Beruflich Dokumente

Kultur Dokumente

Final Report

Hochgeladen von

Nilesh WaghOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Final Report

Hochgeladen von

Nilesh WaghCopyright:

Verfügbare Formate

Fundamental & technical analysis of Chemical & Consumer Durables

RELIANCE LIFE INSURANCE LTD

OBJECTIVE

The project is based on the financial sector of the market. And with the help of the financial sector the dada of the companies are been compared. The main objective of this project is to find the difference between the 2 companies: 1-tata chemicals 2-gujrat alkalies and chemical industry And to find that which companies share is better to buy and which company is not good to buy shares.

INDUSTRY PROFILE

Broad term describing any marketplace where buyers and sellers participate in the trade of assets such as equities, bonds, currencies and derivatives. Financial markets are typically defined by having transparent pricing, basic regulations on trading, costs and fees and market forces determining the prices of securities that trade. Some financial markets only allow participants that meet certain criteria, which can be based on factors like the amount of money held, the investor's geographical location, knowledge of the markets or the profession of the participant. Financial markets can be found in nearly every nation in the world. Some are very small, with only a few participants, while others like the New York Stock Exchange (NYSE) and the forex markets trade trillions of dollars daily. Most financial markets have periods of heavy trading and demand for securities; in these periods, prices may rise above historical norms. The financial sector is in a process of rapid transformation. Reforms are continuing as part of the overall structural reforms aimed at improving the productivity and efficiency of the economy. The role of an integrated financial infrastructure is to stimulate and sustain economic growth. NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

The growth of financial sector in India at present is nearly 8.5% per year. The rise in the growth rate suggests the growth of the economy he financial policies and the monetary policies are able to sustain a stable growth rate

TYPES OF FINANCIAL MARKET

Capital market

Capital market is market where individuals invest for a longer duration i.e. more than a year is called as capital market. The capital market has two segments mainly: a. DEBT SEGMENT : The Debt segment deals with debt paper like government bonds and corporate debentures b. EQUITY SEGMENT : The Equity segment deals with transactions in equity shares Capital market is important from the point of view of the investor as well as the entity requiring funds. The investor has saving or surplus funds which the investor would like to park in investment avenues giving good return and with the safety of funds. The entity requiring funds could be a company for expansion or growth and could be government of India for various welfare programs or for bridging the gap between budget revenue and expenditure. Therefore, capital market essentially is an intermediary between the investor and the entity requiring funds. Capital market divided into following parts:

PRIMARY MARKET

Primary market is form of capital market where various companies issue new stock. Primary market is a form of market where stocks and securities are issued for the first time by companies. Its called as IPO i.e. initial public offer. Only listed company can make IPO to investor. A company must have three years profits record for being eligible to make on IPO. At present the book building route is to be followed for an IPO where investors actually bid for shares at a price which is appropriates according to their judgment and therefore unlike in the past all appoints a lead book runner and the promoters along with the lead book runner stipulates a price banner. Investor can apply for the shares at any price within the price ban. The other entities involved in an IPO are underwritten to

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

the issue bankers to issue and register to the issue. The lead book runner is responsible for coordinating THE ACTIVITIES OF ALL THE PARTICIPANTS. THE UNDERWRITERS PROVIDE AN INSURANCE TO THE ISSUE IN THE SENSE THAT if the public response is not adequate then the underwriter will take up the under subscription portion of the issue.

SECONDARY MARKET

The secondary market is for transacting shares of listed companies and therefore after an investor receives allotment in the primary market then he cancelled the shares in the secondary market. In the secondary market, the transactions are done on a T+2 settlement basis. It is called a rolling settlement. The investor whether he purchases or rolls the shares the settlement is done on T+2 bases. T stands for transaction day and therefore if the transaction day is a Monday the settlement would be on Wednesday. Settlement involves making payment for the shares sold. Time is very important in the stock market and therefore if shares are sold on the Monday then they must be transferred from the sellers account to the brokers account on or before commencement of the market on Wednesday. Any delay would entail optioning of shares.

MONEY MARKET

The money market is a segment of the financial market in which financial instrument with high liquidity and very short terms are traded. Money market is a short term for money investment where the duration of the debt paper is below 365 days. The majority of different papers range between one working day to 364 days. He major players in the money market are scheduled commercial banks, financial institution, insurance companies, and mutual funds. The shortest avenue for investment in the money market is the call money. Money market consist certificates of deposit (CDs), Call money, commercial paper, treasury bills, municipal notes, repurchase agreement. Money market investments are also called cash investments because of their short maturities. Following are some of the important money market instruments or securities.

(A)CALL MONEY:

Call money is mainly used by the banks to meet their temporary requirement of cash. They borrow and lend money from each other normally on a daily basis. It is repayable on demand and its maturity period varies in between one day to a fortnight. The rate of interest paid on call money loan is known as call rate. NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

(B)TREASURY BILL:

Treasury bill is a promissory note issued by the RBI to meet the short-term requirement of funds. Treasury bills are highly liquid instruments that mean, at any time the holder of treasury bills can transfer of or get it discounted from RBI. These bills are normally issued at a price less than their face value; and redeemed at face value. So the difference between the issue price and the face value of the Treasury bill represents the interest on the investment. These bills are secured instruments and are issued for a period of not exceeding 364 days. Banks, Financial institutions and corporations normally play major role in the Treasury bill market.

(C) COMMERCIAL PAPER:

Commercial paper (CP) is a popular instrument for financing working capital requirements of companies. The CP is an unsecured instrument issued in the form of promissory note. This instrument was introduced in 1990 to enable the corporate borrowers to raise short-term funds. It can be issued for period ranging From 15 days to one year. Commercial papers are transferable by endorsement and delivery . The highly reputed companies (Blue Chip companies) are the major player of commercial paper market.

(D)CERTIFICATE OF DEPOSIT:

Certificate of Deposit (CDs) are short-term instruments issued by Commercial Banks and Special Financial Institutions (SFIs), which are freely transferable from one party to another The maturity period of CDs ranges from 91 days to one year . These can be issued to individuals, co-operatives and companies.

(E)TRADE BILL:

Normally the traders buy goods from the wholesalers or manufactures on credit. The sellers get payment after the end of the credit period. But if any seller does not want to wait or in immediate need of money he/she can draw a bill of exchange in favor of the buyer . When buyer accepts the bill it becomes a negotiable instrument and is termed as bill of exchange or trade bill. This trade bill can now be discounted with a bank before its maturity. On maturity the bank gets the payment From the drawee i.e., the buyer of goods. When trade bills are accepted by Commercial Banks it is known as Commercial Bills. So trade bill is an instrument, which enables the drawer of the bill to get funds for short period to meet the working capital need

SPOT MARKET

NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

Investing in spot market is highly sophisticated, with opportunities for both big losses and big gains. In the spot market, goods are sold for cash and are delivered immediately. Prices are settled in cash on the spot at current market prices. The spot market is complex and dedicate and not suitable for inexperienced traders. A market in which commodities, such as grain, Gold, crude oil or RAM chips, are bought and sold for cash and delivered immediately. Also called cash market.

DERIVATIVE MARKET

The derivate is named so for a reason : its value is derived from its underlying asset or assets. A derivative is a contract, but in this case the contract price is determined by the market price of the core asset. If that found complicated, its because it is. The derivatives market adds yet another layer of complexity and is therefore not ideal for inexperienced traders looking to speculate. Examples of common derivatives: are forwards, futures, options, swaps and contracts for difference (CFDs). There are also many derivatives , structured products and collateralized, obligations available, mainly in the over the counter market, that professional investors, institutions and hedge fund managers use to varying degrees but that play an insignificant role in private investing.

FOREX AND THE INTERBANK MARKET

The interbank market is the financial system and trading of currencies among banks and financial institutions, excluding retail investors and smaller trading parties. While some interbank trading is performed by banks on behalf of large customers, most interbank trading takes place from the banks' own accounts. The forex market is where currencies are traded. The forex market is the largest, most liquid market in the world .The forex is the largest market in the world in terms of the total cash value traded, and any person, firm or country may participate in this market. There is no central marketplace for currency exchange trade is conducted over the counter. The forex market is open 24 hours a day, five days a week and currencies are traded worldwide among the major financial centers of London, New York, Tokyo, Frankfurt, Hong Kong, Singapore, Paris and Sydney. Until recently, forex trading in the

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

currency market had largely been the domain of large financial institutions, operations, central banks, hedge funds and extremely wealthy individuals.

ROLE OF REGULATORY BODY

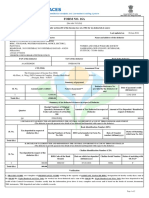

The SEBI is the regulatory authority in India. SEBI established under section 3 of SEBI Act. And this act made especially for protecting the interest of investor in securities and promoting the development and also for regulating, the securities market and for matters connected therewith and incidental thereto. SEBI has made rules and regulation to be followed by the financial intermediaries such as brokers, etc. SEBI looks after the complaints received from investors for fair settlement. It also issues booklets for the guidance and protection of small investors. SEBI has made rules and regulation to be followed by the financial intermediaries such as brokers, etc. SEBI looks after the complaints received from investors for fair settlement. It also issues booklets for the guidance and protection of small investors. To regulate and control the business on stock exchanges and other security markets. For this, SEBI keeps supervision on brokers. Registration of brokers and subbrokers is made compulsory and they are expected to follow certain rules and regulations. Effective control is also maintained by SEBI on the working of stock exchanges. To make registration and to regulate the functioning of intermediaries such as stock brokers, subbrokers, share transfer agents, merchant bankers and other intermediaries operating on the securities market. In addition, to provide suitable training to intermediaries. This function is useful for healthy atmosphere on the stock exchange and for the protection of small investors. To register and regulate the working of mutual funds including UTI (Unit Trust of India). SEBI has made rules and regulations to be followed by mutual funds. The purpose is to maintain effective supervision on their operations & avoid their unfair and anti-investor activities. Prime objectives of SEBI Protecting the interest of the investors in securities Promoting development of, and Regulating, the security market and for the matter connected therewith.

STATUTORY BODIES

1. RESERVE BANK OF INDIA: Reserve Bank of India is the apex monetary Institution of India. It is also called as the central bank of the country. The Reserve Bank of India was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934. The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937. Though originally privately owned, since nationalization in 1949, the Reserve Bank is fully owned by the Government of India. The preamble of the reserve bank of India is as follows: NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

"To regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage." 2. SECURITIES AND EXCHANGE BOARD OF INDIA: SEBI Act, 1992: Securities and Exchange Board of India (SEBI) was first established in the year 1988 as a non-statutory body for regulating the securities market. It became an autonomous body in 1992 and more powers were given through an ordinance. Since then it regulates the market through its independent powers. 3. INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY: The Insurance Regulatory and Development Authority (IRDA) is a national agency of the Government of India and are based in Hyderabad (Andhra Pradesh). It was formed by an Act of Indian Parliament known as IRDA Act 1999, which was amended in 2002 to incorporate some emerging requirements. Mission of IRDA as stated in the act is "to protect the interests of the policyholders, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto."

PART OF THE MINISTRIES OF THE GOVERNMENT OF INDIA:

FORWARD MARKET COMMISSION INDIA (FMC): Forward Markets Commission (FMC)

headquartered at Mumbai, is a regulatory authority which is overseen by the Ministry of Consumer Affairs, Food and Public Distribution, Govt. of India. It is a statutory body set up in 1953 under the Forward Contracts (Regulation) Act, 1952 This Commission allows commodity trading in 22 exchanges in India, out of which three are national level.

PFRDA UNDER THE FINANCE MINISTRY: Pension Fund Regulatory and Development Authority

PFRDA were established by Government of India on 23rd August, 2003. The Government has, through an executive order dated 10th October 2003, mandated PFRDA to act as a regulator for the pension sector. The mandate of PFRDA is development and regulation of pension sector in India.

FINANCIAL PLANNING

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

Financial planning means to prepare the financial plan. A financial plan is also called capital plan for the company. A financial plan is an estimate of the total capital requirements of the company. It selects the most economical sources of finance. It also tells us how to use this finance profitably. Financial plan gives a total picture of the future financial activities of the company. This all the financial planning in simple. A financial plan contains answers to the following questions: How much finance (short-term, medium-term and long-term) will be required by the company or an individual? From where this finance will be acquired (gathered)? In other words, what are the sources of finance? That is, owned capital (promoter contribution, share capital) and borrowed capital (debentures, loans, overdrafts, etc.). How the company will use this acquired finance? That is, application or utilization of funds. Financial plan is generally prepared during promotion stage. It is prepared by the Promoters (entrepreneurs) with the help of experienced (practicing) professionals. The promoters must be very careful while preparing the financial plan. This is because a bad financial plan will lead to over-capitalization or under-capitalization. It is very difficult to correct a bad financial plan. Hence immense care must be taken while preparing a financial plan in company. As well as an individual also can prepare the financial planning for their future requirement with help of available resources. It mostly did by financial planner.

TYPES OF FINANCIAL PLANNING

Short-term financial plan is prepared for maximum one year. This plan looks after the working capital needs of the company. Medium-term financial plan is prepared for a period of one to five years. This plan looks after replacement and maintenance of assets, research and development, etc. Long-term financial plan is prepared for a period of more than five year.

It looks after the long-term financial objectives of the company, its capital structure, expansion activities, etc.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

OBJECTIVES OF FINANCIAL PLANNING

a. Determining capital requirements- This will depend upon factors like cost of current and fixed assets, promotional expenses and long- range planning. Capital requirements have to be looked with both aspects: short- term and long- term requirements. b. Determining capital structure- The capital structure is the composition of capital, i.e., the relative kind and proportion of capital required in the business. This includes decisions of debt- equity ratio- both short-term and long- term. c. Framing financial policies with regards to cash control, lending, borrowings, etc. d. A finance manager ensures that the scarce financial resources are maximally utilized in the best possible manner at least cost in order to get maximum returns on investment.

IMPORTANCE OF FINANCIAL PLANNING

Financial Planning is process of framing objectives, policies, procedures, programmers and budgets regarding the financial activities of a concern. This ensures effective and adequate financial and investment policies. The importance can be outlined as1. Adequate funds have to be ensured. 2. Financial Planning helps in ensuring a reasonable balance between outflow and inflow of funds so that stability is maintained. 3. Financial Planning ensures that the suppliers of funds are easily investing in companies which exercise financial planning. 4. Financial Planning helps in making growth and expansion programmes which helps in long-run survival of the company. 5. Financial Planning reduces uncertainties with regards to changing market trends which can be faced easily through enough funds. 6. Financial Planning helps in reducing the uncertainties which can be a hindrance to growth of the company. This helps in ensuring stability a d profitability in concern.

ADVANTAGES OF FINANCIAL PLANNING

it will help you to obtain funding if you need it.

It will set out clearly the money that you need to put together to start the business and then to run it for a period. It will help prevent you from going into a business that will not be successful. It will highlight periods where your business may need extra financial help. It will help you to spot problems early so you can make plans for the necessary solution. (For example, it will highlight whether you are holding too much stock or whether your collection is less than it should be or that you will be short of cash at a particular time). It will inspire confidence in lenders and banks that you may have to approach for finance.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

DISADVANTAGES OF FINANCIAL PLANNING

It can take a lot of time. It can be a costly process because you will need the assistance of your accountant or financial adviser. A financial plan merely forecasts

INVESTMENT OPTION

In simple terms, Investment refers to purchase of financial assets. While Investment Goods are those goods, which are used for further production. Investment implies the production of new capital goods, plants and equipments. Mostly is basically earning something from the available saving with us through the different options like FD, Mutual Funds, LIC, PF, equity market, etc.

INVESTMENT OPTIONS GIVEN AS FOLLOWS:

1) MUTUAL FUND

Mutual Fund is an investment trust that collects money from investors having a common financial goal. The collected money is invested in various capital market instruments like shares, debentures and other securities. The income earned through these investments is shared with all the investors Growth Schemes: - To have good long term growth potential for company and industry. Balanced Schemes: - Combination of both stocks and bonds Income Schemes: - It Offers investors a regular income usually paid out in the form of monthly dividend

2) BANK FIXED DEPOSIT

Fixed Deposit (FD) is a financial instrument where an investment is made for a fixed period of time resulting in a higher rate of Interest in return. This is best suited for investors with a low risk Appetite

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

3) NATIONAL SAVING CERTIFICATE

Scheme specially designed for Government employees, Businessmen and other salaried classes who are Income Tax assesses. No maximum limit for investment. Certificates can be kept as collateral security to get loan from banks. Investment up to INR 1, 00,000/- per annum Rate of interest 8.50%.

4) PUBLIC PROVIDENT FUND (PPF)

Public Provident Fund (PPF) is a statutory scheme by the Central Government of India. It is one of the instruments suitable for long term investment. PPF scheme is for a period of 15 years. The minimum investment required in a PPF account is Rs 500 per year and the maximum investment amount is Rs 70,000 per year.

5) STOCK MARKET

Stock Market is one of the interesting investment options. This is the investment option which offers a very high rate of return coupled with maximum risk. Based on information & analysis, future share prices are predicted but the probability of the share prices reaching the target price is always a 50:50 chance.

6) SILVER

Silver considered as a poor mans gold is one of the attractive investment option. Normally Gold is preferred over Silver by all investors. The silver market is much smaller in value than the gold market. Silver is a better investment in a bull market. Price of silver is driven by speculation and supply and demand. Silver price is significantly volatile. This is because of lower market liquidity, and demand fluctuations between industrial and store of value uses.

7) GOLD

Gold, the shining yellow metal is one of the most popular investment options. It is considered as a safe haven against all national, political and cultural crises majority of the financial planners recommends around 15- 20% allocation of the total portfolio to Gold NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

8) UNIT LINKED INSURANCE PLANS (ULIPS)

Unit Linked Insurance Plans, popularly known as ULIPs, it is an investment option provided by Insurance Companies. It is a single contract comprising of insurance cover with an investment benefit.

9) REAL ESTATE

Real Estate refers to investment in immovable properties which includes land, buildings, flats etc. Investing in real estate involves the purchase of real estate and selling it for a profit.

10) ANTIQUE

Antiques are extremely vulnerable to fluctuations in public demand, so they are considered high-risk, speculative investments. Antiques have always been a solid investment.

PRODUCT OFFERED BY BROKING HOUSES

A brokerage house, also called a brokerage firm, is a company licensed to buy and sell stocks or securities. Acting as an intermediary between buyers and sellers, a brokerage house typically employs brokers who carry out the wishes of the firm's clients as they pertain to the trading of stocks. Broker services are usually provided on a commission basis. Commission amounts charged for the buying and selling of securities vary with each brokerage house. Often, the price per trade is indicative of the level of service the firm offers. For example, a brokerage house that charges fees on the lower end of the scale may not execute trades as quickly as one that charges higher fees. Likewise, a firm that charges higher commissions usually offers more personalized service. In addition to commissions, a brokerage firm may charge various other fees. These fees may include charges for transferring assets, closing an account, and wiring money. Additionally, a brokerage firm may require the payment of IRA custodian fees, as well as annual services charges and fees related to periods of account inactivity. Depending on the policies of the brokerage house, a client's account may also incur a fee for failing to meet a minimum required account balance. Several brokerage houses have come up with the prepaid products to attract investors and retain them. Typically, the concept of a pre-paid brokerage cost means paying an upfront brokerage and enjoying discounted rates on your broking transactions. Some brokerage houses also call this an annual maintenance contract (AMC).Large brokerage houses are keen on such schemes as their infrastructure keeps a check on costs while margins improve with a surge in the number of clients. Each brokerage house has a different pre-paid product. Some have pre-paid products starting from as low as. 2,000 a NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

year, while for high end customers it could go up to. 1 lakh a year. Similarly, the validity of each pre-paid brokerage account could vary. There number of broking houses: 1) Share khan 2) Angel broking 3) Shushilfinance 4) Bonanza 5) Canmoney 6) HDFC Securities 7) Indian bull 8) ICICI Direct 9) Indian info line 10) Kotak Security 11) Motilal Oswal 12) Reliance money 13) SBI These are the some broking house in India & and they are offering different product to investors like mutual funds, equity, commodity, insurance & other.

1) MUTUAL FUNDS:

A mutual fund is an entity that pools the money of many investors its unit-holders to invest in different securities. Investments may be in shares, debt securities, money market securities or a combination of these. Those securities are professionally managed on behalf of the unit-holders, and each investor holds a pro-rata share of the portfolio i.e. entitled to any profits when the securities are sold, but subject to any losses in value as well. Benefits of investing through a mutual fund Professional Investment Management Diversification Low Cost Convenience and Flexibility Personal Service Liquidity Transparency Two Types of mutual funds schemes

Open ended(Open-ended schemes can issue and redeem units any time during the life of the scheme ) Closed ended(close-ended schemes cannot issue new units except in case of bonus or rights issue)

2) COMMODITY:

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

A physical substance, such as food, grains, and metals, which is interchangeable with another product of the same type, and which investors buy or sell, usually through futures contracts. The price of the commodity is subject to supply and demand. Risk is actually the reason exchange trading of the basic agricultural products began. For example, a farmer risks the cost of producing a product ready for market at some time in the future because he doesn't know what the selling price will be. More generally, a product which trades on a commodity exchange; this would also include foreign currencies and financial instruments and indexes.

3) EQUITY:

There are two ways in which you can invest in equities through the secondary market by buying shares that are listed in Stock exchanges and through the primary market by buying shares that are offered to public by companies first time after listing in stock market. Broking houses do that on behalf of the investor of client of them.

4) INSURANCE:

They also provide insurance policy with different plans or the investors which helps them investor to earn more money. These are the some product which is offer by the many broking firms to the investors.

COMPANY PROFILE

Reliance Industries Limited (RIL) is Indias largest private sector company on all major financial parameters. It has emerged as the only Indian company in the list of global companies that create most value for their shareholders, published by Financial Times based on a global survey and research conducted by PricewaterhouseCoopers in 2004. RIL features in the Forbes Global list of worlds 400 best big companies and in FT Global 500 list of worlds largest companies. Reliance Info communication is the outcome of late Dhirubhai Ambanis dream of bringing about a digital revolution in India that will bring to every Indians doorstep an affordable means of information and communication. It founded by Mr D.Ambani. Reliance Industries Ltd is an India-based company. The company is India's largest private sector company on all major financial parameters. They are the first private sector company from India to feature in the Fortune Global 500 list of 'World's Largest Corporations' and ranks 117th amongst the world's Top 200 companies in terms of profits. The company operates world-class manufacturing NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

facilities across the country at Allahabad, Barabanki, Dahej, Hazira, Hoshiarpur, Jamnagar, Nagothane, Nagpur, Naroda, Patalganga, Silvassa and Vadodara. The company operates in three business segments: petrochemicals, refining, and oil and gas. But after death of Mr.D.Ambani his both sons got separated and share their business and manage by themselves . and reliance capital is one of the small part of the reliance industries and its owned by Mr.Anil Ambani. Reliance Capital Limited (RCL) was incorporated in year 1986 at Ahmedabad in Gujarat as Reliance Capital & Finance Trust Limited. The name RCL came into effect from January 5, 1995. In 2002, RCL shifted its registered office to Jamnagar in Gujarat before it finally moved to Mumbai in Maharashtra, in 2006. In 2006, Reliance Capital Ventures Limited merged with RCL and with this merger the shareholder base of RCL rose from 0.15 million shareholders to 1.3 million. RCL entered the Capital Market with a maiden public issue in 1990 and in subsequent years further tapped the capital market through rights issue and public issues. The equity shares were initially listed on the Ahmedabad Stock Exchange and The Stock Exchange Mumbai. Presently the shares are listed on The Stock Exchange Mumbai and the National Stock Exchange of India. And 1200+ employees across the 162 location spread across the country at services purpose to try to complete vision of the company. The corporate Office at Goregoa, Mumbai has approximately 350 people belonging to these various functions. They are not in India but they moved all over the world. They moved to West Asia, South East Asia, Africa and Euroup

VISION

Reliance capital s vision isthe most profitable, innovation, and most trusted financial services company in India and in the emerging market.

MISSION

To create and nurture a world-class, high performance environment aimed at delighting our customers by providing endless financial products in all part of the country.

VALUES

Our growth and success are based on the ten core values of Care, Citizenship, Fairness, Honesty, Integrity, Purposefulness, Respect, Responsibility, Safety and Trust

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

PROMOTER AND PROMOTER GROUP

Total Shares held Name of the Shareholder AAA Enterprises Pvt Ltd AAA Infrastructure Consulting & Engineers Pvt Ltd Sonata Investments Ltd Reliance ADA Group Trustees Pvt Ltd - Trustees of RCAP ESOS Trust Reliance Innoventures Pvt Ltd Kokila D Ambani Anil D Ambani Tina A Ambani Jaianmol A Ambani Jaianshul A Ambani Total Number 98,414,206 27,975,633 3,250,000 1,600,000 576,450 545,126 273,891 263,474 83,487 5 132,982,272 As a % 40.07 11.39 1.32 0.65 0.23 0.22 0.11 0.11 0.03 0 54.14

BOARD OF DIRECTORS

Mr. Amit Bapna chief financial officer Mr.Amitabh Mohanty-He.ad of debt stratergy Mr.Anup Rau-Chief executive officer and director Mr.Asokan Arumugam- Chief compliance officer Mr.Arun Hariharan-President, quality and knowledge mgt Mr.K.V.Srinivasan chief people officer Mr.K.Achuthan chief people officer Mr.Lav Chaturvedi- Chief risk Officer Mr.Madhusudan Kela- Chief investment officer Mr.Rakesh Jain Chief Executive Officer Mr. Sam Ghosh-chief executive officer Mr.shrirish Chitte-Chief Technology Officer Mr.Sundeep Sikka-Chief executive officer Mr.V.R.Mohan-president and company secretary Mr.Vikrant Gugnani- Chief executive officer

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

PRODUCTS & SERVICES

EQUITY

The Equities markets offers range of investment opportunities and Reliance Securities bring along with the added advantage of innovative products to suite customers investment profile and help customers make the right decision.

IPO

IPOs have gained popularity owing to the fact that retail investors can become stake holders in the success of a company. From a company's perspective, IPOs help raise capital for growth or diversification as stipulated in the prospectus of the offer and the investors also get to become part owners of the company. Investing in IPOs is no more a hassle. You can invest in IPOs through us with ease

INSURANCE

Reliance Composite Insurance broking is the wholly owned subsidiary of Reliance Capital and an independent insurance broker offering complete insurance solutions and services to major corporate houses.

NRI OFFERINGS

Today, the Indian economy boasts a stable annual growth rate and booming capital markets. Top fund managers, investors and analyst are optimistic on long term, domestic demand driven growth story of India, supporting valuations and financial market outperformance. Reliance Securities with its extensive market reach, experience and cutting edge technology platforms, provides the perfect vehicle for customers to invest and benefit from the Indian markets. Reliance Securities is glad to introduce the most competitive products for the Non Resident Indian (NRI) audience, supported by a dedicated NRI investment team to cater to their investment needs. Currently reliance securities offer services to NRIs based in UAE, Kuwait, Bahrain, Singapore & Malaysia.

DERIVATIVES

If you trade on leverage - Derivatives are meant for you. Transact in Futures and Options on NSE Bye using reliance securities unique products to take advantage of intraday and long term position benefits. If any customer is an active trader and believe in making the most of market movements, reliance reports on derivatives can be useful to customers. As an advanced trader seeking information NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

on futures, options and derivative strategies, advisory team of reliance can help you make informed investment decisions.

MUTUAL FUNDS

Keen to invest in Equities but dont have time to track on daily basis? Mutual Funds are perfect option. Mutual Funds not only provide wider diversification, thus enhancing investors power to be with market movements. Plus these are professionally managed to provide optimum value to investments.

TRADE

Reliance Securities understand investors requirements completely and walk a step further to make the right investment decisions. Value Proposition:

Online trading Assisted trading Research support s Dedicated customer service desk Dedicated Relationship Management

RELIANCE COMMODITIES

Reliance Commodities - a part of the Reliance Capital group, is ranked amongst the top 3 private sector financial services and banking companies in terms of net worth it is the fastest growing private sector financial service company in India. Reliance Commodities Limited was initiated to spearhead Exchange based Commodity Futures Trading.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

FUNDAMENTAL ANALYSIS OF CHEMICAL AND CONSUMER DURABLE GOODS

CHEMICAL SECTOR IN INDIA

Chemical sector of India is one of the oldest industrial sectors in India. It has contributed significantly towards the phenomenal growth of Indian industry and economy. The chemical sector of India directly or indirectly acts as a supplier of many of the commodities of daily use. It is extremely scientific in its approach and facilitates the provision of many of the important chemicals which are the basic materials for end-products like paper, leather, paint, varnish, textile, and so on. The chemical sector in India stands as the keystone of the agrarian and industrial development which provides support for other industries. The chemical sector of India is one of the major industries in the Indian economy. It is estimated to be worth around US$ 35 billion, which is almost 3% of the country's gross domestic product. The investment in chemical sector of India is around US$ 60 billion. It generates employment of about 1 million. The chemical sector of India provides around 13-14% of total exports and its total imports are about 8-9%. It is ranked 12th globally and 3rd in Asia. The per capita consumption of chemical industry products in India is .01% of the global average. It has transformed itself into an innovative and successful industry from being merely a chemical producer once upon a time. The chemical sector in India constitutes of small and large companies. There is a spree of restructuring activities in the chemical sector. With the emphasis on branch building, environmental friendliness, and product innovation, the chemical sector has increasingly moved towards customer orientation. Though India revels in the ample supply of basic materials, it would have to improve on the technological aspects and the capabilities of proper marketing to confront the global competition.

THE INDUSTRIES USING CHEMICALS AS RAW MATERIALS:

Dye Industry Pesticides Industry Pharmaceuticals Industry Paper Industry Detergent and Soap Industry Paints and Varnishes Industry Plastic Industry Cement Industry

PRODUCTION TRENDS

The Indian chemical industry includes both large scale and small scale units. The fiscal concessions granted to the small-scale units in the mid-eighties led to establishments of large ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

NILESH DINESH WAGH

Fundamental & technical analysis of Chemical & Consumer Durables

number of units in the Small Scale Industries (SSI) sector. Currently, the Indian chemical industry is in the midst of a phase of major restructuring & consolidation. With the shift in emphasis on product innovation, brand building & environmental friendliness, this industry is moving towards greater customer orientation. Even though India enjoys an abundant supply of raw materials, it will have to build upon technical services & marketing capabilities to face global competition and increase its share of exports. As the Indian economy was protected till the early nineties, very limited large scale R&D was undertaken by the chemical industry to create intellectual property. The product patent regime came into force w.e.f. January 2005. Accordingly, units have to be more effective with state of the art R&D establishments. This will help in the development of newer molecules. With a number of scientific institutions, the countrys strength lies in its large pool of highly trained scientific personnel. India also produces a large number of fine & specialty chemicals, which have very specific uses & find wide uses as food additives, pigments, polymer additives, anti-oxidants in the rubber industry, etc.

PRODUCTION OF SELECTED MAJOR CHEMICALS

Sector Production (in 000 Metric Tonne) Growth CARG 201112/05-06 2.94 - 1.46 -2.61 4.14 9.95 1.71

2007-08 2008-09 2009-10 2010-11 Alkali Chemicals Inorganic chemicals Organic Chemicals Pesticides (Tech.) Dyes & Dyestuffs Total Major Chemicals 5443 609 1552 102 117 7823 5442 512 1254 105 110 7423 5602 518 1280 104 149 7651 5891 572 1342 111 164 8170

2011-12 6113 574 1396 120 171 8374

2012-13 upto sep 2973 267 656 60 86 4041

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

MAJOR CHEMICAL GROUPS & SEGMENTS PRODUCED IN INDIA

Alkali - The Chloro Alkali industry consists of Soda Ash, Caustic soda and liquid chlorine. Caustic soda, finds use in various applications, such as, finishing operations in textiles, manufacture of soaps and detergents, control of pH (softening) of water for various applications and general cleansing or bleaching applications. Glass manufacturing is the largest application for soda ash. Liquid chlorine is used primarily for various bleaching applications, across paper and pulp, textiles and other industries.

COMPOSITION OF CHLORO ALKALI INDUSTRY

36%

40%

Soda Ash Liquid Chlorine Caustic Soda

24%

Inorganic chemicals - The key organic chemicals are titanium dioxide, carbon black, and calcium carbide. Other inorganic chemicals include aluminium fluoride, potassium chlorate, red phosphorous, and sodium chlorate. The industry caters to a host of end user industries such as paints and dyestuff, tyres, leather, paper, detergent, explosives, rubber chemicals, cigarette, etc.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

COMPOSITION OF INORGANIC INDUSTRY

4% 11%

15%

Titanium Dioxide Calcium Carbide Carbon Black Others

70%

Organic chemicals Organic chemicals are a group of petroleum-derivative chemicals used as intermediates to produce other chemicals, which, in turn, are used to manufacture a wide variety of end-use products, including construction materials, apparel, adhesives, plastics,and tyres. The majority of the organic chemicals are derived from benzene, a petroleum derivative. The key organic chemicals are acetic acid, methanol, formaldehyde, acetaldehyde, chloromethane, phenol, benzene and its derivatives (that include nitrobenzene, aniline, ortho nitro chlorobenzene (ONCB), para nitro chloro-benzene (PNCB). Pesticides - With expanding agricultural production supported by good monsoons, improvement in technology and growing awareness among farmers, the consumption of agrochemicals has been on the upswing. The agrochemicals industry is made up of insecticides (74%), herbicides (20%) and fungicides (6%). Cotton, paddy or rice, vegetables and fruits account for over 80% of the pesticide consumption in the country. While cotton is planted on about 4.5-5% of the total cultivable area (on about 9.3-9.6 million hectares or mha), it accounts for about 33% of pesticide consumption in India, followed by rice (23%), vegetables (9%), wheat (8%), and pulses (6%). India is one among the most dynamic generic pesticides manufacturing countries with a total market size of Rs 8,900 crore per annum. And yet, Indias own average consumption of pesticides is very low at 480 gm per hectare which results in crops worth about Rs 12,000 crore being destroyed annually by pests.

Fertilizers The Indian chemical fertiliser (hereafter referred to only as fertilisers) industry mainly concerns itself with providing the three primary nutrientsN, P, and Kto the ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

NILESH DINESH WAGH

Fundamental & technical analysis of Chemical & Consumer Durables

agricultural sector. While nitrogen is expressed in the elemental form (N), phosphorous and potassium are expressed as their oxide forms, viz. phosphate (P2O5) and potash (K2O). Besides, being used as fertilisers themselves, these three nutrients are combined to produce several complex fertilisers.

SHARE OF NUTRIENT OF TOTAL FERTILIZER COMPOSITION

12%

Nitrogen 24% 64% Phosphorous Potassium

Dyes & Dyestuff - The consumption of Dyes and Dyestuffs is closely related to the performance of the textile industry. Organic pigment colours account for the largest share of dye industry followed by sulphur dyes and Azo dyes.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

COMPOSITION OF DYE & DYESTUFF INDUSTRY

21% Organic pigment colours Sulphur Dyes 11% 50% Azo dyes Others 18%

Petrochemicals - Petrochemicals are chemical products made from raw materials of petroleum (hydrocarbon) origin. The distillation of crude oil yields naphtha, gas oil, natural gas (NG), and petroleum gases which are mainly used as feedstock by the petrochemicals industry. The cracking (process whereby complex organic molecules are converted to simpler molecules) of naphtha/NG yields six major petrochemicals. These are olefins such as ethylene, propylene, and butadiene; and aromatics such as benzene, toluene, and xylene. While NG-based crackers invariably produce light olefins (mainly ethylene), naphtha-based crackers have a higher share of propylene and aromatics (benzene and xylenes). Indias petrochemicals production facility presently is categorised into five groups as in the figure below. Polymers are the largest segment of the Indian petrochemicals industry, accounting for around 64% of Indias aggregate production of major petrochemicals, followed by synthetic fibres (26%).

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

COMPOSITION OF PETROCHEMICAL INDUSTRY

28%

Polymers Elastomers Surfactants

1%

7% 1%

63%

Performance Plastics Synthetic Fibres

REGIONAL CONCENTRATION OF THE BASIC CHEMICALS INDUSTRY

Though the chemical industry is spread across the country, there is relatively a high concentration along the west-coast, largely due to the proximity to raw materials and ports. Gujarat alone is estimated to contribute around 53% to the total production in the country, followed by Maharashtra, which contributes 9%. The other major producing states include UP, TN, MP and Punjab. On the other hand, in the case of heavy chemicals segment, especially inorganic chemicals, fuel availability is a determining factor, and hence there is a concentration of these companies around power plants. Due to the regional NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

concentration of chemical companies in certain pockets, logistics costs for the industry have tended to become a significant position of total costs.

INDEX OF INDUSTRIAL PRODUCTION

The production performance of Chemical & Chemical products is also used for performance in Indian Industrial growth. The weight of Chemical & Chemical Products is 100.59 out of 1000 in the Index of Industrial Production. The Index of Industrial Production for the chemical & chemical products sector for the month of September 2012 stands at 127.3% which is 1.7% higher as compared to the level in the month of September 2011. The cumulative growth in general IIP during April- September 2012-13 over the corresponding period in 2011-12 has been 0.1%, as against the growth -0.3% in case of manufacturing & 2.3% in case of chemical & chemical products. The behavior of IIP of Chemical & Chemical products during 2005-06 to 2011-12 is depicted in following chart.

AVERAGE ANNUAL INDICES OF INDUSTRIAL PRODUCTION

200 180 160 140 120 100 80 60 40 20 0 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 Chemical & ChemicalProducts Manufacturing General

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

WHOLESALE PRICE INDEX (WPI)

The weight of Chemical & Chemical Products in terms of movement of WPI is 12.02 out of all commodities weight of 100. The movement of WPI for Chemical & Chemical Products sector during the years 2005-06 to 2011-12 is shown in following chart.

WPI FOR CHEMICAL & CHEMICAL PRODUCTS VISA-VIS OTHER COMMODITIES

250

200

All Commodities Food Articles

150

Manufactured Products Chemical & Chemical Products

100

50

0 2011-12 2010-11 2009-10 2008-09 2007-08 2006-07 2005-06

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

TRENDS IN EXPORT OF MAJOR CHEMICALS & PETROCHEMICALS

140000 120000

Rs. in 100000 Crores 80000

60000 40000 20000 0 2006-07 2007-08 2008-09 2009-10 2010-11 61152 65681 77964 84220 103883

135067

2011-12

TRENDS IN EXPORT OF MAJOR CHEMICALS & PETRO-CHEMICALS

140000 120000

Rs. in 100000 Crores 80000

60000 40000 20000 0 2006-07 2007-08 2008-09 2009-10 2010-11 61152 65681 77964 84220 103883

135067

2011-12

KEY PLAYERS IN CHEMICAL SECTOR

NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

M/s.United Phosphorous Ltd, Mumbai M/s. P.I.Industries, Jaipur M/s.BASF India, Mumbai M/s.BASF India, Mumbai M/s. Excel India, Mumbai M/s.Atul Ltd., Bulsar M/s. Colour Chem Ltd., Mumbai M/s. Sudarshan Chemical Industries, Pune M/s.Colourtex, Ahmedabad M/s. Monsantu Chem Ltd., Mumbai M/s. Jubilant Organosys Ltd., New Delhi M/s. Herdilia-Schentady Ltd. Mumbai National Organics Chemicals Ltd., Mumbai DCM Sri Ram Consolidation Ltd., New Delhi M/s. Gujarat Heavy Chemicals Ltd., Ahmedabad M/s. India Glycols Ltd., New Delhi M/s. Gujarat Alkalies and Chemicals Ltd., Baroda M/s.Rayalseema Chemcials, Hyderabad

STRATEGIC ANALYSIS

THREAT OF NEW ENTRANTS

It is relatively easy to enter the chemical industry for a new player as there are very less barriers and encouragement from the government in the form of fewer regulations. The government has allowed 100% FDI, which encourages foreign players to enter this sector. As the sector is comprised of many small scale companies, there is bound to be cut-throat competition. High prices of feed stock are seen as the major barrier to entry. In addition to this environmental concerns & dumping issues force the new companies to rethink their entry. Many chemicals are still reserved for production under small scale sector, which becomes a disadvantage for large companies.

POWER OF SUPPLIERS

Chemical industry relies on supplies from a few large corporations (such as those in petrochemicals industry) Chemical producers have limited substitutes for inputs Most suppliers are not dependent on their sales to chemical manufacturers.

BARGAINING POWER OF BUYERS

Those in chemical industry have many end-customers; dont rely on one customer The products (chemicals) are not greatly differentiated ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

NILESH DINESH WAGH

Fundamental & technical analysis of Chemical & Consumer Durables

Usually purchased through long-term contracts, so switching costs are high

COMPETITIVE RIVALRY

The degree of rivalry is generally high in the chemical industry, which in the commodity business has lead to domination by price considerations and pressure to increase productivity. Furthermore, there is a strong incentive to innovate for increased efficiency on the one hand, and for differentiation in the specialty chemicals and biotech businesses on the other hand, which in some cases have led to the development of niche markets with less rivalry. This is also reflected in the extensive array of company types, with certain chemical companies belonging to the largest companies in the world, but the majority of chemical companies being relatively small in size. With the larger companies producing major quantities of a variety of chemicals, and the smaller companies manufacturing only a few or even one single special product, the large corporations account for the major volume of chemicals sold, with the total of small producers accounting for the majority of different types of chemicals sold. As globalization is still intensifying, the chemical industry has seen a lot of restructuring, mainly within the top companies as well as for the whole industry, leading to an increased concentration of the industry. The complexity of the relations within the chemical industry is further reflected in the trade balances between the producing companies and countries. A major part of the national chemicals production is sold locally and another big part is sold within OECD countries. Most of the purchases and in particular the sales by non-OECD countries have only been rising significantly within the last two decades. Some other features of the chemical sector are Large number of competitors all competing for market share All are global competitors[Symbol] little room for expansion All benefiting from economies of scale, so competing on price Little differentiation among current players High fixed costs, and high exit costs

THREAT OF SUBSTITUTES

Buyers tend to need specific chemicals as inputs There really are no similar substitutes for chemicals Even if another chemical can be used, it is most likely produced by the same Industry Players.

INDUSTRY LIFE CYCLE

The chemical industry can be seen to be at a shakeout stage. It is past the growth stage but not yet reached the maturity stage.There is relatively steady growth & intense completion in this sector. Still this sector has scope for growth due to continuous demand in the local as well as foreign markets.

GROWTH DRIVERS

The chemical industry forms the backbone of the Indian manufacturing base. Some key strengths of the sector that can drive growth for the industry include low cost manpower, large domestic market, strong forward and backward linkages and conducive policy environment.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

Considering the vastness of this sector, some of the common growth drivers that could be identified for the sector include: (A) MACROECONOMIC FACTORS Being largely an intermediate product, a strong economic growth is an important factor for sustaining demand for the chemical industry. In fact, the per capita consumption of most of the finished products under this sector is far below the world average, giving a hint to the potential growth for the industry. (B) INTEGRATION ALONG THE VALUE CHAIN The industry participates in different stages of the value chain by producing intermediates and finished goods. This makes integration of processes easier. In fact, growing competition in select chemical segments has forced the industry to scale up production, which, inter-alia, requires backward or forward integration in some cases. Higher consolidation and capacity building has driven growth. (C) FOCUS ON R&D Specialty and fine chemicals are essentially a knowledge-based industry, which requires sustained investment in R&D. During the past few years, the chemical industry has witnessed a rise in R&D and technology up-gradation. This has led to many new products being introduced in the market, thus boosting demand. (D) OUTSOURCING AND CONTRACT MANUFACTURING On the strength of low-cost production and world-class technology, India is being looked upon as a preferred destination for outsourcing and contract manufacturing. This has led to higher utilization of capacity and revenue generation for the participants.

CHALLENGES

The Indian chemical industry today is emerging from a protected environment into highly competitive global market, and at the same time the domestic market is already reaching a mature level where demand potential for chemical end-products is on the rise. In these changing circumstances, the industry faces some key challenges.

(A) POWER COSTS

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

Chemicals, especially heavy chemicals, are power intensive sectors, and sustained supply of power is imperative. Volatility in power supply and prices of crude oil has been impacting the margins of the chemical companies.

(B) TECHNOLOGY

Although India has shown remarkable improvement in technological innovation, it still lags behind international standards. Chemical sectors are one, where technological changes are rapid and needs continuous up-gradation and innovation.

(C) INFRASTRUCTURE

Poor infrastructure, like roads, rail and ports are other detrimental factors. Regional concentration of the chemical industry requires better infrastructure and logistics to reach across the country.

(D) DUMPING

Growing international competition and low customs duty on some of the chemicals have led the dumping of certain chemicals in domestic industry. Notably, most of the cases related to anti-dumping duty in India relates to chemical sector.

BUDGET PROVISIONS

The following announcements have been proposed in the Union budget 2013-14 No change in the peak rate of basic customs duty of 10% for non-agricultural products. No change in the normal rate of excise duty of 12% and the normal rate of service tax of 12% Surcharge increased from 5% to 10 % on domestic companies whose taxable income exceeds Rs 10 crore. In the case of foreign companies, who pay the higher rate of corporate tax, the surcharge will increase from 2% to 5%. NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

In all other cases such as dividend distribution tax or tax on distributed income, current surcharge increased from 5% to 10%. Additional surcharges will be in force for only one year i.e. FY14 Education cess for all tax payers shall continue at 3% Companies investing Rs 100 crore or more in plant and machinery during the period 1.4.2013 to 31.3.2015 will be entitled to deduct an investment allowance of 15% of the investment. Concessional rate of tax of 15% on dividend received by an Indian company from its foreign subsidiary proposed to continue for one more year. Further, the Indian company shall not be liable to pay dividend distribution tax on the distribution to its shareholders of that portion of the income received from its foreign subsidiary. Increase the rate of tax on payments by way of royalty and fees for technical services to non-residents from 10% to 25%. However, the applicable rate will be the rate of tax stipulated in the DTAA (Double Tax Avoidance Agreements) Work on draft GST Constitutional amendment bill and GST law expected to be taken forward. sum of Rs 9,000 crore is set apart in the budget towards the first instalment of the balance of CST compensation A final withholding tax at the rate of 20% on profits distributed by unlisted companies to shareholders through buyback of shares

BUDGET IMPACT

No direct impact on Chemical industry.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

TATA CHEMICAL INDUSTRY

Company background:

1939

- The Company was Incorporated on 23rd January, at Mumbai. The Company Manufacture salt, byproducts of salt, alkalies, heavy chemicals and insecticides and flux technical and battery grades. - 37,000 equity shares issued without payment in cash.

1978

- The expansion of Soda Ash capacity from 3,60,000 to 5,00,000 tonnes per annum was completed.

1982

- The Company proposed to take up production of phosphatic fertilizer through its wholly-owned subsidiary, Tata Fertilisers, Ltd. at a complex planned to be set up at Babrala in U.P. The Company subscribed to an initial amount of Rs 30 crores in the shares capital of Tata Fertilisers, Ltd.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

- 30,00,000 equity shares (prem. Rs 10 per share) and 36 shares (prem. Rs 2 per share) allotted to 13.5% and 10.5% convertible bond holders respectively.

1983

- The Company issued 13.5% secured rights convertible bonds of Rs 100 each aggregating Rs 30 crores. Out of this, Rs 26.27 crores were issued to equity shareholders in the proportion of one bond for every four equity shares held and the balance of Rs 3.73 crores was issued to employees, associates, friends, preference shareholders and deposit holders. An amount of Rs 20 per bond was compulsorily and automatically convertible into one equity share on 1.11.1983. The portion of Rs 40 each are redeemable at the end of 10 years. However, these bond holders were given the right to apply for one equity share for every part of Rs 40 upon payment of Rs 40 in cash separately during 1st November, 1984 and 30th April, 1988. - The Company formed a 100% investment subsidiary, with a paid-up capital of Rs 20 lakhs, in the name and style of General Investment & Trading Company Private Ltd.

1984

- The Company made a rights issue of 15% non-convertible debentures of the face value of Rs 35 crores to meet a part of the capital expenditure on various schemes of modernisation and rehabilition. The issue was oversubscribed and the CCI accorded consent for the Company to retain a further amount of Rs 17.5 crores. These are redeemable in three annual instalments commencing 9th May, 1992. - The holders of 29,73,268 bonds of Rs 80 each applied for 59,46,536 equity shares. Out of these 18,69,739 shares were allotted with effect from 1st January, 1985 and the remaining 40,76,797 shares were allotted on 1st April, 1985. By appropriating the sale proceeds of `B' and `C' portions of these convertible bonds or receiving share amount and premium, the following equity shares were allotted at a premium of Rs 30 per shares: (i) 4,014 shares during 1986-87; (ii) 3,162 shares on 10th April, 1987; (iii) 1,141 shares on 1st July, 1987, (iv) 474 shares on 1st October, 1987 and (v) 790 shares on 1st January,

1988. 1985

- The Company also issued 15% non-convertible debentures aggregating Rs 10 crores to the Unit Trust of India. These are redeemable at a premium of 5% on 19th August, 1992. The date of redemption was extented for a further period of 7 years at an enhanced rate of 19% per annum. - 40,76,797 Equity shares (prem. Rs 30 per share) allotted to 13.5% convertible bondholders. 77,69,096

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

bonus equity shares then issued in prop. 2:5.

1986

- Rehabilitation and upgradation of this unit was in progress. It continued to cater to the needs of expansion, modernisation and replacement programmes of the chemical complex at Mithapur. - The Company cancelled 59,970-7.14% cumulative (non-redeemable) preference shares and in lieu thereof allotted 15% secured redeemable non-convertible bonds of Rs 100 each at par. These bonds would be redeemable at par on 27.1.1999. - Pref. shares cancelled by issuing 15% bonds in lieu. 4,014 equity shares allotted against `B' & C' Parts of 13.5% convertible bonds (prem. Rs 30 per share) by receiving shares amount and prem. or through sale proceeds. - The name was changed to Sabras Investment and Trading Co. Ltd.

1987

- Effective from 31st March, the Company ceased to be a subsidiary consequent upon an issue on a private and preferential basis of the equity and cumulative convertible preference (ccp) shares of the face value of Rs 13.70 crores to the shareholders of the Company. - The Company issued 72,50,000-13.5% convertible debentures of the face value of Rs 100 each for cash at par aggregating of the face value of Rs 100 each for cash at par aggregating to Rs 72.50 crores. Of this, debenture worth Rs 67.97 crores were issued to the shareholders on rights basis in the proportion of 1 debenture for every 4 equity shares held, Rs 3.40 crores to the employees (including working directors) and Rs 1.13 crores to NRI's. Including the retention of oversubscription the following debentures were allotted; (i) 84,96,250 debentures to shareholders; (ii) 3,64,035 debentures to employees including Indian working directors and (iii) 1,41,250 debentures to NRI's. - An amount of Rs 40 out of the face value of each debenture of Rs 100 was automatically converted into 1 equity share of Rs 10 each at a premium of Rs 30 per share effective from 1st April. Accordingly 90,01,535 equity shares were issued to the holders of 13.5% debentures. The holders of the balance Rs 60 portion were given option to seek for allotment of 1 equity share at a premium of Rs 50 per share on payment of cash between 1st October 1987 to 31st March 1998. Also, from 1st October 1987 upto the date of redemption (end of the 7 year period), the Company reserved to itself the right to repurchase at its discretion, the non-convertible portion of Rs 60 of the face value of each debenture. By appropriating these sale proceeds of `B' portion of these convertible debenture or by receiving share amount and premium, the Company allotted 83,43,700 equity shares on 1st April 1988 and 3,58,381 equity shares on NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

25th October, 1988. - On the 22nd May, a Memorandam of Understanding was signed between Indian Oil Corporation Ltd., the Government and the Company for promotion of a joint venture Company under the name and style of `Tata-Indian Oil Refineries Ltd.

1988

- The Steam power plant unit continued to perform fully well meeting the stream requirement of the chemical complex, except for the outage of one 13-MW turbo-generator causing power shortage for 4 months. - The Process Equipment unit was substantially upgraded and reorganized and received approvals under `IBR' and Lloyds. The Process Equipment unit undertakes sophisticated fabrication job and manufactures heavy, sophisticated process equipment. - As at 31st March, Tata Chemicals had accounted for Rs 52 crores in the CCP and Rs 8 crores in the equity shares of the Company. A Scheme of Amalgamation of Tata Fertilisers, Ltd. with the Company was approved by the Mumbai High Court on 7th September 1989. - The Research and Development unit is oriented towards process improvement, project development, waste utilisation and environmental control, supporting production activities.

1989

- The Process Equipment division undertook equipment design and preparatory work to take up substantial fabrication of the fertiliser plant being set up at Babrala. - The Company issued 15,00,000-14% non-convertible debentures of Rs 100 each on private placement basis to financial institutions. These are redeemable at a premium of 5% on 26th October, 1996. - The Company proposed to offer financial managerial and technical participation in the Rs 3,000 crore Haldia Petrochemicals Complex (HPL), a huge green-field project. West Bengal Industries Development Corporation and Tata Tea, Ltd. and its associates are the joint sector partners in the said complex. - 42,49,864 shares allotted without payment in cash to members of Tata Fertilisers, Ltd. on its merger.

1990

- The Company achieved self sufficiency in its requirements of Kurkutch salt-a basic raw material NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

required for the production of a wide range of products. During the year, the Company proposed to introduce low-priced, high quality iodised Kurkutch salt. - At the end of March, a new BHEL low-pressure turbo-generator was commissioned. The low-pressure turbo generator and the topper turbine suffered major prolonged outages. - The Company signed the contract for supply of natural gas to the fertiliser project at Babrala with the Gas Authority of India, Ltd. The implementation of the project remained slow due to non receipt of "Deemed Export Status" despite several appeals made to the Finance Ministry and the long delay experienced in the receipt of bulk import licence. - DGTD registration was received for the manufacture of 1,50,000 TPA of unadulterated environmentally safe detergent materials. - The Company undertaken to set up a cement plant at the existing chemical complex at Mithapur having a capacity of about 2,50,000 TPA of ordinary portland cement or 4,40,000 TPA of Pozzolana Portland cement. Budgetary offers for a wholly indigenous plant having a 900 TPD capacity was received and an application was made for an industrial licence. - The Company offered 125,00,000 - 12.5% partly convertible debentures (PCDs) of Rs 150 each on Rights basis in the proportion 1 PCD: 6 equity shares held (all were taken up). Additional 18,75,000 debentures were allotted to retain oversubcription. Another 6,25,000-12.5% PCDs were issued to employees of the Company (including Indian working Directors)/workers on an equitable basis. (All were taken up). - Rs. 50 (Part `A') of the face value of each debenture was to be automatically and compulsorily converted into one equity share of Rs 10 each at a premium of Rs 40 per share on 1st August 1992. Accordingly 150,00,000 equity shares were allotted. - Rs. 50 (Part `B') of the face value of each debenture was to be automatically and compulsorily converted into one equity share of Rs 10 each. Accordingly 150,00,000 equity shares were allotted for cash at par during 1992-93. The remaining Rs. 50 of the face value of each debenture was to be redeemed at the end of 10 years from the date of allotment of the debentures with an option to the Company to redeem the same in whole or in parts at any time after 7 years from the date of allotment along with the residual portion, if any, of part `B' above. - The Company also offered 123,00,000 - 14% non-convertible debentures (NCD) of Rs 100 each on Rights basis in the proportion 1 NCD:6 equity shares held (all were taken up). These debentures were to be redeemed on expiry of 7 years from the date of allotment of debentures at a premium of 5% of 10th January, 1998. NILESH DINESH WAGH ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

- The Company issued 46,00,000 - 12.5% Partly Convertible Debentures (PCDs) of Rs 175 each of which the following debentures were reserved for allotment on a preferential basis: (i) 22,00,000 PCDs to shareholders of the Company (all were taken up) and (ii) 2,30,000 PCDs to employees (including working directors)/workers on an equitable basis (only 275 debentures taken up). The balance 21,70,000 PCDs, along with 2,29,725 PCDs not taken up by employees, were offered for public subscription (all were taken up). - Rs 50 (Part `A') of the face value of each debenture was to be automatically and compulsorily converted into 1 equity share of Rs. 10 each at a premium of Rs 40 per share. Accordingly 46,00,000 equity shares were allotted on 1st August 1992. - Rs 50 (Part `B') of the face value of each debenture was to be automatically and compulsorily converted into 1 equity share of Rs 10 each at the end of 30 months from the date of allotment of debentures. Accordingly 46,00,000 equity shares were allotted during 1992-93. - Rs 75 of the face value of each debenture was to be redeemed at par at the end of the 10 years from the date of allotment of debentures with an option to the Company to redeem the same in whole or in parts at any time after 7 years from the date of allotment, along with residual portion, if any, of part `B' above. - 245,84,279 bonus shares allotted on 1.10.1990 in prop. 1:2.

1991

- A major replacement job was undertaken at CEHP boiler No. 1 which was completed in a record time of 15 days. - During 1991-92, it was proposed to give consent to the termination of MOU and leave IOC had expressed the desire to do so despite the withdrawal of the Soviets and substantial cost escalations. - The last quarter of 1991, hurdles such as grant of deemed export house status for the indigenous manufactures, allocation of foreign exchange etc., were resolved.

1992

- During the year, a modern circo-fluid high pressure boiler having a capacity of 200 TPH steam and a 16 MWT lopping turbo generator set together form a co-generation systems were being installed. The Company commission the circo-fluid boiler and 16 MW topping turbo generator by 1994.

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

- The Company proposed to add a new circulating fluidised bed boilder and topper turbine to the stream power plant for generation of additional steam and power.

1993

- Rs 320 crores Mithapur Vikas Plan project made headway with the construction of new boiler and turbine. Equipments were being added in a phased manner to the soda ash plant and production capacity is started to increase from 7 lakh TPA to 10 lakh TPA over the next 33 years.

1994

- The fertiliser project at Babrala commissioned in December. - The Company entered into a sales agreement with Rallis India Ltd. for distribution and sales of urea from Babrala to Punjab, Haryana, U.P. and Rajasthan.

1995

- A new Circo Fluid boiler and a new 16.5 MW turbo generator set was commissioned. However, the steam-power position remained below expectation due to the teething problems in the initial stages and a fire which damaged the turbine's casing. - The testing of the new boiler and turbine were started during March, and the co-generation of power plant was commissioned in May. Equipments were added to the soda ash plant to increase production capacity to one million tonnes per year. - In order to meet increasing demand of Urea, the company proposed to double the production capacity of Fertiliser complex at Babrala. - 67,771,703 bonus equity shares allotted in prop. 3:5.

1996

- The gradual increase in soda ash capacity to one million tonnes per year was continuing. The installation of a new Dense ash plant and the expansion of the Sodium Bicarbonate was expected to be commissioned by September 1997.

1997

NILESH DINESH WAGH

ARUNA MANHARLAL SHAH INSTITUTE MANAGEMENT & RESEARCH

Fundamental & technical analysis of Chemical & Consumer Durables

- Tata salt recorded a market share of 32% in the branded, iodized salt market maintaining a Company leadership position. - 40 Tata Kisan Kendras were being set up to provide a complete package of agricultural inputs and impart knowledge and training of improved farm practices to farmers. - Tata Chemicals Ltd (TCL) has shelved its expansion project of setting up another urea plant with a capacity of 7.26 lakh tonnes per annum adjacent to its existing unit. - Tata Chemicals may buy-out the loss-making new fertiliser plant of Sanderson Industries Ltd in Jamshedpur, which sources coke-oven waste from Tisco as its base raw material.

1998