Beruflich Dokumente

Kultur Dokumente

Assignment of Corporate Finance

Hochgeladen von

Sakshi PanwarOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assignment of Corporate Finance

Hochgeladen von

Sakshi PanwarCopyright:

Verfügbare Formate

Assignment of Corporate Finance

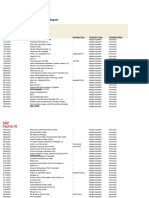

Q1. Discuss the utility of cash budget as a tool of cash management. What are the steps involved in the construction of cash budget. Give an example. Ans. Utility of Cash Budget as a Tool: It gives a complete picture of all the items of expected cash flows so that firm is enabled to arrange finances. It is a sound toll of managing daily cash operations. It helps to utilize ideal funds in better ways. On basis of Cash budget, firm can decide the surplus cash in marketable securities. Steps of construction of Cash Budget: Receipt and Payment method 1. Begins with the opening balance of cash in hand and at bank. 2. In OB cash receipts from various sources will be added. 3. All payments of cash whether on capital or revenue account, will be deducted. Example: A company is expecting to have Rs. 25,000 cash in hand on 1st apr10 and it requires you to prepare cash budget for three months, April to June 2010. The following information is supplied to you. February March April May June

Other information:

Sales 70,000 80,000 92,000 1,00,000 1,20,000

Purchases 40,000 50,000 52,000 60,000 55,000

Wages 8,000 8,000 9,000 10,000 12,000

Expenses 6,000 7,000 7,000 8,000 9,000

a) Period of credit allowed by suppliers is two months; b) 25% of sale is for cash and the period of credit allowed to customers for credit sale is one month; c) Delay in payment of wages and expenses one month;

d) Income tax Rs. 25,000 is to be paid in June 2010. Solution: April(Rs.) Opening balance Receipts: Cash sales Debtors Total Payments: Creditors Wages Expense Income tax Total Closing balance 25000 May(Rs.) 53000 June(Rs.) 81000 Total 25000

23000 60000 83000 40000 8000 7000 55000 53000

25000 69000 94000 50000 9000 7000 66000 81000

30000 75000 105000 52000 10000 8000 25000 95000 91000

78000 204000 282000 142000 27000 22000 25000 216000 91000

Q2. What is meant by credit terms ?What are the expected effects of a) decrease in cash discount b) decrease in credit period. Ans. Credit Terms: The stipulations under which the firm sells on credit to customers are called credit terms. These stipulations include: a) the credit period, and b) the cash discount. a) Effects of decrease in cash discount: A firm uses cash discount as a tool to increase sales and accelerate collections from customers. Thus, the level of receivables and associated costs may be reduced. But if a firm decreases the

cash discount then 1) sales would decrease and 2) collection period would increase because it acts as an attraction to customer. b) Effects of decrease in credit period: a firm lengthens credit period to increase its operating profit through expanded sales. With increased sales and extended credit period, investment in receivables would increase. But firm decreases the credit period then 1) operating profit would affected negatively and 2) investment in receivables would decreases. There would be fewer customers. Q3. Length of the operating cycle is the major determinant of working capital. Explain. Ans. Operating cycle is the time duration required to convert sales after the conversion of resources into inventories into cash. It inverse three phases: 1) acquisition of resource, 2) manufacture of product and 3) sale of product. If the length of the operating cycle is more, the will need more working capital whereas if the length is short, the company will need less working capital because in short operating cycle funds are generated automatically through sales of product.

Das könnte Ihnen auch gefallen

- Financial StatementDokument36 SeitenFinancial StatementKopal GargNoch keine Bewertungen

- Session 10-11, CVP Analysis - PPTX (Repaired)Dokument35 SeitenSession 10-11, CVP Analysis - PPTX (Repaired)Nikhil ChitaliaNoch keine Bewertungen

- Corporate Finance Model AnswerDokument3 SeitenCorporate Finance Model AnswersrikanthNoch keine Bewertungen

- Corporate Finance-Assignment June 2017 PDFDokument2 SeitenCorporate Finance-Assignment June 2017 PDFnbala.iyerNoch keine Bewertungen

- Corporate Finance - Assignment September 2017 isuTxyQsX4 PDFDokument3 SeitenCorporate Finance - Assignment September 2017 isuTxyQsX4 PDFA Kaur MarwahNoch keine Bewertungen

- HRM Case and Solution On JADokument13 SeitenHRM Case and Solution On JAAshhab Zaman RafidNoch keine Bewertungen

- Assignment DMBA103 MBA 1 Set-1 and 2 Mar 2022Dokument3 SeitenAssignment DMBA103 MBA 1 Set-1 and 2 Mar 2022Assignment SolveNoch keine Bewertungen

- Chapter 2-Descriptive StatisticsDokument18 SeitenChapter 2-Descriptive StatisticsAyn RandNoch keine Bewertungen

- Developments in International Safety Glass Test Method StandardsDokument30 SeitenDevelopments in International Safety Glass Test Method StandardsKedar A. MalusareNoch keine Bewertungen

- Corporate FinanceDokument11 SeitenCorporate FinanceShamsul HaqimNoch keine Bewertungen

- Assignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BDokument4 SeitenAssignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BAnshum SethiNoch keine Bewertungen

- FINS3625 Case Study Report Davy Edit 1Dokument15 SeitenFINS3625 Case Study Report Davy Edit 1DavyZhouNoch keine Bewertungen

- Waiting Line ManagementDokument19 SeitenWaiting Line ManagementStephAlvaradoBlanzaNoch keine Bewertungen

- Management Accounting Exam Paper August 2012Dokument23 SeitenManagement Accounting Exam Paper August 2012MahmozNoch keine Bewertungen

- Corporate Finance Assignment PDFDokument13 SeitenCorporate Finance Assignment PDFسنا عبداللهNoch keine Bewertungen

- Waiting Time ParadoxDokument9 SeitenWaiting Time ParadoxmelanocitosNoch keine Bewertungen

- Sem 2 Question Bank (Moderated) - Financial ManagementDokument63 SeitenSem 2 Question Bank (Moderated) - Financial ManagementSandeep SahadeokarNoch keine Bewertungen

- Management Accounting Chapter 4Dokument53 SeitenManagement Accounting Chapter 4yimer100% (1)

- Management Accounting MAY 2013Dokument21 SeitenManagement Accounting MAY 2013MahmozNoch keine Bewertungen

- Corporate FinanceDokument4 SeitenCorporate FinanceSaurabh Singh RawatNoch keine Bewertungen

- Sampling and ItDokument14 SeitenSampling and ItNouman ShahidNoch keine Bewertungen

- New Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionDokument9 SeitenNew Heritage Doll Company: Capital Budgeting Exhibit 1 Selected Operating Projections For Match My Doll Clothing Line ExpansionIleana StirbuNoch keine Bewertungen

- Assignment Corporate FinanceDokument3 SeitenAssignment Corporate FinanceRose Abd Rahim50% (2)

- Valuation of Bonds and SharesDokument45 SeitenValuation of Bonds and SharessmsmbaNoch keine Bewertungen

- MR - Ksenou L&T PrecastDokument53 SeitenMR - Ksenou L&T PrecastHarssh ShahNoch keine Bewertungen

- Corporate Finance (United Pigpen) AssignmentDokument1 SeiteCorporate Finance (United Pigpen) AssignmentPhilip HabersaatNoch keine Bewertungen

- MA Exam Paper May 2010Dokument23 SeitenMA Exam Paper May 2010MsKhan0078Noch keine Bewertungen

- SYBCom Semster III Business Economics 2014-15Dokument56 SeitenSYBCom Semster III Business Economics 2014-15ginga716Noch keine Bewertungen

- Free Cash FlowDokument31 SeitenFree Cash FlowKaranvir GuptaNoch keine Bewertungen

- Assignment No 2Dokument3 SeitenAssignment No 2Adeel AwanNoch keine Bewertungen

- QTIA Report 2012 IQRA UNIVERSITYDokument41 SeitenQTIA Report 2012 IQRA UNIVERSITYSyed Asfar Ali kazmiNoch keine Bewertungen

- New Heritage Doll CompanyDokument8 SeitenNew Heritage Doll CompanyKDNoch keine Bewertungen

- CF Assignment 1 Group 4Dokument41 SeitenCF Assignment 1 Group 4Radha DasNoch keine Bewertungen

- Assignment 1Dokument3 SeitenAssignment 1Abbaas AlifNoch keine Bewertungen

- Research QuestionsDokument37 SeitenResearch QuestionsAmmar HassanNoch keine Bewertungen

- Corporate Finance AssignmentDokument4 SeitenCorporate Finance AssignmentShamim NoorNoch keine Bewertungen

- Carlos Hilado Memorial State College: College of Business Management and AccountancyDokument14 SeitenCarlos Hilado Memorial State College: College of Business Management and AccountancyMa.Cristina JulatonNoch keine Bewertungen

- Chapter 24. Tool Kit For Portfolio Theory, Asset Pricing Models, and Behavioral FinanceDokument22 SeitenChapter 24. Tool Kit For Portfolio Theory, Asset Pricing Models, and Behavioral Financetreeken2Noch keine Bewertungen

- Corporate Finance Assignment 1Dokument3 SeitenCorporate Finance Assignment 1tientran91Noch keine Bewertungen

- Management Accounting Exam Paper May 2012Dokument23 SeitenManagement Accounting Exam Paper May 2012MahmozNoch keine Bewertungen

- Assignment 1 Back Bay Battery Simulation Shreya Gupta Final PDFDokument10 SeitenAssignment 1 Back Bay Battery Simulation Shreya Gupta Final PDFAditya MohamadNoch keine Bewertungen

- 1 Corporate Finance Assignment 2Dokument6 Seiten1 Corporate Finance Assignment 2sachin2727Noch keine Bewertungen

- ACC209 Assignment 2 AlternateDokument14 SeitenACC209 Assignment 2 Alternatehtet aungNoch keine Bewertungen

- Amtrak Case SummaryDokument1 SeiteAmtrak Case SummarySteve SmithNoch keine Bewertungen

- Amtrak Case StudyDokument8 SeitenAmtrak Case Studyapi-302845667Noch keine Bewertungen

- Management AccountingDokument17 SeitenManagement AccountingAndi RavNoch keine Bewertungen

- Bond ValuationDokument12 SeitenBond ValuationvarunjajooNoch keine Bewertungen

- Chapter 4 SolvedDokument21 SeitenChapter 4 SolvedQuế Hoàng Hoài ThươngNoch keine Bewertungen

- AmtrakDokument1 SeiteAmtrakAmit JindalNoch keine Bewertungen

- Some Exercises On Capital Structure and Dividend PolicyDokument3 SeitenSome Exercises On Capital Structure and Dividend PolicyAdi AliNoch keine Bewertungen

- Irr and NPVDokument13 SeitenIrr and NPVAbin VargheseNoch keine Bewertungen

- Business Statistics Etf1100 Notes Business Statistics Etf1100 NotesDokument56 SeitenBusiness Statistics Etf1100 Notes Business Statistics Etf1100 NotesIshan MalakarNoch keine Bewertungen

- New Heritage Doll CompanyDokument11 SeitenNew Heritage Doll CompanyLightning SalehNoch keine Bewertungen

- New Heritage Doll CompanyDokument4 SeitenNew Heritage Doll Companyvenom_ftwNoch keine Bewertungen

- Cash ManagementDokument16 SeitenCash ManagementdhruvNoch keine Bewertungen

- Budgetary ControlDokument11 SeitenBudgetary ControlDurga Prasad NallaNoch keine Bewertungen

- Lesson-10 Budgetory ControlDokument11 SeitenLesson-10 Budgetory ControlSumit YadavNoch keine Bewertungen

- IMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Dokument5 SeitenIMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)Noch keine Bewertungen

- Lecture 7-8 Cash Budget - Cash Operating CycleDokument18 SeitenLecture 7-8 Cash Budget - Cash Operating CyclesajedulNoch keine Bewertungen

- Banking System in India: Presented By-Sakshi VermaDokument9 SeitenBanking System in India: Presented By-Sakshi VermaSakshi PanwarNoch keine Bewertungen

- Perspective ManagementDokument42 SeitenPerspective ManagementSakshi PanwarNoch keine Bewertungen

- Business OrganigationDokument172 SeitenBusiness OrganigationSakshi PanwarNoch keine Bewertungen

- Internship Project Report: India Infoline (IIFL)Dokument2 SeitenInternship Project Report: India Infoline (IIFL)Sakshi PanwarNoch keine Bewertungen

- HDFCDokument4 SeitenHDFCSakshi PanwarNoch keine Bewertungen

- Table of Content - 6279Dokument4 SeitenTable of Content - 6279Wing Laam Tam (Bobo)Noch keine Bewertungen

- PESTELDokument5 SeitenPESTELtakawira chirimeNoch keine Bewertungen

- IT & Tekecom TransactionsDokument20 SeitenIT & Tekecom TransactionsRohil0% (1)

- PA-STARNet Overview and Fact SheetDokument2 SeitenPA-STARNet Overview and Fact SheetDaryl JonesNoch keine Bewertungen

- Javascript For Abap Programmers: Chapter 3.5 - ArraysDokument26 SeitenJavascript For Abap Programmers: Chapter 3.5 - ArraysvenubhaskarNoch keine Bewertungen

- Carson Moniz Resume 2021Dokument2 SeitenCarson Moniz Resume 2021Carson MonizNoch keine Bewertungen

- A.zerrouki Et El The Natural Circulation Solar Water Heater ModelDokument11 SeitenA.zerrouki Et El The Natural Circulation Solar Water Heater ModelJuan-Pierre HerbothNoch keine Bewertungen

- Lecture 4 Assessment B Slides 2023Dokument22 SeitenLecture 4 Assessment B Slides 2023Malkee TisseraNoch keine Bewertungen

- PricelistDokument3 SeitenPricelistZakaria ZebbicheNoch keine Bewertungen

- M123SP Service ManualDokument57 SeitenM123SP Service ManualJhonatan Diaz100% (1)

- NDEC Medication Standing Orders General InformationDokument2 SeitenNDEC Medication Standing Orders General InformationSillieteNoch keine Bewertungen

- Dezurik Cast Stainless Steel Knife Gate Valves KGN RSB KGN Msu KGN RSB Resilient Seated Technical 29-00-1dDokument8 SeitenDezurik Cast Stainless Steel Knife Gate Valves KGN RSB KGN Msu KGN RSB Resilient Seated Technical 29-00-1dOleg ShkolnikNoch keine Bewertungen

- Decline of RomeDokument3 SeitenDecline of RomeTruman Younghan IsaacsNoch keine Bewertungen

- LPC 2138 Datasheet PDFDokument41 SeitenLPC 2138 Datasheet PDFRituparnaNoch keine Bewertungen

- 01 Six Sigma Methodology - Wisnu & SadonoDokument3 Seiten01 Six Sigma Methodology - Wisnu & SadonojefrymedanNoch keine Bewertungen

- Contra-Rotating PropellersDokument27 SeitenContra-Rotating PropellersPanji Imam AdyanataNoch keine Bewertungen

- High Rise Building Case StudyDokument26 SeitenHigh Rise Building Case StudyJaskiratNoch keine Bewertungen

- Daikin Ducable Unit 5 5tr To 16 7trDokument2 SeitenDaikin Ducable Unit 5 5tr To 16 7trరాజా రావు చామర్తిNoch keine Bewertungen

- Design and Optimization of Spur Gear: Final ReviewDokument41 SeitenDesign and Optimization of Spur Gear: Final ReviewVirat KiranNoch keine Bewertungen

- Republican PartyDokument21 SeitenRepublican PartyVivek GoyalNoch keine Bewertungen

- Wnba Marketing ProposalDokument6 SeitenWnba Marketing Proposalapi-338282536Noch keine Bewertungen

- PortfolioDokument24 SeitenPortfolioAditi SharmaNoch keine Bewertungen

- Engineering Mechanics: StaticsDokument44 SeitenEngineering Mechanics: StaticsDaya AhmadNoch keine Bewertungen

- DD Form 2657 BlankDokument3 SeitenDD Form 2657 BlankdavejschroederNoch keine Bewertungen

- Transformers: What Is An Electric Transformer?Dokument14 SeitenTransformers: What Is An Electric Transformer?Mohamed IbrahemNoch keine Bewertungen

- Reviewer RCCPDokument27 SeitenReviewer RCCPGodwin De GuzmanNoch keine Bewertungen

- PDS Class Test 2: Let Us Establish The Pointer From Autumn Break To PDS!!!Dokument26 SeitenPDS Class Test 2: Let Us Establish The Pointer From Autumn Break To PDS!!!Abhinaba SahaNoch keine Bewertungen

- Oslo Guide PDFDokument10 SeitenOslo Guide PDFDevan BhallaNoch keine Bewertungen

- Nouveau Document Microsoft WordDokument5 SeitenNouveau Document Microsoft Wordlinakha186Noch keine Bewertungen