Beruflich Dokumente

Kultur Dokumente

Engine of Economic Growth

Hochgeladen von

muhammadasifrashidOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Engine of Economic Growth

Hochgeladen von

muhammadasifrashidCopyright:

Verfügbare Formate

Close Window

Tuesday, July 21, 2009

Add to Clippings

Print Story

Engine of economic growth

Dr Ashfaque H Khan Economic growth is essential for job creation and poverty alleviation. Studies have shown that capital accumulation by the private sector drives growth. It is also acknowledged that privatesector investment is highly influenced by the prevailing macroeconomic environment. Macroeconomic stability is therefore one of the critical elements of promoting private-sector investment which, in turn, is the main drivers of growth. Empirical evidence shows that private investment is significantly and negatively influenced by uncertainty and macroeconomic instability. The experiences of Pakistan during the 1990s and over the last two years are in line with empirical evidence. A key objective of the countrys macroeconomic policies should be to establish conditions that facilitate private investment. A substantially large proportion of Pakistans economic activity is in the hands of the private sector. It employs 90 percent of Pakistans labour force. The private sector in Pakistan is not only the main engine of growth but also the main source of employment generation. How to promote private sector investment by improving investment climate is a major challenge for the government over the medium term. What constitutes a good investment climate? There are three broad and interrelated elements that shape good investment climate. These are macroeconomic stability, good governance and strong physical and human infrastructure. As regards the first element, a stable macroeconomic environment is characterised by low and stable inflation, low budget and current account deficits; low realinterest rates, a stable and predictable exchange rate, and comfortable foreign-exchange reserves. A stable macroeconomic environment must be accompanied by wide-ranging structural reform which will make up one crucial set of ingredient for spurring investment and growth. Pakistan maintained a stable macroeconomic environment for a fairly long period in this decade when inflation averaged 5.8 percent, budget and current-account deficits averaged 3.8 percent and 0.7 percent, respectively, foreign-exchange reserves surged from $2.1 billion in 1999-2000 to $16.4 billion in October 2007; and the exchange rate moved in the range of Rs58.4 to Rs60.6 against the dollar. The stable macroeconomic environment was accompanied by wide-ranging structural reforms in various sectors of the economy. What have been the outcomes of stable environment and structural reforms? Quite naturally, domestic investment surged from 17.2 percent to 22.5 percent of the GDP during 2000-07 an increase of 5.3 percentage point of the GDP. The surge in domestic investment was led by private-sector investment, which increased from 10.2 percent to 15.4 percent of the GDP. In other words, private-sector investment contributed 98 percent to the overall increase in investment. The confidence of foreign private investment is also influenced by stable macroeconomic environment. During 2000-07, foreign private investment increased more than eight folds from approximately $1 billion to over $8 billion. The surge in domestic and foreign investment resulted in sharp acceleration of economic growth which averaged almost 7 percent per annum during 2002-07; real per-capita income grew by 4.7 percent per annum; over 13 million jobs were created, thus reducing unemployment from 8.3 percent to 5.3 percent and poverty was reduced to one half from 34.5 percent to 17.2 percent. A worsening of macroeconomic environment over the last two years have adversely affected investment and growth. Investment is down to 19.7 percent from 22.5 percent of the GDP and

economic growth has slowed to 2.0 percent. Consequently, unemployment and poverty have increased and will continue to worsen as long as the macroeconomic environment is not improved. The government, therefore, must concentrate on improving macroeconomic environments, that is, bring inflation to low single-digit, bring budget and current account deficits to around 3 percent and 2-2.5 percent of the GDP, respectively, maintain stability in the exchange rate and build foreign-exchange reserves to provide a cushion against adverse external shocks over the next three years. Unfortunately, the government has decided to revive growth by creating more imbalances in the economy. We may not see a revival of economic growth but widening of budget and current account deficits. As regards good governance, the government must restore confidence which is vital for promoting private-sector investment and growth. The government must concentrate on reforming the tax system and tax administration, merit-based appointments, appointments of right people in right places, ensuring access of the private sector to key economic ministers, improving communication with domestic and foreign investors and markets; ensuring transparency in economic policy making, maintaining consistency and continuity in policies and most importantly getting rid of apna admi Culture. Unless and until the government moves in this direction and is seen as making efforts to improve governance, we may not see investment and growth accelerating in the near future. As regards the third element of the investment climate, the government must assign top priority to strengthening the countrys infrastructure. The government must be seen as improving the supply of power and gas; and making efforts to improve roads, rail, water availability, telecommunication network and modernising ports. The capacity of power generation is not an issue in the short run. The country has the capacity to produce over 19,000 MW of electricity but it is currently producing only 13,000 MW. Power generation can improve in the short-run if the government resolves the issues of circular debt. The prime minister must set up a high-level committee under his chairmanship for improving the investment climate. The committee should meet every month to monitor progress. Needless to say, that a strong investment climate benefits both the formal and informal sectors, and it is the latter where the poor often have the best chance of finding jobs. The writer is dean and professor at NUST Business School, Islamabad. Email: ahkhan @nims.edu.pk

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- SCBA Rejects GB Court's Ruling For Lack of JurisdictionDokument1 SeiteSCBA Rejects GB Court's Ruling For Lack of JurisdictionmuhammadasifrashidNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Imran Is Bound To Bite The DustDokument1 SeiteImran Is Bound To Bite The DustmuhammadasifrashidNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Kabul Police Chief Resigns After Spate of AttacksDokument2 SeitenKabul Police Chief Resigns After Spate of AttacksmuhammadasifrashidNoch keine Bewertungen

- Imran, KP CM Committed TreasonDokument1 SeiteImran, KP CM Committed TreasonmuhammadasifrashidNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Govt Gets Harsher On Imran's Harsh PlanDokument2 SeitenGovt Gets Harsher On Imran's Harsh PlanmuhammadasifrashidNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Pervaiz Rules Out Talks With ImranDokument2 SeitenPervaiz Rules Out Talks With ImranmuhammadasifrashidNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- KP Govt Servants Protest at Imran's ResidenceDokument2 SeitenKP Govt Servants Protest at Imran's ResidencemuhammadasifrashidNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hafeez Out As New Zealand Bat in Second TestDokument2 SeitenHafeez Out As New Zealand Bat in Second TestmuhammadasifrashidNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- No Doctor For 70pc BHUs in Three KP DistrictsDokument2 SeitenNo Doctor For 70pc BHUs in Three KP DistrictsmuhammadasifrashidNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Six Killed in Kabul Suicide Attack On UK Embassy VehicleDokument2 SeitenSix Killed in Kabul Suicide Attack On UK Embassy VehiclemuhammadasifrashidNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- COAS Arrives in WashingtonDokument2 SeitenCOAS Arrives in WashingtonmuhammadasifrashidNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Yen Up Against Dollar After Poor Japan GDP DataDokument3 SeitenYen Up Against Dollar After Poor Japan GDP DatamuhammadasifrashidNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- CANELA Learning Activity - NSPE Code of EthicsDokument4 SeitenCANELA Learning Activity - NSPE Code of EthicsChristian CanelaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Internship ReportDokument46 SeitenInternship ReportBilal Ahmad100% (1)

- Amare Yalew: Work Authorization: Green Card HolderDokument3 SeitenAmare Yalew: Work Authorization: Green Card HolderrecruiterkkNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- M2 Economic LandscapeDokument18 SeitenM2 Economic LandscapePrincess SilenceNoch keine Bewertungen

- Interruptions - 02.03.2023Dokument2 SeitenInterruptions - 02.03.2023Jeff JeffNoch keine Bewertungen

- Profile On Sheep and Goat FarmDokument14 SeitenProfile On Sheep and Goat FarmFikirie MogesNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Tivoli Performance ViewerDokument4 SeitenTivoli Performance ViewernaveedshakurNoch keine Bewertungen

- Walmart, Amazon, EbayDokument2 SeitenWalmart, Amazon, EbayRELAKU GMAILNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- 48 Volt Battery ChargerDokument5 Seiten48 Volt Battery ChargerpradeeepgargNoch keine Bewertungen

- Apm p5 Course NotesDokument267 SeitenApm p5 Course NotesMusumbulwe Sue MambweNoch keine Bewertungen

- Innovations in Land AdministrationDokument66 SeitenInnovations in Land AdministrationSanjawe KbNoch keine Bewertungen

- Datasheet Qsfp28 PAMDokument43 SeitenDatasheet Qsfp28 PAMJonny TNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Business Environment Analysis - Saudi ArabiaDokument24 SeitenBusiness Environment Analysis - Saudi ArabiaAmlan JenaNoch keine Bewertungen

- Sustainable Urban Mobility Final ReportDokument141 SeitenSustainable Urban Mobility Final ReportMaria ClapaNoch keine Bewertungen

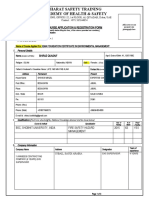

- BST Candidate Registration FormDokument3 SeitenBST Candidate Registration FormshirazNoch keine Bewertungen

- CI Principles of EconomicsDokument833 SeitenCI Principles of EconomicsJamieNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- EnerconDokument7 SeitenEnerconAlex MarquezNoch keine Bewertungen

- QA/QC Checklist - Installation of MDB Panel BoardsDokument6 SeitenQA/QC Checklist - Installation of MDB Panel Boardsehtesham100% (1)

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyDokument44 SeitenNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesNoch keine Bewertungen

- Heavy LiftDokument4 SeitenHeavy Liftmaersk01Noch keine Bewertungen

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingDokument75 SeitenInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspNoch keine Bewertungen

- Check Fraud Running Rampant in 2023 Insights ArticleDokument4 SeitenCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchNoch keine Bewertungen

- Rating SheetDokument3 SeitenRating SheetShirwin OliverioNoch keine Bewertungen

- Oracle Exadata Database Machine X4-2: Features and FactsDokument17 SeitenOracle Exadata Database Machine X4-2: Features and FactsGanesh JNoch keine Bewertungen

- Sophia Program For Sustainable FuturesDokument128 SeitenSophia Program For Sustainable FuturesfraspaNoch keine Bewertungen

- Ts Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFDokument308 SeitenTs Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFSRMPR CRMNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Dike Calculation Sheet eDokument2 SeitenDike Calculation Sheet eSaravanan Ganesan100% (1)

- A. The Machine's Final Recorded Value Was P1,558,000Dokument7 SeitenA. The Machine's Final Recorded Value Was P1,558,000Tawan VihokratanaNoch keine Bewertungen

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDokument27 SeitenSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunNoch keine Bewertungen

- Squirrel Cage Induction Motor Preventive MaintenaceDokument6 SeitenSquirrel Cage Induction Motor Preventive MaintenaceNishantPareekNoch keine Bewertungen