Beruflich Dokumente

Kultur Dokumente

New Medicaid Rules Challenge Seniors

Hochgeladen von

Joseph S. KarpCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

New Medicaid Rules Challenge Seniors

Hochgeladen von

Joseph S. KarpCopyright:

Verfügbare Formate

New Medical Rules Present Serious Challenges For Seniors

The Deficit Reduction Act was Second, the penalty amount of the asset transfer to $750,000, but Florida has yet to

signed into law Feb. 8 with lots of fan- period for such transfers by $3300 (the average make a decision about this.

fare—but the law has few fans among now starts on the date one monthly cost of a Florida If you want to protect your hard-

middle class seniors. Because of the applies for benefits, not nursing home, and an unre- earned assets from nursing home costs

draconian cuts in Medicaid benefits on the date the gift is alistically low figure). Thus, and pass as much as possible to your

for long-term care, seniors are going made, thereby creating Mr. Doe will not be eligible spouse and kids, techniques still ex-

to find it harder than ever to protect even more financial per- to receive benefits for 10 ist that can help you. However, it is

their nest eggs from the ravages of il for families. The fol- months ($33,000 divided by now far more difficult and more com-

nursing home costs. While it may take lowing example illus- $3300), or not until January plicated to do so, and planning must

months for Florida to figure out just trates: Let’s say in March 2008. With no way to pay begin much sooner. In Florida, the

how to implement the federal law, cer- 2006, John Doe gives his the nursing home, the bur- only attorney considered expert in this

tain key provisions are already in ef- son $33,000 to help him Joseph S. Karp, den is going to fall on Mr. painstaking and highly technical area

fect. Those provisions may dramati- purchase a home. In C.E.L.A. Doe’s family members, who is a certified elder law attorney. So

cally affect you and your family. March 2007, Mr. Doe suffers a severe are going to have to come up a way don’t delay—see a certified elder law

First, for all transfers made after stroke and enters a nursing home; with to deal with this financial dilemma. attorney for up-to-date advice.

Feb. 8, 2006, the lookback period is no more assets to his name at that time, Third, the applicant’s home is no Joseph S. Karp is a nationally certified

increased to five he applies for Medicaid. longer considered an exempt asset for and Florida Bar-certified elder law attorney

years. Thus, any as- ...for all transfers made Because Mr. Doe trans- the purpose of Medicaid eligibility. (C.E.L.A.) specializing in the practice of Trusts,

set transfer made after Feb. 8, 2006, the ferred assets within the Only $500,000 in equity is exempt; Estates and Elder Law. His offices are locat-

ed at 2500 Quantum Lakes Drive, Boynton

within five years lookback period is in- lookback period, he is any excess equity counts as an asset Beach; 2875 PGA Blvd., Palm Beach Gar-

prior to the date an creased to five years. ineligible to receive ben- from the point of view of asset spend- dens; and 1100 SW St. Lucie W. Blvd., Port

individual applies efits for a penalty peri- down. An exception is made if the St. Lucie. Call him at 561-752-4550 (Boyn-

for Medicaid, will disqualify the ap- od that begins running the date of ap- spouse, or a child who is under 21 or ton); 561-625-1100 (Palm Beach Gardens);

or 772-343-8411 (Port St. Lucie). Toll-free

plicant from receiving benefits for a plication. In Florida, the penalty pe- disabled, lives in the home. States have from anywhere: 800-893-9911. E-mail: KLF@

certain penalty period. riod is determined by dividing the the option of raising the exemption Karplaw.com. or website www.karplaw.com

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Help May Be Available To Pay For Assisted Living, Home CareDokument1 SeiteHelp May Be Available To Pay For Assisted Living, Home CareJoseph S. KarpNoch keine Bewertungen

- Get Help From A Florida Certified Elder Law Attorney When Applying For Medicaid BenefitsDokument1 SeiteGet Help From A Florida Certified Elder Law Attorney When Applying For Medicaid BenefitsJoseph S. KarpNoch keine Bewertungen

- Holocaust Reparations and Florida Medicaid BenefitsDokument1 SeiteHolocaust Reparations and Florida Medicaid BenefitsJoseph S. KarpNoch keine Bewertungen

- Good New Year ResolutionsDokument1 SeiteGood New Year ResolutionsJoseph S. KarpNoch keine Bewertungen

- Stop The MadnessDokument1 SeiteStop The MadnessJoseph S. KarpNoch keine Bewertungen

- 2010 Tax Laws May Jeopardize Your SpouseDokument1 Seite2010 Tax Laws May Jeopardize Your SpouseJoseph S. KarpNoch keine Bewertungen

- Veterans Benefits For Long-Term CareDokument1 SeiteVeterans Benefits For Long-Term CareJoseph S. KarpNoch keine Bewertungen

- Control Your Medical Destiny With A Living WillDokument1 SeiteControl Your Medical Destiny With A Living WillJoseph S. KarpNoch keine Bewertungen

- Your Children Should KnowDokument1 SeiteYour Children Should KnowJoseph S. KarpNoch keine Bewertungen

- Advance Health Directives: Life PlanningDokument1 SeiteAdvance Health Directives: Life PlanningJoseph S. KarpNoch keine Bewertungen

- Be Prepared For Life's FallsDokument1 SeiteBe Prepared For Life's FallsJoseph S. KarpNoch keine Bewertungen

- Estate Planning Isn't Just For The WealthyDokument1 SeiteEstate Planning Isn't Just For The WealthyJoseph S. KarpNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Investment Climate Brochure - Ethiopia PDFDokument32 SeitenInvestment Climate Brochure - Ethiopia PDFR100% (1)

- Trading Strategy v.1Dokument3 SeitenTrading Strategy v.1Time LapseNoch keine Bewertungen

- Worksheet - Economics - Supply and DemandDokument4 SeitenWorksheet - Economics - Supply and DemandAwais UR RehmanNoch keine Bewertungen

- RM CasesDokument17 SeitenRM CasesAman Lalit Saini (PGDM 17-19)Noch keine Bewertungen

- Land and Property Values in The U.S.: Land Prices For 46 Metro AreasDokument3 SeitenLand and Property Values in The U.S.: Land Prices For 46 Metro AreasMirela Andreea GrigorasNoch keine Bewertungen

- BIR Ruling No 105-99Dokument1 SeiteBIR Ruling No 105-99Cristelle Elaine ColleraNoch keine Bewertungen

- Conversations in Colombia, S. Gudeman and A. RiveraDokument217 SeitenConversations in Colombia, S. Gudeman and A. RiveraAnonymous OeCloZYzNoch keine Bewertungen

- Invitation Letter - Detecting Fraud - MisrepresentationsDokument1 SeiteInvitation Letter - Detecting Fraud - MisrepresentationsANgel Go CasañaNoch keine Bewertungen

- Dornbusch 6e Chapter12Dokument19 SeitenDornbusch 6e Chapter12kushalNoch keine Bewertungen

- Public Relations Plan ProjectDokument11 SeitenPublic Relations Plan ProjectluvdethgalzNoch keine Bewertungen

- ZZZZDokument14 SeitenZZZZMustofa Nur HayatNoch keine Bewertungen

- Electronic Challan .1.9Dokument27 SeitenElectronic Challan .1.9Soumya BisoiNoch keine Bewertungen

- CIBP Projects and Working Groups PDFDokument37 SeitenCIBP Projects and Working Groups PDFCIBPNoch keine Bewertungen

- Unpan93784 Bagus BaganDokument224 SeitenUnpan93784 Bagus BaganFriska Prastya HarlisNoch keine Bewertungen

- Investment Notes PDFDokument30 SeitenInvestment Notes PDFMuhammad NaeemNoch keine Bewertungen

- Assignment of POMDokument4 SeitenAssignment of POMRajiv RanjanNoch keine Bewertungen

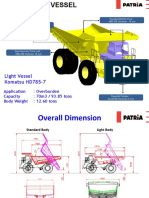

- Patria Light Vessel HD 785-7Dokument9 SeitenPatria Light Vessel HD 785-7bayu enasoraNoch keine Bewertungen

- Trainers Manual For Sustainable Cocoa GhanaDokument199 SeitenTrainers Manual For Sustainable Cocoa GhanaKookoase Krakye100% (1)

- QTN No 213468Dokument4 SeitenQTN No 213468ZakNoch keine Bewertungen

- Getting Moving: A Manifesto For Cycling in Greater ManchesterDokument10 SeitenGetting Moving: A Manifesto For Cycling in Greater ManchesterManchester Friends of the EarthNoch keine Bewertungen

- First Draft of The 2012 City of Brantford Budget DocumentsDokument1.181 SeitenFirst Draft of The 2012 City of Brantford Budget DocumentsHugo Rodrigues100% (1)

- Taco-Viva Riskfactor ReportDokument2 SeitenTaco-Viva Riskfactor Reportmarichu apiladoNoch keine Bewertungen

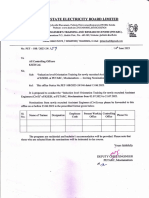

- JMR PH 3Dokument1 SeiteJMR PH 3kuldeep singh rathoreNoch keine Bewertungen

- CHAPTER 18 Multiple Choice Answers With ExplanationDokument10 SeitenCHAPTER 18 Multiple Choice Answers With ExplanationClint-Daniel Abenoja75% (4)

- Advanced Price Action Analysis PDFDokument62 SeitenAdvanced Price Action Analysis PDFFernandoFierroGonzalez67% (6)

- TI Cycles Project ReportDokument4 SeitenTI Cycles Project ReportGaneshNoch keine Bewertungen

- Ae (C)Dokument1 SeiteAe (C)Akesh LimNoch keine Bewertungen

- Institutional Membership FormDokument2 SeitenInstitutional Membership Formdhruvi108Noch keine Bewertungen

- Low Floor Bus DesignDokument10 SeitenLow Floor Bus DesignavinitsharanNoch keine Bewertungen

- Business of Banking (Volumul II) PDFDokument328 SeitenBusiness of Banking (Volumul II) PDFminusdas540Noch keine Bewertungen