Beruflich Dokumente

Kultur Dokumente

DSCB Introduction

Hochgeladen von

Prateek BansalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DSCB Introduction

Hochgeladen von

Prateek BansalCopyright:

Verfügbare Formate

INTRODUCTION

The Delhi State Cooperative bank Ltd was established on 2nd April 1921 and has completed 92 years of service to its clients. Being situated in the Walled city of Delhi, the bank has been a witness to historical events in pre and post-independence era. The bank also has the distinction of serving the clients and the cooperative movement both during pre and post-independence era. Its financial assistance and services to the urban and rural sector has been appreciated at various forums. The bank is an Apex cooperative bank in Delhi and it has a mandate of providing credit to other cooperative societies in the NCT of Delhi. It has also been playing the significant role in the cooperative movement of Delhi. Banks role towards Financial Assistance in rural and urban areas has been appreciated at various forums. Policy initiatives of the bank reflect its concern for fulfilling its mandate and realizing its vision. The bank always strives to promote cooperative principles. Services oriented to its satisfaction has been the core value of The Delhi State Cooperative Bank Ltd. in delivering quality services to its esteemed and loyal customers since 2nd April 1921. It has been into committed services to its customer for the last 91 years and strongly believes in flourishing in more. The Bank has overcome all the challenges it has come across and belives in further enhancing its financial and human resources. The Bank has been marching forward confidently towards celebrating a magnificent century with Hi-Tech culture with all its 49 branches having computerized facility for its valuable customers.

Role DSCB is performing banking functions as per the Banking regulating Act. In this field the bank is doing the basic banking functions of accepting deposits and lending through its branches. DSCB provides credit to cooperative institutions and individuals. DSCB provides assistance in the form of Short term credit, Medium term credit and Long term credit for the constituents as per their requirements.

Other Activities Accept Deposits from Cooperative Societies, other Institutions and Individuals. Provide all types of Loan to member cooperative societies registered in the NCT of Delhi and other Institutions and individuals (nominal members). Provide Kisan credit card facilities and other agricultural loans to farmers. Provide Employee Credit Card to Delhi State Government Employees including Government related and apex Cooperative bodies. Perform and miscellaneous Banking functions.

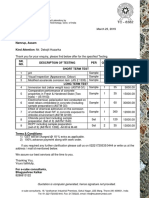

Share Capital The authorized share capital of the bank is Rs 5.00 crore. The paid up capital of the bank was Rs 324.55 crores as on 31.03.2010, increased to Rs 324.89 crores as on 31st March 2012.

Reserve funds Reserve funds and other reserves have increased from Rs 207.06 crore as on 31.03.2011 to Rs 230.11 crore on 31.03.2012. In addition to this Rs 382.95 lacs have been subscribed towards nominal share capital.

Das könnte Ihnen auch gefallen

- Corporate Governance of EBLDokument18 SeitenCorporate Governance of EBLAhAd SAmNoch keine Bewertungen

- Iomm VFD-3 030112Dokument100 SeitenIomm VFD-3 030112Alexander100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- Standards Spec Brochure ME WEBDokument44 SeitenStandards Spec Brochure ME WEBReza TambaNoch keine Bewertungen

- HDFC N SbiDokument129 SeitenHDFC N SbiShruti PoddarNoch keine Bewertungen

- A Study of Financial Analysis of HDFC Bank of Poonam ModDokument58 SeitenA Study of Financial Analysis of HDFC Bank of Poonam ModInderdeepSingh50% (2)

- Home Loans of HDFCDokument75 SeitenHome Loans of HDFCarjunmba119624100% (1)

- Central Bank of IndiaDokument70 SeitenCentral Bank of Indianandini_mba4870100% (6)

- e BankingDokument61 Seitene BankingRiSHI KeSH GawaINoch keine Bewertungen

- The Vapour Compression Cycle (Sample Problems)Dokument3 SeitenThe Vapour Compression Cycle (Sample Problems)allovid33% (3)

- Running Head: ICICI Bank Case Study 1Dokument6 SeitenRunning Head: ICICI Bank Case Study 1Lakshman KotiNoch keine Bewertungen

- Project Report On Credit AppraisalDokument53 SeitenProject Report On Credit AppraisalAMYNoch keine Bewertungen

- Project Report 5678898798999Dokument45 SeitenProject Report 5678898798999Aman BhatiaNoch keine Bewertungen

- IDBIDokument2 SeitenIDBIMarinba JamirNoch keine Bewertungen

- Rajkot District Co-Op. BankDokument90 SeitenRajkot District Co-Op. BankJay Zatakia67% (3)

- HDFC AboutDokument3 SeitenHDFC AboutSavin S KumarNoch keine Bewertungen

- Table of Content Internship Certificate Issued by The Organization Acknowledgement Page No. Chapter 1: Organizational ProfileDokument16 SeitenTable of Content Internship Certificate Issued by The Organization Acknowledgement Page No. Chapter 1: Organizational ProfileAmresh SinghNoch keine Bewertungen

- Idbi Bank LTDDokument86 SeitenIdbi Bank LTDGodwin MorrisNoch keine Bewertungen

- Banking System in India1Dokument7 SeitenBanking System in India1Srikanth Prasanna BhaskarNoch keine Bewertungen

- Economics Board ProjectDokument24 SeitenEconomics Board ProjecttashaNoch keine Bewertungen

- A Study On Financial Services of Commercial Bank With Reference To ICICI Bank (Final)Dokument56 SeitenA Study On Financial Services of Commercial Bank With Reference To ICICI Bank (Final)geetha_kannan32Noch keine Bewertungen

- HDFC Bank: Navigation SearchDokument4 SeitenHDFC Bank: Navigation SearchMukesh JakharNoch keine Bewertungen

- Introduction To Banking SectorDokument6 SeitenIntroduction To Banking Sectorshweta khamarNoch keine Bewertungen

- G H Raisoni Institute of Engineering & Technology, NagpurDokument34 SeitenG H Raisoni Institute of Engineering & Technology, NagpurPratik JainNoch keine Bewertungen

- Main Introduction of The Report: What Is A Bank and Also Its Purpose?Dokument9 SeitenMain Introduction of The Report: What Is A Bank and Also Its Purpose?Anonymous fcqc0EsXHNoch keine Bewertungen

- 1.an Overview of Dhaka Bank Limited (DBL)Dokument14 Seiten1.an Overview of Dhaka Bank Limited (DBL)AlamgirNoch keine Bewertungen

- Customer Satisfaction HDFC BankDokument28 SeitenCustomer Satisfaction HDFC BankDeep GujareNoch keine Bewertungen

- Banking Loan SystemDokument51 SeitenBanking Loan SystemHawk AujlaNoch keine Bewertungen

- Standard Charted BankDokument84 SeitenStandard Charted BankPari SavlaNoch keine Bewertungen

- Customer Satisfaction HDFC Bank - 1Dokument34 SeitenCustomer Satisfaction HDFC Bank - 1Deep GujareNoch keine Bewertungen

- A Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Dokument70 SeitenA Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Umang Vora0% (1)

- BY Anwar Gururaj Revathy Mythiliswaran Saravana Sudhan Maniganda Prabu Mohamad HameemDokument35 SeitenBY Anwar Gururaj Revathy Mythiliswaran Saravana Sudhan Maniganda Prabu Mohamad HameemRavi ShankarNoch keine Bewertungen

- Chapter 1-Introduction: 1.1 The Topic: "Opening Savings Accounts by Meeting Customers"Dokument40 SeitenChapter 1-Introduction: 1.1 The Topic: "Opening Savings Accounts by Meeting Customers"Sanchi JainNoch keine Bewertungen

- Synopsis: Products of Icici BankDokument3 SeitenSynopsis: Products of Icici BankPavni99Noch keine Bewertungen

- Presentation Report On Loans and AdvancesDokument20 SeitenPresentation Report On Loans and AdvancesHawk AujlaNoch keine Bewertungen

- Company Profile of MBCB LTD Malappuram (Project Related)Dokument5 SeitenCompany Profile of MBCB LTD Malappuram (Project Related)Riyas ParakkattilNoch keine Bewertungen

- Evening Brach in Co Operative BankDokument28 SeitenEvening Brach in Co Operative BankGreatway ServicesNoch keine Bewertungen

- Recent Developments: IDBI Bank Limited Is An IndianDokument7 SeitenRecent Developments: IDBI Bank Limited Is An Indianrevahykrish93Noch keine Bewertungen

- HDFC CapstoneDokument28 SeitenHDFC CapstoneParvesh GoyalNoch keine Bewertungen

- Sapana Int Part2Dokument25 SeitenSapana Int Part2Mùkésh RôyNoch keine Bewertungen

- HRM in Private & Public Sector BanksDokument76 SeitenHRM in Private & Public Sector BanksAnonymous hHrsiJnY100% (1)

- Winter Project Report NilojjalDokument26 SeitenWinter Project Report NilojjalAbhijit PhoenixNoch keine Bewertungen

- Project On HDFC BankDokument26 SeitenProject On HDFC BankPrashant GuptaNoch keine Bewertungen

- Banking Sector3Dokument21 SeitenBanking Sector3santhoshniNoch keine Bewertungen

- HDFCDokument3 SeitenHDFCJohn WesleyNoch keine Bewertungen

- HRM IndustryDokument31 SeitenHRM IndustryRizzy PopNoch keine Bewertungen

- Summer Internship Project ReportDokument36 SeitenSummer Internship Project Reportsimply9amazingNoch keine Bewertungen

- State Bank of India (SBI)Dokument2 SeitenState Bank of India (SBI)sandeep kumarNoch keine Bewertungen

- History of HDFC Bank: TH THDokument10 SeitenHistory of HDFC Bank: TH THBhumi PrajapatiNoch keine Bewertungen

- Overview of BanksDokument9 SeitenOverview of BanksParesh MaradiyaNoch keine Bewertungen

- CRMDokument25 SeitenCRMAlana PetersonNoch keine Bewertungen

- FM Project HDFCDokument14 SeitenFM Project HDFCsameer_kiniNoch keine Bewertungen

- Project On HDFC BankDokument67 SeitenProject On HDFC BankAarti YadavNoch keine Bewertungen

- Introduction of The StudyDokument51 SeitenIntroduction of The Studyravikiran1955Noch keine Bewertungen

- BII Final NOTES UNIT1Dokument26 SeitenBII Final NOTES UNIT1SOHAIL makandarNoch keine Bewertungen

- Seminar On Central Bank of IndiaDokument23 SeitenSeminar On Central Bank of IndiaHarshkinder SainiNoch keine Bewertungen

- CRM in Icici BankDokument23 SeitenCRM in Icici BankManindar SinghNoch keine Bewertungen

- Idbi ProjectDokument86 SeitenIdbi ProjectGodwin Morris67% (3)

- BankDokument62 SeitenBankashishshuklaonlineNoch keine Bewertungen

- Dena BankDokument25 SeitenDena BankJaved ShaikhNoch keine Bewertungen

- Bouquet of Services Are at Customers Demand in Todays Banking SystemDokument2 SeitenBouquet of Services Are at Customers Demand in Todays Banking SystemranimehtaNoch keine Bewertungen

- Banking India: Accepting Deposits for the Purpose of LendingVon EverandBanking India: Accepting Deposits for the Purpose of LendingNoch keine Bewertungen

- Nitric AcidDokument7 SeitenNitric AcidKuldeep BhattNoch keine Bewertungen

- WWW Spectrosci Com Product Infracal Model CVH PrinterFriendlDokument3 SeitenWWW Spectrosci Com Product Infracal Model CVH PrinterFriendlather1985Noch keine Bewertungen

- DEIR Appendix LDokument224 SeitenDEIR Appendix LL. A. PatersonNoch keine Bewertungen

- 2 Dawn150Dokument109 Seiten2 Dawn150kirubelNoch keine Bewertungen

- Soal UAS Bahasa Inggris 2015/2016: Read The Text Carefully! Cold Comfort TeaDokument5 SeitenSoal UAS Bahasa Inggris 2015/2016: Read The Text Carefully! Cold Comfort TeaAstrid AlifkalailaNoch keine Bewertungen

- Wisconsin Humane Society To Acquire Kenosha's Safe Harbor Humane Society - Press ReleaseDokument3 SeitenWisconsin Humane Society To Acquire Kenosha's Safe Harbor Humane Society - Press ReleaseTMJ4 NewsNoch keine Bewertungen

- PEOPLE V JAURIGUE - Art 14 Aggravating CircumstancesDokument2 SeitenPEOPLE V JAURIGUE - Art 14 Aggravating CircumstancesLady Diana TiangcoNoch keine Bewertungen

- Narrative Report On Weekly Accomplishments: Department of EducationDokument2 SeitenNarrative Report On Weekly Accomplishments: Department of Educationisha mariano100% (1)

- As ISO 9919-2004 Pulse Oximeters For Medical Use - RequirementsDokument10 SeitenAs ISO 9919-2004 Pulse Oximeters For Medical Use - RequirementsSAI Global - APACNoch keine Bewertungen

- Report in Per Dev CorrectedDokument34 SeitenReport in Per Dev CorrectedJosh lyan RiveraNoch keine Bewertungen

- Registration Statement (For Single Proprietor)Dokument2 SeitenRegistration Statement (For Single Proprietor)Sherwin SalanayNoch keine Bewertungen

- Scope: Procter and GambleDokument30 SeitenScope: Procter and GambleIrshad AhamedNoch keine Bewertungen

- Demages Goods RecordDokument22 SeitenDemages Goods Recordtariq malikNoch keine Bewertungen

- Inducement of Rapid Analysis For Determination of Reactive Silica and Available Alumina in BauxiteDokument11 SeitenInducement of Rapid Analysis For Determination of Reactive Silica and Available Alumina in BauxiteJAFAR MUHAMMADNoch keine Bewertungen

- NRF Nano EthicsDokument18 SeitenNRF Nano Ethicsfelipe de jesus juarez torresNoch keine Bewertungen

- Covid-19 Mitigation PlanDokument8 SeitenCovid-19 Mitigation PlanEkum EdunghuNoch keine Bewertungen

- AFMAN91-201 NewDokument458 SeitenAFMAN91-201 NewbombtechNoch keine Bewertungen

- QA-QC TPL of Ecube LabDokument1 SeiteQA-QC TPL of Ecube LabManash Protim GogoiNoch keine Bewertungen

- Penilaian Akhir TahunDokument4 SeitenPenilaian Akhir TahunRestu Suci UtamiNoch keine Bewertungen

- Tamilnadu Shop and Establishment ActDokument6 SeitenTamilnadu Shop and Establishment ActShiny VargheesNoch keine Bewertungen

- Solar Refrigeration: Prepared by M.DevakumarDokument21 SeitenSolar Refrigeration: Prepared by M.DevakumarEasy StudyNoch keine Bewertungen

- Psychoanalysis AND History: Freud: Dreaming, Creativity and TherapyDokument2 SeitenPsychoanalysis AND History: Freud: Dreaming, Creativity and TherapyJuan David Millán MendozaNoch keine Bewertungen

- Reaction Paper-RprDokument6 SeitenReaction Paper-Rprapi-543457981Noch keine Bewertungen

- Phardose Lab Prep 19 30Dokument4 SeitenPhardose Lab Prep 19 30POMPEYO BARROGANoch keine Bewertungen

- Minyak Atsiri Sereh WangiDokument4 SeitenMinyak Atsiri Sereh Wangicindy paraditha kasandraNoch keine Bewertungen

- Service Bulletins For Engine Model I0360kb.3Dokument6 SeitenService Bulletins For Engine Model I0360kb.3Randy Johel Cova FlórezNoch keine Bewertungen

- 1A Wound Care AdviceDokument2 Seiten1A Wound Care AdviceGrace ValenciaNoch keine Bewertungen