hazing Death CasesArwin CabantingNoch keine Bewertungen

- Addition Grade 1 Single Digit Rainbow Theme Exercises Worksheet PDFDokument1 SeiteAddition Grade 1 Single Digit Rainbow Theme Exercises Worksheet PDFJeremiah TrinidadNoch keine Bewertungen

- P-Insp. Ariel Artilero v. Orlando Casimiro, Et - Al.Dokument10 SeitenP-Insp. Ariel Artilero v. Orlando Casimiro, Et - Al.Jeremiah TrinidadNoch keine Bewertungen

- People vs. CandidoDokument6 SeitenPeople vs. CandidoJeremiah TrinidadNoch keine Bewertungen

- Rosa Lim Guilty of Violating B.P. Bilang 22Dokument3 SeitenRosa Lim Guilty of Violating B.P. Bilang 22Jeremiah TrinidadNoch keine Bewertungen

- People vs. BustineraDokument6 SeitenPeople vs. BustineraJeremiah TrinidadNoch keine Bewertungen

- G.R. No. 149695 April 28, 2004 WILLY G. SIA, Appellee, People of The Philippines, AppellantDokument9 SeitenG.R. No. 149695 April 28, 2004 WILLY G. SIA, Appellee, People of The Philippines, AppellantJeremiah TrinidadNoch keine Bewertungen

- Chang vs. IACDokument3 SeitenChang vs. IACJeremiah Trinidad100% (1)

- Philippine Legal Research GuideDokument54 SeitenPhilippine Legal Research GuideRJ Pas80% (15)

- Bayani Vs PeopleDokument3 SeitenBayani Vs Peoplescartoneros_1Noch keine Bewertungen

- Amada Resterio vs. PeopleDokument4 SeitenAmada Resterio vs. PeopleJeremiah TrinidadNoch keine Bewertungen

- Izon vs. PeopleDokument2 SeitenIzon vs. PeopleJeremiah TrinidadNoch keine Bewertungen

- People vs. LobitaniaDokument5 SeitenPeople vs. LobitaniaJeremiah TrinidadNoch keine Bewertungen

- G.R. No. 135904 acquittal appeal carnapping convictionDokument4 SeitenG.R. No. 135904 acquittal appeal carnapping convictionJeremiah TrinidadNoch keine Bewertungen

- G.R. No. 193362 January 18, 2012 EDGARDO MEDALLA, Petitioner, RESURRECCION D. LAXA, RespondentDokument2 SeitenG.R. No. 193362 January 18, 2012 EDGARDO MEDALLA, Petitioner, RESURRECCION D. LAXA, RespondentJeremiah TrinidadNoch keine Bewertungen

- People vs. Arnel NocumDokument4 SeitenPeople vs. Arnel NocumJeremiah TrinidadNoch keine Bewertungen

- Nego Inst Law FinalDokument56 SeitenNego Inst Law FinalJeremiah TrinidadNoch keine Bewertungen

- People vs. MejiaDokument13 SeitenPeople vs. MejiaJeremiah TrinidadNoch keine Bewertungen

- Regional Payroll Services Unit ATM Implementation Status ReportDokument4 SeitenRegional Payroll Services Unit ATM Implementation Status ReportJeremiah TrinidadNoch keine Bewertungen

- People vs. GarciaDokument4 SeitenPeople vs. GarciaJeremiah TrinidadNoch keine Bewertungen

- CDJ June PVB 00301-000966-1Dokument37 SeitenCDJ June PVB 00301-000966-1Jeremiah TrinidadNoch keine Bewertungen

- Legal CounsellingDokument11 SeitenLegal CounsellingNehru Valdenarro Valera100% (3)

- Dept of Education Check DisbursementsDokument3 SeitenDept of Education Check DisbursementsJeremiah TrinidadNoch keine Bewertungen

- Freedom of Speech and Expression in MalaysiaDokument2 SeitenFreedom of Speech and Expression in Malaysianurain.khairulhiddardNoch keine Bewertungen

- Collective Bargaining and NegotiationsDokument23 SeitenCollective Bargaining and NegotiationsbijuanithaNoch keine Bewertungen

- Reference Guide Alter Ego TrustsDokument5 SeitenReference Guide Alter Ego TrustsStrongHandNoch keine Bewertungen

- Promoting Human Rights Through Science, Education and CultureDokument10 SeitenPromoting Human Rights Through Science, Education and Culturekate saradorNoch keine Bewertungen

- Aibe-Vii - English-Set-CDokument30 SeitenAibe-Vii - English-Set-CRamesh Babu TatapudiNoch keine Bewertungen

- Downfall of Ayub Khan and Rise of Zulfikar Ali BhuttoDokument9 SeitenDownfall of Ayub Khan and Rise of Zulfikar Ali Bhuttoabdullah sheikhNoch keine Bewertungen

- Philippine Law Reviewers Explains Criminal Law Book 1 Articles 21-30Dokument11 SeitenPhilippine Law Reviewers Explains Criminal Law Book 1 Articles 21-30Liezel SimundacNoch keine Bewertungen

- NH Bar Roland WhiteDokument2 SeitenNH Bar Roland WhiteAudra ToopNoch keine Bewertungen

- Caballes V CADokument2 SeitenCaballes V CATintin CoNoch keine Bewertungen

- Law of Evidence - InterimDokument6 SeitenLaw of Evidence - InterimshanikaNoch keine Bewertungen

- Ganapati TDS ChalanDokument3 SeitenGanapati TDS ChalanPruthiv RajNoch keine Bewertungen

- Arcandra Pro TeamDokument10 SeitenArcandra Pro TeamDanu EgaNoch keine Bewertungen

- DL101-Module9-International RegistrationDokument48 SeitenDL101-Module9-International RegistrationMizra BezNoch keine Bewertungen

- People of The Philippines Vs - Eddie ManansalaDokument2 SeitenPeople of The Philippines Vs - Eddie ManansalaDennis Jay A. Paras100% (2)

- List of Minimum Annual Leave by Country - WikipediaDokument29 SeitenList of Minimum Annual Leave by Country - WikipediaJuan joseNoch keine Bewertungen

- Writ of Continuing Mandamus (FIL)Dokument33 SeitenWrit of Continuing Mandamus (FIL)Ronnie RimandoNoch keine Bewertungen

- Cable 504: US and Honduras Negotiate Intelligence Sharing and The Cerro La Mole Radar SystemDokument7 SeitenCable 504: US and Honduras Negotiate Intelligence Sharing and The Cerro La Mole Radar SystemAndresNoch keine Bewertungen

- Adr ProjectDokument14 SeitenAdr ProjectDarpan MaganNoch keine Bewertungen

- General Sense - The Science of Moral Rules, Founded On The Rational Nature of Man, Which Governs His FreeDokument3 SeitenGeneral Sense - The Science of Moral Rules, Founded On The Rational Nature of Man, Which Governs His FreeAmelyn BalanaNoch keine Bewertungen

- Directory 2021Dokument208 SeitenDirectory 2021David LalsangzualaNoch keine Bewertungen

- South Asia Tribune Weekly UKDokument32 SeitenSouth Asia Tribune Weekly UKShahid KhanNoch keine Bewertungen

- Case Study Related To Insider TradingDokument4 SeitenCase Study Related To Insider TradingSylvie KathuriaNoch keine Bewertungen

- Beneficial interpretation of welfare legislation in IndiaDokument7 SeitenBeneficial interpretation of welfare legislation in IndiaVeena Kulkarni DalaviNoch keine Bewertungen

- IBP GOVERNOR DISBARMENTDokument3 SeitenIBP GOVERNOR DISBARMENTMargie Marj GalbanNoch keine Bewertungen

- Maternity Benefit ActDokument9 SeitenMaternity Benefit Acthimanshu kumarNoch keine Bewertungen

- Criminal Jurisprudence Reviewer 1Dokument4 SeitenCriminal Jurisprudence Reviewer 1Judel Kidatan Valdez100% (1)

- MR PenalogaDokument2 SeitenMR PenalogaSarj LuzonNoch keine Bewertungen

- Form 16 FY 19-20Dokument6 SeitenForm 16 FY 19-20Anurag SharmaNoch keine Bewertungen

- BPI v. CADokument6 SeitenBPI v. CAAntonio RebosaNoch keine Bewertungen

- Alteration of ArticlesDokument4 SeitenAlteration of Articleskhadija khanNoch keine Bewertungen