Beruflich Dokumente

Kultur Dokumente

Malaysia's ICM Success Story

Hochgeladen von

Manfadawi FadawiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Malaysia's ICM Success Story

Hochgeladen von

Manfadawi FadawiCopyright:

Verfügbare Formate

Contributed by Securities Commission, Malaysia

Malaysias ICM: A Success Story

Islamic capital market, an integral segment in Malaysias financial system, continues to register robust growth with the full complement of products, infrastructure, institutions, intermediaries and investors contributing to the depth and breadth of the capital market. It has an extensive range of products and mechanisms, including Shariah screening systems for equities, Sukuk, unit trust, exchange-traded funds (ETFs), real estate investment trusts (REITs) and structured products and derivatives. Islamic capital market successes Islamic products now account for a significant portion of Malaysias capital market. In 2007, Sukuk accounted for 76% or US$37.38 billion of bonds approved by the Securities Commission Malaysia (SC). launched the first US$600 million fiveyear global sovereign Sukuk in 2002. Being the largest issuer, representing 60% of global outstanding Sukuk, Malaysia aims to retain its leading position by broadening Sukuk variety from plain vanilla to exotics. Notable Sukuk issuances in Malaysia There are more than 350 Islamic equity funds operating in major financial centers globally, managing more than US$500 billion worth of assets. This indicates huge potential to further develop the Islamic capital market. In the domestic equity market, 85% of securities listed on Bursa Malaysia are Shariah compliant, representing US$182 billion, or 65%, of the bourses total market capitalization. US$5.6 billion representing more than 35% of the global Islamic unit trust industry NAV. The country also has two listed Islamic REITs with hospitals and plantations as their main assets. In January 2008, Asias first Islamic Exchange Traded Fund (ETF), MyETF, was launched tracked by the Dow Jones Islamic Market Malaysia Titan 25. Within the wealth management industry, various structured investment, targeted at institutions and high net worth individuals, have also been launched. The 2008 Budget also included incentives to boost Malaysias Islamic capital market sector - with emphasis on Islamic fund management.

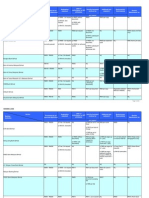

International Finance Corporation (World Bank) Cagamas MBS Khazanah Nasional (Rafflesia Capital Limited) Nucleus Avenue (Malakoff Corporation) Binariang GSM

RM500 million (US$132 million) RM2.05 billion (US$540 million) US$750 million RM8 billion (US$2.5 billion) RM15.35 billion (US$4.8 billion)

2004 2005 2006 2007 2007

First ringgit Sukuk issuance by supranational agency Worlds first Islamic residential mortgage backed securities Worlds first exchangeable Sukuk First hybrid Sukuk in the world Worlds largest Sukuk issue as at end-2007

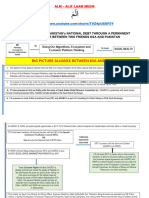

Shariah Advisory Council for capital market Established in 1996 at the SC, the Shariah Advisory Council (SAC) provided the single most important impetus

August/September 2008

. Islamic Finance Asia

Malaysian Islamic Capital Market

49

Malaysia is also committed to work with other centers in creating an Islamic capital market network to provide necessary linkages in optimizing In the unit trust industry, Malaysia, as opportunities across Islamic markets. at June 2008, had 138 Islamic unit In 2007, the SC signed a mutual trusts, from only two in 1993, with a recognition agreement with the Dubai combined net asset value (NAV) of A pioneer in global Sukuk, Malaysia Financial Services Authority for Notable Sukuk issuances in Malaysia cross-border Issuer Amount Year Transaction highlights marketing and Shell MDS RM125 million (US$33 1990 Worlds first ringgit Sukuk issuance by distribution of million) foreign-owned, non-Islamic company Islamic funds Kumpulan Guthrie US$150 million 2001 Worlds first global corporate Sukuk between Malaysia and the UAE. Government of Malaysia US$600 million 2002 Worlds first global sovereign Sukuk

for the success of other initiatives. As the highest point of reference for all Shariah-related matters in the capital market, many other building blocks were put in place. The extensive powers of the SC, in the issue and offering of securities in the market, paved the way for issuance of legally binding guidelines and requirements in the Islamic capital market enabling the SC, for instance, to impose specific requirements for Islamic unit trust funds and Sukuk. Other measures taken include the adoption and pursuit of a screening process to determine Shariah compliant securities; the issuance of numerous guidelines to impose additional requirements on products that are identified as Shariah compliant; and the introduction of education and awareness programs through the publication of SAC resolutions and programs organized by the Securities Industry Development Centre. Continuous product innovation Malaysias Islamic capital market growth is also due to its wide range of products, which saw Islamic institutions evolve into originators of Islamic products and services a notable achievement from the earlier days when they would merely adapt conventional structures as templates for off-the-shelf Islamic products. Today, a diversified array of products ranging from Shariah compliant equities, Sukuk, unit trust funds, Islamic ETFs and REITs to structured products and derivatives are available in Malaysia. Clients increasingly sophisticated financial requirements are also another key driver for product innovation in Islamic finance. There is now greater awareness on the benefits of diversifying their balance sheet risk. Islamic finance investors are also more adventurous by investing in hedge funds and more complex capital market products. The SC has facilitated the introduction of these products in the Malaysian market through numerous productspecific guidelines that provide clarity, consistency and enhanced disclosures Islamic Finance

Budget 2008

Liberalized shareholding structure Foreign ownership of fund management companies and REIT management companies is allowed up to 70%; Islamic fund management companies are allowed 100% foreign ownership; With effect from the 1st October 2007, Islamic funds were permitted to invest 100% of assets abroad Approximately US$2 billion in start-up funding will be channeled by EPF to Islamic fund management companies; Income tax exemption on all Islamic fund Income tax exemption for non-resident Islamic finance experts; One stop-center at the SC for all fund management-related queries.

Facilitative cross-border investment policy Greater access to institutional funds More competitive operating environment management activity fees until 2016;

Table 3 for Shariah compliance such as guidelines for Islamic securities, REITs and ETFs. Facilitative regulatory environment with strong investor protection Malaysias comprehensive, facilitative and sophisticated Islamic capital market regulatory framework ensures participants in its capital market enjoy the same degree of clarity, certainty and protection. With an investor protection regime that is among the best in the world, Malaysia also offers investors in Islamic products end-to-end Shariah compliance. Malaysia also has a comprehensive corporate governance framework in place, an international accounting framework based on the International Accounting Standards Board, and its securities and settlement systems and regulations conform to International Organization of Securities Commissions (IOSCO) principles. According to the World Bank 2006 report, Malaysia scored top marks for disclosure and transparency of accounting standards. Additionally, the World Bank, in its Doing Business Report 2007 and 2008, ranked Malaysia fourth in terms of investor protection. An active member of IOSCO, the SC has an extensive and strong network with fellow regulators globally. It is also a signatory to the IOSCO multilateral memorandum of understanding on information sharing and enforcement of securities laws a major milestone in strengthening supervision and enforcement efforts in the capital market. In addition, it recognizes the SC as a credible regulator with strong enforcement capability. High-quality intermediation services Malaysia has a broad range of intermediaries to meet the needs of investors and issuers in the Islamic capital market. Intermediaries now engage in a broad range of complex financial transactions and operate in various market segments banking, insurance and capital markets and provide specialized over-the-counter hedging and risk management products, and advise on sophisticated transaction structures. Their expertise has been recognized by the global financial community in the Islamic capital market and has received numerous awards and recognition for their innovativeness in structuring Sukuk. A number of Malaysian intermediaries have strengthened their position by forging strategic alliances with foreign jurisdictions and venturing into regional markets, enabling them to acquire skills and expertise on new products and overseas investments. Similarly, the presence of several Islamic financial institutions from the GCC countries in Malaysia has significantly altered the Islamic capital market intermediation landscape here. More efforts are taken to attract more to set up operations in Malaysia.

Malaysian Islamic Capital Market

50

Asia .

August/September 2008

Das könnte Ihnen auch gefallen

- Legal and Regulatory Framework of Islamic Capital MarketDokument74 SeitenLegal and Regulatory Framework of Islamic Capital MarketFarah IlaNoch keine Bewertungen

- Islamic Finance HubDokument72 SeitenIslamic Finance Hubhafiz1979Noch keine Bewertungen

- Islamic Banking Murat ÇETİNKAYA Kuveyt TürkDokument40 SeitenIslamic Banking Murat ÇETİNKAYA Kuveyt TürkrameshNoch keine Bewertungen

- Islamic Finance in Malaysia - Evolution & Current Development - MIFCDokument12 SeitenIslamic Finance in Malaysia - Evolution & Current Development - MIFCmohammedzaidiNoch keine Bewertungen

- IFSL Research: Islamic Finance 2009Dokument8 SeitenIFSL Research: Islamic Finance 2009Sidi Ethmane CheibanyNoch keine Bewertungen

- Osservatorio Del Mediterraneo Ministry of Foreign Affairs Roma, Nov. 4, 2009Dokument33 SeitenOsservatorio Del Mediterraneo Ministry of Foreign Affairs Roma, Nov. 4, 2009rohit7853Noch keine Bewertungen

- Islamic Banking Murat ÇETİNKAYA Kuveyt TürkDokument40 SeitenIslamic Banking Murat ÇETİNKAYA Kuveyt TürkFatima Ezzahra BouchhaNoch keine Bewertungen

- BlueprintDokument12 SeitenBlueprintWan NurwidadNoch keine Bewertungen

- Islamic Finance ReportDokument5 SeitenIslamic Finance ReportAsfand YarNoch keine Bewertungen

- Islamic Financial Market in MalaysiaDokument3 SeitenIslamic Financial Market in MalaysiaSaiful Azhar Rosly100% (6)

- Islamic Investment FundsDokument13 SeitenIslamic Investment Fundskritikabaralia1Noch keine Bewertungen

- Name MD - Zahid Hossain Law200 Sec 07Dokument5 SeitenName MD - Zahid Hossain Law200 Sec 07Zahid HossainNoch keine Bewertungen

- Kuwait - Mohamed IqbalDokument18 SeitenKuwait - Mohamed IqbalAsian Development Bank50% (2)

- Chapter 8 Marketing of Islamic Financial ProductsDokument12 SeitenChapter 8 Marketing of Islamic Financial ProductsadilagidiNoch keine Bewertungen

- Of Islamic Finance A Case Study: Managing InnovationDokument6 SeitenOf Islamic Finance A Case Study: Managing InnovationmirzalkwNoch keine Bewertungen

- Waqf Conference 2023Dokument1 SeiteWaqf Conference 2023RENDI WahyuqNoch keine Bewertungen

- Sukuk in MalaysiaDokument30 SeitenSukuk in Malaysiamusbri mohamedNoch keine Bewertungen

- Islamic FinanceDokument19 SeitenIslamic FinanceArun SinghNoch keine Bewertungen

- Practice & Prospects of Islamic REITsDokument15 SeitenPractice & Prospects of Islamic REITsmonica_dxbNoch keine Bewertungen

- Master Plan To Reduce PAK Nartional Debt, Alliance Between KSA and PAKDokument5 SeitenMaster Plan To Reduce PAK Nartional Debt, Alliance Between KSA and PAKkinzababarNoch keine Bewertungen

- Prudential Financial: Securities Investment Trust Enterprise (Patricia Tsai)Dokument27 SeitenPrudential Financial: Securities Investment Trust Enterprise (Patricia Tsai)National Press FoundationNoch keine Bewertungen

- Sovereign Wealth FundDokument22 SeitenSovereign Wealth Fund2005raviNoch keine Bewertungen

- 4aMFA3053 SukukDokument45 Seiten4aMFA3053 Sukukksenju47Noch keine Bewertungen

- 10-01-21 Islamic Finance - Vs BrandedDokument59 Seiten10-01-21 Islamic Finance - Vs BrandedMohammedNoch keine Bewertungen

- @wbg2030 Islamic Development Bank April 3, 2018: Mahmoud Mohieldin Senior Vice President World Bank GroupDokument30 Seiten@wbg2030 Islamic Development Bank April 3, 2018: Mahmoud Mohieldin Senior Vice President World Bank GroupFarah EgalNoch keine Bewertungen

- Development and Future of Islamic Banking in Turkey: Abdullah Çelik CEO, Bank AsyaDokument19 SeitenDevelopment and Future of Islamic Banking in Turkey: Abdullah Çelik CEO, Bank AsyaAshraf KhanNoch keine Bewertungen

- The Evolution of The Islamic Capital Market Towards A Global HubDokument30 SeitenThe Evolution of The Islamic Capital Market Towards A Global HubAna FienaNoch keine Bewertungen

- Role of IT in Islamic BankingDokument11 SeitenRole of IT in Islamic BankingAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- A Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Dokument19 SeitenA Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Adama KoneNoch keine Bewertungen

- Islamic Financial Contract - FInalDokument64 SeitenIslamic Financial Contract - FInalRianovel MareNoch keine Bewertungen

- SECP Analysis and IonDokument44 SeitenSECP Analysis and IonJunaid Aftab Abbasi0% (1)

- Paper Sukuk IjarahDokument37 SeitenPaper Sukuk Ijarahsafizal azmiNoch keine Bewertungen

- Sukuk StructuringDokument18 SeitenSukuk StructuringRifaldy MajidNoch keine Bewertungen

- SECP-Analysis of Institutions: Pre-Independence ScenarioDokument43 SeitenSECP-Analysis of Institutions: Pre-Independence Scenarioosamahafeez786Noch keine Bewertungen

- Arif Habib Investments ManagementDokument7 SeitenArif Habib Investments Managementk.shaikhNoch keine Bewertungen

- History of Islamic Banking FinanceDokument1 SeiteHistory of Islamic Banking FinanceMilon Sultan100% (1)

- Overview of Legal and Regulatory Framework of Islamic FinanceDokument13 SeitenOverview of Legal and Regulatory Framework of Islamic FinancenanaNoch keine Bewertungen

- Stock Exchage WorkingDokument35 SeitenStock Exchage Workinggrasool11Noch keine Bewertungen

- Mr. Imtiaz Bhatti Challenges & Issues (MS 2003)Dokument12 SeitenMr. Imtiaz Bhatti Challenges & Issues (MS 2003)LaallamKaderNoch keine Bewertungen

- CCIL Role (Ref Art)Dokument6 SeitenCCIL Role (Ref Art)tdp01912Noch keine Bewertungen

- Norhidayu Saad Nbf3d 2019859936 Assignment 2Dokument11 SeitenNorhidayu Saad Nbf3d 2019859936 Assignment 2hidayu saadNoch keine Bewertungen

- Screening of Sukuk Bonds As Islamic Interbank and Investment ToolDokument44 SeitenScreening of Sukuk Bonds As Islamic Interbank and Investment Tooleaboulola100% (1)

- L2 Intro To ICMDokument39 SeitenL2 Intro To ICMBeautys MiracleNoch keine Bewertungen

- Maybank Islamic Berhad - Global Sukuk May 2021Dokument41 SeitenMaybank Islamic Berhad - Global Sukuk May 2021Muhammad ZaheerNoch keine Bewertungen

- Islamic Capital Market PDFDokument13 SeitenIslamic Capital Market PDFnafis786Noch keine Bewertungen

- Islam BNM 2003Dokument22 SeitenIslam BNM 2003Ali FarhanNoch keine Bewertungen

- Press Release On I-REITsDokument1 SeitePress Release On I-REITsAlHuda Centre of Islamic Banking & Economics (CIBE)Noch keine Bewertungen

- Legal Framework of Islamic Capital MarketDokument21 SeitenLegal Framework of Islamic Capital MarketMahyuddin Khalid100% (2)

- Sukuk Defaults and Its Implication: A Case Study of Malaysian CapitalDokument37 SeitenSukuk Defaults and Its Implication: A Case Study of Malaysian Capitalkhairul azlyNoch keine Bewertungen

- Forward Lease Sukuk in Islamic Capital Markets Structure and Governing Rules 1St Ed Edition Ahcene Lahsasna Full ChapterDokument67 SeitenForward Lease Sukuk in Islamic Capital Markets Structure and Governing Rules 1St Ed Edition Ahcene Lahsasna Full Chaptermichael.green397100% (4)

- Cimb Islamic Dali Equity Fund LeaflDokument2 SeitenCimb Islamic Dali Equity Fund Leaflkeramatboy88Noch keine Bewertungen

- Islamic Funds & Investment Report (IFIR 2010), Ernst & YoungDokument68 SeitenIslamic Funds & Investment Report (IFIR 2010), Ernst & YoungBRR_DAGNoch keine Bewertungen

- Making Your BussinesDokument30 SeitenMaking Your Bussinesfaris ridhaNoch keine Bewertungen

- Sukuk in Focus: The Necessity For Global Common PracticesDokument44 SeitenSukuk in Focus: The Necessity For Global Common Practicesahmad farhanNoch keine Bewertungen

- Islamic Investment Funds Islamic Capital Market Bursa MalaysiaDokument28 SeitenIslamic Investment Funds Islamic Capital Market Bursa MalaysiaLuqman X AidilNoch keine Bewertungen

- A Brief History of Events That Have Gotten Pakistan'SDokument2 SeitenA Brief History of Events That Have Gotten Pakistan'SGhulam NabiNoch keine Bewertungen

- MCB-AH Corp Presentation Sept 12 PDFDokument30 SeitenMCB-AH Corp Presentation Sept 12 PDFlordraiNoch keine Bewertungen

- Investing in Emerging Markets: The BRIC Economies and BeyondVon EverandInvesting in Emerging Markets: The BRIC Economies and BeyondNoch keine Bewertungen

- Becoming Successful Financial Life Planner - Mitch AnthonyDokument271 SeitenBecoming Successful Financial Life Planner - Mitch Anthonykudakuda@gawab100% (2)

- Pele StatsDokument222 SeitenPele Statskudakuda@gawabNoch keine Bewertungen

- 03 HousingDokument5 Seiten03 Housingkudakuda@gawabNoch keine Bewertungen

- 00 Comparative Table 20080520Dokument26 Seiten00 Comparative Table 20080520kudakuda@gawabNoch keine Bewertungen