Beruflich Dokumente

Kultur Dokumente

Commodity Price Table

Hochgeladen von

Aishatu Musa AbbaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Commodity Price Table

Hochgeladen von

Aishatu Musa AbbaCopyright:

Verfügbare Formate

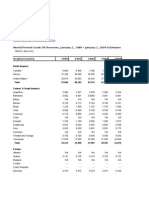

3 Oct 12 Table 3.

Actual Market Prices for Non-Fuel and Fuel Commodities, 2009-2012

Commodities Food Cereals Wheat Maize Rice Barley Vegetable oils and protein meals Soybeans Soybean meal Soybean oil Palm oil Fish meal Sunflower Oil Olive oil Groundnuts Rapeseed oil Meat Beef Lamb Swine Meat Poultry Seafood Fish Shrimp Sugar Free market United States EU Bananas Oranges Beverages Coffee Other milds Robusta Cocoa Beans Tea Agricultural raw materials Timber Hardwood Logs 1/ Sawnwood 1/ Softwood Logs 1/ Sawnwood 1/ Cotton Wool Fine Coarse Rubber Hides Metals Copper Aluminum Iron Ore Tin Nickel Zinc Lead Uranium

Units

2009

2010

2011

11Q4

12Q1

12Q2

12Q3 1/

08-2012

09-2012 1/

$/MT $/MT $/MT $/MT $/MT $/MT $/MT $/MT $/MT $/MT $/MT $/MT $/MT cts/lb cts/lb cts/lb cts/lb $/kg $/kg cts/lb cts/lb cts/lb $/MT $/MT

223.4 165.5 589.4 128.4 378.5 359.3 787.0 644.1 1255.9 1041.7 3509.3 994.6 856.2 119.6 146.9 55.8 85.6 4.9 8.4 18.2 24.3 26.0 848.0 909.0

223.7 186.0 520.6 158.4 384.9 331.3 924.8 859.9 1739.2 1186.0 3171.3 1239.4 1011.7 152.5 145.7 74.4 85.8 6.1 7.5 20.9 31.1 25.7 881.4 1028.4

316.2 291.8 551.7 207.2 484.2 378.9 1215.8 1076.5 1519.3 1621.8 3070.3 1724.0 1366.6 183.2 149.2 89.1 87.4 5.9 8.2 26.2 37.6 26.7 975.9 891.1

279.7 269.1 597.4 210.8 431.6 332.4 1116.0 956.4 1374.8 1551.9 3003.0 1847.8 1264.7 183.7 141.6 87.4 89.3 4.4 8.5 24.7 37.6 26.2 954.1 824.2

278.8 277.7 555.2 215.5 466.5 372.4 1166.2 1058.0 1309.9 1478.5 2895.1 1850.6 1279.7 193.1 125.0 85.1 91.4 4.7 8.3 23.7 34.3 26.1 1046.5 771.0

269.0 270.1 601.5 234.9 524.2 454.7 1155.0 1038.7 1522.8 1441.0 2858.9 1832.5 1241.1 187.7 99.8 83.6 93.9 4.8 8.2 20.9 30.4 26.3 980.4 844.0

349.5 328.6 583.9 258.6 615.8 565.9 1192.4 920.9 1735.6 1546.1 3181.8 1802.4 1233.0 181.2 89.5 83.2 95.1 4.6 8.3 21.2 27.8 26.3 962.8 995.5

349.4 332.2 582.9 267.1 622.9 585.8 1188.5 930.6 1755.7 1549.9 3011.0 1794.6 1221.7 183.1 88.5 86.4 95.0 4.7 8.3 20.6 28.8 26.1 954.8 970.4

353.4 320.7 590.5 259.8 615.2 559.6 1213.3 879.5 1716.1 1582.8 3787.4 1820.0 1267.9 180.3 88.5 68.8 95.6 4.6 8.4 20.2 25.8 26.8 966.9 1001.0

cts/lb cts/lb $/MT cts/kg

141.6 77.1 2895.0 314.0

194.4 84.1 3130.6 316.7

273.2 116.0 2978.5 346.2

247.0 109.9 2469.4 347.3

222.7 111.4 2341.1 339.8

183.2 113.7 2215.2 341.0

182.1 112.4 2494.1 352.3

176.0 113.0 2512.3 353.2

179.6 110.9 2620.3 358.2

$/M3 $/M3 $/M3 $/M3 cts/lb cts/kg cts/kg cts/lb cts/lb $/MT $/MT $/MT $/MT $/MT $/MT $/MT $/lb

285.9 803.1 136.7 291.0 62.8 778.5 611.4 87.2 44.9 5165.3 1669.2 80.0 13602.7 14672.4 1658.4 1719.4 46.7

278.2 849.2 141.5 281.8 103.5 1023.2 820.1 165.7 72.0 7538.4 2173.0 146.7 20367.2 21810.0 2160.4 2148.2 46.0

390.5 939.4 150.0 280.9 154.6 1638.2 1209.2 218.5 82.0 8823.5 2400.6 167.8 26051.4 22909.1 2195.5 2400.7 56.2

409.0 911.8 143.8 283.7 103.6 1445.0 1128.3 163.6 75.5 7511.4 2095.0 140.8 20849.1 18386.0 1906.0 1993.1 52.6

373.3 882.9 144.9 264.4 100.5 1534.8 1338.0 174.7 77.3 8324.7 2181.1 141.8 22942.1 19654.4 2027.6 2092.7 51.9

361.0 883.8 140.8 296.0 90.3 1355.7 1243.2 162.9 84.0 7870.2 1978.8 139.5 20555.1 17154.9 1928.9 1974.6 51.3

354.5 864.3 134.4 295.2 84.2 1217.9 1138.0 134.7 85.3 7727.5 1927.9 111.7 19331.0 16373.5 1891.3 1985.6 49.1

354.7 856.7 134.4 295.2 84.4 1212.9 1133.9 126.7 86.0 7510.4 1843.3 107.8 18675.6 15704.0 1816.3 1897.8 49.3

351.7 878.2 134.4 295.2 84.2 1149.5 1054.3 137.8 86.0 8087.7 2064.1 99.5 20771.3 17288.0 2009.9 2177.7 47.7

Energy Spot Crude 2/ $/bbl 61.8 79.0 104.0 103.2 112.5 102.9 U.K. Brent $/bbl 61.9 79.6 111.0 109.3 118.5 108.9 Dubai $/bbl 61.8 78.1 106.0 106.2 116.0 106.4 West Texas Intermediate $/bbl 61.7 79.4 95.0 94.0 102.9 93.4 Natural Gas Russian in Germany $/000M3 318.8 296.0 381.5 434.9 444.7 452.4 Indonesian in Japan (LNG) $/M3 157.6 197.4 327.2 375.5 368.8 401.7 US, domestic market $/000M3 142.0 158.0 144.0 119.8 88.4 82.1 Coal Australian, export markets $/MT 77.0 106.0 129.6 122.3 120.0 100.6 South African, export markets $/MT 64.6 91.4 116.3 106.8 105.0 93.5 1/ Provisional. 2/ Average Petroleum Spot Price (APSP). Average of U.K. Brent, Dubai, and West Texas Intermediate, equally weighted.

102.8 110.0 106.2 92.2 409.9 401.9 103.9 96.2 88.5

105.3 113.3 108.4 94.1 410.4 401.9 102.2 97.5 89.1

106.3 113.4 111.0 94.6 409.7 401.9 102.7 96.4 89.1

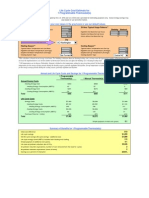

Table 6. Specifications for Commodity prices World Export Weights 2002-2004 100 50.3 45.3 9.7 4.5 U.S. No. 1 hard red winter, ordinary protein, prompt shipment, FOB Gulf of Mexico ports (USDA, Grain and Feed Market News, Washington, DC). U.S. No. 2 yellow, prompt shipment, FOB Gulf of Mexico ports (USDA, Grain and Feed Market News, Washington, D.C.). 1/ Thai, white milled, 5 percent broken, nominal price quotes, FOB Bangkok (USDA, Rice Market News, Little Rock, Arkansas). 2/ Canadian No. 1 Western Barley, spot price (Winnipeg Commodity Exchange) 1/ $/Mt

Commodities Non-Fuel Commodities Edibles Food Cereals Wheat

Price Specifications

Unit

Maize

2.8

$/Mt

Rice

1.7

$/Mt

Barley Vegetable Oils/Protein Meals Soybeans

0.7 12.0 3.3

$/Mt

Soybean futures contract (first contract forward) No. 2 yellow and par Chicago Board of Trade 1/ Soybean Meal Futures (first contract forward) Minimum 48 percent protein Chicago Board of Trade 1/ Crude Soybean Oil Futures (first contract forward) exchange approved grades Chicago Board of Trade 1/ Crude Palm Oil Futures (first contract forward) 4-5 percent FFA Bursa Malaysian Derivatives Berhad 1/ Sunflower Oil, crude, US export price from Gulf of Mexico (DataStream) United Kingdom ex-tanker prices, crude extra virgin olive oil, 1%> ffa (free fatty acid) (DataStream). 1/ Peru Fish meal/pellets 65% protein, CIF (DataStream) 1/ 40/50 (40 to 50 count per ounce), in-shell, cif Argentina (DataStream) Crude, fob Rotterdam 1/ (Datastream)

$/Mt

Soybean Meal

2.3

$/Mt

Soybean Oil

1.2

$/Mt

Palm Oil

1.9

$/Mt

Sunflower/Safflower Oil Olive Oil

0.5 0.8

$/Mt $/Mt

Fishmeal Groundnuts Rapeseed Oil Meat Beef

0.5 0.6 0.9 10.1 3.9

$/Mt $/Mt $/Mt

Australian and New Zealand, frozen boneless, 85 percent visible lean cow meat, U.S. import price FOB port of entry. New Zealand, PL, frozen, wholesale price at Smithfield Market, London (National Business Review, Auckland, New Zealand). 51-52% (.8 - .99 inches of backfat at measuring point) lean Hogs, USDA average base cost price of back fat measured at the tenth rib (USDA). Georgia docks, ready to eat whole body chicken, packed in ice, spot price (USDA).

Cts/lb

Lamb

0.7

Cts/lb

Swine Meat

3.1

Cts/lb

Poultry

2.4

Cts/lb

Seafood Fish Shrimp

8.6 6.9 1.8 Fresh Norwegian Salmon, farm bred, export price (NorStat). Mexican, west coast, white, No. 1, shell-on, headless, 26 to 30 count per pound, wholesale price at New York. US$/kg US$/lb

Sugar Free Market

2.4 1.6 CSCE contract No. 11, nearest future position (Coffee, Sugar and Cocoa Exchange, New York Board of Trade). CSCE contract No. 14, nearest future position (Coffee, Sugar and Cocoa Exchange, New York Board of Trade). EU import price, unpacked sugar, CIF European ports. Negotiated price for sugar from ACP countries to EU under the Sugar Protocol. (EU Office in Washington D.C.). 1/ Central American and Ecuador, first class quality tropical pack, Chiquita, Dole and Del Monte, U.S. importer's price FOB U.S. ports (Sopisco News, Guayaquil). Miscellaneous Oranges, French import price (FruiTROP and World Bank). Cts/lb

United States

0.1

Cts/lb

EU

0.6

Cts/lb

Bananas

1.1

$/Mt

Oranges

1.3

$/Mt

Beverages Coffee Other Milds

4.9 2.3 1.5

International Coffee Organization, Other Mild Arabicas New York cash price. Average of El Salvador central standard, Guatemala prime washed and Mexico prime washed, prompt shipment, ex-dock New York 1/ International Coffee Organization, Robustas New York cash price. Cote d'Ivoire Grade II and Uganda standard, prompt shipment, ex-dock New York. Prior to July 1982, arithmetic average of Angolan Ambriz 2 AA and Ugandan Native Standard, ex-dock New York. 1/

Cts/lb

Robusta

0.9

Cts/lb

Cocoa Beans

1.8

International Cocoa Organization cash price. Average of the three nearest active futures trading months in the New York Cocoa Exchange at noon and the London Terminal market at closing time, CIF U.S. and European ports (The Financial Times, London). 1/ Mombasa auction price for best PF1, Kenyan Tea. Replaces London auction price beginning July 1998.

$/Mt

Tea

0.8

Cts/Kg

Industrial Inputs

49.7

Agricultural Raw Materials Timber Hardwood Logs

20.9 9.1 3.2 1.0 Malaysian, meranti, Sarawak best quality, sale price charged by importers, Japan (World Bank, Washington, D.C.). From January 1988 to February 1993, average of Sabah and Sarawak in Tokyo weighted by their respective import volumes in Japan. From February 1993 to present, Sarawak only. 3/ Malaysian sawnwood, dark red meranti, select and better quality, standard density, C&F U.K. Port (Tropical Timbers, Surrey, England). 3/ $/Cm

Sawnwood Softwood Logs

2.3 5.9 1.0

$/Cm

Average export price of Douglas-fir, Western hemlock and other softwoods exported from Washington, Oregon, Northern California and Alaska. (Pacific Northwest Research Station, USDA Forest Service, Portland, OR). 3/ Average export price of Douglas-fir, Western hemlock and other sawn softwood exported from Canada. Middling 1-3/32 inch staple, Liverpool Index "A", average of the cheapest five of fourteen styles, CIF Liverpool (Cotton Outlook, Liverpool). From January 1968 to May 1981 strict middling 1-1/16 inch staple. Prior to 1968, Mexican 1-1/16. 2/

$/Cm

Sawnwood

4.9

$/Cm

Cotton

1.8

Cts/lb

Wool Fine

1.3 0.6 19 micron (AWEX, Australian Wool Exchange) Sidney, Australia 23 micron (AWEX, Australian Wool Exchange) Sidney, Australia Singapore Commodity Exchange, No. 3 Rubber Smoked Sheets, 1st contract (Bloomberg, RG1 Comdty) U.S., Chicago packer's heavy native steers, over 53 lbs.,wholesale dealer's price, (formerly over 58 lbs.), FOB shipping point (Wall Street Journal, New York). Prior to November 1985, U.S. Bureau of Labor Statistics, Washington, D. C. 1/ Cts/Kg

Coarse

0.7

Cts/Kg

Rubber

1.5

Cts/lb

Hides

7.1

Cts/lb

Metals Copper

28.9 7.7 London Metal Exchange, grade A cathodes, spot price, CIF European ports (Wall Street Journal, New York and Metals Week, New York). Prior to July 1986, higher grade, wirebars, or cathodes. 1/ London Metal Exchange, standard grade, spot price, minimum purity 99.5 percent, CIF U.K. ports (Wall Street Journal, New York and Metals Week, New York). Prior to 1979, U.K. producer price, minimum purity 99 percent. 1/ China import Iron Ore Fines 62% FE spot (CFR Tianjin port; source: The Steel Index). London Metal Exchange, standard grade, spot price, CIF European ports (Wall Street Journal, New York, New York). From Dec. 1985 to June 1989 Malaysian, straits, minimum 99.85 percent purity, Kuala Lumpur Tin Market settlement price. Prior to November 1985, London Metal Exchange (Wall Street Journal, New York and Metals Week, New York). 1/ London Metal Exchange, melting grade, spot price, CIF Northern European ports (Wall Street Journal, New York and Metals Week, New York). Prior to 1980 INCO, melting grade, CIF Far East and American ports (Metal Bulletin, London). 1/ London Metal Exchange, high grade 98 percent pure, spot price, CIF U.K. ports (Wall Street Journal and Metals Weeek, New York). Prior to January 1987, standard grade. 1/ London Metal Exchange, 99.97 percent pure, spot price, CIF European ports (Wall Street Journal, New York and Metals Week, New York). 1/ Metal Bulletin Nuexco Exchange Uranium (U3O8 restricted) price. $/Mt

Aluminum

10.5

$/Mt

Iron Ore

3.6

$/Mt

Tin

0.4

$/Mt

Nickel

3.0

$/Mt

Zinc

1.7

$/Mt

Lead

0.6

$/Mt

Uranium Energy

1.4 100.0

$/lb

Spot Crude Petroleum

85.0

Average of U.K. Brent (light), Dubai (medium), and West Texas Intermediate (heavy), equally weighted. 1/ U.K. light, Brent Blend 38o API, spot price, FOB U.K. ports (International Petroleum Exchanged, London). Prior to 1984, North African Light 37/44o API (Petroleum Intelligence Weekly, New York). Prior to 1974, Libyan Brega 40o API, posted price, ex Marsa El Brega (Platt's Oil Price Handbook and Almanac, New York). Prior to 1961, Qatar Um Said 39o API, posted price, FOB (Platt's Oil Price Handbook and Almanac, New York). 1/

$/bbl

U.K. Brent

28.3

$/bbl

Dubai Fateh

28.3

Dubai, medium, Fateh 32o API, spot price, FOB Dubai. (International $/bbl Petroleum Exchange, London). Prior to 1984, Middle East Light 34o API, spot price, (Petroleum Intelligence Weekly, New York). Prior to 1974, Saudi Arabian Light 34o API, posted price, ex Ras Tanura (Platt's Oil Price Handbook and Almanac, New York). 1/

West Texas Intermediate

28.3

U.S., West Texas Intermediate 40o API, spot price, FOB Midland Texas (New York Mercantile Exchange, New York). In 1983-1984 (Platt's Oilgram Price Report, New York). 1/

$/bbl

Natural Gas Russian Border Price Henry Hub Indonesian Coal Australian Coal

11.1 5.1 3.0 3.0 4.0 Australian thermal coal, 12000 btu/pound, less than 1% sulfur, 14% ash, fob piers, Newcastle/Port Kembla. $/Mt Russian border price in Germany (World Gas Intelligence, New York). Natural Gas Spot Price, Henry Hub, Louisiana. Indonesian Liquid Natural Gas in Japan (World Gas Intelligence, New York). $/000 M3 $/000 M3 $/ M3

1/ Average of daily quotations. 2/ Average of weekly quotations. 3/ Monthly quotations.

Das könnte Ihnen auch gefallen

- World Bank Commodities Price Data (The Pink Sheet) : 4-Aug-2020 Monthly AveragesDokument3 SeitenWorld Bank Commodities Price Data (The Pink Sheet) : 4-Aug-2020 Monthly AveragesRicardoNoch keine Bewertungen

- CMO Pink Sheet October 2021Dokument3 SeitenCMO Pink Sheet October 2021Maqsood AhmedNoch keine Bewertungen

- Potential U.S. Production and Processing: Possible YieldsDokument7 SeitenPotential U.S. Production and Processing: Possible YieldsSuman DashNoch keine Bewertungen

- World Bank Commodities Price Forecast (Nominal US Dollars) : Commodity UnitDokument30 SeitenWorld Bank Commodities Price Forecast (Nominal US Dollars) : Commodity UnitGalihNoch keine Bewertungen

- World Bank Commodities Price Data (The Pink Sheet) : Annual Averages Quarterly Averages 2-Sep-2020 Monthly AveragesDokument3 SeitenWorld Bank Commodities Price Data (The Pink Sheet) : Annual Averages Quarterly Averages 2-Sep-2020 Monthly Averagesrad1962Noch keine Bewertungen

- CMO Pink Sheet November 2023Dokument3 SeitenCMO Pink Sheet November 2023Andrew MayedaNoch keine Bewertungen

- World Bank Commodity PricesDokument3 SeitenWorld Bank Commodity PricesAylin PolatNoch keine Bewertungen

- The Poultry Industry: Dr. Michael SmithDokument27 SeitenThe Poultry Industry: Dr. Michael SmithRahul AroraNoch keine Bewertungen

- ANZ Commodity Daily 850 260613 PDFDokument5 SeitenANZ Commodity Daily 850 260613 PDFAnthony KingNoch keine Bewertungen

- Individual Commodity Price Forecasts June 17, 2015Dokument3 SeitenIndividual Commodity Price Forecasts June 17, 2015Ndika KurniawanNoch keine Bewertungen

- World Bank Commodities Price Data (The Pink Sheet) : Annual Averages Quarterly Averages 2-Jun-2022 Monthly AveragesDokument3 SeitenWorld Bank Commodities Price Data (The Pink Sheet) : Annual Averages Quarterly Averages 2-Jun-2022 Monthly AveragesIkhsan RamadhanNoch keine Bewertungen

- WEO DataDokument60 SeitenWEO DataLucas GomesNoch keine Bewertungen

- ForecastDokument8 SeitenForecastWanNoch keine Bewertungen

- World Bank Commodities Price Forecast (Nominal US Dollars)Dokument4 SeitenWorld Bank Commodities Price Forecast (Nominal US Dollars)rad1962Noch keine Bewertungen

- ANZ Commodity Daily 723 111012Dokument5 SeitenANZ Commodity Daily 723 111012Belinda WinkelmanNoch keine Bewertungen

- ANZ Commodity Daily 860 100713 PDFDokument5 SeitenANZ Commodity Daily 860 100713 PDFJames WoodsNoch keine Bewertungen

- ANZ Commodity Daily 722 101012Dokument5 SeitenANZ Commodity Daily 722 101012Belinda WinkelmanNoch keine Bewertungen

- ANZ Commodity Daily 834 300513 PDFDokument5 SeitenANZ Commodity Daily 834 300513 PDFPablo RobertsNoch keine Bewertungen

- CMO Pink Sheet September 2023Dokument3 SeitenCMO Pink Sheet September 2023nandaauliana96Noch keine Bewertungen

- Individual Commodity Price Forecasts December 15, 2014Dokument3 SeitenIndividual Commodity Price Forecasts December 15, 2014Ndika KurniawanNoch keine Bewertungen

- ANZ Commodity Daily 610 260412Dokument5 SeitenANZ Commodity Daily 610 260412David4564654Noch keine Bewertungen

- Latin American: Market CommentaryDokument6 SeitenLatin American: Market Commentarycharles luisNoch keine Bewertungen

- Weekly Market Updates 8-9-12Dokument3 SeitenWeekly Market Updates 8-9-12BuyEfficientNoch keine Bewertungen

- Raising Chicken and Turkey Broilers in CanadaDokument64 SeitenRaising Chicken and Turkey Broilers in Canadamoekyaw7171Noch keine Bewertungen

- World Bank View On Commodity Prices 02 13Dokument4 SeitenWorld Bank View On Commodity Prices 02 13nafa nuksanNoch keine Bewertungen

- Agrifoods Market Report - ENDokument166 SeitenAgrifoods Market Report - ENRaquel RibeiroNoch keine Bewertungen

- DLR 08-29-11Dokument3 SeitenDLR 08-29-11contact3269Noch keine Bewertungen

- ANZ Commodity Daily 841 120613Dokument5 SeitenANZ Commodity Daily 841 120613David SmithNoch keine Bewertungen

- 2 Bivalves: Global Production and Trade Trends: S. PawiroDokument9 Seiten2 Bivalves: Global Production and Trade Trends: S. PawiroPaulina M. SánchezNoch keine Bewertungen

- ANZ Commodity Daily 718 041012Dokument5 SeitenANZ Commodity Daily 718 041012anon_370534332Noch keine Bewertungen

- ANZ Commodity Daily 599 050412Dokument5 SeitenANZ Commodity Daily 599 050412ChrisBeckerNoch keine Bewertungen

- 1US$ 0.38 Omani Rial, 1gal 4587.3 KG, 1metric Ton 1000kgDokument3 Seiten1US$ 0.38 Omani Rial, 1gal 4587.3 KG, 1metric Ton 1000kgعين الزمردNoch keine Bewertungen

- CommoditiesDokument8 SeitenCommodities4082300573Noch keine Bewertungen

- CropKing Business ExplainedDokument8 SeitenCropKing Business Explainedn3m6Noch keine Bewertungen

- MineralIndustryStatistics MGB Feb2013Dokument1 SeiteMineralIndustryStatistics MGB Feb2013jfmanNoch keine Bewertungen

- Herold - Q3 2011 Upstream Transaction ReviewDokument11 SeitenHerold - Q3 2011 Upstream Transaction ReviewGautam SinghNoch keine Bewertungen

- ANZ Commodity Daily 707 180912Dokument5 SeitenANZ Commodity Daily 707 180912Belinda WinkelmanNoch keine Bewertungen

- Cambodia IndexDokument4 SeitenCambodia Indexhuyhr2000Noch keine Bewertungen

- ANZ Commodity Daily 819 080513Dokument5 SeitenANZ Commodity Daily 819 080513Belinda WinkelmanNoch keine Bewertungen

- Investment Office ANRSDokument27 SeitenInvestment Office ANRSSHASHI SHEKARNoch keine Bewertungen

- Calculator Programmable ThermostatDokument5 SeitenCalculator Programmable Thermostataravoof84Noch keine Bewertungen

- Tutor Oil Market 2008Dokument26 SeitenTutor Oil Market 2008Sabo Doru-CosminNoch keine Bewertungen

- Gruber QADokument1 SeiteGruber QAPrice LangNoch keine Bewertungen

- Crude Oil ReservesDokument20 SeitenCrude Oil ReservesbeungzNoch keine Bewertungen

- Commodity Mantra Pre-Market 020611Dokument5 SeitenCommodity Mantra Pre-Market 020611imukulguptaNoch keine Bewertungen

- ALbert Tacon - Farine PôissonDokument35 SeitenALbert Tacon - Farine PôissonJesus NuñezNoch keine Bewertungen

- ACOPS Yearbook 1986-87: Advisory Committee on Pollution of the Sea, LondonVon EverandACOPS Yearbook 1986-87: Advisory Committee on Pollution of the Sea, LondonAdvisory Committee on PollutioNoch keine Bewertungen

- Commodities Daily: US Natural Gas Price Climbs To 2 - Year HighDokument6 SeitenCommodities Daily: US Natural Gas Price Climbs To 2 - Year HighScoobydo1001Noch keine Bewertungen

- Recent Advances in Animal Nutrition – 1977: Studies in the Agricultural and Food SciencesVon EverandRecent Advances in Animal Nutrition – 1977: Studies in the Agricultural and Food SciencesNoch keine Bewertungen

- UN Commodity Prices BulletinDokument9 SeitenUN Commodity Prices BulletinCumi LautNoch keine Bewertungen

- Agricultural Finance: From Crops to Land, Water and InfrastructureVon EverandAgricultural Finance: From Crops to Land, Water and InfrastructureNoch keine Bewertungen

- Agriculture Export N ImportDokument1 SeiteAgriculture Export N ImportBhargav BezawadaNoch keine Bewertungen

- Ninjatrader Futures CommissionsDokument3 SeitenNinjatrader Futures CommissionsxdjeNoch keine Bewertungen

- An Overview of Florida Pompano Trachinotus Carolinusresearch at MoteDokument18 SeitenAn Overview of Florida Pompano Trachinotus Carolinusresearch at MoteAbdul Nazar100% (1)

- Cereal Supply and Demand DataDokument5 SeitenCereal Supply and Demand DatanicolaecrisNoch keine Bewertungen

- ANZ Commodity Daily 719 051012Dokument5 SeitenANZ Commodity Daily 719 051012anon_370534332Noch keine Bewertungen

- The Colder War: How the Global Energy Trade Slipped from America's GraspVon EverandThe Colder War: How the Global Energy Trade Slipped from America's GraspNoch keine Bewertungen

- ANZ Commodity Daily 837 040613 PDFDokument5 SeitenANZ Commodity Daily 837 040613 PDFDavid SmithNoch keine Bewertungen

- Indirect and Offsets FunctionDokument6 SeitenIndirect and Offsets FunctionAishatu Musa AbbaNoch keine Bewertungen

- Matching Two List of Data PDFDokument6 SeitenMatching Two List of Data PDFAishatu Musa AbbaNoch keine Bewertungen

- Reaction To Grief and Behaivioral Changes PDFDokument11 SeitenReaction To Grief and Behaivioral Changes PDFAishatu Musa AbbaNoch keine Bewertungen

- Changing Formula To Values PDFDokument5 SeitenChanging Formula To Values PDFAishatu Musa AbbaNoch keine Bewertungen

- Learning Theory PDFDokument7 SeitenLearning Theory PDFAishatu Musa AbbaNoch keine Bewertungen

- SumIF and CountIF ProceedureDokument5 SeitenSumIF and CountIF ProceedureAishatu Musa AbbaNoch keine Bewertungen

- Propensity Score AnalysisDokument11 SeitenPropensity Score AnalysisAishatu Musa AbbaNoch keine Bewertungen

- Market Development PDFDokument32 SeitenMarket Development PDFAishatu Musa AbbaNoch keine Bewertungen

- Propensity ScoreDokument5 SeitenPropensity ScoreAishatu Musa AbbaNoch keine Bewertungen

- Market Development PDFDokument32 SeitenMarket Development PDFAishatu Musa AbbaNoch keine Bewertungen

- Marketing Concept and DefiniationDokument8 SeitenMarketing Concept and DefiniationAishatu Musa AbbaNoch keine Bewertungen

- Price Analysis of Selected Agricultural Commodities PDFDokument2 SeitenPrice Analysis of Selected Agricultural Commodities PDFAishatu Musa AbbaNoch keine Bewertungen

- Biological Assessment PDFDokument9 SeitenBiological Assessment PDFAishatu Musa AbbaNoch keine Bewertungen

- Element of Strategic MarketingDokument15 SeitenElement of Strategic MarketingAishatu Musa AbbaNoch keine Bewertungen

- Sr. No Land Ownership Borrow-Ers % Non - Borrowers % All Respondents %Dokument2 SeitenSr. No Land Ownership Borrow-Ers % Non - Borrowers % All Respondents %Aishatu Musa AbbaNoch keine Bewertungen

- Price Analysis of Selected Agricultural Commodities PDFDokument2 SeitenPrice Analysis of Selected Agricultural Commodities PDFAishatu Musa AbbaNoch keine Bewertungen

- Price Analysis of Selected Agricultural Commodities PDFDokument2 SeitenPrice Analysis of Selected Agricultural Commodities PDFAishatu Musa AbbaNoch keine Bewertungen

- Element of Strategic MarketingDokument15 SeitenElement of Strategic MarketingAishatu Musa AbbaNoch keine Bewertungen

- Literacy Levels of The Study Vulnerable GroupsDokument2 SeitenLiteracy Levels of The Study Vulnerable GroupsAishatu Musa AbbaNoch keine Bewertungen

- ActivitiesDokument3 SeitenActivitiesAishatu Musa AbbaNoch keine Bewertungen

- Marketing Concept and DefiniationDokument8 SeitenMarketing Concept and DefiniationAishatu Musa AbbaNoch keine Bewertungen

- Physical and Social Impediments Qualifying Vulnerability of The Study GroupsDokument3 SeitenPhysical and Social Impediments Qualifying Vulnerability of The Study GroupsAishatu Musa AbbaNoch keine Bewertungen

- Simplex MethodDokument6 SeitenSimplex MethodAishatu Musa AbbaNoch keine Bewertungen

- Entrepreneurial Experiences of The Study Vulnerable GroupsDokument2 SeitenEntrepreneurial Experiences of The Study Vulnerable GroupsAishatu Musa AbbaNoch keine Bewertungen

- Spatial Locations and Out-Reach of The NACRDB Branches in Borno StateDokument3 SeitenSpatial Locations and Out-Reach of The NACRDB Branches in Borno StateAishatu Musa AbbaNoch keine Bewertungen

- Impact of Micro Credit Scheme of The PDFDokument3 SeitenImpact of Micro Credit Scheme of The PDFAishatu Musa AbbaNoch keine Bewertungen

- Study Local Government AreasDokument2 SeitenStudy Local Government AreasAishatu Musa AbbaNoch keine Bewertungen

- Marrital Statuses of The RespondentsDokument2 SeitenMarrital Statuses of The RespondentsAishatu Musa AbbaNoch keine Bewertungen

- Impact of Micro Credit Scheme of The PDFDokument3 SeitenImpact of Micro Credit Scheme of The PDFAishatu Musa AbbaNoch keine Bewertungen

- DecisionDokument1 SeiteDecisionAishatu Musa AbbaNoch keine Bewertungen

- Galene Irrigation System ProjectDokument108 SeitenGalene Irrigation System Projectburqa100% (3)

- Program (MANGO, Litchi & Hogpalm)Dokument5 SeitenProgram (MANGO, Litchi & Hogpalm)PrachuriyaNoch keine Bewertungen

- Effects of Cooking, by Herbert SheltonDokument13 SeitenEffects of Cooking, by Herbert SheltonDonciu AlexandraNoch keine Bewertungen

- Can Pakistan Be A Welfare State?Dokument2 SeitenCan Pakistan Be A Welfare State?MUHAMMADNoch keine Bewertungen

- Pancha Karma Sample ProgramDokument6 SeitenPancha Karma Sample ProgramlakshmibavaNoch keine Bewertungen

- Oxidative Stability of Ghee As Affected by Natural Antioxidants Extracted From Food Processing WastesDokument8 SeitenOxidative Stability of Ghee As Affected by Natural Antioxidants Extracted From Food Processing WastesEliana ContrerasNoch keine Bewertungen

- Swaraj 744 XM (ICT) PDFDokument8 SeitenSwaraj 744 XM (ICT) PDFManinder Singh SainiNoch keine Bewertungen

- Asian Small Clawed Otter NutritionDokument22 SeitenAsian Small Clawed Otter NutritionIngrid IunzkovzkiNoch keine Bewertungen

- Chapter 13 Zakat AnswerDokument15 SeitenChapter 13 Zakat AnswerNUR ARISSA BINTI AZHANNoch keine Bewertungen

- Azolla Book1984Dokument4 SeitenAzolla Book1984Mariyath Muraleedharan KiranNoch keine Bewertungen

- Summary Sheets: The Plant KingdomDokument3 SeitenSummary Sheets: The Plant KingdomAreeba Inam RaoNoch keine Bewertungen

- High Density Apple ProductionDokument61 SeitenHigh Density Apple ProductionEugeniu GudumacNoch keine Bewertungen

- Kenyon Collegiate Issue 3.6Dokument6 SeitenKenyon Collegiate Issue 3.6kenyon_collegiateNoch keine Bewertungen

- ANSWERDokument7 SeitenANSWERChristian Nehru ValeraNoch keine Bewertungen

- Hardwood - Softwood - Manufactured Board: TIMBER Is The General Name For Wood MaterialsDokument18 SeitenHardwood - Softwood - Manufactured Board: TIMBER Is The General Name For Wood MaterialspandianvijaybharathiNoch keine Bewertungen

- Connemara Pony Discussion Document October 2015Dokument30 SeitenConnemara Pony Discussion Document October 2015FrankQuinnNoch keine Bewertungen

- The Chalcolithic CultureDokument6 SeitenThe Chalcolithic CultureKing SivanathNoch keine Bewertungen

- Paes 204 Mechanical Rice Thresher SpecificationsDokument8 SeitenPaes 204 Mechanical Rice Thresher SpecificationsEdsel Jay RaperNoch keine Bewertungen

- Factors Affectingaquaculture Productioninuganda, Gulu DistrictDokument52 SeitenFactors Affectingaquaculture Productioninuganda, Gulu DistrictOLOYA LAWRENCE KABILANoch keine Bewertungen

- Highlights of Panglao Island Tourism Masterplan by Palafox (Part 3 of 4)Dokument33 SeitenHighlights of Panglao Island Tourism Masterplan by Palafox (Part 3 of 4)arkioskNoch keine Bewertungen

- NERI - Anti-Cattle Rustling Law Written ReportDokument7 SeitenNERI - Anti-Cattle Rustling Law Written ReportBles NeriNoch keine Bewertungen

- Endosulfan TragedyDokument16 SeitenEndosulfan TragedyAbhiroop SenNoch keine Bewertungen

- The Use of Coal As Fuel For Cement Rotary KilnDokument23 SeitenThe Use of Coal As Fuel For Cement Rotary KilnDheo Ebhee LouVeNoch keine Bewertungen

- EF3e Intplus Quicktest 05 PDFDokument2 SeitenEF3e Intplus Quicktest 05 PDFKate Kireeva100% (1)

- Anacarde DanidaDokument48 SeitenAnacarde DanidaAli DandamunNoch keine Bewertungen

- Research Method Proposal On Teak Tissue CultureDokument8 SeitenResearch Method Proposal On Teak Tissue CultureAmalina Mohamed SooudinNoch keine Bewertungen

- TCW3204201508 Irrigation Systems DesignDokument4 SeitenTCW3204201508 Irrigation Systems DesignNyashah FelixNoch keine Bewertungen

- Diversity of The Triticeae Genetic Resources in The Karabakh Region of AzerbaijanDokument18 SeitenDiversity of The Triticeae Genetic Resources in The Karabakh Region of AzerbaijanPublisher NasirNoch keine Bewertungen

- CASSAVA CHIPS BISNIS RevisiDokument19 SeitenCASSAVA CHIPS BISNIS RevisiTayaNoch keine Bewertungen

- Biology Biodiversity Crit BDokument5 SeitenBiology Biodiversity Crit BRoman SagnerNoch keine Bewertungen