Beruflich Dokumente

Kultur Dokumente

CIR Vs SC Johnson

Hochgeladen von

Arra Balahadia dela PeñaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CIR Vs SC Johnson

Hochgeladen von

Arra Balahadia dela PeñaCopyright:

Verfügbare Formate

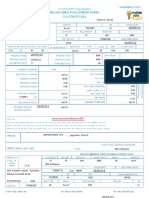

[G.R. No. 127105. June 25, 1999] COMMISSIONER OF INTERNAL REVENUE, petitioner, vs. S.C.

JOHNSON AND SON, INC., and COURT OF APPEALS, respondents. Facts: SC JOHNSON AND SON, USA a domestic corporation organized and operating under the Philippine laws, entered into a license agreement with SC Johnson and Son, United States of America (USA), a non-resident foreign corporation based in the U.S.A. pursuant to which the [respondent] was granted the right to use the trademark, patents and technology owned by the latter including the right to manufacture, package and distribute the products covered by the Agreement and secure assistance in management, marketing and production from SC Johnson and Son, U. S. A.

The said License Agreement was duly registered with the Technology Transfer Board of the Bureau of Patents, Trade Marks and Technology Transfer under Certificate of Registration No. 8064 . For the use of the trademark or technology, SC JOHNSON AND SON, USA was obliged to pay SC Johnson and Son, USA royalties based on a percentage of net sales and subjected the same to 25% withholding tax on royalty payments which respondent paid for the period covering July 1992 to May 1993.00 On October 29, 1993, SC JOHNSON AND SON, USA filed with the International Tax Affairs Division (ITAD) of the BIR a claim for refund of overpaid withholding tax on royalties arguing that, since the agreement was approved by the Technology Transfer Board, the preferential tax rate of 10% should apply to the respondent. We therefore submit that royalties paid by the [respondent] to SC Johnson and Son, USA is only subject to 10% withholding tax pursuant to the most-favored nation clause of the RPUS Tax Treaty in relation to the RP-West Germany Tax Treaty

Issue: WHETHER OR NOT SC JOHNSON AND SON,USA IS ENTITLED TO THE MOST FAVORED NATION TAX RATE OF 10% ON ROYALTIES AS PROVIDED IN THE RP-US TAX TREATY IN RELATION TO THE RP-WEST GERMANY TAX TREATY. Ruling : In the case at bar, the state of source is the Philippines because the royalties are paid for the right to use property or rights, i.e. trademarks, patents and technology, located within the Philippines. The United States is the state of residence since the taxpayer, S. C. Johnson and Son, U. S. A., is based there. Under the RP-US Tax Treaty, the state of residence and the state of source are both permitted to tax the royalties, with a restraint on the tax that may be collected by the state of source.Furthermore, the method employed to give relief from double taxation is the allowance of a tax credit to citizens or residents of the United States against the United States tax, but such amount shall not exceed the limitations provided by United States law for the taxable year. The Philippines may impose one of three rates- 25 percent of the gross amount of the royalties; 15 percent when the royalties are paid by a corporation registered with the Philippine Board of Investments and engaged in preferred areas of activities; or the lowest rate of Philippine tax that may be imposed on royalties of the same kind paid under similar circumstances to a resident of a third state. Given the purpose underlying tax treaties and the rationale for the most favored nation clause, the concessional tax rate of 10 percent provided for in the RP-Germany Tax Treaty should apply only if the taxes imposed upon royalties in the RP-US Tax Treaty and in the RP-Germany Tax Treaty are paid under similar circumstances. This would mean that private respondent must prove that the RP-US Tax Treaty grants similar tax reliefs to residents of the United

States in respect of the taxes imposable upon royalties earned from sources within the Philippines as those allowed to their German counterparts under the RP-Germany Tax Treaty. The RP-US and the RP-West Germany Tax Treaties do not contain similar provisions on tax crediting. Article 24 of the RP-Germany Tax Treaty, expressly allows crediting against German income and corporation tax of 20% of the gross amount of royalties paid under the law of the Philippines. On the other hand, Article 23 of the RP-US Tax Treaty, which is the counterpart provision with respect to relief for double taxation, does not provide for similar crediting of 20% of the gross amount of royalties paid At the same time, the intention behind the adoption of the provision on relief from double taxation in the two tax treaties in question should be considered in light of the purpose behind the most favored nation clause. The purpose of a most favored nation clause is to grant to the contracting party treatment not less favorable than that which has been or may be granted to the most favored among other countries. The most favored nation clause is intended to establish the principle of equality of international treatment by providing that the citizens or subjects of the contracting nations may enjoy the privileges accorded by either party to those of the most favored nation. The essence of the principle is to allow the taxpayer in one state to avail of more liberal provisions granted in another tax treaty to which the country of residence of such taxpayer is also a party provided that the subject matter of taxation, in this case royalty income, is the same as that in the tax treaty under which the taxpayer is liable. The similarity in the circumstances of payment of taxes is a condition for the enjoyment of most favored nation treatment precisely to underscore the need for equality of treatment. The RP-US Tax Treaty does not give a matching tax credit of 20 percent for the taxes paid to the Philippines on royalties as allowed under the RP-West Germany Tax Treaty, private respondent cannot be deemed entitled to the 10 percent rate granted under the latter treaty for the reason that there is no payment of taxes on royalties under similar circumstances. It bears stress that tax refunds are in the nature of tax exemptions. As such they are regarded as in derogation of sovereign authority and to be construed strictissimi juris against the person or entity claiming the exemption. The burden of proof is upon him who claims the exemption in his favor and he must be able to justify his claim by the clearest grant of organic or statute law. Private respondent is claiming for a refund of the alleged overpayment of tax on royalties; however, there is nothing on record to support a claim that the tax on royalties under the RPUS Tax Treaty is paid under similar circumstances as the tax on royalties under the RP-West Germany Tax Treaty.

Das könnte Ihnen auch gefallen

- CIR v. Juliane Baier-Nickel - SUBADokument2 SeitenCIR v. Juliane Baier-Nickel - SUBAPaul Joshua Torda SubaNoch keine Bewertungen

- 44.philam Shipping Corp v. Heung-ADokument2 Seiten44.philam Shipping Corp v. Heung-Amarie melanie BuenaventuraNoch keine Bewertungen

- CIR v. Cebu PortlandDokument2 SeitenCIR v. Cebu PortlandChelle OngNoch keine Bewertungen

- Gutierrez v. CTADokument3 SeitenGutierrez v. CTAHoney BiNoch keine Bewertungen

- Fitness by Design, Inc. v. CIR Case DigestDokument3 SeitenFitness by Design, Inc. v. CIR Case DigestCareenNoch keine Bewertungen

- DIAZ v. SECRETARY OF FINANCEDokument1 SeiteDIAZ v. SECRETARY OF FINANCEKristine VillanuevaNoch keine Bewertungen

- Republic V Bacolod Murcia DigestsDokument2 SeitenRepublic V Bacolod Murcia Digestspinkblush717Noch keine Bewertungen

- DIAZ and TIMBOL Vs Sec of Finance and CIRDokument2 SeitenDIAZ and TIMBOL Vs Sec of Finance and CIRBrylle Deeiah TumarongNoch keine Bewertungen

- Digest - Team Energy Corporation V CirDokument2 SeitenDigest - Team Energy Corporation V CirArthur SyNoch keine Bewertungen

- Gutierrez Vs CollectorDokument2 SeitenGutierrez Vs CollectorBenedict AlvarezNoch keine Bewertungen

- 03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990Dokument4 Seiten03 - 01 The People of The Phils. Vs Pbonifacio Ciobal y Pabrua, Et - Al., G.R. No. 86220, April 20,1990kram.erri2012Noch keine Bewertungen

- 3 CIR V SEAGATEDokument15 Seiten3 CIR V SEAGATEjahzelcarpioNoch keine Bewertungen

- 11 LBP v. Soriano - CastilloDokument2 Seiten11 LBP v. Soriano - CastilloAb CastilNoch keine Bewertungen

- CIR vs. Seagate Technology (Phils)Dokument1 SeiteCIR vs. Seagate Technology (Phils)kaira marie carlosNoch keine Bewertungen

- FAY V WitteDokument2 SeitenFAY V WitteKeith Ivan Ong MeridoresNoch keine Bewertungen

- 3 Case Digest - People v. SamontañezDokument2 Seiten3 Case Digest - People v. SamontañezJoyce AllenNoch keine Bewertungen

- Group 3 - Mendiola Vs Court of Appeals 497 SCRA 346Dokument4 SeitenGroup 3 - Mendiola Vs Court of Appeals 497 SCRA 346jhammyNoch keine Bewertungen

- CIR vs. Tokyo Shipping, 244 SCRA 332Dokument5 SeitenCIR vs. Tokyo Shipping, 244 SCRA 332Machida AbrahamNoch keine Bewertungen

- 67 Medicard Philippines, Inc. v. CIRDokument5 Seiten67 Medicard Philippines, Inc. v. CIRclarkorjaloNoch keine Bewertungen

- SANTOS Case DigestDokument2 SeitenSANTOS Case DigestL-Shy KïmNoch keine Bewertungen

- 04 Heirs of Simon V ChanDokument3 Seiten04 Heirs of Simon V ChanFricela KimNoch keine Bewertungen

- HHFBHJDokument14 SeitenHHFBHJvincent anthonyNoch keine Bewertungen

- Facts:: Vda. de Manalo Vs CA GR No. 129242, January 16, 2001Dokument7 SeitenFacts:: Vda. de Manalo Vs CA GR No. 129242, January 16, 2001Terence ValdehuezaNoch keine Bewertungen

- Nyco Sales Corp Vs BA Finance CorpDokument2 SeitenNyco Sales Corp Vs BA Finance CorpKen AliudinNoch keine Bewertungen

- Digest 2Dokument27 SeitenDigest 2Vianice BaroroNoch keine Bewertungen

- 07 - Visayan Cebu Terminal V CIRDokument2 Seiten07 - Visayan Cebu Terminal V CIRKristine De LeonNoch keine Bewertungen

- Cir VS AvonDokument3 SeitenCir VS AvonnorieNoch keine Bewertungen

- Republic Vs GonzalesDokument2 SeitenRepublic Vs GonzalesCarl MontemayorNoch keine Bewertungen

- Pantranco v. PSC, 70 Phil. 221 KMU Labor Center v. Garcia, 239 SCRA 386Dokument6 SeitenPantranco v. PSC, 70 Phil. 221 KMU Labor Center v. Garcia, 239 SCRA 386Bob LawNoch keine Bewertungen

- Gutierrez v. CIR - SubaDokument1 SeiteGutierrez v. CIR - SubaPaul Joshua SubaNoch keine Bewertungen

- Aguilar V Lightbringers DigestDokument2 SeitenAguilar V Lightbringers DigestJermone MuaripNoch keine Bewertungen

- Bonifacia Sy Po Vs CTADokument2 SeitenBonifacia Sy Po Vs CTACarl Montemayor50% (2)

- 151 Alvero V Dela RosaDokument1 Seite151 Alvero V Dela Rosadwight yuNoch keine Bewertungen

- Bastida v. Menzi and Co., Inc.Dokument2 SeitenBastida v. Menzi and Co., Inc.GR0018Noch keine Bewertungen

- Taxation Reviewer On VATDokument10 SeitenTaxation Reviewer On VATlchieSNoch keine Bewertungen

- Lorenzo Ona V CIRDokument1 SeiteLorenzo Ona V CIREryl YuNoch keine Bewertungen

- LUCAS G. ADAMSON Versus COURT OF APPEALS and LIWAYWAY VINZONS-CHATO, in Her Capacity As Commissioner of The Bureau of Internal RevenueDokument1 SeiteLUCAS G. ADAMSON Versus COURT OF APPEALS and LIWAYWAY VINZONS-CHATO, in Her Capacity As Commissioner of The Bureau of Internal RevenueCharles Roger RayaNoch keine Bewertungen

- CIR Vs CA, CTA, GCLDokument3 SeitenCIR Vs CA, CTA, GCLNoel GalitNoch keine Bewertungen

- 17 CD - Alba Vs Court of AppealsDokument1 Seite17 CD - Alba Vs Court of AppealsVina CagampangNoch keine Bewertungen

- Gancayco V Collector (Items Not Deductible)Dokument5 SeitenGancayco V Collector (Items Not Deductible)nichols greenNoch keine Bewertungen

- #32 Teague Vs MartinDokument2 Seiten#32 Teague Vs MartinSRB4Noch keine Bewertungen

- Hydro Resources vs. CADokument1 SeiteHydro Resources vs. CAA Paula Cruz FranciscoNoch keine Bewertungen

- Rulel 87 Actions by and Against Executors DigestsDokument16 SeitenRulel 87 Actions by and Against Executors Digestsmelaniem_1Noch keine Bewertungen

- Heirs of Ruiz, Edmond Ruiz Vs CA (DIGESTED)Dokument2 SeitenHeirs of Ruiz, Edmond Ruiz Vs CA (DIGESTED)Jonathan UyNoch keine Bewertungen

- Francisco I. Chavez V Jaime B. OngpinDokument2 SeitenFrancisco I. Chavez V Jaime B. OngpinJohn YeungNoch keine Bewertungen

- Bonifacio Water Corp V CIR (Digest)Dokument3 SeitenBonifacio Water Corp V CIR (Digest)Angelo CastilloNoch keine Bewertungen

- Corpo Case PNBDokument2 SeitenCorpo Case PNBCaroline LeeNoch keine Bewertungen

- Bienvenido Gelisan, vs. Benito AldayDokument2 SeitenBienvenido Gelisan, vs. Benito AldayAlvin ClaridadesNoch keine Bewertungen

- Bernardo vs. LegaspiDokument1 SeiteBernardo vs. LegaspiPia SarconNoch keine Bewertungen

- Katarungang Pambarangay Law - Outline.1Dokument4 SeitenKatarungang Pambarangay Law - Outline.1ivyriofloridoNoch keine Bewertungen

- CIR vs. Western Pacific Corporation L-18804Dokument1 SeiteCIR vs. Western Pacific Corporation L-18804magenNoch keine Bewertungen

- Hilton v. Guyot, 159 U.S. 113 (1895)Dokument64 SeitenHilton v. Guyot, 159 U.S. 113 (1895)Scribd Government Docs100% (1)

- Birth Application FormDokument2 SeitenBirth Application FormKim-Ezra Agdaca50% (2)

- Tapuz Vs Del Rosario GR No 182484 17 June 2008Dokument3 SeitenTapuz Vs Del Rosario GR No 182484 17 June 2008Rachel ChanNoch keine Bewertungen

- Benguet Electric Cooperative v. Ferrer-CallejaDokument1 SeiteBenguet Electric Cooperative v. Ferrer-CallejaJulia Camille RealNoch keine Bewertungen

- II-c. Cir Vs S.C. JohnsonDokument2 SeitenII-c. Cir Vs S.C. JohnsonPia SottoNoch keine Bewertungen

- CIR vs. S. C. Johnson and Son, Inc. (G.R. No. 127105 June 25, 1999) - H DIGESTDokument3 SeitenCIR vs. S. C. Johnson and Son, Inc. (G.R. No. 127105 June 25, 1999) - H DIGESTHarleneNoch keine Bewertungen

- G.R. No. 127105. June 25, 1999. Commissioner of Internal Revenue, Petitioner, vs. S.C. Johnson and Son, Inc., and Court of APPEALS, RespondentsDokument5 SeitenG.R. No. 127105. June 25, 1999. Commissioner of Internal Revenue, Petitioner, vs. S.C. Johnson and Son, Inc., and Court of APPEALS, RespondentsConcepcion Mallari GarinNoch keine Bewertungen

- Royalties Based On A Percentage of Net Sales and Subjected The Same To 25% Withholding Tax On Royalty PaymentsDokument3 SeitenRoyalties Based On A Percentage of Net Sales and Subjected The Same To 25% Withholding Tax On Royalty PaymentsPnp KaliboNoch keine Bewertungen

- CIR Vs S.C. Johnson and Son, Inc.Dokument2 SeitenCIR Vs S.C. Johnson and Son, Inc.I took her to my penthouse and i freaked itNoch keine Bewertungen

- Introduction On Climate ChangeDokument8 SeitenIntroduction On Climate ChangeArra Balahadia dela PeñaNoch keine Bewertungen

- Reclusion Temporal: Table Showing The Duration of Divisible Penalties and The Time Included in Each of Their PeriodsDokument1 SeiteReclusion Temporal: Table Showing The Duration of Divisible Penalties and The Time Included in Each of Their PeriodsArra Balahadia dela Peña0% (1)

- Introduction On Climate ChangeDokument8 SeitenIntroduction On Climate ChangeArra Balahadia dela PeñaNoch keine Bewertungen

- Introduction On Climate ChangeDokument8 SeitenIntroduction On Climate ChangeArra Balahadia dela PeñaNoch keine Bewertungen

- Case DigestDokument3 SeitenCase DigestArra Balahadia dela PeñaNoch keine Bewertungen

- Reclusion Temporal: Table Showing The Duration of Divisible Penalties and The Time Included in Each of Their PeriodsDokument1 SeiteReclusion Temporal: Table Showing The Duration of Divisible Penalties and The Time Included in Each of Their PeriodsArra Balahadia dela Peña0% (1)

- Domondon Taxation Notes 2010Dokument79 SeitenDomondon Taxation Notes 2010Charles de Vera100% (6)

- Cases in Income TaxationDokument164 SeitenCases in Income TaxationArra Balahadia dela PeñaNoch keine Bewertungen

- People Vs SandiganbayanDokument18 SeitenPeople Vs SandiganbayanMario BagesbesNoch keine Bewertungen

- Insurance - Atty QuimsonDokument102 SeitenInsurance - Atty QuimsonJoseph Plazo, Ph.DNoch keine Bewertungen

- Compiled Cases - Doctrines in TaxationDokument69 SeitenCompiled Cases - Doctrines in TaxationArra Balahadia dela PeñaNoch keine Bewertungen

- 47 To 51Dokument7 Seiten47 To 51Arra Balahadia dela PeñaNoch keine Bewertungen

- Digests Tax 1Dokument35 SeitenDigests Tax 1Arra Balahadia dela PeñaNoch keine Bewertungen

- Caltex vs. CoaDokument22 SeitenCaltex vs. CoaArra Balahadia dela PeñaNoch keine Bewertungen

- Transcription - PremidtermsDokument33 SeitenTranscription - PremidtermsArra Balahadia dela PeñaNoch keine Bewertungen

- Digests Tax 1Dokument35 SeitenDigests Tax 1Arra Balahadia dela PeñaNoch keine Bewertungen

- A.M. No. 10-2-5-SCDokument13 SeitenA.M. No. 10-2-5-SCArra Balahadia dela PeñaNoch keine Bewertungen

- Hilao V Marcos, 95-15779Dokument25 SeitenHilao V Marcos, 95-15779Arra Balahadia dela Peña100% (1)

- Transcription - PremidtermsDokument33 SeitenTranscription - PremidtermsArra Balahadia dela PeñaNoch keine Bewertungen

- TOLLAND 3 Minutes - Town Council - 2019 - 2019-03-13 Special Budget Meeting MinutesDokument2 SeitenTOLLAND 3 Minutes - Town Council - 2019 - 2019-03-13 Special Budget Meeting MinutesHelen BennettNoch keine Bewertungen

- IRS Doc 6209-2003Dokument665 SeitenIRS Doc 6209-2003mikebigleyNoch keine Bewertungen

- Salary SlipDokument1 SeiteSalary SlipMonty WaghmareNoch keine Bewertungen

- EITCDokument2 SeitenEITCrobertwiblinNoch keine Bewertungen

- Perquisites-WPS OfficeDokument12 SeitenPerquisites-WPS OfficeShashant NagwanshiNoch keine Bewertungen

- Tax Configuration - FIDokument5 SeitenTax Configuration - FIatlanta00100% (1)

- ANSWER SHEET - Project-1-Piecewise-FunctionsDokument6 SeitenANSWER SHEET - Project-1-Piecewise-Functionseve lopezNoch keine Bewertungen

- Solutions To Exercises Txtn1 July 8, 2019: Chapter 1 - Introduction To Taxation Exercise DrillDokument4 SeitenSolutions To Exercises Txtn1 July 8, 2019: Chapter 1 - Introduction To Taxation Exercise DrillRenerey D. DorueloNoch keine Bewertungen

- Taxation: (Pepsi-Cola Bottling Company of The Phil. v. Mun. of Tanauan, Leyte, 69 SCRA 460)Dokument22 SeitenTaxation: (Pepsi-Cola Bottling Company of The Phil. v. Mun. of Tanauan, Leyte, 69 SCRA 460)Emiru KunNoch keine Bewertungen

- Republic of Indonesia Ministry of Finance Directorate General of Customs and ExciseDokument1 SeiteRepublic of Indonesia Ministry of Finance Directorate General of Customs and ExcisePabean AmbonNoch keine Bewertungen

- BIR Form No. 2553Dokument2 SeitenBIR Form No. 2553fatmaaleahNoch keine Bewertungen

- Problem Set - Deferred TaxesDokument2 SeitenProblem Set - Deferred TaxeslykaNoch keine Bewertungen

- By: Rakim L. Perez BSBA 3BDokument66 SeitenBy: Rakim L. Perez BSBA 3BLovely Rizziah Dajao CimafrancaNoch keine Bewertungen

- Franking Account WorkpaperDokument6 SeitenFranking Account WorkpaperCarol YaoNoch keine Bewertungen

- Tax Hand Book - BODokument2 SeitenTax Hand Book - BOnmshamim7750Noch keine Bewertungen

- Direct Tax NotesDokument41 SeitenDirect Tax NotesRenandNoch keine Bewertungen

- Taxation H01 - Fundamental Principles of TaxationDokument9 SeitenTaxation H01 - Fundamental Principles of TaxationAnna TaylorNoch keine Bewertungen

- Gorna Satinali Panchbibi MST Momotaj Begom: Bangladesh Power Development Board Electricity BillDokument1 SeiteGorna Satinali Panchbibi MST Momotaj Begom: Bangladesh Power Development Board Electricity BillAieubNoch keine Bewertungen

- BOR Settlements RPRT Roh8-12 FY22Dokument10 SeitenBOR Settlements RPRT Roh8-12 FY22Honolulu Star-AdvertiserNoch keine Bewertungen

- Module 7 - Merchandising Business Special TransactionsDokument40 SeitenModule 7 - Merchandising Business Special TransactionsMaria Nicole OroNoch keine Bewertungen

- Net Pay: Stone Productions Contracts LTD, 119A ST John's Hill, London, SW11 1SZDokument1 SeiteNet Pay: Stone Productions Contracts LTD, 119A ST John's Hill, London, SW11 1SZ13KARATNoch keine Bewertungen

- InvoiceDokument1 SeiteInvoiceVishal Kumar 5504Noch keine Bewertungen

- Income Statement Analysis of Vitarich CorporationDokument11 SeitenIncome Statement Analysis of Vitarich CorporationLynnie Jane JauculanNoch keine Bewertungen

- Pierre Boulez Case Tax InternationalDokument7 SeitenPierre Boulez Case Tax InternationalPejalanbudgetNoch keine Bewertungen

- Multiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationDokument16 SeitenMultiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationNanananana100% (1)

- GST Search Dimensions Original ArticleDokument17 SeitenGST Search Dimensions Original Articleratneet_dhaliwalNoch keine Bewertungen

- Tax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaDokument1 SeiteTax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaMazhar KhanNoch keine Bewertungen

- 760 Scra 652 PDFDokument2 Seiten760 Scra 652 PDFGhost RiderNoch keine Bewertungen

- Illustrations of Lifeblood TheoryDokument11 SeitenIllustrations of Lifeblood TheoryDarwin Ilustre BacayNoch keine Bewertungen

- Schedules of Alphanumeric Tax CodesDokument5 SeitenSchedules of Alphanumeric Tax CodesKatherine YuNoch keine Bewertungen